- Home

- »

- Pharmaceuticals

- »

-

Vegan Supplements Market Size And Share Report, 2030GVR Report cover

![Vegan Supplements Market Size, Share & Trends Report]()

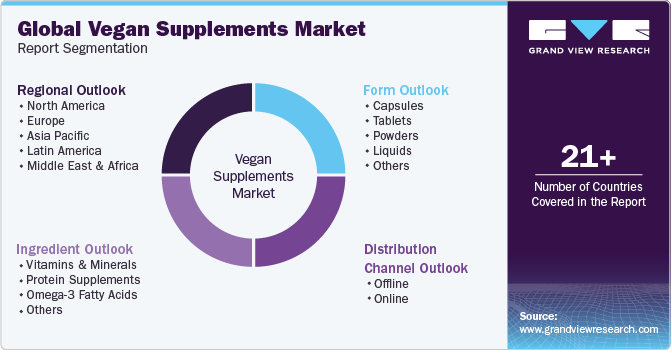

Vegan Supplements Market (2024 - 2030) Size, Share & Trends Analysis Report By Ingredient (Vitamins & Minerals, Protein Supplements), By Form (Capsules, Tablets), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-167-3

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Vegan Supplements Market Summary

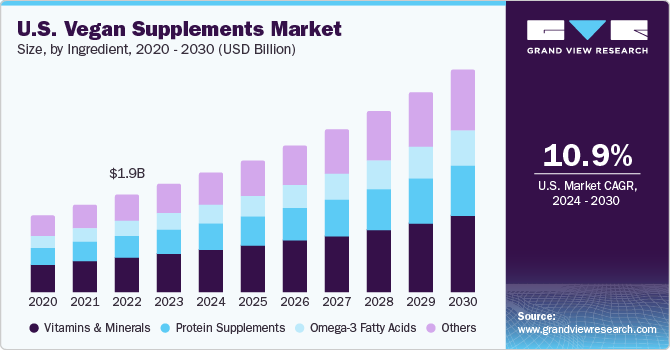

The global vegan supplements market size was estimated at USD 8,416.9 million in 2023 and is projected to reach USD 17,644.6 million by 2030, growing at a CAGR of 11.30% from 2024 to 2030. The growing number of people adopting plant-based diets is a primary driver for market growth.

Key Market Trends & Insights

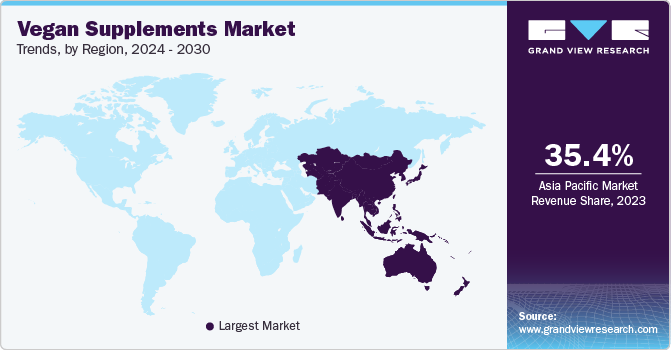

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, Argentina is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, vitamins & minerals accounted for a revenue of USD 2,966.8 million in 2023.

- Protein Supplements is the most lucrative ingredient segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 8,416.9 Million

- 2030 Projected Market Size: USD 17,644.6 Million

- CAGR (2024-2030): 11.30%

- Asia Pacific: Largest market in 2023

For instance, in 2021, as per Vegan Society report, about 2.7 million households in the UK had adopted a vegan lifestyle for better health. In addition, in 2018, as per IPOS survey, about 230 million people, constituting around 3% of the global population, adhered to a vegan lifestyle. As more individuals chose to eliminate animal ingredients from their diets, there is an increased demand for supplements that provide essential nutrients commonly found in plant ingredients.

COVID-19 has heightened awareness of health and wellness, with individuals seeking ways to strengthen their immune systems. This increased focus on personal health has led to a growing interest in plant-based supplements, since they are rich in vitamins, minerals, and antioxidants have gained popularity as consumers seek ways to enhance their immune systems and overall health. For instance, in July 2023, Cymbiotika, a prominent nutritional supplement brand, announced its Elderberry ingredient relaunch, designed to support and boost immune function.

Furthermore, government support and regulations are instrumental in propelling the growth of the market through various strategic initiatives. For instance, government-sponsored nutritional education programs contribute to increased awareness regarding the benefits of plant-based supplements and the significance of obtaining essential nutrients from alternative sources. Such initiatives foster a positive environment of accepting and consuming plant-based supplements. For instance, as per an article published in VegNews, in 2022, global governments have increased their investments in the alternative protein sector, by doubling the funding to reach a total of USD 635 million.

Companies are playing a pivotal role in driving the growth of the market through various strategies that respond to consumer demand, capitalize on trends, and promote sustainability. Furthermore, companies are highly investing in research and development to create innovative and effective plant-based supplement formulations. This includes developing plant-based alternatives for essential nutrients traditionally sourced from animal ingredients, such as protein, omega-3 fatty acids, vitamins, and minerals. For instance, in 2022, Vital Nutrients introduced a vegan omega supplement derived from algae, which includes Specialized Pro-resolving Mediators.

