- Home

- »

- Advanced Interior Materials

- »

-

Vanadium Market Size And Share, Industry Report, 2030GVR Report cover

![Vanadium Market Size, Share & Trends Report]()

Vanadium Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Steel, Non-ferrous Alloys, Chemicals, Energy Storage), By Region (North America, Europe, Asia Pacific, CSA, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-456-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Vanadium Market Summary

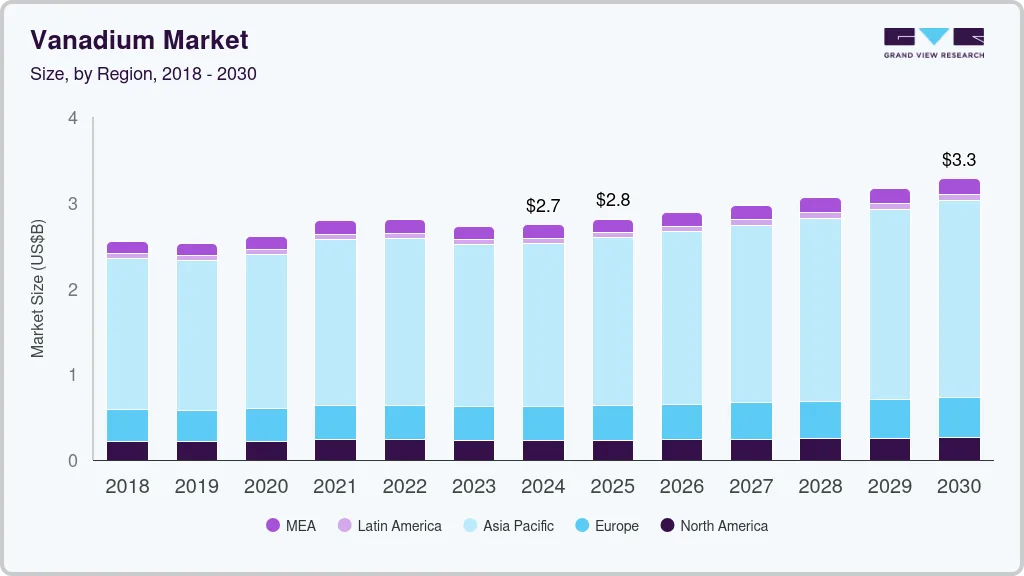

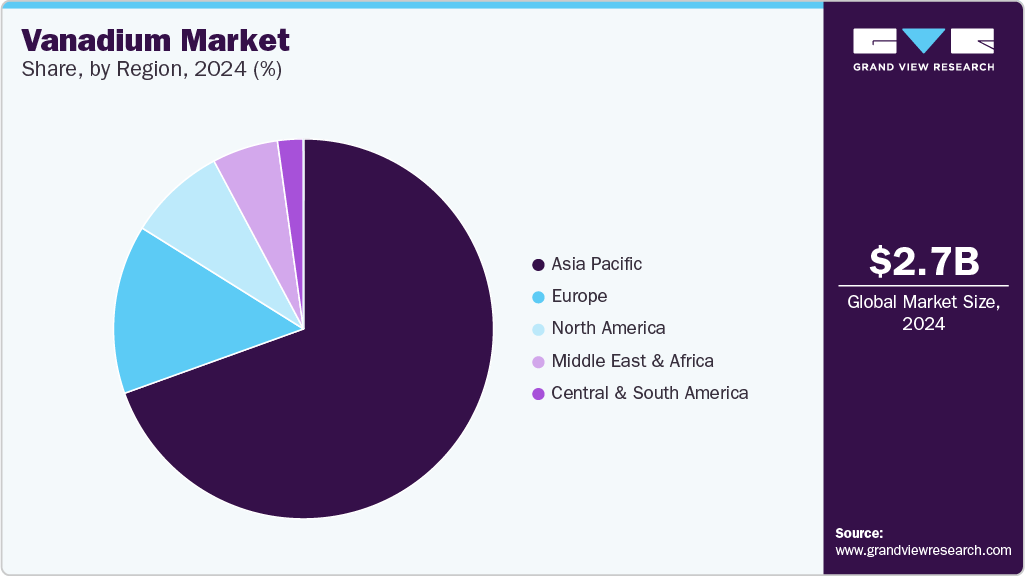

The global vanadium market size was estimated at USD 2.7 billion in 2024 and is projected to reach USD 3.28 billion by 2030, growing at a CAGR of 3.1% from 2025 to 2030. Rising crude steel production, driven by growing demand from the construction, automotive, machinery, and transportation sectors, is encouraging the demand for vanadium in the coming years.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of application segment, steel accounted for a revenue of USD 2,516.2 million in 2024.

