- Home

- »

- Medical Devices

- »

-

U.S. Wound Debridement Market Size, Industry Report, 2033GVR Report cover

![U.S. Wound Debridement Market Size, Share & Trends Report]()

U.S. Wound Debridement Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Gels, Ointments & Creams, Surgical Devices, Medical Gauzes), By Method, By Wound Type, By End-use, By Mode of Purchase, And Segment Forecasts

- Report ID: GVR-4-68040-663-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Wound Debridement Market Summary

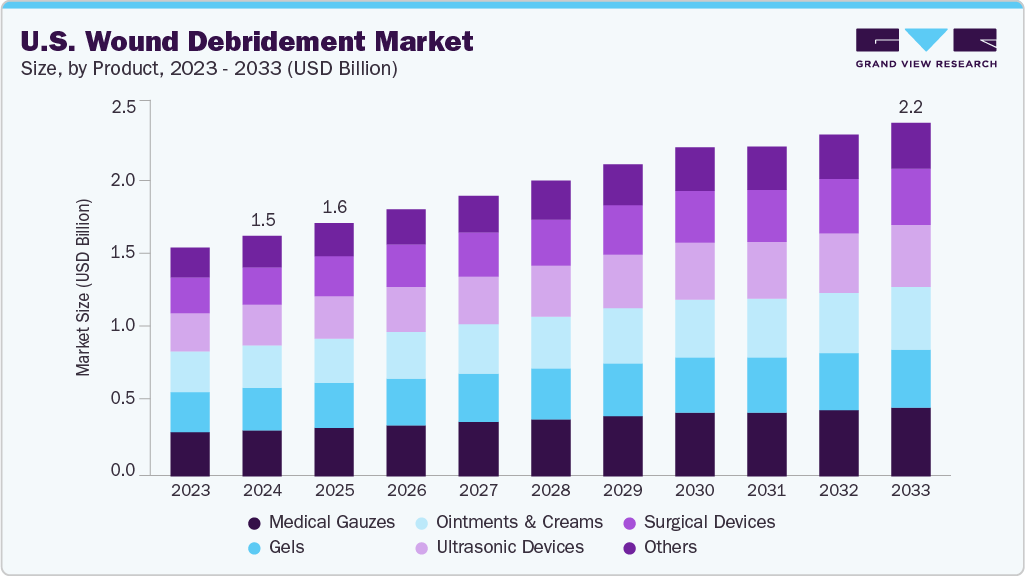

The U.S. wound debridement market size was valued at USD 1.53 billion in 2024 and is projected to reach USD 2.26 billion by 2033, growing at a CAGR of 4.3% from 2025 to 2033. The increasing prevalence of diabetes, obesity, and the growing number of traumatic injuries and chronic wounds continue to drive demand for advanced wound debridement solutions.

Key Market Trends & Insights

- By wound type, the diabetic foot ulcers segment held the highest market share of 32.2% in 2024.

- Based on product, the medical gauzes segment held the highest market share in 2024.

- By method, the surgical segment held the highest market share in 2024.

- By mode of purchase, the prescriptive mode of purchase held the largest revenue share, 62.2%, in 2024.

