- Home

- »

- Animal Health

- »

-

Veterinary Defibrillators Market Size & Share Report, 2030GVR Report cover

![Veterinary Defibrillators Market Size, Share & Trends Report]()

Veterinary Defibrillators Market (2024 - 2030) Size, Share & Trends Analysis Report By Modality (Manual, Automatic), By Technology (Monophasic, Biphasic), By Functionality, By Animal, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-441-8

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Defibrillators Market Size & Trends

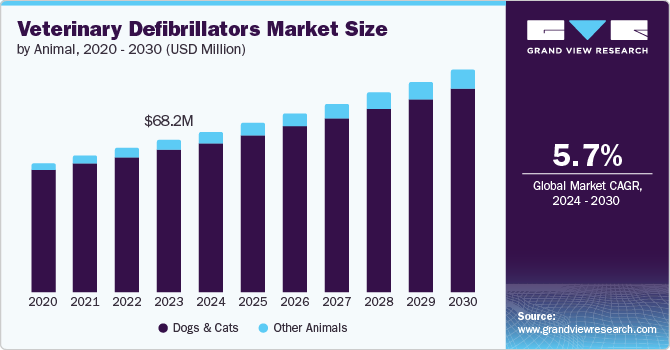

The global veterinary defibrillators market size is estimated to be USD 68.16 million in 2023 and is anticipated to grow at a CAGR of 5.66% from 2024 to 2030. Key factors expected to drive the market growth include the increasing prevalence of cardiovascular diseases in animals, the rising prevalence of associated diseases leading to cardiac arrest in animals, evolving regulatory guidelines, and rising cases of arrhythmia in animals.

Owing largely to factors like obesity, aging, and genetic predispositions, the prevalence of cardiovascular diseases is rising among pets, such as dogs and cats. For example, according to January 2023 data from the MSD Veterinary Manual, approximately 75% of cardiovascular diseases in dogs are caused by myxomatous degenerative valve disease, which is the most prevalent cardiac condition in these species.

In 60% of cases, it mostly affects the mitral valve; in 30% of dogs, there were lesions in both the mitral and tricuspid valves; less than 10% of dogs only had tricuspid valve disease. An increased risk of this condition was seen in older, small-breed dogs. Heart failure brought on by mitral valve disease raises the risk of cardiopulmonary arrest because the heart finds it difficult to pump blood efficiently, which has the potential to turn into fatal consequences.

Furthermore, according to a February 2024 study published in Acta Veterinaria, there is a 12.2% prevalence of dilated cardiomyopathy (DCM) in dogs, with a higher prevalence in Dobermann Pinschers (34.6%), Boxers (23.1%), and Great Danes (20.5%). while male dogs (14.5%) had a higher prevalence compared to female dogs (9.5%). The DCM, which has advanced into later stages, can lead to conduction issues like arrhythmia in the atria and ventricles of the animal heart. This will essentially drive the market for veterinary defibrillators, which are essential for treating cardiac arrhythmias and cardiac arrest.

Another crucial driving factor for the market growth is the rising prevalence of other diseases, such as heartworm disease in animals, that leads to CPA. For example, according to March 2024 data published by Springer Nature, the prevalence of heartworm disease in cats was reported to be around 20%. Moreover, another study from July 2024 reported the prevalence of heartworm diseases in dogs from Brazil to be at 21.3%. Due to damage to the lungs and pulmonary arteries, heartworm disease in dogs and cats can result in cardiopulmonary arrest. This causes respiratory distress in cats, but it causes pulmonary hypertension and right heart failure in dogs. Reduced cardiac output and insufficient oxygenation can lead to cardiopulmonary arrest if the illness is not treated.

Veterinary defibrillators are in demand owing to the increasing prevalence of cardiovascular diseases in pets, such as dilated cardiomyopathy (DCM) and myxomatous degenerative valve disease (Mitral Valve Disease), which elevate the risk of cardiopulmonary arrest. The increasing need for these devices is also driven by the high incidence of heartworm disease in cats and dogs, which can result in cardiopulmonary arrest. Veterinary defibrillators are, therefore, crucial for treating cardiac arrhythmias and animal cardiac arrest. It is anticipated that this rise in demand will propel the market's global expansion.

