- Home

- »

- Animal Health

- »

-

Veterinary EHR Market Size & Share, Industry Report, 2030GVR Report cover

![Veterinary EHR Market Size, Share & Trends Report]()

Veterinary EHR Market (2025 - 2030) Size, Share & Trends Analysis Report By Practice Type (Small Animals, Mixed Animals), By Delivery Mode (Cloud/Web Based, On-premise), By Application (Practice Management, Imaging), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-432-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary EHR Market Summary

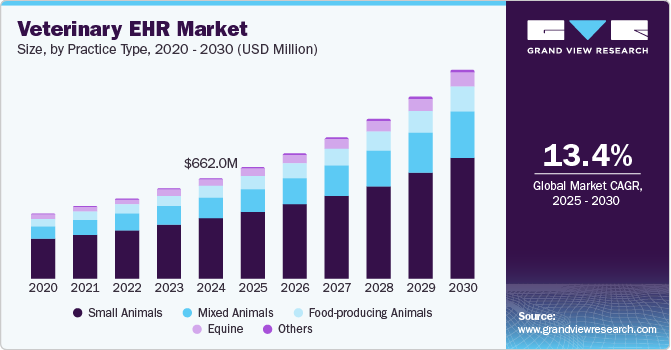

The global veterinary ehr market size was estimated at USD 662.0 million in 2024 and is projected to reach USD 1,376.6 million by 2030, growing at a CAGR of 13.3% from 2025 to 2030. Increasing investments in the chloride production processes and the flourishing construction industry worldwide are anticipated to contribute to the growth of the market for titanium dioxide (TiO2)in the coming years.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, small animals accounted for a revenue of USD 438.7 million in 2024.

- Mixed animals are the most lucrative grade segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 662.0 million

- 2030 Projected Market Size: USD 1,376.6 million

- CAGR (2025-2030): 13.3%

- North America: Largest market in 2024

The market is primarily driven by increasing pet ownership, the rising prevalence of zoonotic diseases, and the need for efficient practice management solutions that improve patient care, streamline workflows, and ensure regulatory compliance. Innovations in cloud computing, data analytics, and mobile technology have enhanced the capabilities of veterinary EHR systems, making them more accessible, user-friendly, and efficient, which boosts market adoption. For example, systems like IDEXX’s Vello, launched in February 2024, integrate seamlessly with existing practice management software, improving communication and workflow efficiency.

Additionally, growing technological advancement and integration of new features in existing software solutions are expected to fuel the demand in the veterinary EHR market. For instance, in June 2024, Vet Connect announced an upgrade to its EMR platform by introducing an advanced "pet health score," set to be available in July 2024 to enhance its veterinary EMR platform. This new feature uses advanced algorithms to analyze individual and aggregated animal health data, allowing veterinarians to predict health trends and address potential issues early, thus improving overall pet care.

Electronic health records (EHR) are increasingly being adopted in animal hospitals and veterinary clinics to manage pet and livestock health data efficiently. EHRs provide accurate and readily accessible records, enabling veterinarians to monitor trends and long-term health changes. Integrating advanced technology in veterinary software enhances diagnostics and treatment by streamlining various processes. EHRs offer veterinarians instant access to detailed patient information, including medical history, vaccination records, and past treatments, which supports precise diagnosis and effective treatment planning.

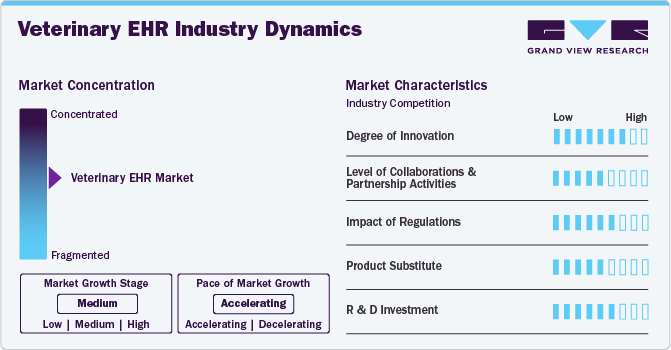

Market Concentration

The veterinary EHR market is highly concentrated, with key players including OSP, Shepherd App, Covetrus Inc. (Henry Schein), IDEXX, Hippo Manager Veterinary Software, and others. Market players are introducing new and innovative products to enhance efficiency and collaborate with other industry leaders to maximize the benefits of their software solutions. For instance, in March 2024, Covetrus introduced vRxPro, an advanced online prescription management tool integrated into VetSuite, to streamline veterinary operations, improve client engagement, and increase revenue.

