- Home

- »

- Next Generation Technologies

- »

-

U.S. Trade Credit Insurance Market, Industry Report, 2030GVR Report cover

![U.S. Trade Credit Insurance Market Size, Share & Trends Report]()

U.S. Trade Credit Insurance Market Size, Share & Trends Analysis Report By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By Coverage, By Application, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-251-7

- Number of Report Pages: 102

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

U.S. Trade Credit Insurance Market Trends

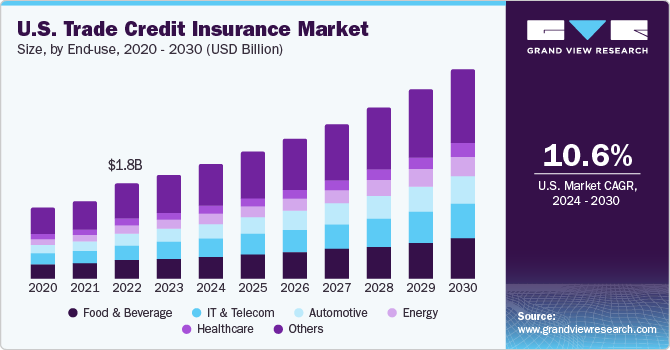

The U.S. trade credit insurance market size was valued at USD 2.02 billion in 2023 and is expected to grow at a CAGR of 10.6% from 2024 to 2030. The rapidly advancing insurance sector in the country plays a significant role in driving growth of the trade credit insurance industry. Providers are increasingly offering trade credit insurance as a way to mitigate risks associated with extending credit to customers. This allows businesses to protect their cash flows and minimize default risk by their customers. Additionally, American insurance companies use data analytics and technology to offer more customized and comprehensive trade credit insurance products, making it easier for businesses to manage risks, helping enable further market expansion.

The U.S. accounted for a revenue share of 19.04% in the global trade credit insurance market in 2023. Insurance companies are collaborating with other service providers, such as fintech companies and banks, to offer bundled solutions that address multiple risks and provide more value to customers. This trend has been accelerated by the increased trade of goods and services from the country globally and expansion in new markets, leading to increased competition, pricing pressure, and other challenges that can impact their cash flow. Trade credit insurance offer a safety net that allows businesses to continue their operations even if a customer fails to pay, helping businesses reduce financial risk and provide financial stability.

Advancements in technologies such as Artificial Intelligence (AI), Internet Of Things (IoT), Machine Learning (ML), and big data are transforming the insurance landscape across the United States. Furthermore, growing digitization across the economy’s insurance industry is expected to drive industry growth. Several insurance companies are investing in strengthening their digital infrastructure and launching digital insurance platforms to enhance customer experiences. Credit insurers and sureties in the U.S. have been leading advocates for adopting cutting-edge technology and innovations, as they improve operational effectiveness and provide clients with an improved experience. Predictive analysis is an increasingly popular tool in the trade credit insurance industry, enabling insurers to assess risk and pricing more accurately for these insurance policies.

The introduction of blockchain technology in the insurance industry is another factor expected to advance this market. Blockchain technology is being leveraged to create secure and transparent ledgers of trade transactions, enabling insurers to assess risk more accurately and reducing the risk of disputes and non-payment. Moreover, electronic payment systems are being developed to facilitate faster and more secure payments between buyers and suppliers, reducing the risk of non-payment and improving business cash flow. Digital platforms are expected to enable businesses to purchase trade credit insurance online, simplifying the process and providing greater transparency and accessibility.

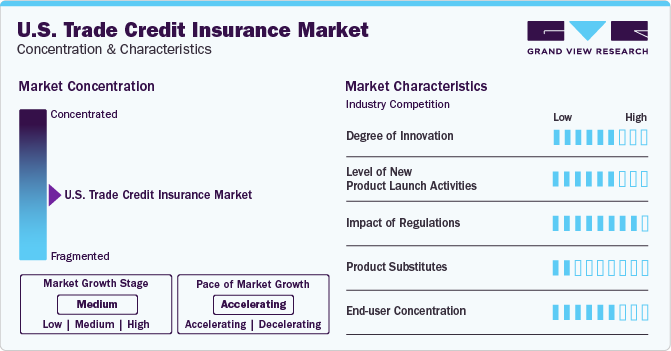

Market Concentration & Characteristics

The market growth stage is moderate, and pace of market growth is accelerating. The industry is expected to substantially expand through the integration of innovative technologies, such as the use of cloud-based credit solutions. For instance, Aon’s CreditHub ecosystem enables the development of cloud offerings to enable a business to establish automated connectivity with its selected insurers. The integration of AI has also empowered insurers to reduce human errors in the application process, as well as assess risks and detect fraudulent activities. This helps insurers in better understanding customer requirements and offering customized plans.

