- Home

- »

- Renewable Energy

- »

-

U.S. Ultra-Thin Solar Cells Market, Industry Report, 2033GVR Report cover

![U.S. Ultra-Thin Solar Cells Market Size, Share & Trends Report]()

U.S. Ultra-Thin Solar Cells Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Cadmium Telluride, Copper Indium Gallium Selenide, Perovskite Solar Cell, Organic Photovoltaic), By End Use (Residential, Commercial), And Segment Forecasts

- Report ID: GVR-4-68040-630-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

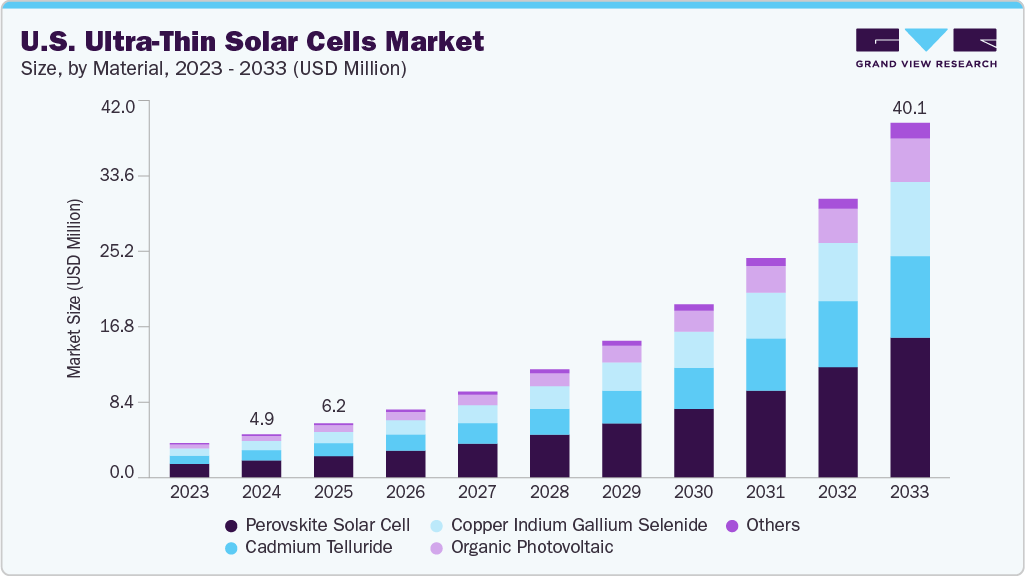

The U.S. ultra-thin solar cells market size was estimated at USD 4.91 million in 2024 and is projected to reach USD 40.11 million by 2033, growing at a CAGR of 26.42% from 2025 to 2033.In the U.S., ultra-thin solar cells are gaining traction as a lightweight and flexible photovoltaic solution, particularly suited for portable power sources, next-gen consumer electronics, and building-integrated solar applications.

Key Market Trends & Insights

- By materials, the perovskite solar cell segment held the highest market share of 39.88% in 2024.

