- Home

- »

- Animal Health

- »

-

Veterinary Diagnostic Services Market, Industry Report, 2030GVR Report cover

![Veterinary Diagnostic Services Market Size, Share & Trends Report]()

Veterinary Diagnostic Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Test Type, By Animal Type (Companion Animals, Production Animals), By Testing Category, By Sector, By Service Provider, By Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-118-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Diagnostic Services Market Summary

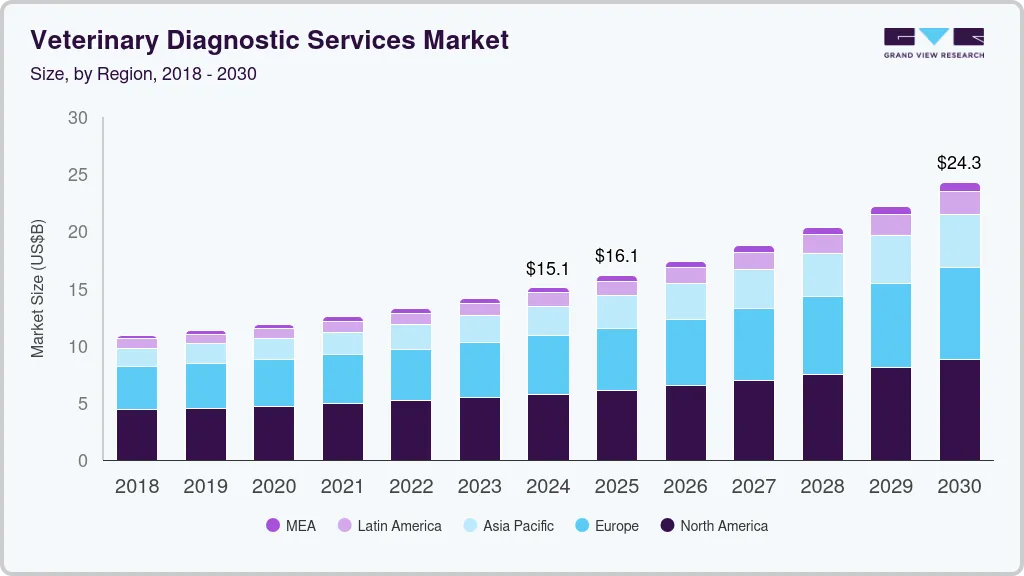

The global veterinary diagnostic services market size was estimated at USD 15.08 billion in 2024 and is projected to reach USD 24.31 billion by 2030, growing at a CAGR of 8.3% from 2025 to 2030. The growth is primarily driven by several factors, such as the rising need for early disease diagnosis coupled with growing animal population and ownership rates; increasing initiatives and investments by government organizations, animal welfare associations, and veterinary industry key players to tackle zoonosis, technological advancements in veterinary diagnosis; and rising uptake of pet insurance.

Key Market Trends & Insights

- The North America veterinary diagnostic services market led with the largest revenue share of over 38.0% in 2024.

- The Asia Pacific veterinary diagnostic services industry is expected to grow at the fastest CAGR of 10.84% from 2025 to 2030.

- By animal type, the companion animals segment held the largest revenue share of 59.22% in 2024.

- By test type, the in vitro diagnosis segment led the market with a revenue share of 86.37% in 2024.

- By testing category, the clinical chemistry segment held the largest revenue share of 23.20% in 2024.

