- Home

- »

- Healthcare IT

- »

-

U.S. Telehealth Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Telehealth Market Size, Share & Trends Report]()

U.S. Telehealth Market Size, Share & Trends Analysis Report By Product (Hardware, Software, Services), By Delivery Mode (On-premises), By End Use (Payers, Providers), By Disease Area, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-590-8

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Stents Market Size & Trends

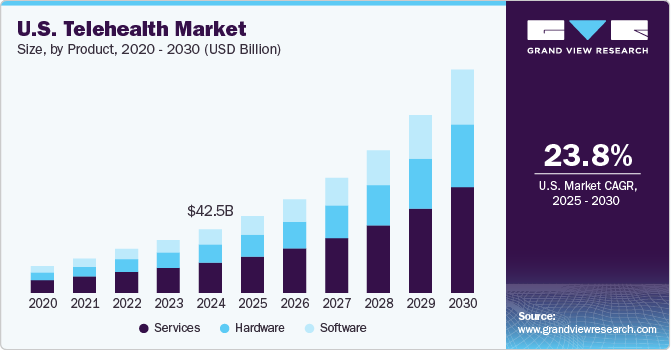

The U.S. telehealth market size was valued at USD 42.54 billion in 2024 and is expected to grow at CAGR of 23.8% from 2025 to 2030. The market growth is driven by growing demand for remote healthcare services coupled with high internet usage & increasing penetration of connected home services, where the need for virtual consultations and remote monitoring surged. Furthermore, advancements in technology, including robust internet connectivity, and adoption of smartphones, and increasing government initiatives to develop telehealth programs contribute to market growth. For instance, according to an article published by Exploding Topics in June 2024, 276.14 million smartphone users in the U.S.

Smartphones have transitioned from communication and entertainment devices to gadgets that track health and fitness. The advent of mobile applications has simplified daily tasks, significantly enhancing convenience and ease of life. With the increasing adoption of smartphones and easy availability of technologically advanced devices, innovators have started investing to make the most of the current situation of the industry by focusing on delivering quality healthcare & comfort through various mobile platforms, which would help patients track their fitness regimes and obtain answers to medical inquiries over the phone, WhatsApp, or through several mobile applications. For instance, several apps such as Doctor Anywhere, Teladoc Health, ClicknCare, and Doctor On Call have been introduced to help patients book appointments, track their consultations & medical prescriptions, and store their healthcare information throughout the treatment.

The growing adoption of telehealth facilities by physicians, patients, and government organizations is fueling the market. Access to healthcare through video consultations and specific applications enables remote communication between physicians and patients, eliminating the need to visit clinics or hospitals. Market players such as IBM, Apple, and Google focus on enhancing the mobile health experience by offering multiple solutions through different subscription plans and emphasizing data security. These factors are anticipated to propel market growth over the forecast period.

A rising number of developments, including partnerships and product launches, aim to improve healthcare delivery and address staffing challenges. For instance, in July 2022, TeleMedCare launched a remote monitoring program for chronic patients in collaboration with the leading U.S. health insurance providers. This initiative, aimed at managing chronic conditions such as CHF, COPD, diabetes, and hypertension, started with a pilot phase involving 300 patients.

To bolster telehealth services and address the healthcare needs of rural areas in the U.S., the Biden-Harris Administration made a significant investment of more than 19 million USD in August 2021. This investment was directed through the Health Resources and Services Administration (HRSA) at the U.S. Department of Health and Human Services (HHS). Market participants are actively involved in developing cutting-edge healthcare products, including secure data storage platforms, telecare platforms, and the establishment of robust network infrastructure. In addition, they promote the adoption of remote health and telemedicine services.

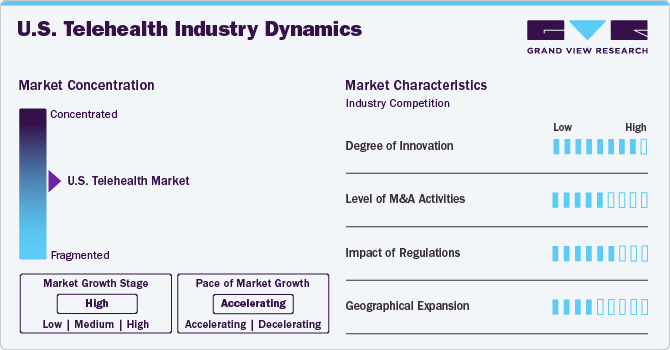

Market Concentration & Characteristics

The degree of innovation in the market is high, characterized by rapid advancements in technology and service delivery. In October 2024, VSee Health, Inc., a telehealth service provider, launched a new program to address obesity and related health issues by integrating GLP-1 prescription medicines within its existing telehealth service offerings.

The market is characterized by a medium level of M&A activities undertaken by leading players. Several companies are undertaking this strategy to strengthen their portfolio. For instance, in February 2023, Amazon completed its USD 3.9 billion acquisition of One Medical, adding 188 in-person locations and virtual care options to its healthcare offerings. One Medical's telehealth services include 24/7 video chats, in-app messaging, and same-day appointments. The merger aimed to integrate One Medical's membership-based primary care model, enhancing Amazon's ability to provide comprehensive healthcare services.

