- Home

- »

- Next Generation Technologies

- »

-

U.S. Travel Insurance Market Size, Industry Report, 2030GVR Report cover

![U.S. Travel Insurance Market Size, Share & Trends Report]()

U.S. Travel Insurance Market Size, Share & Trends Analysis Report By Insurance Coverage (Single-trip Travel Insurance, Annual Multi-trip Travel Insurance), By Distribution Channel, By End-user, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-252-4

- Number of Report Pages: 102

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

U.S. Travel Insurance Market Size & Trends

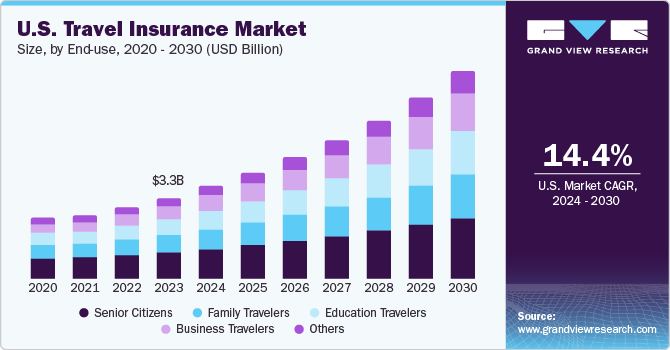

The U.S. travel insurance market size was valued at USD 3.31 billion in 2023 and is anticipated to grow at a CAGR of 14.4% from 2024 to 2030. A rising proclivity of the U.S. population to travel countrywide and abroad has been the main driver for market expansion. According to a recent study by Longwoods International, which specializes in travel & tourism research, 92% of the American travellers surveyed stated that they had made travel plans for the first half of 2024, a substantially higher number over the previous 12 months. However, travelling also carries a risk of unforeseen issues for consumers such as medical emergencies, trip interruptions due to poor weather, and lost or damaged luggage, making it important to buy a travel insurance so that costs for such scenarios are covered. Companies offering travel insurance are introducing plans with different coverage options so that consumers can select as per their budget and the trip, which has helped in boosting market revenue.

The U.S. accounted for a revenue share of 14.16% in the global travel insurance market in 2023. The increasing adoption of advanced technologies among insurance providers such as artificial intelligence, big data, blockchain, and robotic process automation has gained traction across the financial services sector in the country. The insurance industry is also focusing on adopting technologies such as cloud computing, the Internet of Things, and advanced analytics to improve customer experiences and provide tailored offerings. A significant focus among travel insurance providers in the United States has been on incorporating AI tools for updating insurance pricing models and improving business efficiency. Customers prefer having access to insurance products and services through various devices, such as smartphones, laptops, and personal computers, due to which companies are investing heavily to build omnichannel platforms.

The rapid emergence of the insurtech industry, which provides a vastly improved and streamlined customer experience, has opened up several opportunities for the market in the U.S. Established insurers in the country, along with venture capital firms, have increased their involvement in this segment, aiding growth of the travel insurance industry. In 2017, the National Association of Insurance Commissioners (NAIC) launched the Innovation and Technology Task Force to enable insurance regulators stay in touch with the latest market developments and ensure consumer safety. Such initiatives have led to increased customer confidence in insurance offerings, leading to market expansion.

The popularity of travel insurance has steadily increased in the United States; for instance, data from the U.S. Travel Insurance Association (UStiA) 2020-2022 report has shown that around USD 4.27 billion was spent by American citizens on different types of travel protection. These plans were generally purchased via travel agents, travel suppliers, internet aggregators, travel insurance providers, and insurance producers. During this period, approximately 77 million people got protection from more than 49.3 million plans, signifying a positive growth trend for this industry. The U.S. Department of State encourages travellers to buy travel insurance that provides emergency medical benefits, trip cancellation coverage, and coverage for stolen or lost luggage. This has been a major factor driving growth of the travel insurance market in the country.