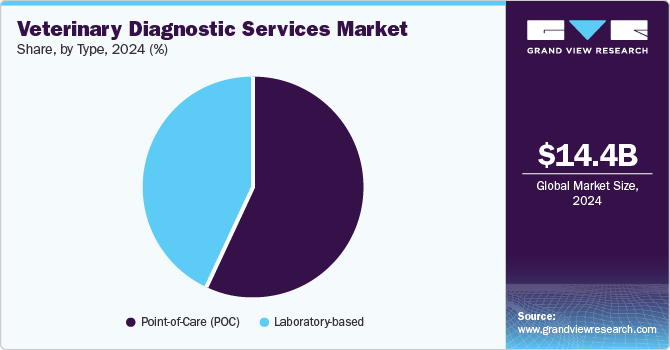

- By type, the point-of-care (POC) segment held the largest revenue share of over 57.18% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 15.08 Billion

- 2030 Projected Market Size: USD 24.31 Billion

- CAGR (2025-2030): 8.3%

- North America: Largest market in 2024

For instance, in August 2024, New York State granted $19.5 million to expand the New York State Veterinary Diagnostic Laboratory at Cornell University, increasing capacity to manage a growing caseload. This expansion reflects the broader trend in the veterinary diagnostic services market, where demand for advanced diagnostic capabilities is rising, driven by the need for more comprehensive testing, workforce development, and preparedness for disease outbreaks.

Additionally, the growing expansion of veterinary hospitals is expected to drive the veterinary diagnostics services market. For instance, in September 2024, CVS' Ayres Vets opened a modern, 6,000 sq. ft. facility in Newcastle Quays, North Shields, following a £2 million investment. The practice now offers advanced diagnostic services, including a new CT scanner, digital x-ray, ultrasound, and an in-house lab, enhancing its capabilities to diagnose and treat complex conditions. Modern facilities with advanced diagnostic tools, such as CT scanners, digital X-rays, ultrasound, and in-house laboratories, enable accurate and timely diagnosis of complex conditions. This improves patient outcomes, attracts more clients, and increases the demand for specialized diagnostic equipment and services, fueling market growth. Additionally, expanded capacities and specialized wards (e.g., for cats, dogs, and exotic animals) enhance service scope and accessibility, further boosting the market.

The constantly rising pet population and growing adoption of dogs and cats are the key drivers of market growth. Most common pet animals, such as dogs and cats, are valued for providing better companionship to humans. Pets have become a part of each household due to their associated benefits, such as psychological comfort, stress reduction, and depression among adults, and helping overcome anxiety in humans. Such factors have increased pet ownership and pet humanization in various countries.

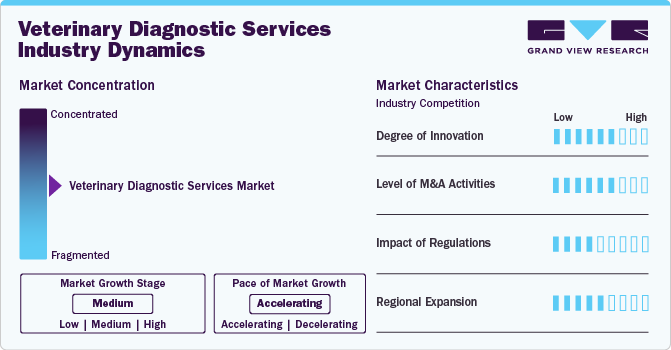

Market Concentration & Characteristics

The veterinary diagnostic services market has a moderate market concentration. The market is currently in a medium growth stage. One major factor propelling the market growth is the increasing pet ownership and rising adoption of pet insurance. The global pet population has been steadily increasing, driven by various factors such as changing demographics, urbanization, and lifestyle trends. As more people adopt pets, the overall pet population is anticipated to expand over the forecast period. This growth in pet ownership directly correlates with increased demand for pet-related products and services, including veterinary care & pet insurance. For instance, in the UK, 4.3 million pets are insured, with dogs & cats being the most common pets covered.

The market demonstrates a moderate to high degree of innovation, characterized by technological advancements. Technological innovations in veterinary diagnostics services are transforming the way veterinarians diagnose and treat animals. These advancements improve the accuracy, speed, and efficiency of diagnostics, ultimately leading to better patient outcomes. For instance, portable diagnostic tools allow veterinarians to perform tests directly at the point of care, providing immediate results. Examples include handheld blood analyzers and portable ultrasound machines.

