- Home

- »

- Advanced Interior Materials

- »

-

Valve Positioners Market Size, Share, Industry Report, 2033GVR Report cover

![Valve Positioners Market Size, Share & Trends Report]()

Valve Positioners Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type, By Application (Energy & Power, Chemical, Oil & Gas, Water & Wastewater Management, Food & Beverage), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-360-2

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Valve Positioners Market Summary

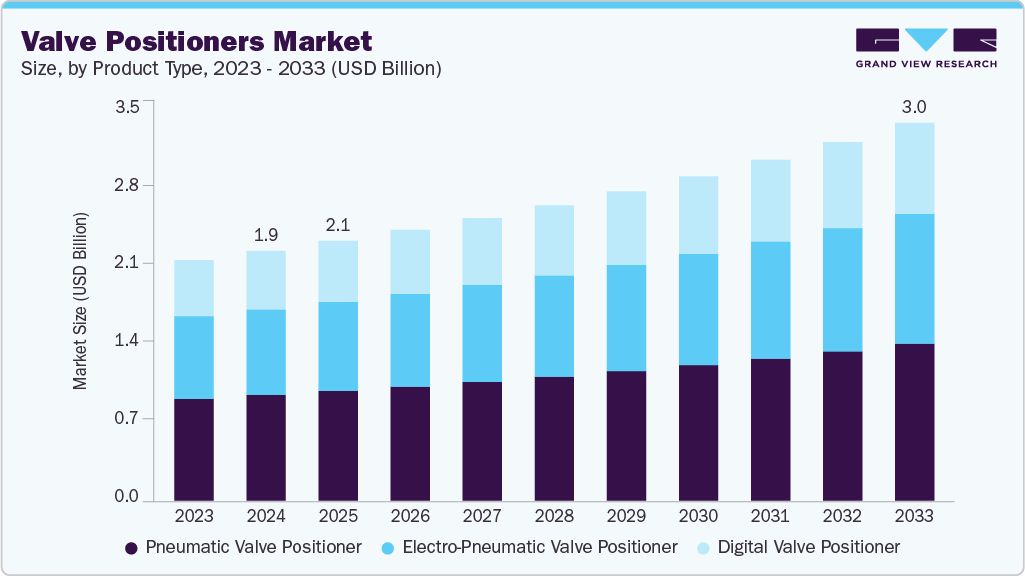

The global valve positioners market size was estimated at USD 1.99 billion in 2024 and is projected to reach USD 3.01 billion by 2033, growing at a CAGR of 4.8% from 2025 to 2033. This growth is attributed to the rising demand for industrial automation across sectors such as oil and gas, chemicals, and pharmaceuticals.

Key Market Trends & Insights

- Asia Pacific dominated the valve positioners market with the largest revenue share of 36.2% in 2024.

- The valve positioners market in China is expected to grow at a significant CAGR over the forecast period.

- By product type, the digital valve positioner segment is expected to grow at the fastest CAGR of 5.1% over the forecast period.

- By application, the water & wastewater management segment is expected to grow at the fastest CAGR of 5.5% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1.99 Billion

- 2033 Projected Market Size: USD 3.01 Billion

- CAGR (2025-2033): 4.8%

- Asia Pacific: Largest market in 2024

Automated processes require precise control of valve operations to ensure efficiency, safety, and reliability. Advanced valve positioners, including digital and electro-pneumatic models, provide necessary precision and control, thereby fueling market growth.In addition, there is a growing emphasis on process optimization and efficiency improvements in industries across the world such as power generation, water treatment, and manufacturing. Valve positioners are integral to achieving optimal process performance by ensuring accurate valve positioning, which enhances overall system efficiency and reduces operational costs. This factor is further expected to fuel product demand over years.

The development of digital technologies and communication protocols is driving the adoption of digital valve positioners. Digital positioners offer enhanced functionality, which supports their increasing market penetration. Furthermore, inclination towards energy efficiency in industrial processes is a key driver for this product. Product contribute to energy efficiency by optimizing valve control, reducing energy waste, and improving system performance.

The initial cost of advanced valve positioners, especially digital and electro-pneumatic models, can be a significant barrier for adoption, particularly for small and medium-sized enterprises. Furthermore, technical expertise required for proper setup and ongoing maintenance can be a challenge for organizations lacking skilled personnel or resources.

However, stringent safety regulations and standards in various industries necessitate reliable and precise control systems. The product plays a crucial role in meeting these regulations by ensuring proper valve operation and preventing safety hazards.