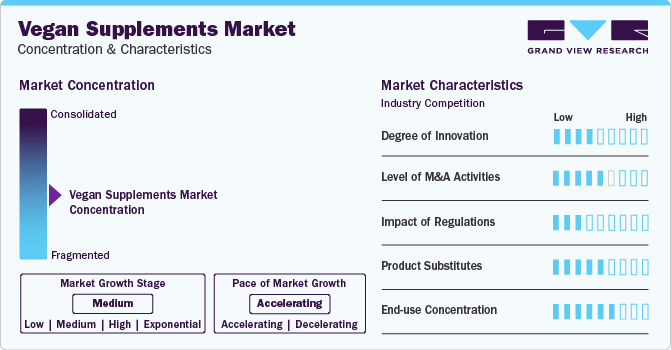

Market Concentration & Characteristics

The market is witnessing a rapid growth due to various expansion efforts from key industry participants. For instance, in February 2022, Nestlé Health Science acquired a majority stake in Orgain, a prominent player in plant-based nutrition, as part of its strategy to broaden its presence in the industry.

The global market is characterized by a high degree of innovation, with new technologies and methods being developed and introduced at regular intervals. This innovation extends across ingredient formulations, delivery methods, and sustainability practices.

Several market players such as Deva Nutrition LLC, NOW Foods, and Solgar, Inc are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

Regulations play a crucial role in shaping the market by ensuring ingredient safety, efficacy, and transparent information for consumers.

A variety of product substitutes exist for vegan supplements, offering alternatives for individuals seeking essential nutrients from sources other than traditional supplements. Whole foods, encompassing a diverse range of fruits, vegetables, whole grains, nuts, seeds, and legumes, serve as a better alternative option to fulfill nutritional needs.

Ingredient Insights

Vitamins & minerals segment held the largest revenue share of 35.25% in 2023. The rising number of individuals adopting vegan and flexitarian diets alongside a health-conscious population has resulted in a surge in demand for vegan vitamins & minerals supplements with enhanced ingredient profiles personalized to specific nutritional needs. The World Animal Foundation (WAF) in March 2023 registered 88 million vegan population globally. The foundation also stated that around 629,000 people registered for the Veganuary Campaign in 2022. Studies have shown that vegans have lower levels of certain nutrients and health markers than non-vegetarians, including vitamin D, iodine, selenium, etc. In addition, according to a research study by King’s College of London, 20% of vegans are at risk of Vitamin B12 deficiency. Thus, with such high demand, the vitamins and minerals segment is expected to show a lucrative growth in coming years.

Protein supplements segment is anticipated to witness the fastest CAGR of 12.32% over the forecast period. This is due to the increased popularity of plant-based protein supplements among vegetarians. Plant-based proteins are free of allergens and are non-GMO, making them a popular choice for those with food sensitivities. The demand for these supplements is on the rise to meet the nutritional needs of lactose-intolerant consumers and those with specific dietary preferences.

Form Insights

Capsules segment held the largest revenue share in 2023. The preference for plant-based supplements in capsule form is increasing, primarily due to their availability, allergen-free and non-GMO attributes, and ethical and environmental considerations. In addition, capsules are tasteless, dissolve quickly in the intestines, and are easy to manufacture compared to tablets, making them a popular choice among consumers. Furthermore, newer capsules are being introduced to improve bioavailability, release, and extend the benefits of supplements. Hence, various benefits offered by capsule formulations, such as higher rate of absorption & lower irritation to the Gastrointestinal (GI) tract and their availability in various sizes, based on dosage, are factors contributing to segment growth.

Powder segment is estimated to register the fastest CAGR over the forecast period. Vegan supplements in powdered form are easier to break down, process, and be absorbed by the body, leading to reduced bloating and improved digestion compared to other options. Furthermore, powder supplements can be used in versatile forms such as baked goods, soups, stews, and smoothies, and as a garnish on salads and prepared vegetables, making them popular among the vegan populations.

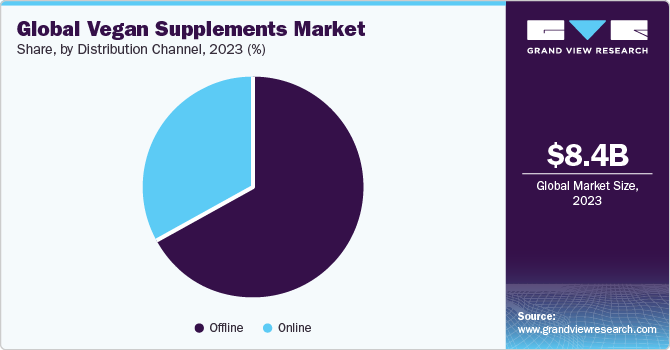

Distribution Channel Insights

Offline segment dominated the market in 2023. The offline distribution channels for vegan supplements, encompassing drug stores, hypermarkets, and supermarkets, showcase a multifaceted landscape of consumer preferences and market dynamics.These platforms offer diverse product selections, allowing customers to physically examine products, read labels, seek advice from knowledgeable staff, and also offer loyalty programs and the convenience of easy access. Offline retailers continue to play a crucial role in offering personalized assistance, immediate access to ingredients, and creating tangible connection between consumers, and the expanding array of plant-based supplement options.

