- Home

- »

- Automotive & Transportation

- »

-

Utility Terrain Vehicles Market Size, Industry Report, 2030GVR Report cover

![Utility Terrain Vehicles Market Size, Share & Trends Report]()

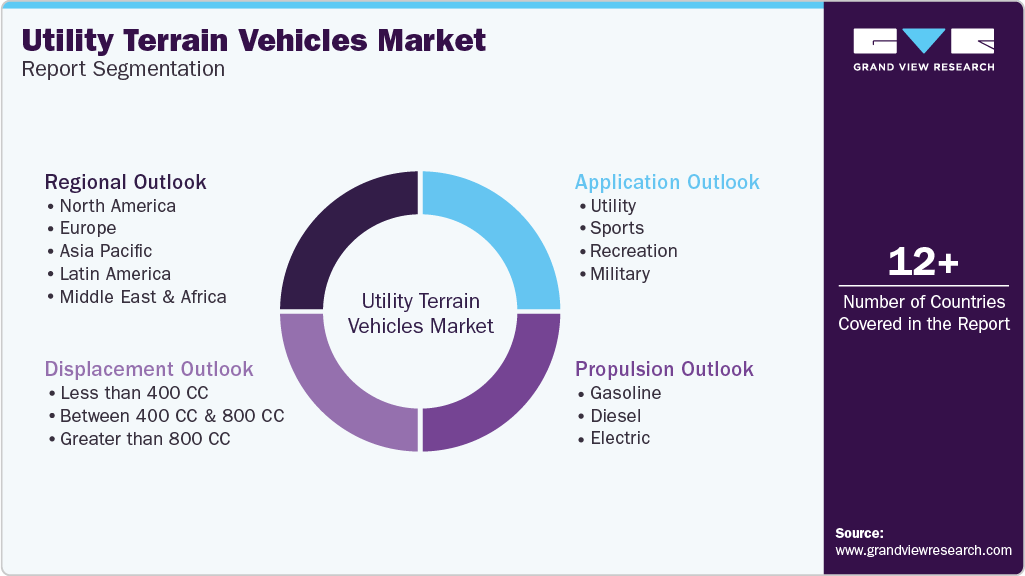

Utility Terrain Vehicles Market (2025 - 2030) Size, Share & Trends Analysis Report By Displacement (Between 400 CC & 800 CC, Greater than 800 CC), By Propulsion (Gasoline, Diesel, Electric), By Application (Sports, Recreation, Military), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-580-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Utility Terrain Vehicles Market Size & Trends

