- Home

- »

- Medical Devices

- »

-

U.S. Ventral Hernia Mesh Devices Market Size Report, 2030GVR Report cover

![U.S. Ventral Hernia Mesh Devices Market Size, Share & Trends Report]()

U.S. Ventral Hernia Mesh Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Mesh Type (Resorbable, Partially Absorbable), By Indication (Umbilical Hernia, Epigastric Hernia), By Procedure, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-575-6

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

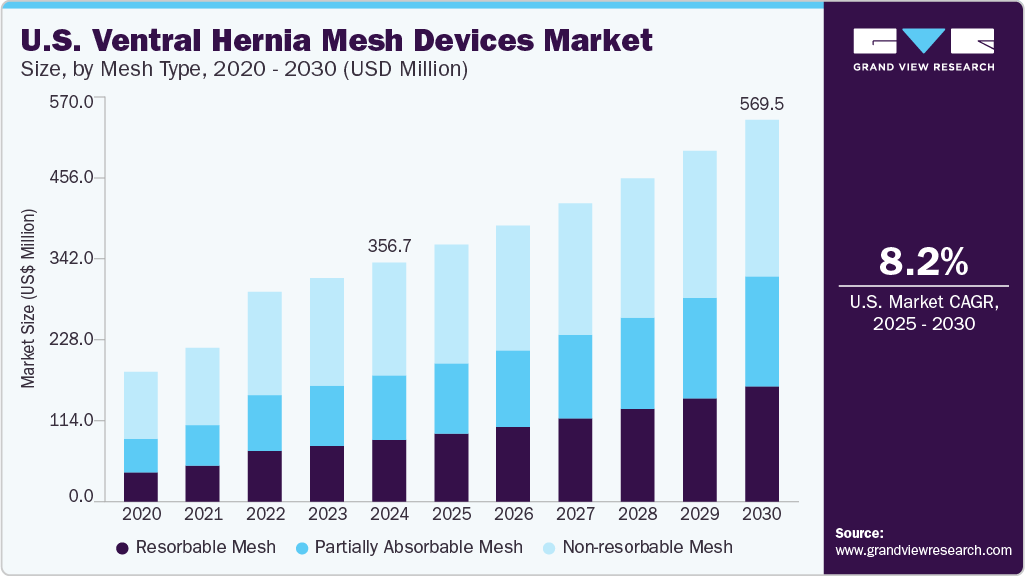

The U.S. ventral hernia mesh devices market size was estimated at USD 356.7 million in 2024 and is projected to grow at a CAGR of 8.27% from 2025 to 2030. The increasing cases of hernias, technological advancements in mesh repair, a shift towards preventive healthcare, growing preference for minimally invasive procedures, and a growing healthcare infrastructure are the factors affecting market growth. According to the U.S. FDA, over a million hernia repair procedures are performed annually in the U.S.

Hernia repair is one of the most common surgical procedures worldwide. The incidence of hernia is higher in men than in women. According to the International Journal of Surgery, approximately 300,000 ventral hernia repairs are performed annually. Among these, 75% are primary ventral hernia repairs (mainly epigastric and umbilical) and 25% are incisional hernia repairs. Furthermore, incisional hernias are common in nearly 10-30% of patients in the U.S. who undergo midline laparotomies. The annual costs for hernia repairs are estimated at approximately USD 3.2 billion. This is viewed as a major healthcare challenge for patients and a significant financial hurdle for the U.S. healthcare system.

The presence of favorable reimbursement scenarios for hernia mesh devices is encouraging patients to opt for surgery. The government and industry players provide patients with easy access to detailed reimbursement codes and ratios. The codes are granulated into types of hernias (primary or recurrent) and surgery methods (open or laparoscopic).

Technological advancements in hernia mesh devices have significantly improved patient outcomes and reduced complications. One notable innovation is the development of lightweight and composite meshes. These meshes, such as Parietex Composite Mesh, combine absorbable and nonabsorbable materials, providing strength while reducing postoperative discomfort and the risk of chronic pain. These advancements include innovations like Deep Blue Medical Advances, Inc.’s advanced mesh technology. In 2024, the company launched a smaller version of the T-Line Mesh, known as the T-Line Mini, tailored for umbilical hernias and small defects. Moreover, the T-Line Hernia Mesh's coated and biosynthetic composite versions are developing. The company states that:

“For hernia surgeries, there is a growing trend to use biosynthetic meshes, which are made of polymers that will get absorbed into the body over time. We are also working on a coated composite T-Line Hernia Mesh designed to stop adhesions, which can be problematic if the mesh is placed inside the abdomen. One example of where this is particularly true is for breast reconstruction performed after cancer or for cosmetic reasons, and we are developing the T-Line Scaffold for Breast Surgery to meet this need. So now, the T-Line has moved from one product that proves the principles of solving this soft tissue failure mode to a soft tissue surgery platform with several applications.”

