- Home

- »

- Consumer F&B

- »

-

Plant Based Protein Supplements Market Size Report, 2033GVR Report cover

![Plant Based Protein Supplements Market Size, Share & Trends Report]()

Plant Based Protein Supplements Market (2025 - 2033) Size, Share & Trends Analysis Report By Raw Material (Soy, Spirulina), By Product (Protein Powder, Protein Bars), By Application, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-764-3

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plant Based Protein Supplements Market Summary

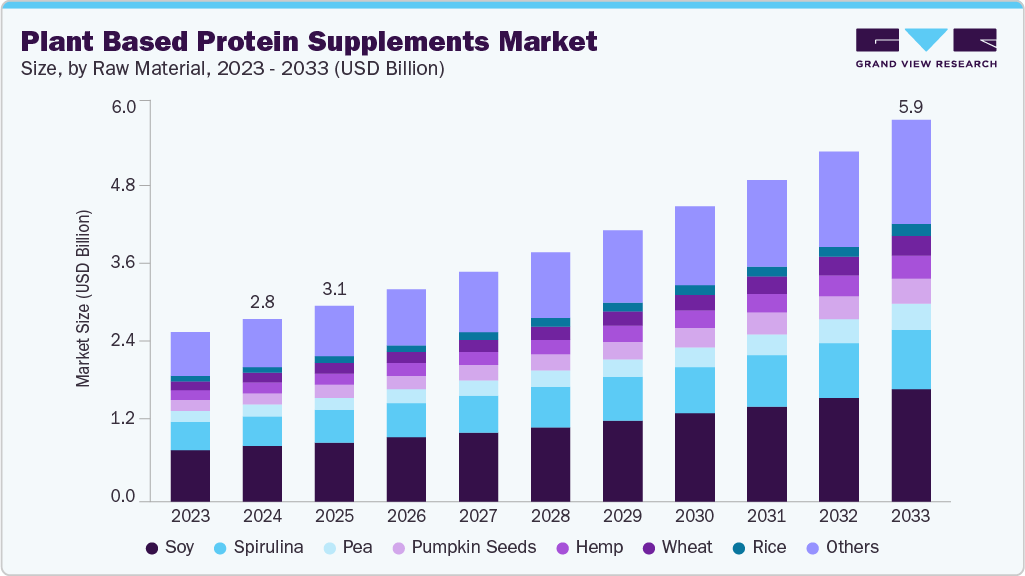

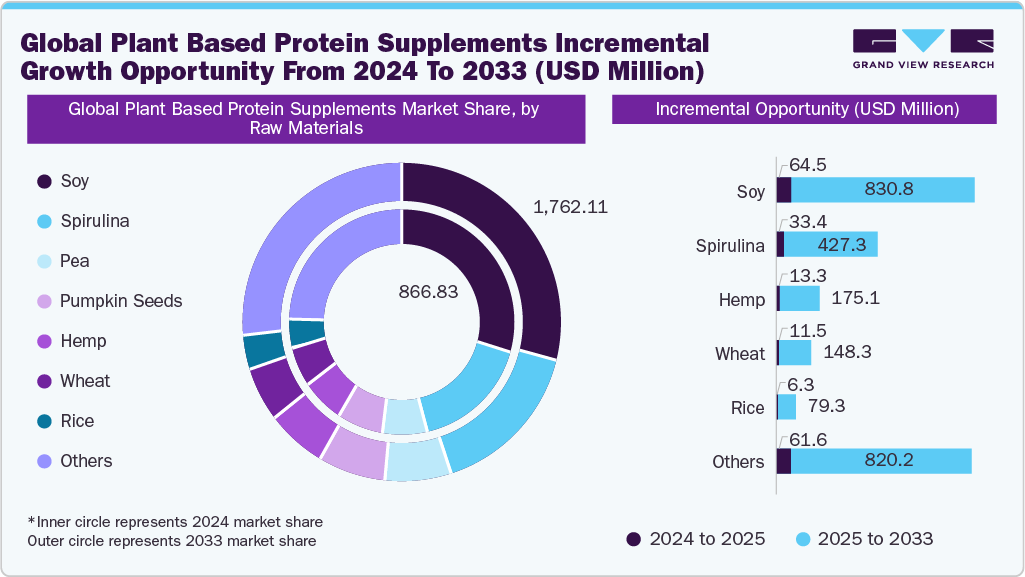

The global plant based protein supplements market size was estimated at USD 2,839.7 million in 2024 and is projected to reach USD 5,939.4 million by 2033, growing at a CAGR of 8.6% from 2025 to 2033. The market is being fueled by a clear shift in consumer lifestyles and dietary habits.

