- Home

- »

- Consumer F&B

- »

-

Vegan Protein Powder Market Size And Share Report, 2030GVR Report cover

![Vegan Protein Powder Market Size, Share & Trends Report]()

Vegan Protein Powder Market Size, Share & Trends Analysis Report By Source (Hemp Protein, Pea Protein), By Flavor (Vanilla, Strawberry), By End-use, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-148-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Vegan Protein Powder Market Size & Trends

The global vegan protein powder market size was estimated at USD 344.3 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.5% from 2023 to 2030. This market for vegan protein powder is anticipated to witness exponential growth due to increasing awareness about its health and nutritional benefits. In the past, plant-based protein powders were often criticized for their gritty texture and unpleasant taste. However, advancements in food technology and formulation have addressed these issues, resulting in vegan protein powders with improved taste and texture. Manufacturers now employ various techniques to create smoother powders that mix well with liquids and offer a pleasant mouthfeel.

There have been notable improvements in flavor profiles, with a wide range of delicious options available, including chocolate, coffee, vanilla, and fruit flavors. These developments have made vegan protein powders more palatable and appealing to a broader consumer base. The enhanced taste and texture have helped overcome reservations that some people had about plant-based protein powders, encouraging them to incorporate these products into their diets more frequently.

Concerns regarding the environmental impact of animal agriculture have also driven many consumers to search for sustainable protein alternatives. The production of vegan protein powders results in lower greenhouse gas emissions and has a smaller carbon footprint compared to their animal-based counterparts. Plant-based protein production involves less water consumption, reduced land use, and decreased pollution compared to the rearing of livestock for protein production.

By opting for vegan protein powders, customers contribute to reducing their ecological footprint and promoting environmental sustainability. The alignment of vegan protein powders with the values of eco-conscious consumers has been a significant driver of market growth, attracting those who prioritize sustainability.

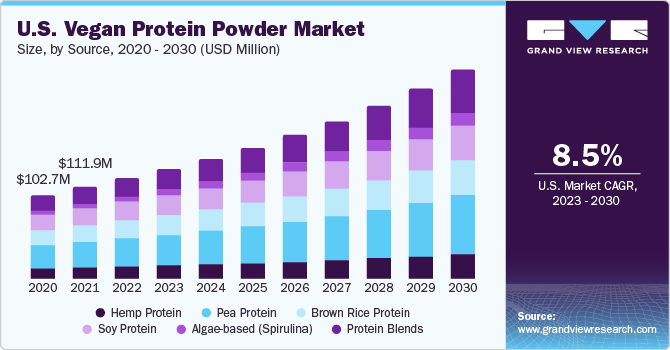

Source Insights

Based on source, the pea protein segment accounted for a market value of USD 99 million in 2022. Pea protein powder is easily digestible and well-tolerated by many customers. It contains relatively low levels of anti-nutritional factors compared to other plant-based proteins, such as soy or hemp. As a result, it is a favorable choice for individuals with sensitive stomachs or those who experience digestive issues with other protein sources.

The algae-based proteins represent the most lucrative vegan protein source, with the market projected to grow at a (CAGR) of 13.2%. The market for algae-based protein powders is still relatively new, offering opportunities for growth and innovation. Ongoing research and development efforts hold the potential for the discovery and commercialization of new algae strains with enhanced nutritional profiles, improved taste and texture, and increased protein yields.

Flavor Insights

Based on flavor, the chocolate, and coffee segment accounted for a revenue share of approximately 31% in 2022. These flavors are popular as they complement the inherent taste of plant-based proteins like pea, rice, or hemp. The rich and slightly sweet taste of chocolate enhances the earthy and nutty notes of plant-based proteins, resulting in an improved overall flavor profile. Similarly, the robust and slightly bitter taste of coffee adds depth and complexity to vegan protein powders, creating a more enjoyable sensory experience. This wide customer preference contributes to their significant market share.