High treatment costs in the hernia mesh devices market are a significant concern, with robotic hernia surgery being a major contributor. While offering precision and minimally invasive benefits, robotic surgeries involve expensive equipment, training, and maintenance, which increase overall treatment expenses. These costs can limit patients' access to advanced surgical options and strain healthcare budgets.

Cost of Hernia Surgeries in Outpatient Centers and Surgery Centers (USD), by U.S. state

U.S. States

Outpatient Centers Cost (USD)

Surgery Centers Cost (USD)

Alabama

7,274

5,067

Arizona

8,232

5,734

California

9,034

6,293

Delaware

8,455

5,889

Georgia

7,487

5,215

Illinois

8,350

5,817

Massachusetts

8,923

6,215

Michigan

8,219

5,725

Minnesota

9,251

6,444

New York

8,980

6,255

Texas

7,801

5,434

Washington

8,660

6,032

Source: Sidebar Health, GVR Analysis

Furthermore, favorable reimbursement policies for hernia repair procedures are expected to positively impact the growth of the hernia mesh devices market. The Centers for Medicare and Medicaid Services provide Current Procedural Terminology (CPT) codes for various hernia repair surgical procedures, depending on hernia type and medical facility. The availability of reimbursement for several hernia repair procedures is anticipated to increase the adoption of hernia repair devices, thereby driving market growth.

Several CPT codes for hernia repair that describe applicable techniques are mentioned below:

Surgeon Code

Procedure

National Average Medicare Payment

49560

Repair initial incisional or ventral hernia; reducible

USD 768

49561

Repair initial incisional or ventral hernia; incarcerated or strangulated

USD 968

49565

Repair recurrent incisional or ventral hernia; reducible

USD 799

49566

Repair recurrent incisional or ventral hernia; incarcerated or strangulated.

USD 977

49568

Implantation of mesh or other prosthesis for open incisional or ventral hernia repair

USD 279

Source: American College of Surgeons

Market Concentration & Characteristics

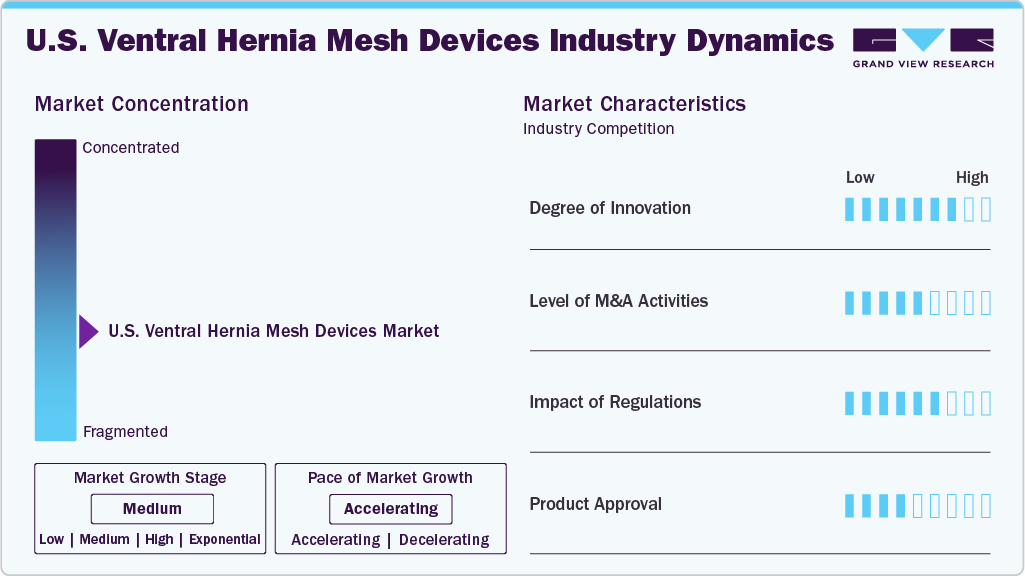

The U.S. ventral hernia mesh devices industry exhibits moderate industry concentration, with several key players dominating the market. Initiatives to raise awareness and knowledge about hernia cases and early diagnosis further stimulate market growth.

