- Home

- »

- Medical Devices

- »

-

U.S. Wound Closure Devices Market, Industry Report, 2030GVR Report cover

![U.S. Wound Closure Devices Market Size, Share & Trends Report]()

U.S. Wound Closure Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Sutures, Adhesives), By Wound Type, By End Use (Acute Care Hospital, Home Healthcare), By Mode Of Purchase, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-595-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

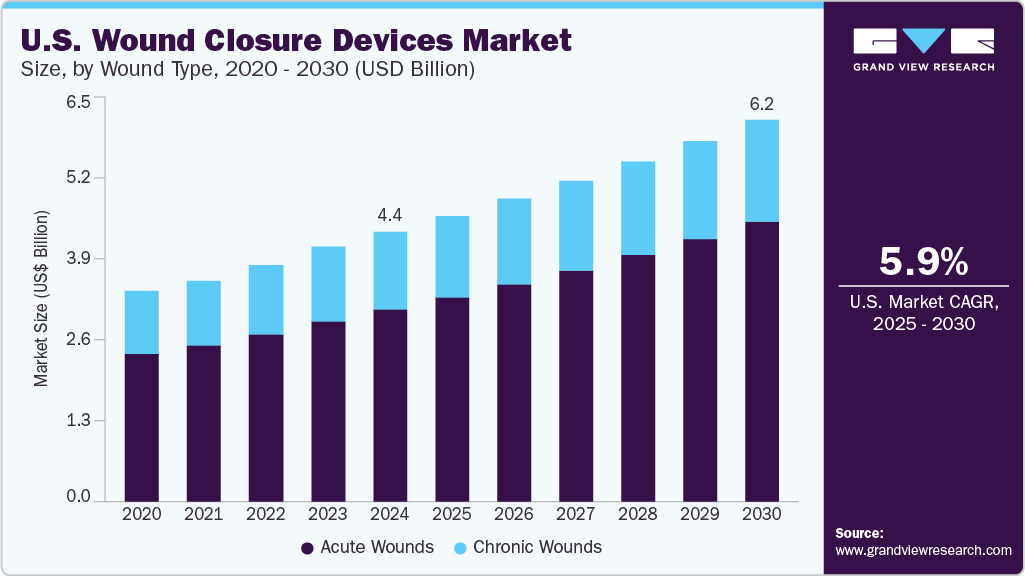

The U.S. wound closure devices market size was estimated at USD 4.37 billion in 2024 and is expected to grow at a CAGR of 5.96% from 2025 to 2030. The rising number of surgical procedures and the growing prevalence of chronic wounds, such as diabetic foot ulcers & pressure ulcers, are factors driving the market growth. Furthermore, advancements in wound closure products and the growing geriatric population of the country are anticipated to boost market growth. According to the Population Reference Bureau (PRB), the elderly population in the country aged 65 years is expected to increase from 58 million in 2022 to around 82 million in 2050.

The increasing incidence of chronic wounds, including pressure ulcers and diabetic foot ulcers, is expected to drive the growth of the U.S. wound closure devices industry over the forecast period. A study published by the American Medical Association in November 2023 indicates that approximately 33.33% of people with diabetes will experience a foot ulcer at some point in their lives, affecting about 1.6 million individuals annually in the U.S. As the older population in the U.S. continues to grow, the incidence of chronic wounds is expected to rise. These devices, which are essential for treating and managing chronic wounds such as diabetic foot ulcers & pressure ulcers, promote faster healing and improve overall patient outcomes. The high prevalence of these conditions further contributes to the growing need for innovative wound management solutions, fueling market growth.

The table below highlights diabetes prevalence across the U.S. states, ranging from 7.8% in Utah to 18.2% in West Virginia. Southern states show significantly higher rates, indicating regional health disparities and a greater burden of chronic disease. Higher diabetes prevalence correlates with increased cases of chronic wounds and surgical interventions. As a result, states with elevated diabetes rates are expected to drive stronger demand for wound closure devices, especially for managing diabetic ulcers and related complications.

