- Home

- »

- Clinical Diagnostics

- »

-

Vacuum Blood Collection Tube Market Size Report, 2030GVR Report cover

![Vacuum Blood Collection Tube Market Size, Share & Trends Report]()

Vacuum Blood Collection Tube Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Coagulation, EDTA Tubes), By Tube Material (PET/Plastic, Glass), By End-use (Blood Banks), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-020-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vacuum Blood Collection Tube Market Summary

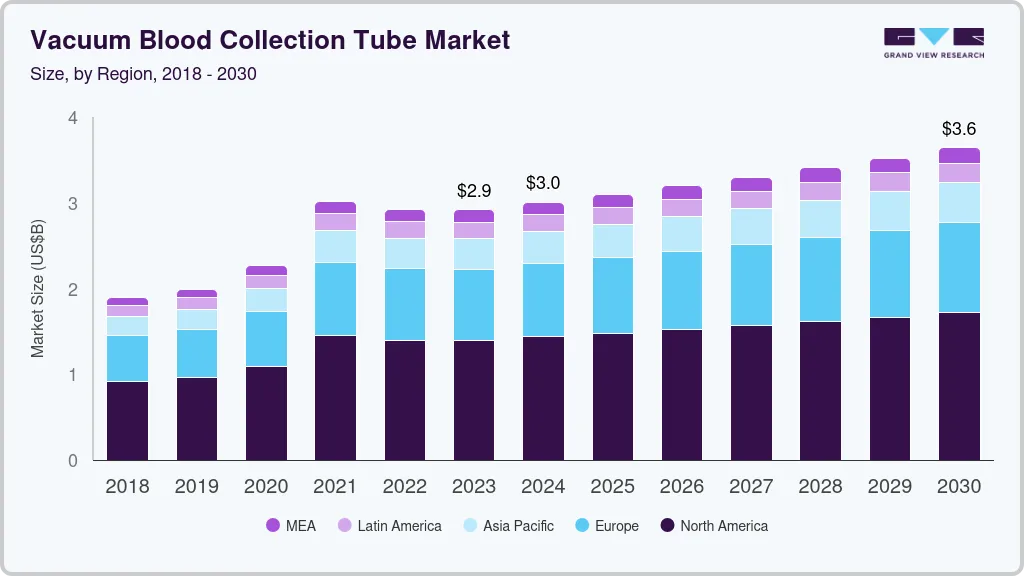

The global vacuum blood collection tube market size was estimated at USD 2.92 billion in 2023 and is projected to reach USD 3.64 billion by 2030, growing at a CAGR of 3.23% from 2024 to 2030. The growth of the market is attributed to the rising prevalence of chronic and infectious diseases, growing number of blood transfusions, and rising prevalence of hematological disorders.

Key Market Trends & Insights

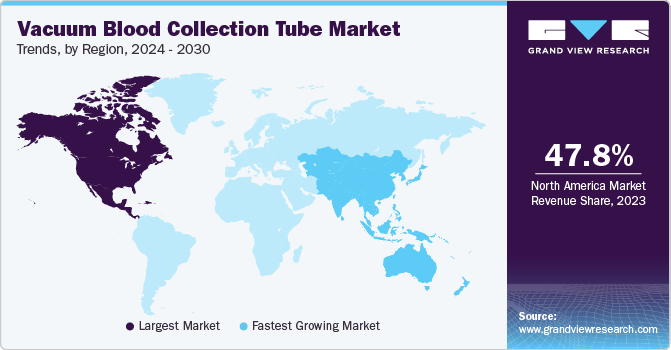

- North America vacuum blood collection tube market reported the largest revenue share of 47.81% in 2023.

- By type, the serum separating tube segment dominated the market with a share of 28.89% in 2023.

- By tube material, the PET/Plastic segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.92 Billion

- 2030 Projected Market Size: USD 3.64 Billion

- CAGR (2024-2030): 3.23%

- North America: Largest market in 2023

The increasing prevalence of chronic diseases such as diabetes and cardiovascular diseases drives the demand for vacuum blood collection devices. These conditions require regular blood testing and monitoring, making reliable collection methods indispensable in managing these diseases effectively.

As per the data from the IDF Diabetes Atlas, there were about 537 million adults living with diabetes in 2021, and this number is anticipated to increase to 643 million by 2030. The disease is estimated to have caused 6.7 million deaths in 2021. Thus, the increasing prevalence of diabetes is boosting the demand for vacutainers for performing recurring diagnostic tests, such as blood sugar assays.

