- Home

- »

- Automotive & Transportation

- »

-

Vehicle Subscription Market Size, Industry Report, 2030GVR Report cover

![Vehicle Subscription Market Size, Share & Trends Report]()

Vehicle Subscription Market (2025 - 2030) Size, Share & Trends Analysis Report By Service Provider (OEM, Third Party Providers), By Subscription Type, By Subscription Period, By Vehicle Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-557-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Vehicle Subscription Market Summary

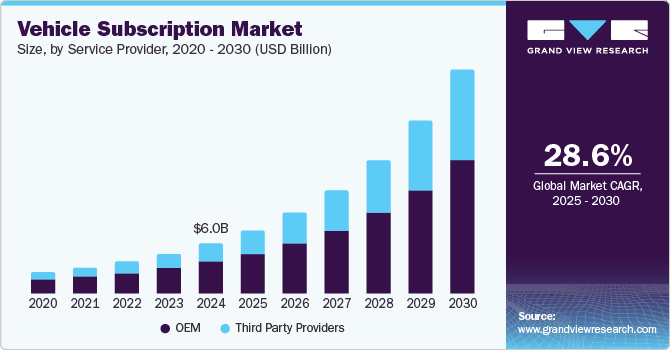

The global vehicle subscription market size was valued at USD 6.04 billion in 2024 and is projected to reach USD 26.77 billion by 2030, growing at a CAGR of 28.6% from 2025 to 2030. Vehicle subscription is a flexible alternative to traditional car ownership and leasing, allowing customers to access a vehicle for a monthly recurring fee.

Key Market Trends & Insights

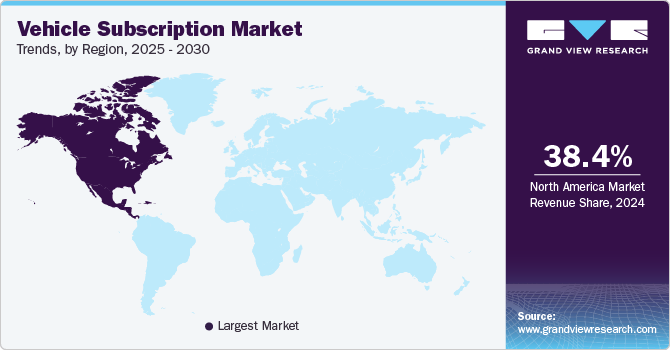

- North America vehicle subscription market accounted for the largest revenue share of 38.4% in 2024.

- The vehicle subscription market in the U.S. held a dominant position in 2024.

- By service provider, the OEM segment accounted for the largest share of 64.0% in 2024.

- By subscription type, the single brand subscription segment is expected to register the fastest CAGR of 29.4% during the forecast period.

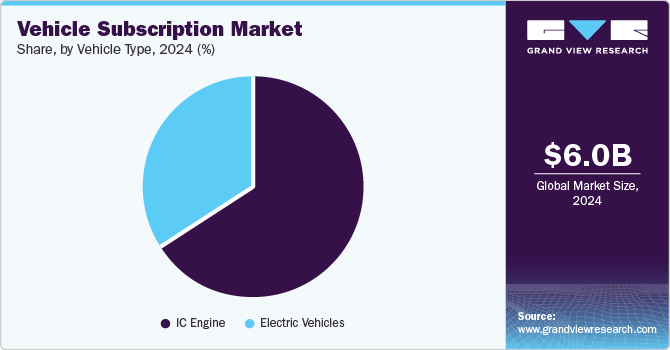

- By vehicle type, the IC engine segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.04 Billion

- 2030 Projected Market Size: USD 26.77 Billion

- CAGR (2025-2030): 28.6%

- North America: Largest market in 2024

This model typically includes insurance, maintenance, roadside assistance, and sometimes even the ability to swap cars based on needs or preferences. Factors such as increased demand for flexible mobility solutions, technology integration and digitalization, sustainability, and the rise of Electric Vehicle (EV) subscriptions can be attributed to the growth of the vehicle subscription market.Consumers are shifting away from traditional vehicle ownership in favor of flexible mobility options that allow them to drive a car without long-term commitments. The growing preference for subscription-based services in various industries, including entertainment and software, drives this trend. Vehicle subscriptions provide users with the ability to swap cars, pause or cancel their plans, and avoid large upfront costs. As urbanization increases and car-sharing services gain popularity, the demand for flexible mobility solutions is expected to continue to grow, attracting more automakers and startups to enter the space, thereby propelling the growth of the vehicle subscription industry.

