- Home

- »

- Beauty & Personal Care

- »

-

U.S. Women’s Grooming Market Size & Share, Report, 2030GVR Report cover

![U.S. Women’s Grooming Market Size, Share & Trends Report]()

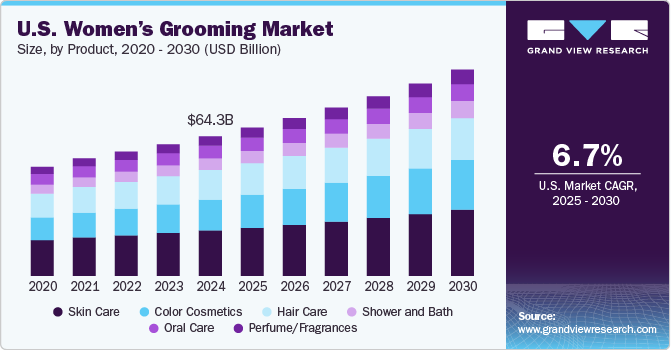

U.S. Women’s Grooming Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Skin Care, Hair Care, Oral Care, Color Cosmetics, Shower & Bath, Perfume/Fragrances), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-057-1

- Number of Report Pages: 65

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Women’s Grooming Market Trends

The U.S. women’s grooming market size was estimated at USD 68.20 billion in 2024 and is expected to grow at a CAGR of 6.7% from 2025 to 2030. The increasing focus on health, wellness, and self-care is one of the major factors driving the growth of the market. As consumers prioritize holistic health, including mental wellness, sleep, and stress management, they are turning to products that address these needs, from calming skin care to nourishing creams. The "me-mentality" and demand for personalized solutions are further fueling growth, with women seeking tailored products that reflect their individual preferences and lifestyles. With wellness now a multi-billion industry in the U.S., this shift is pushing growth in beauty and personal care, especially as brands cater to the desire for self-expression, stress relief, and enhanced well-being.

The rising trend of self-care has transformed the beauty and wellness industry, with consumers increasingly seeking products that align with their values and holistic well-being. Social media platforms such as TikTok and Instagram have amplified these trends, promoting mindful ingredient selection, relaxation rituals, and the importance of overall health. This shift has driven brands to offer beauty products that not only enhance appearance but also nurture mental and physical wellness, creating a strong connection between beauty and self-care.

Teenagers are emerging as a key demographic in the U.S. market, driving increased spending on makeup and skin care. According to Piper Sandler Companies' 45th "Taking Stock With Teens" survey, published in 2023, teen makeup spending rose 32% year-over-year, while skincare grew 11%. Teen girls now spend an average of USD 123 on makeup and USD 119 on skin care annually, reversing previous trends. With 45% of teens wearing makeup daily, compared to 37% in 2022, their average cosmetic spending reaches USD 185. Cosmetic and skincare brands are ramping up social media marketing targeting teens, making them a significant contributor to the ongoing rise in beauty and wellness spending.

As K-beauty continues to gain traction, brands such as Laneige and Amore Pacific have expanded their offerings to cater to diverse skin needs. With a focus on education and accessibility, consumers are more inclined to explore various products, from essences to exfoliants, driving sales across all price points. This intricate routine not only elevates daily skin care but also promotes a culture of self-care and experimentation, encouraging beauty enthusiasts to evolve their regimens continuously.

The growing demand for clean beauty and natural ingredients presents a significant opportunity for the beauty and personal care products market in the U.S. As women become more conscious of the environmental and health impacts of the products they use, there's a noticeable shift toward eco-friendly and ingredient-transparent cosmetics. This trend is being driven largely by Millennials and Gen Z, whose preferences for natural and sustainable skincare are reshaping the market. Social media also plays a key role in influencing beauty purchases and reinforcing the importance of clean, safe formulations. Brands that prioritize sustainability and clean ingredients are poised for growth in this evolving landscape.

