- Home

- »

- Animal Health

- »

-

Veterinary Digital Pathology Market, Industry Report, 2030GVR Report cover

![Veterinary Digital Pathology Market Size, Share & Trends Report]()

Veterinary Digital Pathology Market (2025 - 2030) Size, Share & Trends Analysis Report By Animal Type (Livestock, Companion, Exotic), By Product (Whole Slide Imaging Systems, Image Analysis Software), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-553-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Digital Pathology Market Trends

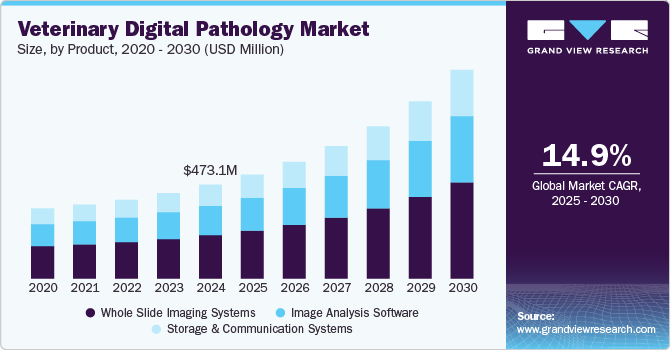

The global veterinary digital pathology market size was estimated at USD 473.1 million in 2024 and is anticipated to grow at a CAGR of 14.9% from 2025 to 2030. The market is driven by several key factors, including the increasing prevalence of chronic diseases in animals, growing pet adoption, and the rising demand for rapid and accurate diagnostic tools. Technological advancements such as whole-slide imaging and AI-based diagnostic algorithms are enhancing diagnostic efficiency and accuracy, further fueling market growth. Additionally, the growing awareness about animal health, the expansion of veterinary telemedicine, and the need for remote consultation and collaboration among pathologists are encouraging the adoption of digital pathology solutions.

The rising prevalence of chronic diseases in animals, such as cancer, diabetes, and kidney disorders, is significantly driving the market growth. These long-term conditions require ongoing monitoring and detailed diagnostic evaluations, which digital pathology enables through high-resolution image analysis, remote consultations, and streamlined data sharing. For instance, according to an article published by the National Library of Medicine, in January 2025, lymphoma remained one of the most prevalent cancers in dogs in 2024, accounting for approximately 24% of all canine malignancies and 85% of hematological cancers. The most common form, multicentric lymphoma, represents about 84% of cases and typically manifests as painless lymph node enlargement. A dog diagnosed with lymphoma may need repeated histopathological assessments to monitor the progression or response to therapy tasks made faster and more accurate through digital pathology platforms. This demand for efficient, precise, and scalable diagnostic tools is pushing veterinary practices to adopt digital solutions, fueling market expansion.

Furthermore, the rising adoption of pet insurance is significantly driving the market by increasing pet owners' ability to afford advanced diagnostic services. As insurance coverage reduces out-of-pocket expenses for veterinary care, more owners are opting for comprehensive diagnostic procedures, including digital pathology, which offers rapid and accurate analysis of tissue samples. This trend enhances early disease detection and treatment planning, encouraging clinics to invest in digital pathology systems. For example, a pet insurance policy that covers diagnostic tests enables a veterinarian to utilize digital pathology to detect cancerous cells in a dog’s biopsy, ensuring timely and precise intervention that might otherwise be cost-prohibitive without insurance.

Table 1 U.S. Pet Expenditure, USD Bn

Year

Expenditure (USD Bn)

2025 (Projected)

157.0 (Projected)

2024

151.9

2023

147.0

2022

136.8

2021

123.6

2020

103.6

Source: APPA, Grand View Research

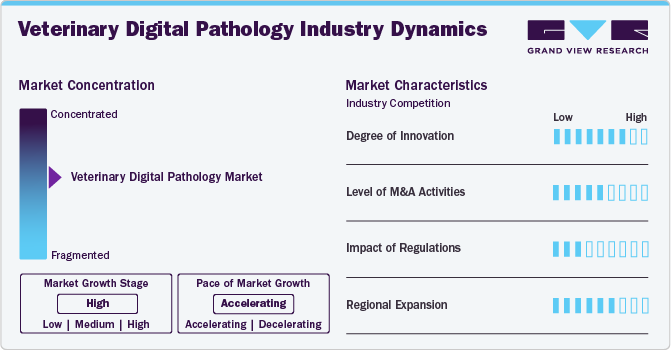

Market Concentration & Characteristics

The veterinary digital pathology market exhibits a high market concentration, and the pace of the market growth is accelerating. One of the key factors fueling the market growth is rapid technological advancements. Innovations such as high-resolution whole-slide imaging, artificial intelligence (AI)-powered image analysis, and cloud-based data storage allow veterinarians to rapidly digitize and share pathology slides for expert consultation and real-time diagnosis. For example, AI algorithms can now automatically detect abnormalities in tissue samples, such as tumors or infections, which significantly reduces the workload of veterinary pathologists and improves diagnostic turnaround time. These advancements streamline workflows in veterinary clinics and research institutions, ultimately improving animal health outcomes.

