- Home

- »

- Animal Health

- »

-

U.S. Veterinarians Market Size, Share, Industry Report, 2033GVR Report cover

![U.S. Veterinarians Market Size, Share & Trends Report]()

U.S. Veterinarians Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Public/Corporate, Private), By Gender (Male, Female, Others), And Segment Forecasts

- Report ID: GVR-4-68039-431-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Veterinarians Market Summary

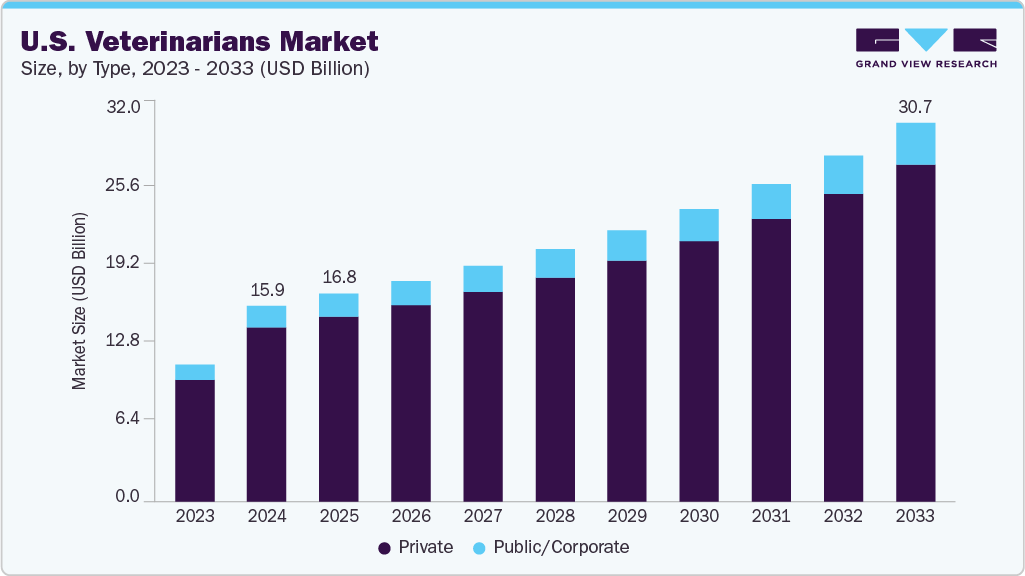

The U.S. veterinarians market size was estimated at USD 15.87 billion in 2024 and is projected to reach USD 30.67 billion by 2033, growing at a CAGR of 7.79% from 2025 to 2033. Some of the key factors propelling market growth are a shortage of veterinary professionals driving wage growth & service expansion, expanding pet health concerns & disease burden, and rising government initiatives for veterinarians.

Key Market Trends & Insights

- By type, the privatesegment led the market with the largest revenue share of 88.76% in 2024.

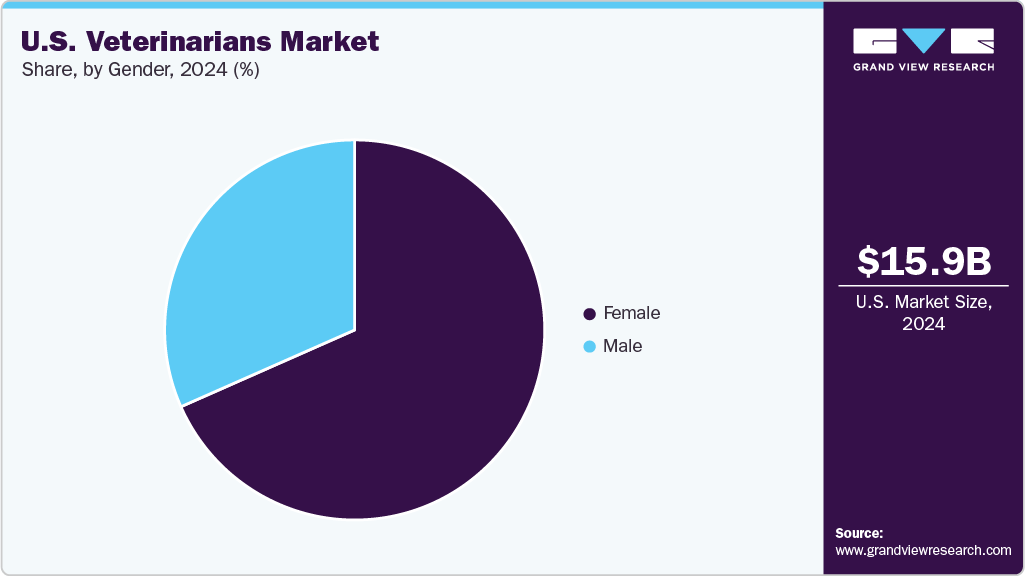

- By gender, the female segment led the market with the largest revenue share in 2024.

