- Home

- »

- Animal Health

- »

-

U.S. Veterinary Surgical Disposables Market, Report, 2030GVR Report cover

![U.S. Veterinary Surgical Disposables Market Size, Share & Trends Report]()

U.S. Veterinary Surgical Disposables Market Size, Share & Trends Analysis Report By Product (Surgical Sutures, Surgical Mesh), By End-use (Clinics, Hospitals), By Animal Type, By State, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-262-4

- Number of Report Pages: 157

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

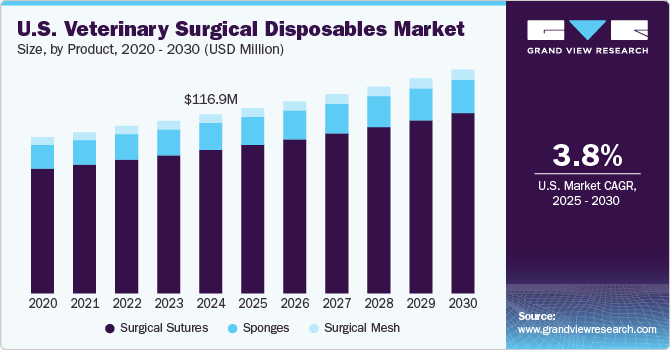

The U.S. veterinary surgical disposables market size was estimated at USD 116.95 million in 2024 and is projected to grow at a CAGR of 3.83% from 2025 to 2030. The market is primarily being driven by the increasing uptake of pet insurance and product advancements. The increasing prevalence of chronic diseases in animals is significantly driving the market growth. According to the Association for Pet Obesity Prevention (APOP), in October 2023, 59% of dogs in the U.S. were classified as overweight or obese, with 37% being overweight and 22% considered obese. Dogs are also more likely to develop other serious conditions like diabetes mellitus, arthritis, heart disease, and respiratory disorders. With the rise in chronic diseases among animals, the frequency of surgeries and medical procedures is also increasing, further fueling the demand for these disposable products.

Increasing efforts to promote the use of veterinary sutures during surgeries is driving the market growth. For instance, in July 2024, the Vet Aide Club partners with the UC Davis Veterinary Medical Teaching Hospital and offers workshops in collaboration with the vet school’s surgery club, where students learn surgical skills such as suturing, sterilization, and scrubbing into surgery. These experiences provide a strong foundation for students interested in veterinary surgery, contributing to the growing demand for specialized skills in veterinary surgeries. Furthermore, the focus on skill-building in sutures and surgical practices helps meet the increasing need for qualified professionals in animal care. These initiatives contribute to the growing demand for advanced training in veterinary surgical techniques, which is driving market growth.

As the animal population grows, the need for veterinary care to ensure the health and well-being of these animals also increases. This includes wildlife species. National parks often serve as protected habitats for various wildlife species. With more national parks in states like California and Utah, there might be a larger and healthier population of wildlife, which could lead to more instances where surgical intervention is required due to injuries, illnesses, or other health issues. National parks play a crucial role in wildlife conservation efforts. In some cases, surgical procedures may be part of conservation initiatives aimed at managing wildlife populations, treating diseases, or rehabilitating injured or orphaned animals.

An increase in the adoption of pet insurance can lead to a rise in the number of surgeries performed on pets. Pet insurance typically helps cover the costs of veterinary care, including surgeries. When pet owners have insurance, they may be more likely to authorize necessary surgeries for their pets, knowing that a portion of the costs will be covered. This can result in more surgeries being performed overall. In addition, with insurance coverage, pet owners may be more inclined to seek out advanced or specialized procedures that they might have otherwise deemed too expensive.

Market Characteristics & Concentration

The market exhibits a moderate concentration. The market growth stage is high, and the pace is accelerating. The increasing pet ownership in the U.S. is fueling the demand for veterinary services, including surgical procedures. This trend is expected to continue as more people consider pets as part of their families, thus driving the demand for veterinary surgical disposables. According to the American Pet Products Association National Pet Owners Survey 2023-2024, around 66% of families in the U.S. owned a pet in 2023, which translates to approximately 86.9 million homes owning a pet. In addition, pet owners are becoming more aware of the importance of regular veterinary care for their animals’ health and well-being. This increased awareness translates into higher spending on veterinary services, including surgeries, which, in turn, boosts the demand for surgical disposables.

