- Home

- »

- Animal Health

- »

-

Veterinary Endocrinology Market Size & Share Report, 2030GVR Report cover

![Veterinary Endocrinology Market Size, Share & Trends Report]()

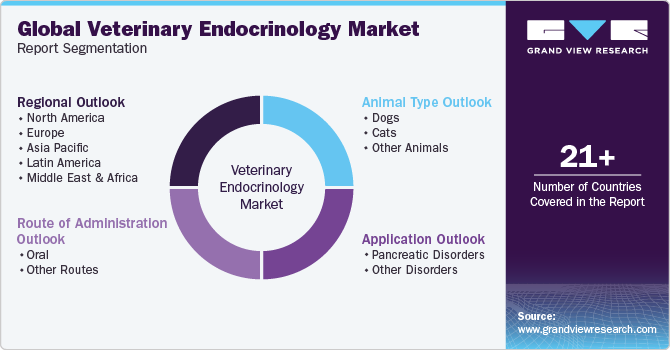

Veterinary Endocrinology Market (2024 - 2030) Size, Share & Trends Analysis Report By Animal Type (Dogs, Cats), By Application (Pancreatic Disorders, Other Disorders), By Route Of Administration (Oral, Other Routes), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-295-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Endocrinology Market Trends

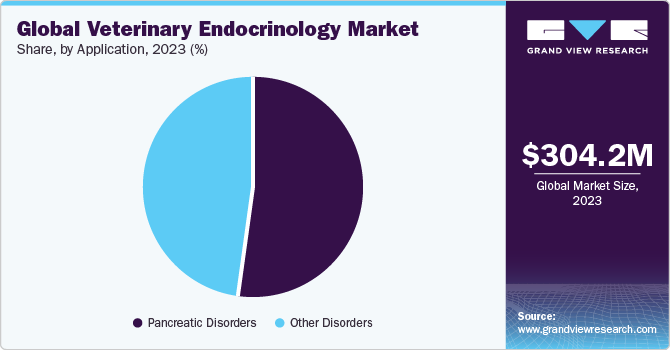

The global veterinary endocrinology market size was estimated at USD 304.24 million in 2023 and is projected to grow at a CAGR of 6.8% from 2024 to 2030. The primary drivers of market growth include increasing pet humanization, disease prevalence, medicalization rate, adoption of pet insurance, and R&D initiatives & other strategic initiatives by key companies. In August 2023, Boehringer Ingelheim received FDA approval for Senvelgo- the first liquid oral medicine for glycemic control in cats with diabetes mellitus. This expanded the company’s portfolio.

The increasing prevalence of endocrine disorders such as diabetes, Cushing's disease, Addison's disease, and thyroid disorders in pets is significantly driving the market growth. This trend is largely due to advancements in veterinary diagnostics, which enable more frequent and accurate detection of these conditions. As awareness among pet owners and veterinarians grows, there is a higher demand for specialized treatments to manage these disorders effectively. As per a study published in December 2021 in the National Library of Medicine, the prevalence for Cushing's syndrome in dogs in the UK was estimated at 0.17%.

The market is also driven by increasing R&D efforts from leading companies focusing on key endocrine conditions in animals. Key players like Dechra and Boehringer Ingelheim are spearheading this growth by developing innovative diagnostic tools and therapeutic solutions. In 2023, Dechra reported that endocrine therapy under feasibility for dogs while another endocrine therapy was under research for cats. The company also reported 2 endocrine therapies under development for dogs and horses respectively. Moreover, the company is pursuing registration for an endocrine diagnostic product and an endocrine therapy for dogs thus indicating a robust R&D pipeline.

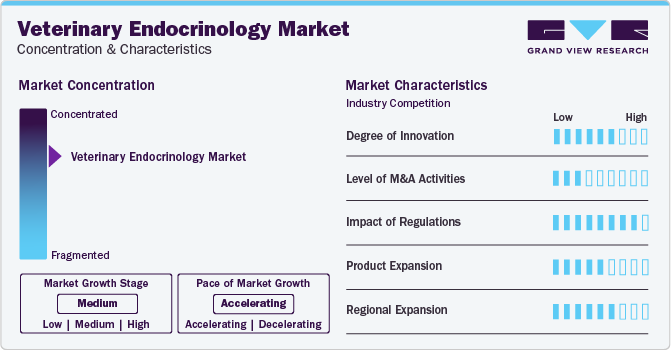

Market Concentration & Characteristics

The veterinary endocrinology market exhibits a high degree of concentration, dominated by a few large corporations. Key players in this market include Dechra, Zoetis, Boehringer Ingelheim, Merck, and Elanco. These companies hold substantial market shares due to their product lines, strong R&D capabilities, and comprehensive distribution networks.