The demand for efficient treatment options for cardiac emergencies in pets is anticipated to fuel the market's expansion. Along with improvements in veterinary care, pet owners' increasing awareness of the value of prompt intervention in cardiac emergencies is anticipated to drive demand for veterinary defibrillators. As more veterinarians and pet owners realize how important defibrillators are to saving the lives of animals with cardiac problems, the market is expected to grow significantly.

However, a major inhibitory factor for the market is the repurposed use of human-used defibrillators. Globally, veterinary facilities have been procuring refurbished defibrillators for veterinary purposes. Furthermore, many veterinary equipment suppliers are selling refurbished defibrillators manufactured by companies like Philips, Zoll, and Medtronic for use on animals. This inhibits the adoption of devices specifically designed for use in these animals, like dogs and cats, restraining the market's growth.

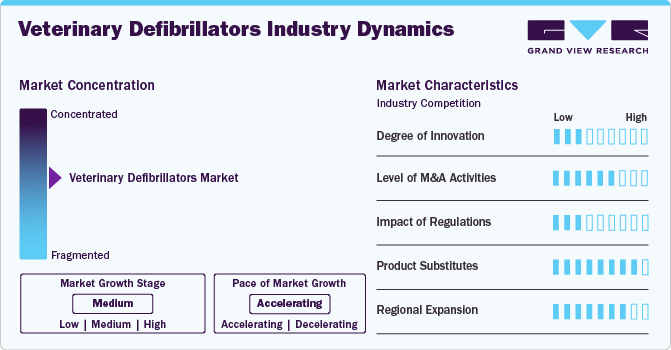

Market Concentration & Characteristics

The degree of innovation in this market is estimated to be low. This is because the manufacturers in this industry seem to be relying heavily on OEM manufacturing. The standard practice in this market space is to get the defibrillator manufactured by an established OEM manufacturer.

The industry is experiencing low-to-moderate levels of M&A activities. Leading manufacturers are focusing on acquiring regulatory approvals to expand their businesses into different geographies. For example, in December 2023, ARI Medical Technology Co. Ltd. acquired the approval to register its products with the US FDA, penetrating further into the North American market.

The impact of regulation is low to moderate in this industry. Regulations and guidelines framed for these devices rely heavily on their human-use counterparts. Guidelines for the use of defibrillators in animals have been framed by referencing the guidelines for human-use defibrillators and based on the testing done on animal models. Furthermore, apart from the RECOVER Guidelines set by AVMA in 2012, the market lacks any concrete regulations. This greatly impacts the adoption of these products across the globe.

The industry has a high level of product substitutes. Due to a lack of research and development initiatives, veterinarians rely on repurposing human-used defibrillators for animal use. This greatly affects the growth and adoption of devices specifically designed for veterinary use. Most veterinary settings prefer refurbished devices due to their lower cost, which in turn dampens the adoption of veterinary-specific defibrillators.

The industry is experiencing a moderate-to-high impact of regional expansion. Dominating industry players are expanding their businesses overseas by establishing manufacturing and retail presences in various countries across the world, targeting market spaces with comparatively lower market penetration by other defibrillator manufacturers.

Animal Insights

The dogs & cats segment had the largest revenue share of 93.64% in 2023 due to the presence of structured guidelines for the cardiopulmonary resuscitation of these animals. These guidelines ensure that proper protocol is followed to achieve the effectiveness of defibrillation due to their widespread ownership and increased susceptibility to cardiac conditions like cardiomyopathy and heartworm disease, which indicate defibrillation therapy. The need for veterinary defibrillators is also being driven by pet owners' increased propensity to spend money on cutting-edge medical care for their cats and dogs.

The other animals segment, which includes horses, pigs, and livestock animals, is estimated to grow at the fastest CAGR over the forecast period because the demand for sophisticated veterinary care is growing in these species. The demand for veterinary defibrillators is being driven by the expanding livestock industry and the rising incidence of cardiac diseases in these animals. Moreover, technology and veterinary medicine developments are improving the effectiveness and accessibility of defibrillation therapy for these animals.

