- Home

- »

- Food Additives & Nutricosmetics

- »

-

U.S. Xanthan Gum Market Size, Share, Industry Report 2033GVR Report cover

![U.S. Xanthan Gum Market Size, Share & Trends Report]()

U.S. Xanthan Gum Market (2026 - 2033) Size, Share & Trends Analysis Report By Application (Food & Beverage, Oil & Gas, Pharmaceuticals, Cosmetics & Personal Care, Other Applications), Consumer Behavior And Competitive Analysis, And Segment Forecasts

- Report ID: GVR-4-68040-845-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Xanthan Gum Market Summary

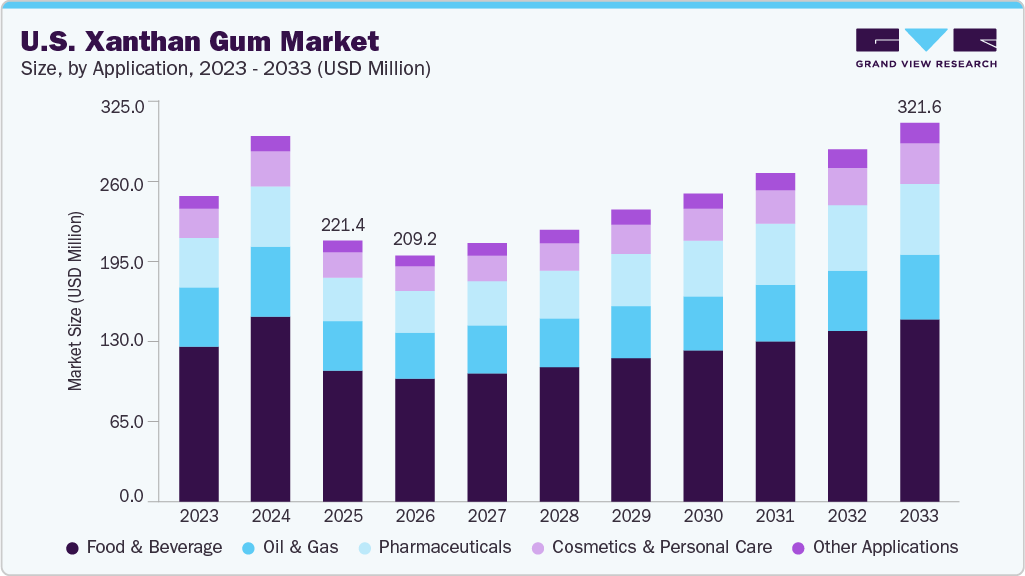

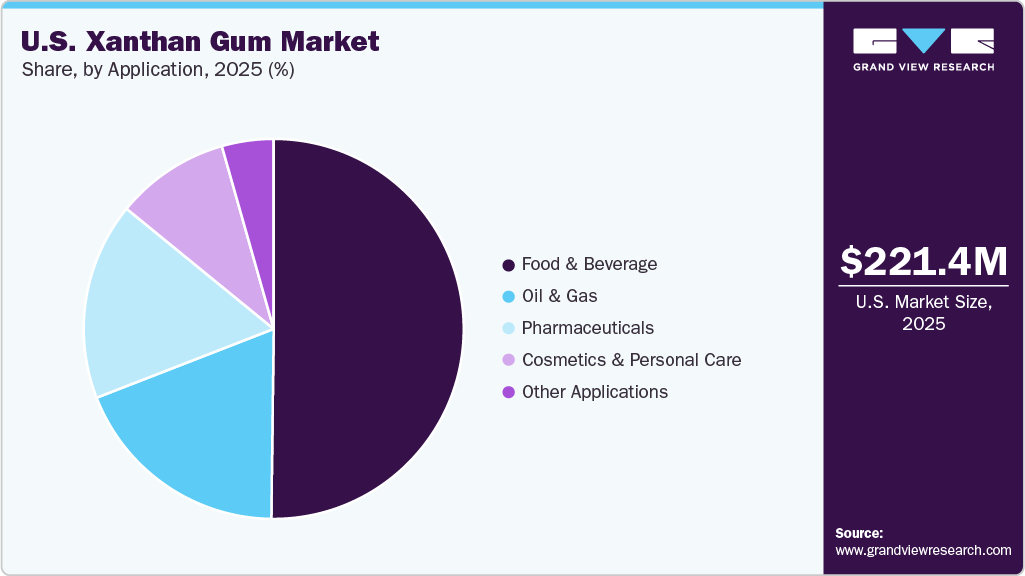

The U.S. xanthan gum market size was estimated at USD 221.4 million in 2025 and is projected to reach USD 321.6 million by 2033, growing at a CAGR of 6.3% from 2026 to 2033. Increasing consumer preference for clean-label, low-fat, and gluten-free products in the U.S. is boosting xanthan gum demand.