The veterinary EHR market is characterized by a high degree of innovation, with advancements such as AI-driven diagnostics, telemedicine integration, and advanced data analytics becoming prominent. Innovations focus on enhancing clinical decision-making, improving patient care, and streamlining practice management. Technological progress and evolving veterinary needs drive continuous updates and new features. For instance, in March 2024, Covetrus launched vRxPro, an advanced online prescription management solution within VetSuite, to streamline veterinary practices' operations, enhance client engagement, and boost revenue.

The veterinary EHR market is seeing a high level of collaboration and partnership activities, with software providers increasingly partnering with veterinary clinics and technology firms. These collaborations focus on integrating advanced features like AI and data analytics into EHR systems. Additionally, partnerships with industry associations and regulatory bodies are helping to standardize practices and drive adoption across regions. For instance, in May 2024,Evette and Shepherd Veterinary Software collaborated to address the veterinary industry's challenges by integrating Evette's relief staffing request form into Shepherd's software interface, benefiting over 600 clinics nationwide. Their partnership aimed to streamline operations, combat turnover, and alleviate burnout among veterinary professionals, offering customized solutions and personalized support.

Strict regulations in the veterinary industry can significantly influence the EHR market. Compliance requirements for data security, patient privacy, and accurate record-keeping drive the adoption of robust EHR systems. These regulations ensure that veterinary practices maintain high care and data management standards, increasing the demand for reliable and compliant EHR solutions. As a result, vendors must continuously update their systems to meet evolving regulatory standards, impacting the market dynamics and product offerings.

The high costs associated with implementing veterinary EHR systems can drive smaller practices to consider alternative solutions, such as manual record-keeping or less sophisticated software, impacting the overall adoption rate of advanced EHR systems in the market. While potentially more affordable, these substitutes may lack full-scale EHR solutions' comprehensive features and efficiencies.

Regional expansions in the veterinary EHR market are marked by strategic partnerships and increased market penetration. For instance, global EHR providers are expanding their presence in emerging markets by collaborating with local veterinary networks to integrate advanced solutions. These partnerships enhance regional access to cutting-edge technologies and improve veterinary care standards. Additionally, regional expansions often involve establishing local support and training centers to facilitate the adoption and optimization of EHR systems. For instance, in April 2024, Weave integrated with Shepherd, enhancing its capabilities in client communication and engagement for businesses. This integration streamlined communication processes and improved customer service, benefiting businesses using Weave's platform.

Practice Type Insights

The small animals segment accounted for the largest revenue share, 60.00%, in 2024. This high share is attributable to their need for efficient patient record management, improved data accessibility, and enhanced client engagement. Their focus on personalized care and advanced diagnostics drives significant EHR adoption, streamlining operations and boosting care quality.

Other veterinary practices, including those focusing on large animals and exotic species, are expected to increase their demand for veterinary EHR during the forecast period due to the growing need for comprehensive data management, improved operational efficiency, and enhanced diagnostics. The expanding focus on data-driven care and regulatory compliance will drive the adoption of advanced EHR systems.

Delivery Mode Insights

Based on delivery mode, the market is segmented into cloud/web-based and On-premise. The cloud/Web-Based segment will dominate in 2024 with a market share of 79.98% and is estimated to be the fastest-growing segment with the highest CAGR of 14.5% over the forecast period. This is due to the benefits of cloud/web-based EHR, such as lower hardware costs, enhanced data security, and increased flexibility. Cloud solutions eliminate the need for costly local servers and IT infrastructure, provide advanced security features, and offer 24/7 remote access, making them more efficient and scalable than traditional on-site systems.

Cloud-based solutions are highly scalable, catering to the needs of veterinary clinics of all sizes. This flexibility allows them to effectively support both large, multi-location veterinary hospitals and small, independent practices. Thus, they are expected to grow at the fastest CAGR during the forecast period.

Application Insights

The practice management segment dominated the market and accounted for the largest share, 76.24%, in 2024. Practice management software (PMS) is widely used in veterinary EHR systems due to its comprehensive support for standard-of-care practices and health guidelines. It assists with billing, resource management, inventory control, and treatment procedures while tracking patient health. This integration enhances profitability and operational efficiency, driving significant market growth in established and developing economies.

