- Home

- »

- Next Generation Technologies

- »

-

Used Car Market Size And Share, Industry Report, 2030GVR Report cover

![Used Car Market Size, Share & Trends Report]()

Used Car Market (2025 - 2030) Size, Share & Trends Analysis Report By Vehicle Type (Hybrid, Conventional), By Vendor Type (Organized, Unorganized), By Fuel Type (Diesel, Petrol), By Size, By Sales Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-119-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Used Car Market Summary

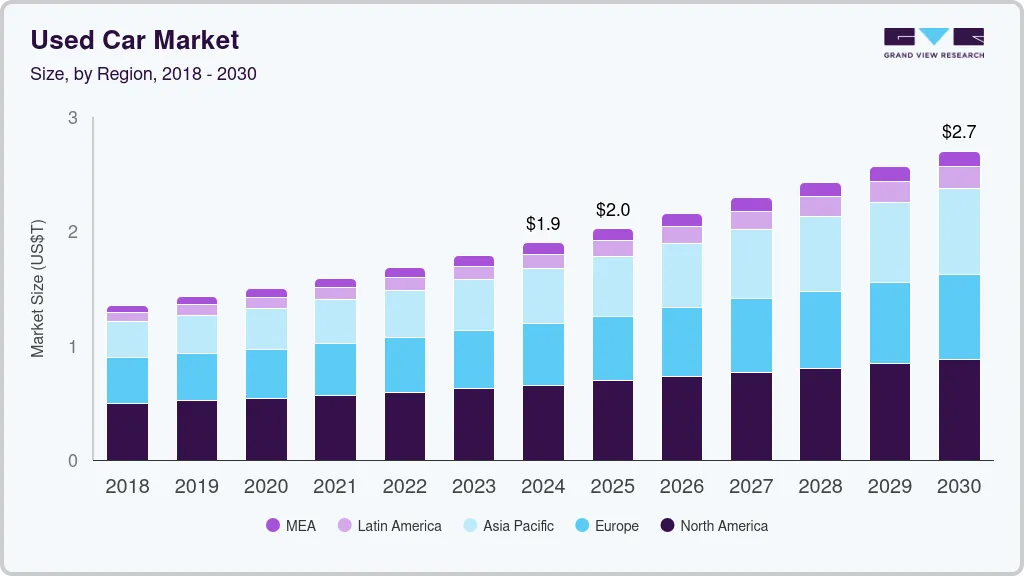

The global used car market size was valued at USD 1.90 trillion in 2024 and is projected to reach USD 2.70 trillion by 2030, growing at a CAGR of 6.0% from 2025 to 2030. The market has been experiencing significant growth, driven by various factors, including economic shifts, changing consumer preferences, and advancements in technology.

Key Market Trends & Insights

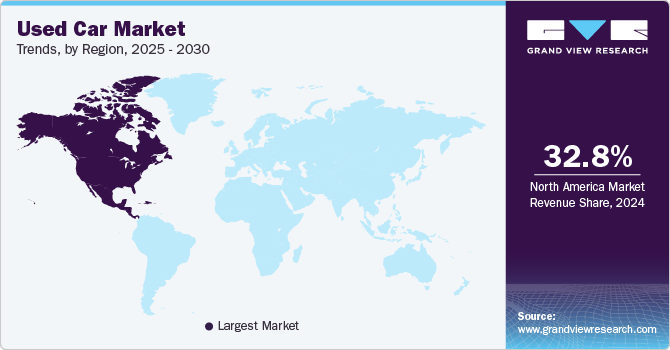

- North America used car market accounted for a leading share of 32.8% in 2024.

- By vehicle type, the conventional vehicle segment accounted for the dominant share of 41.7% in 2024.

- By fuel type, petrol segment dominated the market in 2024.

- By size, the SUV segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.90 Trillion

- 2030 Projected Market Size: USD 2.70 Trillion

- CAGR (2025-2030): 6.0%

- North America : Largest market in 2024

As new car prices rise, many buyers are turning to used cars as a more affordable alternative. This trend is particularly evident in the aftermath of the COVID-19 pandemic, which disrupted supply chains and led to inventory shortages in new car dealerships. As a result, the demand for used vehicles has surged, with consumers seeking reliable options that fit their budgets. Moreover, the rise of remote work and lifestyle changes has influenced purchasing decisions, prompting people to seek vehicles that cater to their new routines. The increasing availability of online platforms for buying and selling used cars has also made the process more convenient, allowing consumers to access a wider range of options.