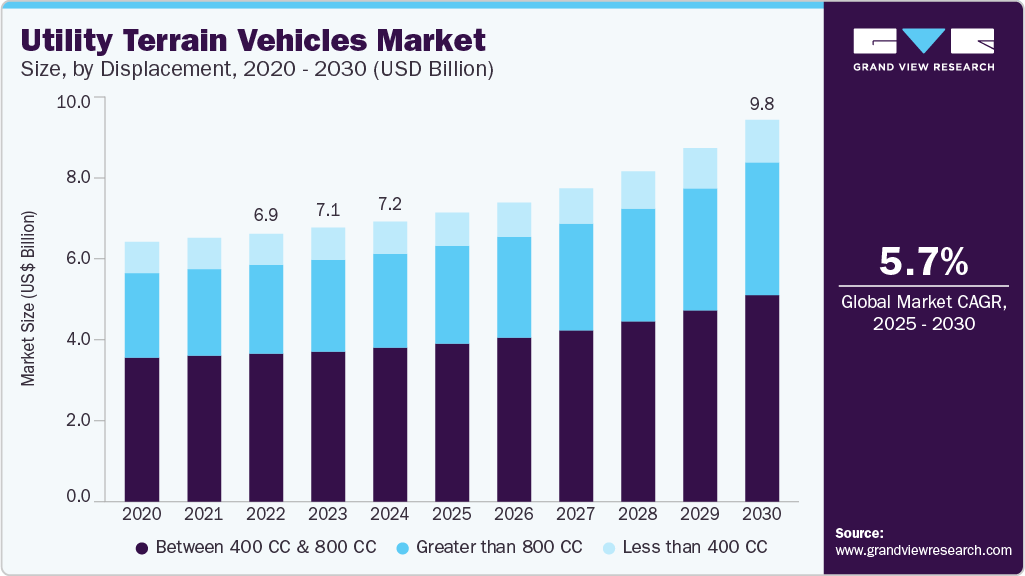

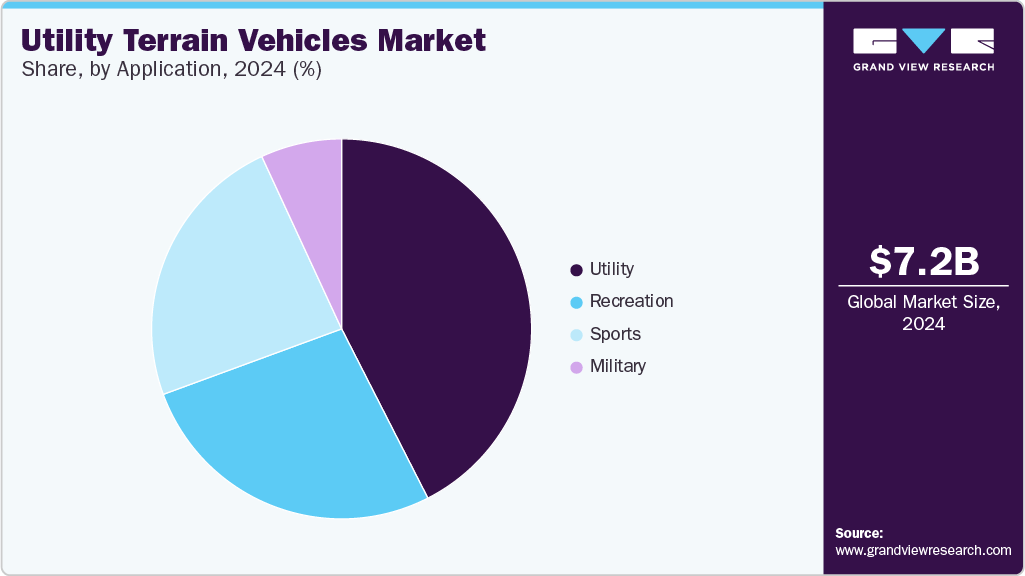

The global utility terrain vehicles market size was estimated at USD 7.23 billion in 2024 and is projected to grow at a CAGR of 5.7% from 2025 to 2030. The increasing demand for versatile, off-road-capable vehicles across agriculture, construction, outdoor recreation, and defense sectors drives market growth.

Key Highlights:

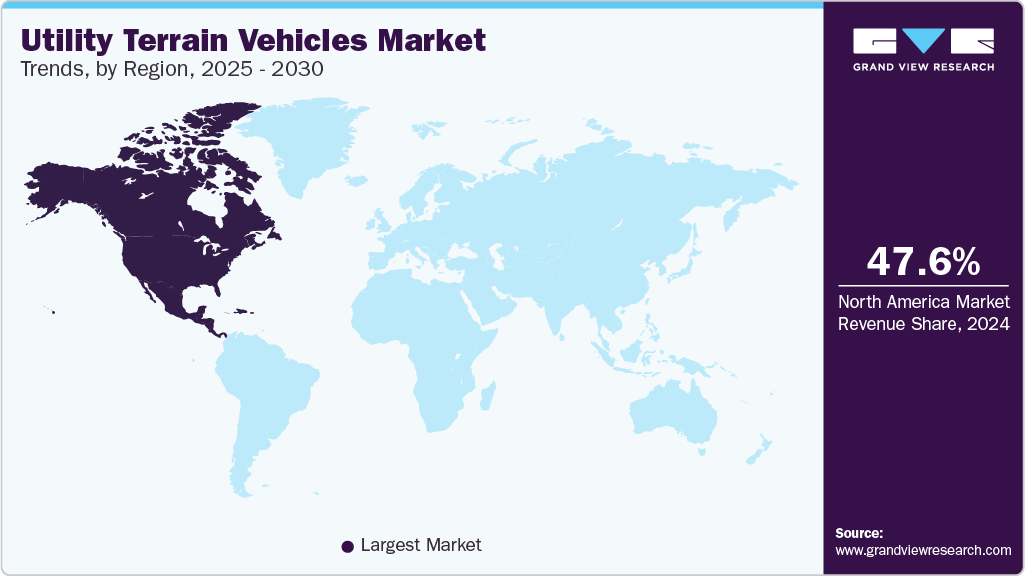

- The North America utility terrain vehicles market held the largest share of 47.6% in 2024.