The market is highly innovative, driven by advancements in AI-powered image analysis, cloud-based diagnostic platforms, and integrated digital workflows. Companies are leveraging machine learning algorithms to enhance diagnostic accuracy and speed, allowing real-time image sharing and remote consultations between veterinary pathologists. For example, firms like Proscia and Indical Bioscience have introduced AI-enabled platforms that support automated slide scanning, image interpretation, and cloud collaboration.

Within the market, there exists a moderate level of mergers and acquisitions activity, driven by increasing demand for advanced diagnostic solutions and consolidation among key players seeking to expand their technological capabilities and geographic reach. For instance, in January 2024, Zoetis expanded its portfolio through the acquisition of a digital imaging company, aiming to strengthen its diagnostic offerings and streamline workflows for veterinary clinics.

The veterinary digital pathology market operates within a regulatory framework that is generally less stringent than that for human medical devices. This relative flexibility facilitates the adoption of digital pathology technologies in veterinary settings. The U.S. Food and Drug Administration (FDA) primarily regulates digital pathology devices intended for human use, veterinary applications often fall outside the scope of stringent FDA oversight. This distinction allows for more rapid implementation of digital pathology solutions in veterinary medicine.

Companies operating in the industry market are increasingly focusing on regional expansion to tap into the growing demand for advanced diagnostic solutions. Key players are entering emerging markets in Asia-Pacific and Latin America, leveraging rising pet ownership, increasing veterinary healthcare expenditure, and improving infrastructure.

Product Insight

The whole slide imaging systems segment dominated the market and accounted for a revenue share of over 46.00% in 2024, due to their ability to digitize entire tissue slides at high resolution, allowing for seamless remote analysis, sharing, and long-term storage. These systems enable pathologists to examine veterinary samples in detail without the need for physical slides, significantly enhancing workflow efficiency and diagnostic accuracy. For example, a veterinary diagnostic lab in Germany uses WSI systems to scan slides from biopsy samples taken from pets across Europe. These digital slides are uploaded to a cloud platform where pathologists can access them in real-time, collaborate with colleagues remotely, and use AI tools to assist in diagnosing diseases such as canine lymphoma or feline kidney disease. This not only reduces turnaround time but also helps maintain consistency in diagnoses across locations.

The image analysis software segment is anticipated to grow at the fastest CAGR over the forecast period. These software solutions use advanced algorithms, often powered by AI and machine learning, to automatically detect, quantify, and classify pathological features in digital slides such as tumors, infections, or inflammatory responses in animals. This reduces human error, speeds up diagnosis, and allows for consistent and repeatable results.

By Animal Type Insights

The companion segment dominated the market with the largest revenue share in 2024. This can be attributed to the factors such as the rising pet population and increasing pet expenditure. Moreover, several strategic moves by key players in launching digital pathological solutions for pets and offering comprehensive products for companions further contribute to the segment's growth. For instance, Antech Diagnostics, a Mars Petcare company, expanded its digital pathology services in North America, leveraging AI and WSI to provide rapid diagnostics for companion animals, including cancers and chronic diseases.

The exotic segment is expected to exhibit the fastest growth rate during the forecast period, owing to the rising demand for veterinary care for exotic species. Exotic pets often require specialized diagnostics due to their unique anatomy and disease profiles, making traditional pathology methods less efficient or applicable. Digital pathology, especially Whole Slide Imaging (WSI), allows for detailed and remote analysis of rare or complex tissue samples, enabling faster and more accurate diagnoses. As exotic pet ownership increases globally, veterinary clinics and specialty labs are investing in digital pathology solutions to meet the growing need for precise and timely diagnostics tailored to these unique species.

End-use Insight

Veterinary hospitals and clinics held the dominant share of the market in 2024, due to their high caseload, need for rapid diagnostics, and access to advanced infrastructure. These facilities often handle complex cases requiring immediate and accurate pathology results, making digital solutions essential. Moreover, their ability to invest in advanced technology and integrate digital pathology into routine workflows further solidifies their leading role in driving market growth and adoption.

The veterinary reference laboratories segment is anticipated to grow at the fastest CAGR over the forecast period. Reference laboratories are adopting digital pathology to improve efficiency, enable remote consultations, and reduce turnaround times. The rise in exotic and companion animal ownership, coupled with growing awareness of animal health, boosts demand for specialized diagnostics. These labs also support veterinary clinics lacking in-house pathology, further driving digital pathology adoption across regions.