- By type, the public/corporate segment is expected to grow at the second-fastest CAGR over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 15.87 Billion

- 2033 Projected Market Size: USD 30.67 Billion

- CAGR (2025-2033): 7.79%

The persistent shortage of veterinarians and licensed technicians in the U.S. is driving the market growth by increasing wages, enhancing practice profitability, and accelerating investment in clinic expansion. According to a June 2024 study, veterinarian burnout has led to early exits from the profession, with projected demand through 2032 requiring 70,092 new veterinarians. However, expected graduates meet only 76% of this demand, creating uneven geographic shortages. Additionally, hospitals face difficulties filling clinical positions and experiencing higher caseload pressure. This drives practices to adopt efficient tools such as tele-triage, workflow automation, and AI-assisted diagnostics.

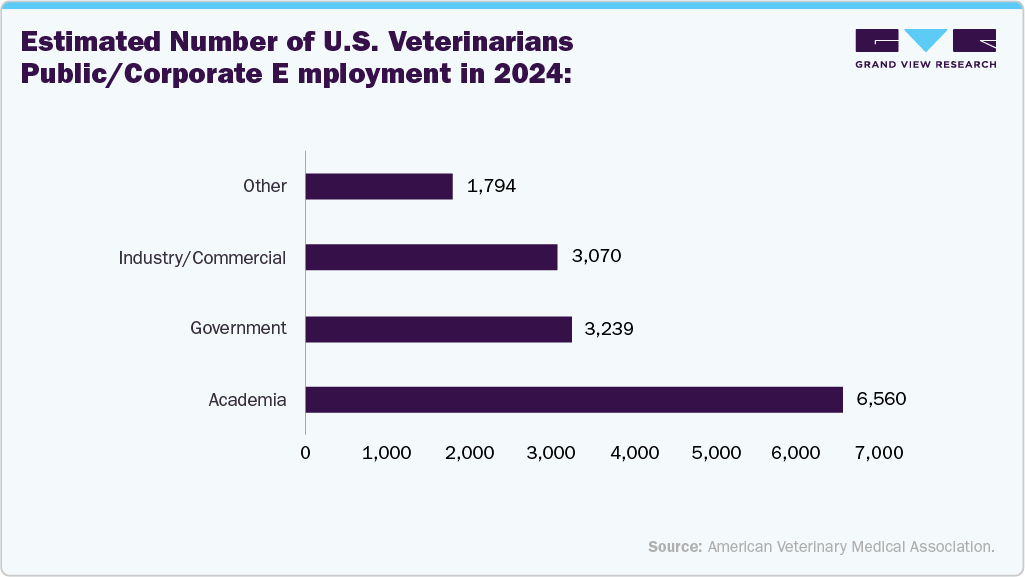

This scarcity of talent also raises the market value of veterinary services, as clinics increase prices to match labor demand. As a result, the workforce gap intensifies recruitment efforts, specialty training, and practice consolidations, ultimately stimulating growth in veterinary service delivery, staffing solutions, and overall market capacity in the U.S. The chart below highlights the public/corporate employment landscape of U.S. veterinarians with an employment of 14,663 in 2024:

In addition, the increasing prevalence of chronic, lifestyle-related, and age-associated conditions in pets, such as obesity, diabetes, dental disease, arthritis, cancer, and dermatological disorders, is a major driver of the market. As pets live longer and owners humanize pet care, the demand for regular checkups, advanced diagnostics, prescription medications, and disease-management plans continues to grow. Besides this, rising awareness of early-stage detection, preventive wellness programs, and long-term therapeutic care increases the frequency of veterinary visits and expands the scope of services provided. In addition, anxiety and behavioral issues in indoor pets, food allergies, and infectious diseases further heighten clinical caseloads. For instance, researchers reported in December 2024 highlighted a rising concern for pets’ mental well-being. In a survey of nearly 45,000 pet guardians, 99% reported moderate or severe behavioural issues, with separation anxiety and attachment problems being the most common in pets. Thus, expanding health concerns require more veterinary expertise, specialty practitioners, and continuous care models, directly boosting market growth.