Key Market Trends & Insights

- By application, the food & beverage segment dominated the market with the largest revenue share of 50.2% in 2025.

- By application, the cosmetics & personal care segment is expected to grow at the fastest CAGR of 7.6% from 2026 to 2033 in terms of revenue.

Market Size & Forecasts

- 2025 Market Size: USD 221.4 Million

- 2033 Projected Market Size: USD 321.6 Million

- CAGR (2026-2033): 6.3%

Its ability to improve texture, stability, and shelf-life makes it a preferred ingredient for food & beverage manufacturers aiming to meet evolving consumer expectations and regulatory standards. The expanding U.S. personal care and cosmetics market is driving xanthan gum adoption due to its functional role in enhancing viscosity, texture, and formulation stability. Rising demand for natural, multifunctional, and high-performance products is creating new growth opportunities for xanthan gum across lotions, shampoos, and other personal care applications.

The growing U.S. plant-based and functional foods sector presents a significant opportunity for xanthan gum. As manufacturers develop dairy alternatives, protein-enriched products, and other innovative formulations, xanthan gum’s ability to provide stability, texture, and mouthfeel positions it as a key ingredient to support this high-growth segment.

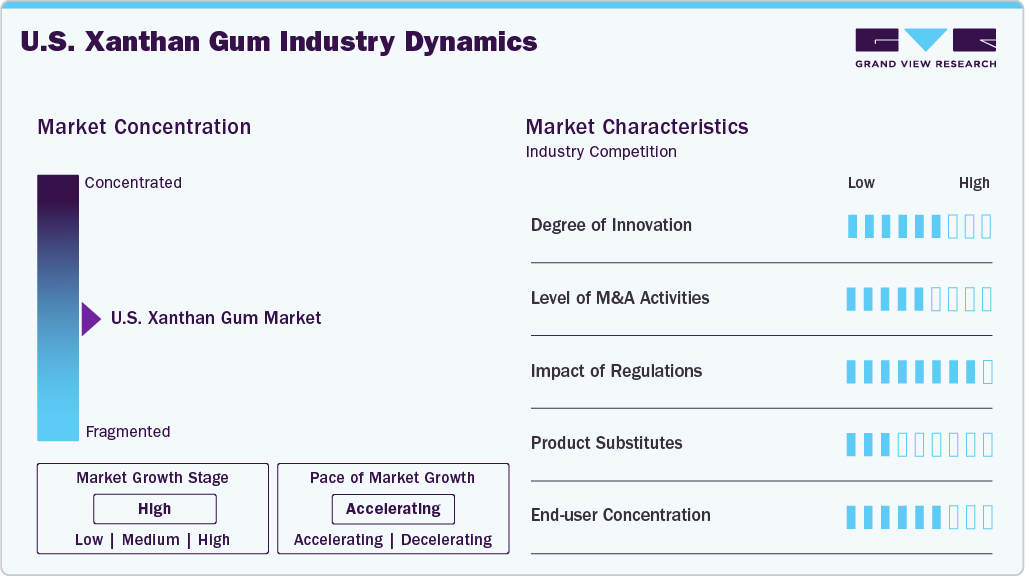

Market Concentration & Characteristics

The U.S. xanthan gum market is moderately concentrated, with a few global and regional players, such as Cargill and Tate & Lyle, commanding significant market share. This concentration allows key companies to leverage scale, distribution networks, and technical expertise to maintain a competitive advantage and influence pricing dynamics.

The U.S. xanthan gum industry is characterized by high technical specialization, strong regulatory oversight, and growing demand across food, personal care, and industrial applications. Product innovation, quality consistency, and application support are critical success factors that drive collaboration between manufacturers and end users.

Application Insights

The food & beverage segment led the U.S. xanthan gum market, capturing the largest revenue share of 50.2% in 2025, as manufacturers increasingly focus on clean-label, low-fat, and gluten-free products that require texturizing and stabilizing agents. Xanthan gum’s ability to improve viscosity, mouthfeel, and shelf-life makes it a critical ingredient, reinforcing its position as the largest application segment in the U.S. market.