With the presence of several established companies in the U.S. market for trade credit insurance, there is a high level of strategic activities such as mergers & acquisitions, partnerships, and new product launches that help generate revenue. For instance, Aon plc partnered with PayPal Holdings, Inc. in May 2022, offering its CoverWallet solution for the PayPal Commerce Platform. This development is aimed at enabling small business customers of PayPal to purchase and manage insurance coverage according to their needs. Such initiatives are expected to drive industry expansion in the coming years.

The market is expected to be shaped by regulations concerning domestic and cross-border trade. Different cross-border laws and regulations discourage businesses in the U.S. from conducting trade with other countries. This can potentially hamper growth of the Export Credit Insurance (ECI) space, as it is dependent on international trade activities. Credit insurance companies need to consider various conflicting trade policies across different jurisdictions around the globe while designing and offering a policy to customers, which is expected to drive innovations in the industry. Furthermore, policymakers in the U.S. are prioritizing the promotion of stable and predictable trade policies to facilitate market growth and mitigate geopolitical risks that can otherwise limit coverage availability.

There is a moderate risk of substitutes in the market, with alternatives such as letters of credit and factoring invoices available for customers. However, they carry a higher risk that is not associated with trade credit insurance, with the latter offering protection during uncertain economic environments. Also, policyholders are able to pass on the costs to their customers, lowering the threat of substitutes in this industry.

The end-user base for trade credit insurance offerings is extensive, as businesses operating in various industries such as food & beverages, IT & telecom, healthcare, energy, and automotive require financial security during difficult periods. Businesses can confidently sell their products or services using this policy, knowing they are protected against the risk of non-payment. They can also receive prompt payment for their goods and services, which helps in improving their cash flow and reduces the need to carry large reserves or pursue costly collection efforts.

Coverage Insights

The whole turnover coverage segment accounted for the highest revenue share of 62.23% in the U.S. market for trade credit insurance in 2023. As a majority of companies in the country have a diverse set of customers, whole turnover coverage proves to be much more beneficial for them due to its cost-effectiveness and easier management when compared to insuring individual buyers. This insurance segment covers all or a significant part of trade credit receivables and protects every buyer from the risk of non-payment. It helps businesses in attracting new clients by enabling optimal extension of credit terms, while preventing cash flow disruptions, maintaining a healthy balance sheet, and lowering financial distress risks. Notable principal underwriters offering whole turnover insurance policies in the United States include Allianz Trade, Coface, AIG, and QBE Insurance.

The single buyer coverage segment is expected to contribute substantially to market expansion during the forecast period. Several credit insurers in the country provide single-buyer policies and excess-of-loss covers on a single buyer, in addition to conventional whole turnover insurance. Excess-of-loss policies have historically been the most common in the U.S.; there is a growing demand from large businesses that form captive insurance firms and purchase reinsurance from trade credit insurers for their highest-risk exposures. These rules can be tailored to the needs of large corporations with internal credit management departments.

Application Insights

The international segment held the dominant revenue share in the market in 2023. A large number of businesses in the U.S. conduct international operations through exports, which also increases the risk of non-payment by foreign buyers. Export credit insurance (ECI) offers protection to exporters in such situations by offering conditional assurance about payments in case the buyer is unable to pay. Coverage is provided for commercial risks such as bankruptcy or buyer insolvency, as well as political risks such as terrorism or wars. Besides these advantages, trade credit insurance in the international segment also helps improve customer relationships by understanding creditworthiness of buyers to negotiate better deals, while improving the balance sheet of the company and increasing its competitive strength.