Furthermore, supportive government initiatives are significantly driving the growth of the U.S. veterinary industry by expanding workforce capacity, improving access to care, and strengthening national animal health infrastructure. For instance, in November 2025, programs such as the USDA’s Veterinary Services Grant Program provide funding of USD 3.8 million for rural practice enhancement, equipment upgrades, and training initiatives that help clinics expand services and improve operational capability. These grants directly address critical shortages of food-animal veterinarians, enabling more professionals to establish or sustain practices in underserved regions. In addition, federal initiatives such as the Rural Veterinary Action Plan, launched in September 2025, focus on recruitment, retention, and loan-repayment incentives that make veterinary careers more accessible and financially viable. Thus, by building a stronger veterinary workforce, enhancing rural service availability, and improving disease-prevention systems, these government actions propel sustained demand for veterinary professionals across the country.

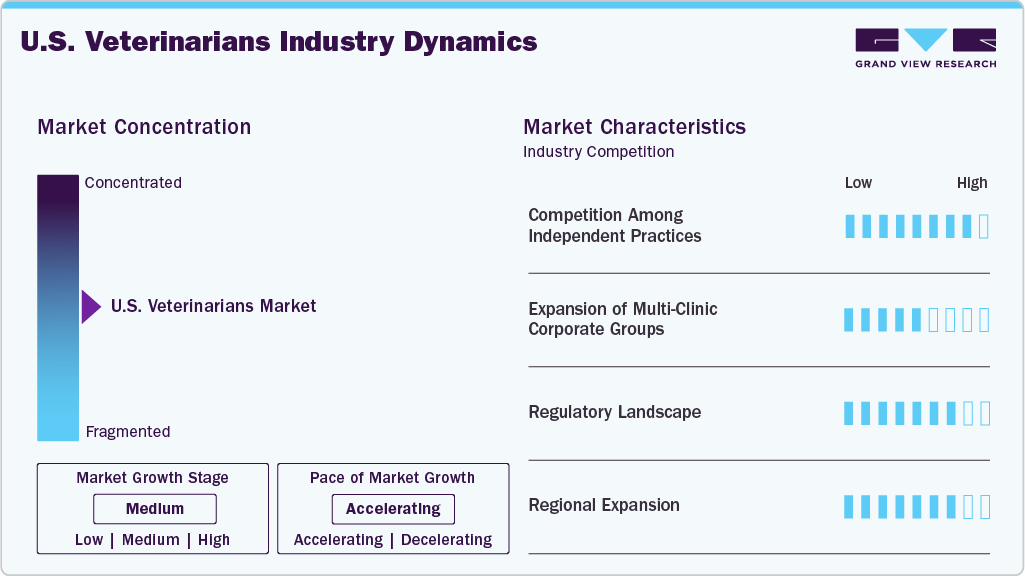

Market Concentration & Characteristics

The U.S. veterinarians market growth stage is moderate, and pace of growth is accelerating. The market is characterized by competition among independent practices, expansion of multi-clinic corporate groups, the regulatory landscape, and regional expansion.

Independent veterinary practices in the U.S. remain substantial despite consolidation pressures. These small clinics compete based on personalized care, community presence, and trust. A resurgence is possible as rising interest in independent ownership grows. For instance, a strong independent practice segment intensifies local competition, which the Federal Trade Commission (FTC) actively protects by scrutinizing consolidations. This competitive environment encourages innovation, fair pricing, better service quality, and diverse care models.

Corporate consolidators, supported by private equity, are rapidly acquiring veterinary clinics, driving scale, efficiency, and standardization of services. Major chains command a growing share of the market, leveraging cost synergies, centralized operations, and a broad geographic reach.

Veterinary professionals in the U.S. are regulated at the state level. These state veterinary licensing boards enforce education, facility, and professional standards via the American Association of Veterinary State Boards. (AAVSB) system, ensuring public protection and ethical practice. For instance, in June 2024, the AAVSB’s 2023 survey led the board to prioritize expanding the scope of practice for veterinary technicians due to underutilization, regulatory concerns, and the need to strengthen access to care.

Regional dynamics are transforming the growth of veterinary practices. Urban centers witness dense networks of independent and corporate clinics, whereas underserved rural or growing suburban regions attract expansion through mobile clinics, new satellite practices, and multi-clinic chains. This geographic diversification helps meet increasing demand across different populations and pet ownership.