E-commerce and direct-to-consumer (DTC) models are rapidly reshaping the U.S. beauty industry, offering brands new opportunities to connect with consumers. With the rise of personalized shopping experiences and advanced technology, brands can now tailor their offerings to individual needs, creating deeper customer engagement. This shift is driven by consumer demand for convenience, sustainability, and innovative products, including cruelty-free and vegan options. The DTC approach allows brands to have more control over pricing, marketing, and customer interactions, providing an agile platform to compete in a growing market. As online shopping becomes increasingly popular, the beauty industry is evolving to meet the expectations of digitally savvy women, making e-commerce an essential avenue for future growth.

Product Insights

The skincare products held a market share of 32.61% in 2024. The increasing significance of skincare has markedly transformed consumer attitudes towards grooming products, with heightened awareness driving demand for comprehensive skincare regimens. As consumers prioritize effective skincare solutions, manufacturers are responding by developing a diverse array of innovative products tailored to current trends. Furthermore, many prominent makeup brands are diversifying their portfolios by entering the skincare segment, thus enhancing their market presence.

The influence of celebrities and social media influencers has been pivotal in shaping consumer preferences within the U.S. women's grooming market. For instance, Selena Gomez launched Rare Beauty in September 2020, a brand that emphasizes inclusivity and mental health advocacy, which resonates profoundly with younger demographics through various social media channels. Similarly, Jennifer Lopez's JLo Beauty, introduced in January 2021, strategically targets the anti-aging sector, with Lopez's enduring beauty serving as a central marketing theme. The success of these celebrity-backed brands, heavily promoted across social platforms, has significantly impacted consumer behavior and contributed to the robust growth observed in the U.S. women's grooming landscape.

In addition, established skincare brands, including Sephora, Kiehl’s, Vichy, and Bobbi Brown, are leveraging cutting-edge technology such as virtual advisors to facilitate direct and real-time communication with consumers online. This digital approach emulates the in-store consultation experience, thereby addressing the challenges posed by overwhelming product selections and ambiguous marketing claims. By enhancing consumer confidence in online purchasing, these initiatives have proven effective in driving sales and positively influencing the growth trajectory of skincare products within the U.S. women's grooming market.

The demand for color cosmetics is anticipated to grow with a CAGR of 8.3% from 2025 to 2030. Celebrities are significantly shaping the demand for color cosmetics by entering the market with their beauty brands. Prominent international figures such as Rihanna, Selena Gomez, and Lady Gaga have successfully launched lines like Fenty Beauty, Rare Beauty, and Haus Labs, respectively. This trend illustrates how celebrities are harnessing their influence to establish skincare and makeup product lines, effectively shaping consumer preferences and propelling market growth. The rising prominence of social media platforms, including Instagram, TikTok, and YouTube, has further intensified the demand for face color cosmetics. These platforms are saturated with makeup tutorials, product reviews, and influencer-driven beauty trends, making face color cosmetics increasingly accessible and desirable. Consumers are continually exposed to innovative looks, techniques, and product endorsements, prompting them to explore a diverse range of color cosmetics, such as foundations, blushes, bronzers, and highlighters, to achieve various aesthetic outcomes.

Face color cosmetics have emerged as essential tools for self-expression, creativity, and confidence. As societal perceptions of beauty evolve, individuals are increasingly using makeup not only to enhance their features but also to communicate their uniqueness. This cultural shift is reflected in the growing popularity of vibrant and varied color options in products such as foundations, blushes, and highlighters, as well as the expansion of inclusive shade ranges that cater to a broader spectrum of skin tones. The beauty industry’s commitment to inclusivity-demonstrated by brands offering extensive shade selections for all skin types-has enhanced the appeal of face color cosmetics, making them accessible to a diverse consumer demographic.