Vacuum blood collection devices play a crucial role in diagnosing and monitoring both chronic & infectious diseases. They provide a safe, hygienic, and efficient method for collecting samples, ensuring accurate test results & reducing the risk of contamination. In the context of the COVID-19 pandemic, these devices have been essential for collecting samples for diagnostic testing, tracking disease spread, and monitoring patient health.

The rising number of blood transfusions is a key driver for the vacuum blood collection tubes market. According to the National Blood Collection and Utilization Survey (NBCUS), the U.S. observed a 1.7% increase in the number of Red Blood Cell (RBC) units collected between 2019 and 2021. In 2021, 10.76 million RBC units were transfused, and 11.78 million RBC units were collected. Moreover, the number of whole blood units collected for nondirected and allogeneic donations in 2021 increased up to 9.84 million units by 0.7%, and the number of apheresis RBC units collected rose up to 1.93 million units by 7.3%.Every 2 seconds, someone in the U.S. needs blood or platelets, highlighting the constant demand for blood products. Approximately 29,000 units of RBCs are required daily in the U.S., along with nearly 5,000 units of platelets and 6,500 units of plasma. In total, almost 16 million blood components are transfused each year in the U.S.

Moreover, the rising incidence of hematological disorders is a significant factor driving the use of collection devices. The prevalence of hematologic diseases, including anemia; sickle cell disease; bleeding disorders, such as clots & hemophilia; and cancer types, including myeloma, lymphoma, & leukemia, is growing. For example, in the U.S., every 9 minutes, someone dies from blood cancer, representing about 157 people each day or more than 6 people every hour. Myeloma, leukemia, and lymphoma are expected to cause the deaths of an estimated 57,380 people in the U.S. in 2023, accounting for 9.4% of cancer deaths that year.

Furthermore, an estimated 437,337 people are living with or in remission from leukemia, and an estimated 879,242 people are living with or in remission from lymphoma in the U.S. Furthermore, approximately 900,000 people in the U.S. develop clots annually, and clots are responsible for approximately 100,000 deaths each year. It is worth noting that fewer than one in four people show any recognizable signs and symptoms of clot.

However, vacuum blood collection tubes often contain materials that can be harmful to the environment if not disposed of properly, such as plastics and potentially hazardous chemicals used in tube coatings and additives. Regulatory bodies worldwide have implemented strict guidelines for the disposal of medical waste, including collection tubes, to mitigate environmental pollution and public health risks. Compliance with these regulations adds complexity and cost to the disposal process for healthcare facilities and laboratories, which may deter adoption or increase the operational expenses associated with vacuum blood collection tube usage.

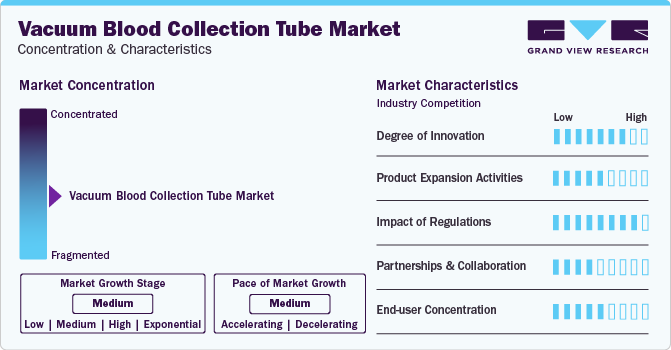

Market Concentration & Characteristics

The degree of innovation is high in market, particularly in the development of tubes that minimize the risk of contamination and improve the stability of the blood sample, are contributing to the growth of this segment. These innovations make the process more efficient and safer, encouraging banks to adopt these technologies.

Several players engage in product expansion to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve competency. For instance, in July 2021, BD was granted FDA Emergency Use Authorization (EUA) for BD Vacutainer Plus Citrate Plasma Tubes (UK Manufacturing Site). These tubes, designed for collecting, transporting, and storing samples for coagulation testing, are crucial for identifying & treating coagulopathy in patients, including those with known or suspected COVID-19. This authorization marked a significant step in BD’s coagulation testing product portfolio.

Stringent regulations for the disposal of vacuum blood collection tubes may significantly restrain market growth. As the use of these tubes continues to increase due to rising demand for transfusions and diagnostic testing, concerns regarding their environmental impact have intensified.

Several market players are focusing on collaboration to strengthen their market position. For instance, in August 2020, Greiner Bio-One and Hematologic Technologies (HTI) have joined forces to provide comprehensive development and custom manufacturing services for blood collection tubes used in in vitro diagnostics (IVD) and clinical diagnostic devices.