Telehealth practice is regulated by statutory provisions or bodies and regulations implemented by state authority licensing bodies, such as the Board of Medicine. The Health Insurance Portability and Accountability Act (HIPAA) of 1996, as amended by the Health Information Technology for Economic and Clinical Health (HITECH) Act, is a prime section of digital health legislation in the U.S. Telehealth platforms must adhere to regulations outlined in HIPAA, which health organizations and providers should follow to ensure patient privacy & security of health information.

Companies such as GE Healthcare, Siemens Healthineers, Medtronic, and American Well have a strong presence in the North American markets and have established many manufacturing facilities in the region. However, these companies are focusing on market expansion in European and Asian countries.

Product Insights

The services segment held the largest revenue share of 47.4% in 2024. The growing demand for telehealth applications in chronic disease management, real-time monitoring, and the continuous advancements in digital infrastructure, internet accessibility, and smartphone usage contribute to this segment's growth. For instance, in September 2024, Kajeet Inc., a provider of IoT connectivity solutions, partnered with Avery Telehealth, a telehealth platform, to help Avery Telehealth provide reliable connectivity for telehealth solutions across the U.S.

Furthermore, the market growth is supported by the presence of many service providers. Moreover, the current trend of outsourcing these services is fueling the growth of the services segment. Healthcare facilities often lack the necessary resources and expertise to implement digital health solutions, leading to outsourcing these services.

The software segment is anticipated to witness the fastest CAGR growth over the forecast period. Favorable government initiatives and the growing demand for cutting-edge Healthcare IT solutions are expected to drive innovation, with new products and upgraded software versions set to be launched. For instance, in June 2022, GoMeyra announced the launch of GoVirtual Clinic, a cloud-based telehealth platform that enables seamless communication between healthcare professionals and patients

Delivery Mode Insights

The web-based segment held the largest revenue share of 45.9% in 2024. The segment’s growth is fueled by the rising use of web-based delivery methods in mobile health communication and remote patient monitoring, which aim to enhance the quality of healthcare in rural regions. Furthermore, the widespread adoption of web-based platforms by healthcare providers and patients is contributing to the revenue generated by this segment. For instance, in September 2023, Kismet Health, a digital health company, introduced a revolutionary pediatric telehealth platform developed for providers by providers. The expanding telehealth industry and the cost-effectiveness of virtual care are also expected to support the growth of web-based delivery over the forecast period.

Web-based solutions are delivered via web servers using internet protocol and encompass four components: internet connectivity, data management, web servers, and software coding systems. Leveraging the internet and web-based services facilitates access even in remote areas with a single computer or monitoring device.

The cloud-based delivery segment is anticipated to witness the fastest CAGR from 2025 to 2030. Owing to the increasing adoption of cloud-based applications among healthcare providers and patients and the introduction of advanced technological solutions, the segment is experiencing significant growth. Furthermore, the seamless data storage and recovery, high bandwidth capabilities, enhanced security features, and easy accessibility offered by cloud-based applications are further driving this expansion. These solutions enable patient monitoring and teleconsultation, which is particularly beneficial for individuals needing urgent medical assistance in rural and remote areas.

Disease Area Insights

The psychiatry segment dominated the market with a revenue share of 12.4% in 2024 and is anticipated to grow at the fastest rate over the forecast period. In the U.S., as per the National Alliance on Mental Illness, 1 in 5 individuals experience mental illness each year. Similarly, 17% of individuals in the U.S. aged 6-17 years’ experience mental disorders annually. Thus, the demand for telepsychiatry solutions among patients is growing. In addition, the shortage of psychiatrists in the country, especially in specialties such as child psychiatry, fuels the segment growth. Several individuals do not have sufficient access to mental health services and professionals in their area. As a result, more people are turning to telepsychiatry solutions, which allow them to connect with mental health professionals regardless of their location.

The radiology segment is anticipated to grow at a significant rate from 2025 to 2030. Factors such as integrating AI into teleradiology, growing R&D activities regarding eHealth, and implementing a Picture Archiving and Communication System (PACS) drive segment growth. Moreover, various strategies are adopted by market participants to capture the larger market share. For instance, in October 2023, Qure.ai partnered with USARAD Holdings Inc. to broaden its presence in the U.S. teleradiology market to enhance radiological decision-making