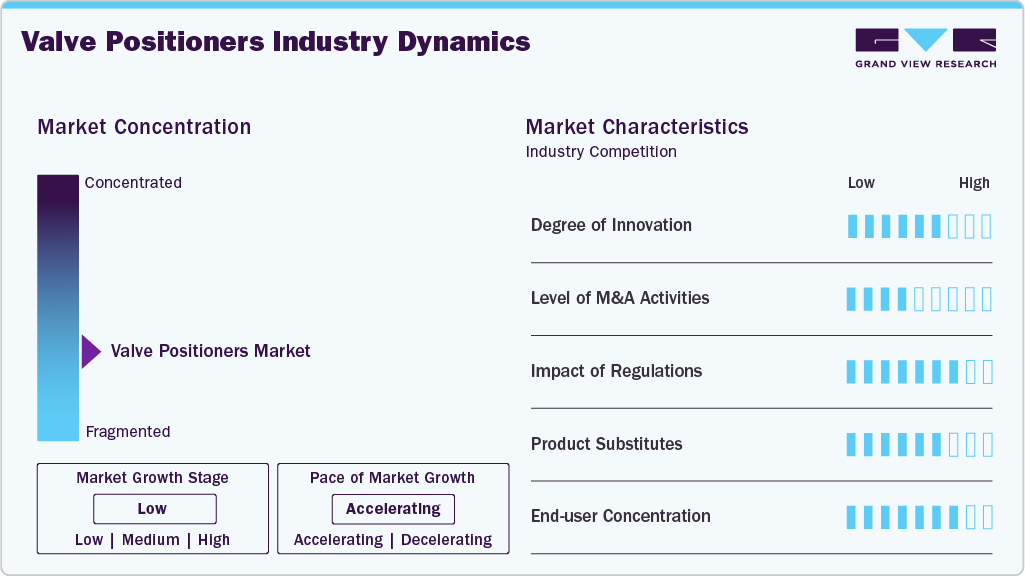

Market Concentration & Characteristics

The valve positioners industry is at a medium growth stage, with the pace of market growth accelerating due to rising adoption of process automation and increasing focus on operational efficiency across industries. The industry is moderately fragmented, with the presence of numerous global and regional players offering a wide portfolio of pneumatic, electro-pneumatic, and digital valve positioners designed for various end-use applications such as oil & gas, power generation, water treatment, and chemicals.

Market participants are increasingly emphasizing technological innovation, digital integration, and cost optimization to strengthen their competitive positioning. Leading manufacturers are focusing on developing smart and digital valve positioners equipped with advanced diagnostics, real-time monitoring, and remote calibration features to improve plant reliability and minimize downtime.

The market consists of a large number of medium and small-scale manufacturers alongside established automation solution providers, which increases end-user bargaining power. As many suppliers offer comparable product ranges with similar performance levels and pricing, the degree of product differentiation remains relatively low, intensifying competition across the market.

Product Type Insights

The market is segmented into pneumatic valve positioner, electro-pneumatic valve positioner, and digital valve positioner. The pneumatic valve positioner segment led the market with the largest revenue share of 42.3% in 2024 and this segment is expected to witness at the fastest CAGR over forecast period. Their widespread use is attributed to their proven reliability, simplicity, and cost-effectiveness for various industrial applications. They are favored in environments where pneumatic control systems are prevalent, such as in the oil and gas, chemical, and power generation industries.

The electro-pneumatic valve positioners segment is expected to grow at a significant CAGR during the forecast period, on account of their versatility and increasing adoption in modern industrial processes. Their growing popularity is driven by advancements in automation technologies and the increasing demand for precise control in industries such as manufacturing, water treatment, and pharmaceuticals. Furthermore, digital valve positioners offer advanced features such as digital communication protocols, enhanced diagnostics, and greater precision.

