- Home

- »

- Power Generation & Storage

- »

-

U.S. Vertical Storage Tank Market Size, Industry Report 2030GVR Report cover

![U.S. Vertical Storage Tank Market Size, Share & Trends Report]()

U.S. Vertical Storage Tank Market (2025 - 2030) Size, Share & Trends Analysis Report By Type, By API Standard (API 620, API 650), By Location, By Application (Crude Oil Storage, Refined Product Storage), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-619-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Vertical Storage Tank Market Trends

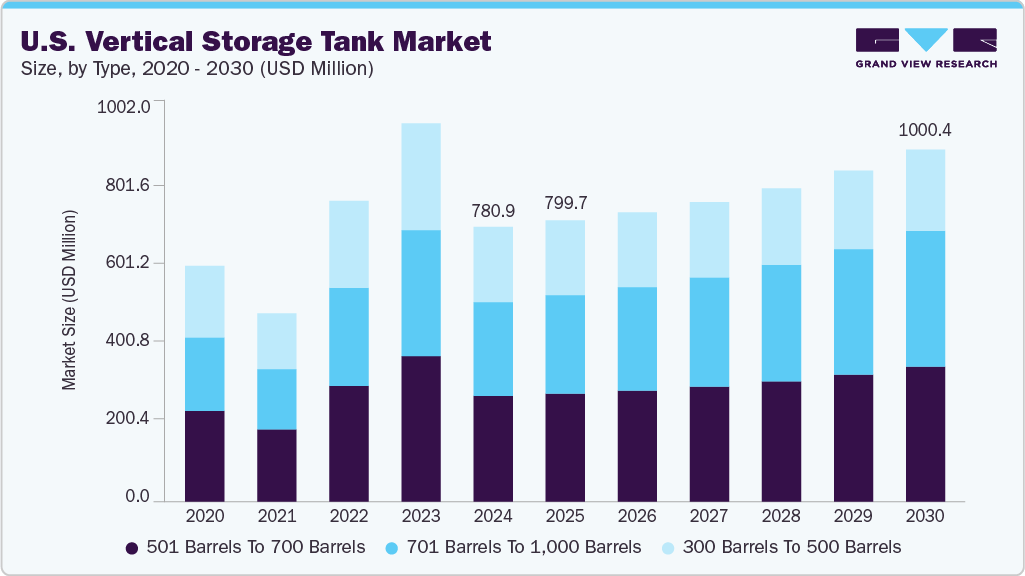

The U.S. vertical storage tank market size was valued at USD 780.9 million in 2024 and is projected to grow at a CAGR of 4.6% from 2025 to 2030. This growth is driven by increasing demand across various sectors. Vertical storage tanks are essential for storing crude oil, refined products, and chemicals in the oil and gas sector. The chemical industry also relies on these tanks to safely store hazardous and non-hazardous materials. Advancements in tank materials and designs and stringent environmental regulations further propel market growth.

In February 2024, CST Industries, a leading manufacturer of storage tanks and covers, expanded its global presence by acquiring Ostsee Tank Solutions GmbH (OTS). This strategic acquisition aimed to leverage OTS's advanced facilities and solutions to enhance CST's production capabilities and adoption of its Optidome EUproduct line. The integration of OTS's state-of-the-art technologies is expected to strengthen CST's offerings in the vertical storage tank segment, catering to the growing demands of various industries.

In the chemical storage segment, companies focus on developing specialized tanks to meet the unique requirements of storing various chemicals. For instance, in June 2024, Hypro introduced a new line of cryogenic storage tanks designed for the global market. These tanks are engineered to handle extremely low temperatures, making them suitable for storing liquefied gases and other temperature-sensitive chemicals. Hypro's innovation reflects the industry's commitment to advancing storage solutions that ensure safety, efficiency, and compliance with stringent regulations.