Online segment is anticipated to grow at the fastest CAGR during the forecast period. Increasing adoption of e-commerce platforms for sales of vegan supplements is a key driver for segment growth. Furthermore, the rise in self-directed consumers is a pivotal factor propelling the utilization of online channels for purchasing nutritional ingredients, owing to the typically high frequency of discounts on a diverse range of supplements. For instance, in October 2022, Amazon offered 50% off on leading supplement brands like Solgar, Inc. Due to the higher need for personalized ingredients by consumers and the ease of purchasing supplements through online channels compared to traditional modes, high sales of supplements have been observed on e-commerce platforms, thereby contributing to the overall segment growth.

Regional Insights

Asia Pacific region dominated the market with a revenue share of 35.44% in 2023. The region's large and diverse population, coupled with a rising awareness of health and wellness, has spurred a significant shift toward plant-based diets. Furthermore,growing concerns about environmental sustainability and animal welfare also contribute to the popularity of plant-based supplements in the Asia Pacific region.

Japan held a significant share of the market in Asia Pacific in 2023.With a strong cultural tradition of plant-based diets, including a history of Buddhist vegetarianism, Japan has a receptive population for vegan products. Furthermore, the country's aging population is increasingly focused on health and wellness, driving a growing demand for nutritional supplements, including vegan options.

North America is anticipated to grow at a lucrative CAGR from 2024 to 2030. The region has witnessed a substantial increase in the adoption of plant-based diets and vegan lifestyles, driven by a growing awareness of health and environmental concerns. Furthermore, the presence of key market players, continuous product innovation, and a proactive approach to sustainable and ethical consumer choices contribute to North America's prominence in driving the growth of the market.

U.S. accounted for the largest share of the market in North America in 2023. The surge in the adoption of plant-based diets and vegan lifestyles is the prime factor that drives the overall market growth. For instance, in 2021 as per Vegetarian Times Magazine, the vegan population in the U.S. is experiencing rapid growth, reaching a record of 9.7 million people adhering to a vegetarian-based diet in the region.

Key Companies & Market Share Insights

-

NOW Foods offers a wide range of vegan supplement products and has a prominent geographical presence in key regions. It also has a Now Kids + Now Baby product line, which caters to vegan supplement options for kids.

-

Solgar is a mature player in the industry with its establishment in 1947 and a dominant presence in the multivitamins space. The company also offers several vegan supplement products and also undertakes various strategic activities.

-

PlantFusion, Nutricost, NutraBlast are some of the emerging participants in the market.

-

Nutricost offers diverse plant-based supplement products at affordable prices. The company caters to health-conscious consumers seeking budget-friendly vegan supplement options.

-

PlantFusion is an emerging player that offers innovative plant-based protein blends that are cruelty-free and allergen-friendly. It was founded in 2009 and focuses on providing authentic plant-based products.

Key Vegan Supplements Companies:

- Deva Nutrition LLC

- Amazing Grass

- Vega

- NOW Foods

- Nordic Naturals

- PlantFusion

- Orgain, LLC

- Solgar, Inc

- Nutricost

- NutraBlast

Recent Developments

-

In July 2023, Dr. Vegan, a UK-based supplements company, introduced two new vegan supplements tailored to enhance cardiovascular health and to meet the specific needs of women's well-being.

-

In February 2022, ZeoNutra, a division of Zeon Lifesciences, introduced its SlimPlus vegan supplement powder specifically targeted for weight management and waist slimming.

Vegan Supplements Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.28 billion

Revenue forecast in 2030

USD 17.64 billion

Growth rate

CAGR of 11.30% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredient, form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Deva Nutrition LLC; Amazing Grass; Vega; NOW Foods; Nordic Naturals; Plant Fusion; Orgain, LLC; Solgar, Inc; Nutricost; NutraBlast

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vegan Supplements Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vegan supplements market report based on ingredient, form, distribution channel, and region:

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamins & Minerals

-

Protein Supplements

-

Omega-3 Fatty Acids

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Capsules

-

Tablets

-

Powders

-

Liquids

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global vegan supplements market size was estimated at USD 8.42 billion in 2023 and is expected to reach USD 9.28 billion in 2024.

b. The global vegan supplements market is expected to grow at a compound annual growth rate of 11.30% from 2024 to 2030 to reach USD 17.64 billion by 2030.

b. Asia Pacific dominated the vegan supplements market with a share of 35.44% in 2023. This is attributable to rising awareness about health and wellness and growing concern about environmental sustainability

b. Some key players operating in the vegan supplements market include Deva Nutrition LLC, Amazing Grass, Vega, NOW Foods, Nordic Naturals, Plant Fusion, Orgain, LLC, Solgar, Inc, Nutricost, and NutraBlast

b. Key factors that are driving the market growth include increasing adoption of vegan and plant-based lifestyles along with increasing availability of plant-based raw materials

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.