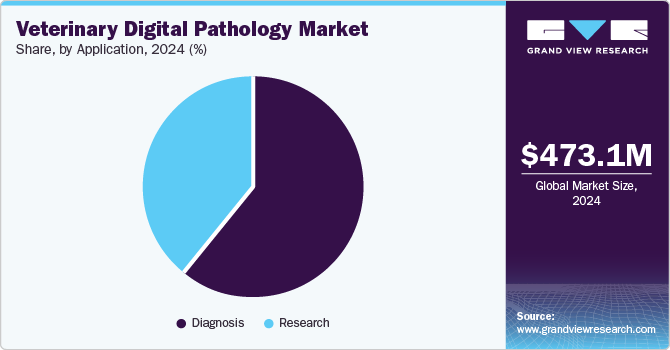

By Application Insights

The diagnosis segment dominated the market for veterinary digital pathology with a revenue share of over 60.0% in 2024, because it is the primary application driving the adoption of digital tools in veterinary healthcare. Accurate and timely diagnosis is critical for effective treatment planning, especially for complex diseases in companion animals, livestock, and exotic species. Moreover, veterinarians rely on rapid and accurate diagnostics to treat animals, making digital pathology essential for timely interventions. For instance, a veterinary clinic can digitally scan a biopsy from a dog with suspected cancer and send it to a specialist for same-day analysis, enabling faster treatment decisions. In contrast, research applications, while important, have longer timelines and less frequent use. The urgent need for real-time diagnostics in daily veterinary care makes diagnosis the leading application in this market.

The research segment is expected to exhibit the fastest growth rate of over 15.0% over the forecast period. Unlike diagnosis, which focuses on immediate clinical outcomes, research leverages digital pathology for high-throughput analysis, multi-species investigation, and global collaboration. It drives the development of AI tools, enhances data reproducibility, and supports drug development and disease modelling. Research institutions also benefit from greater funding and infrastructure, allowing for the adoption of cutting-edge technologies.

Regional Insights

North America veterinary digital pathology market dominated the global market and accounted for a revenue share of over 39% in 2024, due to its advanced veterinary healthcare infrastructure, high adoption of technology, and strong presence of key market players. The region benefits from well-established veterinary reference laboratories, widespread use of Whole Slide Imaging (WSI), and increasing demand for telepathology services. For example, companies like IDEXX Laboratories and Antech Diagnostics in the region. offer digital pathology solutions that enable rapid, remote diagnoses for veterinary clinics. Additionally, the growing pet population, increased spending on animal health, and supportive regulatory environment further fuel market growth. These factors collectively position North America as a leader in digital veterinary diagnostics.

U.S. Veterinary Digital Pathology Market Trends

The U.S. veterinary digital pathology market is anticipated to grow significantly due to the high pet population and rising pet expenditure in the country. For instance, according to APPA, pet spending reached USD 152.0 billion in 2024. As more households adopt pets, the need for regular health checkups, disease screenings, and early diagnosis grows. Simultaneously, pet owners are spending more on veterinary care, driven by growing pet humanization and a focus on preventive healthcare. This encourages veterinary clinics and reference labs to adopt digital pathology tools that offer faster turnaround, higher accuracy, and remote consultation capabilities, improving overall animal care.

Europe Veterinary Digital Pathology Market Trends

The veterinary digital pathology market in the region is anticipated to grow, attributed to increased pet ownership and increased adoption of pet insurance. For instance, according to the FEDIAF report 2024, 50% of European homes own 166 million of the 352 million pets in Europe, the number of pet owners is rising. With more households treating pets as family members, there is a heightened focus on preventive care, early disease detection, and personalized treatment necessitating the use of digital pathological solutions.

UK veterinary digital pathology market is anticipated to grow at a constant rate due to the increasing demand for veterinarians in the country. For instance, according to an article published by Veterinary Business Development Ltd, in December 2024, the number of veterinarians licensed to practice in the UK is projected to increase by over 50% within the next ten years. This projected growth reflects an expanding veterinary workforce that will increase demand for efficient diagnostic tools and services. As caseloads rise, digital pathology solutions become essential to support faster, more accurate diagnoses and enable collaboration across practices. The growing vet population also promotes specialization and referral networks, further accelerating the adoption of digital pathology to meet the evolving needs of modern veterinary care.

Asia Pacific Veterinary Digital Pathology Market Trends

In Asia Pacific, the market is expected to register the fastest growth rate during the forecast period, due to rising pet ownership, increased livestock production, and growing awareness of advanced animal healthcare. Countries like China, India, and Japan are witnessing rapid urbanization and a surge in companion animals, prompting demand for accurate and timely diagnostic services. Moreover, Government support and presence of key players further accelerate market growth in the region.

