- Home

- »

- Medical Devices

- »

-

U.S. Wheelchair Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Wheelchair Market Size, Share & Trends Report]()

U.S. Wheelchair Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Manual, Electric), By Category Type (Adult, Pediatric), By Application (Ambulatory Surgical Centers, Rehabilitation Centers), And Segment Forecasts

- Report ID: GVR-4-68040-215-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Wheelchair Market Size & Trends

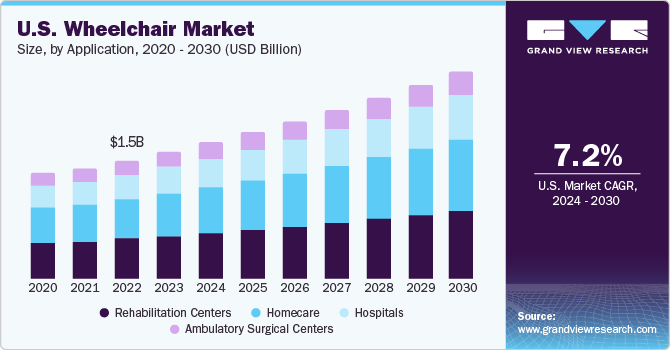

The U.S. wheelchair market size was estimated at USD 1.63 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.2% from 2024 to 2030. The market growth is driven by growing geriatric population that needs long-term care and injuries related to spinal cord issues, accidents, and falls. Moreover, the demand for wheelchairs is anticipated to rise due to demographic trends and advancements in assistive technology. These innovations cater to the needs of individuals experiencing mobility challenges, resulting from chronic diseases and aging-related conditions.

According to the National Spinal Cord Injury Statistical Center, around 17,730 new spinal cord injuries occur in the U.S. every year, with vehicular crashes being the leading cause of injury. The halting of wheelchair operations across the country during the COVID-19 pandemic affected market growth; however, hospitals witnessed consistent demand owing to a spike in the number of elderly populations getting admitted due to the COVID-19 infection. Thus, the demand for wheelchairs in the country spiked after the resumption of operations.

The decline in mobility and agility associated with aging has necessitated using mobility products, such as wheelchairs, to maintain independent functioning. Moreover, older individuals are more susceptible to falls, which can result in fatal or nonfatal injuries heightening mobility issues. As per the U.S. CDC (Centers for Disease Control and Prevention) and few other research on fall, over 25.0% Americans aged over 65, experience fall annually, making it the leading reason of fatal & non-fatal injuries among older adults in the country. Moreover, aging is considered the greatest risk factor for developing chronic conditions.

According to the Urban Institute, geriatric American population is expected to double over the next four decades, reaching 80 million by 2040. Innovations in wheelchair designs reflect a consumer-oriented approach to healthcare, fostering the adoption of advanced technologies like personalized wearable devices, digital patient records, and internet-connected systems. These technologies aim to deliver intelligent, user-friendly, and convenient healthcare services at home. Many market players are actively investing in this technological advancement.

Market Concentration & Characteristics

The U.S. wheelchair market is currently at a moderate growth pace and is experiencing an acceleration. The ongoing technological advancements in the design of wheelchairs are anticipated to fuel future sales in the industry. Innovations in wheelchair design have led to the incorporation of features such as whistles, bells, motorized walking aids, comfort-enhancing positioning devices, and attachment bags for carrying personal items. The development of advanced wheelchair accessories not only improves user comfort but also makes them more portable, as they can now be easily folded and carried around. Moreover, public and private funding initiatives for research and development in the region are likely to propel the industry.

The industry is consolidated, and industry players have used strategically implemented mergers and acquisitions to expand their product offerings and broaden their footprint in the country. For example, in June 2020, GF Health Products, Inc. declared its acquisition of Gendron, Inc., a prominent designer and producer of mobile patient management systems. This acquisition is set to aid the company in extending its operations in the U.S.

Favorable government policies coupled with increase in funding for R&D is expected to help in development of innovative products. The U.S. federal laws like the Americans with Disabilities Act, which allow people with disability employment protection, new health care options for long-term support & services, and access to high-quality & affordable health care. For instance, the U.S. government has started several programs to help people who have disabilities, and this is likely to drive the industry’s growth.

