- Home

- »

- Homecare & Decor

- »

-

U.S. Tool Storage Products Market, Industry Report, 2033GVR Report cover

![U.S. Tool Storage Products Market Size, Share & Trends Report]()

U.S. Tool Storage Products Market (2025 - 2033) Size, Share & Trends Analysis Report By Product, By Material (Metal, Plastic & Composite Materials, Wood), By Application (Residential, Commercial), And Segment Forecasts

- Report ID: GVR-4-68040-802-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Tool Storage Products Market Summary

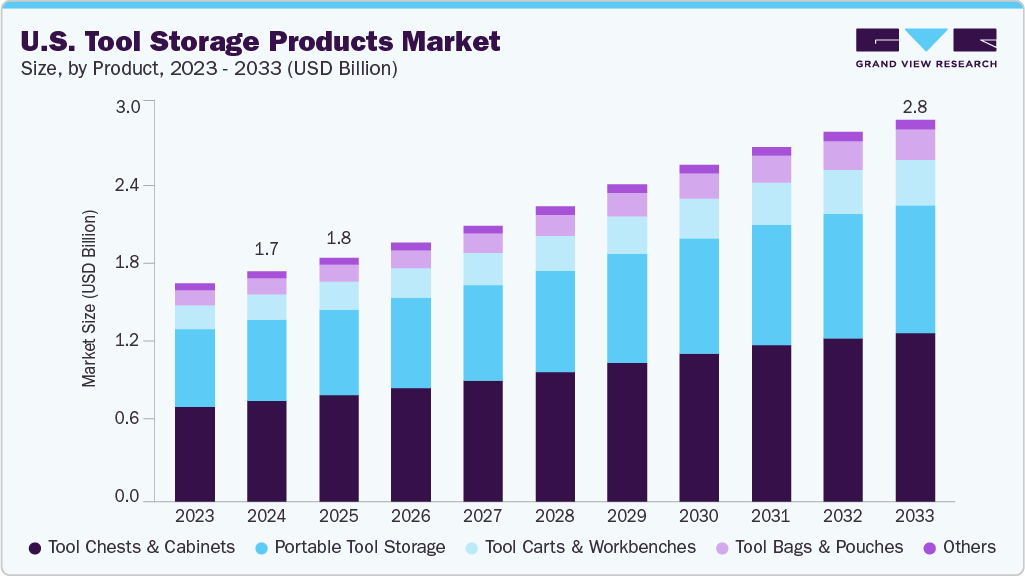

The U.S. tool storage products market size was estimated at USD 1.71 billion in 2024 and is projected to reach USD 2.83 billion by 2033, growing at a CAGR of 5.8% from 2025 to 2033. Growth is fueled by a rising class of small trade operators and skilled contractors who view organised storage as part of service professionalism.

Key Market Trends & Insights

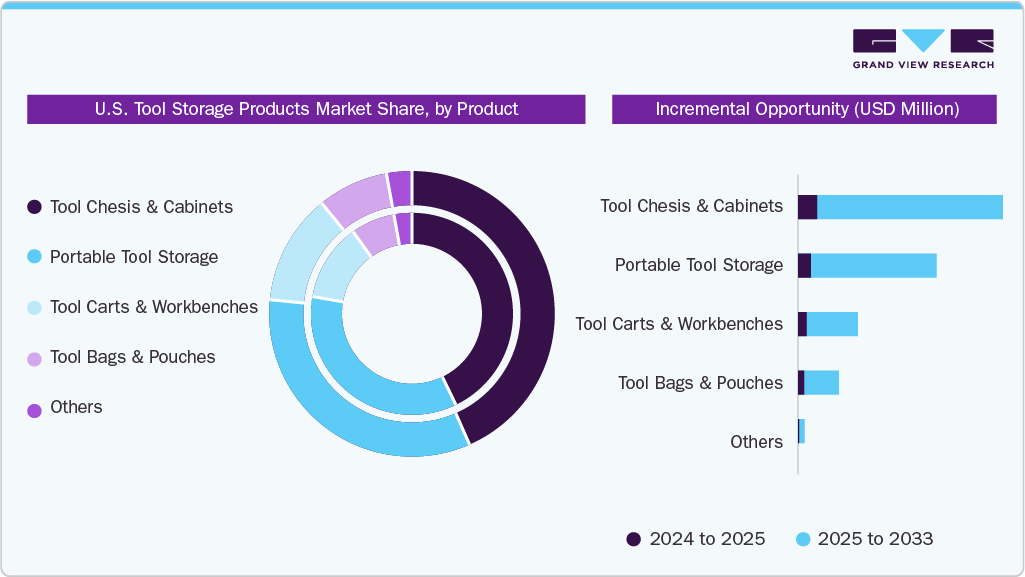

- By product, tool chests & cabinets products led the market and accounted for a share of 46.6% in 2024.