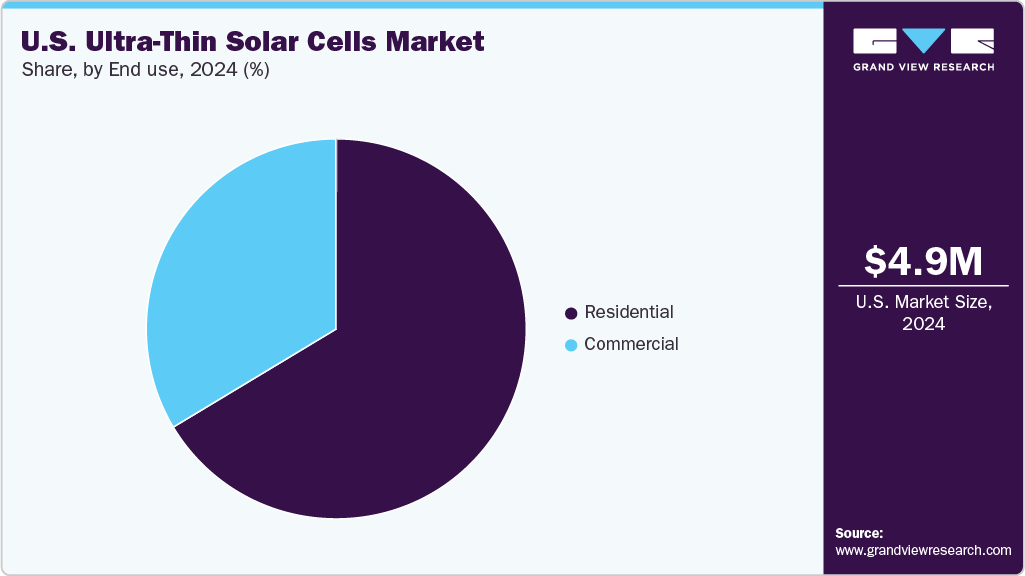

- Based on End use, the commercial segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.91 Million

- 2033 Projected Market Size: USD 40.11 Million

- CAGR (2025-2033): 26.42%

These cells offer significant design versatility and material efficiency advantages, making them ideal for curved surfaces and constrained environments. Strong federal and state-level incentives for solar adoption and increased investment in R&D by U.S.-based manufacturers and startups drive market growth. The rising demand for sustainable energy solutions in defense, aerospace, and smart infrastructure supports adoption. In addition, innovation hubs in California, Texas, and Massachusetts are fostering advancements in perovskite and organic photovoltaic materials, reinforcing the U.S. as a key player in the global ultra-thin solar technology landscape.

In the United States, ultra-thin solar cells are increasingly utilized in applications demanding lightweight construction, flexibility, and minimal spatial footprint. While traditional silicon-based panels dominate utility-scale installations, ultra-thin variants enable novel uses across consumer electronics, portable military systems, and BIPV solutions in urban infrastructure. Their adaptability to curved and non-traditional surfaces, including windows, facades, and fabrics, makes them a strategic fit for next-generation smart cities and defense technologies.

The combination of strong federal tax incentives, decarbonization mandates, and growing investments in distributed solar technologies creates a favorable environment for widespread adoption across public and private sectors.

Drivers, Opportunities & Restraints

The U.S. ultra-thin solar cells market is driven by rising demand for compact, lightweight, and adaptable photovoltaic technologies, particularly in defense, aerospace, and consumer electronics. Government backed initiatives such as the Inflation Reduction Act and state level solar incentives bolster investment in advanced solar technologies. The growing emphasis on energy independence and carbon reduction goals also encourages innovation in thin-film and ultra-thin PV applications for urban infrastructure and smart mobility solutions.

Opportunities are emerging through advancements in perovskite and organic solar cell materials, which promise improved efficiency and durability in variable U.S. climates. Integrating ultra-thin solar cells into electric vehicles, IoT-connected devices, and BIPV systems will unlock new commercial pathways. However, adoption is challenged by cost barriers associated with R&D and pilot-scale manufacturing, as well as competition from mature silicon based solar panels. Concerns around long-term performance, especially in humid or harsh environments, and a fragmented regulatory landscape across states also constrain widespread deployment.

Material Insights

The perovskite solar cell sub-segment dominated the U.S. ultra-thin solar cells market in 2024, accounting for a revenue share of over 39.88%, and is expected to register the fastest growth over the forecast period. As the U.S. shifts toward lightweight and flexible solar technologies, perovskites have gained traction for their high efficiency, tunable properties, and compatibility with emerging device formats. Research institutions and startups across California, Massachusetts, and New York spearhead commercialization efforts, supported by federal grants and Department of Energy (DOE) innovation programs targeting next-generation photovoltaics.

Perovskite materials allow for producing ultra-thin, low-cost solar cells using scalable roll-to-roll manufacturing, aligning with U.S. goals for domestic clean energy supply chains. Their superior light absorption and adaptability to flexible substrates make them ideal for BIPV, defense tech, portable power sources, and disaster relief applications. Continued R&D to improve moisture resistance and operational stability will unlock further commercial viability. As climate policy accelerates investment in decentralized and mobile solar technologies, perovskite-based ultra-thin solar cells are poised to play a pivotal role in the future of distributed clean energy in the U.S.