Within the market, there exists a moderate to high level of mergers and acquisitions activity, indicative of ongoing consolidation, strategic acquisitions, and partnerships among industry players. For instance, in July 2024, Mars, Incorporated completed its acquisition of Cerba HealthCare’s stake in Cerba Vet and ANTAGENE, integrating them into its Mars Science & Diagnostics division. This move enhances Mars Petcare's diagnostics portfolio, supporting advanced veterinary diagnostics and genetic testing to improve pet health outcomes globally.

Regulations have a moderate effect on the market. Laboratories often need accreditation from recognized bodies to ensure they meet international standards for competence and quality. Hence, regulations are crucial in shaping the veterinary diagnostics services market, influencing everything from product development and market access to operational practices and data management. While they ensure quality and safety, they also pose challenges that require strategic navigation by industry players.

Moderate levels of regional growth operations in the market are caused by initiatives by major competitors in the market. For example, in January 2024, IDEXX Laboratories expanded its Fecal Dx antigen testing platform to include Cystoisospora, a common intestinal parasite in young dogs and cats, providing early & accurate detection alongside other common parasites.

Animal Type Insights

Based on animal type, the companion animals segment dominated the market in 2024 with a market share of 59.22%. This can be attributed to the increasing pet population and growing awareness about early disease diagnosis & health management. According to the American Pet Products Association (APPA) study conducted between 2023 and 2024, approximately 66% of households in the U.S. have at least one pet, totaling around 86.9 million households. Most insured pets are dogs, accounting for about 80% of the insured population, while cats comprise 20%. The pet population, expenditure on pets, pet humanization, medicalization rate, and uptake of pet insurance are expected to continue increasing in the near future, thus propelling segment growth.

The production animals segment is projected to grow at the fastest CAGR during the forecast period, primarily owing to rising livestock productivity. Cattle, pigs, chickens, and other livestock are considered production animals. Rising zoonotic disease occurrence and a high livestock population are the main drivers of the production animal diagnostic services market. In addition, major market players are diversifying their product & service portfolios of diagnostic solutions and providing their services globally, which is anticipated to accelerate market growth.

By Test Type Insights

Regarding test type, the in vitro diagnosis segment dominated the market with a revenue share of 86.37% in 2024. Veterinary in vitro diagnosis (IVD) services are used to diagnose several animal diseases and monitor the health status of animals & therapeutic procedures by analyzing samples, such as blood, tissue, urine, feces, and other biological fluids. IVD services use various methods, including sequencing technology, polymerase chain reaction, mass spectrometry, and microarray techniques, to test the sample preparation. IVD tests are essential for managing normal animal health. Appropriate diagnosis and testing enable early-stage interventions, saving late-stage healthcare spending; thus, pet parents prefer IVD testing services. Therefore, demand for IVD services will increase during the forecast period.

The in vivo diagnosis segment is projected to grow at the fastest CAGR during the forecast period. In vivo diagnostics services mainly consist of imaging technologies. Customer needs for veterinary in vivo diagnostics services have increased due to recent advancements in veterinary imaging. Demand has increased particularly for dual imaging technologies (PET/CT, PET/MR, and SPECT/CT), cross-sectional methods (MRI and CT imaging), and nuclear medicine techniques (PET and SPECT). Moreover, the surge in pet ownership rate, the growing need for efficient veterinary imaging, and advancements in in vivo diagnostic solutions are expected to boost the market growth during the forecast period.

Testing Category Insights

In terms of the testing category, the clinical chemistry segment held the largest market share of 23.20% in 2024. The increasing volume of veterinary analytical services is the main factor driving the demand for diagnostic services for clinical pathological applications. Clinical chemistry examinations are crucial for determining the function of various animal organs, such as the liver, kidneys, and other organs. They can aid in diagnosing diseases like pancreatitis or diabetes in animals. The effectiveness of a pet’s treatment can also be tracked using these tests. The segment growth is also attributable to the accessibility of various clinical chemistry diagnostic services and their affordability. Major players such as IDEXX and Zoetis are engaged in the development and introduction of clinical chemistry diagnostic testing services necessary to diagnose numerous animal diseases. For instance, in September 2024, Zoetis launched Vetscan OptiCell, an AI-powered cartridge-based hematology analyzer for advanced Complete Blood Count (CBC) analysis. Offering lab-quality accuracy at the point of care, the device enhances clinic efficiency with minimal maintenance.