On the other hand, the domestic segment is expected to advance at a faster growth rate through 2030. Domestic trade credit insurance protects a company from losses arising from non-payment by its domestic customers. Businesses across the country have a significant number of domestic buyers and partners; consequently, such types of insurance policies have become vital to cover the risk of non-payment by a buyer of goods or services sold on credit terms. Domestic trade credit insurance helps businesses protect themselves against a risk of bad debts and payment defaults. This insurance covers a range of risks, such as buyer insolvency, non-payment due to political or economic factors, and even fraud or disputes over quality or delivery of goods. By purchasing domestic trade credit insurance, a business can mitigate the financial risk associated with selling on credit terms and improve its cash flow.

End-use Insights

The food and beverage segment individually held the largest revenue share in the U.S. trade credit insurance market in 2023. There has been a noticeable increase in the number of food & beverage product manufacturers in the U.S.; however, this sector often involves a high degree of credit risk due to the involvement of perishable items and the reliance on a few large customers. Trade credit insurance for the food and beverage industry can offer protection from a range of issues, including non-payment due to the insolvency of buyers, payment delays, and disputes over the quality or delivery of goods. Businesses utilize these policies to improve their internal credit control functions, increase credit limits to improve profits, and offset negative impacts of inflation.

The automotive segment is expected to advance at the fastest CAGR during the forecast period. The U.S. is home to several major global automakers such as Ford, Tesla, and General Motors, making it a major contributor to the U.S. economy. However, the industry is susceptible to several types of business risks such as plant closings; exposure to catastrophic property losses from natural and man-made calamities; business interruptions; erratic product liability judgments; and supply chain disruptions. As a result, businesses require a comprehensive risk management plan that can offer an optimal balance between risk transfer and risk retention. This is a leading factor driving demand for trade credit insurance in the automotive sector.

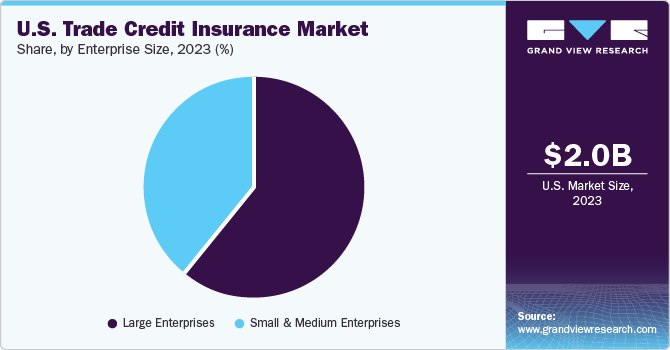

Enterprise Size Insights

The large enterprises segment accounted for a substantial revenue share in the market in 2023. The presence of several large national and multi-national organizations in the U.S. is expected to drive market growth, as trade credit insurance helps them in improving their credit management, introducing lines of credit, expanding sales markets, enhancing their balance sheet to increase shareholder value, and protecting cash flow. Additionally, these policies can be drafted as per business requirements, driving their adoption. For instance, Allianz Trade offers a bespoke solution named “Corporate Advantage” for large enterprises, offering benefits such as predictive trade insights, ongoing customer analysis, and efficient indemnification. The company offers solutions for multinational corporations also, such as “World Program”, “Excess of Loss”, and “Specialty Credit”, which help firms to expand their markets and ensure their profitability.

The small and medium enterprises segment is expected to witness the fastest growth rate from 2024 to 2030. There has been a steady rise in the number of SMEs across the United States in recent years. As per a U.S. Small Business Association report published in March 2023, there were over 33 million small businesses in the country and they accounted for around 45% of the GDP. However, the issue of late payments remains a major challenge for SMEs, as they can lead to a negative impact on the cash flow and revenue, as well as payroll delays. As a result, trade credit insurance has become a growing necessity in this space, protecting accounts receivables from losses due to unpaid commercial debts, ensuring that small-sized enterprises can maintain their operations in the long run.

Key U.S. Trade Credit Insurance Company Insights

The U.S. industry for trade credit insurance is fragmented in nature due to the presence of various established global and regional companies. These companies are focusing on launching advanced solutions, along with geographical expansions and partnerships, to establish their authority. Moreover, building reputation and customer relationships is vital in ensuring expansion of their customer base. Meanwhile, emerging companies are leaning towards technological innovations to attract more customers, which is expected to intensify competition among organizations.