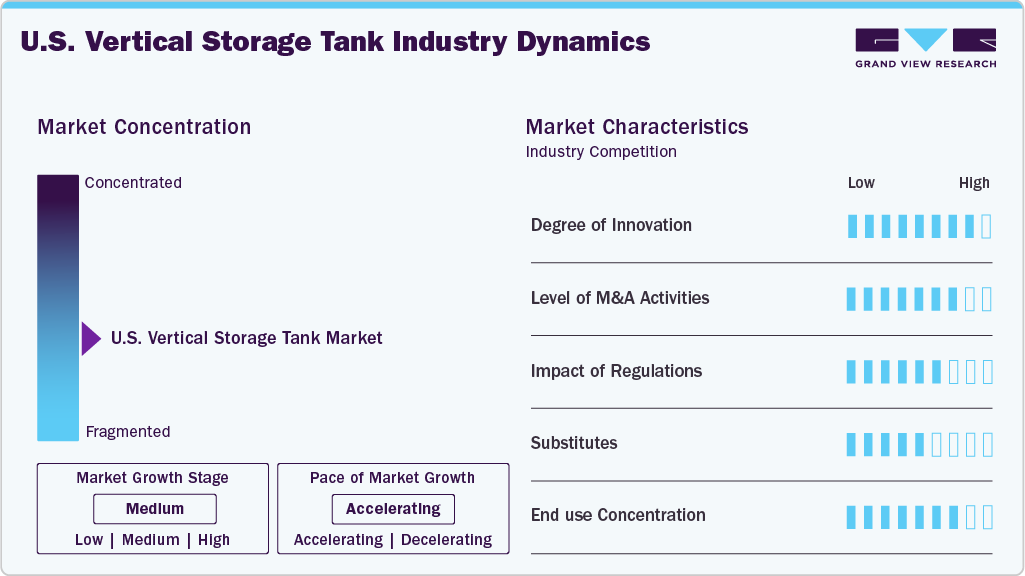

Market Concentration & Characteristics

The industry growth stage is medium, and the pace of industry growth is accelerating. The industry is experiencing significant growth, driven by technological advancements, stringent regulatory frameworks, and concentrated demand from key sectors. Innovations in tank design and materials enhance operational efficiency and safety. Simultaneously, regulatory bodies like the Environmental Protection Agency (EPA) enforce standards that ensure environmental protection and public safety. The industry's expansion is propelled by its role in oil & gas, chemicals, and water treatment sectors.

An example of innovation within the U.S. vertical storage tank industry is Elkhart Plastics, a Myers Industries company that recently introduced a new line of vertical water storage tanks. These tanks feature multiple connection points with risers and tie-downs, dual manway lids for secure access, integrated air bleeds for efficient filling, and reinforced tank tops with increased wall thickness for sun protection. Such design enhancements help improve the functionality of the tanks and address specific challenges related to durability and environmental exposure, reflecting the industry's commitment to continuous improvement and adaptation to end-user needs.

Regulatory measures also influence the market. The EPA's Underground Storage Tanks (USTs) regulations encompass technical requirements, financial responsibility, and state program approval objectives, ensuring storage systems avoid leaks and environmental contamination. These regulations require tank owners and operators to implement approved leak detection systems and adhere to strict maintenance protocols. Moreover, the industry's growth is closely tied to its applications in sectors like oil & gas, chemicals, and water treatment, where vertical storage tanks are essential for the safe and efficient storage of various substances, underscoring the importance of compliance with regulatory standards to meet sector-specific demands.

Type Insights

501 barrels to 700 barrels registered the largest revenue share of 38.5% in 2024. This dominance can be attributed to their widespread use across various sectors, including oil and gas, chemicals, and water treatment, where moderate storage capacities are often sufficient. The adoption of smart technologies in the U.S. vertical storage tank industry, such as IoT-enabled sensors for real-time monitoring, has further enhanced the appeal of these tanks by improving operational efficiency and safety. In February 2025, as per a press release in Business Wire, Iveda deployed its LevelNOW system for Gulf Western Oil. The system provides real-time monitoring and data analytics to automate workflows, enhance operational efficiency, and improve liquid storage management across the company’s facilities. The deployment aims to boost safety, visibility, and revenue optimization. It has transformed the company’s liquid storage services, ensuring better management and safety.