Percentage of adults who reported ever being told by a health professional that they had diabetes, 2023

Rank

State

Diabetes Prevalence (%)

1

Utah

7.80%

2

Colorado

8.60%

3

Alaska

8.70%

4

Vermont

9.30%

5

Montana

9.40%

6

North Dakota

9.50%

7

Washington

9.60%

8

Idaho

9.80%

8

Massachusetts

9.80%

8

New Hampshire

9.80%

11

Connecticut

9.90%

12

Minnesota

10.50%

12

New Jersey

10.50%

14

Nebraska

10.60%

14

New York

10.60%

16

Wyoming

10.80%

17

Oregon

10.90%

18

Hawaii

11.30%

18

Iowa

11.30%

18

Wisconsin

11.30%

21

Arizona

11.40%

21

Kansas

11.40%

21

Maine

11.40%

24

California

11.50%

25

Rhode Island

11.80%

25

South Dakota

11.80%

25

Virginia

11.80%

28

Nevada

11.90%

29

Illinois

12.20%

29

Maryland

12.20%

31

Missouri

12.30%

32

Michigan

12.40%

32

North Carolina

12.40%

32

Oklahoma

12.40%

35

Florida

12.50%

35

New Mexico

12.50%

37

Georgia

12.70%

37

Texas

12.70%

39

Indiana

13.20%

39

Ohio

13.20%

41

Delaware

13.30%

42

Arkansas

14.50%

42

Tennessee

14.50%

44

South Carolina

14.90%

45

Alabama

15.70%

46

Louisiana

16.10%

47

Mississippi

17.00%

48

West Virginia

18.20%

Source: U.S. Department of Health and Human Services, Centers for Disease Control and Prevention, Behavioral Risk Factor Surveillance System, 2023

The increasing number of surgical procedures, which encompasses cosmetic, orthopedic, and gynecologic surgeries, is expected to drive the growth of the U.S. wound closure devices industry in the upcoming years. Various wound closure devices, including sutures, staples, and strips, play a crucial role in these surgical interventions. A study from the National Library of Medicine published in July 2020 indicates that approximately 310 million major surgical procedures are performed globally each year, with around 40 to 50 million of those occurring in the U.S.

Colorectal cancer is the third most common cancer diagnosed in both men and women in the U.S. Surgical interventions for colorectal cancer necessitate effective wound closure solutions to minimize postoperative complications and promote healing. Effective wound closure is critical in reducing surgical site infections, a common complication in colorectal surgeries. Implementing care bundles that include advanced wound closure techniques has decreased SSI rates, improving patient outcomes and reducing healthcare costs. According to estimates from the American Cancer Society (ACS), there will be 152,810 new cases of colorectal cancer in 2024. Of these, 81,540 cases are expected to occur in men and 71,270 in women. It includes 106,590 cases of colon cancer and 46,220 cases of rectal cancer.

“These highly concerning data illustrate the urgent need to invest in targeted cancer research studies dedicated to understanding and preventing early-onset colorectal cancer. The shift to diagnosis of more advanced disease also underscores the importance of screening and early detection, which saves lives.” - Karen E. Knudsen, MBA, PhD, Chief Executive Officer, ACS

The advancements in wound closure devices are expected to drive the growth of the U.S. wound closure devices market. These innovative products are also receiving increasing support from regulatory authorities. For instance, in May 2022, AMS announced the U.S. approval of LiquiBand XL, an innovative tissue adhesive for surgical applications. This advanced product offers a strong bond for wound closure, enhancing the efficiency and effectiveness of surgical procedures. LiquiBand XL is designed to improve patient outcomes by providing a reliable alternative to traditional sutures and staples. Similarly, in May 2024, AVITA Medical received FDA approval for its RECELL GO System, a next-generation device for autologous cell harvesting aimed at treating thermal burn wounds and skin defects. This system enhances healing using less donor skin, reduces pain, and improves aesthetic outcomes. Such regulatory approvals for advanced technologies are expected to drive significant market growth.

