- Home

- »

- Consumer F&B

- »

-

Vegan Dessert Market Size & Trends, Industry Report, 2030GVR Report cover

![Vegan Dessert Market Size, Share & Trends Report]()

Vegan Dessert Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Biscuits/Cookies, Cakes & Pastries, Custards & Puddings, Frozen Desserts), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-803-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vegan Dessert Market Summary

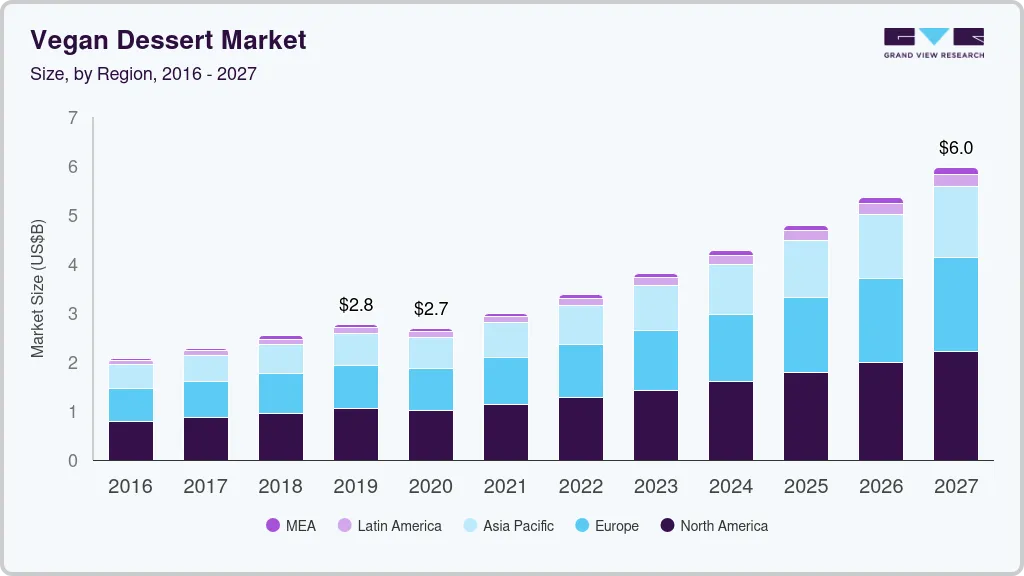

The global vegan dessert market size was valued at USD 4.28 billion in 2024 and is anticipated to reach USD 8.32 billion by 2030, growing at a CAGR of 11.6% from 2025 to 2030. The growing popularity of the vegan lifestyle in developed economies of North America and Europe has been driving the global market for vegan desserts.

Key Market Trends & Insights

- North America led the market for vegan desserts in 2024 with a 37.3% share of global revenue.

- The U.S. dominated the North America vegan dessert market in 2024.

- By product, the cakes and pastries segment dominated the market in 2024 with a revenue share of 29.3%.

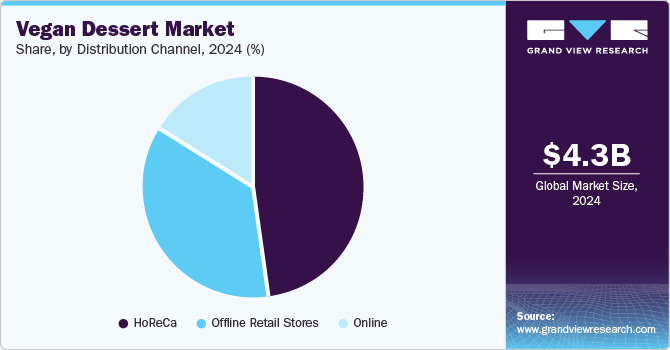

- By distribution channel, the HoReCa segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.28 Billion

- 2030 Projected Market Size: USD 8.32 Billion

- CAGR (2025-2030): 11.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Furthermore, increasing demand for dairy alternatives is another crucial factor contributing to the progress of the vegan dessert industry. Over the past few years, awareness about veganism and an extensive range of plant-based products have increased. Vendors in the industry have been offering numerous plant-based sweet dishes that deliver the quality, taste, and visual appeal of traditional desserts. Some international chefs have been increasingly exploring the industry and innovating plant-based sweet dishes. For instance, Chef Naimita Jagasia, founder of An Ode To Gaia, India’s first luxury patisserie, globally recognized as the influencer on vegan desserts, provides recipes and books, consultations, and cooking classes. Organizations like IUV are recreating vegan adaptations of local recipes worldwide through the World Vegan Festival. Such services have been expanding the consumer base of the industry. Vegan desserts are increasingly gaining a place on the menu of several restaurants and cafes to appeal to consumers with dietary concerns, such as egg allergies, lactose intolerance, and high cholesterol levels. Furthermore, the wide availability of plant milk and fats has fueled the supply of vegan desserts.