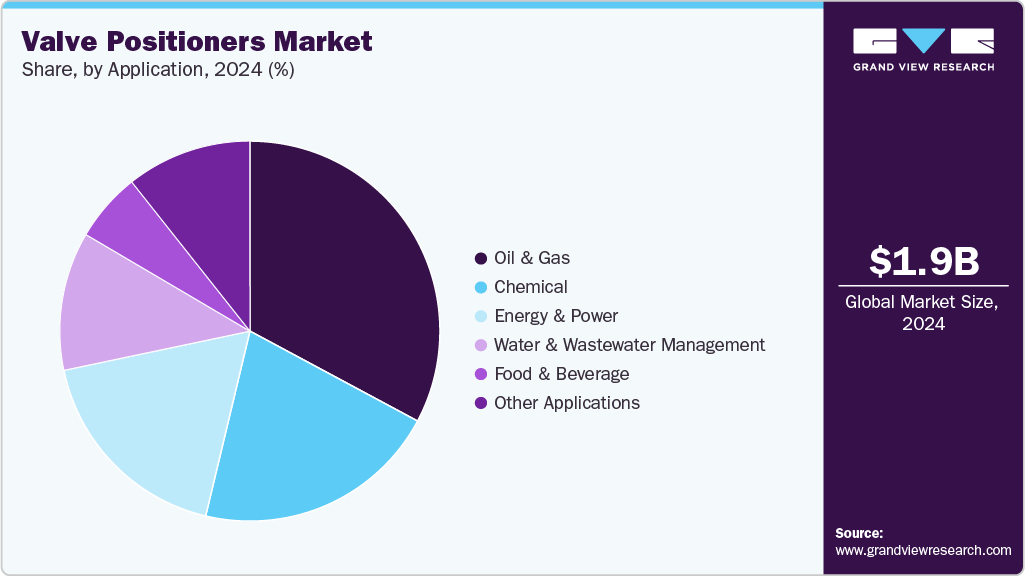

Application Insights

The market is segmented into energy & power, chemical, oil & gas, water & wastewater management, and food & beverage. Among these, the oil & gas applications segment led the market with the largest revenue share of 32.8% in 2024 and is further expected to grow at a significant CAGR over forecast period. Valve positioners are indispensable for the safe and efficient operation of various processes involved in the exploration, production, and transportation of hydrocarbons in oil & gas sector. These positioners are utilized in a wide array of applications, including upstream exploration and production, midstream transportation, and downstream refining processes.

Furthermore, in water and wastewater management sector, this product is vital for effective control and regulation of water treatment processes, distribution systems, and wastewater treatment facilities.

In energy & power sector, valve positioners play a critical role in enhancing operational efficiency, safety, and reliability across a range of applications. In power generation plants, valve positioners are integral to controlling the flow of steam, water, and fuel within the system.

Regional Insights

The North America valve positioners market is expected to grow at a significant CAGR over the forecast period. This is attributed to the substantial expansion of the industrial automation sector, which is increasingly being adopted across manufacturing, energy, and infrastructure projects in the region. The oil and gas sector of the North American economy is also driving demand for the product as the industry focuses on increasing production efficiency, ensuring safety, and reducing environmental impact.

U.S. Valve Positioners Market Trends

The valve positioners market in the U.S. is in rapid growth, as the e-commerce sector has spurred investments in advanced packaging and logistics solutions, where the product is used in various automated systems for improved efficiency and reliability. Furthermore, the U.S. has increased emphasis on infrastructure modernization and adoption of sustainable practices, which are fostering demand for valve positioners that meet stringent regulatory requirements and support green technologies.

Europe Valve Positioners Market Trends

The valve positioners market in Europe is growing rapidly. One of the primary drivers of demand for the product is the European Union’s stringent regulations and standards aimed at improving energy efficiency, reducing emissions, and promoting environmental sustainability. These regulatory frameworks are pushing industries across Europe to adopt advanced technologies, including state-of-the-art valve positioners, to meet compliance requirements and enhance operational performance. Thereby, fueling product demand.

Asia Pacific Valve Positioners Market Trends

Asia Pacific dominated the valve positioners market with the largest revenue share of 36.19% in 2024 and is expected to register at the fastest CAGR over the forecast period. There is significant growth potential in emerging markets such as the Asia-Pacific. As regions continue to industrialize and develop, there is an increasing need for advanced valve positioners to support their expanding infrastructure and manufacturing capabilities.

Key Valve Positioners Company Insights

Some of the key players operating in the market are Emerson Electric Co., ABB, Schneider Electric:

-

Emerson Electric Co. is a Missouri-based company that was established in 1890. It is involved in engineering and automation technology services. The company serves many industries such as oil and gas, power generation, water and wastewater management, and manufacturing. Its extensive portfolio includes a broad spectrum of automation products, with a significant focus on valve positioners that cater to diverse industrial applications.

-

Schneider Electric is involved in the digital transformation of energy management and automation. It was founded in 1836 and headquartered in Rueil-Malmaison, France. Schneider Electric’s portfolio includes a broad range of products and services for industrial automation, energy management, and building management systems.

Flowserve Corporation, Christian Bürkert GmbH & Co. KG, and ControlAir Crane Co. are some of the emerging participants in the market.

-

Flowserve Corporation, founded in 1997 and headquartered in Irving, Texas, USA, is a manufacturer of fluid motion and control products and services. The company specializes in designing, manufacturing, and servicing pumps, valves, seals, and related equipment for various industrial applications.

