- Home

- »

- Medical Devices

- »

-

U.S. Ventricular Assist Devices Market, Industry Report 2030GVR Report cover

![U.S. Ventricular Assist Devices Market Size, Share & Trends Report]()

U.S. Ventricular Assist Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Bi-Ventricular Assist Device, Total Artificial Heart), By Type Of Flow, By Application (Bridge To Transplant, Destination Therapy), By Design, And Segment Forecasts

- Report ID: GVR-4-68040-226-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. VADs Market Size & Trends

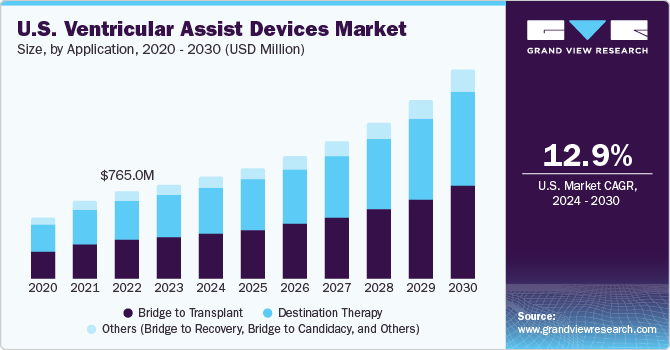

The U.S. ventricular assist devices market size was valued at USD 821.77 million in 2023 and is projected to grow at a CAGR of 12.9% from 2024 to 2030. Key factors responsible for the market growth include the rapid increase in the geriatric population prone to medical conditions such as cardiovascular diseases, diabetes, and end-stage heart failure. These diseases are expected to increase the risk of organ failures or damage, thereby promoting the adoption of Ventricular Assist Devices (VADs).

The U.S. accounted for over 35% of the global ventricular assist devices market in 2023. Economic development, advanced facilities for R&D, universities & hospitals, and the presence of key medical device manufacturers are factors driving product development and commercialization in this region. Unhealthy lifestyle habits and high-risk factors such as reduced physical activity, increased consumption of junk food & alcohol, and use of tobacco are key factors leading to the high global prevalence rate of cardiac diseases. The impact of these factors is high, especially in developed economies like the U.S.

The U.S. accounts for the majority of the global obese population, which is one of the high-impact-rendering factors for the increase in cardiovascular diseases. The high prevalence of cardiovascular disease in the region coupled with the presence of technologically advanced healthcare infrastructure is anticipated to boost treatment rates, thereby propelling market growth in the coming years. Furthermore, the presence of a favorable reimbursement structure is also expected to drive the market by increasing the treatment rate and significantly reducing out-of-pocket expenses.

According to the World Bank health expenditure report estimates, the U.S. allocates over 17% of its GDP toward healthcare, which is one of the key factors attributed to the presence of advanced healthcare options in the region. In the U.S., CMS provides health coverage to people suffering from chronic disease or those diagnosed with a life-threatening disease. It offers National Coverage Determination (NCD), which states whether the payment for a medical device, item, or service (reimbursement) will be made, by recognizing the services or the item as necessary and reasonable. These factors are projected to positively impact the U.S. market growth.

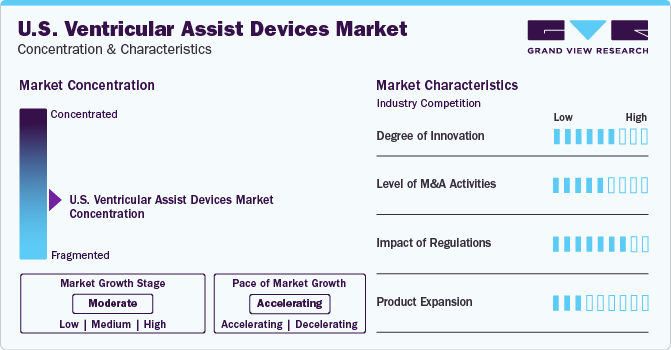

Market Concentration & Characteristics

The industry is indicating moderate growth at an accelerating pace. This is due to the presence of several key players in the region investing in various growth strategies such as R&D activities, product launches, partnerships, and product expansion.

Players in the ventricular assist device industry undertake the strategy of product launch and expansion to strengthen their product portfolios and offer diverse technologically advanced and innovative products to their customers. This also increases their geographic presence and the outreach of their products in the industry. This strategy is the most prominently adopted strategy by companies to attract more customers in the industry. As a result of continual investments being made to upgrade technology, new product developments are expected to attract investments from private equity players and venture capitalists; thus, technology is expected to be a key driving factor for industry expansion over the forecast period.