- By material, metal sales held the highest market share of 59.4% in 2024.

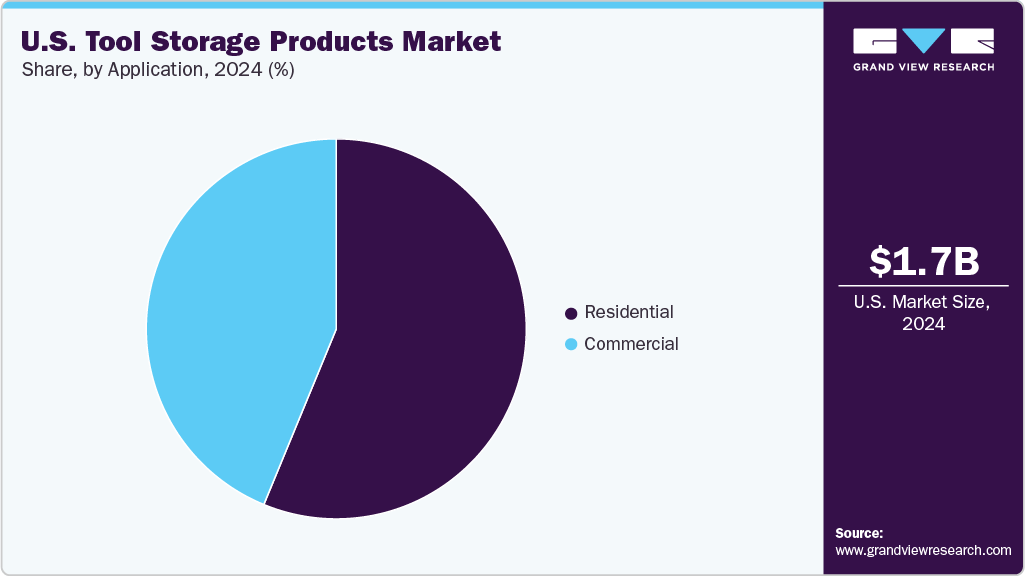

- By application, residential sales held the highest market share of 54.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.71 Billion

- 2033 Projected Market Size: USD 2.83 Billion

- CAGR (2025-2033): 5.8%

Field technicians and mobile mechanics are replacing ad hoc arrangements with structured rolling cabinets, wall grids, and stackable chests that save time on every job. Compact workstations with folding surfaces or removable modules appeal to technicians who must transport tools quickly and protect them from vibration, weather, and daily wear across multiple worksites. For tradespeople balancing mobility with image, tidy storage reinforces brand credibility.

The growing enthusiasm among Americans for DIY projects has become a significant driver of demand for tool storage. According to a 2024 CivicScience survey, 62% of homeowners planned to undertake a renovation or remodel within the next 12 months. Notably, 43% intended to complete the projects entirely on their own, a strong indication of continued DIY momentum in the U.S. Similarly, the 2024 U.S. Houzz & Home Study, which surveyed over 32,000 users (including 17,713 renovating homeowners), documented a steady increase in renovation activity and homeowner investment in home improvement projects. As more individuals take on painting, carpentry, repairs, and furniture-building tasks independently, the range and number of household tools continue to grow. This expansion naturally drives demand for efficient tool storage solutions, such as tool chests and modular systems, enabling homeowners to keep their expanding collections organized, safe, and accessible.

Additionally, the growth of the U.S. construction, automotive repair, and manufacturing sectors is significantly fueling demand for industrial tool storage solutions. Expansions in construction projects, increasing vehicle ownership, and the rise of precision-driven manufacturing have created an environment where efficient tool management is critical. Industrial facilities and workshops handle an increasing volume and variety of tools, necessitating organized storage solutions such as modular cabinets, mobile toolboxes, and specialized racks to maintain workflow efficiency and productivity.