- The utility terrain vehicles market in the U.S. is expected grow at a significant CAGR over the forecast period.

- By displacement, between 400 CC & 800 CC segment accounted for the largest share of 54.8% in 2024.

- Based on propulsion, the gasoline segment held the largest market share of 68.9% in 2024.

- By application, the military segment is projected to grow at a significant CAGR of 7.3% over the forecast period.

Greater utility in rugged terrain and improved load-carrying capacity and maneuverability have led to widespread adoption. Expanding recreational and sports activities in North America, Europe, and parts of Asia have also supported the market, where off-road tourism and outdoor motorsports have gained tractionRising demand from military applications for lightweight and high-mobility platforms has contributed to market momentum. Significant technological advancements have been observed across the UTV industry, particularly in areas such as electric propulsion, advanced suspension systems, GPS-based navigation, and autonomous driving capabilities. Battery-powered UTVs are being increasingly developed to meet environmental and regulatory standards, offering reduced emissions and lower operational costs. Integration of IoT features, telematics, and safety technologies such as rollover protection and terrain response systems has also been prioritized to improve vehicle performance and user experience. These innovations have been instrumental in enhancing both the functionality and appeal of UTVs across commercial and recreational use cases.

Robust investment activity has been witnessed in the sector, driven by growing demand and competitive pressures. Major manufacturers have supported expansion strategies through partnerships, acquisitions, and R&D investments. Electric UTV startups have attracted venture funding, while established OEMs have allocated capital towards developing hybrid and autonomous models. New production facilities are being established, especially in North America and Asia, to meet rising consumer demand and optimize distribution networks. These capital inflows have enabled product diversification and capacity scaling, allowing brands to tap into high-growth regions.

The regulatory landscape has been evolving to address safety, environmental, and usage standards associated with UTV operations. Emission regulations have been enforced in North America and Europe, pushing manufacturers toward electrification and cleaner combustion technologies. Safety regulations, including those related to occupant protection, speed limits, and usage zones (e.g., public roads vs. off-road trails), have also been tightened. In several regions, classification and licensing requirements are being clarified to distinguish UTVs from similar vehicle categories such as ATVs, influencing design and compliance strategies across manufacturers.

Despite strong growth drivers, the market faces several restraints. High initial costs associated with advanced UTVs-especially electric or military-grade models-have limited adoption among price-sensitive consumers. Limited charging infrastructure has slowed the growth of electric UTVs in rural or industrial settings. In addition, safety concerns, particularly in unregulated or informal riding environments, have led to hesitancy among potential users. Seasonal demand fluctuations and regulatory uncertainty in emerging markets have further constrained consistent market expansion. These challenges are expected to moderate growth in certain segments over the medium term.

Displacement Insights

The between 400 CC and 800 CC segment accounted for the largest share of 54.8% in 2024. The segment's growth is attributed to a unique balance between power, affordability, and versatility. UTVs in this displacement range are particularly attractive to both recreational users and commercial operators who require a vehicle that offers robust performance without the higher cost and fuel consumption associated with larger engines. These vehicles are powerful enough to handle demanding off-road terrains, towing, and hauling duties, while remaining compact and fuel-efficient, making them a popular choice in agriculture, construction, and utility services.

The greater than 800 CC segment is expected to grow significantly during the forecast period. The segment's growth is primarily driven by increasing demand for high-performance and heavy-duty applications. These larger displacement UTVs offer superior power, torque, and payload capabilities, making them highly suitable for rugged terrains, steep inclines, and demanding utility tasks such as towing and hauling. Industries such as mining, agriculture, construction, and military require machines operating in extreme environments without compromising performance.

Propulsion Insights

The gasoline segment held the largest market share of 68.9% in 2024. Performance efficiency, widespread availability, and lower upfront costs fuel the segment's growth. Gasoline-powered UTVs are widely favored due to their strong power-to-weight ratio, making them suitable for a broad range of utility, recreational, and sport applications. These vehicles typically offer quicker acceleration, smoother handling, and more responsive throttle control than their diesel or electric counterparts, making them ideal for tasks requiring agility and speed, such as off-road sports, trail riding, and light-duty hauling.