Technological advances are transforming the market. Online marketplaces and digital platforms have emerged as vital tools for both buyers and sellers, streamlining the purchasing process. Consumers can now browse vast inventories, read reviews, and compare prices with just a few clicks, making informed decisions without the need to visit multiple dealerships. Furthermore, technologies like vehicle history reports, virtual inspections, and augmented reality tools enhance transparency and build trust in the buying process. These innovations have contributed to increased consumer confidence, leading to more people considering used cars as viable options. Moreover, data analytics helps dealers optimize inventory management and pricing strategies, further enhancing market efficiency. As technology continues to evolve, the market is expected to benefit from ongoing innovations that improve the overall buying experience.

The growth of the market also reflects changing attitudes toward vehicle ownership and sustainability. Many consumers are now prioritizing the environmental impact of their purchasing decisions, leading to a preference for used vehicles as a more sustainable choice. Buying a used car often results in a smaller carbon footprint compared to purchasing a new vehicle, as it extends the lifecycle of existing cars and reduces waste. Furthermore, automakers are increasingly focusing on producing durable and long-lasting vehicles, which aligns with consumers' desires for sustainability. This shift is accompanied by a growing awareness of the benefits of reducing waste and conserving resources. As a result, the used car market is likely to continue expanding as more people embrace eco-friendly choices in their vehicle purchases.

Vehicle Type Insights

The conventional vehicle segment accounted for the dominant share of 41.7% in 2024 due to the established infrastructure and consumer familiarity with internal combustion engine (ICE) vehicles. Gasoline and diesel-powered cars have been the primary mode of transportation for decades, benefiting from extensive refueling networks and a broad range of available models. This dominance is further bolstered by the affordability and convenience of traditional vehicles, which have made them the default choice for many consumers. Moreover, the internal combustion engine has seen continuous improvements in fuel efficiency and performance, maintaining its appeal in a competitive market.

The electric vehicle (EV) market is experiencing rapid growth, fueled by advancements in battery technology and increasing consumer awareness of sustainability. As governments implement stricter emissions regulations and offer incentives for EV purchases, more consumers are considering electric options. The range of available EV models is expanding, catering to various preferences and budgets, which helps to attract a broader audience. Furthermore, the development of charging infrastructure is enhancing the practicality of owning an electric vehicle, making it more accessible for everyday use. This combination of factors is positioning electric vehicles as a viable alternative, contributing to their increasing share in the overall automotive market.

Vendor Type Insights

The organized segment dominated the market in 2024 by utilizing established dealerships and certified pre-owned programs, creating a structured purchasing environment for consumers. These dealerships enhance consumer confidence through various benefits, such as warranties, comprehensive vehicle history reports, and accessible financing options. By adhering to higher standards of vehicle quality and customer service, organized players offer a more reliable buying experience that attracts cautious consumers. Moreover, their compliance with regulatory requirements and safety standards fosters trust among buyers, which is crucial in the used car market.

The unorganized segment offers several benefits that attract price-sensitive consumers. This segment is characterized by individual sellers, small dealerships, and online classifieds, providing a wide variety of options at potentially lower prices. Consumers in this market can negotiate directly with sellers, often resulting in better deals and personalized service. Furthermore, the unorganized market typically features a diverse range of vehicles, including older models and unique finds that may not be available at organized dealerships. However, buyers in this segment should be cautious, as the lack of standardized quality assurance can lead to potential risks regarding vehicle reliability and transparency in vehicle history.

Fuel Type Insights

The petrol segment dominated the market in 2024 primarily due to its widespread availability and the long-standing preference among consumers for petrol-powered vehicles. Petrol cars are often perceived as more cost-effective in terms of initial purchase price and maintenance, making them a popular choice for budget-conscious buyers. Moreover, advancements in petrol engine technology have led to improved fuel efficiency and reduced emissions, which appeal to environmentally conscious consumers. The smoother driving experience and quieter operation of petrol vehicles further enhance their desirability.

The diesel segment is witnessing significant growth in the used car market, driven by increasing consumer interest in fuel efficiency and torque performance. Diesel engines are known for their superior fuel economy, making them an attractive option for buyers who drive long distances or have high mileage needs. As environmental regulations become stricter, manufacturers are focusing on producing cleaner diesel vehicles that meet modern emissions standards, helping to mitigate some of the negative perceptions associated with diesel fuel. Moreover, the growing availability of diesel models in the used car market offers buyers a wider selection of vehicles.