The cytopathology segment is estimated to witness the fastest CAGR during the forecast period. Cytopathology testing services can help identify cancerous cells or determine if a tumor is benign or malignant. It can also detect infectious microorganisms and others, such as yeast, with a unique appearance. The growing incidences of cancer in companion animals and the increased use of cytopathological cancer diagnosis services are expected to boost the segment share during the forecast period. Additionally, the availability of advanced veterinary analyzers is expected to boost demand for veterinary cytopathology testing services during the forecast period. For instance, in January 2024, IDEXX introduced the IDEXX inVue Dx Cellular Analyzer, a groundbreaking slide-free, AI-powered platform that delivers reference-lab-quality cytology and blood morphology results in just 10 minutes. This innovation streamlines workflows reduces manual errors, and enhances diagnostic accuracy, offering veterinarians deeper clinical insights and improved patient care.

Sector Insights

In terms of sector, the private sector held the largest market share in 2024 and is anticipated to grow at the fastest CAGR of 8.75% over the forecast period. The private sector includes corporate reference laboratories and privately owned clinics/hospital-based laboratories. Private laboratories often focus solely on veterinary diagnostics, allowing them to develop specialized expertise. This specialization enables them to offer a wide range of advanced diagnostic tests & services specifically designed to the needs of veterinarians and their patients. Additionally, growing mergers and acquisitions of reference laboratories by key players to expand geographic footprints are expected to drive segment growth rapidly. For instance, in August 2023, Mars, Incorporated acquired SYNLAB Vet, a European veterinary diagnostics provider, to enhance its Mars Petcare Science & Diagnostics division. This acquisition will expand Mars' veterinary laboratory footprint in Europe, complementing its global diagnostics offerings and advancing veterinary care through technology and innovation.

Furthermore, rather than investing in costly equipment and personnel training, veterinary clinics & hospitals may find it more cost-effective to outsource certain diagnostic procedures to private laboratories. Private laboratories can conduct these tests on a large scale, distributing the expenses among numerous customers and making their services cheaper for individual veterinary practices. These factors drive market growth.

Type Insights

In terms of type, the point-of-care (POC) segment held the largest revenue of over 57.18% in 2024. The segment focuses on testing services offered at the POC, such as a farm, veterinary establishment, or home. Results are delivered within minutes or a few hours (much faster than sending out lab results), allowing veterinarians to provide efficient diagnoses and decide future steps (such as additional testing or treatment) within the same appointment. Overall, POC diagnostics in veterinary medicine transformed how veterinarians approach diagnosis and treatment, resulting in better patient outcomes and growing demand for such testing solutions in the market.

The laboratory-based segment is estimated to witness the fastest CAGR during the forecast period. The laboratories are owned and operated by companies or public entities. Veterinary laboratories provide a comprehensive range of diagnostic tests and services to diagnose and monitor various animal diseases & disorders. Blood work, urinalysis, imaging investigations (X-rays, ultrasounds), cytology, histology, and specialized tests for infectious disorders such as parvovirus, heartworm, and feline leukemia are some regularly performed. Moreover, laboratories are necessary to monitor disease trends and outbreaks in animals.

Service Provider Insights

In terms of service providers, the veterinary hospital/clinic laboratories segment dominated the market in 2024 and is expected to grow at a CAGR of 8.31% over the forecast period. Owing to the increasing demand for diagnostics and readily accessible advanced diagnostic technologies in hospitals. This segment represents the revenue of veterinary hospitals, clinics, and academic institutions from the diagnostic services they provide to pet owners and livestock farmers. Veterinary hospitals often invest in advanced diagnostic technologies to enhance their diagnostic capabilities. These may include digital radiography, ultrasound, MRI, CT scans, and advanced laboratory equipment. The adoption of such technologies drives the growth of the diagnostic market as these hospitals become potential customers for diagnostic manufacturers.