Key Market Trends & Insights

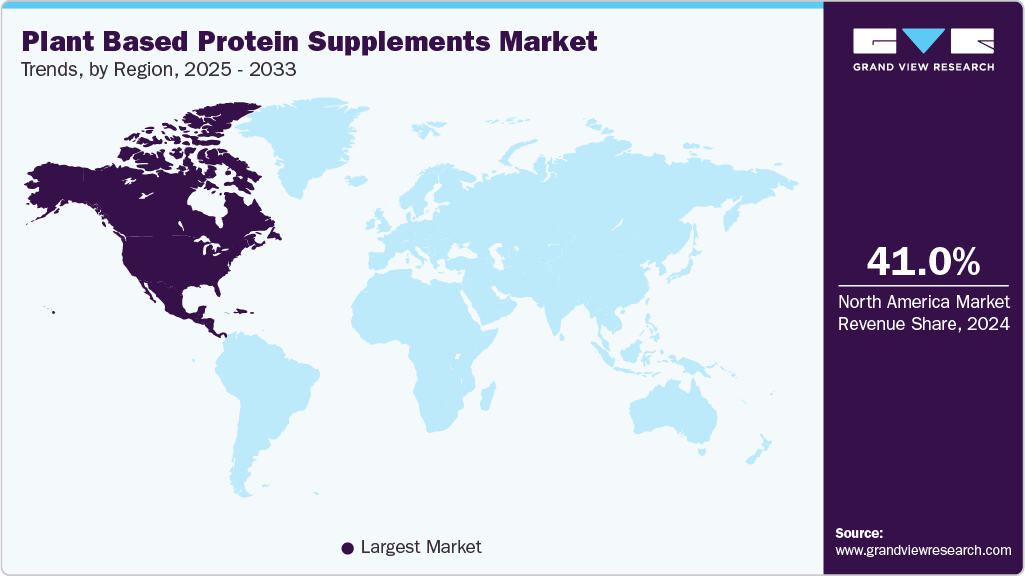

- North America dominated the global plant based protein supplements industry in 2024 with a revenue share of 41.0%.

- The U.S. plant based protein supplements market industry is expected to grow at a CAGR of 7.9% from 2025 to 2033.

- By raw material, the soy accounted for a market share of 30.53%in 2024.

- By product, the protein powder accounted for a market share of 44.17% in 2024.

- By application, the functional foods accounted for a market share of 52.22% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2,839.7 Million

- 2033 Projected Market Size: USD 5,939.4 Million

- CAGR (2025-2033): 8.6%

- North America: Largest market in 2024

As more people adopt vegan, vegetarian, and flexitarian diets, the demand for alternatives to animal-derived proteins is accelerating. Rising health awareness is also central, with consumers increasingly avoiding dairy due to lactose intolerance, allergies, or digestive discomfort, and turning instead to soy, pea, rice, and hemp protein supplements. Younger demographics, particularly millennials and Gen Z, are driving this momentum by integrating plant-based powders, bars, and ready-to-drink formats into their fitness, weight management, and everyday wellness routines. For them, clean nutrition, natural sourcing, and sustainability are non-negotiable, making plant-based proteins the preferred choice.The expansion of the plant-based protein supplements industry is also supported by increasing sports nutrition demand and personalized health trends. Fitness enthusiasts, athletes, and active lifestyle consumers are increasingly turning to plant-based proteins as part of their recovery and performance regimens, driven by the perception of these products as cleaner and easier to digest than whey or casein. In parallel, the rise of personalized nutrition, fueled by digital health platforms, DNA-based diets, and tailored supplement plans, is encouraging consumers to explore plant-derived proteins that align with their specific dietary restrictions or wellness goals. Combined with the influence of social media, celebrity endorsements, and health-conscious influencers, these factors are not only raising awareness but also normalizing plant-based proteins as a mainstream supplement choice. This layered demand, spanning ethical, environmental, health, and lifestyle motivations, continues to propel the market forward at a rapid pace.