The rise of digital platforms and artificial intelligence is transforming how vehicle subscription services operate. Advanced telematics, AI-driven pricing models, and seamless mobile apps allow companies to offer personalized experiences, track vehicle usage, and optimize fleet management. Digitalization enhances customer convenience, making it easier to access, manage, and switch between vehicles through a smartphone. Thus, with continuous advancements in technologies, vehicle subscription providers are expected to continue to leverage data analytics to refine their offerings, improving user satisfaction and operational efficiency. This, in turn, is expected to boost the growth of the vehicle subscription market in the coming years.

The global push for sustainability is intensifying, leading to the growing popularity of electric vehicle (EV) subscription services. Consumers looking to transition to EVs without committing to ownership see subscriptions as a low-risk option. These services often include charging solutions, battery maintenance, and software updates, making EV adoption more convenient. Governments worldwide are also supporting this trend with incentives and policies promoting sustainable transportation. Thus, the introduction of more electric vehicle models by automakers is driving rapid expansion of EV subscription programs, accelerating the shift toward greener mobility.

While vehicle subscription services offer enhanced convenience and flexibility, they also present certain drawbacks, which could hamper the growth of the vehicle subscription industry. One notable challenge is the potential for higher costs compared to traditional leasing or purchasing options. The premium charged for the added flexibility and convenience makes it crucial for prospective subscribers to carefully assess their budgets and long-term objectives. In addition, subscription models may not provide the same level of convenience as vehicle ownership. Most subscription plans require the vehicle to be returned at the end of the month, or the subscription must be renewed to continue usage. This limitation can complicate long-distance travel or off-road excursions, as subscribers must plan and consider both the time and financial costs involved.

Service Provider Insights

The OEM segment accounted for the largest share of 64.0% in 2024. Several automakers are increasingly entering the vehicle subscription market by launching their own programs. These OEM-backed services provide customers with direct access to high-quality vehicles, maintenance, and insurance under a single payment. Automakers benefit from stronger brand loyalty, better fleet utilization, and a steady revenue stream. With car ownership models evolving, OEMs are expected to continue to refine and expand their subscription services, making them more accessible and appealing to a broader audience, thereby driving the segment’s growth.

The third-party providers segment is expected to grow at the highest CAGR during the forecast period. Third-party providers play a pivotal role in the market’s growth by offering vehicle subscription services that cater to customers seeking alternatives to traditional car ownership and leasing. These providers typically partner with automakers or operate independently to provide a wide selection of vehicles, from various brands, under flexible terms. Third-party vehicle subscription providers offer an all-inclusive service that includes maintenance, insurance, and other essential services within one predictable monthly fee. This is appealing to customers who prefer a fixed, upfront cost structure, as it eliminates the uncertainties associated with traditional vehicle ownership, such as unexpected repair costs and fluctuating insurance premiums.

Subscription Type Insights

The multi-brand subscription segment held the largest market share in 2024. The multi-brand subscription segment is gaining traction as consumers increasingly seek flexibility and variety in their vehicle choices. This model allows subscribers to access a range of vehicles from different brands under a single subscription plan. Growth factors driving this segment include rising consumer preference for diverse mobility solutions, the increasing adoption of shared mobility, and the demand for flexible, commitment-free alternatives to ownership.

The single brand subscription segment is expected to register the fastest CAGR of 29.4% during the forecast period. The single-brand subscription model is primarily driven by automakers looking to enhance customer retention and brand loyalty. This segment allows manufacturers to offer a curated selection of vehicles, often bundling services such as insurance, maintenance, and roadside assistance into a single payment. Growth in this segment is fueled by consumers seeking a premium brand experience, particularly in luxury and EV categories.