The Imaging segment is anticipated to grow at the fastest rate over the forecast period due to its ability to enhance diagnostic accuracy and streamline medical imaging management. Imaging software integrates seamlessly with EHR systems, allowing for better storage, retrieval, and analysis of diagnostic images. This integration supports improved patient care, facilitates more informed treatment decisions, and enhances overall workflow efficiency in veterinary practices.

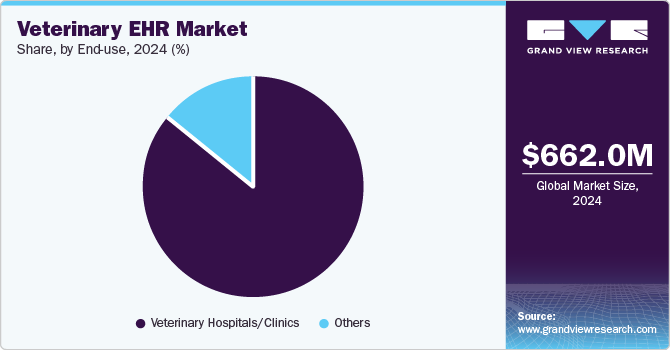

End-use Insights

The veterinary hospitals/clinics segment dominated the end use segments with the largest market share of 85.97% in 2024 and is also anticipated to grow at the fastest rate of 13.6% CAGR over the forecast period. The rapid digitization of veterinary practices and the recognition of software benefits for patient care and operational efficiency drive growth in the veterinary hospitals and clinics segment.

Veterinary hospitals and clinics offering various services, from surgery to emergency care, require sophisticated software to manage complex patient care. These facilities, dealing with higher patient volumes, benefit from advanced EHR systems for managing appointments, records, billing, and inventory. The integration of imaging and telehealth software is also expanding, improving diagnostic capabilities and workflow efficiency. The demand for comprehensive EHR solutions in veterinary practices is expected to rise as technology advances and practices seek to enhance service quality and operational effectiveness.

Regional Insights

North America veterinary EHR market accounted for the largest market share of 41.14% in 2024. The increasing adoption of digital solutions in veterinary practices due to the growing need for improved efficiency, accuracy, and data management is driving regional growth. Enhanced software features, such as integrated billing, inventory management, and client communication tools, contribute to streamlined operations. For example, cloud-based platforms like ezyVet and Avimark are popular for their scalability and accessibility. Additionally, rising awareness of data security and regulatory compliance requirements pushes practices to upgrade to advanced EHR systems. The demand for comprehensive, user-friendly solutions that support diverse veterinary services fuels market growth, with practices seeking technologies that enhance patient care and operational efficiency.

U.S. Veterinary EHR Market Trends

The U.S. veterinary EHR market is anticipated to dominate the North America Veterinary EHR Market due to the growing trend toward integrating specialized regulatory requirements into veterinary management systems, boosting the adoption of comprehensive EHR solutions across practices in the U.S. For instance, In June 2023, The Hospital & Veterinary Management System (HVMS) launched an integration with the Horseracing Integrity and Safety Authority (HISA) to streamline reporting and enhance workflow efficiency. This integration allows for seamless submission of HISA-related medical records, reduces duplicate entries, and simplifies compliance by automating data flow. HVMS users benefit from time savings and reduced input errors, with new practices regularly added to the system. This integration drives growth in the U.S. veterinary EHR market by improving efficiency and accuracy in compliance reporting for equine practices.

Europe Veterinary EHR Market Trends

Europe veterinary EHR market was identified as a lucrative region in the veterinary EHR market. Adopting Electronic Health Records (EHRs) in veterinary medicine is a growing trend in Europe. A 2019 survey conducted by the European Association of Veterinary Specialists (EAVS) found that 44% of responding veterinary clinics in Europe used EHRs, with the highest adoption rates in the Netherlands (73%), the UK (63%), and Germany (56%). Another study published in the Journal of Veterinary Medical Education in 2020 reported that 55% of veterinary clinics in the European Union used EHRs. Additionally, initiatives such as raising funds and innovating veterinary EHR systems contribute to market growth in Europe. For instance, in January 2023, Digitail, a Romanian pet tech company, raised over USD 10.5 million, intending to scale redesigned pet care worldwide and automate veterinarians' daily tasks.