Another key driver of this market is the combination of sustainability and innovation. Growing awareness of the environmental footprint of livestock production, high greenhouse gas emissions, water use, and land consumption, has made plant-based alternatives a more attractive and responsible option. This shift is reinforced by both corporate ESG commitments and government initiatives that encourage sustainable food choices. Meanwhile, advances in processing technology are solving earlier barriers around taste, texture, and amino acid completeness, making products more appealing to mainstream consumers. Combined with wider retail penetration and rapid growth in e-commerce, these improvements are expanding access and boosting trust.

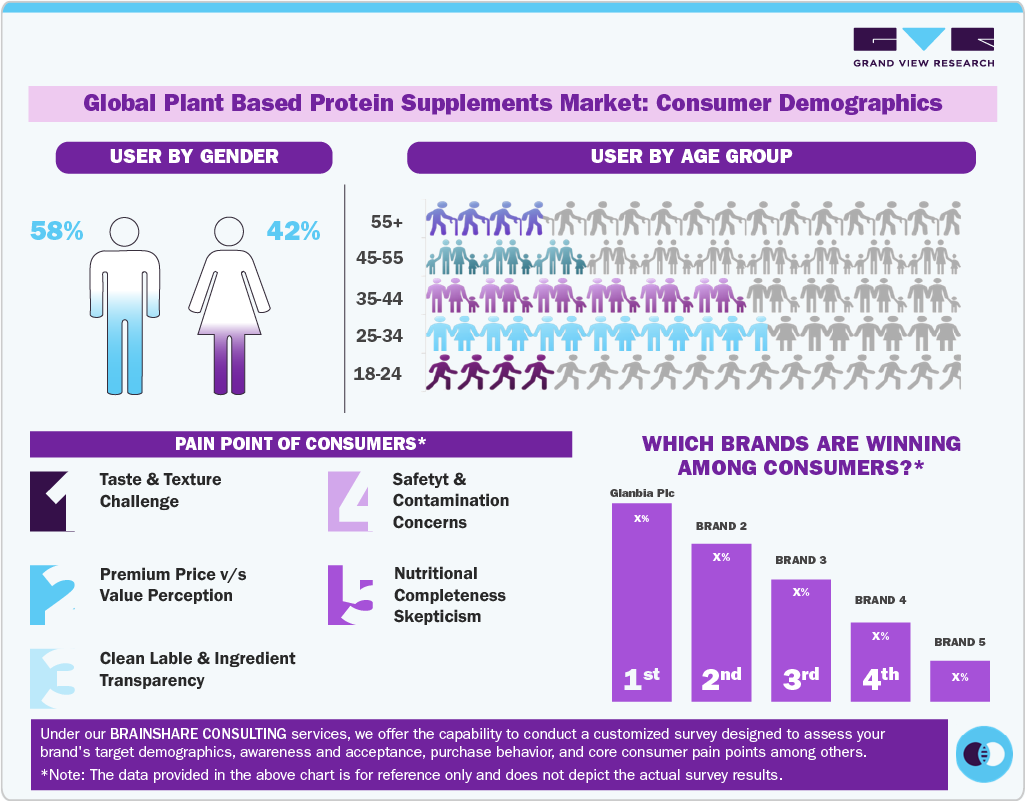

Consumer Demographic Insights

Consumers globally are increasingly drawn to plant-based protein supplements due to their health benefits, sustainability credentials, and the clean-label experience they provide compared to traditional animal-derived options. Millennials and Gen Z are at the forefront of this shift, motivated by fitness, weight management, and ethical considerations such as animal welfare and environmental impact. These groups value plant-based proteins for their convenience and versatility across formats such as powders, ready-to-drink shakes, and nutrition bars, which fit seamlessly into their active lifestyles.

The rise of environmentally conscious consumers, especially in developed markets, is driving demand for supplements that are not only nutritious but also eco-friendly, with reduced carbon footprints and sustainable sourcing of raw materials. Health-focused individuals, particularly in the 25-44 age group, are turning to plant-based protein supplements as they seek products that support muscle recovery, provide energy, and enhance overall wellness. Advances in product innovation-such as improved taste, solubility, and amino acid completeness, are further accelerating adoption, making plant-based proteins a mainstream choice for consumers who value both performance and sustainability.

Raw Material Insights

The soy segment accounted for a market share of 30.5% in 2024. The market is driven by its high protein density, complete amino acid profile, and affordability compared to other plant sources. It is widely recognized for supporting muscle growth and recovery, making it popular among athletes and fitness enthusiasts. Soy is also allergen-friendly compared to dairy proteins, attracting consumers with lactose intolerance or dairy allergies and due to its long history of safe consumption, broad availability, and versatility across powders, shakes, and bars further strengthen adoption. In addition, soy benefits from established supply chains and cost efficiency, allowing brands to scale products more easily.