701 barrels to 1,000 barrels segment is expected to grow at the fastest CAGR of 6.7% over the forecast period. This growth is driven by the increasing demand for larger storage solutions in industries that require bulk storage capabilities. Innovations in tank construction using advanced materials and coatings have made these larger tanks more viable by enhancing their structural integrity and resistance to environmental factors. In addition, the integration of smart monitoring systems allows for better management of stored contents, aligning with the industry's move toward digitalization and automation.

API Standard Insights

API 650 segment accounted for the largest revenue share in 2024. This dominance is primarily due to its widespread application in storing petroleum, chemicals, and water. These tanks are designed for atmospheric pressure storage and are commonly used in oil and gas facilities. The publication of the 13th Edition of API Standard 650—Welded Tanks for Oil Storage—by the American Petroleum Institute underlines the industry's commitment to safety and environmental performance, ensuring that storage tanks meet rigorous standards for design and construction.

API 620 tanks are expected to experience the fastest growth rate over the forecast years. This growth can be attributed to their suitability for storing liquefied gases and cryogenic liquids at low pressures. These tanks are designed for higher-pressure applications and are essential in industries requiring the storage of substances like LNG and ammonia. As per a press release in May 2022, CB&I received an award for the designing and construction of a 1.2 million-gallon API 620 low-pressure liquid storage tank, highlighting the increasing demand and recognition for such tanks in specialized applications.

Location Insights

Aboveground storage tanks accounted for the largest market share of the U.S. vertical storage tank industry in 2024. This dominance is due to their ease of installation, maintenance, and inspection. Easy visibility means leaks and damage are quickly found and fixed, making them best for storing fuel, processing chemicals, and treating water. With industries seeking efficient and accessible storage solutions, the demand for Aboveground Storage Tanks (ASTs) is anticipated to remain robust. In addition, the reduced excavation and groundwork needed for ASTs result in faster and more economical installation. Their flexibility to handle various tasks and seamless integration with smart tech for monitoring levels and pressure boost their popularity in sectors like oil & gas, water treatment, and agriculture.

Underground storage tanks are expected to grow at a notable rate, driven by increasing regulatory requirements, environmental concerns, and advancements in tank technology. The Underground Storage Tanks (USTs) market is influenced by factors such as the rising need for fuel storage due to industrial expansion and growing environmental awareness, leading to demand for safer, leak-resistant storage solutions. USTs are preferred where land availability is limited or aesthetic considerations require concealed infrastructure, such as in urban developments and service stations. Their double-walled construction and leak detection systems help meet environmental compliance requirements, making them suitable for storing hazardous materials in sensitive environments. Government incentives for leak prevention and sustainable containment systems further support this evolving infrastructure.

