- Home

- »

- Medical Devices

- »

-

U.S. Surgical Stapling Devices Market, Industry Report 2030GVR Report cover

![U.S. Surgical Stapling Devices Market Size, Share & Trends Report]()

U.S. Surgical Stapling Devices Market (2024 - 2030) Size, Share & Trends Analysis By Product (Powered, Manual), By Type (Disposable, Reusable), By End-use (Hospitals, Ambulatory Surgical Centers), And Segment Forecasts

- Report ID: GVR-4-68040-229-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Surgical Stapling Devices Market Trends

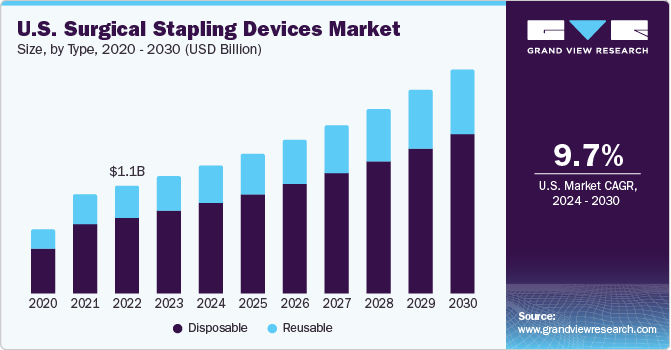

The U.S. surgical stapling devices market size was valued at USD 1.25 billion in 2023 and is expected to grow at a CAGR of 9.7% from 2024 to 2030. The availability of advanced healthcare facilities in the country, the presence of global companies, and the high prevalence of chronic diseases are the key factors for the growth of the market. Increasing preference of minimally invasive surgeries due to their lower risk and trauma is a critical factors attributing to the growth of surgical stapling devices market in the country. Additionally, wound and tissue management devices play a vital role in the market as they aid in the healing process and reduce the risk of complications after surgery.

The U.S. accounted for nearly 25% of the global surgical stapling devices market in 2023. A rise in the number of surgeries and a significant increase in the prevalence of chronic diseases, such as cardiovascular & gastrointestinal diseases, are the primary factors driving the market. The favorable reimbursement scenario provides access to healthcare services to a large section of the population. Subsequently, it creates a demand for cost-effective and efficient surgical procedures. In addition, this increases the need for cost-effective surgical stapling devices and the integration of telehealth in the care delivery system.

In the U.S., 4 out of 10 adults have two or more chronic diseases, and 6 out of 10 adults have a chronic disease. According to WHO, non-communicable diseases are responsible for the death of approximately 40 million people, representing 74% of deaths, annually worldwide. According to the CDC, chronic diseases are the leading cause of disability and mortality. Such high prevalence of target conditions will continue to drive the market growth in the coming 5-6 years.

The prevalence of obesity is increasing among adults as well as adolescents below 18 years of age owing to several factors such as sedentary lifestyles and unhealthy diet patterns in this age group. Severe cases of obesity cause other conditions, such as diabetes and cardiovascular conditions, resulting in many opting for bariatric surgery. The CDC estimates that over 42% of people across the U.S. are obese. This indicates the high demand for these surgeries owing to increasing awareness about surgical options for weight loss.

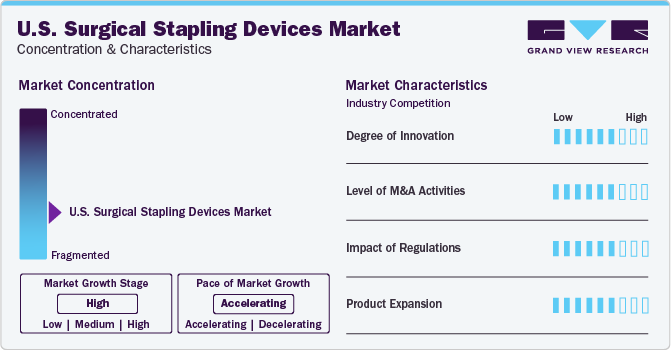

Market Characteristics & Concentration

The industry is highly fragmented and comprises a large number of global and local players. Large industry participants are also implementing acquisition and consolidation tactics to increase their product portfolios and geographic footprint while reducing competition.