The pumpkin seeds segment is projected to grow at a CAGR of 9.2% from 2025 to 2033. The market is gaining traction due to its rich nutritional profile and allergen-friendly positioning. It is naturally free from common allergens such as gluten and lactose, appealing to sensitive consumers. Pumpkin seeds are a strong source of magnesium, zinc, and iron, alongside high-quality plant protein, making them attractive for both fitness and general wellness. Their image as a natural, minimally processed, and clean-label ingredient resonates with health-conscious buyers seeking transparency and purity. In addition, the growing demand for functional nutrition supports adoption, as pumpkin seed protein is linked to heart health, immune support, and satiety.

Product Insights

The protein powder segment accounted for a market share of 44.2% in 2024. The market is driven by its versatility, convenience, and high consumer acceptance. It can be easily incorporated into shakes, smoothies, and recipes, making it adaptable for daily use among fitness enthusiasts and general wellness consumers. The 25-44 age group, particularly millennials and Gen Z, drives demand as they prioritize fitness, weight management, and sustainable nutrition. Advances in formulation technology have improved the taste, solubility, and amino acid completeness of plant-based powders, removing earlier adoption barriers. E-commerce growth and wide retail availability further expand access, while aggressive marketing by both legacy brands and startups strengthens visibility.

The RTD (Ready-to-drink) segment is projected to grow at a CAGR of 9.4% from 2025 to 2033. The market is growing rapidly due to its on-the-go convenience and lifestyle fit. Consumers, especially busy millennials and Gen Z, prefer RTDs because they eliminate the need for preparation, offering instant nutrition after workouts, during commutes, or at work. The format aligns with rising demand for functional beverages, which combine protein with added vitamins, minerals, or adaptogens. RTDs also benefit from wider distribution through gyms, convenience stores, and e-commerce, making them more accessible than powders. Innovation in flavors, textures, and packaging, such as re-sealable bottles and eco-friendly materials, has improved consumer experience and sustainability appeal. These factors, paired with premium positioning and strong marketing, are driving RTDs to be the fastest-growing product segment.

Application Insights

The functional foods segment accounted for a market share of 52.2% in 2024. The market is driven by rising demand for nutrition-packed everyday products. Consumers are increasingly seeking foods that deliver both taste and health benefits, such as protein-enriched snacks, cereals, and baked goods. Plant-based proteins supplements are being integrated into these products to boost satiety, muscle recovery, and energy levels without relying on animal sources. The shift toward clean-label, allergen-free, and sustainable ingredients further supports adoption, especially among health-conscious millennials and Gen Z. In addition, food manufacturers are innovating with fortification and functional blends that target immunity, digestion, and weight management.

The sports nutrition segment is projected to grow at a CAGR of 9.4% from 2025 to 2033. The market is fueled by rising fitness culture and active lifestyle trends. Athletes and gym-goers increasingly view plant proteins as effective for muscle building, recovery, and endurance, comparable to whey. The surge in vegan and flexitarian athletes, along with lactose-intolerant consumers, is expanding demand for dairy-free alternatives. Plant proteins such as soy, pea, and hemp, offer strong amino acid profiles and are now formulated for improved digestibility and performance outcomes, reducing earlier concerns. Endorsements from professional athletes and fitness influencers have further boosted credibility.