Subscription Period Insights

The 6 to 12 months segment dominated the market in 2024. The 6-12 month vehicle subscription model is growing in popularity as it strikes a balance between flexibility and cost-effectiveness. This segment appeals to consumers who seek an alternative to traditional leasing but still require a longer commitment than short-term rentals. Growth factors include the increasing preference for hassle-free vehicle access without long-term ownership commitments, rising demand from expatriates, business professionals, and corporate clients needing mid-term mobility solutions.

The 1 to 6 months segment is expected to grow at the fastest CAGR during the forecast period. The 1-6 month vehicle subscription model caters to consumers prioritizing maximum flexibility and short-term mobility solutions. Growth in this segment is driven by seasonal demand, such as tourists, temporary workers, and business travelers, as well as individuals testing new vehicle models before making a purchase decision. In addition, urban consumers who need on-demand access to cars without long-term commitments find shorter subscriptions ideal. The rise of remote work and gig economy professionals also contributes to this segment’s expansion, as they require adaptable mobility solutions without the constraints of ownership or leasing.

Vehicle Type Insights

The IC engine segment dominated the market in 2024. Growth of this segment is driven by factors such as lower upfront costs, higher resale value, and extensive refueling infrastructure, particularly in regions where EV charging networks are still developing. In addition, many consumers prefer IC engine subscriptions as a transitional option while exploring electric alternatives. Fleet operators and businesses also contribute to demand, as commercial and high-mileage users often find IC engine vehicles more practical for long-distance travel and heavy-duty usage.

The electric vehicle segment is expected to grow at the fastest CAGR during the forecast period. The EV subscription segment is experiencing rapid growth, driven by increasing consumer interest in sustainable mobility, government incentives, and advancements in charging infrastructure. Many consumers are turning to EV subscriptions as a way to test electric vehicles before committing to ownership, reducing concerns about battery life, range anxiety, and resale value. In addition, businesses and fleet operators are increasingly adopting EV subscriptions to meet sustainability targets and lower operational costs. As automakers expand their EV offerings, and subscription services include benefits such as home charging solutions and flexible mileage plans, the demand for EV subscriptions is expected to surge, particularly in urban areas with strong environmental policies.

Regional Insights

North America vehicle subscription market was identified as a lucrative region in 2024. The market is growing due to changing consumer preferences, increasing urbanization, and the rising demand for flexible mobility solutions. Consumers are looking for alternatives to traditional leasing and ownershisp, especially as vehicle prices continue to rise. The rise of EV adoption and the growing influence of tech-driven mobility startups further contribute to the expansion of the subscription model in the region.

U.S. Vehicle Subscription Market Trends

The vehicle subscription market in the U.S. held a dominant position in 2024. The market is being driven by millennials and Gen Z consumers, who value convenience and flexibility over long-term commitments. The market benefits from strong infrastructure, widespread digital adoption, and the increasing availability of luxury and EV subscription programs from major automakers such as Tesla Subscription Services.

Europe Vehicle Subscription Market Trends

Europe vehicle subscription market is expected to register a moderate CAGR from 2025 to 2030. The market’s growth is driven by high vehicle ownership costs, strict environmental regulations, and a strong push toward sustainable mobility.

The U.K. vehicle subscription market is expected to grow rapidly in the coming years. The market for vehicle subscriptions is being driven by increasing demand for flexible car ownership alternatives, particularly in urban areas, where congestion charges and high parking fees make traditional ownership less appealing.

Germany vehicle subscription market held a substantial market share in 2024. As a major automotive hub, Germany is seeing rapid growth in vehicle subscriptions, particularly in the luxury and electric vehicle segments. German automakers such as Mercedes-Benz and Volkswagen are actively investing in subscription-based models to attract younger and environmentally conscious consumers.

Asia Pacific Vehicle Subscription Market Trends

Asia Pacific vehicle subscription market is anticipated to grow at a CAGR of 30.2% during the forecast period. The region is emerging as a high-potential market for vehicle subscriptions, driven by rapid urbanization, digital transformation, and evolving consumer preferences. With increasing congestion and rising car prices, many consumers prefer the flexibility of subscription-based mobility over traditional ownership. Countries such as China, and Japan are witnessing growing interest in vehicle subscriptions, particularly among younger professionals and businesses looking for fleet solutions.