In addition to efficiency, safety and protection of tools have become essential drivers. Tools in industrial environments are often expensive and precision-engineered, and they are prone to wear and damage if not stored properly. Storage systems help protect tools from environmental damage and accidental mishandling while also minimizing workplace hazards caused by improperly stored equipment. Advanced storage products with secure compartments, ergonomic designs, and smart inventory tracking are increasingly adopted to ensure safety, compliance with regulations, and durability of critical equipment.

The Occupational Safety and Health Administration (OSHA) mandates safe storage and handling of tools and materials in industrial workplaces. Regulations such as 1926.250 require materials to be stacked, racked, or secured to prevent sliding, falling, or collapsing. Additionally, 1910.176(c) emphasizes keeping storage areas free of hazards like tripping, fire, or obstruction. These rules emphasize the importance of organized and secure tool storage to ensure worker safety and prevent workplace accidents.

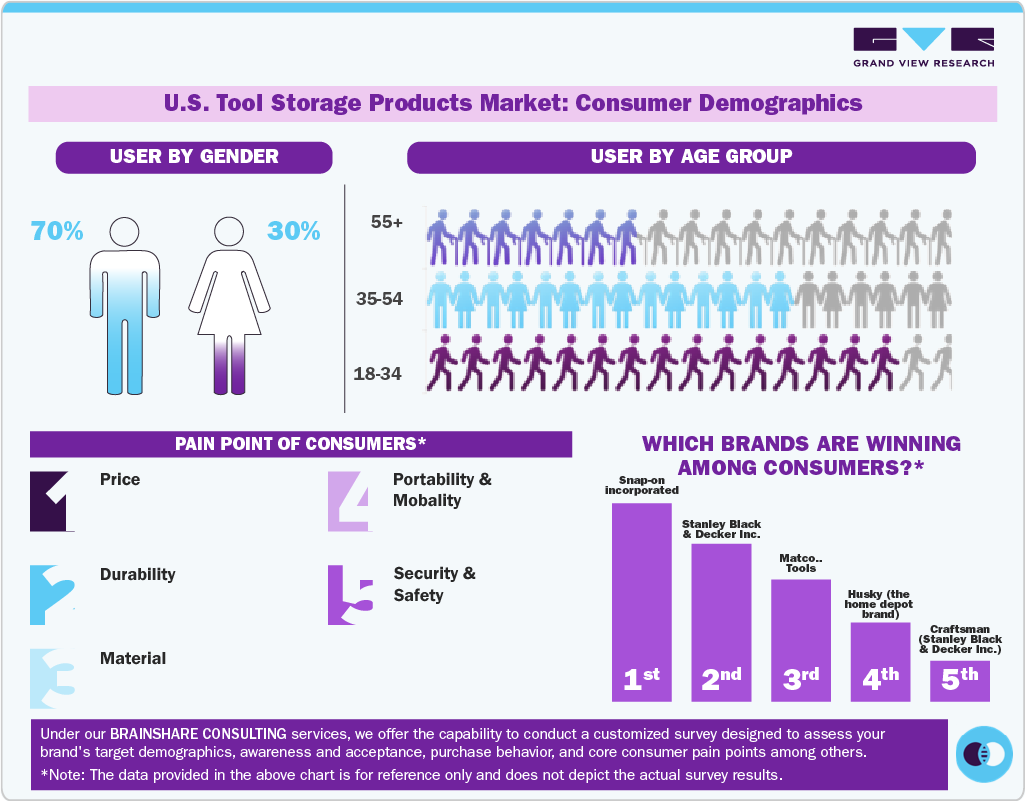

Consumer Insights

The rise in DIY and home improvement activities drives the demand in the U.S. tool storage products industry. These projects clearly require organized, accessible, and safe storage solutions. As homeowners take on more projects and acquire additional tools, they naturally seek cabinets, wall systems, tool chests, and portable organizers to manage their growing collections.