Germany's veterinary EHR market is growing rapidly because German veterinary clinics are recognizing the value of data analytics and business intelligence in EHRs to improve patient care, optimize operations, and make data-driven decisions. VetCloud, Vetrix, EasyVet, VetRecord, and Animana are key players operating in the Germany veterinary EHR market. Furthermore, the rising number of acquisitions in the country among key players will likely drive the market. For instance, in January 2022, Heska Corporation acquired VetZ GmbH, a German company operating in veterinary Practice Information Management Software (PIMS) solutions. According to the terms of the purchase agreement, 100% of VetZ’s share capital was purchased by Heska GmbH, a wholly owned division of the company, during the closing of the acquisition.

The veterinary EHR market in UK is growing due to a high pet ownership rate, with about 60% of households having pets, which increases the need for veterinary care. Rising disease incidence and enhanced healthcare initiatives for pets and farm animals drive demand. The concentration of major players in the market and their increasing revenue reflect the growing reliance on veterinary software for standard hospital and clinic services.The presence of key companies, such as Covetrus and Zoetis, and the increase in strategic initiatives are aiding market expansion. For instance, In May 2022, Covetrus Introduced Ascend, a cloud-based practice management software built to enable veterinary practices nationwide. The software can help improve efficiency, internal communication, and collaboration, creating a better experience for clients & staff.

Asia Pacific Veterinary EHR Market Trends

Asia Pacific Veterinary EHR Market is anticipated to witness a substantial growth of 15.09% CAGR over the forecast period. The Asia Pacific veterinary EHR market is growing rapidly due to increasing pet ownership, higher demand for livestock products, and rising zoonotic diseases. Veterinary practices in developing countries like China and India are adopting software to enhance efficiency and focus on patient care. Market growth is further supported by established competitors and advanced software solutions, such as FUJIFILM Healthcare Asia Pacific Pte. Ltd.'s expansion in Thailand in February 2023. The company introduced a comprehensive suite of diagnostic imaging and informatics solutions, including advanced medical image analysis and AI, as part of its One-stop, Total Healthcare Solution.

The veterinary EHR market in Japan is experiencing significant growth due to recent regulatory changes and increasing demand for online veterinary services. The Japanese government is set to fully permit online consultations for pets to improve accessibility and convenience. For instance, in June 2024, Japan announced plans to fully permit online veterinary consultations for pets, with new guidelines set to be developed by the Ministry of Agriculture, Forestry and Fisheries. This initiative aims to enhance the adoption of online services among veterinarians and improve convenience for pet owners. The guidelines will be integrated into the regulatory reform promotion council's implementation plan, pending Cabinet approval. This move follows the Japan Veterinary Medical Association’s 2022 guidelines and builds on the success of similar reforms for human healthcare and farm animals. Strong support from pet owners and veterinarians underscores the growing trend toward integrating digital solutions in veterinary care.

Latin America Veterinary EHR Market Trends

The Latin America Veterinary EHR Market is driven by increasing pet ownership and rising awareness of animal healthcare, which drives the need for efficient management solutions. Additionally, internet connectivity and technological infrastructure improvements facilitate the adoption of digital tools. The growing emphasis on enhancing veterinary services and operational efficiency further boosts the demand for advanced EHR systems.

The veterinary EHR market in Brazil is experiencing significant growth due to rapid growth, driven by increasing pet ownership, expenditure on animal healthcare, and government initiatives to promote digitalization in healthcare. The Brazilian government has also launched several initiatives to promote digitalization in healthcare, including the National Digital Health Strategy. The strategy aims to encourage the use of digital technologies in healthcare, including EHRs, telemedicine, health analytics, and Digital Health Agencies. The agency was established to regulate and promote digital health technologies in Brazil. These initiatives are expected to drive growth in the Brazilian veterinary EHR market as clinics seek to improve patient care, streamline operations, and enhance data analysis.

Middle East & Africa Veterinary EHR Market Trends

The Middle East and Africa Veterinary EHR Market is experiencing significant growth, driven by increasing pet ownership, expenditures on animal healthcare, and government initiatives to promote digitalization in healthcare. With the implementation of data protection regulations in the MEA region, veterinary clinics are prioritizing EHR systems that ensure robust data protection and security measures to safeguard sensitive patient information.