The reference laboratories segment is projected to grow at the fastest CAGR during the forecast period. The sector represents revenue from diagnostic services directly offered to pet owners by independent or corporate-affiliated laboratories, such as Zoetis Reference Laboratories and World Organization for Animal Health/OIE-certified laboratories. For example, Zoetis Reference Laboratories offers full-service diagnostics, covering most species, with microbiology, hematology, serology, endocrinology, chemistry, and other advanced assays and comprehensive clinical and anatomic pathology testing.

Regional Insights

North America veterinary diagnostic services market held the largest revenue share of more than 38% in 2024. North America has seen a rise in pet ownership, with many households considering pets as family. This growing pet population has increased the demand for veterinary diagnostics services to ensure the health and well-being of these animals. In addition, pet owners are willing to spend more on their pets' healthcare, including diagnostics, surgery, and other medical services. The rise in veterinary healthcare expenditure has contributed to the growth of the market. Moreover, the presence of veterinary diagnostics laboratories and a growing distribution network of veterinary diagnostics suppliers in the region contributes to market growth. For instance, in August 2024, Parasight System Inc. entered into a strategic distribution agreement with Midwest Vet Supply to expand access to its advanced diagnostic technology, which offers unmatched accuracy and speed in detecting parasitic infections. This collaboration highlights key trends, such as the increasing adoption of innovative, rapid diagnostic tools that improve care efficiency and outcomes.

U.S. Veterinary Diagnostic Services Market Trends

The veterinary diagnostic services market in the U.S. is growing due to rising pet ownership, advancements in diagnostic technology, and increased focus on preventive care. Key trends include the adoption of AI-driven diagnostics, the expansion of molecular testing, and a growing demand for faster, more accurate testing solutions. Furthermore, the increasing accreditation of laboratories by the regulatory authorities is bolstering trust in U.S. veterinary diagnostic services, driving market growth through enhanced reliability and standardization. For instance, in November 2024, The Oklahoma Animal Disease Diagnostic Laboratory (OADDL) earned American Association of Veterinary Laboratory Diagnosticians (AAVLD) accreditation, recognizing its high standards in veterinary diagnostics, including pathology, bacteriology, and toxicology, with accreditation valid through 2029. OADDL's recent accreditation underscores advancements in diagnostic capabilities, fostering demand for high-quality animal health services nationwide.

Europe Veterinary Diagnostic Services Market Trends

Europe veterinary diagnostic services market held the second-largest share in 2024, owing to numerous players operating in the region. The veterinary diagnostics industry has seen significant advancements in diagnostic technologies, such as molecular diagnostics, digital imaging, & point-of-care testing. These technologies offer more accurate & efficient diagnostic solutions, driving demand in veterinary practices. For instance, in November 2024, Alveo Technologies launched its Alveo Sense Avian Influenza Test, marking its entry into the animal health diagnostics sector. This rapid, field-based test for avian flu, developed in partnership with Royal GD and x-OvO, will initially roll out in the EU and EMEA regions, offering faster, decentralized testing to improve outbreak response. The move highlights the growing demand for efficient, on-site diagnostic solutions in Europe's veterinary market.

The veterinary diagnostic services market in Germany is growing as major players are implementing strategies, including mergers & collaborations, to expand their product lines and produce high-value products, which is anticipated to increase demand for veterinary diagnostic kits in Germany. GVG Diagnostics GmbH, for instance, represents reliability, innovation, & excellence.