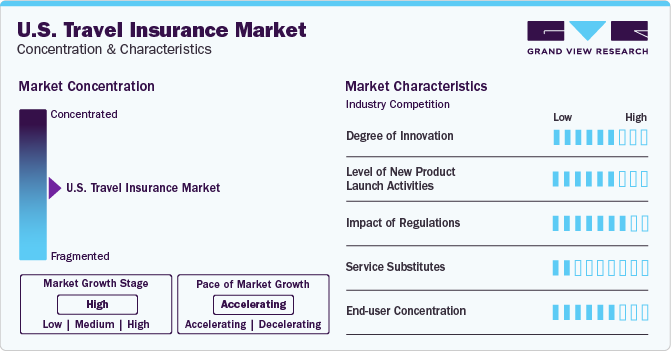

Market Concentration & Characteristics

The market growth stage is high, and pace of market growth is accelerating. Insurance companies are aiming to launch services that offer increased transparency to modern consumers, while also providing a convenient purchase experience. Conventional insurance policies come with significant drawbacks such as high prices and slow processing of claims that can prove to be very inconvenient for customers facing high losses. The implementation of artificial intelligence has increased the level of personalization in protection options so that customer requirements can be understood in real time, which proves beneficial for all parties involved. Additionally, machine learning models are being deployed to improve risk assessment of claims and predict chances of a loss through data analysis and pattern identification.

In recent years, there has been an increased rate of launch of new offerings by major insurance providers in the U.S., leading to intensifying competition in this space. For instance, in April 2022, USI Affinity, a subsidiary of the New York-based USI Insurance Services, launched the ‘Road Trip Insure’ travel protection plan through the company’s Travel Insurance Services division. This plan has been tailored to meet the demands of U.S. residents traveling internationally or domestically by vehicles. In another instance, in October 2021, Travel Insured International introduced the Cruise Trip Protector product, designed to address the needs of cruise customers with benefits such as optional cancel & trip cancellation for any reason.

The U.S. has a list of regulations aimed at enabling insurance providers to provide improved services to customers. Each state in the country has different regulations for sale of travel insurance. Although not mandatory, travel insurance is highly encouraged to ensure that travellers are well-protected in the event of a medical emergency, owing to the expensive healthcare and hospitalization bills in most developed countries. The Working Group appointed by the Property and Casualty (C) Committee in 2016 drafted a model law concerning the regulatory structure of travel insurance. This law is based on the National Conference of Insurance Legislators (NCOIL) Travel Insurance Model Act and has been adopted by 29 states in the country in one form or another, as of March 2023. Such developments are expected to shape the industry in the coming years.

There is a low risk of substitutes in the market since there is no direct and viable alternative for travel insurance. The U.S. government has taken several initiatives to promote travel insurance plans in the country, with insurance companies working on improving their portfolio through technological integrations.

There has been a steady growth in the number of end-users buying customized travel insurance policies to minimize the financial impact of any unforeseen situations. Companies are offering their services to a varied base of customers, including business travellers, education travellers, family travellers, and senior citizens, among others such as group travellers and individuals. Buyers focus on parameters such as pricing and what is covered under the plan, along with the kind of trip they are undertaking, before buying.

Distribution Channel Insights

The insurance companies segment accounted for the largest revenue share of 33.97% in the market in 2023. They operate by consolidation of risk among several policyholders, and the premiums are set as per the chances of occurrence of a specific incidence and the financial losses that can result from it. Insurance companies provide various insurance policies covering scenarios such as flooding, fire, theft, breakage, travel, death, and financial loss. Some companies mainly provide one type of insurance while others offer insurance in a variety of sectors. Examples of companies in the U.S. that specialize in travel insurance include AIG Travel, Seven Corners, HTH Travel Insurance, Travelex Insurance Services, Allianz Travel Insurance, and Generali Global Assistance.