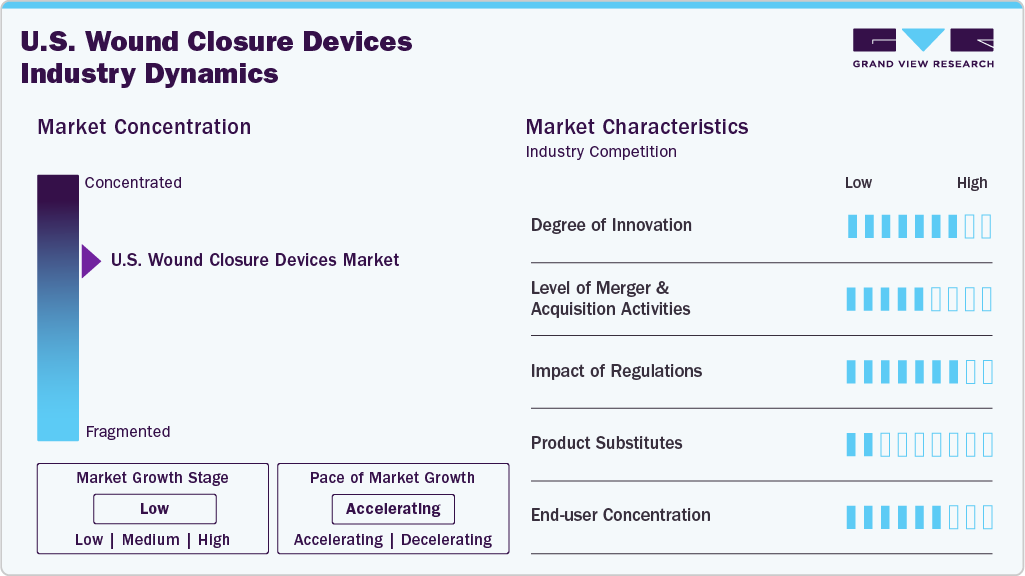

Market Concentration & Characteristics

The market growth stage is low, and the pace of growth is accelerating. The U.S. wound closure devices market is characterized by a low degree of growth owing to the rising prevalence of chronic wounds, the growing geriatric population base, the rising number of surgeries, and technological advancements in wound closure devices.

The degree of innovation is high as market players are focusing on developing innovative products to enhance their product offerings and improve their products. Furthermore, noninvasive, adjustable closure devices and clip-based wound closure systems are being developed. Moreover, industry players are also increasingly focusing on knotless sutures.

The level of mergers & acquisition activity in the U.S. wound closure devices industry is moderate as various established market players are acquiring emerging players in the market to increase their presence and offerings. For instance, in June 2024, Riverpoint Medical acquired CP Medical, a company specializing in medical devices. This acquisition aims to enhance Riverpoint's product range and strengthen its market position in the healthcare sector. CP Medical also specializes in brachytherapy products, medical sutures, and surgical tools for professional and veterinary markets.

Regulatory bodies play a crucial role in classifying wound closure devices to ensure their proper use and better outcomes. For instance, in December 2021, the FDA's guidance announced that the non-powered suction apparatus intended for negative pressure wound therapy (NPWT) to be classified as a Class II device. This device is designed to manage wounds by applying negative pressure to remove fluids and infectious materials. Manufacturers must adhere to specific safety measures and performance testing guidelines to ensure efficacy and safety.

The end users of wound closure devices include various healthcare facilities such as hospitals, clinics, trauma centers, and others. The demand in these facilities is driven by a high volume of surgical procedures and trauma cases that require a variety of wound closure solutions, including sutures and staples.

Product Insights

The sutures segment dominated the market, accounting for 39.97% of the revenue in 2024 due to the advancements in materials and coatings used in sutures, aimed at improving the flexibility & strength and reducing the risk of infection. Moreover, innovations such as antibacterial-coated sutures and barbed sutures, which enable knotless tissue closure, are gaining popularity due to their ability to reduce complications and accelerate the wound closure process. For instance, in October 2024, Corza Medical announced the launch of its Onatec ophthalmic microsurgical sutures at the American Academy of Ophthalmology conference. This new product line features needles made from tempered stainless steel, ensuring durability and precision for delicate tissue stitching.