Key players in the surgical stapling devices industry are focusing on innovation for developing surgical stapling products, with a focus on improving treatment efficiency and reducing the procedure and recovery time. These players have strong product portfolios with the presence of advanced products. Several key players are further investing in R&D to launch more technologically advanced minimally invasive surgical instruments.

The companies are focused on competitive pricing and trying to gain industry share. The majority of industry players have strong collaborations with manufacturers and suppliers to ensure uninterrupted supply. Moreover, many companies are involved in strategic partnerships and mergers & acquisitions as their global strategy. For instance, in October 2022, Teleflex Incorporated announced the acquisition of Standard Bariatrics, Inc.

Surgical stapling devices are classified as class II medical devices under the Code of Federal Regulations. Class II medical devices generally pose a high risk to the patient or user. Stringent regulations can create challenges for innovators, manufacturers, and exporters to receive approval for market distribution. In addition, a lack of standardization in healthcare-related procedures may restrain the market growth. However, factors such as government initiatives to provide primary healthcare services at affordable rates and increase awareness about chronic diseases are further anticipated to boost market growth during the forecast period.

Product Insights

The manual segment accounted for the largest share of 62.88% in 2023 owing to their features such as quick and efficient, which reduces the time required for surgical procedures and further reduces the risk of complications associated with long surgical procedures. In addition, manual surgical stapling offers higher precision than traditional suturing methods. Hence, manual surgical stapling devices offer significant advantages over traditional suturing methods, and they can be helpful in modern surgical procedures.

The powered segment is expected to witness the fastest CAGR over the forecast period. These devices allow surgeons to perform surgeries faster and with higher efficiency, thereby reducing the time the patient is under anesthesia. Some novel surgical stapling devices are designed with increased range of motion and flexibility, enabling surgeons to access hard-to-reach areas and perform complex surgical procedures. Powered surgical stapling devices are integrated with other surgical technologies, such as robotic systems, to enable more efficient and precise surgical procedures, which is anticipated to boost the market growth.

Type Insights

The disposable surgical stapling device segment accounted for the largest share of 70.91% in 2023. Companies such as Medtronic and 3M are manufacturing disposable skin staples with added features such as short trigger stroke and higher staple visibility. The efforts to sterilize traditional devices equal the environmental impact of disposable staples. Hence, the demand for disposable stapling devices is expected to surge owing to the increased concerns related to infection.

The reusable surgical stapling device segment is expected to witness a considerable CAGR over the forecast period. Reusable surgical stapling devices can be cleaned and sterilized quickly, reducing the amount of time required between surgeries. They can be used multiple times, resulting in significant cost savings over a period. Novel reusable devices are available with smart stapling technology, which allows real-time feedback and monitoring during surgeries. This technology can help surgeons ensure that each staple is placed accurately & at the correct angle, thereby improving patient outcomes and increasing the demand for these devices.

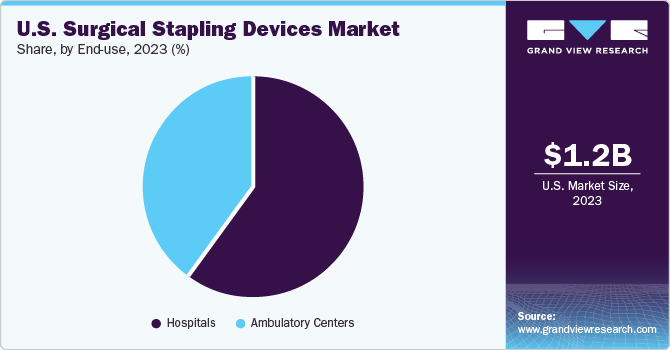

End-use Insights

The hospital segment accounted for the largest share of 59.84% in 2023. The increasing number of hospitals is projected to fuel the market growth. According to the American Hospital Association, the U.S. had a total of 6,120 hospitals in 2024. Hospitals offer superior care to patients, along with reimbursements in most cases, which promotes their adoption. Several surgeries require patients to stay in a hospital for more than a day. This factor further contributes to the segment growth.