End Use Insights

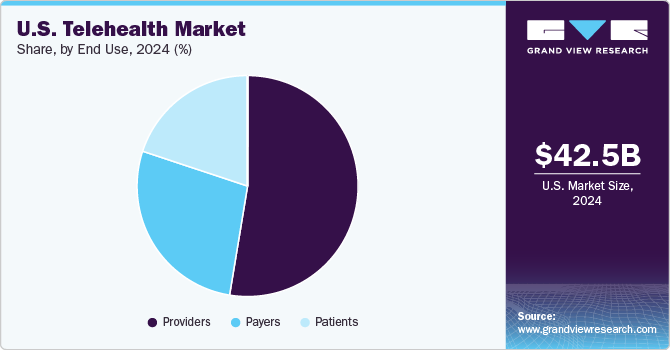

The providers segment dominated the market with a revenue share of 52.6% in 2024. The growth is attributed to the growing adoption of telehealth, teleconsultation, and telemedicine among healthcare professionals to reduce the burden on healthcare facilities. Furthermore, the increased convenience provided by these solutions for seamless and quick access to real-time quality reporting, enhanced decision-making, patient health records, improved eHealth solutions, and data management is anticipated to boost the adoption of these services among the providers. Many healthcare organizations have witnessed substantial improvement in workflow management through adopting these services, which is increasing its adoption.

The patient segment is anticipated to grow at the fastest rate from 2025 to 2030. The segmental growth is attributed to several key factors, such as increasing awareness among the patient population regarding the benefits and convenience of telehealth services. Moreover, the high level of internet penetration in the U.S. enables widespread access to telehealth platforms. The affordability and potential for improved clinical outcomes associated with telehealth services drive this segment's growth. Moreover, the rising number of smartphone users, the presence of technology-friendly users, and the continuous expansion of internet connectivity across the country are expected to further support the segment’s growth.

Key U.S. Telehealth Company Insights

The key players in the market have been involved in mergers and acquisitions to increase their share in the market and provide innovative solutions for users, which is anticipated to boost market growth during the forecast period. Furthermore, several initiatives are being undertaken by the key players, significantly contributing to market growth.

Key U.S. Telehealth Companies:

- Koninklijke Philips N.V

- GE Healthcare

- Oracle (Cerner Corporation)

- Siemens Healthineers

- Medtronic

- Teladoc Health Inc.

- American Well

- MDLIVE

- Doctor On Demand

- GlobalMed

View a comprehensive list of companies in the U.S. Telehealth Market.

Recent Developments

-

In January 2024, Optum Perks, a digital health technology company, introduced a new telehealth solution to provide prescription treatments and affordable care for various conditions.

-

In February 2024, VerifiNow Inc. launched PatientVerifi, a solution designed to verify patients' identities for telehealth providers. This product is developed to meet the demand for secure patient identity verification in virtual healthcare.

-

In April 2023, Cosmos Health Inc. entered into a definitive agreement to acquire a 100% stake in Telemed Medical Services, a telehealth company based in the U.S. This acquisition is part of Cosmos Health's strategy to expand its telehealth services and offerings. The acquisition is expected to enhance Cosmos Health's telehealth capabilities and expand its reach, particularly in the U.S. market.

U.S. Telehealth Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 51.53 billion

Revenue forecast in 2030

USD 150.13 billion

Growth rate

CAGR of 23.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, delivery mode, diseases area, end use

Country scope

U.S.

Key companies profiled

Koninklijke Philips N.V.; GE Healthcare; Oracle (Cerner Corporation); Siemens Healthineers; Medtronic; Teladoc Health Inc.; American Well; MDLIVE; Doctor On Demand;, GlobalMed

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. Telehealth Market Report Segmentation

This report forecasts revenue growth in the country and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. telehealth market based on product, delivery mode, end use, and disease area:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Monitors

-

Medical Peripheral Devices

-

Blood Pressure Meters

-

Blood Glucose Meters

-

Weighing Scales

-

Pulse Oximeters

-

Peak Flow Meters

-

ECG Monitors

-

Others

-

-

-

Software

-

Standalone Software

-

Integrated Software

-

-

Services

-

Remote Patient Monitoring

-

Real-Time Interactions

-

Store and Forward

-

Others

-

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Web-based

-

Cloud-based

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Payers

-

Providers

-

Patients

-

-

Disease Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Psychiatry

-

Substance Use

-

Radiology

-

Endocrinology

-

Dermatology

-

Gastroenterology

-

Neurological Medicine

-

ENT

-

Cardiology

-

Oncology

-

Dental

-

Gynecology

-

General Medicine

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. telehealth market size was estimated at USD 42.54 billion in 2024 and is expected to reach USD 51.53 billion in 2025.

b. The U.S. telehealth market is expected to grow at a compound annual growth rate of 23.8% from 2025 to 2030, reaching USD 150.13 billion by 2030.

b. The services segment dominated the U.S. telehealth market with a share of 47.4% in 2024. The growing demand for telehealth applications in chronic disease management, real-time monitoring, and growing internet accessibility, and smartphone usage contribute to this segment's growth.

b. Some key players operating in the U.S. telehealth market include Koninklijke Philips N. V; Siemens Healthineers; Oracle (Cerner Corporation); GE Healthcare; Medtronic; Teladoc Health Inc; American Well; Doctor on Demand; GlobalMed; MDLIVE.

b. The advancements in technology, including robust internet connectivity, and adoption of smartphones, and increasing government initiatives to develop telehealth programs contribute to market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."