The other segment of the U.S. wound closure devices market is expected to grow the fastest over the forecast period. The other product segments include innovative solutions such as negative pressure wound therapy and skin grafts or skin substitutes, which are gaining traction for their unique benefits in wound management. The increasing number of burns and chronic injury cases is anticipated to support the segment's growth in the coming years.

Wound Type Insights

The acute wounds segment dominated the U.S. wound closure devices industry in 2024 and is expected to witness the fastest CAGR of 6.51% over the forecast period. The rising incidence of burns, injuries, and the number of surgical procedures can be attributed to the growth of the segment. Acute wounds resulting from trauma, surgical interventions, or burns require prompt medical care and efficient closure to enhance healing and reduce complications. According to the CDC, burn injuries are a leading cause of accidental death and injury in the U.S., with over 398,000 individuals seeking medical care for burns each year. Thus, the growing number of burn cases, along with a rise in surgical procedures due to an aging population and a higher prevalence of lifestyle-related injuries, is contributing to segment growth.

The chronic wounds segment is expected to witness significant growth during the forecast period due to demographic changes and health-related issues. The prevalence of chronic wounds, such as diabetic foot ulcers and pressure ulcers, is rising due to an aging population and increasing rates of chronic conditions such as diabetes and obesity. The State of Obesity 2023 report from the Trust for America's Health indicates that approximately 41.9% of the U.S. population is classified as obese. As the prevalence of these health issues increases, the need for effective wound management solutions grows, requiring advanced closure devices that enhance healing and reduce complications.

End Use Insights

The acute care hospital segment dominated the market and accounted for the largest revenue share in 2024. An acute care hospital primarily provides short-term medical treatment for patients facing serious or urgent health conditions. Commonly found in small towns and rural areas, these facilities offer comprehensive and specialized care for illnesses or injuries that demand immediate medical intervention. Acute care hospitals handle a large number of surgeries, creating a consistent and substantial demand for wound closure devices. As the number of hospitals increases, so does the volume of surgeries, driving the market for these devices. For instance, according to the AHA 2023 annual survey, there were 6,120 registered acute care hospitals in the U.S.

The home healthcare segment is expected to grow at the fastest CAGR during the forecast period. The shift toward home-based care is driven by an aging population, cost-efficiency, and patient preference for recovering in familiar environments. Wound closure products that require minimal clinical expertise and reduce the need for frequent dressing changes are especially valuable in this setting. Moreover, technological advancements have developed wound closure devices explicitly designed for non-hospital use, supporting patient independence and caregiver convenience. As home healthcare continues to expand, it is expected to play a growing role in driving demand within the wound closure device market.

Mode of Purchase Insights

The prescribed mode of purchase continues to dominate the U.S. wound closure devices industry in 2024, primarily due to the widespread use of advanced surgical and trauma-related wound care in clinical settings such as hospitals, ambulatory surgical centers, and specialty care clinics. These devices often require professional handling and are part of standardized medical procedures, making them eligible for reimbursement through public and private health insurance plans. The involvement of healthcare professionals in selecting and applying these products ensures better clinical outcomes, further supporting their prevalence in the prescribed segment.

The non-prescribed or over-the-counter (OTC) segment is expected to register the fastest CAGR over the forecast period. This trend is driven by a growing consumer preference for home-based and self-administered wound care solutions, particularly for minor cuts, lacerations, and post-surgical recovery. The increasing availability of OTC wound closure strips, adhesive bandages, and skin closure devices through pharmacies and online channels has made access easier and more convenient. Additionally, heightened awareness around hygiene and self-care, especially in the post-pandemic period, continues to fuel demand in this segment.