Homeowners increasingly view garages not just as parking areas but as functional extensions of the home, serving as workshops, hobby spaces, or organized storage zones. Consumers are investing in integrated storage systems such as cabinets, slatwall panels, pegboards, and overhead racks to achieve a clean and efficient layout. These solutions help maintain accessibility while minimizing clutter, aligning with broader trends of home organization and space maximization.

Nearly 80% of garage owners store power and hand tools, while 76% keep outdoor equipment such as lawn mowers, hedge trimmers, and leaf blowers inside. Power drills (56%) and shop vacs (41%) are the most frequently used tools, underscoring the need for storage solutions that provide easy access and protect frequently used items. Moreover, 67% of adults report owning so many tools that organization is essential, and 52% prefer that their tools and storage systems match aesthetically, reflecting a trend toward integrated, visually cohesive, and personalized storage solutions.

The popularity of outdoor tools further drives consumer demand for specialized storage options. Leaf blowers (62%), string trimmers (57%), walk-behind lawn mowers (51%), hedge trimmers (49%), and chainsaws (48%) require durable, space-efficient storage, often with safety considerations. This indicates a growing preference for versatile, modular, and heavy-duty storage systems that accommodate large outdoor equipment and smaller hand tools.

Consumers are moving toward tool storage solutions that combine functionality, aesthetics, and convenience. There is an increasing demand for modular systems, portable organizers, and smart storage innovations that enable efficient use of space, easy access to frequently used tools, and visually appealing setups. As DIY activities, home improvement projects, and outdoor maintenance continue to increase, tool storage products that cater to these consumer preferences are poised for strong adoption and market growth.

Product Insights

Tool chests & cabinets accounted for a 43.6% revenue share of the U.S. tool storage products market in 2024. As garage upgrades and home workshop setups become more mainstream, heavy-gauge steel cabinets with lockable drawers are increasingly replacing lightweight plastic bins and mixed storage solutions. This long-term value and protection advantage has positioned metal tool chests and cabinets as a high-priority purchase in workshop organization.

Durability, modular expansion options, and ease of access shape consumer buying decisions. Many users are opting for cabinets with ball-bearing drawer slides, reinforced frames, and powder-coated exteriors that help preserve the finish over time. Rolling bases and stackable upper chests appeal to users building adaptable workspaces, while taller tower-style cabinets are favored in garages that require higher tool density with a compact footprint. Security has also become a strong adoption driver as cordless power tools and lithium-ion batteries continue to gain popularity and increase in retail value.

The demand for tool bags & pouches is anticipated to grow at a CAGR of 7.4% from 2025 to 2033. Demand is driven by portability and practicality, especially for users who need their tools within reach rather than stored away in fixed cabinets. Compact size, easy carry, and flexible pocket layouts have elevated tool bags and pouches from an accessory item to an essential part of everyday hardware handling.

Technicians and DIY users are gravitating toward designs that allow selective carry, only the tools required for a particular repair, reducing bulk and improving mobility. Structured pockets, reinforced bottoms, and abrasion-resistant fabrics are preferred because they strike a balance between a lightweight design and a long service life. There is also a growing interest in belt-mounted or clip-on pouches among professionals who require uninterrupted access while working at heights or frequently moving across a job site.

Material Insights

Metal tool storage products accounted for 59.4% of the U.S. tool storage products industry in 2024. Tool owners are shifting away from improvised or ad-hoc storage toward engineered metal solutions that support long-term use, load security, and material stability. This is driving demand for a wide spectrum of steel-based storage formats, including stackable boxes, all-metal organizers, modular lockers, hybrid workshop units, and contractor-grade mobile systems. Metal storage is positioning itself as a core infrastructure purchase for both residential garages and on-site work environments.

As more homes incorporate multi-purpose utility zones, garages and sheds are being reconfigured into organized work areas rather than overflow storage spaces. Metal tool storage is especially favored where heavy equipment, high-torque tools, or sharp-edged hardware are used regularly, because reinforced metal housing offers better protection and weight-bearing strength than polymer or fabric alternatives.