The industry is expected to grow due to advancements in products and a rising demand for manual as well as electric wheelchairs, positively impacting sales. Key players such as Invacare Corporation, Permobil, and Sunrise Medical, who currently dominate the industry, are likely to maintain their revenue share.

Adoption of new-age platforms, such as online portals, for selling and distribution of wheelchairs highly benefits end users in finding the best possible mobility aids, based on their requirement and comfort, thus increasing the industry reach for industry players. For instance, in August 2022, Sunrise Medical announced the launch of RGK line of manual wheelchairs in North America.

Product Insights

Manual wheelchairs dominated this market with a 61.18% revenue share. This segment is also expected to grow with the fastest CAGR during the forecast period. Manual wheelchairs have long been considered as the most popular and commonly used form of mobility assistive devices, providing essential support to people with disabilities and the elderly population. It is a cost-effective and practical solution to maintain independent functioning, enabling individuals to accomplish daily activities and participate in social events without any discomfort. This type of wheelchairs is propelled by the user or pushed by another person and is differentiated into three types: self-propelled, attendant propelled, and wheelbase. According to WHO, in the U.S. alone, around 20.0% women and 17.0% men have some type of disability.

Electric wheelchairs in the U.S. are also expected to witness lucrative growth over the forecast period, owing to the electric or power chairs provide high independence & comfort and ability to travel without round-the-clock assistance of a second individual. Various technological advancements are taking place in the field of electrical wheelchair manufacturing, and this segment is expected to exhibit significant growth over the forecast period.

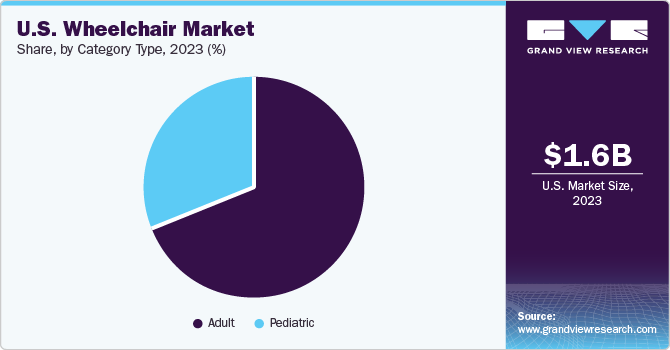

Category Type Insight

Adults dominated and accounted for nearly 69.0% share in U.S. wheelchairs market in 2023. With the aging population in this country on the rise, the prevalence of mobility-related challenges increases. With growing geriatric population, prevalence of chronic conditions, such as diabetes, cardiovascular disorders, arthritis, and other lifestyle disorders, is expected to increase, aiding market growth. The elderly is key target population for personal mobility devices like wheelchairs.

Pediatric segment is expected to grow at the highest CAGR over the forecast period due to the growing number of childhood disorders such as cerebral palsy. Cerebral palsy is one of the most common movement disorders that require wheelchairs. It is the most diagnosed movement disability in childhood in the U.S. Moreover, many companies offer a wide range of pediatric wheelchairs that are equipped with adjustable frames, which can be altered as per kids’ growth.

Application Insights

Rehabilitation centers accounted for the highest revenue market share of over 70.0% in 2023. Based on application, the U.S. wheelchair market has been divided into homes, hospitals, ambulatory surgical centers, and rehabilitation centers. Mobility devices, such as wheelchairs, can be part of a rehabilitation program. The process involves steady progression toward independence with the help of assisted/unassisted walking. Moreover, these centers provide various medical services, including physiotherapy and occupational therapy, to help individuals regain their independence and freedom.

Hospitals are anticipated to register the fastest growth from 2024 to 2030. Many severe brain injuries or accidents, diseases, congenital disorders, or spinal cord trauma are still treated better in a hospital environment. The major goal of a hospital service is to stabilize a person and not provide long-term care. Therefore, a person suffering from temporary or permanent disability needs to obtain a doctor’s prescription to buy a wheelchair and avail Medicare benefits. Moreover, the increasing cases of medical emergencies and post-surgical requirements boost the demand for wheelchairs. In hospitals, these chairs are mainly used for transporting patients and visiting a doctor’s office in a large-scale medical facility.

