- Home

- »

- Pharmaceuticals

- »

-

U.S. Women’s Health And Beauty Supplements Market, Industry Report, 2030GVR Report cover

![U.S. Women’s Health And Beauty Supplements Market Size, Share & Trends Report]()

U.S. Women’s Health And Beauty Supplements Market Size, Share & Trends Analysis Report, By Product, By Application, By Age-group, By Consumer Group, By Sales Channel, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-247-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The U.S. women’s health and beauty supplements market size was estimated at USD 18.35 billion in 2023 and is expected to grow a CAGR of 4.56% from 2024 to 2030. The rising awareness about health and the growing preference for preventative healthcare are significantly driving the global women’s health and beauty supplements market.

The U.S. accounted for over 30% of the global women’s health and beauty supplements market in 2023. The impact of the COVID-19 has further amplified the focus on health and wellness, leading to increased consumption of supplements. Women, in particular, are turning to vitamins, minerals, and herbal supplements, to enhance their overall well-being and health. Furthermore, the increasing demand for stress-relieving, pre & post-natal, bone & joint health, and digestive health supplements is anticipated to contribute significantly to the growth of the women’s health and beauty supplements market. These supplements cater to various health concerns and contribute to overall well-being, aligning with the current focus on health and wellness among consumers.

Unhealthy dietary habits have led to increased risks of chronic diseases such as diabetes, cardiovascular diseases, cancer, and obesity. According to the International Diabetes Federation, the number of diabetes patients is expected to rise from 537 million in 2021 to 643 million by 2030. In the U.S., individuals spent nearly USD 2.1 billion annually on weight-loss dietary supplements in 2021, as reported by the Office of Dietary Supplements, NIH. As awareness about the benefits of supplements for managing chronic diseases grows, the market is set to experience positive growth.

Furthermore, women in the U.S. are increasingly focusing on their nutritional needs and becoming more aware of the importance of preventative healthcare. Increasing internet penetration and manufacturers’ efforts to raise awareness about their products have contributed to this shift. Moreover, the growing awareness among women about the health benefits associated with beauty supplements and their preference for safe and effective beauty products have driven the demand for these supplements. Many women are concerned with obtaining healthy skin, hair, and nails, leading to a growing need for beauty supplements to prevent premature skin aging.

Increasing disposable income and the emphasis on maintaining a healthy lifestyle are significant factors driving the women’s health and beauty supplements market. In the U.S., health-conscious women, particularly those aged 19 to 50, are increasingly adopting health supplements due to the rising incidence of chronic diseases. Millennial women aged 16 to 34 are significant drivers of online supplement and vitamin purchases.

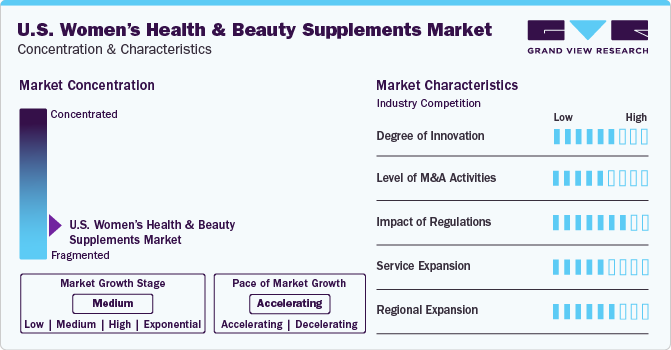

Market Concentration & Characteristics

The women’s health and beauty supplements market is poised to continue its steady growth over the next 5-6 years. The growth can be attribute to fierce competition among market participants to gain market share by constantly developing new products, improve label styles with clinical claims, incorporating novel ingredients, and getting clinicians to prescribe their products. The market also witnesses a high degree of product innovations, and M&A activities among other brand building activities by leading the companies.

Players lean toward launching new products, adopting product differentiation strategies, and entering into industry partnerships, which contribute to industry growth. Many new exotic ingredients are being researched for commercialization, which is likely to propel industry growth during the forecast period.

The level of mergers and acquisitions in the industry is moderately high, and companies are entering into partnerships with various domestic players for product development & distribution. For instance,in November 2023, Pharmavite acquired Bonafide Health, a company focused on menopause management solutions, for USD 425 million. This move strengthened Pharmavite’s position as a leading women’s health nutraceutical company and aligned with its goal of ensuring nutrition education and reinforcing its commitment to science-based solutions in the underserved women’s health space.