The U.S. ventral hernia mesh devices industry is characterized by high innovation. Advancements primarily focus on developing biologic and hybrid mesh materials that improve biocompatibility, reduce infection rates, and promote better tissue integration. Key players have also invested in proprietary composite meshes that combine synthetic and absorbable layers, addressing challenges like adhesion and recurrence. Furthermore, innovations in 3D-printed, patient-specific meshes and antimicrobial coatings are gaining interest, especially for complex or high-risk hernia cases.

Regulatory frameworks significantly influence the U.S. ventral hernia mesh devices industry, as most regions classify these products as medical devices. Compliance with regulatory requirements, such as US FDA guidelines or EU CE marking, is imperative for market entry and consumer trust. These regulations govern various aspects, including mesh design, manufacturing processes, and post-market surveillance, influencing product development timelines and market access. Evolving regulatory landscapes necessitate continuous monitoring and adaptation by industry players to ensure compliance and navigate market dynamics effectively.

Mergers and acquisitions in the U.S. ventral hernia mesh devices industry are rising due to the need for research and development, reflecting the industry's dynamic nature. Companies engage in mergers and acquisitions to expand their product portfolio, enter new markets, acquire cutting-edge technologies, and achieve economies of scale. Certain key players focus on acquiring smaller companies to strengthen their positions in the soft tissue repair segment. For instance, in February 2024, RTI Surgical, Inc. acquired Cook Group Incorporated, strengthening its position in the surgical and regenerative medicine markets. This move allowed RTI to expand its portfolio of biologic and synthetic products, particularly in hernia repair and wound management, thereby enhancing its ability to provide innovative solutions for surgical procedures.

The U.S. ventral hernia mesh devices industry faces competition from traditional and emerging imaging methods. There is a rise in suture-only repairs in low-risk or small hernia cases, biologic meshes derived from human or animal tissues, and newer absorbable synthetic meshes. The growing popularity of robotic-assisted surgery also influences the choice of mesh, with some platforms promoting meshless techniques in select patient populations. However, the effectiveness of these alternatives varies, and recurrence rates are typically higher in non-mesh repairs.

Mesh Type Insights

The non-resorbable mesh segment accounted for the largest market share of 47.20% in 2024. Factors such as demonstrated clinical effectiveness, cost efficiency, and strong acceptance by surgeons influence market growth. For instance, more than 90% of ventral hernia repairs in the U.S. utilize synthetic mesh, highlighting its leading role in the field. In addition, surgeons favor non-resorbable mesh for its adaptability to different hernia sizes, suitability for minimally invasive procedures, and proven safety track record.

The resorbable mesh segment is expected to grow at the fastest CAGR of 11.15% over the forecast period. This growth is attributed to increasing clinical preference for materials that minimize long-term foreign body presence and reduce the risk of chronic complications. Surgeons are increasingly adopting these meshes, especially in high-risk or contaminated cases, due to their ability to provide temporary mechanical support while gradually being absorbed by the body, facilitating natural tissue regeneration. Advances in resorbable polymer technologies, improved clinical outcomes, and the growing demand for mesh alternatives in patients concerned about permanent implants further support the market momentum.

Indication Insights

The incisional hernia segment accounted for the largest share of 43.40% in 2024. Incisional hernia is the second most common type of hernia after inguinal hernia. The factors attributed to the growth of the market include high incidence following abdominal surgeries, an aging population and comorbidities, high recurrence rates without mesh, and standardization of mesh use in clinical guidelines. According to Elsevier Ltd. data published in November 2023, a high body mass index (BMI) and a history of abdominal aortic aneurysm (AAA) are associated with up to a 40% increased risk of developing an incisional hernia. Incisional hernia recurrence rates can reach 52%, but using mesh, especially laparoscopically, can reduce it to as low as 3.4%, making mesh the preferred treatment approach.

The umbilical hernia segment is expected to grow significantly over the forecast period. An umbilical hernia is where abdominal contents, such as fat or intestine, protrude through a weak spot in the abdominal wall near the belly button (umbilicus). These hernias are not common, resulting in a lesser number of repairs performed for the treatment of umbilical hernias. Increasing intra-abdominal pressure due to factors such as obesity, pregnancy, heavy lifting, or persistent coughing is driving the market. These factors weaken abdominal muscles and strain the tissues around the belly button, leading to the protrusion of abdominal contents through a weakened spot or opening.