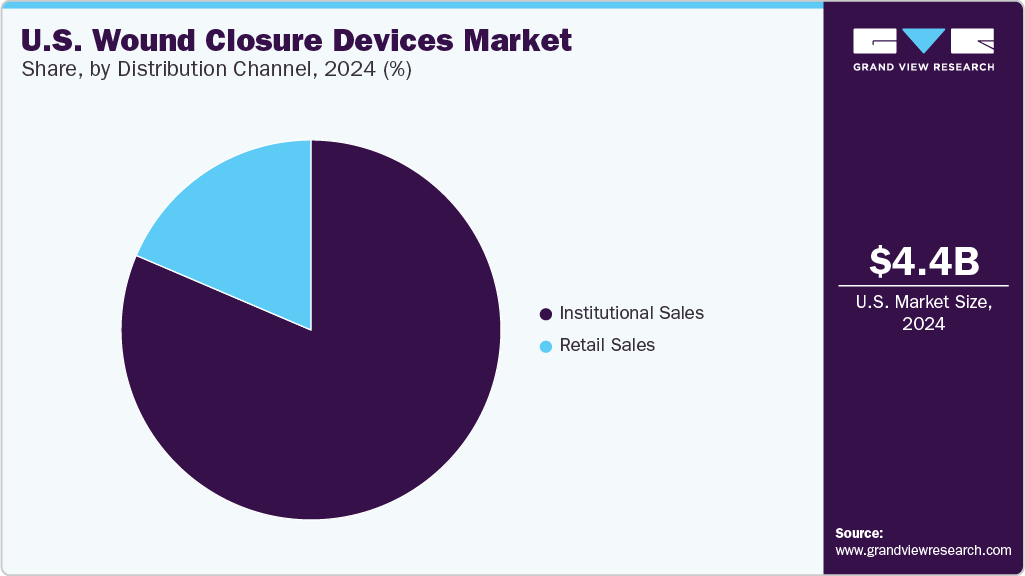

Distribution Channel Insights

The institutional sales segment dominated the U.S. wound closure devices market with the largest revenue share in 2024, owing to the high demand from hospitals, surgical centers, and specialized clinics, where wound closure products are extensively used during surgeries and emergency care. To meet procedural needs, these healthcare facilities require large volumes of advanced wound closure solutions, including sutures, staples, and adhesive strips. Additionally, institutional purchasing is supported by bulk procurement agreements and long-term supplier contracts, reinforcing the strong market hold of this channel.

The retail sales channel is expected to grow at the fastest CAGR over the forecast period. This growth is driven by an increasing shift toward self-care and home healthcare, supported by rising consumer awareness about wound management. The availability of user-friendly wound closure products in pharmacies and online platforms has made it easier for individuals to manage minor injuries at home. Moreover, the growing elderly population and chronic wound cases are also contributing to higher retail demand, positioning this segment for rapid expansion in the forecast years.

Key U.S. Wound Closure Devices Company Insights

3M; Ethicon (Johnson & Johnson Services, Inc.); Medtronic; Baxter; Smith+Nephew; Stryker; Riverpoint Medical; DermaClip; AVITA Medical, Inc.; KitoTech Medical, Inc.; Corza Medical; and Advanced Medical Solutions Group plc are some of the major market players. The players are undertaking several strategic initiatives such as acquisitions, partnerships, and collaborations. Moreover, the launch of novel products is anticipated to boost the competitive rivalry in the market.

Key U.S. Wound Closure Devices Companies:

- 3M

- Ethicon (Johnson & Johnson Services, Inc.)

- Medtronic

- Baxter

- Smith+Nephew

- Stryker

- Riverpoint Medical

- DermaClip

- AVITA Medical, Inc.

- KitoTech Medical, Inc.

- Corza Medical

- Advanced Medical Solutions Group plc

Recent Developments

-

In April 2025, Henry Schein, Inc., announced a new distribution agreement with Health Future, a healthcare consortium owned by Oregon hospitals and health systems. The agreement grants Health Future access to Henry Schein’s Disposable Skin Stapler and Skin Staple Remover for all its facilities. Health Future will incorporate these products into wound closure procedures throughout its 22 hospitals, clinics, and care centers as part of the partnership. This collaboration is designed to improve patient outcomes, simplify procurement processes, and enhance resource efficiency across the organization.