Health supplements and nutraceuticals in the country are recognized as dietary supplements by the FDA.The industry experiences continuous change in regulatory policies and enforcement processes. These regulations vary across different regions, further complicating the scenario for companies that seek to sell their products across regions. Favorable government initiatives aimed at addressing nutritional deficiencies for regulating health and beauty supplements are expected to drive the industry.

key companies are constantly launching new products to expand their product portfolio to increase their market share. For instance, in August 2022, GNC expanded its women’s wellness portfolio by introducing four new exclusive products in collaboration with The Honest Company. This partnership aimed to support women’s health and well-being, further strengthening GNC’s position in the industry.

The growth of the U.S. market is driven by factors such as heightened awareness about nutrition and beauty, rising consumer expenditure on cosmetic products, a diverse range of beauty-enhancing solutions, and companies adopting direct-to-consumer strategies to engage customers directly. Thus, companies have expanded their geographical reach in the country to cater to the increasing demand.

Product Insights

Vitamins held the largest market share in 2023, accounting for nearly 34% of the total revenue. Research suggests that approximately 30% women in the U.S. may have nutritional deficiencies in one or more essential vitamins and minerals. This highlights the importance of addressing nutritional needs, particularly for specific groups such as pregnant or breastfeeding women, to maintain overall health and well-being. The increasing demand for multivitamins and specific vitamins like A, B, C, D, and E among women of various age groups dealing with vitamin deficiencies is a major market driver. It is often challenging for pregnant or breastfeeding women to meet their vitamin A requirements, leading experts to recommend vitamin A supplements, typically in the form of retinyl acetate, beta carotene, or a combination of provitamin A.

Enzymes are anticipated to grow at the fastest rate over the forecast period owing to the increasing adoption of enzyme-based products and heightened awareness among women regarding the benefits of enzymatic supplements. Some popular enzyme supplements for women’s health and beauty include GNC’s Coenzyme Q10 Softgels, containing 100 mg of CoQ10, and Healthvit’s CoQ-Vit Coenzyme Q-10, available as 100 mg capsules. These supplements contribute to the growing interest in enzymatic products for maintaining and improving women’s well-being.

Application Insights

The women’s health segment dominated the market in 2023 with over 65% of the revenue share and is anticipated to be the fastest-growing segment over the forecast period. The rising preference for health and nutrition products has led to a shift in women’s choices, as they now opt for vitamins and supplements to maintain their wellbeing. As consumers adopt a holistic approach to healthcare, companies are focusing on offering advanced women’s health products and services. Consequently, key players in the industry are upgrading their product categories to gain a competitive edge in the market.

Beauty supplements are anticipated to witness lucrative growth over the forecast period due to the increasing demand for personalized beauty products and beauty supplements that are being introduced in the market. One popular ingredient in these supplements is lycopene, a potent carotenoid sourced from tomatoes. Studies suggest that an oral lycopene supplement supports skin’s anti-aging properties. Consequently, many companies are focusing on developing beauty supplements with lycopene as the key ingredient, such as Inneov, a joint venture between L’Oréal and Nestlé, which offers lycopene-based supplements for skin and hair care.

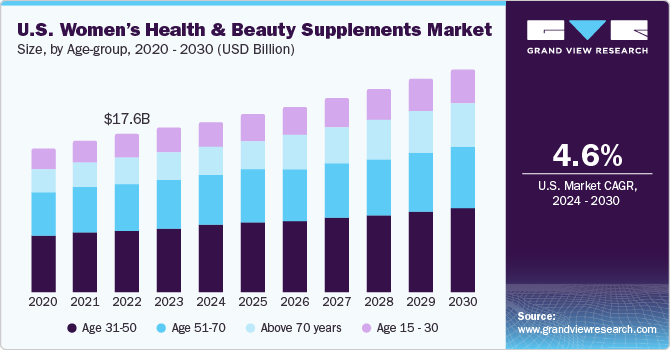

Age-group Insights

The ages 31-50 segment led the market in 2023 with nearly 39% of the total revenue share. For women in this age group, maintaining health involves consuming a folate-rich diet or adding vitamin B supplements to their routine. Pregnant or planning-to-be-pregnant women must meet specific requirements through folic acid supplements, which is expected to boost market growth. Moreover, a significant portion of the population, heavily influenced by social media, drives companies to promote beauty products through various platforms. These promotions often emphasize youthful and vibrantly packaged products to appeal to their target audience.