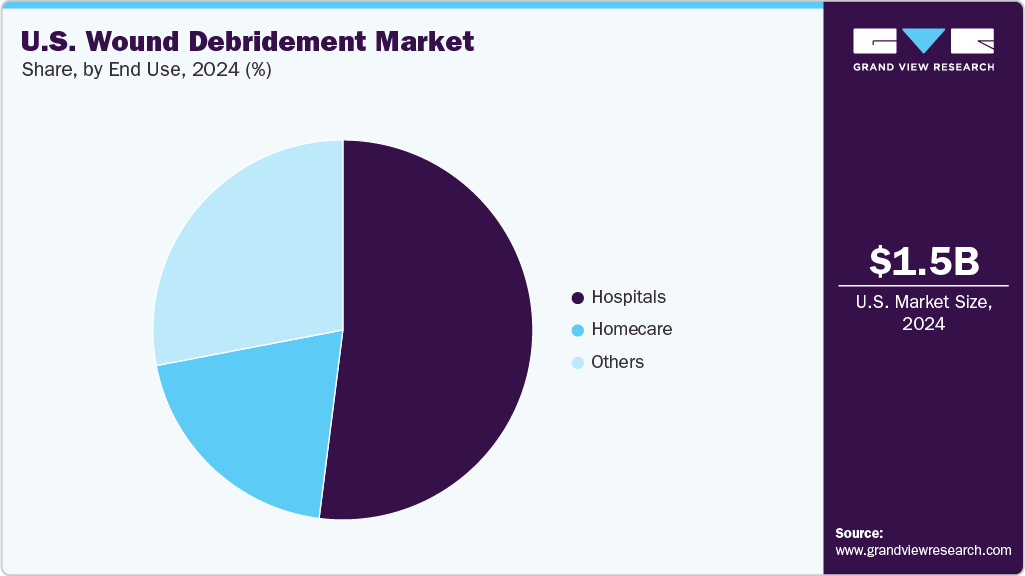

- Based on end use, the hospital segment held the largest revenue share of 51.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.53 Billion

- 2033 Projected Market Size: USD 2.26 Billion

- CAGR (2025-2033): 4.3%

According to the CDC, approximately 129 million Americans live with at least one major chronic illness, and nearly 2% of the population suffers from chronic wounds, with incidence rising notably among older adults. These wounds, such as diabetic foot ulcers, pressure sores, and venous stasis ulcers, present significant clinical challenges and are associated with extended healing times, increased risk of complications, and substantial healthcare resource consumption.

On the regulatory and innovation front, U.S. federal agencies like the FDA are actively reshaping the landscape. The FDA has proposed reclassifying certain wound-care products-gels, creams, ointments, and liquid washes containing antimicrobials-into Class II or III devices, requiring more rigorous oversight through 510(k) notifications or premarket approvals (PMAs).

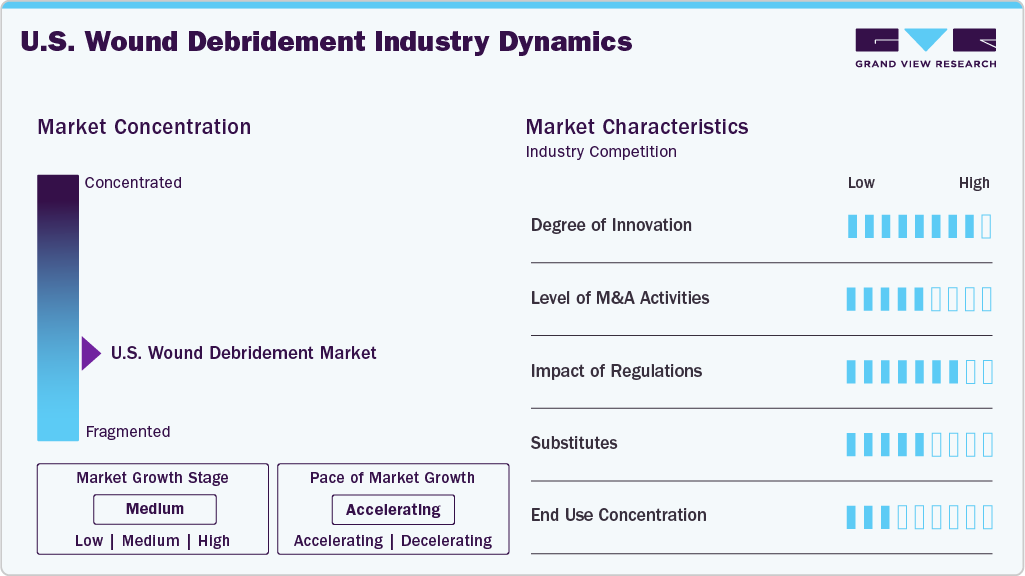

Market Concentration & Characteristics

The pace of growth in the U.S. wound debridement market is accelerating. Macro trends-an aging population and heightened incidence of diabetes-related and pressure-type wounds-underpin greater clinical need. CMS data also indicate a strategic shift in care settings: severe wound care is increasingly managed in acute-care hospitals and inpatient rehab facilities, while stays in high-cost long-term-care hospitals decline.