- Energy Storage is the most lucrative application segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 2.7 Billion

- 2030 Projected Market Size: USD 3.28 Billion

- CAGR (2025-2030): 3.1%

- Asia Pacific: Fastest growing market

Rising crude steel production, driven by growing demand from the construction, automotive, machinery, and transportation sectors, is encouraging the demand for vanadium in the coming years. Vanadium is mainly utilized as an alloying element in steel manufacturing, as it enhances steel’s strength, durability, and resistance to wear. The increasing need for high-strength steel across construction, automotive, and aerospace industries continues to propel vanadium consumption. Besides rising global investments in infrastructure and industrial manufacturing is boosting the demand for vanadium . For instance, as reported by the International Energy Agency (IEA), global investment in infrastructure rose from USD 3.2 trillion in 2019 to USD 3.8 trillion in 2023, which in turn is expected to drive the demand for high-strength steel and subsequently propelling the vanadium industry.

The global vanadium market is experiencing steady growth, driven by its essential role in high-strength steel production, which accounts for approximately 90% of its consumption. Vanadium's ability to enhance the strength, durability, and corrosion resistance of steel makes it indispensable in key sectors such as construction, automotive, and heavy machinery. According to the World Steel Association, global crude steel output increased from 1,878.6 million tons in 2019 to 1,892.6 million tons in 2023, underscoring a stable demand trajectory from steel-intensive industries.

The market is also benefiting from the global shift toward renewable energy, with vanadium redox flow batteries (VRFBs) gaining prominence due to their long operational lifespan, scalability, and suitability for grid-scale energy storage. Projects such as China’s 100 MW/400 MWh Dalian VRFB installation highlight vanadium’s potential in stabilizing renewable energy supply. Additionally, the nuclear sector presents another avenue for demand, as vanadium-based alloys are increasingly used in advanced reactors due to their low neutron absorption and high resistance to extreme temperatures and corrosion.

Emerging markets are creating momentum, as urbanization and infrastructure development drive steel consumption. Efforts by countries including Australia and the U.S. to develop domestic vanadium sources also reflect growing geopolitical interest in securing critical mineral supply chains. As clean energy and carbon neutrality goals being prioritized, vanadium’s role in enabling both energy storage and clean power generation is making it a material of strategic importance.

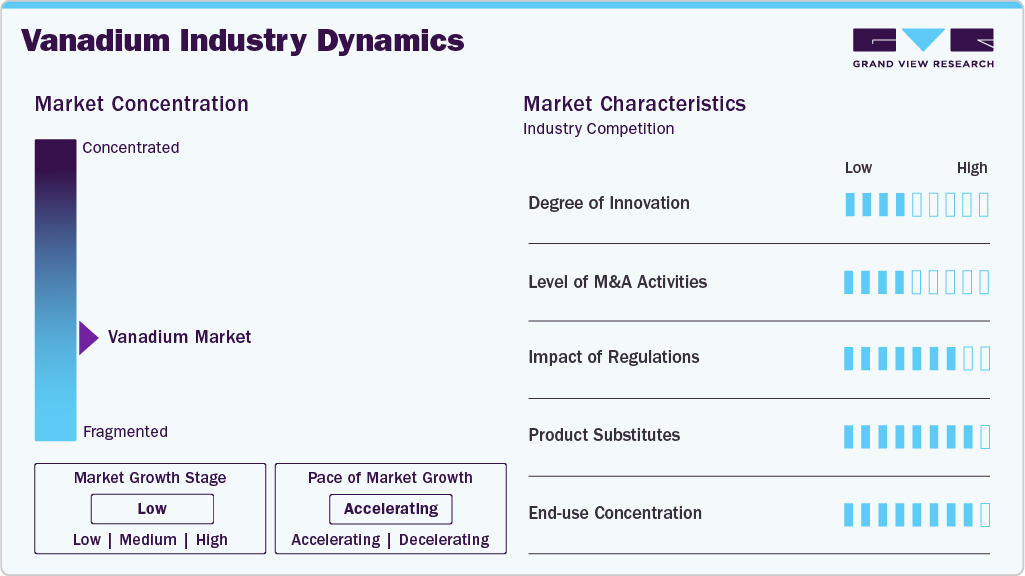

Market Concentration & Characteristics

The market growth stage is low, and the pace of market growth is accelerating. The vanadium industry exhibits a moderate degree of innovation, largely driven by the growing development of vanadium redox flow batteries (VRFBs) for energy storage and ongoing research into high-performance alloys for use in advanced sectors such as aerospace and nuclear energy. Industry has witnessed a rise in R&D investments, particularly in regions prioritizing clean energy technologies. Despite this, reliance on conventional extraction and processing techniques continues to limit breakthrough advancements. Mergers and acquisitions remain relatively subdued, reflecting the concentrated nature of vanadium production, which China, Russia, and South Africa dominate. Additionally, strategic partnerships and vertical integration efforts are gaining traction, especially in Australia and North America, where there is a push to establish secure, domestic supply chains.