The unflavored vegan protein powders are also on the rise and are expected to grow at a CAGR of 12.2% over the forecast period. Unflavored varieties typically have shorter ingredient lists compared to flavored options. They often contain fewer additives, sweeteners, or artificial flavors, making them appealing to customers who prioritize clean and minimal ingredient protein profiles.

End-use Insights

Based on end-use, the dietary supplements segment has surpassed the market for sports nutrition, and it is expected to reach a market value of USD 424.1 million by 2030. Protein constitutes a key part of an athlete's diet owing to its muscle recovery benefits. the market is highly driven by its growing demand among vegan athletes, fitness enthusiasts, and individuals involved in intense physical activities. Protein supplementation is commonly used to support muscle repair, enhance muscle protein synthesis, reduce muscle soreness, and achieve muscle-building goals.

Vegan protein powders offer a convenient solution for meeting protein requirements. They are easy to use and can be incorporated into a variety of recipes and preparations. They can be mixed with water or plant-based milk to create a quick protein shake, added to smoothies, blended into baked goods, or used as an ingredient in protein-rich snacks. The versatility of vegan protein powders allows individuals to integrate them into their preferred foods and beverages, enabling them to meet their daily protein needs more easily.

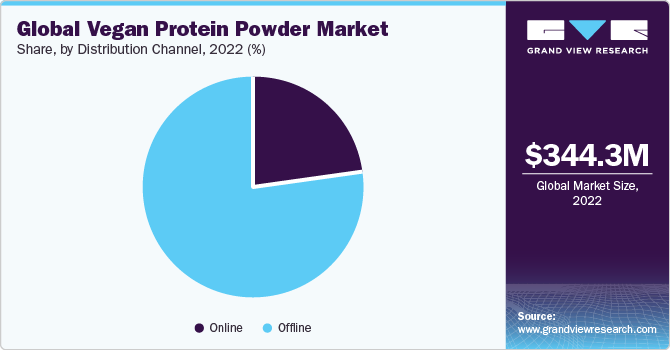

Distribution Channel Insights

Based on distribution channel, the offline segment dominated the market with a revenue share of 76.7% in 2022. Offline channels, such as supermarkets, health food stores, pharmacies, and specialty stores, have an advantage due to their well-established retail networks. These physical retail outlets have extensive reach and customer bases, making them easily accessible to consumers. Many customers still prefer the traditional brick-and-mortar shopping experience, as it allows them to physically see, touch, and evaluate products before making a purchase decision. Offline distribution channels cater to these preferences and provide a tangible shopping experience, contributing to their continued market dominance.

Many consumers have developed long-standing relationships with their local stores and have built trust in the authenticity and quality of products available offline. They are often familiar with the brands and retailers in their area, which gives them confidence in the products they purchase. This trust factor is a crucial element in driving customers to prefer offline channels over online alternatives. Personal interaction, face-to-face communication, and the ability to physically examine products contribute to the sense of trust and assurance that offline channels offer.

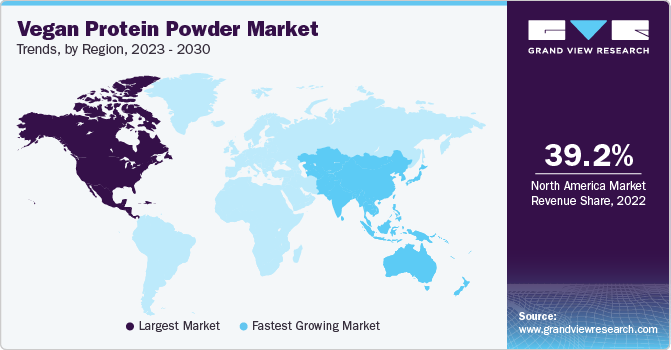

Regional Insights

North America led the market with a revenue share of over 39.2% in 2022. This dominance can be attributed to the significant rise in the number of people adopting vegan and vegetarian diets in the region. Concerns for animal welfare, health consciousness, and environmental sustainability are driving factors behind this dietary shift. As a result, there is a strong demand for vegan protein powders as a convenient and accessible source of plant-based protein.