In addition, rising health consciousness among consumers has encouraged producers to use healthier food ingredients. With increasing awareness about the negative impact of white sugar, consumers have been avoiding foods containing white sugar. Therefore, industry producers have been using sugar alternatives, such as sweet potatoes.

Additionally, increasing demand for new flavors and ingredients, along with healthier dessert options, is further fueling the market growth. For instance, using aquafaba as a substitute for eggs and oats & coconut milk for ice creams can be a healthier and tastier alternative to conventional deserts. Additionally, using superfoods such as moringa and chia seeds for numerous desserts and puddings can provide protein-rich & keto-friendly dessert options.

Product Insights

The cakes and pastries segment dominated the market in 2024 with a revenue share of 29.3%. These are the most popular products in the industry as they are also considered a celebratory dish served on ceremonial events, such as birthdays, weddings, and anniversaries. Rapid urbanization, along with the increased purchasing power of millennial consumers, has fueled the growth of this segment. Over the years, the demand for plant-based cakes and pastries has notably increased, especially in Europe and North America. The regional players are introducing numerous cakes and pastries along with various flavors, which is further driving the segment growth. For instance, in September 2024, the UK-based food producer Oggs expanded their selection of vegan baked goods by introducing a Lemon Drizzle Loaf Cake to UK stores.

The frozen dessert segment is expected to expand at the fastest CAGR over the forecast period. The increasing launch of ice creams made with plant-based milk and fat is expected to boost the growth of this segment. As of 2024, nearly 65% of the population is lactose intolerant, which represents a wide consumer base for the vegan dessert industry. Furthermore, the rising inclination of consumers toward vegan desserts owing to its benefits in managing cholesterol levels by substituting animal-based ingredients with plant-based alternatives is fueling the growth of this segment.

Distribution Channel Insights

The HoReCa distribution channel segment held the largest revenue share in 2024. The increasing dining-out trend has fueled the sales of vegan desserts through hotels, restaurants, and cafes. As per the US FOODS, INC. survey published in 2024, on average, Americans buy takeout delivery 4.5 times a month and eat out three times a month, and more than 65% of Americans claim to eat out at least once a week. Additionally, the average monthly restaurant expenditure in 2024 was USD 191, up from USD 166 in 2023. Therefore, increasing spending on hotels and restaurants is driving the segment growth.

The offline retail stores retail stores such as supermarkets, hypermarkets, grocery stores, and convenience stores held a significant market share in 2024. A large number of consumers prefer this distribution channel due to its wide range of product availability and discounted price. Therefore, several companies opt for these stores to distribute their products. For instance, Albertsons added 12 new plant-based foods to its Open Nature private label. The latest additions include yogurt, shredded cheese, almond ice cream, and others, which are available at Albertsons banner stores and supermarkets such as Vons, Safeway, ACME, and Jewel-Osco.

Regional Insights

North America led the market for vegan desserts in 2024 with a 37.3% share of global revenue. The increasing vegan population has propelled the sales of vegan desserts in the region. The key factors influencing young adults between 25 and 34 to choose a vegan lifestyle are ethical and environmental concerns, health considerations, and social trends. Furthermore, retail sales of plant-based foods increased over the years, as per a report published by the Plant Based Foods Association and The Good Food Institutes.

U.S. Vegan Dessert Market Trends

The U.S. dominated the North America vegan dessert market in 2024. A large number of people are adopting plant-based diets due to rising health concerns and animal welfare. Vegan desserts support sustainable and ethical consumption by minimizing animal exploitation and reducing greenhouse gas emissions, water use & land degradation. These choices are prevalent among the younger urban population, who prioritize sustainability & health and are more inclined to support sustainable brands. The presence of big brands, dynamic cultural trends, frequent product launches, and widespread retail penetration is stimulating the vegan lifestyle.

Europe Vegan Dessert Market Trends

The Europe vegan dessert market was identified as a lucrative region in 2024. The regional industry is expanding due to consumer demand for high-end, cutting-edge, and health-conscious goods. Sugar-free, organic, and artisanal desserts are popular right now, emphasizing distinctive flavors and high quality. Europe’s traditional and artisanal baking heritage is driving the growth of the vegan dessert market. Craftsmanship, premium ingredients & refined techniques enable the seamless transformation of classical recipes into modern vegan versions. La Besnéta, a well-known bakery in Spain, offers a variety of cakes, cupcakes & dessert jars that capture the traditional essence of Spanish sweetness.