Plastic & composite materials are expected to grow at a CAGR of 6.3% from 2025 to 2033. Plastic and composite tool storage products are gaining momentum as users prioritize portability, corrosion resistance, and weatherproof construction over sheer load capacity. These solutions excel in environments where exposure to moisture, temperature fluctuation, or outdoor placement would prematurely degrade metal systems. Composites reinforced with fiberglass, carbon additives, or structural ribs deliver higher impact resistance, preventing cracking or warping during transport and routine handling. Lightweight molded housings enable easier lift-and-carry mobility for contractors, electricians, gardeners, and DIY hobbyists who frequently move tools between rooms, job sites, or outdoor areas.

Application Insights

Residential use of tool storage products accounted for 54.7% of the U.S. tool storage products market in 2024. The U.S. residential tool storage market is growing as more households maintain dedicated work areas for home repair, maintenance, and hobby activities. Instead of storing tools loosely in closets or plastic bins, consumers are investing in structured solutions that keep equipment organized, protected from wear, and ready for use. Growth is particularly strong among homeowners who treat the garage or basement as a functional workspace rather than a simple storage area.

Commercial use of tool storage products is expected to grow at a CAGR of 6.3% from 2025 to 2033. In commercial settings, tool storage is considered an integral part of the operational infrastructure, where reliability and rapid access directly impact productivity and turnaround time. Adoption is strongest in sectors such as HVAC, electrical, automotive service, property maintenance, and fabrication, where tools are in continuous rotation throughout the workday. Commercial buyers prefer systems that can be easily staged near the work area, rolled through corridors or job sites, or integrated into service vehicles without requiring reorganization.

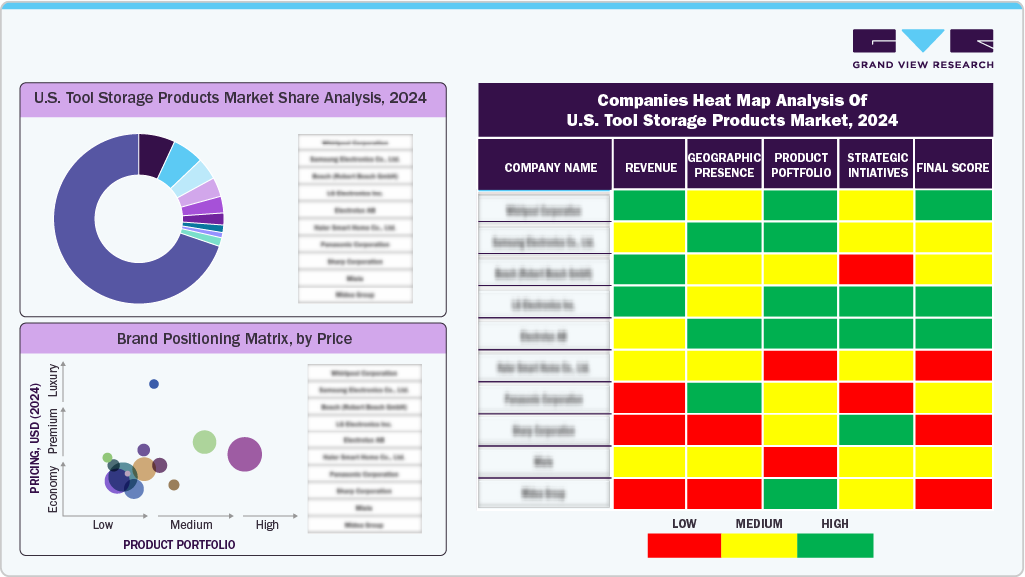

Key U.S. Tool Storage Products Company Insights

The U.S. tool storage products market is characterized by a diverse mix of well-established manufacturers, premium innovators, and emerging online-focused brands serving both professional tradespeople and DIY consumers. Leading players such as Snap-on, Stanley Black & Decker, and Husky (The Home Depot brand) dominate the mainstream segment through their extensive retail networks, durable designs, and strong brand heritage, which have built long-standing trust among users seeking reliability and functionality. In the premium category, brands such as Matco Tools, Kennedy Manufacturing, and Lista International cater to industrial and automotive professionals by offering high-capacity, precision-engineered storage systems with modular configurations, enhanced durability, and ergonomic designs tailored for optimal workshop efficiency.

Key U.S. Tool Storage Products Companies:

- Snap-on Incorporated

- Stanley Black & Decker, Inc.