The market demonstrates a moderate degree of innovation, characterized by ongoing product launch, partnership and collaboration between market players, and supportive initiatives. For instance, in January 2024, MWI Animal Health, a subsidiary of Centora (formerly AmerisourceBergen), collaborated with Hound, a leading veterinary talent platform, to provide innovative technology and services for veterinary practices in a rapidly changing industry.

Within the market, there exists a low to moderate level of mergers and acquisitions activity, indicative of ongoing consolidation and strategic partnerships among industry players. For instance, in March 2023, Patterson Companies' Animal Health division, a subsidiary of Patterson Companies, Inc., signed an agreement with Stratford Care USA, a subsidiary of Swedencare, to acquire exclusive rights to market & promote the Animal Pharmaceuticals brand of dermatology, dental, and nutritional products in the U.S. animal health market.

The market experiences a low impact of regulations. Veterinary medical devices, including surgical sutures and sponges, are typically regulated by government agencies responsible for overseeing veterinary medicine or medical devices. In the U.S., for example, the FDA regulates veterinary medical devices through its Center for Veterinary Medicine (CVM). Veterinary surgical sutures and sponges may be classified as medical devices and are subject to regulatory requirements based on their intended use, materials, & risk level. Class I medical devices are considered as low risk, while class II & III medical devices pose higher risks and are subject to more stringent regulatory controls.

The risk of substitutes is expected to be moderate. emerging biologically derived glues and sealants may offer alternatives to sutures in certain veterinary surgeries, posing a threat to the growth of the suture market. As minimally invasive and noninvasive procedures become more prevalent in veterinary medicine, there might be reduced reliance on sutures for wound closure. Moreover, the threat of internal substitutes is considered to be moderate, as there are a significant number of players offering surgical disposables such as sponges and sutures at lower costs.

Product Insights

The surgical sutures segment led the market with the largest revenue share of 80.10% in 2024, and is also estimated to grow at the fastest CAGR during the forecast period. This growth can be attributed to several key factors, including technological innovations, focus on animal welfare, and increasing pet ownership. Advancements in material science and manufacturing technologies have led to the development of surgical sutures that offer superior strength, flexibility, and biocompatibility. These innovations enhance surgical outcomes and drive the adoption of disposable sutures in veterinary surgery. There is a growing awareness and emphasis on animal welfare, leading to an increase in the demand for safe & effective surgical products. Veterinary surgeons prioritize the use of high-quality disposable items to minimize the risk of postoperative complications and infections in animals.

In small animal surgery, numerous types of surgical sutures can be used based on the type of tissue being sutured, the location of the surgery, and the duration of tissue support required. Monofilament or multifilament suture materials have been used intradermally to close skin incisions in dogs and cats. Some of the sutures used in small animals are SilverGlide Suture, Chromic Catgut, Fluoromid, and Polydioxanone. Moreover, key players offering surgical sutures for small and large animals include VeterSut (Sutumed Corp), ProNorth Medical, and B. Braun Vet Care GmbH.

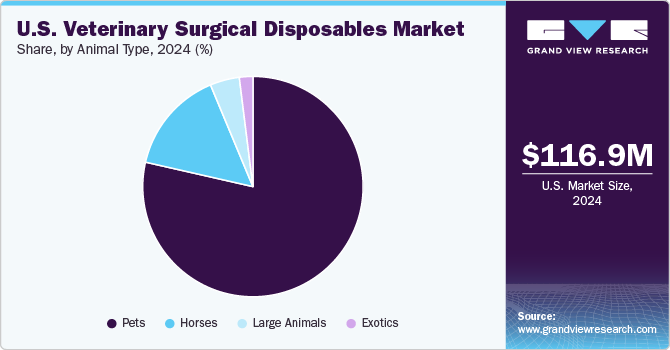

Animal Type Insights

Based on animal type, the pets segment led the market with the largest revenue share of 78.57% in 2024. Increasing pet ownership, growing awareness of pet healthcare, increasing pet humanization, and rising prevalence of chronic diseases in pets are among the key drivers of the segment. Pet ownership has steadily increased in the U.S. over the years. Dogs are the most popular pets overall. Around 66% of U.S. households (86.9 million ) owned a pet as of 2024, with the number of U.S. households having a pet dog being 65.1 million.