On the other hand, the banks segment is expected to advance at the fastest CAGR through 2030. Leading banks in the country offer several travel insurance options, either through direct purchase or through their cards, to their clients and customers, which has led to strong market growth. For instance, American Express cards offer a range of benefits such as trip delay insurance, car rental loss & damage insurance, baggage insurance plans, and trip cancellation insurance. On the other hand, their separate medical insurance policy offers emergency health coverage for travellers. Bank of America, through its ‘Bank of America Premium Rewards’ credit card, offers several travel benefits such as emergency assistance and trip delay reimbursement. Thus, the well-established banking infrastructure is expected to augment segment growth.

End-user Insights

The senior citizens end-user segment held the largest revenue share in the U.S. travel insurance market in 2023. The rising population of people aged above 60 years in the country has presented an attractive and sizeable market for insurance providers. Senior citizen travel insurance policies cover emergency evacuation, repatriation of remains, hospital room and board, ambulance services, trip interruption or delays, loss of baggage or personal items, and accidental death. In addition, various products and services for senior travelers (average age from 65 to 80 and above for U.S. citizens) are offered by providers such as Seven Corners travel, Voyager Choice, Atlas Travel, and Globe Hopper Senior.

The business travelers segment is expected to expand at the highest growth rate during the forecast period. Travel insurance policies for business travelers mainly cover company employees who regularly travel for business meetings, special events, and other work-related tasks. In the United States, there has been a significant growth in the number of working professionals, owing to high rate of commercialization and industrialization. As a result, there is a large population that generally travels across the U.S. and abroad, highlighting the need for travel insurance options. The cost of travel insurance for business traveler plans varies based on the location and cost of each trip, but most travel insurances cost 5% nearly of the total trip cost. However, some destinations that need additional costs for medical care and evacuation can make the insurance plan more expensive.

Insurance Coverage Insights

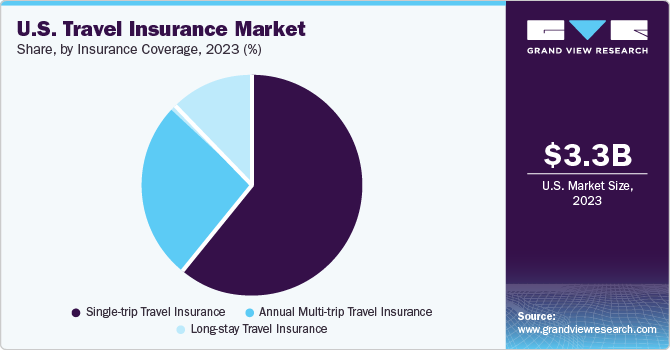

In terms of insurance coverage, single-trip travel insurance accounted for the largest revenue share in 2023. The high popularity of these insurance policies can be attributed to their comprehensive coverage of a short trip or a one-off holiday plan. Single-trip travel insurance policies protect against unforeseen circumstances, such as holiday or accommodation cancellation, loss of belongings, baggage, passport, money, documents, delayed departures, personal accidents, and medical and hospital expenses. In most cases, there is no upper age limit to opt for a single-trip insurance policy, and several insurance service providers, banks, and intermediaries provide cost-efficient single-trip travel insurance with 24/7 assistance in the United States.

The annual multi-trip travel insurance segment is expected to contribute significantly to market growth. The availability of various multi-trip travel insurance plans, including travel medical plans, emergency evacuation plans, and accidental death plans, is driving segment growth. Annual multi-trip insurance policies cover instances/expenses such as trip cancellations, over a hundred sports and activities, emergency dental treatment, loss of personal belongings and baggage, money, passport, travel documents, accommodation expenses, and legal expenses. Travel insurance players are innovating and updating policies to enhance the offerings of their multi-trip travel insurance plans to standout from competitors and serve customers better.

Key U.S. Travel Insurance Company Insights

There are several international firms offering advanced travel insurance options in the United States, along with various regional competitors. These companies are focusing mainly on strategic collaborations and integrating newer technologies such as machine learning and AI to improve decision-making and convenience for customers. Fintech companies are being increasingly preferred over conventional insurance companies due to their ability to offer cost-effective and embedded insurance products and their increasing collaborations with travel companies, which is expected to drive future market growth.