Size Insights

The SUV segment dominated the market in 2024. Known for their spacious interiors and higher seating positions, SUVs offer a sense of safety and comfort that many buyers prioritize. Moreover, the popularity of SUVs has led manufacturers to produce a wide variety of models, catering to different tastes and budgets. As fuel efficiency has improved in newer models, many consumers are increasingly drawn to SUVs, contributing to their market dominance. Furthermore, the lifestyle-oriented marketing strategies employed by manufacturers have successfully positioned SUVs as desirable vehicles for families and adventure-seekers alike.

The mid-sized vehicle segment is experiencing significant growth due to changing consumer preferences and increasing fuel efficiency standards. As buyers seek more affordable and economical options, mid-sized cars offer a balance of comfort, performance, and cost-effectiveness. These vehicles are often seen as ideal for urban driving, providing ample space while being easier to maneuver and park than larger SUVs. Moreover, advancements in technology and safety features have made mid-sized cars more appealing to buyers who value modern amenities. As consumers become more environmentally conscious, the growth of hybrid and electric mid-sized options further enhances their attractiveness, positioning this segment for continued expansion in the market.

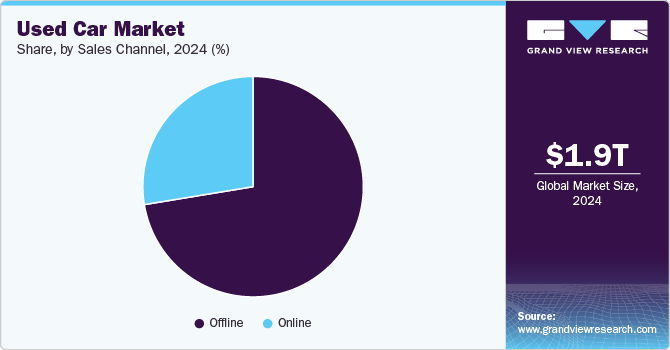

Sales Channel Insights

The offline segment dominated the market in 2024 due to its established infrastructure and the trust buyers place in physical dealerships. These traditional outlets offer a tangible experience, allowing customers to inspect vehicles, test drive them, and negotiate face-to-face with sellers. The personalized service and sense of security that comes with buying from a reputable dealer have contributed to the offline segment's stronghold in the market. Moreover, many buyers feel more comfortable purchasing cars through a process they can physically engage with, which has further supported offline dominance.

The online segment has been experiencing steady growth as more consumers turn to digital solutions for convenience. Online platforms provide users with a wider selection of vehicles, transparent pricing, and the ability to compare options without leaving their homes. This ease of access, coupled with advancements in technology such as virtual car tours and secure online payment systems, has boosted the appeal of buying used cars online. Consequently, while offline channels still lead, the online sector is quickly growing and changing how this market is structured.

Regional Insights

North America used car market accounted for a leading share of 32.8% in 2024. In North America, the market is expanding due to a shift in consumer preferences towards more affordable vehicle options. Economic factors, such as inflation and rising new car prices, have driven many buyers to consider used cars as a cost-effective alternative. The growing availability of certified pre-owned programs has further boosted confidence in the quality of used vehicles. Moreover, online platforms are making it easier for consumers to access a wider range of used cars, enhancing the market’s accessibility. These factors combined have led to steady growth in the region’s used car market.

U.S. Used Car Market Trends

The used car market in the U.S. is seeing significant growth, driven by high demand for both affordable and reliable transportation. Economic uncertainty has led many consumers to seek cheaper alternatives to new vehicles, boosting sales in the used car sector. A strong focus on certified pre-owned programs by dealerships has built trust among buyers, further fueling the market. Online platforms are also contributing by making the buying process more convenient and transparent for U.S. consumers.

Europe Used Car Market Trends

The used car market in Europe is growing due to an increasing preference for fuel-efficient vehicles amid rising fuel costs and environmental concerns. The transition to electric vehicles (EVs) has also impacted the market, with many consumers opting for used EVs as a more affordable option. Regulatory incentives in certain countries further support the growth of the used car market by encouraging sustainable transportation. Online platforms have played a significant role in expanding access to a wider variety of vehicles across borders.

Asia Pacific Used Car Market Trends

The used car market in Asia Pacific is driven by a growing middle class seeking affordable transportation options. In countries with dense urban populations, used cars offer a cost-effective alternative to new vehicles, especially as vehicle ownership increases. Economic growth and rising disposable incomes are also contributing to higher demand for used cars. Moreover, online marketplaces are helping streamline the buying and selling process, attracting more consumers to the market. This, combined with the increased availability of financing options, is fueling the growth of the used car market across the region.