-

ControlAir Crane Co., established in 1980 and based in Manchester, New Hampshire, USA, is a manufacturer of precision control products for industrial automation. The company specializes in pneumatic and electro-pneumatic control devices used in a variety of industrial applications.

Key Valve Positioners Companies:

The following are the leading companies in the valve positioners market. These companies collectively hold the largest market share and dictate industry trends.

- Emerson Electric Co.

- ABB

- Schneider Electric

- Azbil Corporation

- Baker Hughes Company

- Bray International

- Flowserve Corporation

- Christian Bürkert GmbH & Co. KG

- ControlAir Crane Co.

- Dwyer Instruments LTD.

Recent Developments

-

In November 2023, Emerson Electric Co. launched its new high quality, durable, and compact valve positioner which offers reliable close/open position feedback in various industries such as food & beverage, water & wastewater management, and industrial utilities. Furthermore, this product features components made from stainless steel which allows it to withstand harsh environment.

Valve Positioners Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.07 billion

Revenue forecast in 2033

USD 3.01 billion

Growth rate

CAGR of 4.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

Emerson Electric Co.; ABB; Schneider Electric; Azbil Corporation; Baker Hughes Company; Bray International; Flowserve Corporation; Christian Bürkert GmbH & Co. KG; ControlAir Crane Co.; Dwyer Instruments LTD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

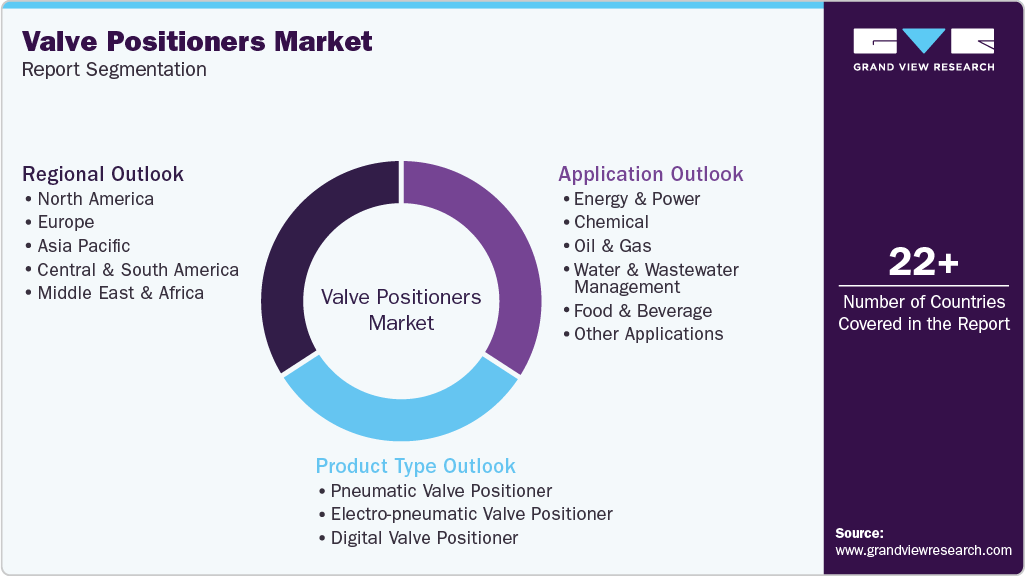

Global Valve Positioners Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2021 to 2033. For this study, Grand View Research has segmented the global valve positioners market report based on the product type, application, and region:

-

Product Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Pneumatic Valve Positioner

-

Electro-pneumatic Valve Positioner

-

Digital Valve Positioner

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Energy & Power

-

Chemical

-

Oil & Gas

-

Water & Wastewater Management

-

Food & Beverage

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global valve positioners market size was estimated at USD 1.99 billion in 2024 and is expected to reach USD 2.07 billion in 2025.

b. The global valve positioners market is expected to grow at a compound annual growth rate (CAGR) of 4.8% from 2025 to 2033 to reach USD 3.01 billion by 2033.

b. Oil & gas application accounted for largest revenue share of 32.8% in 2024. Demand for valve positioners in the oil & gas industry is expected to increase due to the growing need for precise flow control, automation, and operational efficiency in complex process environments.

b. Some key players operating in the valve positioners market include Emerson Electric Co., ABB, Schneider Electric, Azbil Corporation, Baker Hughes Company, Bray International, Flowserve Corporation, Christian Bürkert GmbH & Co. KG, ControlAir Crane Co., and Dwyer Instruments LTD.

b. The key factors that are driving the valve positioners market growth is the rising demand for industrial automation across sectors such as oil and gas, chemicals, and pharmaceuticals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.