Type Insights

In 2024, the private segment led the U.S. veterinarians industry, with the largest revenue share of 88.76% and is expected to grow at the fastest CAGR over the forecast period. The growth is driven by the dominance of privately owned clinics, corporate hospital networks, and specialty practices delivering companion animal care. Most veterinary professionals work in private practice settings, reflecting strong demand for preventive care, diagnostics, surgery, and chronic disease management. Additionally, growth is reinforced by rising pet ownership, increased spending on advanced treatments, and the rapid expansion of multi-clinic corporate groups backed by private equity. Moreover, independent practices also make significant contributions, offering personalized care and serving local communities. Thus, these private providers form the backbone of veterinary service delivery across the U.S.

The public/corporate segment is expected to grow at the second-fastest CAGR over the forecast period, fueled by rapid consolidation, expanding multi-clinic networks, and increasing investment from private equity–backed hospital groups. Corporate organizations offer standardized care models, advanced diagnostic capabilities, centralized procurement, and scalable technology platforms, all of which enhance operational efficiency. In addition, public institutions, including universities, government agencies, and research centers, also contribute by expanding clinical, regulatory, and research-focused veterinary roles.

Gender Insights

In 2024, female veterinarians represented the largest revenue segment in the U.S. veterinarians industry, due to long-standing trends in veterinary school enrollment where women consistently make up over 80% of graduates. According to the AVMA's 2024 report, the estimated number of female veterinarians in the U.S. was 88,588, surpassing the number of male veterinarians, who accounted for 40,968. This demographic shift has transformed the profession, contributing to greater representation in small-animal practice, academia, public health, and specialty care. The growing presence of women in leadership roles across clinics, corporate groups, and regulatory bodies further strengthens the segment. Additionally, evolving workplace policies, mentorship networks, and flexible employment models support the participation and advancement of women in their careers.

The others segment is expected to grow at the fastest CAGR from 2025 to 2033, reflecting increasing diversity, broader gender identity representation, and more inclusive environments within veterinary education and workplaces. Veterinary schools and professional organizations are adopting stronger diversity, equity, and inclusion initiatives, encouraging individuals across the gender spectrum to pursue careers in veterinary medicine. Additionally, supportive policies, gender-affirming workplace practices, and increased visibility within professional associations are also contributing to the expansion of participation. As the profession becomes more inclusive, this segment is experiencing higher enrollment and employment growth, contributing to a more diverse workforce that strengthens collaboration, patient communication, and the overall resilience of the U.S. veterinary sector.

Recent Developments

-

In August 2025, USDA announced new actions to strengthen the rural veterinary workforce, including grant awards and a consolidated Mississippi office, reinforcing efforts to protect livestock, food security, and agricultural communities. This strengthens national animal-health infrastructure.

-

In July 2025, AVMA highlighted how AI enhances diagnostics, early disease prediction, and personalized treatments while keeping veterinarians central to clinical judgment and ethics. This highlights AI’s increasing role in enhancing the quality of veterinary care.

-

In February 2024, more than 140 veterinary professionals met with lawmakers to advocate for the Rural Veterinary Workforce Act and the Healthy Dog Importation Act, addressing shortages and disease risks. This advocacy aims to strengthen national veterinary capacity and biosecurity.

U.S. Veterinarians Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16.83 billion

Revenue forecast in 2033

USD 30.67 billion

Growth rate

CAGR of 7.79% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, gender

Country scope

U.S.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Veterinarians Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. veterinarians market report based on type and gender:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Public/Corporate

-

Government

-

Industrial/Commercial

-

Academics

-

Others

-

-

Private

-

Companion Animal Practice

-

Food Animal Practice

-

Equine Practice

-

Mixed Practice

-

Others

-

-

-

Gender Outlook (Revenue, USD Million, 2021 - 2033)

-

Male

-

Female

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. veterinarians market size was estimated at USD 15.87 billion in 2024 and is expected to reach USD 16.83 billion in 2025.

b. The U.S. veterinarians market is expected to grow at a compound annual growth rate of 7.79% from 2025 to 2033 to reach USD 30.67 billion by 2033.

b. Private segment dominated the U.S. veterinarians market with a share of 88.67% in 2024. This is attributable to shortage of veterinary professionals driving wage growth & service expansion, expanding pet health concerns & disease burden and rising government initiatives for veterinarians.

b. The U.S. veterinarians market has been segmented on the basis of the type and gender. The type segment comprises public/ corporate and private whereas gender segment comprises of male, female and others.

b. Key factors that are driving the U.S. veterinarians market growth include shortage of veterinary professionals driving wage growth & service expansion, expanding pet health concerns & disease burden and rising government initiatives for veterinarians.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.