Key Used Car Company Insights

Some of the key companies in the used car market include Alibaba.com, CarMax Enterprise Services, LLC, Asbury Automotive Group, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Alibaba.com has expanded into the used car market by utilizing its vast e-commerce platform to connect buyers and sellers. The company offers a wide range of vehicles, making use of its established logistics and payment systems for seamless transactions. Alibaba has integrated AI-driven solutions to enhance the buyer experience, including virtual tours and pricing comparisons.

-

Asbury Automotive Group is a major player in the U.S. used car market, operating an extensive network of dealerships offering a wide range of pre-owned vehicles. The company has made significant investments in digital platforms to enhance its online sales capabilities, including features like home delivery and virtual consultations. Strategic acquisitions and dealership expansions have strengthened its presence in the used car sector.

Key Used Car Companies:

The following are the leading companies in the used car market. These companies collectively hold the largest market share and dictate industry trends.

- Alibaba.com.

- CarMax Enterprise Services, LLC

- Asbury Automotive Group

- TrueCar, Inc.

- Scout24 SE

- Lithia Motor Inc.

- Group 1 Automotive, Inc.

- eBay.com

- Hendrick Automotive Group

- AutoNation.com

Recent Developments

-

In August 2024, MOTORS collaborated with Parkers, a U.K. platform for used car buyers, to expand the reach of its multisite advertising service. This collaboration aims to give dealers more visibility and offer consumers a broader selection of used cars on one of the U.K.'s most trusted automotive platforms.

-

In October 2023, TrueCar, Inc. collaborated with Car and Driver to enhance the online car shopping experience for Car and Driver's 15 million users by integrating TrueCar's platform into their model review pages. This collaboration aims to provide a seamless process for consumers while expanding visibility for TrueCar dealers and utilizing Car and Driver's comprehensive automotive content and insights.

-

In January 2023, CarMax Enterprise Services, LLC collaborated with UVeye Inc., an automatic vehicle inspection provider, to implement automated vehicle assessment technology, enhancing AI-driven condition reports for wholesale vehicle buyers at auctions. This collaboration aims to improve transparency and efficiency in the wholesale auction process by providing detailed imagery and automated inspections of vehicles.

Used Car Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.02 trillion

Revenue forecast in 2030

USD 2.70 trillion

Growth rate

CAGR of 6.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2020

Forecast period

2025 - 2030

Quantitative units

Volume in million units; revenue in USD million/trillion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Vehicle type, vendor type, fuel type, size, sales channel, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; Japan; India; Australia, South Korea, Brazil, KSA, UAE, South Africa

Key companies profiled

Alibaba.com, CarMax Enterprise Services, LLC, Asbury Automotive Group, TrueCar, Inc., Scout24 SE, Lithia Motor Inc., Group 1 Automotive, Inc., eBay.com, Hendrick Automotive Group, AutoNation.com

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Used Car Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global used car market report based on vehicle type, vendor type, fuel type, size, sales channel, and region:

-

Vehicle Type Outlook (Shipment, Million Units; Revenue, USD Trillion, 2018 - 2030)

-

Hybrid

-

Conventional

-

Electric

-

-

Vendor Type Outlook (Shipment, Million Units; Revenue, USD Trillion, 2018 - 2030)

-

Organized

-

Unorganized

-

-

Fuel Type Outlook (Shipment, Million Units; Revenue, USD Trillion, 2018 - 2030)

-

Diesel

-

Petrol

-

Others

-

-

Size Outlook (Shipment, Million Units; Revenue, USD Trillion, 2018 - 2030)

-

Compact Car

-

Mid-Sized

-

SUV

-

-

Sales Channel Outlook (Shipment, Million Units; Revenue, USD Trillion, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Shipment, Million Units; Revenue, USD Trillion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global used car market size was estimated at USD 1.90 trillion in 2024 and is expected to reach USD 2.02 trillion in 2025.

b. The global used car market is expected to grow at a compound annual growth rate of 6.0% from 2025 to 2030 to reach USD 2.70 trillion by 2030.

b. North America dominated the used car market with a share of 32.8% in 2024, in terms of shipment. This is attributable to its robust demand, diverse inventory, and well-established sales channels.

b. Some key players operating in the used car market include Asbury Automotive Group, Alibaba Group Holding Ltd., AutoNation Inc., eBay Inc., Maruti Suzuki India Ltd., Pendragon PLC, Penske Automotive Group Inc., and TrueCar Inc.

b. Key factors driving the growth of the used car market include increasing consumer demand for affordable transportation options, rising vehicle prices for new cars, advancements in online marketplaces facilitating easier access to inventory, and enhanced vehicle financing options.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.