Regulatory frameworks significantly shape the vanadium market, with the mineral designated as critical in jurisdictions including the U.S., EU, and Australia. Environmental regulations around mining practices, waste disposal, and emissions are becoming more stringent, affecting project feasibility and operational costs. Simultaneously, government incentives promoting renewable infrastructure and strategic mineral reserves are supporting vanadium demand, especially for its applications in clean energy. Despite its advantages, vanadium faces moderate to high substitution risks. In steel production, niobium can partially replace vanadium, and in energy storage, lithium-ion batteries present stiff competition due to their lower costs and widespread use. However, vanadium remains difficult to replace in nuclear and aerospace uses, where its material properties are uniquely suited.

The market is also characterized by high end-user concentration, with over 90% of global vanadium supply consumed by the steel industry. This dependency exposes the market to volatility, particularly tied to fluctuations in steel output in major economies including China and India. Although new applications in renewable energy and nuclear power offer diversification, the market’s growth remains closely linked to industrial and infrastructure cycles that are influenced by broader economic and policy shifts.

Application Insights

Steel accounted for the largest market share of 89.7% in 2024. The vanadium market is set to grow steadily, primarily driven by its critical role in steel manufacturing. As a key alloying element, vanadium enhances the strength, durability, and corrosion resistance of steel, making it vital for steel used in infrastructure, construction, automotive, and industrial machinery. With global urbanization, industrialization, and government investments in resilient infrastructure and transportation networks on the rise, demand for high-performance steel continues to climb. Additionally, the shift toward lightweight, fuel-efficient vehicles and sustainable construction practices further boosts the use of vanadium-enhanced steel. Growth in adjacent sectors such as renewable energy, where robust materials are needed for wind turbines and grid infrastructure, indirectly supports vanadium demand. The close link between steel usage and broad economic development ensures the expansion of vanadium industry.

The rapid growth of the energy storage sector, projected to expand at a CAGR of 5.2%, presents a significant opportunity for the vanadium market. This expansion is largely driven by the global transition toward renewable energy sources such as solar and wind, which require reliable, long-duration storage to balance intermittent supply. Vanadium redox flow batteries (VRFBs) have emerged as a preferred solution due to their long cycle life, deep discharge capabilities, and scalability for grid applications. As countries invest in decarbonizing their power systems and improving grid resilience, demand for VRFBs is expected to rise. Since vanadium is the core element in these batteries, their adoption directly translates into increased vanadium consumption. Furthermore, government support for energy storage technologies and clean energy goals globally will continue to accelerate this trend, reinforcing vanadium’s strategic role in the future energy economy.

Regional Insights

North America holds a notable position in the global vanadium market, driven primarily by demand from the U.S. The region’s focus on renewal of infrastructure, automotive advancements, and domestic production of critical minerals is shaping vanadium consumption patterns. Steel manufacturing remains the dominant application, however, there is a growing push toward energy storage technologies and high-performance alloys. Policies promoting clean energy and supply chain resilience are encouraging investment in domestic vanadium sources. As the region continues transitioning toward renewable energy and electrification, North America's vanadium demand is expected to strengthen steadily.

U.S. Vanadium Market Trends

In the U.S., the vanadium market is largely centered around the steel industry, which absorbs the majority of its consumption due to ongoing infrastructure projects and durable goods manufacturing. Other applications, such as chemical production, aerospace alloys, and energy storage account for a smaller share and are also gaining momentum. Government’s emphasis on clean energy solutions and grid modernization is fostering interest in advanced battery systems, including vanadium-based technologies. The U.S. is also investing in recycling and domestic recovery initiatives, positioning itself for long-term vanadium supply stability and end-use diversification.

Europe Vanadium Market Trends

The vanadium market in Europe is expanding steadily, driven by the region’s focus on sustainable industrial practices and the transition toward clean energy. European countries are increasingly adopting vanadium in applications such as catalytic converters, essential for reducing vehicle emissions, and in renewable energy storage systems to support grid reliability. The region is also active in researching and deploying vanadium redox flow batteries for long-duration energy storage, aligning with their climate goals. This steady growth is supported by regulatory frameworks, investment in green technologies, and a push toward circular economies across member states.