The launch of new plans and services, as well as mergers & acquisitions, have helped in boosting market expansion in the country. For instance, in April 2022, USI Insurance Services, LLC announced the acquisition of Benefits 7, Inc., an employee benefits advisory and brokerage firm based in Indiana, thus strengthening its ability to help employers optimize plans by leveraging its expertise and industry-leading solutions. In another development, in June 2021, Travel Insured International announced the launch of the Annual Multi-Trip Protector travel protection plan. This plan features medical expense coverage capped at USD 100,000 per trip along with travel inconvenience benefits.

Key U.S. Travel Insurance Companies:

- Allianz

- American International Group, Inc.

- AXA

- USI Insurance Services, LLC

- battleface

- Seven Corners Inc.

- Travel Insured International

- Zurich

- Delphi Financial Group, Inc.

- Nationwide Mutual Insurance Company

Recent Developments

-

In February 2024, Seven Corners announced that its travel insurance plans would be made available through TravelInsurance.com, a leading marketplace for comparing travel insurances. Travelinsurance.com provides a convenient way for travellers to compare and buy insurance products and services online from leading global travel insurers.

-

In October 2023, Travel Insured International announced that it would be collaborating with Robin Assist, a tech-based platform for emergency travel assistance. The partnership aims to offer responsive customer services, emergency medical and travel assistance, as well as claims to insured customers anywhere and anytime from any device. The platform would offer customers of Travel Insured with services such as all-day multi-lingual customer support, locating medical facilities, and emergency evacuation & travel assistance, among others.

-

In September 2023, battleface and CELITECH announced a strategic collaboration, wherein battleface would offer the latter’s eSIMs to its customers. As per the partnership, travellers would be able to remotely install these eSIMs using a QR code and access internet services anywhere across the globe. Moreover, users would also be able to gain real-time information regarding medical facilities along with local services during crisis or emergency situations.

-

In December 2022, Nationwide Mutual Insurance Company entered into a partnership with RetireOne, which is a platform that provides fee-based insurance solutions. The partnership intends to expand the distribution network of Nationwide Mutual Insurance Company’s insurance advisory annuity offerings, enabling a wider reach across the United States.

U.S. Travel Insurance Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 8.49 billion

Growth rate

CAGR of 14.4% from 2024 to 2030

Historical data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Insurance coverage, distribution channel, end-user

Key companies profiled

Allianz; American International Group, Inc.; AXA; USI Insurance Services, LLC; battleface; Seven Corners Inc.; Travel Insured International; Zurich; Delphi Financial Group, Inc.; Nationwide Mutual Insurance Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Travel Insurance Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. travel insurance market report based on insurance coverage, distribution channel, and end-user:

-

Insurance Coverage Outlook (Revenue, USD Million, 2017 - 2030)

-

Single-trip Travel Insurance

-

Annual Multi-trip Travel Insurance

-

Long-stay Travel Insurance

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Insurance Intermediaries

-

Insurance Companies

-

Banks

-

Insurance Brokers

-

Insurance Aggregators

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Education Travelers

-

Business Travelers

-

Senior Citizens

-

Family Travelers

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. travel insurance market size was estimated at USD 3.31 billion in 2023 and is expected to reach USD 3,796.8 million in 2024.

b. The U.S. travel insurance market is expected to grow at a compound annual growth rate of 14.4% from 2024 to 2030 to reach USD 8.49 billion by 2030.

b. The single-trip travel insurance segment dominated the market in 2023. The growth of the segment can be attributed to the fact that consumers are opting for travel insurance to be covered from unforeseen events during their trips such as loss of baggage, emergency dental treatment costs, fire, trip interruption or cancellation, missed flight connection, and many more such events.

b. Some key players operating in the U.S. travel insurance market include American International Group, Inc.; USI Insurance Services, LLC; Seven Corners Inc.; Travel Insured International; and Delphi Financial Group, Inc. among others.

b. Factors such as the rising demand for tourism and technological development are driving the demand for the travel insurance market. Additionally, the increasing travel laws and regulations by the government for travelers and travel insurance providers are harnessing travel insurance market’s growth in U.S.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."