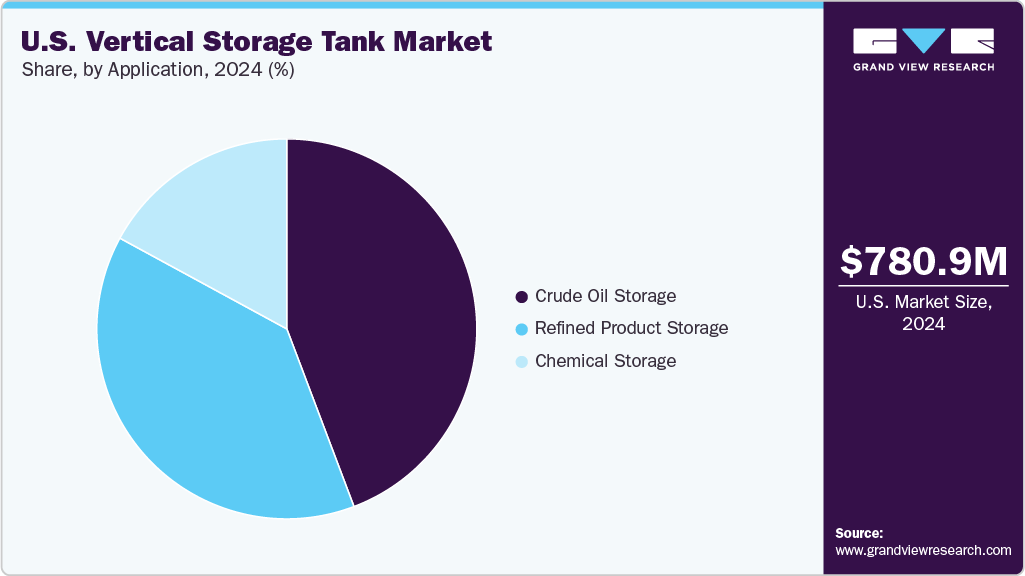

Application Insights

Crude oil accounted for the largest revenue share in 2024. This growth is attributable to increased demand for storage capacity amid market volatility. As per an article in Reuters, in May 2025, U.S. crude oil storage demand surged significantly as traders anticipated a substantial increase in oil supply from OPEC+, leading to a rise in storage requests across major U.S. hubs like the Midwest and Gulf Coast. The anticipated increase in oil supply from OPEC+ was influenced by geopolitical factors, including President Trump's push for higher production. This heightened demand underscores the critical role of crude oil storage tanks in managing supply fluctuations and ensuring energy security. Crude oil tanks are essential for balancing production with downstream processing and transportation capabilities. Their usage is particularly strategic during geopolitical shifts and supply chain disruptions, helping mitigate pricing volatility. The construction of large-scale crude oil storage tanks also supports inventory build-up for strategic petroleum reserves, providing a buffer against international supply shocks.

The refined product storage sector is projected to grow at the fastest CAGR over the forecast period. This growth can be attributed to the increasing consumption of refined petroleum products and the need for efficient storage solutions. In August 2024, Philippine Tank Storage International, the largest petroleum products import storage facility in the Philippines, sought strategic investment to expand its operations, reflecting the growing demand for refined product storage in the region. These tanks are pivotal in ensuring a steady supply of gasoline, diesel, and aviation fuels to meet domestic and commercial needs. The growing emphasis on fuel quality, blending capabilities, and environmental compliance further strengthens the case for modern refined product storage infrastructure. In addition, the expansion of the U.S. vertical storage tank industry in transportation and power generation continues to boost the need for advanced storage and distribution networks.

End Use Insights

The midstream sector accounted for the largest revenue share in 2024. This dominance in the market is attributable to the segment's critical role in transporting and storing oil and gas between upstream production and downstream refining. The midstream oil and gas equipment market, encompassing storage tanks, has experienced significant growth due to increased domestic energy production and the need for expanded infrastructure. Investments in pipeline safety and modernization have further bolstered this segment, ensuring efficient and secure transportation of hydrocarbons. The strategic position of the midstream segment within the energy supply chain has led to substantial investments in storage solutions to manage supply fluctuations and meet demand.

The downstream segment is expected to grow at a significant rate, driven by the increasing demand for refined products and the need for efficient storage solutions to manage inventory and distribution. In response to this demand, companies are investing in advanced storage technologies and expanding their storage capacities to ensure a steady supply of refined products. The chemical industry is another end user that relies on vertical storage tanks to contain various chemical substances safely. These tanks are designed to meet stringent safety and environmental regulations, ensuring the secure storage of hazardous and non-hazardous chemicals.

Key U.S. Vertical Storage Tank Company Insights

The U.S. vertical storage tank industry is intensely competitive. Some of the major companies in the market are CST Industries, McDermott (CB&I), and Fisher Tank Company Companies have increasingly focused on continuous R&D activities and product development through strategic collaborations, mergers and acquisitions, and more.

-

CST Industries is a global leader in engineered storage solutions, specializing in factory-coated metal storage tanks, silos, aluminum domes, and specialty covers. It has over 130 years of experience and a global footprint that includes manufacturing facilities and design centers across North America, Europe, the U.K., and Vietnam. CST Industries is recognized for its innovative technologies, which enhance corrosion resistance in glass-fused-to-steel tanks.