Procedure Insights

The open surgery segment held the largest share of 40.10% in 2024. This significant portion arises from factors like its effectiveness for dealing with complex, large, or recurring hernias that necessitate extensive dissection and careful mesh placement-situations where minimally invasive approaches might not suffice. Furthermore, the common knowledge of general surgeons regarding open repair, particularly in community and rural hospitals, bolsters its ongoing use. Open surgery is also easier to access, requires less specialized equipment, and often leads to lower procedural costs, making it a feasible option in various healthcare environments. Collectively, these aspects maintain open surgery as the predominant market segment.

The robotic surgery segment is expected to grow significantly over the forecast period. This growth is driven by its precision, improved ergonomics, and enhanced visualization, which enable more controlled and complex hernia repairs. Surgeons benefit from better access to difficult anatomical planes and the ability to perform advanced suturing and mesh placement with reduced strain, especially in abdominal wall reconstruction. Patients often experience less postoperative pain, fewer complications, and shorter hospital stays than with open surgery, boosting adoption. Hospitals and surgical centers increasingly invest in robotic platforms to stay competitive and meet patient demand for minimally invasive options. For instance, in July 2024, Memorial Healthcare System expanded its robotic surgery program by acquiring seven advanced Intuitive da Vinci Xi systems across five hospitals, resulting in a 22% increase in robotic procedures, including hernia repairs.

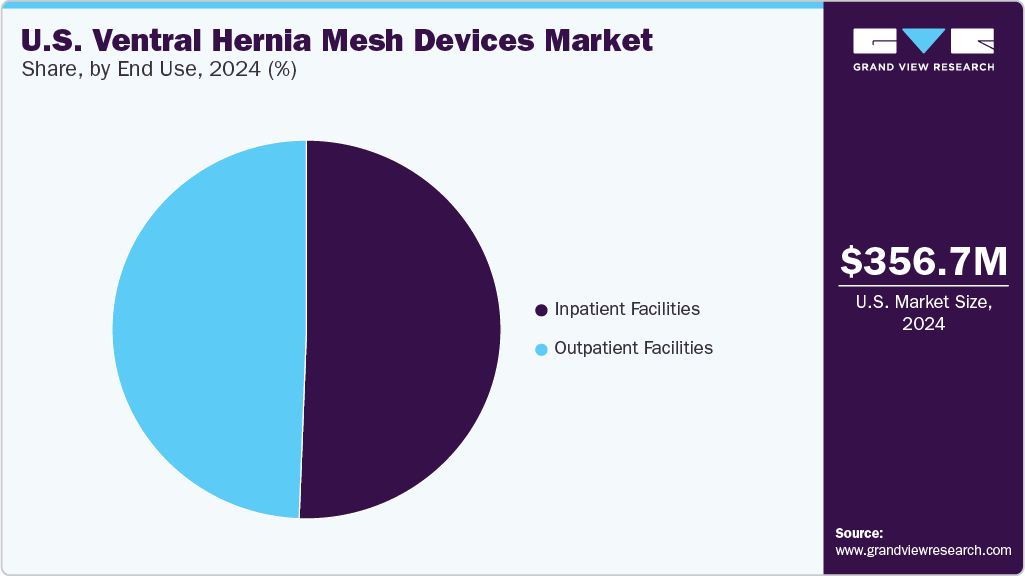

End Use Insights

The inpatient facilities segment held the largest share of 50.61% in 2024. Inpatient facilities such as hospitals and clinics play a pivotal role in the market, serving as primary settings for hernia repair surgeries. They drive demand for hernia mesh products and influence market trends by adopting advanced surgical techniques and technologies. Hospitals and clinics also contribute to market growth by participating in clinical trials and research studies, fostering innovation in hernia mesh technology. For instance, according to Springer Nature data published in April 2024, the FDA collaborates with hospitals through programs such as MedSun and the Medical Device Innovation Consortium (MDIC) to enhance post-market surveillance of hernia mesh devices.

The outpatient facilities market is expected to grow significantly during the forecast period. Outpatient facilities include ambulatory surgical centers that provide same-day surgical care, including diagnostic and preventive procedures. They are becoming popular for their cost-effectiveness, convenience, and reduced infection risk compared to traditional hospitals. Companies such as Medtronic support ASCs by providing advanced surgical technologies and comprehensive solutions tailored for outpatient settings. Medtronic offers a range of hernia repair products, including high-quality mesh and fixation devices, designed for minimally invasive procedures. The company also provides clinical education, training programs, and technical support to ensure the effective use of its products. In addition, Medtronic assists ASCs in workflow optimization, regulatory compliance, and operational efficiencies, helping them deliver safe, cost-effective, & high-quality care to patients.