End Use Insights

The commercial segment accounted for the largest revenue share of approximately 66.37% in the U.S. ultra-thin solar cells market in 2024. Demand is driven by businesses seeking lightweight, space-efficient solar solutions for retrofitting and new construction projects. Ultra-thin solar cells are increasingly integrated into building facades, glass windows, and rooftops of commercial establishments such as office complexes, retail centers, educational campuses, and hospitality venues through Building-Integrated Photovoltaics (BIPV). Their ability to blend with architectural designs while contributing to LEED and other sustainability certifications makes them particularly attractive in dense urban markets such as New York City, Los Angeles, and Chicago.

Strong federal and state-level solar incentives, such as investment tax credits and net metering policies, continue supporting commercial adoption. Although some concerns persist around long-term durability and efficiency trade-offs compared to traditional panels, their lightweight structure and ease of installation make ultra-thin solar cells ideal for buildings with load-bearing constraints or complex surfaces. The industrial segment comprising warehouses, logistics hubs, and manufacturing facilities also see growing interest due to rising electricity costs and the push for carbon neutrality. These facilities leverage ultra-thin solar panels for supplemental or backup power, especially in remote or grid-constrained locations.

Key U.S. Ultra-Thin Solar Cells Companies Insights

Some of the key players operating in the U.S. ultra-thin solar cells market include First Solar, Inc., Mitsubishi Electric Corporation, Ascent Solar Technologies, Inc., and Canadian Solar Inc., among others. These companies invest in research and development to enhance cell efficiency, durability, and flexibility.

Key U.S. Ultra-Thin Solar Cells Companies:

- First Solar, Inc.

- Ascent Solar Technologies, Inc.

- PowerFilm, Inc.

- Solar Frontier K.K.

- Kaneka Corporation

- Canadian Solar Inc.

- Mitsubishi Electric Corporation

- Hanwha Qcells

- Canadian Solar Inc.

- Trina Solar Limited

Recent Developments

- In March 2025, Ascent Solar Technologies, Inc. announced the scaling up of its Thornton, Colorado facility to expand production of flexible CIGS-based ultra-thin solar modules. The upgrade focuses on meeting rising demand for lightweight, high-performance solar solutions across aerospace, defense, and off-grid residential applications. This move aligns with the growing U.S. shift toward advanced solar technologies that support portable power, building integration, and energy resilience in remote and mobile environments.

U.S. Ultra-Thin Solar Cells Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.15 million

Revenue forecast in 2033

USD 40.11 million

Growth rate

CAGR of 26.42% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, end use, region

Country scope

U.S.

Key companies profiled

First Solar, Inc.; Ascent Solar Technologies, Inc.; PowerFilm, Inc.; Solar Frontier K.K.; Kaneka Corporation; Canadian Solar Inc.; Mitsubishi Electric Corporation; Hanwha Qcells; Canadian Solar Inc.; Trina Solar Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Ultra-Thin Solar Cells Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the U.S. ultra-thin solar cells market report on the basis of material, end use, and region.

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Cadmium Telluride

-

Copper Indium Gallium Selenide

-

Perovskite Solar Cell

-

Organic Photovoltaic

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Frequently Asked Questions About This Report

b. The U.S. ultra-thin solar cells market size was estimated at USD 4.91 million in 2024 and is expected to reach USD 6.15 million in 2025.

b. The U.S. ultra-thin solar cells market is expected to grow at a compound annual growth rate of 27.41%from 2025 to 2033 to reach USD 40.11 million by 2033.

b. Based on the material segment, Perovskite Solar Cells held the largest revenue share of more than 39.88% in 2024 owing to their superior power conversion efficiency, low manufacturing cost, and flexibility, making them highly suitable for next-generation solar technologies and portable energy solutions.

b. Some of the key players in the U.S. ultra-thin solar cells market include Mitsubishi Electric Corporation, First Solar, Ascent Solar Technologies, and Hanwha Qcells, among others.

b. The key factors driving the Ultra-Thin Solar Cells market include the rising demand for lightweight, flexible, and high-efficiency solar technologies. These cells support a wide range of applications, from portable electronics to building-integrated photovoltaics, making them ideal for accelerating the U.S. shift toward sustainable and decentralized energy solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.