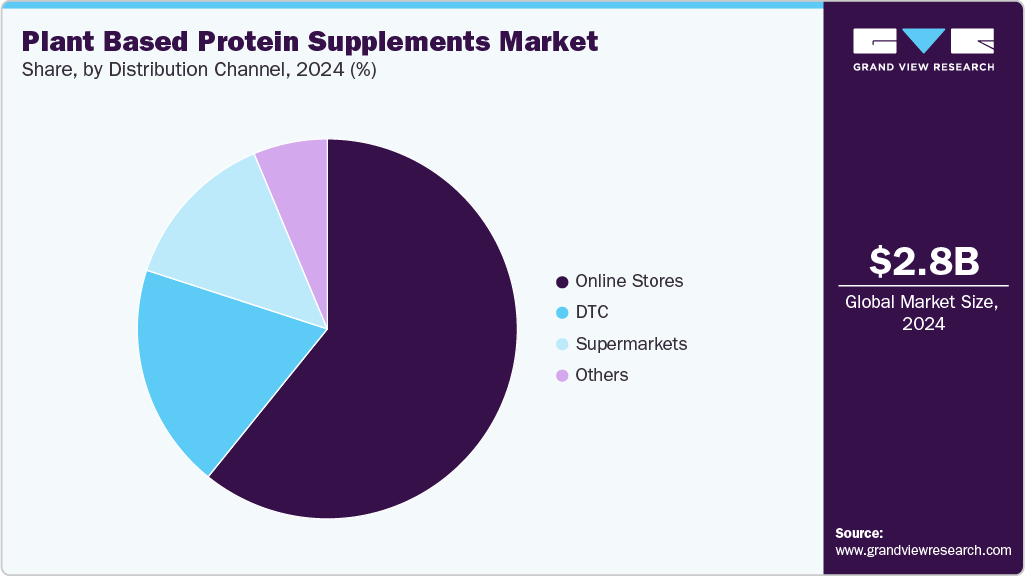

Distribution Channel Insights

The sales of plant based protein supplements through online stores accounted for a share of around 60.8% of the revenue in 2024. The market is driven by convenience, accessibility, and variety. Consumers increasingly prefer e-commerce platforms for the ability to compare prices, read reviews, and access a wider range of products than in physical retail. The surge in digital-native millennials and Gen Z buyers, who value seamless online shopping experiences, has accelerated this trend. Subscription models and personalized recommendations offered by online platforms enhance customer loyalty and repeat purchases. In addition, global e-commerce giants and specialized health retailers provide direct-to-consumer access, often with discounts and fast delivery. Social media marketing and influencer endorsements further fuel awareness, making online sales the dominant and fastest-growing channel in this market.

Plant based protein supplements sales through online supermarkets are projected to grow at a CAGR of 9.7% from 2025 to 2033. The market is growing due to their high visibility, convenience, and trust factor. Consumers prefer supermarkets for the ability to physically evaluate products, check labels, and compare brands side by side before purchase. The growing placement of plant-based protein powders, bars, and RTDs in dedicated health and wellness aisles has boosted awareness and impulse buying. Supermarkets also cater to a wide demographic, including older consumers who may be less inclined to shop online. Strategic partnerships between supplement brands and large retail chains ensure wider distribution and competitive pricing, while frequent promotions and in-store sampling encourage trial.

Regional Insights

The North America plant based protein supplements industry dominated the global market with a share of more than 41.0% in 2024. The market is driven by high consumer awareness and advanced health trends. The region has a strong base of fitness enthusiasts and athletes who increasingly favor plant proteins for muscle recovery, endurance, and clean nutrition. Rising prevalence of lactose intolerance and dairy allergies further pushes consumers toward soy, pea, and hemp protein alternatives. Millennials and Gen Z, who dominate supplement consumption, are motivated by ethical, environmental, and sustainability concerns, aligning with the broader plant-based movement. In addition, strong innovation pipelines from leading U.S. brands, robust retail and e-commerce penetration, and widespread adoption of vegan and flexitarian diets reinforce North America’s dominant growth position in this market.

U.S. Plant Based Protein Supplements Market Trends

The U.S. plant based protein supplements industry is expected to grow at a CAGR of 7.9% from 2025 to 2033. The market growth is fueled by high consumer health consciousness and advanced fitness culture. A large share of Americans actively uses supplements for muscle building, weight management, and wellness, with growing interest in plant-based options due to lactose intolerance and dairy sensitivities. The country also has one of the highest adoption rates of vegan, vegetarian, and flexitarian diets, making plant-derived proteins a natural fit. Strong presence of global players and innovative startups ensures continuous product innovation, improving taste, texture, and amino acid profiles. Coupled with robust e-commerce penetration, strong retail networks, and influencer-driven marketing, these factors make the U.S. the fastest-growing regional market for plant-based protein supplements.

Asia Pacific Plant Based Protein Supplements Market Trends

The Asia Pacific plant based protein supplements industry is expected to grow at a CAGR of 9.4% from 2025 to 2033. The market is primarily driven by rapid urbanization, rising disposable incomes, and shifting dietary habits. Growing awareness of health, fitness, and preventive nutrition is pushing consumers toward supplements, with plant-based options gaining favor due to lactose intolerance and cultural preferences for plant foods. Countries such as China, India, and Australia are experiencing strong demand from millennials and Gen Z, who are embracing vegan and flexitarian lifestyles. Expanding gym memberships, sports nutrition uptake, and e-commerce penetration further fuel growth. In addition, governments and local brands are promoting sustainable, plant-based diets, creating strong momentum.