Women aged over 70 years are expected to witness the fastest growth rate from 2024 to 2030 due to their increased need for medical assistance caused by higher natality rates and an increasing geriatric population. Moreover, the rise in nutritional deficiencies has increased the demand for supplements. For these women, essential supplements include vitamins B12 and D, calcium, potassium, and protein. Vitamin D is crucial for immune support, as the body’s ability to produce it from sunlight decreases with age, making vitamin D supplements vital for meeting nutritional needs.

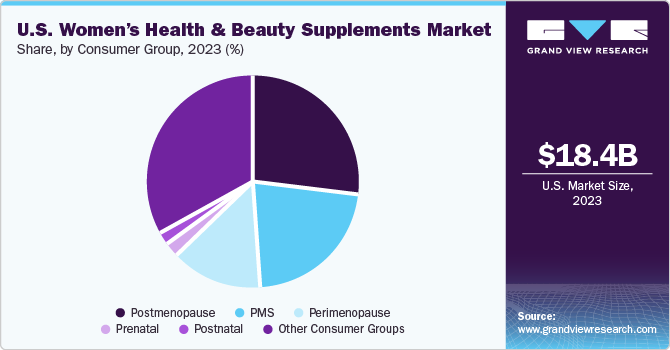

Consumer Group Insights

Supplements catering to women in post-menopause stages held the largest market share in 2023, accounting for approximately 27% of the total revenue. Women over 50, specifically in the post-menopause phase, form a major consumer group. Bone health is a significant concern for this demographic, as approximately one-third of postmenopausal women are at risk of osteoporosis, leading to fragile bones and elevated fracture risks. Postmenopausal women should consume 600 mg calcium supplements twice daily to maintain optimal calcium levels. Magnesium, a mineral beneficial for anti-aging, is also recommended at around 300 mg daily for this group. This increased demand for these supplements contributes to market growth.

Postnatal supplements are expected to register the fastest CAGR from 2024 to 2030 owing to heightened concerns associated with breastfeeding and losing postpartum weight. As a result, consumption of dietary supplements is being promoted among women due to their positive effects in weight loss and achieve better health. Furthermore, dietary deficiencies can contribute to the development of postnatal depression. In certain cases, consuming additional dietary supplements daily may help prevent this condition. Supplements that aid in preventing postnatal depression include omega-3 fatty acids, s-adenosyl-l-methionine, iron, cobalamin (vitamin B12), folate, pyridoxine (vitamin B6), vitamin D, calcium, and riboflavin (vitamin B2).

Sales Channel Insights

In 2023, pharmacies/drug stores were the most preferred sales channel and generated nearly 34% of the total revenue share. Pharmacies and drug stores offer a wide range of products, including women’s health and beauty supplements alongside various pharmaceuticals. These establishments typically stock supplements from multiple companies, enabling customers to select from diverse options and compare pricing.

Online sales are anticipated to register the fastest CAGR over the forecast period. The increasing popularity of personalized vitamins and health supplements, along with the growing adoption of e-commerce platforms by women of all age groups, are key factors fueling the growth of online sales. The convenience of purchasing supplements online compared to traditional retail outlets, coupled with the rising demand for personalized products among consumers, is significantly contributing to the market expansion. Notably, e-commerce platforms have experienced substantial sales of women’s health and beauty supplements.

Key U.S. Women’s Health And Beauty Supplements Company Insights

The market is fragmented, with players leaning towards launching new products, adopting product differentiation strategies, and entering industry partnerships, consequently contributing to market growth. Herbalife International of America, Inc.; GNC Holdings, Inc; Nature’s Bounty; Bayer AG; Suntory Holdings Limited; Taisho Pharmaceutical Co., Ltd; and FANCL Corporation are some companies operating in the U.S. women’s health and beauty supplements market.

Companies in the market have a strong motivation to expand their product portfolios and aim to cater to diverse consumer demands, increase revenue streams, and maintain a robust presence in the ever-evolving business landscape.For instance, in November 2023, Pharmavite acquired Bonafide Health for USD425 million, making it the leading company in the women’s health nutraceutical sector. This acquisition expanded Pharmavite’s existing women’s health portfolio, including Uqora and Equelle.