The Asia Pacific region is expected to register a CAGR of about 12.4% over the forecast period. This growth is driven by a growing emphasis on health and wellness in the region, with consumers seeking products that align with their lifestyle choices and dietary preferences. Vegan protein powders are perceived as healthier alternatives to traditional animal-based protein powders, as they are free from cholesterol, lactose, and potential allergens.

Increasing awareness of the health benefits associated with plant-based diets is contributing to the growth of the vegan protein powder industry in Asia Pacific. The region is projected to experience a year-on-year (YoY) growth rate of 12.6% by 2030, indicating a substantial market expansion.

Key Companies & Market Share Insights

Companies have been implementing various expansion strategies such as new product launches, capacity expansions, strengthening of online presence, and mergers & acquisitions, to gain a competitive advantage. For instance:

-

In February 2023, Archer Daniels Midland Company inaugurated a USD 30 million state-of-the-art production facility in Spain to support the growing demand for probiotics and other products.

-

In June 2022, A&B Ingredients broadened its range of plant protein offerings by introducing textured faba bean proteins.

Key Vegan Protein Powder Companies:

- Bactolac Pharmaceutical, Inc.

- Archer Daniels Midland Company

- AMCO Proteins

- Titan Biotech Limited

- SMP Nutra

- AGT Foods

- A&B ingredients

- Garden of Life

- Sunwarrior LLC

- Orgain, Inc.

Vegan Protein Powder Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 376.0 million

Revenue forecast in 2030

USD 714.2 million

Growth rate

CAGR of 9.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, flavor, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; UK; Germany; Spain; France; China; India; Australia; Brazil; Argentina

Key companies profiled

Bactolac Pharmaceutical, Inc.; Archer Daniels Midland Company; AMCO Proteins; Titan Biotech Limited; SMP Nutra; AGT Foods; A&B ingredients; Garden of Life; Sunwarrior LLC; Orgain, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vegan Protein Powder Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global vegan protein powder market report based on source, flavor, end-use, distribution channel, and region.

-

Source Outlook (Revenue, USD Million, 2017 - 2030)

-

Hemp Protein

-

Pea Protein

-

Brown Rice Protein

-

Soy Protein

-

Algae-based (Spirulina)

-

Protein Blends

-

-

Flavor Outlook (Revenue, USD Million, 2017 - 2030)

-

Chocolate & Coffee

-

Vanilla

-

Strawberry

-

Banana

-

Unflavored

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Dietary Supplements

-

Sports Nutrition

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

UK

-

Germany

-

Spain

-

France

-

-

Asia Pacific

-

China

-

India

-

Australia

-

-

South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global vegan protein powder market size was estimated at USD 344.3 million in 2022 and is expected to reach USD 376.0 million in 2023.

b. The global vegan protein powder market is expected to grow at a compounded growth rate of 9.5% from 2023 to 2030 to reach USD 714.2 million by 2030.

b. In terms of sourcing, pea protein will hold a market value of USD 99 million by the end of the year 2022. Pea protein powder is easily digestible and well-tolerated by many customers. It contains relatively low levels of anti-nutritional factors compared to other plant-based proteins, such as soy or hemp. As a result, it is a favorable choice for individuals with sensitive stomachs or those who experience digestive issues with other protein sources.

b. Some key players operating in the vegan protein powder market are Bactolac Pharmaceutical, Inc., Archer Daniels Midland Company, AMCO Proteins, Titan Biotech Limited, SMP Nutra, AGT Foods, A&B ingredients, Garden of Life, Sunwarrior LLC, Orgain, Inc.

b. This market is expected to experience significant growth throughout the forecast period, driven by increasing consumer awareness of the nutritional and health benefits associated with vegan protein powder.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."