- Home

- »

- Healthcare IT

- »

-

U.S. Virtual Visits Market Size & Share Analysis Report, 2030GVR Report cover

![U.S. Virtual Visits Market Size, Share & Trends Report]()

U.S. Virtual Visits Market (2023 - 2030) Size, Share & Trends Analysis Report, By Service Type (Allergies, Urgent Care), By Commercial Plan Type (Small Group, Medicaid), By Age Group, By Gender, And Segment Forecasts

- Report ID: 978-1-68038-818-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

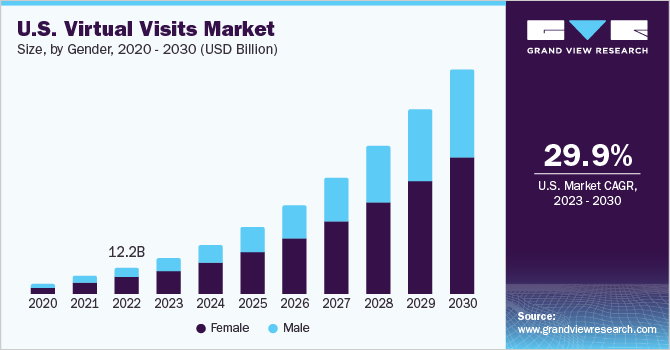

The U.S. virtual visits market size was estimated at USD 12.2 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 29.9% from 2023 to 2030. The increase in penetration of smartphones has positively impacted the growth of the market in the U.S. In addition, the ever-increasing and changing technology and fast adoption rates by the population is also a key factor driving the growth of the market. The COVID-19 pandemic had a positive impact on the market. The pandemic brought about a change in the way patients took consultations, the new norm was teleconsultations to communicate with the healthcare practitioners, which was responsible for a substantial growth in the market.

According to a report published by the Centers for Disease Control and Prevention (CDC), there was a significant increase in telehealth encounters during week 13 of 2020, amounting to a 154% increase compared to the previous period in 2019. Oregon Health & Science University witnessed a substantial rise in the adoption of digital health services within one month in 2020. The number of visits escalated significantly from 1,100 visits in February to 13,000 visits in March. Furthermore, a recent study highlighted the growth in telehealth visits during April 2020, which reached a peak 78 times higher than the number recorded in February 2020. The number of initiatives by the government has fueled the growth of the virtual visits market and is expected to keep growing over the forecast period. The pandemic brought about a change in the way patients took consultations, and an increasing trend in teleconsultations to communicate with healthcare practitioners was witnessed, which was responsible for substantial growth in the virtual visits market.

The landscape of telehealth has been continuously changing with apps and devices bringing patients and caregivers closer virtually, with a significant shift in consumer behavior from patients and doctors in the wake of the pandemic. This not only created a huge market opportunity for technological advancements to develop around different apps and devices to monitor various health conditions but also for people to connect to doctors even in remote locations where there were no functional hospitals or care centers. The virtual visit market has become a way to provide remote and rural as well as urban areas with safe and convenient access to healthcare for conditions like migraines, birth control, diabetes, hypertension, and other health conditions.

Access to quality, affordable health care is a basic human right, regardless of a patient's location, economic status, or race. According to the American Medical Association, telehealth is expected to become an important tool to address long-term health disparities in historically marginalized racial and ethnic groups that have been disproportionately affected by the COVID-19 pandemic. The American Medical Association motivates physicians to examine their practices to ensure fairness in nursing. Based on the increased awareness of the social impact of health determinants, physicians are paying more attention and prioritizing health equity to address the socioeconomic needs of patients.

The past few years have witnessed a significant surge in the demand for individualized healthcare services. This trend is particularly apparent in underserved regions where hospitals and healthcare facilities are already scarce. In these areas, there has been a lack of specialized and personalized care, leaving many individuals without proper medical attention. However, the introduction of teleconsultation services has effectively addressed this issue. This innovative approach to remote healthcare consultations has not only resolved the problem but also gained increasing acceptance among certified healthcare professionals. Initially driven by the urgent circumstances of the pandemic, teleconsultations have now emerged as the preferred method for providing remote care consultations.

Patients in remote areas can connect to specialists and experts from the comfort of their homes to anywhere in the country, This has resulted in faster and widespread adoption of telehealth and teleconsultations, resulting in the growth of the market. An increase in smartphone penetration and adoption of 4G & 5G technologies and devices have enabled both patients and caregivers to connect easily.