Innovation in the U.S. wound debridement market continues gaining momentum, driven by advancements in products and technology. As per an article published in April 2024, The University at Buffalo received USD 3 million in NIH funding to develop a mobile app that uses AI and imaging to detect perfusion changes in chronic wounds, aimed at remote monitoring, especially for rural patients.

The U.S. wound care market has witnessed M&A activity that reshapes competitive positioning. In July 2023, Coloplast announced the acquisition of Kerecis in a deal valued at up to USD 1.3 billion. This acquisition adds Kerecis’ fish-skin-derived graft technology to Coloplast’s portfolio. It also broadens Coloplast’s reach within chronic and burn wound care, strengthening its position in advanced wound management in the U.S. market.

In March 2023, Convatec received the U.S. FDA clearance for InnovaBurn placental extracellular matrix medical device developed for managing complex burns and surgical wounds, including second-degree burns. The device joined Convatec’s InnovaMatrix platform and is positioned as the first and only placental-derived medical device specifically designed for treating burns, hard-to-heal wounds, and complex surgical wounds. In March 2022, Convatec acquired Triad Life Sciences. The Triad team, product pipeline, and current portfolio would transition to Convatec's Advanced Wound Care (AWC) business as Convatec Advanced Tissue Technologies.

Product Insights

Based on product, the medical gauze segment accounted for the largest revenue share of 19.2% in 2024. The widespread use of medical gauze across U.S. acute care hospitals, outpatient wound clinics, and home healthcare settings underscores its continued relevance in wound debridement workflows. Medical gauze is pivotal in managing moisture levels, facilitating autolytic debridement, and providing a protective barrier, aligning with the CDC’s best practices for wound management and infection prevention. The segment benefits from the high volume of chronic wound cases in the U.S., including diabetic foot ulcers and pressure injuries, which affect over 8 million Americans annually and drive consistent demand for cost-effective, easily applicable debridement products.

The ultrasonic devices segment is projected to grow at the fastest CAGR over the forecast period. This high-tech debridement category is gaining traction, driven by the need for precision treatment of complex chronic wounds-such as diabetic foot ulcers and pressure injuries-without harming healthy tissue. Ultrasonic wound debridement is increasingly adopted across U.S. advanced wound care centers and outpatient surgical facilities due to its ability to remove non-viable tissue while precisely minimizing trauma to healthy tissue, which is critical for complex chronic wounds and infected ulcers.

Method Insights

Based on the method, the surgical method held the largest revenue share of 28.9% in 2024. Surgical debridement remains the primary approach in U.S. acute-care settings, leveraging sharp instruments or operating-room procedures to swiftly remove necrotic tissue and reduce microbial burden. The CDC's Surgical Site Infection (SSI) Prevention Guideline highlights the importance of promptly removing devitalized tissue during surgery to minimize infection risks. Surgical site infections (SSIs) occur in 2-5% of U.S. surgical patients, leading to extended hospital stays of 7-11 days and significantly higher mortality rates (up to 11×) compared to uninfected cases. This underscores the importance of surgical debridement to remove necrotic tissue rapidly and highlights potential risks if sterility is compromised.

The autolytic method segment is expected to grow at the fastest CAGR over the forecast period due to its gentle, patient-friendly nature and alignment with emerging outpatient and home care trends. Autolytic debridement uses moisture-retentive dressings to harness the body's enzymes and immune response to dissolve necrotic tissue-a selective, low-pain alternative ideal for non-infected chronic wounds.

Wound Type Insights

Based on type, the diabetic foot ulcers segment accounted for the highest revenue share of 32.2% in 2024. A diabetic foot ulcer (DFU) is an open wound or sore that occurs on the foot (commonly on the bottom or toes) in people with diabetes. The large market share reflects the significant clinical burden of DFUs in the U.S., where “up to 25% of patients with diabetes develop a DFU in their lifetime,” and more than half of those DFUs become infected. This high lifetime incidence contributes to the frequent use of debridement products and services, as DFUs often require repeated interventions to control infection, promote granulation, and prevent amputations.