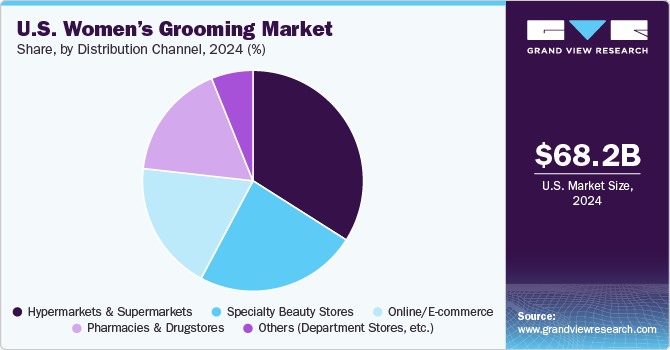

Distribution Channel Insights

The sales of women’s grooming products through supermarkets and hypermarkets accounted for a market share of 33.99% in 2024. The expansion of beauty and personal care products within hypermarkets and supermarkets significantly influences the U.S. women's grooming market. Retail giants have successfully established a comprehensive shopping environment that enables consumers to conveniently access a diverse array of grooming products under one roof. This convenience is a key driver of consumer behavior, as shoppers value the ability to effortlessly locate their preferred brands and discover new offerings without the necessity of visiting multiple retail locations.

Prominent supermarket chains such as Kroger, Edeka Group, Walmart, Macy's, and Target are enhancing their product portfolios and broadening their offerings to cater to a wider demographic. These retailers are adopting an omnichannel distribution strategy, which integrates both online and in-store shopping experiences, to better serve consumer needs. In addition, these establishments are committed to delivering high-quality products at competitive prices, thereby ensuring accessibility and affordability for consumers in the women's grooming segment.

The sales through e-commerce/online platforms are expected to grow at a CAGR of 8.4% from 2025 to 2030. The proliferation of the beauty and personal care products market via e-commerce is largely fueled by the convenience and accessibility inherent in online shopping platforms. These platforms have streamlined the process for consumers to browse, compare, and purchase an extensive variety of beauty products from the comfort of their homes. The availability of comprehensive product information, customer reviews, and educational resources online empowers consumers to make informed purchasing decisions, thereby enhancing their confidence in online transactions.

Company websites frequently showcase the latest innovations in skincare, haircare, and makeup, effectively attracting consumers in search of cutting-edge products and a broad selection of options. For example, Sephora has recently established dedicated sections on its website for new product launches, specifically catering to customers interested in beauty, skincare, haircare, and makeup products.

Key U.S. Women’s Grooming Company Insights

The competitive landscape of the U.S. women's grooming market is characterized by a dynamic interplay of established multinational corporations and emerging niche brands, each striving to capture a share of this lucrative sector. Key players, including Procter & Gamble, Unilever, Estée Lauder Companies, and L'Oréal, dominate the market with extensive product portfolios that encompass a wide range of categories such as skincare, haircare, and cosmetics. These corporations leverage their significant financial resources and robust distribution networks to maintain a competitive edge, ensuring widespread availability and visibility of their products across various retail channels.

In recent years, the market has seen a marked rise in the presence of direct-to-consumer brands and innovative startups that emphasize personalization and sustainability, catering to the evolving preferences of modern consumers. Companies such as Glossier and Billie have effectively utilized digital marketing strategies and social media engagement to foster brand loyalty and resonate with younger demographics. This shift towards e-commerce and social selling has intensified competition, compelling established brands to enhance their digital strategies and invest in omnichannel distribution approaches to meet consumer expectations.

Moreover, trends such as clean beauty, natural ingredients, and inclusivity have significantly influenced product development and branding strategies within the market. As consumers increasingly prioritize ethical and sustainable practices, companies that align their offerings with these values are poised to capture greater market share. Overall, the competitive landscape of the U.S. women's grooming market is dynamic and evolving, driven by innovation, consumer preferences, and the necessity for brands to adapt to an increasingly digital and socially conscious marketplace.

Key U.S. Women’s Grooming Companies:

- Procter & Gamble Co.

- Unilever PLC

- Estée Lauder Companies Inc.

- L'Oréal S.A.

- Revlon Inc.

- Coty Inc.

- Johnson & Johnson

- Colgate-Palmolive Company

- Mary Kay Inc.