The increasing number of government initiatives has also positively affected the growth of the virtual visits market in the U.S. For instance, in April 2020, The Federal Communications Commission (FCC) established a USD 200 million COVID-19 Telehealth program, which connected and enabled caregivers to provide appropriate consultations to patients in rural settings and remote areas, the latest funding for this purpose was announced on January 26, 2022. In addition, in June 2021, the FCC also launched a connected care pilot program, wherein it approved guidance for this program to begin a 3-year project. Many more initiatives have been undertaken to improve the telehealth landscape in the country in turn boosting the growth of the market.

Age Group Insights

In terms of age group, the 18 – 34 years segment dominated the market with the largest revenue share in 2022. An increase in the penetration of smartphones in this age group, increasingly high internet usage, and a steady increase in the number of mental health issues have resulted in a large market share. The increase in the number of people reporting mental health issues and the increased rate of anxiety and depression among people in this age group is expected to propel growth in this segment.

The 35 to 49 years age group segment is expected to grow at the fastest CAGR over the forecast period due to the increasing prevalence of chronic illnesses like diabetes, hypertension, and various cardiovascular diseases. According to a report by the Centers for Disease Control and Prevention, nearly 18.2 million adults aged 20 and above suffer from coronary artery disease; nearly half the adult population in the U.S. has hypertension, and 47% population or 116 million people have hypertension. The numerous advantages associated with virtual visits like lesser waiting time due to pre-scheduling, decreased chances of contracting additional infections from hospitals, and ease and comfort of the process are all expected to propel the virtual visits market in the forecast period.

Gender Insights

In terms of gender, the female segment dominated the market with the largest revenue share of 64.5% in 2022. The pandemic highlighted the need to access healthcare facilities in a safe environment for pregnant women to avoid the risk of contracting the virus through hospital visits, which was the primary factor for the large revenue share for this segment. Virtual visits were the need of the hour and were increasingly adopted by women all over the country.

The male segment is expected to grow at the fastest CAGR of 31.7% over the forecast period owing to the ease of use of teleconsultations for various conditions like increasing mental health issues, sexual health concerns like erectile dysfunction and STDs, stress management, and various other health conditions without visiting the doctor in person. Virtual visits have come a long way and are not just restricted to video calling, connected apps, and devices that make patient monitoring easier. Consumers are increasingly leaning towards this form of consultation to avoid wastage of time and resources by going to hospitals unless necessary. These factors are expected to boost the growth of the segment over the forecast period.

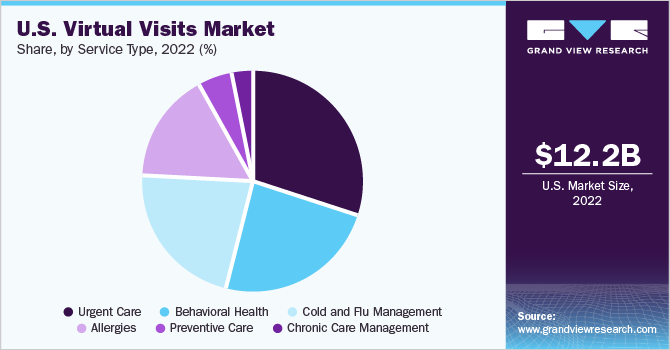

Service Type Insights

In terms of service type, the urgent care segment dominated the market with the largest revenue share of 29.5% in 2022. The increase in demand for virtual visits within the urgent care segment can be attributed to the convenience and accessibility that virtual visits offer to patients. By seamlessly integrating technology into the urgent care industry, individuals have the opportunity to seek medical advice and treatment remotely, thereby eliminating the need for physical visits to healthcare facilities.

The allergies segment is expected to grow at the fastest CAGR of 35.5% over the forecast period. Allergies, which can cause mild discomfort to severe reactions, are a prevalent health condition that affects a large percentage of the U.S. population. Individuals can seek medical advice and treatment for allergy-related illnesses through virtual visits, which eliminates the need for in-person visits to healthcare institutions. Virtual visits enable individuals to communicate with licensed healthcare providers via a variety of online portals, smartphone apps, and telecommunication channels. Individuals seeking allergy-related care have found this ease of access to virtual appointments to be extremely beneficial.

The cold and flu management segment held a considerable market share of 29.8% in 2022. This can be attributed to the fact that patients are increasingly preferring virtual visits to consult physicians regarding cold and flu symptoms. The majority of the patients in this category resorted to teleconsultations to avoid the spread of infection and contracting additional symptoms through physical visits to hospitals. An increase in the prevalence of influenza during the pandemic has also resulted in the growth of the segment. In 2020, there was a huge spike in the number of influenza cases that led to the growth of this segment.