Key U.S. Wheelchair Company Insights

Prominent companies in the U.S. wheelchair market are enhancing their product offerings and integrating new technologies to broaden their customer base, strengthen their market position, and diversify their product portfolio. Some key players in the market include Carex Health Brands, Inc.; Drive Medical Design & Manufacturing; Graham-Field Health Products, Inc.; Invacare; Medline Industries; Sunrise Medical LLC; Karman Healthcare; Quantum Rehab; Numotion; Pride Mobility Products Corp.; and Sermax Mobility Ltd.

The market players are mainly focusing on product launches and upgradation to gain market share. For instance, in February 2020, Numotion announced a strategic alliance with NOW Technologies, a firm that develops advanced power wheelchair control systems.

Key U.S. Wheelchair Companies:

- Carex Health Brands, Inc.

- DeVilbiss Healthcare LLC

- GF Health Products, Inc.

- Invacare Corporation

- Medline Industries, Inc.

- Sunrise Medical

- Karman Healthcare, Inc.

- Quantum Rehab

- Numotion

- Pride Mobility Products Corp.

- Sermax Mobility Ltd.

Recent Developments

-

In January 2024, Robooter showcased the innovative power wheelchair X40 at the Consumer Electronics Show (CES 2024), introducing a new space and mobility solution for individuals with disabilities.

-

In September 2023, Revolve Mobility launched the Revolve Air travel wheelchair on Kickstarter, designed to fold to cabin luggage size. This innovative wheelchair aimed to enhance accessibility and mobility for individuals with disabilities, aligning with advancements in cancer care technology.

-

In September 2023, General Motors' Cruise unveiled a wheelchair-accessible robotaxi based on its Origin driverless vehicle, designed to accommodate people with disabilities. The Cruise WAV, lacking a steering wheel and pedals, offers passengers-facing seating arrangements.

-

In February 2022, Invacare Corporation unveiled the Invacare AVIVA STORM RX Narrow Base power wheelchair, an upgrade to the AVIVA STORM RX, a next-generation chair launched in August 2021.

-

In July 2021, Sunrise Medical launched QUICKIE Nitrum, an ultra-light wheelchair with the highest rigidity and strength.

-

In December 2020, LUCI and Numotion, a mobility product provider, struck a national distribution deal. Numotion was the first distributor of LUCI's hardware and software in the U.S.

-

In June 2020, GF Health Products, Inc. announced an extension of Everest & Jennings Traveler L3 Plus. This new model provides additional seat heights, includes 20" rear wheels and 6" casters, and exemplifies product development in the post-pandemic market.

U.S. Wheelchair Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.76 billion

Revenue forecast in 2030

USD 2.67 billion

Growth rate

CAGR of 7.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, category type, application

Country scope

U.S.

Key companies profiled

Carex Health Brands, Inc.; DeVilbiss Healthcare LLC; GF Health Products, Inc.; Invacare Corporation; Medline Industries, Inc.; Sunrise Medical; Karman Healthcare, Inc.; Quantum Rehab; Numotion; Pride Mobility Products Corp.; Sermax Mobility Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Wheelchair Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. wheelchair market based on product, category type, and application:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual

-

Electric

-

-

Category Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult

-

Pediatric

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Homecare

-

Hospitals

-

Ambulatory Surgical Centers

-

Rehabilitation Centers

-

Frequently Asked Questions About This Report

b. The U.S. wheelchair market was estimated at USD 1.63 billion in 2023 and is expected to reach 1.76 USD billion in 2024.

b. The U.S. wheelchair market is expected to grow at a CAGR of 7.2% from 2024 to 2030 to reach USD 2.67 billion in 2030.

b. Adults dominated and accounted for nearly 69.0% share in U.S. wheelchairs market in 2023. With the aging population in this country on the rise, the prevalence of mobility-related challenges increases.

b. Some key players in the market include Carex Health Brands, Inc.; Drive Medical Design & Manufacturing; Graham-Field Health Products, Inc.; Invacare; Medline Industries; Sunrise Medical LLC; Karman Healthcare; Quantum Rehab; Numotion; Pride Mobility Products Corp.; and Sermax Mobility Ltd.

b. The market growth is driven by growing geriatric population that needs long-term care and injuries related to spinal cord issues, accidents, and falls.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.