The electric segment is expected to register the fastest CAGR of 9.4% during the forecast period. The segment's growth is attributed to a shift toward cleaner and more sustainable transportation solutions. Governments across regions are promoting zero-emission vehicles through regulations, incentives, and subsidies, encouraging manufacturers and consumers to transition from gasoline and diesel-powered UTVs to electric alternatives. Moreover, advancing battery and electric drivetrain technologies have significantly improved the performance and reliability of electric UTVs, further boosting adoption.

Application Insights

The utility segment dominated the market in 2024. The market's growth is driven by increasing demand for efficient, durable, and compact vehicles capable of handling tough jobs in various work environments. UTVs are widely used in agriculture, construction, mining, forestry, and infrastructure maintenance due to their ability to transport tools, materials, and personnel across rugged or undeveloped terrain. Their adaptability, lower operating costs compared to larger machinery, and ability to function in off-road conditions make them a preferred alternative for daily operations in demanding sectors.

The military segment is projected to grow at a significant CAGR of 7.3% over the forecast period. The growing need for agile, lightweight, and versatile mobility solutions across diverse combat and support operations drives the adoption of the utility terrain vehicles market in the military. Traditional military vehicles such as Humvees and armored personnel carriers often lack the maneuverability and speed required for certain missions, especially in rugged or confined environments. UTVs, with their compact design, off-road capabilities, and ability to navigate difficult terrains quickly, have become ideal for reconnaissance, logistics support, casualty evacuation, and rapid troop deployment. Their adaptability makes them suitable for both peacetime operations and combat scenarios.

Regional Insights

The North America utility terrain vehicles market held a significant share in 2024, due to strong demand from agriculture, construction, military, and recreational sectors. The region benefits from expansive rural and off-road landscapes, well-established distribution networks, and a robust outdoor recreation culture. In addition, the presence of leading OEMs and consistent investments in product innovation contribute to sustained market growth. Advancements in electric UTV models and the integration of smart technologies are further enhancing market potential.

U.S. Utility Terrain Vehicles Market Trends

The utility terrain vehicles market in the U.S. dominated in 2024 due to the high consumer spending power and widespread use across commercial and government applications. The agricultural and forestry sectors heavily rely on UTVs for day-to-day operations, while recreational usage remains strong due to the popularity of trail riding and motorsports. Government contracts, particularly from the defense sector, continue to drive procurement of specialized military UTVs.

Europe Utility Terrain Vehicles Market Trends

The utility terrain vehicles market in Europe was identified as a lucrative region in 2024. The growth in the region is supported by increased adoption in agriculture, municipal services, and industrial applications. Demand is rising for compact, emission-compliant off-road vehicles, particularly in regions with stringent environmental regulations. The European market also benefits from innovation in electric and hybrid UTV technologies, which aligns with the region’s strong push toward sustainability.

The UK utility terrain vehicles market is expected to grow rapidly in the coming years due to the strong demand from farming, land management, and utility sectors. Rural and estate operations are increasingly adopting UTVs as efficient alternatives to traditional vehicles for towing, transportation, and maintenance tasks. Government emphasis on low-emission zones and sustainable farming practices is prompting a shift toward electric and hybrid UTVs.

The utility terrain vehicles industry in Germanyheld a substantial market share in 2024. Germany’s UTV market is driven by industrial use cases, particularly in construction, forestry, and mining. The country’s focus on automation and productivity pushes the adoption of technologically advanced UTVs equipped with telematics and safety features.

Asia Pacific Utility Terrain Vehicles Market Trends

The utility terrain vehicles market in Asia Pacific is anticipated to grow at a CAGR of 7.5% during the forecast period. The market is experiencing rapid growth, supported by expanding industrialization, agricultural modernization, and increasing interest in off-road recreational activities. Countries across the region are investing in rural development and infrastructure, creating strong demand for versatile utility vehicles. Local manufacturing capabilities and favorable government policies in key markets are also reducing cost barriers and accelerating adoption.

Japan utility terrain vehicles marketis expected to grow rapidly in the coming years. The country’s emphasis on precision agriculture and technological innovation shapes the market. UTVs are being integrated into smart farming ecosystems, particularly in remote or mountainous areas where larger machinery is impractical. Adopting electric and hybrid UTVs is gaining momentum in line with Japan’s decarbonization targets.

The utility terrain vehicles market in China held a substantial market share in 2024. The market's growth in the country is attributed to expanding agricultural mechanization, infrastructure projects, and military modernization. Government initiatives supporting rural development and advanced farming technologies create strong demand for high-capacity UTVs. The domestic market also benefits from low manufacturing costs and rapid technological innovation, especially in electric powertrains.