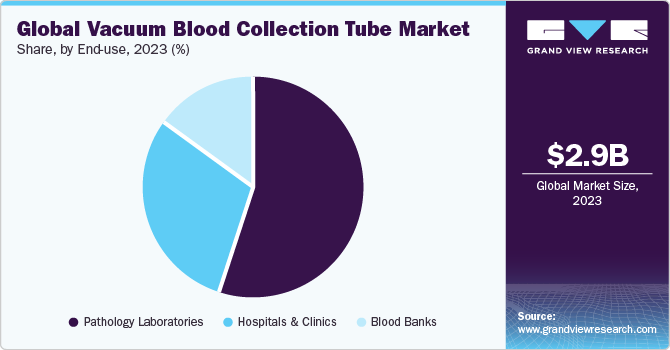

The market shows a high end-user concentration, with a significant portion of revenue generated from a limited number of key customers, primarily in the hospitals, clinics, and pathology laboratories. This concentration is driven by the dominance of a few major players.

Type Insights

Serum separating tube segment dominated the market with a share of 28.89% in 2023driven by several key factors and influenced by significant trends, presenting lucrative opportunities for manufacturers. One of the primary market drivers is the increasing demand for diagnostic testing, particularly with the rising global prevalence of chronic diseases and the growing need for accurate & efficient laboratory procedures.

Technological advancements in SST design, such as improved gel formulations and tube materials, are enhancing the performance and reliability of these tubes, further driving market growth. The trend toward personalized medicine is also influencing the market, driving the need for specialized diagnostic tests and creating opportunities for SST manufacturers to develop tailored products.

Coagulation tubes segment is expected to register fastest CAGR during the forecast period. Coagulation tubes are a critical component of collection systems, designed to collect samples for coagulation testing. The market for coagulation tubes is primarily driven by the increasing prevalence of coagulation disorders and the growing demand for accurate and timely diagnostic tests. One of the key factors driving the market is the rising incidence of chronic diseases such as cardiovascular diseases, diabetes, and cancer, which are often associated with coagulation disorders. As the global burden of these diseases continues to increase, so does the demand for coagulation testing, boosting the market for coagulation tubes.

Tube Material Insights

PET/Plastic segment dominated the market in 2023 and is anticipated to grow at fastest growth rate of 3.39% over the forecast period. Polyethylene Terephthalate (PET), commonly known as plastic, is used to manufacture collection tubes due to its versatility, durability, and compatibility with various medical applications. The use of PET in these tubes is likely to be driven by several factors. PET offers excellent chemical resistance, making it suitable for storing blood samples without the risk of contamination or degradation. This property is essential for maintaining the integrity of the collected samples during transportation and storage.

Glass segment is expected to register considerable CAGR during the forecast period. Glass has been the traditional material for collection tubes due to its excellent properties for preserving blood samples. However, its use has decreased in favor of PET due to safety concerns regarding breakage and the potential for injury. Despite this, glass still offers several advantages in specific applications, especially in laboratory settings where its unique properties are beneficial.

One of the primary benefits of using glass to manufacture vacuum blood collection tubes is its inert nature. Glass is nonreactive and does not interact with the contents of the tube, ensuring that the integrity of the sample is maintained. This is particularly important for certain laboratory tests that require a stable environment for accurate results.

Application Insights

Blood routine examination segment dominated the market with a share of 25.06% in 2023due to the increasing prevalence of chronic diseases and conditions that require regular monitoring & diagnosis, such as diabetes, cardiovascular diseases, and cancer. These tubes are essential for collecting, transporting, and preserving samples for routine examination. Advancements in healthcare infrastructure in emerging economies are facilitating easier access to diagnostic services.

This development is expected to increase the patient pool and boost the demand for blood testing services. Moreover, the global importance of preventive healthcare measures has increased routine health checkups among the general population.These checkups include comprehensive blood tests to evaluate various health indicators, contributing to the growth of the routine examination application segment.

Coagulation tests segment is expected to register fastest growth during the forecast period. Increasing prevalence of clotting disorders, such as hemophilia and Deep Vein Thrombosis (DVT), are expected to drive the segment over the forecast period. As per the 2021 World Federation of Hemophilia Report on the Annual Global Survey, 233,577 people were diagnosed with hemophilia across the globe. The survey covered 118 countries, and the total number of people with bleeding disorders was 386,966. Coagulation tests are critical in analyzing and monitoring patients with hematology clotting disorders. These tests are also essential in preoperative screening to assess the clotting ability of blood, which can influence surgical outcomes.