The ambulatory segment is expected to witness the fastest CAGR over the forecast period. This can be attributed to advanced market reach, especially in developing economies. Furthermore, these centers provide easy treatment options as patients do not have to stay more than a day after treatment. They also provide cheaper surgical options compared to hospitals and specialty centers. In addition, ambulatory surgical centers enable large volumes of surgeries in a short period, which is expected to drive the market during the forecast period.

Key U.S. Surgical Stapling Devices Company Insights

Some of the prominent U.S. surgical stapling devices companies include Stryker Corporation, Medtronic, Intuitive Surgical, CONMED Corporation, Smith & Nephew, 3M Healthcare, and Johnson & Johnson Services, Inc. The presence of these dominant players contributes to the exceptional market growth in the region.

Key buyers in the market include hospitals, group purchasing organizations, clinics, and other healthcare settings. Several key industry contributors are focusing on developing advanced surgical stapling devices to expand their market reach. Companies are also focusing on strategic growth initiatives to strengthen their market presence.

Key U.S. Surgical Stapling Devices Companies:

- Covidien

- Ethicon US., LLC

- Intuitive Surgical

- Cardica, Inc.

- Stryker

- Smith & Nephew

- CONMED Corporation

- CareFusion Corporation

- 3M Healthcare

- BioPro, Inc.

Recent Developments

-

In November 2023, Paragon 28, Inc. launched the JAWS Great White Staple System which is developed to offer increased strength and stability of the osteotomy or fusion site when compared to traditional staple systems. The staples were designed to provide a uniform compression profile across the osteotomy

-

In June 2022, Ethicon announced the launch of the ECHELON 3000 Stapler for surgeons in the U.S. which is designed to transect and staple different kinds of tissues throughout open and minimally invasive surgical operations

U.S. Surgical Stapling Devices Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2.38 Billion

Growth rate

CAGR of 9.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors & trends

Segments covered

Product, type, end-use

Country scope

U.S.

Key companies profiled

Covidien; Ethicon US., LLC; Intuitive Surgical; Cardica, Inc.; Stryker; Smith & Nephew; CONMED Corporation; CareFusion Corporation; 3M Healthcare; BioPro, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Surgical Stapling Devices Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the U.S. surgical stapling devices report based on product, type, and end-use:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Powered

-

Manual

-

-

Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Disposable

-

Reusable

-

-

End Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Hospitals

-

Ambulatory Centers

-

Frequently Asked Questions About This Report

b. The U.S. surgical stapling devices market size was estimated at USD 1.25 billion in 2023 and is expected to reach USD 1,365.6 million in 2024.

b. The U.S. surgical stapling devices market is expected to grow at a compound annual growth rate of 9.7% from 2024 to 2030 to reach USD 2.38 billion by 2030.

b. Based on type, the disposable segment dominated the U.S. surgical stapling devices market with a share of 70.9% in 2023 as a result of heightened concerns over communicable infections.

b. Some key players operating in the U.S. surgical stapling devices market include Covidien, Ethicon US., LLC, Intuitive Surgical, Cardica, Inc., Stryker, Smith & Nephew, CONMED Corporation, CareFusion Corporation, 3M Healthcare, and BioPro, Inc.

b. Key factors that are driving the U.S. surgical stapling devices market growth include the increasing preference for staples over sutures, the demand for surgical stapling is expected to increase owing to the rise in bariatric procedures and implementation of advanced technology to perform endoscopic procedures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.