Japan vehicle subscription market is expected to grow at a moderate rate during the forecast period. Japan’s vehicle subscription industry is influenced by its aging population, dense urban areas, and declining interest in vehicle ownership among younger generations. In addition, the growing emphasis on EV adoption and the rise of corporate fleet subscriptions are also driving market growth in Japan.

China vehicle subscription market held a substantial market share in 2024. China’s market is expanding due to high vehicle ownership costs, government policies promoting EV adoption, and the rise of smart mobility solutions. In addition, ride-sharing and digital leasing platforms are integrating subscription services to offer consumers greater convenience, thereby driving the growth of the vehicle subscription industry in China.

Key Vehicle Subscription Company Insights

Some of the key companies in the vehicle subscription industry include Sixt, FINN, and Mercedes-Benz Mobility, among others. Key players are taking several strategic initiatives, such as new product launches, business expansions, and partnerships, among others.

-

Sixt is a global provider of premium mobility services, operating in over 105 countries. Their Sixt+ car subscription service enables drivers to subscribe to a vehicle for as little as one month.

-

FINN is a car subscription service provider that has rapidly gained traction in the automotive market. Established to cater to the evolving needs of consumers, FINN offers a flexible alternative to traditional car ownership and leasing.

Key Vehicle Subscription Companies:

The following are the leading companies in the vehicle subscription market. These companies collectively hold the largest market share and dictate industry trends.

- Sixt

- Carvolution

- FINN

- ORIX

- Mercedes-Benz Mobility

- Volkswagen AG

- Roam

- TeslaRents

- MARUTI SUZUKI INDIA LIMITED

- The Hertz System Inc.

Recent Developments

-

In October 2024, Volkswagen Group of America, in collaboration with Volkswagen Financial Services, introduced a vehicle subscription service, VW Flex, available in the Atlanta metro area. This new month-to-month subscription program offers select Volkswagen models with a single monthly payment that covers maintenance, insurance, and 24/7 roadside assistance, providing consumers with a flexible and convenient mobility solution.

-

In January 2023, FINN launched its car subscription service for businesses in the U.S., providing exceptional flexibility, maintenance, 24/7 customer support, and roadside assistance. Following the success of FINN's B2B service in Germany, this expansion further strengthens the company's presence in the U.S. market.

Vehicle Subscription Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.62 billion

Revenue forecast in 2030

USD 26.77 billion

Growth rate

CAGR of 28.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service provider, subscription type, subscription period, vehicle type, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, KSA, UAE, South Africa

Key companies profiled

Sixt; Carvolution; FINN; ORIX; Mercedes-Benz Mobility; Volkswagen AG; Roam; TeslaRents; MARUTI SUZUKI INDIA LIMITED; and The Hertz System Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vehicle Subscription Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global vehicle subscription market report based on service provider, subscription type, subscription period, vehicle type, and region.

-

Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM

-

Third Party Providers

-

-

Subscription Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Multi Brand Subscription

-

Single Brand Subscription

-

-

Subscription Period Outlook (Revenue, USD Million, 2018 - 2030)

-

1 to 6 Months

-

6 to 12 Months

-

More than 12 Months

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

IC Engine

-

Electric Vehicles

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the vehicle subscription market include Sixt, Carvolution, FINN, ORIX, Mercedes-Benz Mobility, Volkswagen AG, Roam, TeslaRents, MARUTI SUZUKI INDIA LIMITED, and The Hertz System Inc.

b. Factors such as increased demand for flexible mobility solutions, technology integration and digitalization, and sustainability and the rise of Electric Vehicle (EV) subscriptions can be attributed to the growth of the vehicle subscription market.

b. The global vehicle subscription market size was estimated at USD 6.04 billion in 2024 and is expected to reach USD 7.62 billion in 2025.

b. The global vehicle subscription market is expected to grow at a compound annual growth rate of 28.6% from 2025 to 2030 to reach USD 26.77 billion by 2030.

b. The OEM segment accounted for the largest share of 64.0% in 2024. Several automakers are increasingly entering the vehicle subscription market by launching their own programs. These OEM-backed services provide customers with direct access to high-quality vehicles, maintenance, and insurance under a single payment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.