There are an increasing number of mergers & acquisitions (M&A), partnerships, and collaborations in this industry to gain more market share. In addition, an increasing number of collaborations among hospitals, manufacturers, and insurance companies on the expansion of armamentariums for mechanical circulatory support options for infants is expected to propel industry growth over the forecast period.

Legal regulations enforced by various governments ensure data recording, related to product batch numbers, product recall, and compliance with other regional laws. The regulatory framework ensures that anti-competitive trade practices, misleading marketing activities, and violation of other legal requirements attract stringent punishment. However, favorable government initiatives and funding from several research organizations are driving the industry. The scarcity of heart donors and increasing demand for heart transplants are also aiding the adoption of VADs.

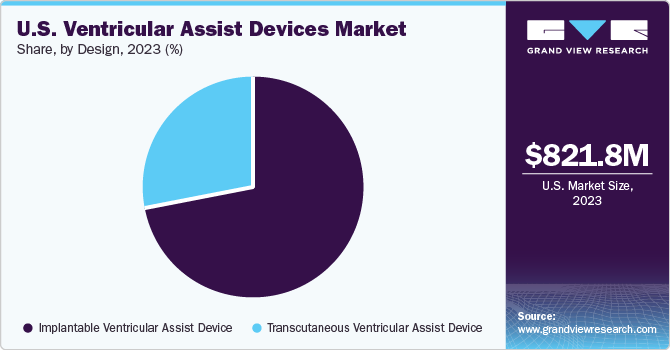

Design Insights

The implantable ventricular assist device segment accounted for the largest revenue share of 71.52% in 2023. Increasing preference for long-term treatment methods among patients who are not eligible for a heart transplant is driving segment growth. However, risks associated with the adoption of these devices, such as severe bleeding, and infection at the incision site are a few key challenges for the market players.

The transcutaneous ventricular assist devices segment is expected to witness a considerable CAGR over the forecast period. The scarcity of suitable donor organs, along with a rising number of patients waiting for a heart transplant, has resulted in significant adoption of alternate techniques, which include mechanical circulatory support. A transcutaneous VAD, when compared to an implantable device, is a short-term VAD used during or postcardiac surgery. Patients with TVADs are confined to the hospital bed due to the external setup of the VAD control unit. This limits the adoption of these devices among patients, limiting revenue growth.

Product Insights

The left ventricular assist devices (LVAD) device segment accounted for the largest revenue share of 64.63% in 2023. Shortage of organ donors and increased demand of LVADs for bridge to transplantation in patients suffering from end-stage heart failure are expected to positively impact market growth over the forecast period. In addition, these devices are featured with advanced ventricular assist device technology with increased reliability and durability, which are potentially beneficial for long-term support. In addition, increasing number of FDA approvals for novel devices coupled with growing acceptance of these devices for destination therapy is expected to boost usage rates.

The bi-ventricular assist devices (BiVAD) segment is projected to witness the highest growth rate over the forecast period. These devices are mainly used for the treatment of severe congestive heart failures for medium- to long-term mechanical support. Furthermore, patients awaiting transplantation are often advised a biventricular assist device implantation as compared to left & right ventricular assist device implantations.

Type of Flow Insights

The non-pulsatile or continuous flow segment accounted for the largest revenue share of 89.81% in 2023. This can be attributed to the rising demand for miniature ventricular assist devices with high durability and energy efficiency. The demand for continuous flow type devices with minimal noise and fewer rotating parts has resulted in their increased demand and popularity among physicians & researchers. They offer several mechanical benefits over pulsatile-flow devices, including smaller size, longer endurance, and simplicity of implantation.

The pulsatile segment is expected to witness the highest growth rate over the forecast period. According to the CDC, in September 2020, nearly 6.7% or 18.2 million adults had critical congenital artery disease, and it has been estimated that approximately 2 in 10 adults aged 65 & below are likely to die from this disease. Pulsatile mechanical ventricular assist devices became a standard treatment for patients with severe heart failure as a bridge to transplantation or in part as a rehabilitation aid. The market is witnessing the entry of new players that are focused on developing innovative products.