India veterinary digital pathology market is growing at a rapid pace, due to the increasing prevalence of cancers in pets. For instance, according to an article published by International Journal of Zoological Investigations, in October 2023, India has witnessed a significant rise in cancer cases among domestic animals, especially dogs and cats. Mostly domestic animals suffer from malignant cancers. Cancer diagnosis in animals requires detailed histopathological examination, which is efficiently supported by digital pathology tools like Whole Slide Imaging (WSI). These technologies allow veterinary pathologists to view, analyze, and share high-resolution digital tissue slides remotely, improving diagnostic speed and precision.

Latin America Veterinary Digital Pathology Market Trends

Latin America veterinary digital pathology market is expected to grow owing to increasing livestock production, and growing investment in veterinary healthcare infrastructure. Countries like Brazil and Argentina are witnessing a surge in demand for advanced diagnostic tools to support both companion animal and livestock health. With large-scale farming operations and rising concerns about zoonotic diseases, there is a growing need for rapid, high-throughput diagnostic solutions.

Veterinary digital pathology market in Brazil drives the veterinary digital pathology market through its expanding veterinary healthcare infrastructure, increasing pet ownership, and growing livestock sector. The country’s growing population of companion animals, such as dogs and cats, alongside its significant livestock industry, creates a high demand for advanced diagnostic tools.

Middle East & Africa Veterinary Digital Pathology Market Trends

South Africa, Saudi Arabia, UAE, and Kuwait constitute the Middle East & Africa (MEA). The market in this region is anticipated to grow due to rising awareness about zoonotic diseases, and a growing focus on livestock health. With growing concerns over public health risks, such as those seen in outbreaks like avian influenza or rabies, there is an increased demand for early and accurate disease detection in animals.

South Africa veterinary digital pathology market is anticipated to grow at a lucrative rate during the forecast period. This growth is attributed to specific government initiatives aimed at enhancing overall animal healthcare, including improvements in diagnostic capabilities. With livestock production contributing up to 25% of the national income, there is a strong focus on maintaining animal health to support economic stability. South Africa's ability to produce chicken at the sixth lowest cost per kilogram globally underscores its competitiveness in the poultry industry. As a result, increasing government support for advancing the poultry sector particularly through the adoption of modern diagnostic technologies like digital pathology.

Key Veterinary Digital Pathology Company Insights

The market is competitive and marked by the presence of key players. The key parameters affecting competition include rapid technological advancements. Additionally, to maintain market share and expand their product portfolios, leading companies are increasingly adopting strategies such as mergers and acquisitions, strategic partnerships, and the launch of innovative products.

Key Veterinary Digital Pathology Companies:

The following are the leading companies in the veterinary digital pathology market. These companies collectively hold the largest market share and dictate industry trends.

- IDEXX Laboratories Inc.

- Zoetis Services LLC.

- Antech Diagnostics, Inc.

- Hamamatsu Photonics

- Motic

- Scopio Labs

- Indica Labs Inc

Recent Developments

-

In December 2024, Zoetis launched new diagnostic tool, Vetscan OptiCell—a cartridge-based, AI-powered hematology analyzer designed to deliver advanced Complete Blood Count (CBC) analysis.

-

In February 2020, Scopio Labs, a leader in digital microscopy innovation launched ScopioVet Digital Cytology System across the United States and Canada.

Veterinary Digital Pathology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 523.5 million

Revenue forecast in 2030

USD 1,050.2 million

Growth rate

CAGR of 14.9% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

IDEXX Laboratories Inc.; Zoetis Services LLC.; Antech Diagnostics, Inc.; Hamamatsu Photonics; Motic; Indica Labs Inc; Scopio Labs

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Digital Pathology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary digital pathology Market report based on animal type, product, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Whole Slide Imaging Systems

-

Image Analysis Software

-

Storage and Communication Systems

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnosis

-

Research

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Livestock

-

Poultry

-

Cattle

-

Swine

-

Others

-

-

Companion

-

Canine

-

Feline

-

Others

-

-

Exotic

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals and Clinics

-

Veterinary Reference Laboratories

-

Veterinary Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of LATAM

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global veterinary digital pathology market size was estimated at USD 473.1 million in 2024 and is expected to reach USD 523.5 million in 2025.

b. The global veterinary digital pathology market is expected to grow at a compound annual growth rate of 14.94% from 2025 to 2030 to reach USD 1,050.2 million by 2030.

b. North America dominated the veterinary digital pathology market with a share of over 39.0% in 2024. This is attributable to its advanced veterinary healthcare infrastructure, high adoption of technology, and strong presence of key market players.

b. Some key players operating in the veterinary digital pathology market include IDEXX Laboratories Inc., Zoetis Services LLC., Antech Diagnostics, Inc., Hamamatsu Photonics, Motic, Indica Labs Inc, Scopio Labs

b. Key factors that are driving the market growth include the increasing prevalence of chronic diseases in animals, growing pet adoption, and the rising demand for rapid and accurate diagnostic tools.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.