Asia Pacific Veterinary Diagnostic Services Market Trends

The Asia Pacific veterinary diagnostic services market is estimated to grow at the fastest CAGR of 10.84% in 2024. Major reasons anticipated to propel the regional market growth are the rise in middle-class families, increasing disposable income, adopting companion animals, and the growing demand for animal proteins. Countries such as China & India are anticipated to have strong growth potential, with the number of industrial facilities in the region increasing. Increasing R&D investment by market players in developing value-added products is expected to boost regional market growth. For instance, in July 2024, SK Telecom launched its AI veterinary diagnostic tool, 'X Caliber,' in Malaysia, Thailand, and Vietnam, partnering with key regional players to meet Southeast Asia's growing pet care demand.

The veterinary diagnostic services market in China is growing rapidly due to an increase in middle-class families, a rise in disposable income, and an increasing number of people interested in spending money on their pets. In China, senior citizens are most likely to own pets. Increased pet ownership has led to a strong need for efficient healthcare services.

Latin America Veterinary Diagnostic Services Market Trends

The Latin America veterinary diagnostic services market is driven by increasing meat consumption. The Latin American market includes Argentina & Brazil. According to FAO, Meat and milk consumption are perhaps more important both economically & politically in Latin America than in any other part of the world. The region's average annual per capita meat intake is 45 kg, nearly 2.5 to three times what is found in Asia & Africa.

The veterinary diagnostic services market in Brazil is expected to grow during the forecast period owing to an increase in the number of healthcare reforms and expenditures. The increasing demand for better healthcare facilities is anticipated to boost market growth. In addition, the rising adoption of companion animals and growing demand for animal food products will likely boost Brazil's veterinary diagnostic services market.

Middle East & Africa Veterinary Diagnostic Services Market Trends

The Middle East & Africa veterinary diagnostic services market is anticipated to expand steadily over the forecast period due to rising pet ownership, increasing demand for livestock disease control, and growing awareness of zoonotic diseases. Additionally, governments in the MEA region are investing heavily in veterinary infrastructure to strengthen disease surveillance and control. For instance, in July 2024, Saudi Arabia invested $46 million to establish a state-of-the-art veterinary laboratory in Riyadh, focused on diagnosing animal diseases and developing local vaccines for regional strains. The lab will enhance disease control, vaccine production, and research, aiming to safeguard livestock health and combat zoonotic diseases in alignment with international standards.

The veterinary diagnostic services market in South Africa has a growing demand for disease diagnosis and a high target population, which is projected to fuel market growth in this country. Increased government focus on improving animal health through investments in veterinary infrastructure and training supports market growth. In partnership with international organizations, the South African government has been modernizing veterinary facilities to improve disease surveillance and control, boosting demand for diagnostic services. For instance, in March 2024, The FAO, with USAID support through the Global Health Security Agenda, renovated Sierra Leone's Central Veterinary Laboratory (CVL) in Makeni to Biosafety Level 2 standards. This upgrade enhances disease surveillance and control capacities, enabling accurate testing for zoonotic and endemic diseases and strengthens the nation's overall health security. Upgraded laboratories play a critical role in combating zoonotic and endemic diseases, fostering trust in veterinary services, and driving demand for advanced diagnostic equipment and expertise, which collectively boost market growth.

Key Veterinary Diagnostic Services Company Insights

The market is competitive due to the presence of a wide range of players, from small companies to huge global animal health companies such as IDEXX and Zoetis. These involve implementing cutting-edge and efficient diagnostic services to promote animal healthcare outcomes, diagnostic accuracy, efficiency, and cost reduction. Existing market players keep executing strategic initiatives such as joint ventures, mergers, and acquisitions and introducing new products and product upgrades to strengthen their position in the market. For example, in June 2023, IDEXX Laboratories, Inc. launched the first animal diagnostic test to detect kidney damage in dogs and cats. Later in 2023, the tests will be performed in IDEXX Reference Laboratories in the US and Canada, and the test will be rolled out across Europe in 2024.

Key Veterinary Diagnostic Services Companies:

The following are the leading companies in the veterinary diagnostic services market. These companies collectively hold the largest market share and dictate industry trends.

- Zoetis Services LLC

- Antech Diagnostics, Inc. (Mars, Inc.)

- IDEXX

- Neogen Corporation

- Agrolabo S.p.A.