Asia Pacific Vanadium Market Trends

The Asia Pacific Vanadium market is anticipated to grow at a CAGR of 3.3% during the forecast period. This growth is attributed to significantly increasing investments in vanadium market across the region. China dominates the vanadium market in the Asia Pacific region due to its massive steel production capacity and vertically integrated supply chains. The country benefits from abundant vanadium-bearing resources and a well-established manufacturing ecosystem, allowing it to meet large-scale domestic demand across construction, automotive, and infrastructure sectors. Additionally, China has been proactive in developing vanadium redox flow battery projects to support its renewable energy goals, further cementing its role as a global vanadium hub. The combination of policy support, industrial scale, and technological integration underpins its leading position.

India, the fastest-growing vanadium market in the region, is expanding steadily, supported by rapid urbanization, infrastructure development, and increasing investment in construction and transportation. The government's focus on strengthening domestic manufacturing and expanding renewable energy capacity is also contributing to the rise in vanadium demand. While still emerging compared to regional leaders, India’s growth trajectory is supported by economic development and industrial expansion, indicating strong potential for vanadium consumption in the coming years.

Key Vanadium Company Insights

Some of the key companies in the vanadium market include HBIS Group Co., Ltd., Bushveld Minerals, Largo Inc., Australian Vanadium Limited, and others. These organizations are strategically focused on expanding their production capacity, securing long-term supply chains, and tapping into emerging applications such as energy storage. To gain a competitive edge, leading players are actively engaging in initiatives such as mergers and acquisitions, joint ventures, and partnerships-particularly in regions prioritizing renewable energy and critical minerals development. This collaborative approach is aimed at strengthening their market presence and responding to the rising global demand for vanadium across industrial and clean energy sectors.

-

HBIS Group Co., Ltd. is one of the world's largest steelmakers and a leading vanadium producer. HBIS operates captive vanadium resources and integrates vanadium extraction into its steel production chain. The company's scale and supply chain control make it a dominant player in the market.

-

Bushveld Minerals is a vertically integrated vanadium platform with ownership of primary vanadium assets, processing facilities, and downstream energy storage projects (including VRFBs).

Key Vanadium Companies:

The following are the leading companies in the vanadium market. These companies collectively hold the largest market share and dictate industry trends.

- AMG

- Aura Energy Ltd

- Australian Vanadium Limited

- Bushveld Minerals

- EVRAZ plc

- Glencore

- HBIS Group

- Largo, Inc.

- Pangang Group Vanadium and Titanium Resources Co., Ltd.

- Vanadium Resources Limited

Recent Developments

-

In November 2024 VanadiumCorp Resource Inc. successfully passed the qualification process with CellCube for its Quebec-produced vanadium electrolyte. This development strengthens the North American vanadium redox flow battery (VRFB) supply chain and marks progress toward domestic energy storage solutions.

-

In October 2024 - Largo Inc. boosts vanadium production and secures a supply deal. Largo Inc. reported a 42% increase in vanadium pentoxide (V₂O₅) production in Q3 2024, totaling 3,072 tons. The company also finalized a binding agreement to supply 2,100 tonnes of V₂O₅ worth USD 23.5 million, showcasing strong operational momentum and rising demand.

-

In February 2024, AMG Vanadium acquired processing technologies and IP-related business from Transformation Technologies Inc. (TTI), which focuses on green energy and recyclable metals. With this acquisition, the company aims to improve its leadership position in recycling refinery waste. AMG Vanadium recycled vanadium from oil refining residues.

-

In February 2024, Australian Vanadium Limited (AVL) completed the merger with Technology Metals Australia. AVL acquired all the shares of Technology Metals Australia. With this strategic move, the company wants to broaden its footprint in primary vanadium production.

Vanadium Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.81 billion

Revenue forecast in 2030

USD 3.28 billion

Growth rate

CAGR of 3.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America, Europe, Asia Pacific, Central and South America, MEA

Country scope

U.S., Canada, Mexico, Germany, France, Italy, China, Japan, India, Brazil

Key companies profiled

AMG; Aura Energy Ltd.; Australian Vanadium Limited Bushveld Minerals; EVRAZ plc Glencore; HBIS Group; Largo, Inc.; Pangang Group Vanadium and Titanium Resources Co., Ltd.; and Vanadium Resources Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vanadium Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vanadium market report based on application and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Steel

-

Non-Ferrous Alloys

-

Chemicals

-

Energy Storage

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.