Key Plant Based Protein Supplements Company Insights

Established and emerging players in the global plant-based protein supplements industry operate in a highly competitive landscape, driven by continuous product innovation, nutritional enhancement, and strategic pricing. Companies are investing heavily in e-commerce platforms and digital marketing to reach health-conscious consumers and capture the growing online demand for supplements. The shift toward sustainability and clean-label products is reshaping consumer preferences, with rising interest in eco-friendly sourcing, minimal processing, and transparent ingredient lists.

Leading brands sustain their dominance through strong retail distribution, global presence, and trusted reputations, while newer entrants focus on direct-to-consumer models and niche positioning, such as organic or allergen-free offerings. Sustainability remains central, alongside demand for personalized, functional supplements tailored to fitness, recovery, or wellness needs.

Key Plant Based Protein Supplements Companies:

The following are the leading companies in the plant based protein supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Nestlé Health Science

- Abbott Laboratories

- Glanbia plc

- Myprotein

- Vega

- NOW Foods

- ALOHA

- IOVATE Health Sciences International, Inc.

- MusclePharm Corporation

- Transparent Labs

Recent Developments

-

In August 2025, Ranveer Singh launched SuperYou Pro, a fermented yeast-based protein powder, branded as “the smartest protein on the planet.” Packed with 24 g of vegan protein per scoop, it delivers all essential amino acids and BCAAs, offers a smooth, non-chalky texture, and is free from dairy, soy, and gluten. Enhanced with probiotics, digestive enzymes, and naturally sweetened with monk fruit, this bio‑fermented protein is positioned as both performance- and gut-friendly.

-

In February 2025, Vega announced a major rebrand under the new tagline “VEGA - Perform Better”, unveiling a refreshed look and a performance-focused product line. The launch introduced innovations such as Protein + Creatine, an upgraded Pre-Workout Energy blend, and a plant-based Ready-To-Drink protein shake, all designed to deliver clean, plant-powered support for energy, endurance, and recovery.

-

Wellbeing Nutrition launched a range of vegan protein powders with whole-food ingredients and herbal blends, such as their Her Superfood Plant Protein supporting hormonal balance and metabolism. Their products combine pea protein, quinoa, sprouted amaranth, and algae with added supergreens and digestive enzymes for enhanced absorption and health benefits.

Plant Based Protein Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,060.4 million

Revenue forecast in 2033

USD 5,939.4 million

Growth rate

CAGR of 8.6% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central and South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; India; China; Japan; Australia; South Korea; Brazil; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Nestlé Health Science; Abbott Laboratories; Glanbia plc; Myprotein; Vega; NOW Foods; ALOHA; IOVATE Health Sciences International, Inc.; MusclePharm Corporation; Transparent Labs

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plant Based Protein Supplements Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global plant based protein supplements market report based on raw material, product, application, distribution channel, and region.

-

Raw Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Soy

-

Spirulinas

-

Pumpkin Seed

-

Wheat

-

Hemp

-

Rice

-

Pea

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Protein Powder

-

Protein Bars

-

RTD

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Sports Nutrition

-

Functional Foods

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Supermarkets

-

Online Stores

-

DTC

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Central and South America

-

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global plant based protein supplements market size was estimated at USD 2,839.7 million in 2024 and is expected to reach USD 3,060.4 million in 2025.

b. The global plant based protein supplements market is expected to grow at a compound annual growth rate of 8.6% from 2025 to 2033 to reach USD 5,939.4 million by 2030.

b. Online stores dominated the distribution channel segment with share of 60.8% in 2024 owing to their convenience, accessibility, and the variety they offer.

b. Some of the key players operating in the plant based protein supplements market include Nestlé Health Science, Abbott Laboratories, Glanbia plc, Myprotein, Vega, NOW Foods, ALOHA, IOVATE Health Sciences International, Inc., MusclePharm Corporation, Transparent Labs

b. The key factors that are driving the plant based protein supplements market include a shift in consumer lifestyles towards vegan and flexitarian diets, increased health awareness, and a growing preference for plant-based protein supplements due to lactose intolerance, allergies, and digestive concerns.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.