- Matco Tools Corporation

- Husky (The Home Depot brand)

- Craftsman (Stanley Black & Decker, Inc. brand)

- Apex Tool Group, LLC

- Waterloo Industries

- Kobalt (Lowe’s Companies, Inc. brand)

- Kennedy Manufacturing Co.

- Lista International Corporation

Recent Developments

-

In September 2025, Craftsman released a special U.S.-themed rolling tool cabinet at Lowe’s featuring a bold flag and eagle graphic across its exterior. The workstation features a heavy-gauge steel construction and is equipped with nine drawers, a wooden work surface, and an integrated power strip that includes standard outlets and USB ports for charging equipment. It rides on heavy-duty casters to support large loads and can be positioned securely with its locking wheels. Although it has the styling of a limited-edition model, Craftsman has not formally marketed it as one. The product is currently positioned as a premium patriotic design option in their mobile storage lineup.

-

In April 2025, Hilti announced ProKit, a new modular tool-storage lineup designed for professional tradespeople and scheduled for a phased rollout beginning late 2025. The system is built around a wheeled base and stackable storage units of various sizes, including large and medium toolboxes, a clear-lid organizer for fasteners and small parts, and a multi-compartment soft tool bag. One of its key design advantages is that the trolley handle and wheel assembly can be separated from the lower box, allowing it to function as a mobile platform for other modules.

-

In November 2024, Wayne Taylor Racing broadened its collaboration with Sonic Tools USA to include the team’s expanded two-car Cadillac effort in the IMSA GTP category. Under the renewed agreement, Sonic will equip the operation with its branded storage systems and professional hand-tool setups, specifically tailored to meet the workflow needs of the racing team. The deal strengthens an already long-standing relationship between the two organizations as WTR scales up its top-class prototype program, aiming to improve pit-lane efficiency, garage organization, and overall race‐day readiness.

-

In July 2023, BoxoUSA formed a partnership with Hoonigan to outfit the Tire Slayer Studios workshop with a full suite of professional tool storage and organization systems. The installation features extensive cabinet runs and multiple Pro Series carts, along with foam-cut tool sets that secure every piece in a designated slot. The collaboration aims to streamline the management of tools during filming and vehicle builds, providing the studio with a cleaner layout and faster access to equipment while working on performance projects.

U.S. Tool Storage Products Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.81 billion

Revenue forecast in 2033

USD 2.83 billion

Growth rate

CAGR of 5.8% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, application

Key companies profiled

Snap-on Incorporated; Stanley Black & Decker, Inc.; Matco Tools Corporation; Husky (The Home Depot brand); Craftsman (Stanley Black & Decker, Inc. brand); Apex Tool Group, LLC; Waterloo Industries; Kobalt (Lowe’s Companies, Inc. brand); Kennedy Manufacturing Co.; Lista International Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Tool Storage Products Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. tool storage products market report based on product, material, and application:

-

Price Outlook (Revenue, USD Million, 2021 - 2033)

-

Tool Chests & Cabinets

-

Portable Tool Storage

-

Tool Carts & Workbenches

-

Tool Bags & Pouches

-

Others

-

-

Material (Revenue, USD Million, 2021 - 2033)

-

Metal

-

Plastic & Composite Materials

-

Wood

-

-

Application (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Frequently Asked Questions About This Report

b. The U.S. tool storage products market size was estimated at USD 1.71 billion in 2024 and is expected to reach USD 1.81 billion in 2025.

b. The U.S. tool storage products is expected to grow at a compounded growth rate of 5.8% from 2025 to 2033 to reach USD 2.83 billion by 2033.

b. Metal tool storage products accounted for 59.4% of the market. Tool owners are shifting away from improvised or ad-hoc storage toward engineered metal solutions that support long-term use, load security, and material stability. This is driving demand for a wide spectrum of steel-based storage formats, including stackable boxes, all-metal organizers, modular lockers, hybrid workshop units, and contractor-grade mobile systems.

b. Some key players operating in U.S. tool storage products market include Snap-on Incorporated, Stanley Black & Decker, Inc., Matco Tools Corporation, Husky (The Home Depot brand), Craftsman (Stanley Black & Decker, Inc. brand), and others

b. Key factors that are driving the market growth include Growth in residential renovation/remodeling and DIY participation and ergonomic design and organization efficiency

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.