-

In October 2024, Corza Medical launched its new Onatec ophthalmic microsurgical sutures during the American Academy of Ophthalmology (AAO) conference in Chicago. These sutures are designed with advanced precision, utilizing high-tempered stainless-steel needles that enhance bending resistance and durability. The automated manufacturing process ensures precise needle geometry, which supports the delicate handling of fine tissues during ophthalmic procedures.

-

In July 2024, AVITA Medical entered into a multi-year partnership with Regenity Biosciences to create and distribute a range of wound care products. Following FDA 510(k) approval, AVITA will take charge of marketing, sales, and distribution. This collaboration is aimed at enhancing AVITA's offerings in wound care and skin restoration by utilizing Regenity's expertise in bioresorbable technologies.

U.S. Wound Closure Devices Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 6.18 billion

Growth rate

CAGR of 5.96% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Product, wound type, end use, mode of purchase, and distribution channel

Country scope

U.S.

Key companies profiled

3M; Ethicon (Johnson & Johnson Services, Inc.); Medtronic; Baxter; Smith+Nephew; Stryker; Riverpoint Medical; DermaClip; AVITA Medical, Inc.; KitoTech Medical, Inc.; Corza Medical; Advanced Medical Solutions Group plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Wound Closure Devices Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. wound closure devices market report based on product, wound type, mode of purchase, distribution channel, and end use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sutures

-

Surgical Suture

-

Absorbable

-

Non-Absorbable

-

-

Barbed Suture (only Absorbable)

-

Uni-directional barbed suture

-

Bi-directional barbed suture

-

-

Gut Suture

-

Microsutures

-

-

Adhesives

-

Staples

-

Powered

-

Manual

-

-

Strips

-

By Sterility

-

Sterile

-

Non-Sterile

-

-

By Product

-

Reinforced Strips

-

Flexible Strips

-

-

-

Clips

-

Sealants

-

Non-Synthetic

-

Collagen Based

-

Synthetic

-

Topical Cyanoacrylates

-

Others

-

-

-

Others

-

-

Wound Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Acute Wounds

-

Surgical/ Procedure

-

Obstetrics / Gynecology

-

Colorectal

-

Cardiovascular

-

Bariatric and Upper GI

-

Plastic and Reconstructive Surgery

-

Urology

-

Hepato-pancreato-biliary (HPB)

-

Dermatology

-

Others (ENT, Ortho trauma, Neuro, etc.)

-

-

Lacerations & Minor Cuts

-

Burns

-

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

Other Chronic Wounds

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Acute Care Hospital

-

Ambulatory Surgery Center (ASC)

-

Hospital Outpatient Wound Care Clinic

-

Home Healthcare

-

Skilled Nursing Facility (SNF)

-

Physician Office

-

Burn Center

-

Inpatient Rehabilitation Facility (IRF)

-

Long-term Acute Care Hospital (LTACH)

-

Long-term Care (residential living setting)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Institutional Sales

-

Retail Sales

-

-

Mode of Purchase Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescribed

-

Non-prescribed (OTC)

-

Frequently Asked Questions About This Report

b. The U.S wound closure devices market size was estimated at USD 4.37 billion in 2024.

b. The U.S wound closure devices market is expected to grow at a compound annual growth rate of 5.96% from 2025 to 2030 to reach USD 6.18 billion by 2030.

b. The sutures segment dominated the market, accounting for 39.97% of the revenue in 2024, due to advancements in materials and coatings used in sutures, which aim to improve flexibility and strength and reduce the risk of infection.

b. Some key players operating in the U.S wound closure devices market include 3M, Ethicon (Johnson & Johnson Services, Inc.), Medtronic, Baxter, Smith+Nephew, Stryker, Riverpoint Medical, DermaClip, AVITA Medical, Inc., KitoTech Medical, Inc., Corza Medical, and Advanced Medical Solutions Group plc.

b. Key factors driving the market growth include the rising prevalence of chronic wounds, particularly due to diabetes and an aging population, which is increasing the demand for effective wound management solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.