Key U.S. Women’s Health And Beauty Supplements Companies:

- Herbalife International of America, Inc.

- GNC Holdings, Inc

- Nature’s Bounty

- Bayer AG

- Suntory Holdings Limited

- Taisho Pharmaceutical Co., Ltd

- Pharmavite LLC

- Pfizer, Inc

- Blackmores

- FANCL Corporation

- Asahi Group Holdings, Ltd

- USANA Health Sciences, Inc.

- Nu Skin Enterprise, Inc.

- BY-HEALTH Co., Ltd.

- Revital Ltd

- The Himalaya Drug Company

- Vita Life Sciences

- Standard Foods Corporation

- Garden of Life (Nestlé)

Recent Developments

-

In January 2024, Garden of Life, a Nestlé Health Science brand, was recognized as a 2024 Real Leaders Top Impact Company for its commitment to purpose-driven nutrition and empowering extraordinary health. This accolade highlighted the brand’s contributions, showcasing their dedication to formulating Certified USDA Organic, B Corp certified, and Non-GMO Project Verified supplements.

-

In October 2023, Revivele launched Essentials by Revivele, a tailored supplement system designed to support women’s cognitive function, hormone balance, and disease prevention, particularly during perimenopausal and post-menopausal years.

-

In January 2022, Gynov entered the U.S. market by launching its women’s health supplements products intended to address chronic conditions, ranging from puberty to post-menopause such as endometriosis and polycystic ovary syndrome.

-

In April 2021, Nestlé acquired The Bountiful Company’s core brands, including Nature’s Bounty, Solgar, Osteo Bi-Flex, and Puritan’s Pride, for USD5.75 billion. This acquisition allowed Nestlé to expand its presence in mass retail, food, drug, and club channels

U.S. Women’s Health And Beauty Supplements Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 18.35 billion

Revenue forecast in 2030

USD 24.84 billion

Growth rate

CAGR of 4.56% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, age-group, consumer group, sales channel

Country scope

U.S.

Key companies profiled

Herbalife International of America, Inc.; GNC Holdings, Inc; Nature’s Bounty; Bayer AG; Suntory Holdings Limited; Taisho Pharmaceutical Co., Ltd; Pharmavite LLC; Pfizer, Inc; Blackmores; FANCL Corporation; Asahi Group Holdings, Ltd; USANA Health Sciences, Inc.; Nu Skin Enterprise, Inc.; BY-HEALTH Co., Ltd.; Revital Ltd; The Himalaya Drug Company; Vita Life Sciences; Standard Foods Corporation; Garden of Life (Nestlé)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Women’s Health And Beauty Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. women’s health and beauty supplements market report based on product, application, age-group, consumer group, and sales channel.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamins

-

Mineral

-

Enzymes

-

Botanicals

-

Proteins

-

Omega - 3

-

Probiotics

-

Other Products

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Beauty

-

Skin Care

-

Nail Care

-

Hair Care

-

Other Applications

-

-

Women’s Health

-

-

Age-group Outlook (Revenue, USD Million, 2018 - 2030)

-

Age 15 - 30

-

Age 31-50

-

Age 51-70

-

Above 70 years

-

-

Consumer Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Prenatal

-

Postnatal

-

PMS

-

Perimenopause

-

Postmenopause

-

Other Consumer Groups

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Direct Sales

-

Pharamcies/Drug Stores

-

Other Offline Channels

-

Frequently Asked Questions About This Report

b. The U.S. women’s health and beauty supplements market size was estimated at USD 18.35 billion in 2023.

b. U.S. women’s health and beauty supplements market is expected to register a compound annual growth rate (CAGR) of 4.56% from 2024 to 2030 to reach USD 24.84 billion by 2030.

b. Vitamins held the largest market share in 2023, accounting for nearly 34% of the total revenue. Research suggests that approximately 30% women in the U.S. may have nutritional deficiencies in one or more essential vitamins and minerals.

b. Herbalife International of America, Inc.; GNC Holdings, Inc; Nature’s Bounty; Bayer AG; Suntory Holdings Limited; Taisho Pharmaceutical Co., Ltd; and FANCL Corporation are some companies operating in the U.S. women’s health and beauty supplements market.

b. The rising awareness about health and the growing preference for preventative healthcare are significantly driving the global women’s health and beauty supplements market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."