In November 2021, Atradius N.V. expanded its trade insurance for digital platforms. This initiative has helped the company to address the rapidly rising demand for embedded insurance from B2B marketplaces. The company offers its Single Transaction Cover Insurance (STCI) to buyers in over 130 countries. In another development, in August 2023, Allianz Trade and Coface partnered with Flexport, a logistics platform, to help launch its trade credit insurance solution for the company’s American clients. Similar initiatives by other companies are helping advance the trade credit insurance market in the United States.

Key U.S. Trade Credit Insurance Companies:

- Allianz Trade

- Atradius N.V.

- Coface

- American International Group, Inc. (AIG)

- Zurich

- Chubb

- QBE Insurance Group Limited

- Great American Insurance Company

- Aon plc

- Marsh

Recent Developments

-

In March 2024, Allianz Trade introduced ‘Allianz Trade pay’, which offers services catering to the B2B e-commerce sector. Notable offerings of this payment solution include a partner-backed instant financing solution, a digital buyer onboarding offering, a comprehensive fraud risk management and mitigation system, and trade credit insurance during checkout. The e-commerce credit insurance feature would allow B2B e-merchants to lay down payment terms for their clients while protecting themselves from the risk of non-payment

-

In March 2023, the FCIA Trade Credit & Political Risk Division of Great American Insurance Company and Crum & Forster's Credit Division partnered with Navitas Assurance Partners, a specialty managing general underwriter, to offer trade credit insurance to businesses in the energy market in North America. The partnership would utilize the financial strength of these companies and their industry expertise to provide alternative assurance products to meet demands for alternative assurance solutions in this area

-

In January 2023, Coface announced the acquisition of Rel8ed, a data analytics boutique with offices in the U.S. and Canada. This acquisition is expected to benefit the trade credit insurance business of Coface, helping the company better serve its clients looking to monitor their credit and supply chain risks closely

-

In February 2022, QBE Insurance Group joined the United Nations-convened Net Zero Insurance Alliance. By being a part of this alliance, the company aims to collaborate with other organizations in the insurance sector to determine the methodology required to evaluate the carbon intensity of underwriting portfolios and establish intermediate goals set on a scientific basis

U.S. Trade Credit Insurance Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 4.07 billion

Growth rate

CAGR of 10.6% from 2024 to 2030

Historical data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Enterprise size, coverage, application, end-use

Country Scope

U.S.

Key companies profiled

Allianz Trade; Atradius N.V.; Coface; American International Group, Inc. (AIG); Zurich; Chubb; QBE Insurance Group Limited; Great American Insurance Company; Aon plc; Marsh

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Trade Credit Insurance Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. trade credit insurance market report based on enterprise size, coverage, application, and end-use.

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Coverage Outlook (Revenue, USD Million, 2017 - 2030)

-

Whole Turnover Coverage

-

Single Buyer Coverage

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Domestic

-

International

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Food & Beverage

-

IT & Telecom

-

Healthcare

-

Energy

-

Automotive

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. trade credit insurance market size was estimated at USD 2.02 billion in 2023 and is expected to reach USD 2,219.9 million in 2024.

b. The U.S. trade credit insurance market is expected to grow at a compound annual growth rate of 10.6% from 2024 to 2030 to reach USD 4.07 billion by 2030.

b. Some key players operating in the U.S. trade credit insurance market include Allianz Trade, Atradius N.V., Coface, American International Group, Inc. (AIG), Zurich, Chubb, QBE Insurance Group Limited, Great American Insurance Company, Aon plc, and Marsh.

b. Some key players operating in the U.S. trade credit insurance market include Allianz Trade, Atradius N.V., Coface, American International Group, Inc. (AIG), Zurich, Chubb, QBE Insurance Group Limited, Great American Insurance Company, Aon plc, and Marsh.

b. The rapidly advancing insurance sector in the country plays a significant role in driving growth of the trade credit insurance industry. Providers are increasingly offering trade credit insurance as a way to mitigate risks associated with extending credit to customers, which is harnessing the market’s growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."