Germany is the market leader in this region, generating nearly one-fourth of the revenue. There is a high level of environmental and ethical awareness, along with strong regulatory support, such as the European Alliance for Plant-Based Foods (EAPF) promoting vegan labeling and reduced VAT for vegan products across the European Union. The EU Green Deal is also encouraging consumer demand for organic, healthier, and sugar-free products, which is helping the vegan dessert industry grow.

Asia Pacific Vegan Dessert Market Trends

The Asia Pacific vegan dessert market is anticipated to grow at the highest pace during the forecast period. The regional market growth is driven by rising health awareness, increased lactose intolerance, and a flexitarian population. China & India are experiencing the fastest growth owing to increasing disposable income, urbanization, and growing health consciousness. Demand for plant-based food is increasing significantly in other Asia Pacific nations, including Japan, Australia, Vietnam, and the Philippines. As a result, companies in the industry have been expanding their reach in this region.

China accounted for the largest market share of the region in 2024 owing to rapid urbanization, rising disposable incomes, and exposure to Western dietary habits, which has influenced Chinese consumers’ preferences, leading to a surge in demand for diverse and innovative vegan dessert options. The increasing availability of such products in urban centers caters to the evolving tastes of a more cosmopolitan population. Over 85% of the Chinese population is lactose intolerant, combined with a cultural shift toward ethical and sustainable consumption, encouraging the adoption of vegan desserts as healthier and more environmentally friendly alternatives.

Key Vegan Dessert Company Insights

Some of the key companies in the vegan dessert industry include Ben & Jerry’s, Danone S.A., Oggs, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as product launch, portfolio diversification, business expansion, partnership, and others.

-

BOSH MEDIA LTD. offers a wide range of desserts and bakery products across major UK supermarkets like Tesco & Sainsbury’s. The company’s products include vegan cakes and brioche buns & cookbooks. It has partnered with brands like Costa Coffee for vegan chocolate slices and kettle chips.

-

HP Hood LLC launched the Plant Oat brand in 2018 to cater health conscious and lactose intolerant consumers. Its product lineup includes oat milk and coffee creamers & frozen desserts.

Key Vegan Dessert Companies:

The following are the leading companies in the vegan dessert market. These companies collectively hold the largest market share and dictate industry trends.

- HP Hood LLC (Planet Oat)

- Unilever

- Danone S.A.

- cadoicecream

- Bliss Unlimited, LLC.

- Daiya Foods

- Alternative Food Network Inc.

- Ben & Jerry's Homemade, Inc.

- BOSH MEDIA LTD.

- Grupo Bimbo

- OGGS

Recent Developments

-

In April 2025, US-based vegan chocolate brand Galaxy launched a ‘melt-in-your-mouth’ vegan honeycomb chocolate bar. It is made from hazelnut paste, cocoa, and honeycomb pieces and is certified by the Vegan Society. This new launch is an extension of its vegan, dairy-free, and gluten-free range.

-

In April 2025, Danish premium ice cream maker Kastberg acquired V Lable certification for its range of vegan sorbets. These sorbets are made with minimal processing and using fruit base and are available in flavors such as lemon, raspberry & mango. Its consistent texture is optimized for storage in a professional kitchen.

-

In April 2025, Kraft Heinz introduced ‘JELL-O Oat Milk Chocolate Pudding’ as its first vegan dessert. These puddings are lactose-free, vegan, and the company’s first-time use of oat milk as a base. It’s available at retailers across the U.S.

-

In May 2024, Portland-based ice cream shop Kate's Ice Cream opened its second location. Known for flavors like marionberry cobbler and rosewater cardamom almond, the brand continues to grow, reflecting increased demand for plant-based frozen desserts.

-

In May 2024, Jars by Dani introduced a new product line called Bites, which includes vegan and gluten-free options. Each container features 14 samples of the brand's signature jar desserts, catering to dessert lovers with dietary preferences.

-

In March 2024, GoodPop debuted a range of fudgy frozen dessert bars made with oat milk, including Fudge n' Vanilla Crunch, Double Chocolate Fudge, Mint n' Fudge Chip, and Fudge n' Caramel Crunch. They are available at Whole Foods, Wegmans, Harris Teeter, and HEB starting in April 2025.

Vegan Dessert Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.80 billion

Revenue forecast in 2030

USD 8.32 billion

Growth rate

CAGR of 11.6% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil

Key companies profiled

HP Hood LLC (Planet Oat); Unilever; Danone S.A.; cadoicecream; Bliss Unlimited, LLC.; Daiya Foods Inc.; Alternative Food Network Inc; Ben & Jerry's Homemade, Inc.; BOSH MEDIA LTD.; OGGS; Grupo Bimbo

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vegan Dessert Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vegan dessert industry report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Biscuits/ Cookies

-

Cakes & Pastries

-

Custards & Puddings

-

Frozen Desserts

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline Retail Stores

-

HoReCa

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.