Key U.S. Ventral Hernia Mesh Devices Company Insights

The market is highly competitive. Key players such as Medtronic plc, Ethicon Inc., Becton, Dickinson and Company, Novus Scientific AB, and B. Braun SE hold significant positions. Leading companies are pursuing a mix of organic and inorganic strategies, including new product development, partnerships, acquisitions, mergers, and regional growth, to address their customers' unmet demands.

Key U.S. Ventral Hernia Mesh Devices Companies:

- Medtronic plc

- Becton, Dickinson and Company

- Ethicon Inc. (Johnson & Johnson MedTech)

- Meril Life Sciences Pvt. Ltd.

- Novus Scientific AB

- B. Braun SE

- TELA Bio, Inc.

- BG Medical LLC

- Integra LifeSciences Corporation

- W. L. Gore & Associates, Inc.

- Atrium Medical

Recent Developments

-

In April 2025, BD (Becton, Dickinson and Company) secured FDA 510(k) clearance and introduced the Phasix ST Umbilical Hernia Patch, a fully absorbable mesh tailored for umbilical hernia repair.

-

In February 2024, RTI Surgical, Inc. acquired Cook Group Incorporated, strengthening its position in the surgical and regenerative medicine markets. This move allowed RTI to expand its portfolio of biologic and synthetic products, particularly in hernia repair and wound management, thereby enhancing its ability to provide innovative solutions for surgical procedures.

-

In June 2023, Advanced Medical Solutions Limited received FDA approval for its LiquiFix FIX8 and Precision Hernia Mesh Fixation Devices. These devices utilize a liquid adhesive to secure mesh during laparoscopic and open hernia surgeries, offering broader fixation points and potentially reducing pain compared to traditional tacks.

U.S. Ventral Hernia Mesh Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 382.8 million

Revenue forecast in 2030

USD 569.5 million

Growth rate

CAGR of 8.27% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Mesh type, indication, procedure, end use

Country scope

U.S.

Key companies profiled

Medtronic plc; Becton, Dickinson and Company; Ethicon Inc. (Johnson & Johnson MedTech); Meril Life Sciences Pvt. Ltd.; Novus Scientific AB; B. Braun SE; TELA Bio, Inc.; BG Medical LLC; Integra LifeSciences Corporation; W. L. Gore & Associates, Inc.; Atrium Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Ventral Hernia Mesh Devices Market Report Segmentation

This report forecasts country-level revenue growth and analyzes the latest industry trends and opportunities in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. ventral hernia mesh devices market report based on mesh type, indication, procedure, and end use:

-

Mesh Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Resorbable Mesh

-

Partially Absorbable Mesh

-

Non-resorbable Mesh

-

-

Indication Outlook (Revenue, USD Million 2018 - 2030)

-

Umbilical Hernia

-

Epigastric Hernia

-

Incisional Hernia

-

Others

-

-

Procedure Outlook (Revenue, USD Million 2018 - 2030)

-

Open Surgery

-

Laparoscopic Surgery

-

Robotic Surgery

-

Others

-

-

End Use Outlook (Revenue, USD Million 2018 - 2030)

-

Inpatient Facilities

-

Outpatient Facilities

-

Frequently Asked Questions About This Report

b. The U.S. ventral hernia mesh devices market size was estimated at USD 356.7 million in 2024 and is expected to reach USD 382.8 million in 2025.

b. The U.S. ventral hernia mesh devices market is expected to grow at a compound annual growth rate of 8.27% from 2025 to 2030, reaching USD 569.5 million by 2030.

b. The non-resorbable mesh segment dominated the U.S. ventral hernia mesh devices market, with a revenue share of 47.2% in 2024.

b. Some key players operating in the U.S. ventral hernia mesh devices market include Medtronic plc, Becton, Dickinson and Company, Ethicon Inc. (Johnson & Johnson MedTech), Meril Life Sciences Pvt. Ltd., Novus Scientific AB, B. Braun SE, TELA Bio, Inc., BG Medical LLC, Integra LifeSciences Corporation, W. L. Gore & Associates, Inc., Atrium Medical

b. Key factors that are driving the U.S. ventral hernia mesh devices market growth include the increasing cases of hernias, technological advancements in mesh repair, a shift towards preventive healthcare, and a growing preference for minimally invasive procedures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.