Modality Insights

The automatic (AED) segment dominated the market with a revenue share of 42.7% in 2023 and it is also estimated to witness the fastest CAGR due to the rising need for refined, user-friendly defibrillation equipment. Designed to assess cardiac rhythm and initiate an automated shock if required, automatic defibrillators are more effective and efficient in situations of emergency. Furthermore, technological developments have led to an improvement in the size, portability, and cost of automatic defibrillators, which has accelerated their use in veterinary medicine. Pet owners, as well as any individual, do not require any special training to use the AED in animals.

Technology Insights

The biphasic segment dominated the market with a share of over 90% in 2023 and is estimated to grow with the fastest CAGR due to its demonstrated advantages over monophasic in restoring a regular cardiac rhythm. When cardioverting animals, biphasic defibrillators have been proven to be more effective than monophasic ones in delivering two consecutive energy pulses. Biphasic defibrillators are becoming increasingly prevalent in veterinary care because they are more adaptable and can be used for a larger variety of patients and cardiac conditions.

Functionality Insights

The multiparameter-capability segment dominated the market in terms of revenue share in 2023 and CAGR over the forecast period. This is considering this functionality gives veterinarians the ability to monitor and treat a range of cardiac conditions owing to its advanced features and capabilities. Several parameters, including blood pressure, oxygen saturation, and ECG, can be monitored by these defibrillators, giving a more complete picture of the animal's health. They are also more effective in treating cardiac emergencies as they have sophisticated algorithms and features such as cardiac rhythm analysis and shock advisory.

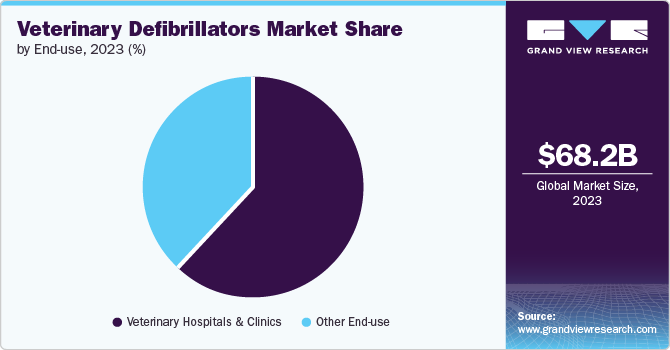

End-use Insights

The veterinary hospitals & clinics segment dominated the market in 2023 since these settings provide a concentration of emergency services and advanced medical care. Defibrillators are necessary for rapid intervention in complex cardiac emergencies, which are commonly dealt with by veterinary hospitals. Demand for these devices is also driven by the increasing rate of heart diseases in animals and the growing awareness of pet cardiac health, as these settings are where they can be utilized most effectively.

The other end use segment such as research & training centers, public places, animal shelters, etc. is witnessing growth because of rising adoption of automated external defibrillators (AEDs). More non-clinical settings are realizing the value of being ready for cardiac emergencies as awareness of animal cardiac health increases. This is creating a demand for portable, easily operative AEDs that non-veterinary professionals can use to save lives in a variety of settings.

Regional Insights

The veterinary defibrillators market in North America was among the leading markets globally in 2023. Some of the drivers for this region are high pet ownership prevalence, growing pet health awareness, and an increase in the occurrence of cardiovascular diseases in animals. Further factors supporting market expansion include improvements in veterinary care, the presence of specialty veterinary hospitals, and the use of advanced medical devices like defibrillators. Another important factor is the focus on enhancing pet emergency care and the growing use of Automated External Defibrillators (AEDs) outside of clinical settings.

U.S. Veterinary Defibrillators Market Trends

The veterinary defibrillators market in the U.S. is experiencing a lucrative CAGR due to the presence of standardized guidelines for the CPR of animals in case of emergencies. The American College of Veterinary Emergency and Critical Care (ACVECC) formulated RECOVER guidelines to ensure a proper protocol is followed while treating emergencies pertaining to animals. They provide protocols to be followed for veterinary cardiopulmonary resuscitation (CPR), emphasizing the importance of timely and effective interventions, including the use of defibrillators, during cardiac emergencies. These protocols ensure greater penetration of these devices, driving the market growth.