The market is also currently experiencing a moderate growth stage, characterized by steady and incremental advancements. This growth is driven by factors such as the increasing diagnostic rate of endocrine disorders in animals, heightened awareness among pet owners, and advancements in diagnostic and treatment options.

The pace of market growth is estimated to be accelerating reflecting a rapid expansion driven by technological advancements among others. Technological advancements in diagnostic tools and treatment options have significantly improved the ability to diagnose and manage endocrine disorders in animals, such as diabetes and thyroid diseases. These innovations make endocrine care more effective and accessible, prompting a swift increase in demand.

The market is characterized by a moderate to high degree of innovation, driven by ongoing advancements in diagnostic technologies, treatment methodologies, and pharmaceutical developments. This innovation is fueled by increased research and development investments, as well as a deeper understanding of endocrine diseases in veterinary medicine.

The market exhibits a low level of merger and acquisition (M&A) activities, indicating that companies in this sector are primarily focusing on organic growth and innovation rather than consolidating through mergers or acquisitions. This can be attributed to the specialized nature of veterinary endocrinology, where expertise and proprietary technologies play a significant role. As a result, firms tend to invest heavily in R&D to advance their own diagnostic tools and treatments rather than seeking to acquire other companies.

The impact of regulations on the market is high, which play a crucial role in shaping the development, approval, and distribution of endocrine treatments. Regulatory bodies, such as the FDA in the United States and EMA in Europe, enforce stringent guidelines to ensure the safety, efficacy, and quality of veterinary endocrine therapies.

The market experiences a moderate degree of product expansion, indicating a steady but not overwhelming increase in the variety and sophistication of available treatments.

The market is characterized by a moderate to high degree of regional expansion reflecting a growing global reach of products. This expansion is driven by increasing awareness and demand for advanced veterinary care across various regions, including emerging markets where pet ownership and the focus on animal health are rising.

Animal Type Insights

By animal type, dogs segment dominated the market with a share of 61.2% in 2023. This is due to the higher prevalence of endocrine disorders in dogs compared to other pets and increasing diagnostic rates. The humanization of pets and longer lifespan of pets further drive the demand for specialized veterinary care. This results in a significant share of the market focusing on canine endocrinology, supported by advancements in veterinary diagnostics and treatment options tailored to the unique endocrine health needs of dogs. As per an April 2024 survey by Canine Addison's Resources & Education (CARE), out of the 808 dogs diagnosed with Addison’s disease, about 77% were over the age of 2 years.

Other animals segment comprising horses is expected to grow at the fastest growth rate during the forecast period. This is owing to an increasing awareness and diagnosis of endocrine disorders in equine populations. Conditions such as equine metabolic syndrome and pituitary pars intermedia dysfunction (PPID) are gaining recognition among veterinarians and horse owners, driving the demand for specialized endocrine treatments and diagnostics. Additionally, advancements in veterinary medicine and technology are making it easier to diagnose and manage these conditions in horses, thereby accelerating market growth in this segment. In February 2024, Dechra launched Pergocoat- for the treatment of pituitary pars intermedia dysfunction (PPID) in horses.

Application Insights

The pancreatic disorders segment held the highest share of the market by application in 2023. This segment is driven by the high prevalence and chronic nature of diabetes mellitus in pets, particularly dogs and cats. Managing diabetes in animals requires continuous monitoring, insulin administration, and regular veterinary check-ups, all of which contribute to substantial market demand. The increased awareness among pet owners about the symptoms and long-term management of diabetes, along with advances in veterinary diagnostics and treatment options, have cemented this segment's leading position. Vetsulin by Merck for instance, is a porcine insulin zinc suspension for diabetes management in dogs and cats.

On the other hand, the other disorders segment, which includes conditions such as Addison's disease, Cushing's syndrome, and thyroid disorders (both hypo- and hyperthyroidism), is expected to grow the fastest at a rate of 7.08% in the near future. This rapid growth is fueled by a rising recognition and diagnosis of these endocrine disorders across a wider range of animal species. Improved diagnostic techniques, availability of medications, and a broader understanding of these conditions among veterinarians and pet owners have led to increased detection and treatment. As per Dechra’s 2023 Annual report, Vetoryl is the only licensed treatment for Cushing’s syndrome or hyperadrenocorticism in dogs.