- Shiseido Company, Limited

Recent Developments

-

In October 2024, Coty Inc., launched a new campaign to promote its Ultimate Miracle Worker Face & Neck Cream, aiming to make retinol less intimidating for consumers under its brand, Philosophy. Inspired by horror themes, the campaign addressed common concerns about retinol's side effects, such as flakiness and irritation. The product delivered clinical-strength retinol with a luxurious texture, helping improve lines, wrinkles, and skin firmness without irritating, making it more approachable for users.

-

In August 2024, Johnson & Johnson's brand, Neutrogena, launched Neutrogena Collagen Bank, featuring its patented micro-peptide technology, aimed at addressing Gen Z's growing concerns about aging. This innovative skincare line, designed with dermatologists, offered affordable solutions for preventing early collagen loss.

U.S. Women’s Grooming MarketReport Scope

Report Attribute

Details

Market size value in 2025

USD 72.46 billion

Revenue forecast in 2030

USD 100.85 billion

Growth rate

CAGR of 6.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Key companies profiled

Procter & Gamble Co.; Unilever PLC; Estée Lauder Companies Inc.; L'Oréal S.A.; Revlon Inc.; Coty Inc.; Johnson & Johnson; Colgate-Palmolive Company; Mary Kay Inc.; Shiseido Company, Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Women’s Grooming Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. women’s grooming market report based on product, and distribution channel.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Skin Care

-

Face Skin Care

-

Lotions, Face Creams, & Moisturizers

-

Cleansers & Face Wash

-

Facial Serums

-

Sunscreen/Sun Care

-

Sheet Face Masks

-

Others (Scrub, etc.)

-

-

Body Skin Care

-

Hair Removal Products

-

Lotions, Creams, & Moisturizers

-

Body Sunscreen/Sun Care

-

Body Scrub

-

Others (Serum, Oils, etc.)

-

-

-

Hair Care

-

Shampoo

-

Conditioner

-

Oils

-

Serums

-

Others (Hair Masks, Peels, Etc.)

-

-

Oral Care

-

Toothpaste

-

Toothbrush

-

Mouthwashes/Rinses

-

Dental Floss

-

Others (Tongue Cleaners, Dental Water Jets, etc.)

-

-

Color Cosmetics

-

Face Color Cosmetics

-

Foundation

-

Concealer

-

Blush and Bronzer

-

Powder

-

Others (Highlighter, etc.)

-

-

Lip Color Cosmetics

-

Lipstick

-

Lip Liner

-

Lip Gloss

-

Lip Tint

-

Others (Lip Powder, Plummer, etc.)

-

-

Eye Color Cosmetics

-

Eye Shadow

-

Eye Liner

-

Mascara

-

Eye Pencil

-

False Eyelashes

-

Others (Eye Primer, etc.)

-

-

Nail Color Cosmetics

-

-

Shower and Bath

-

Perfume/Fragrances

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Beauty Stores

-

Pharmacies & Drugstores

-

Online/E-commerce

-

Others (Department Stores, etc.)

-

Frequently Asked Questions About This Report

b. The U.S. women's grooming market was estimated at USD 68.20 billion in 2024 and is expected to reach USD 72.46 billion in 2025.

b. The U.S. women's grooming market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2030, reaching USD 100.85 billion by 2030.

b. The skincare product segment captured the largest market share, 32.61%, in 2024. This growth is driven by rising consumer demand for wellness and grooming products and an ever-growing trend of natural and sustainable beauty products in the U.S.

b. Some of the key players operating in the U.S. women's grooming market include Procter & Gamble Co., Unilever PLC, Estée Lauder Companies Inc., L'Oréal S.A., Revlon Inc., Coty Inc., Johnson & Johnson, Colgate-Palmolive Company, Mary Kay Inc., and Shiseido Company, Limited.

b. The market's growth is driven by an increasing focus on health, wellness, and self-care. As consumers prioritize holistic health, including mental wellness, sleep, and stress management, they are turning to products that address these needs, from calming skin care to nourishing creams.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.