Behavioral health is expected to grow at a significant rate during the forecast period. The onset of the pandemic made teleconsultations and virtual visits a norm, even in the behavioral health segment. The increasing demand for virtual visits for several conditions like depression, anxiety, LGBTQ counseling, and a wide array of mental health issues has resulted in the growth of this segment. The pandemic saw a massive increase in the number of patients suffering from depression and anxiety, also contributing to the growth of the behavioral health segment.

Commercial Plan Type Insights

In terms of commercial plan type, the self-funded/ASO group plans segment dominated the market with the largest revenue share in 2022 owing to an increase in the prevalence of chronic diseases, skyrocketing healthcare costs, and an increase in demand for affordable healthcare solutions.

The small group commercial plan segment is anticipated to grow at the fastest CAGR over the forecast period. Demand for virtual care has been steadily increasing and more so due to the COVID-19 pandemic, Several initiatives undertaken by both public and private entities to decrease the burden of healthcare costs on small businesses and their employees, which in turn is expected to boost the growth of small group commercial plan segment.

Despite the various advantages of telehealth and virtual consultations, Medicare and Medicaid programs do not comprehensively cover all expenses related to these services. This coverage gap places a financial burden on patients and caregivers. However, the implementation of specific healthcare plans tailored to address this issue has led to improved access to healthcare services and enhanced patient adherence. As a result, the utilization of such plans has contributed to the expansion of this segment, providing greater opportunities for individuals to receive necessary medical care through telehealth and virtual consultations.

Key Companies & Market Share Insights

The rise in the adoption of telehealth services has created a huge demand for virtual visits. The high demand has created fierce competition in the regional market making space for new companies to venture into this field through connected apps and disruptive technology opening up space for innovation in this field. The companies are strategically expanding their offering through new and improved apps or connected devices, collaborating with third parties and other companies to make virtual care accessible to all. For instance, in March 2023, Royal Phillips, a health technology company and a subsidiary of Koninklijke Philips N.V., announced the launch of Philips Virtual Care Management. It encompasses a comprehensive range of flexible services and solutions aimed at supporting employer groups, payers, providers, and health systems in establishing remote connections with patients. By focusing on effective chronic illness management, this integrated portfolio helps in reducing healthcare expenses and relieving the strain on hospital staff by reducing emergency department visits. Some prominent players in the U.S. virtual visits market:

-

American Well

-

MDLIVE

-

Doctor On Demand by Included Health, Inc.

-

eVisit

-

Teladoc Health, Inc.

-

MeMD

-

HealthTap, Inc.

-

Vidyo, Inc.

-

PlushCare

-

Zipnosis

U.S. Virtual Visits Market Report Scope

Report Attribute

Details

Revenue forecast 2030

USD 105.4 billion

Growth rate

CAGR of 29.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, age group, gender, commercial plan type

Key companies profiled

American Well; MDLIVE; Doctor On Demand by Included Health, Inc.; eVisit; Teladoc Health, Inc.; MeMD; HealthTap, Inc.; Vidyo, Inc.; PlushCare; Zipnosis

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Virtual Visits Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. virtual visits market report based on service type, age group, gender, and commercial plan type:

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cold and Flu Management

-

Allergies

-

Urgent Care

-

Preventive Care

-

Chronic Care Management

-

Behavioral Health

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Age 18-34

-

Age 35-49

-

Age 50-64

-

Age 65 and above

-

-

Gender Outlook (Revenue, USD Million, 2018 - 2030)

-

Male

-

Female

-

-

Commercial Plan Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Group

-

Self-Funded/ASO Group Plans

-

Medicaid

-

Medicare

-

Frequently Asked Questions About This Report

b. The U.S. virtual visits market size was estimated at USD 12.2 billion in 2022 and is expected to reach USD 16.8 billion in 2023.

b. The U.S. virtual visits market is expected to grow at a compound annual growth rate of 29.9% from 2023 to 2030 to reach USD 105.4 billion by 2030.

b. The cold and flu segment dominated the U.S. virtual visits market with a share of 29.5% in 2022. This is attributable to increasing patient demand for immediate care while avoiding the spread of infections in waiting rooms at hospitals & other healthcare facilities.

b. Some key players operating in the U.S. virtual visits market include Teladoc, Inc., American Well Corporation, MDLive, Inc., Doctor on Demand, Inc., Vidyo, Inc., HealthTap, Inc., MeMD, eVisit, and PlushCare.

b. Key factors that are driving the U.S. virtual visits market growth include increasing penetration of smartphones, increasing prevalence of chronic diseases, rising geriatric population, and the emergence of connected care.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.