Europe Veterinary Defibrillators Market Trends

The veterinary defibrillators market in Europe is growing due to increasing government initiatives in different countries of the region to increase the penetration of veterinary care and emergency services for animals. For instance, in February 2020, the government of Romania opened the country’s first emergency veterinary hospital. This hospital is equipped with advanced veterinary equipment, such as defibrillators and CT scans, among others. This region also has the presence of some of the leading manufacturers of defibrillators specifically designed for veterinary use.

The veterinary defibrillators market in the UK is mainly driven by funding for veterinary research, expanded pet insurance coverage, and improved emergency care training. Demand is further boosted by regulatory requirements and the growth of specialty veterinary clinics. The increased demand for defibrillators is also a result of increased awareness of emergency preparedness and technology integration in veterinary practices.

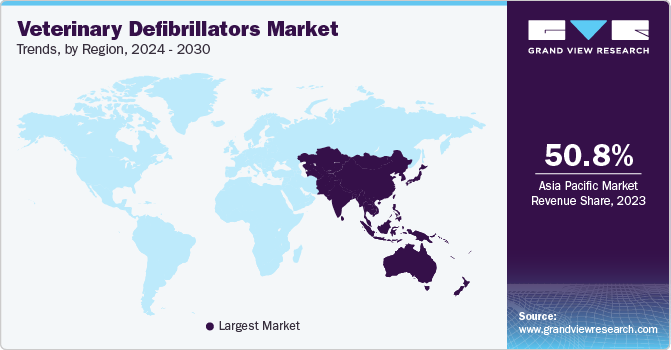

Asia Pacific Veterinary Defibrillators Market Trends

The Asia Pacific veterinary defibrillators market dominated globally with a share of 50.80%, and it is anticipated to continue its dominance with a projected CAGR of 6.78% over the forecast period. This can be attributed to the presence of industry-dominant veterinary defibrillator manufacturers like Mindray International Limited, Shenzhen Comen Medical Instruments Co., Ltd., and Meditech Equipment Co., Ltd, among others.

China veterinary defibrillators market is one of the dominant market in the region due to presence of large number of defibrillators manufacturers as well as e-commerce platforms. The companies in the country have achieved economies of scale by acting as OEM manufacturers for other veterinary defibrillator manufacturers across the world. Apart from that, leading e-commerce platforms from the country, like Alibaba and Made-in-China, have ensured that the devices manufactured in the country capture the market across the world to ensure the penetration of these products.

Latin America Veterinary Defibrillators Market Trends

the veterinary defibrillator market in Latin America is driven by increasing government initiatives to improve animal healthcare, the growing awareness of livestock and companion animal health, and the expansion of veterinary services into urban areas. The development of more sophisticated veterinary clinics and rising investments in veterinary infrastructure are also driving the market's expansion.

The veterinary defibrillator market in Brazil is primarily driven by several initiatives taken by leading market players in the veterinary industry to enhance pet care in the country. For example, in September 2022, Vimian launched its VetFamily initiative in Brazil, which is designed to encourage entrepreneurs for innovations within the veterinary industry.

Middle East & Africa Veterinary Defibrillators Market Trends

The Middle East and Africa veterinary defibrillators market is driven by several factors, including the rising pet ownership rates, an increase in the frequency of cardiovascular diseases in animals, an expanding healthcare infrastructure, and technological advancements. The market in this region is also being driven by government initiatives to support the development of veterinary equipment and an increase in the number of cardiac disease cases.

The veterinary defibrillators market in South Africa is primarily driven by the initiative taken by veterinary professionals in the country who are making great strides in expanding their expertise in veterinary beyond dogs & cats. For example, in May 2023, Onderstepoort Veterinary Academic Hospital and a University of Pretoria (UP) veterinary specialist performed the first transvenous electrical cardioversion (TVEC) on a horse in South Africa. This is reportedly the first time the operation has been carried out in Africa.