In pets, sutures are used to close surgical incisions after procedures such as spaying, neutering, tumor removal, or orthopedic surgeries. For example, As per the study published by VCA animal hospitals in 2023, Obesity is the most prevalent disease in dogs in North America. Similarly, according to the Association for Pet Obesity Prevention, over 50% of dogs are classified as overweight. The hospital reports that one in three dogs and cats is overweight. Obesity leads to comorbid conditions, such as osteoarthritis, which frequently require surgical interventions. For example, according to the same source, the most common osteoarthritis conditions affecting cats and dogs were arthritis and ligament or tendon conditions. This is estimated to increase the need for orthopedic surgeries in pets.

The exotics segment comprises pet birds, small mammals, and reptiles. It is anticipated to grow at the fastest CAGR during the forecast period, as market players are diversifying their offerings. All animals are susceptible to orthopedic disorders such as arthritis, luxation, and fractures. Over time, the popularity of small mammals has grown, and many of these species have orthopedic issues that can be successfully resolved surgically. Moreover, hospitals that provide care for small mammals or reptiles include Winter Park Veterinary Hospital. Although they might not need much outdoor exercise, pocket pets such as hamsters, guinea pigs, and ferrets are nevertheless susceptible to illness, according to Winter Park Veterinary Hospital. Furthermore, rabbits and pocket pets require regular veterinarian care, a healthy diet, interaction with humans, and proper environment management, just like dogs & cats.

End-use Insights

Based on end use, the hospitals segment led the market with the largest revenue share of 83.24% in 2024. Veterinary hospitals generally provide a wide range of medical services, including emergency care, specialty services, surgery, dentistry, diagnostics, and preventive care. As a result, they need an extensive variety of equipment and disposables to effectively support these services. Compared to smaller clinics or mobile practices, veterinary hospitals serve a higher number of patients, which translates to increased utilization of equipment and disposables daily.

The clinics segment is anticipated to grow at the fastest CAGR of 5.19% over the forecast period. Veterinary clinics are primary consumers of veterinary surgical sutures. As the number of pets and animals requiring surgical procedures continues to rise, the demand for sutures increases proportionally. Surgical procedures such as spaying, neutering, orthopedic surgeries, and wound closures performed in veterinary clinics are boosting the demand for sutures. Moreover, the presence of a large number of veterinary clinics in the country that offer services, including diagnostics, general surgery, and dental care, is fueling the market growth.

State Insights

California dominated the U.S. Veterinary Surgical Disposables Market with the largest revenue share of 16.20% in 2024. The growing pet population in California is increasing the demand for veterinary services, including surgeries. Thereby, increasing the need for surgical disposables such as sutures, drapes, and gloves. In addition, several animal shelters are collaborating with nongovernmental organizations and are offering spay and neuter surgeries in California to reduce pet overpopulation. This increase in free spay and neuter surgeries results in increased surgical volumes and demand for related products & services, which is expected to drive the market growth. For instance, in February 2024, Bradshaw Animal Shelter collaborated with Animal Balance to organize free spay/neuter clinics in Sacramento County's North Highlands and Florin communities to reduce pet overpopulation.

The increase in demand for veterinary sutures creates opportunities for sutures manufacturers and suppliers to expand their market presence in California. Absorbable sutures such as Polydioxanone (PDS II) are commonly used in spay & neuter surgeries of cats & dogs due to their balance of strength and decreased reactivity, making them suitable for a large, varied population.

Key U.S. Veterinary Surgical Disposables Company Insights

The market is characterized by high competitive rivalry among existing players. Existing players are enhancing their product portfolios with technologically advanced products and are widening their geographic reach by acquiring small & local players. These market players undertake several strategic initiatives to boost their market presence and share, including partnerships & collaborations, mergers & acquisitions, facility expansion, and product launches. For instance, Membra, a novel hydrogel wound sealant introduced by Animus Surgical in March 2023, provides an innovative solution to treating open wounds and safeguarding suture sites across a range of species. Membra is a novel, translucent hydrogel membrane that degrades naturally and is safe. These factors are likely to intensify rivalry in the market.