Application Insights

The destination therapy segment accounted for the largest revenue share of nearly 50% in 2023. This can be attributed to an increase in the incidence of end-stage heart failure and cardiovascular diseases. In addition, the shortage of donor organs and the rapidly expanding pool of patients waiting for heart transplantation have led to an increase in the demand for VADs to address the shortfall of heart transplants. This, in turn, is anticipated to positively impact market growth.

The bridge to transplantation segment is projected to witness the highest growth rate over the forecast period. Ventricular assist devices are used as bridge-to-transplantation devices to help patients stabilize their physiological stress during transplantation surgeries. VADs in the bridge to transplantation are used for a brief period (2 to 6 months only) in stabilizing patients from the physiological stress of the transplantation surgical process. Furthermore, VAD use in bridge to transplantation is gaining wide-scale adoption and acceptance owing to the enhancements in technology and a decline in VAD-related complications.

Key U.S. Ventricular Assist Devices Company Insights

Development of technologically advanced products by the key U.S. ventricular assist devices companies, including Abbott; Medtronic plc; ABIOMED; Berlin Heart; CardiacAssist, Inc.; Jarvik Heart, Inc.; ReliantHeart, Inc.(CardioDyme); and Sun Medical Technology Research Corp. coupled with increasing regulatory approvals is expected to positively boost market growth in the coming years.

These players are under constant pressure to develop and introduce new products as well as find new avenues for revenue generation. The high prevalence of target diseases and subsequent increase in treatment rate will create lucrative growth opportunities for players operating in the market.

Key U.S. Ventricular Assist Devices Companies:

- Abbott

- Berlin Heart

- JARVIK HEART, INC.

- Calon Cardio-Technology Ltd.

- Evaheart, Inc.

- CorWave SA

- Windmill Cardiovascular Systems, Inc.

- AdjuCor GmbH

- ABIOMED

- CARMAT

- SynCardia Systems, LLC

- BiVACOR Inc.

Recent Developments

-

In Aug 2022, Abbott Cardiovascular’s HeartMate 3, which was approved by the U.S. FDA in 2018 demonstrated extended survival rate of patients of advanced heart failure by over five years.

-

In June 2021, ABIOMED announced the acquisition of preCARDIA to expand its solutions portfolio for patients with acute decompensated heart failure.

U.S. Ventricular Assist Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 890.56 million

Revenue forecast in 2030

USD 1.84 billion

Growth rate

CAGR of 12.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million, number of patients treated in thousands, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type of flow, application, design

Country scope

U.S.

Key companies profiled

Abbott, Berlin Heart, JARVIK HEART, INC., Calon Cardio-Technology Ltd, Evaheart, Inc., CorWave SA, Windmill Cardiovascular Systems, Inc, AdjuCor GmbH, ABIOMED, CARMAT, SynCardia Systems, LLC, BiVACOR Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Ventricular Assist Devices Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. ventricular assist devices market report based on product, type of flow, application, and design:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Left Ventricular Assist Device

-

Right Ventricular Assist Device

-

Bi-Ventricular Assist Device

-

Total Artificial Heart

-

-

Type of Flow Outlook (Revenue, USD Million, 2018 - 2030)

-

Pulsatile Flow

-

Continuous Flow

-

-

Design Outlook (Revenue, USD Million, 2018 - 2030)

-

Implantable Ventricular Assist Device

-

Transcutaneous Ventricular Assist Device

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bridge to Transplant

-

Destination Therapy

-

Others (Bridge to Recovery, Bridge to Candidacy, and Others)

-

Frequently Asked Questions About This Report

b. The U.S. ventricular assist devices market size was valued at USD 821.77 million in 2023 and is expected to reach USD 890.56 million in 2024.

b. The U.S. ventricular assist devices market is growing at a CAGR of 12.2% from 2024 to 2030 to reach USD 1.84 billion in 2030.

b. The non-pulsatile or continuous flow segment accounted for the largest revenue share of 89.81% in 2023. This can be attributed to the rising demand for miniature ventricular assist devices with high durability and energy efficiency.

b. Key players in the U.S. ventricular assist devices market include Abbott; Medtronic plc; ABIOMED; Berlin Heart; CardiacAssist, Inc.; Jarvik Heart, Inc.; ReliantHeart, Inc.(CardioDyme); and Sun Medical Technology Research Corp.

b. Key factors responsible for the market growth include the rapid increase in the geriatric population prone to medical conditions such as cardiovascular diseases, diabetes, and end-stage heart failure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.