Key Veterinary Defibrillators Company Insights

Companies in this industry are actively involved in bringing novel technologies into the veterinary defibrillators industry. They are engaged in achieving economies-of-scale in manufacturing devices and establishing a manufacturing and OEM hub in countries like China. Other companies globally are importing OEMs manufactured by Chinese manufacturers and selling these products in different geographies. Furthermore, leading manufacturers from China are utilizing dominant e-commerce platforms like Alibaba and MadeInChina to spread their business across the globe.

Key Veterinary Defibrillators Companies:

The following are the leading companies in the veterinary defibrillators market. These companies collectively hold the largest market share and dictate industry trends.

- ARI Medical Technology Co., Ltd

- Wuhan Union Medical Technology Co., Ltd.

- Digicare Biomedical

- Meditech Equipment Co., Ltd

- Promed Technology Co., Limited

- Kalstein

- Shenzhen Comen Medical Instruments Co., Ltd.

- Chongqing Vision Star Optical Co., Ltd

- New Gen Medical Systems

- Hefei Eur Vet Technology Co., Ltd

- Mindray Medical International Limited

Recent Developments

-

In March 2024, ARI Medical Technology Co. Ltd., one of the leading veterinary defibrillator manufacturers, received an ISO13485 certification.

-

In 2024, Meditech Equipment Co., Ltd launched a new Automated External Defibrillator (AED) for human as well as veterinary use.

-

In May 2024, Shenzhen Comen Medical Instruments Co., Ltd. expanded its global footprint by enhancing its focus on the Latin American region, investing in resources, and introducing novel technologies.

-

In February 2024, Shenzhen Comen Medical Instruments Co., Ltd. signed an MOU with the Uzbekistan government to expand into new geographies.

-

In September 2022, Mindray International Limited donated over USD 22,000 for a mobile animal medical clinic in China to ensure the delivery of medical and emergency care to stray animals.

-

In June 2022, Mindray International Limited established its first branch in Europe, in the Netherlands.

Veterinary Defibrillators Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 71.86 million

Revenue forecast in 2030

USD 99.99 million

Growth rate

CAGR of 5.66% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, modality, technology, functionality, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, and Kuwait

Key companies profiled

ARI Medical Technology Co., Ltd, Wuhan Union Medical Technology Co., Ltd., Digicare Biomedical, Meditech Equipment Co., Ltd, Promed Technology Co., Limited, Kalstein, Shenzhen Comen Medical Instruments Co., Ltd., Chongqing Vision Star Optical Co., Ltd, New Gen Medical Systems, Hefei Eur Vet Technology Co., Ltd, and Mindray Medical International Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Defibrillators Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary defibrillators market report based on animal, modality, technology, functionality, end use, and region:

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs & Cats

-

Other Animals

-

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual

-

Automatic

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Monophasic

-

Biphasic

-

-

Functionality Outlook (Revenue, USD Million, 2018 - 2030)

-

Standard

-

Multiparameter-capability

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Other end use (research & training centers, public places, animal shelters, etc.)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global veterinary defibrillators market is estimated to be USD 68.16 million in 2023 and is expected to reach USD 71.86 million in 2024.

b. The global veterinary defibrillators market is expected to grow at a compound annual growth rate of 5.66% from 2024 to 2030 to reach USD 99.99 million by 2030.

b. The Asia Pacific region dominated the market with a share of 50.80% and is anticipated to continue to do so over the forecast period with a CAGR of 6.78%. This can be owed to presence of the industry dominant veterinary defibrillator manufacturers like Mindray International Limited, Shenzhen Comen Medical Instruments Co., Ltd., Meditech Equipment Co.,Ltd, among others.

b. Some key players operating in the veterinary defibrillators market include ARI Medical Technology Co., Ltd, Wuhan Union Medical Technology Co., Ltd., Digicare Biomedical, Meditech Equipment Co.,Ltd, Promed Technology Co., Limited, Kalstein, Shenzhen Comen Medical Instruments Co., Ltd., Chongqing Vision Star Optical Co., Ltd, New Gen Medical Systems, Hefei Eur Vet Technology Co., Ltd, and Mindray Medical International Limited,

b. Key factors expected to drive the market increasing prevalence of cardiovascular diseases in animals, rising prevalence of associated-diseases leading cardiac arrest in animals, evolving regulatory guidelines, and rising cases of arrhythmia in animals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.