-

Fisher Tank Company, established in 1948, is a U.S.-based specialist in the design, fabrication, and field erection of welded steel storage tanks. The company focuses on delivering high-quality vertical storage tank solutions for diverse industries, including terminals, power generation, municipal water, and chemicals. It also provides comprehensive services, from engineering and custom fabrication to construction, repairs, and modifications, ensuring robust and reliable vertical tank infrastructure for its clients.

Key U.S. Vertical Storage Tank Companies:

- CST Industries

- McDermott.

- Superior Tank Co.

- Tank Connection

- NOV.

- Highland Tank

- Fisher Tank Company.

Recent Developments

-

In April 2025, CB&I, in partnership with Shell, GenH2, and the University of Houston, completed the design and testing of a first-of-its-kind non-vacuum liquid hydrogen storage tank at NASA’s Marshall Space Flight Center—paving the way for scalable, cost-effective hydrogen storage solutions in the U.S.

-

In December 2024, CB&I was acquired by a Mason Capital-led consortium in partnership with IES Holdings, Inc. in an all-cash equity transaction intended to position the company for long-term growth in the U.S. storage tank market.

-

In May 2024, CB&I was honored with three prestigious “Tank of the Year” awards 2023 by the Steel Tank Institute/Steel Plate Fabricators Association for projects including liquid hydrogen spheres and large LNG tanks—underscoring the company’s leadership in advanced tank fabrication and safety standards.

-

In November 2023, TerraVest Industries entered an agreement to acquire Highland Tank for USD 78 million, with the founder retained as the president. This move is set to enhance Highland’s growth through TerraVest’s broader infrastructure support.

-

In February 2022, Fisher Tank Company achieved zero OSHA recordable incidents at its Chester, PA fabrication shop, marking 3,000 consecutive days without a recordable safety event, reflecting its strong commitment to workplace safety.

U.S. Vertical Storage Tank Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1,000.39 million

Growth rate

CAGR of 4.6% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in units, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, API standard, location, application, end use

Key companies profiled

CST Industries, McDermott (CB&I), Synalloy Corporation, Superior Tank Co., Tank Connection, Columbian Steel Tank, Containment Solutions, Highland Tank, Fisher Tank

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Vertical Storage Tank Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. vertical storage tank market report based on type, API standard, location, application, and end use:

-

Type Outlook (Volume, Units, Revenue, USD Million, 2018 - 2030)

-

300 barrels to 500 barrels

-

501 barrels to 700 barrels

-

701 barrels to 1,000 barrels

-

-

API Standard Outlook (Volume, Units, Revenue, USD Million, 2018 - 2030)

-

API 12F

-

API 650

-

API 620

-

-

Location Outlook (Volume, Units, Revenue, USD Million, 2018 - 2030)

-

Aboveground Storage Tanks

-

Underground Storage Tanks

-

-

Application Outlook (Volume, Units, Revenue, USD Million, 2018 - 2030)

-

Crude Oil Storage

-

Refined Product Storage

-

Chemical Storage

-

-

End Use Outlook (Volume, Units, Revenue, USD Million, 2018 - 2030)

-

Upstream

-

Midstream

-

Downstream

-

Frequently Asked Questions About This Report

b. The U.S. vertical storage tank market size was estimated at USD 0.78 billion in 2024 and is expected to reach USD 0.80 billion in 2025.

b. The U.S. vertical storage tank market is expected to grow at a compound annual growth rate of 4.6% from 2025 to 2030 to reach USD 1.0 billion by 2030.

b. Based on the application segment, crude oil storage product storage accounted for the largest revenue share, accounting for over 50.0% of the revenue in 2024. This growth is primarily due to heightened global focus on strategic petroleum reserves (SPRs) and commercial stockpiling, driven by ongoing geopolitical tensions, supply chain disruptions, and price volatility.

b. Some key players operating in the U.S. vertical storage tank market include AGI Westeel, Argent Storage BV, BHI (OP Tanks), and Centpro Engineering PVT. LTD, Coyote Tanks, CST Industries.

b. The key factors driving the U.S. vertical storage tank market include rising demand across the oil & gas and chemical industries, growing global energy needs, and increasing emphasis on water and wastewater management.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.