Key Utility Terrain Vehicles Company Insights

Some key utility terrain vehicles market companies include Arctic Cat Inc., BMS Motorsports, Inc., BRP., HISUN, and others. Organizations focus on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Arctic Cat Inc. manufactures snowmobiles, all-terrain vehicles (ATVs), and side-by-side vehicles. Over the decades, Arctic Cat has grown from a small snowmobile company into a leading name in powersports, known for precision-engineered machines that cater to outdoor enthusiasts and adventurers. The company has a strong legacy of innovation, racing, and community engagement, with most of its manufacturing still based in Minnesota.

-

BMS Motorsports, Inc., is a California-based company that specializes in the manufacturing and distribution of high-quality off-road vehicles, including UTVs, go-karts, sport side-by-sides, gas scooters, and dirt bikes. BMS Motorsports emphasizes EPA and CARB compliance, ensuring that many of its products meet stringent environmental standards, particularly for the California market.

Key Utility Terrain Vehicles Companies:

The following are the leading companies in the utility terrain vehicles market. These companies collectively hold the largest market share and dictate industry trends.

- Arctic Cat Inc.

- BMS Motorsports, Inc.

- BRP

- CFMOTO

- DRR USA

- HISUN

- American Honda Motor Co., Inc.

- Kawasaki Motors Corp., U.S.A.

- Polaris Inc.

- Yamaha Motor Co., Ltd.

Recent Developments

-

In October 2024, Kawasaki Motors Corp., U.S.A., launched a new commercial brand featuring a line of Utility Terrain Vehicles (UTVs) called the Kawasaki Commercial KT models, specifically designed to meet the demanding needs of government and fleet customers. Set to debut in early 2025, these UTVs prioritize durability, power, and practicality over luxury features, catering to professional users in sectors such as public safety, park management, and heavy-duty construction. The KT models are engineered to perform reliably in tough worksite environments, offering ruggedness and efficiency tailored to fleet operations.

-

In October 2024, Massimo Motor partnered with ATOMdesign to launch an Outdoors Hybrid Utility Terrain Vehicle (HUTV) that features the first-ever integration of an iPad dashboard. This collaboration introduces a new Hybrid Utility Terrain Vehicles category by blending utility, sport, and on-road capabilities into a single versatile platform. Integrating the iPad as the vehicle’s dashboard provides users an advanced, user-friendly interface that enhances connectivity, navigation, and overall control, leveraging the iPad’s intuitive touchscreen and app ecosystem.

Utility Terrain Vehicles Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.45 billion

Revenue forecast in 2030

USD 9.84 billion

Growth rate

CAGR of 5.7% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report propulsion

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Displacement, propulsion, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Arctic Cat Inc.; BMS Motorsports, Inc.; BRP; CFMOTO; DRR USA; HISUN; American Honda Motor Co., Inc.; Kawasaki Motors Corp., U.S.A.; Polaris Inc.; Yamaha Motor Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Utility Terrain Vehicles Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global utility terrain vehicles market report based on displacement, propulsion, application, and region:

-

Displacement Outlook (Revenue, USD Million, 2018 - 2030)

-

Less than 400 CC

-

Between 400 CC and 800 CC

-

Greater than 800 CC

-

-

Propulsion Outlook (Revenue, USD Million, 2018 - 2030)

-

Gasoline

-

Diesel

-

Electric

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Utility

-

Sports

-

Recreation

-

Military

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the utility terrain vehicles market include Arctic Cat Inc.; BMS Motorsports, Inc.; BRP; CFMOTO; DRR USA; HISUN; American Honda Motor Co., Inc.; Kawasaki Motors Corp., U.S.A.; Polaris Inc.; Yamaha Motor Co., Ltd.

b. The growth of the market is driven by the increasing demand for versatile, off-road-capable vehicles across sectors such as agriculture, construction, outdoor recreation, and defense.

b. The global utility terrain vehicles market size was estimated at USD 7.23 billion in 2024 and is expected to reach USD 7.45 billion in 2025.

b. The global utility terrain vehicles market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2030 to reach USD 9.84 billion by 2030.

b. North America dominated the utility terrain vehicles market with a share of 47.6% in 2024 due to strong demand from agriculture, construction, military, and recreational sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.