The pressure ulcers segment is expected to be the fastest-growing segment with a CAGR of 4.6% over the forecast period due to the increasing incidence of hospital-acquired pressure injuries (HAPIs) and a rapidly aging population in the U.S. It is estimated that approximately 2.5 million patients in the U.S. develop pressure ulcers each year, often leading to serious complications such as infections and extended hospitalizations, thereby necessitating frequent wound debridement interventions to remove necrotic tissue and support wound bed preparation.

Mode Of Purchase Insights

The prescriptive mode of purchase held the largest revenue share, 62.2%, in 2024. Prescription wound care products-including surgical dressings, advanced occlusive dressings, and debridement agents-dominate due to their use in complex and chronic wound management in clinical settings. These are primarily covered under Medicare’s Surgical Dressings Benefit, which reimburses dressings used in treating qualifying wounds during or after professional debridement by a healthcare provider.

The over-the-counter mode of purchase is anticipated to grow at a 4.5% CAGR from 2025 to 2033. This growth is driven by rising consumer preference for self-care and minor wound management in home settings using OTC advanced wound dressings. The U.S. OTC advanced wound care market covers foam, hydrocolloid, and hydrogel dressings. These products are readily available through retail pharmacies and online platforms, aligning with evolving patient autonomy and convenience trends.

End Use Insights

Based on end use, the hospital segment held the largest revenue share of 51.6% in 2024. This market share can be attributed to their advanced infrastructure, reimbursement mechanisms, and high volume of complex and acute wound cases.

The homecare segment of the U.S. wound debridement market is expected to grow rapidly in the coming years. This growth can be attributed to an aging population, rising chronic wound prevalence, and enhanced outpatient reimbursement. Patients managing pressure injuries and diabetic foot ulcers increasingly favor user‑friendly home debridement tools-like mechanical pads, enzymatic gels, and autolytic dressings, as they’re convenient and comfortable.

Key U.S. Wound Debridement Company Insights

The market is slightly competitive, with the presence of many large- and small-scale players. Most companies focus on R&D efforts, mergers, acquisitions, collaborations, and partnerships to achieve greater market share.

-

Coloplast offers foam dressings and silicone-based products. Its offerings are tailored for managing diabetic foot ulcers and surgical wounds.

-

Smith & Nephew offers mechanical and surgical debridement tools to hospitals and ambulatory care centers. The company’s product line includes advanced wound systems such as VERSAJET and RENASYS, designed for acute and chronic wound treatment.

Key U.S. Wound Debridement Companies:

- Zimmer Biomet

- Smith+Nephew

- Coloplast Group

- Convatec Group PLC

- C. R. Bard

- Lohmann & Rauscher

Recent Developments

-

In January 2024, Coloplast launchedBiatain Silicone Fit, a silicone foam dressing specifically for pressure injury prevention and wound management in the U.S. market.

U.S. Wound Debridement Market Report Scope

Report Attribute

Details

Revenue forecast in 2033

USD 2.26 billion

Growth rate

CAGR of 4.3% from 2025 to 2033

Base year of estimation

2024

Historical Period

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, method, wound type, mode of purchase, end use

Country Scope

U.S.

Key companies profiled

Zimmer Biomet; Smith+Nephew; Coloplast Group; Convatec Group PLC; C. R. Bard; Lohmann & Rauscher

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Wound Debridement Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. wound debridement market report based on product, method, wound type, mode of purchase, and end use:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Gels

-

Ointments & Creams

-

Surgical Devices

-

Medical Gauzes

-

Ultrasonic Devices

-

Others

-

-

Method/Procedure Outlook (Revenue, USD Million, 2021 - 2033)

-

Autolytic

-

Enzymatic

-

Surgical

-

Mechanical

-

Others

-

-

Wound Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Pressure Ulcers

-

Diabetic Foot Ulcers

-

Venous Leg Ulcers

-

Burn Wound

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Homecare

-

Others

-

-

Mode of Purchase Outlook (Revenue, USD Million, 2021 - 2033)

-

Prescription

-

Over The Counter

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.