- Esaote SPA

- Thermo Fisher Scientific, Inc.

- NationWide Laboratories

- Ellie Diagnostics

- FUJIFILM Corporation.

Recent Developments

-

In September 2024, Zoetis Inc. introduced Vetscan OptiCell, a new cartridge-based hematology analyzer that employs AI-powered technology to deliver precise Complete Blood Count (CBC) analysis at the point of care, offering lab-quality results with time, cost, and space efficiencies for veterinary clinics.

-

In July 2024, EKF Diagnostics launched the Biosen C-Line, an advanced glucose and lactate analyzer designed for enhanced usability. It features a touch screen and advanced connectivity options to integrate seamlessly with hospital and lab IT systems via EKF Link. This benchtop analyzer provides highly precise glucose and lactate measurements and is used in clinical settings for diabetes management and by elite sports teams to track lactate production during training.

-

In February 2024, MiDOG Animal Diagnostics introduced an advanced All-in-One Diagnostic Test capable of rapidly detecting bacterial and fungal infections, including antibiotic resistance, across various animal species. This innovation aims to enhance veterinary care by replacing traditional testing methods with efficient molecular-based diagnostics, supporting comprehensive treatment strategies for diverse animals, from pets to exotic species.

-

In January 2024, IDEXX Laboratories expanded its Fecal Dx antigen testing platform to include Cystoisospora, a common intestinal parasite in young dogs and cats, providing early & accurate detection alongside other common parasites.

Veterinary Diagnostic Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16.14 billion

Revenue forecast in 2030

USD 23.30 billion

Growth Rate

CAGR of 8.3% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, testing category, sector, type, service provider, test type

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Netherlands, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Zoetis Services LLC; Antech Diagnostics, Inc. (Mars, Inc.); IDEXX; Neogen Corporation; Agrolabo S.p.A.; Esaote SPA; Thermo Fisher Scientific, Inc.; NationWide Laboratories; Ellie Diagnostics; FUJIFILM Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Diagnostic Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the veterinary diagnostic services market report based on animal type, testing category, sector, service provider, test type, and region.

-

Test Type Outlook (Revenue, USD Million, 2018 - 2030)

-

In Vitro Diagnosis

-

In Vivo Diagnosis

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Others

-

-

Production Animals

-

Cattle

-

Poultry

-

Swine

-

Others

-

-

-

Testing Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Chemistry

-

Microbiology

-

Parasitology

-

Histopathology

-

Cytopathology

-

Hematology

-

Immunology & Serology

-

Imaging

-

Molecular Diagnostics

-

Other Categories

-

-

Sector Outlook (Revenue, USD Million, 2018 - 2030)

-

Public

-

Private

-

-

Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospital/Clinic Laboratories

-

Reference Laboratories

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Point-of-Care (POC)

-

Laboratory-based

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global veterinary diagnostic services market size was estimated at USD 14.40 billion in 2024 and is expected to reach USD 15.40 billion in 2025.

b. The global veterinary diagnostic services market is expected to grow at a compound annual growth rate of 8.53% from 2025 to 2030 to reach USD 23.20 billion by 2030

b. North America held the largest share of more than 38.00% of the total market by region in 2024. North America has seen a rise in pet ownership, with many households considering pets as family. This growing pet population has increased the demand for veterinary diagnostics services to ensure the health & well-being of these animals.

b. Some key players operating in the veterinary diagnostic services market include Zoetis Services LLC, Antech Diagnostics, Inc. (Mars, Inc.), IDEXX, Neogen Corporation, The Animal Medical Center, Embark Veterinary, Inc., SYNLAB, NationWide Laboratories, Ellie Diagnostics, VETERINARY HEALTHCARE COMPANY (VETHC).

b. The market is primarily driven by the rising need for early disease diagnosis coupled with growing animal population & ownership rates; increasing initiatives by government organizations, animal welfare associations, & veterinary industry key players to tackle zoonosis, technological advancements in veterinary diagnosis; and rising uptake of pet insurance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.