End-use Insights

Pathology laboratories segment dominated the market with a share of 55.23% in 2023 and is expected to grow at fastest growth rate over the forecast period. Pathology laboratories are important in conducting a wide range of tests essential for diagnosing diseases, monitoring patient health, and guiding treatment decisions. With the growing prevalence of chronic diseases, such as diabetes, cardiovascular disease, and cancer, there is a surge in demand for tests that help in early diagnosis & monitoring.

As per the IDF's Diabetes Atlas 10th Edition 2021, an estimated 537 million adults aged 20 to 79 years were living with diabetes in 2021. By 2023, this figure is expected to reach approximately 643 million; by 2045, it is projected to reach 783 million. Pathology laboratories are often the first avenue where patients undertake diagnostic tests that use vacuum blood collection tubes, thereby driving the market.

Hospitals & clinics are expected to hold considerable share in the market in 2023. Hospitals and clinics are primary healthcare facilities and witness a high daily patient footfall. It includes patients needing routine blood tests, emergency cases, and surgical procedures. The high volume of blood tests conducted in these settings necessitates a steady demand for collection tubes. Hospitals and clinics cater to various medical conditions requiring various diagnostic tests. From routine full blood counts to more specific tests for diseases such as diabetes, cancer, and infectious diseases, vacuum blood collection tubes are essential for accurate & efficient sample collection.

Regional Insights

North America vacuum blood collection tube market reported the largest revenue share of 47.81% in 2023. The dominant share can be due to the local presence of major key players, well-established infrastructure, and the increasing prevalence of diabetes patients in the region. Diabetes is the most common disease among children and is a major noncommunicable disease that affects adults & children. Moreover, asthma affects more adult women than adult men in the U.S. According to the American Diabetes Association, around 25 million people in the U.S. were reported to have asthma. According to the same source, in 2021, diabetes affected 38.4 million people in the U.S., which represents 11.6% of the entire population. Out of these cases, around 29.7 million had been diagnosed, while 8.7 million remained undiagnosed.

U.S. Vacuum Blood Collection Tube Market Trends

The vacuum blood collection tube market in the U.S. is expected to grow over the forecast period attributed to the prevalence of various chronic diseases that necessitate regular monitoring and blood testing for effective management and treatment.

Europe Vacuum Blood Collection Tube Market Trends

Europe vacuum blood collection tube market was identified as a lucrative region in this industry. Ongoing advancements & investments in healthcare infrastructure in European countries significantly drive the demand for efficient and reliable blood collection methods, including vacuum blood collection tubes.

The vacuum blood collection tube market in UK is growing primarily due to the high incidence of cancer, which significantly raised the disease burden on the National Health Service (NHS).

France vacuum blood collection tube market is expected to grow over the forecast period due to various initiatives undertaken by public & private organizations focusing on developing and commercializing novel vacuum blood collection tubes. Moreover, the rising investments in developing novel advanced therapy products are anticipated to support market growth over the forecast period.

The vacuum blood collection tube market in Germany is expected to witness substantial growth owing to increasing focus on geographic expansion, new product launches, and the presence of key players in Germany.

Asia Pacific Vacuum Blood Collection Tube Market Trends

Asia-Pacific vacuum blood collection tube market is expected to witness the fastest CAGR over the projected period. Asia Pacific is expected to be the fastest-growing market owing to significant influence by prevalence of various diseases that need blood tests for diagnosis and monitoring. With a rapidly increasing diabetic population, especially in China and India, the need for blood glucose testing & monitoring is significant. This is expected to drive the demand for vacuum blood collection tubes used in glucose testing. In addition, Asia Pacific has seen a rise in Cardiovascular Diseases (CVDs) due to changing lifestyles and increasing aging populations. Blood tests for lipid profiles and other markers are essential for diagnosing & monitoring CVDs, driving market growth.

The vacuum blood collection tube market in China is expected to grow over the forecast period, owing to the presence of a large target population and continuous government initiatives to expand the diagnostics industry in the country.

Japan vacuum blood collection tube market is expected to grow over the forecast period presence of a well-established healthcare system and high adoption of advanced technology are expected to boost the market in the country.

Latin America Vacuum Blood Collection Tube Market Trends

The vacuum blood collection tube market in Latin America was identified as a lucrative region in this industry. This is due to the growing healthcare infrastructure, rising awareness & demand for diagnostics, and the increasing prevalence of chronic diseases, such as diabetes and cancer, in the region.

Brazil vacuum blood collection tube market is expected to grow over the forecast period owing to the rising prevalence of various chronic diseases that necessitate regular monitoring and blood testing for effective management and treatment.