In Saudi Arabia, the veterinary EHR market is experiencing notable growth driven by increasing pet ownership and a growing focus on advanced animal healthcare, which are significant factors. The government's investment in digital infrastructure and healthcare modernization supports adopting EHR systems. Additionally, rising awareness among veterinarians and pet owners about the benefits of digital records is fueling market expansion. The influx of international EHR providers and local initiatives to enhance veterinary services further contribute to the market's growth.

Key Veterinary EHR Company Insights

Some key players operating in the market include IDEXX, Covetrus Inc. (Henry Schein), and others. The market is highly competitive, with many key players accounting for most of the share. New product developments, mergers and acquisitions, and collaborations are major strategies these players adopt to counter the stiff competition.

Key Veterinary EHR Companies:

The following are the leading companies in the veterinary EHR market. These companies collectively hold the largest market share and dictate industry trends.

- OSP

- Shepherd App

- Covetrus Inc. (Henry Schein)

- IDEXX

- Hippo Manager Veterinary Software

- Onward Vet

- DaySmart Software, Inc.

- Digitail

- ProVet (NordHealth)

- Oehm und Rehbein GmbH.

Recent Developments

-

In November 2024, Schwarzman Animal Medical Center in New York City, the largest veterinary teaching hospital in the world and a Level 1 trauma center, adopted “Instinct” as its veterinary practice management software as it supports AMC's mission to elevate patient safety and use data more effectively while minimizing the time spent on record-keeping.

-

In March 2024, the Breeders' Cup World Championships collaborated with Equine MediRecord to utilize the latter's equine welfare compliance software platform for the 2024 world championships.

-

In February 2024, IDEXX Laboratories launched Vello, a pet owner engagement software designed to integrate with ezyVet, Neo, and Cornerstone practice management systems. This tool simplifies communication between veterinary practices and pet owners, reducing no-shows and enhancing client interaction through automated reminders, online scheduling, and two-way texting.

-

In January 2024, Instinct Science acquired VetMedux to expand and improve essential resources like Clinician's Brief and Plumb's, strengthening Instinct's position in the veterinary software market. Both companies collaborated to utilize their technology and clinical content expertise to enhance veterinary care.

Veterinary EHR Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 735.76 million

Revenue Forecast in 2030

USD 1.37 billion

Growth Rate

CAGR of 13.4% from 2025 to 2030

Historical data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Practice type, delivery mode, application, end-use, region.

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait.

Key companies profiled

OSP, Shepherd App, Covetrus Inc. (Henry Schein), IDEXX, Hippo Manager Veterinary Software, Onward Vet, DaySmart Software, Inc., Digitail, ProVet (NordHealth), Oehm und Rehbein GmbH.

Customization scope

Free report customization (equivalent to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary EHR Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. for this study, Grand View Research has segmented the global veterinary EHR market report based on practice type, delivery mode, application, end-use, and region.

-

Practice Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Animals

-

Mixed Animals

-

Equine

-

Food-producing Animals

-

Others

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud/Web-Based

-

On-premise

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Practice Management

-

Imaging

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals/Clinics

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global veterinary EHR market size was estimated at USD 662.0 million in 2024 and is expected to reach USD 735.8 million in 2025.

b. The global veterinary EHR market is expected to grow at a compound annual growth rate of 13.4% from 2025 to 2030 to reach USD 1.37 billion by 2030.

b. North America accounted for the largest market share of 41.14% in 2024. The increasing adoption of digital solutions in veterinary practices due to the growing need for improved efficiency, accuracy, and data management is driving regional growth.

b. Some key players operating in the veterinary EHR market include OSP, Shepherd App, Covetrus Inc. (Henry Schein), IDEXX, Hippo Manager Veterinary Software, Onward Vet, DaySmart Software, Inc., Digitail, ProVet (NordHealth) and Oehm und Rehbein GmbH.

b. The market is primarily driven by increasing pet ownership, the rising prevalence of zoonotic diseases, and the need for efficient practice management solutions that improve patient care, streamline workflows, and ensure regulatory compliance. Innovations in cloud computing, data analytics, and mobile technology have enhanced the capabilities of veterinary EHR systems, making them more accessible, user-friendly, and efficient, which boosts market adoption

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.