The cosmetics & personal care segment is expected to grow at the fastest CAGR of 7.6% during the forecast period. Rising consumer preference for natural and multifunctional personal care products is accelerating xanthan gum adoption in the U.S. cosmetics market. Its role in enhancing texture, stability, and product performance in formulations such as lotions, shampoos, and creams is driving robust growth, making this the fastest-expanding application segment.

Key U.S. Xanthan Gum Company Insights

Some of the key players operating in the U.S. xanthan gum market include ADM, Foodchem International Corporation, Deosen Biochemical (Ordos) Ltd., Cargill, and Tate & Lyle.

-

Cargill, Incorporated is a leading food and agriculture company with a significant presence across the domestic and global value chain. In the U.S. market for xanthan gum, the company participates through its specialty texturizing and hydrocolloid solutions that enhance viscosity, stability, and functional performance in formulated products. Cargill’s portfolio supports key end-use sectors including food & beverages, personal care, household products, animal nutrition, and selected industrial applications. Backed by extensive U.S. manufacturing assets, application laboratories, and a well-integrated logistics network, the company is well-positioned to meet evolving customer requirements and regulatory standards across the U.S. market.

-

Tate & Lyle PLC is an established participant in the U.S. xanthan gum industry, providing hydrocolloid solutions that enhance viscosity, stability, and formulation consistency. The company supports applications across food & beverages, bakery, personal care, pharmaceuticals, and select industrial segments, backed by strong manufacturing and application development capabilities in the Americas.

Key U.S. Xanthan Gum Companies:

- ADM

- Foodchem International Corporation

- Deosen Biochemical (Ordos) Ltd.

- Cargill, Incorporated

- Ingredion

- Tate & Lyle

- Fufeng Group

- Scimplify

- Bob’s Red Mill

- Economy Polymers & Chemicals

- Jungbunzlauer

Recent Developments

-

In June 2024, Cargill acquired full ownership of its xanthan gum joint venture in China, Zibo Cargill Huanghelong Bioengineering (ZCHB). This allows the company to expand its xanthan gum production, including industrial, food, and cosmetic grades, and transfer advanced technology from its French facility to improve product quality. The move positions Cargill to meet rising demand in China’s growing food and beverage market.

-

In July 2025, Jungbunzlauer unveiled TayaGel LA, a low‑acyl gellan gum product at the IFT FIRST 2025 conference, complementing its existing xanthan gum portfolio and offering formulators new options for texture and gel formation. This innovation supports enhanced suspension and clean‑label formulation strategies across food and beverage applications.

U.S. Xanthan Gum Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 209.2 million

Revenue forecast in 2033

USD 321.6 million

Growth rate

CAGR of 6.3% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application

Key companies profiled

ADM; Foodchem International Corporation; Deosen Biochemical (Ordos) Ltd.; Cargill, Incorporated; Ingredion; Tate & Lyle; Fufeng Group; Scimplify; Bob’s Red Mill; Economy Polymers & Chemicals; Jungbunzlauer

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Xanthan Gum Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the U.S. xanthan gum market report based on application:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Food & Beverage

-

Oil & Gas

-

Pharmaceuticals

-

Cosmetics & Personal Care

-

Other Applications

-

Frequently Asked Questions About This Report

b. The U.S. xanthan gum market size was estimated at USD 221.4 million in 2025 and is expected to reach USD 209.2 million in 2026.

b. The U.S. xanthan gum market is expected to grow at a compound annual growth rate (CAGR) of 6.3% from 2026 to 2033, reaching USD 321.6 million by 2033.

b. Food & beverage segment led the U.S. xanthan gum industry, capturing the largest revenue share of 50.2% in 2025, as manufacturers increasingly focus on clean-label, low-fat, and gluten-free products that require texturizing and stabilizing agents. Xanthan gum’s ability to improve viscosity, mouthfeel, and shelf-life makes it a critical ingredient, reinforcing its position as the largest application segment in the U.S. market.

b. Some of the key players operating in the U.S. xanthan gum market include ADM, Foodchem International Corporation, Deosen Biochemical (Ordos) Ltd., Cargill, Ingredion, Tate & Lyle, Fufeng group, etc.

b. Increasing consumer preference for clean-label, low-fat, and gluten-free products in the U.S. is boosting xanthan gum demand. Its ability to improve texture, stability, and shelf-life makes it a preferred ingredient for food & beverage manufacturers aiming to meet evolving consumer expectations and regulatory standards.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.