Key U.S. Veterinary Surgical Disposables Companies:

- Medtronic

- Ethicon US, LLC (Johnson & Johnson)

- VeterSut (Sutumed Corp)

- B. Braun Vet Care GmbH

- Vitrex Medical A/S

- AmerisourceBergen Corporation (Cencora)

- Med-Vet International

- CP Medical (Theragenics)

- Génia

- Covetrus

- ProNorth Medical

- Patterson Veterinary

- Vedco Inc.

- PHOENIX SUTURE

Recent Developments

-

In August 2024, Dolphin Sutures launched two innovative products for veterinary surgeons: fluorescent sutures, which enhance visibility under UV light and reduce tissue trauma during surgery, and cassette sutures, pre-loaded for convenience and minimizing contamination risks. These advancements improve surgical precision, streamline workflows, and promote faster healing in animals.

-

In January 2024, MWI Animal Health, a subsidiary of Centora (formerly AmerisourceBergen), collaborated with Hound, a leading veterinary talent platform, to provide innovative technology and services for veterinary practices in a rapidly changing industry.

U.S. Veterinary Surgical Disposables Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 121.04 million

Revenue forecast in 2030

USD 146.07 million

Growth Rate

CAGR of 3.83% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, animal type, end-use, state

Country scope

U.S.

State scope

California; Florida; Texas; Michigan; Washington; Colorado; Pennsylvania; Missouri; Ohio; Wyoming

Key companies profiled

Medtronic; Ethicon US, LLC; VeterSut (Sutumed Corp); B. Braun Vet Care GmbH; Vitrex Medical A/S; ProNorth Medical; AmerisourceBergen Corporation; Med-Vet International; CP Medical; Génia; Patterson Veterinary; Covetrus; Vedco Inc; PHOENIX SUTURE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Veterinary Surgical Disposables Market Report Segmentation

This report forecasts revenue growth at a state level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. veterinary surgical disposables market report based on product, animal type, end use, and state:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical Sutures

-

Absorbable

-

Non-Absorbable

-

-

Surgical Mesh

-

Sponges

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pets

-

Surgical Sutures

-

Absorbable

-

Non-Absorbable

-

-

Surgical Mesh

-

Sponges

-

-

Horses

-

Surgical Sutures

-

Absorbable

-

Non-Absorbable

-

-

Surgical Mesh

-

Sponges

-

-

Exotics

-

Surgical Sutures

-

Absorbable

-

Non-Absorbable

-

-

Surgical Mesh

-

Sponges

-

-

Large Animals

-

Surgical Sutures

-

Absorbable

-

Non-Absorbable

-

-

Surgical Mesh

-

Sponges

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinics

-

Hospitals

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

California

-

Florida

-

Texas

-

Michigan

-

Washington

-

Colorado

-

Pennsylvania

-

Missouri

-

Ohio

-

Wyoming

-

Others

-

-

Frequently Asked Questions About This Report

b. The U.S. veterinary surgical disposables market size was estimated at USD 116.95 million in 2024 and is expected to reach USD 121.04 million in 2025.

b. The U.S. veterinary surgical disposables market is expected to grow at a compound annual growth rate of 3.83% from 2025 to 2030 to reach USD 146.07 million by 2030.

b. California dominated the U.S. veterinary surgical disposables market with a share of 16.20% in 2024. This is attributable to growing pet population, and increase in demand for veterinary sutures.

b. Some key players operating in the U.S. veterinary surgical disposables market include Medtronic, Ethicon US, LLC, VeterSut (Sutumed Corp), B. Braun Vet Care GmbH, Vitrex Medical A/S, ProNorth Medical, AmerisourceBergen Corporation, Med-Vet International, CP Medical, Génia, Patterson Veterinary, Covetrus, Vedco Inc, PHOENIX SUTURE.

b. Key factors that are driving the market growth include the increasing uptake of pet insurance, product advancements, and increasing prevalence of chronic diseases in animals.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."