MEA Vacuum Blood Collection Tube Market Trends

The vacuum blood collection tube market in MEA was identified as a lucrative region in this industry. The market in this region is driven by rapid economic development in emerging markets, such as South Africa, the high unmet healthcare needs, and the increasing prevalence of cancer.

Saudi Arabia vacuum blood collection tube market is expected to grow over the forecast period attributed to the increasing awareness and prevalence of infectious diseases, including HIV, and other conditions requiring blood diagnostics.

Key Vacuum Blood Collection Tube Company Insights

Some of the leading players operating in the market include Sekisui Chemical, BD, Greiner AG, Cardinal Health. Key players adopt various operating strategies to maintain their market positions. One key strategy is product innovation and differentiation. These companies invest in R&D to introduce new products with enhanced features, such as improved safety, compatibility with automated systems, and specialized tubes for specific tests.

Advin Health Care, AdvaCare Pharma, Hindustan Syringes & Medical Devices, MB Plastic Industries are some of the emerging market participants in the market. Emerging players often focus on developing novel products with unique features to differentiate themselves in the market. Another strategy is strategic partnerships and collaborations. Emerging players may collaborate with research institutions, healthcare facilities, or distributors to expand their reach and access new markets.

Key Vacuum Blood Collection Tube Companies:

The following are the leading companies in the vacuum blood collection tube market. These companies collectively hold the largest market share and dictate industry trends.

- SEKISUI CHEMICAL CO., LTD.

- BD (Becton, Dickinson and Company)

- Cardinal Health

- Greiner AG

- Advin Health Care

- AdvaCare Pharma

- Hindustan Syringes & Medical Devices Ltd

- MB Plastic Industries

- Biota

Recent Developments

-

In April 2024, Streck, Inc. announced the launch of Protein Plus BCT, a direct whole blood draw collection tube used for stabilizing the draw-time concentration of plasma proteins during ambient temperature storage

-

In October 2023, YourBio Health announced the approval of TAP Micro Select blood collection device with CE marking which would help in enhancing the process of blood collection during clinical trials

-

In May 2023, CML Biotech installed a fully integrated collection tube manufacturing machine in India. The company currently has manufacturing capacity of 100 million non-vacuum collection tubes and 120 million vacuum collection tubes

Vacuum Blood Collection Tube Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.01 billion

Revenue forecast in 2030

USD 3.64 billion

Growth rate

CAGR of 3.23% from 2024 to 2030

Actual data

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, tubes material, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

SEKISUI CHEMICAL CO., LTD.; BD (Becton, Dickinson and Company); Cardinal Health; Greiner AG; Advin Health Care; AdvaCare Pharma; Hindustan Syringes & Medical Devices Ltd; MB Plastic Industries; Biota

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vacuum Blood Collection Tube Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vacuum blood collection tube market report based on type, tubes material, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Serum Separating Tube

-

Plasma Separation Tubes

-

EDTA Tubes

-

Rapid Serum Tubes

-

Coagulation Tubes

-

Others

-

-

Tube Material Outlook (Revenue, USD Million, 2018 - 2030)

-

PET/Plastic

-

Glass

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Serology & Immunology

-

Blood Routine Examination

-

Coagulation Tests

-

Genetic Studies

-

Blood Sugar Assay

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Pathology Laboratories

-

Blood Banks

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global vacuum blood collection tubes market size was estimated at USD 2.98 billion in 2022 and is expected to reach USD 2.60 billion in 2023.

b. The global vacuum blood collection tubes market is expected to grow at a compound annual growth rate of 3.02% from 2023 to 2030 to reach USD 3.20 billion by 2030.

b. The serum separation tubes segment dominated the global market in 2023 and captured the maximum share of the overall revenue. The large share can be attributed to the advantages associated with separation tubes such as the rapid separation of serum from cellular components of blood, eliminates of the need for aliquotting serum, reduces the aerosolization of hazardous substances, decreases the pre-analytical turnaround time, and enables easy transportation.

b. Some key players operating in the vacuum blood collection tubes market include SEKISUI CHEMICAL, BD, Cardinal Health, Greiner AG, InterVacTechnology, Advin Health Care, AdvaCare Pharma, Hindustan Syringes & Medical Devices, MB Plastic Industries and Biota.

b. The increasing incidence of chronic diseases such as various infectious diseases and non-infectious diseases (including diabetes, cardiovascular diseases, & cancer) is a major factor driving the growth of the vacuum blood collection tubes market globally. Furthermore, the rising number of accidents and injuries will propel the demand for blood transfusion during the study period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.