By Route Of Administration Insights

By route of administration, oral segment dominated the market in 2023. This is attributed to the convenience and ease of administering oral medications to pets. Pet owners generally prefer oral medications because they can be given at home without the need for professional assistance, making it less stressful for both the pet and the owner. Oral medications are also widely available and often more cost-effective compared to other forms. The broad acceptance and adherence to oral treatments for managing chronic endocrine disorders, such as diabetes and thyroid conditions, have reinforced the prominence of this segment in the market. Vetoryl, Forthyron, Bexacat, SENVELGO, Felimazole, Thyro-Tabs, and Thyforon are some of the key endocrine medications given orally to pets.

Conversely, the other routes segment, primarily comprising injectables, is anticipated to grow at the fastest CAGR from 2024 to 2030. This growth is driven by the increasing recognition of the effectiveness and rapid action of injectable treatments, especially for acute and severe endocrine disorders. Additionally, advancements in veterinary biotechnology have led to the development of long-acting injectable formulations, reducing the frequency of administration and improving compliance. The growing demand for these advanced therapeutic options, along with their expanding availability and adoption by veterinary professionals, is expected to significantly boost the growth of the injectables segment in the coming years.

Regional Insights

The North American market attributed to the largest share of 40.3% of the total market by region in 2023. The market continues to expand due to the high prevalence of endocrine disorders among companion animals and the advanced state of veterinary care in the region. Pet ownership rates are high, with a significant proportion of households considering pets as family members, leading to increased spending on pet health. The region benefits from a well-established veterinary infrastructure, extensive research and development activities, and a strong presence of key market players.

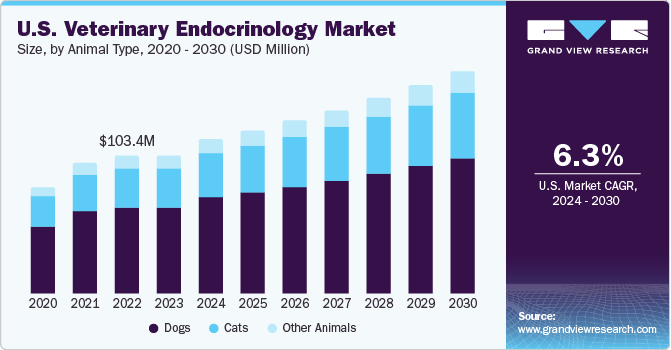

U.S. Veterinary Endocrinology Market Trends

The market in the U.S. accounted for the largest share by country in North America in 2023. This dominance is driven by a combination of high pet ownership, a substantial focus on pet health, and advanced veterinary practices. The growing awareness among pet owners about the importance of managing endocrine health issues, coupled with the availability of state-of-the-art diagnostic and therapeutic technologies, supports the market's growth. Additionally, the strong network of veterinary clinics and hospitals, along with a highly skilled veterinary workforce, ensures effective delivery of endocrine care, making the U.S. a leading market within North America.

Europe Veterinary Endocrinology Market Trends

The market in Europe is driven by the region's large and diverse pet population and the increasing awareness of endocrine disorders among pet owners. European countries such as Germany, France, and the UK are witnessing advancements in veterinary care, with a focus on early detection and comprehensive management of conditions like diabetes, thyroid disorders, and adrenal dysfunctions in companion animals. The presence of well-established veterinary infrastructure, extensive research and development activities, and collaborations between veterinary professionals and pharmaceutical companies contribute to the market's expansion.

The UK veterinary endocrinology market dominated the European market by country in 2023. The presence of leading veterinary research institutions and collaborations between academia and industry drive innovation in the field, ensuring continuous advancements in veterinary endocrinology. Additionally, stringent regulatory frameworks and quality standards uphold the integrity of veterinary products and services, further bolstering the growth and sustainability of the market in the UK.

Asia Pacific Veterinary Endocrinology Market Trends

The market in Asia Pacific is anticipated to grow at the highest CAGR of 7.96% from 2024 to 2030. Economic growth and rising disposable incomes in countries such as India, Japan, and Australia are enabling pet owners to spend more on advanced veterinary care. The region is also witnessing improvements in veterinary infrastructure and access to state-of-the-art diagnostic and treatment technologies for endocrine disorders like diabetes, thyroid diseases, and adrenal dysfunctions. Furthermore, growing investments in veterinary education and professional training are enhancing the capabilities of veterinarians in the region, contributing to the market's growth.

The China veterinary endocrinology market dominated the Asia Pacific market by country in 2023. This is driven by the country’s rapidly expanding pet population and increasing emphasis on pet health care. Chinese pet owners are becoming more aware of endocrine disorders such as diabetes and hypothyroidism, leading to a higher demand for specialized veterinary services. The development of veterinary infrastructure, including advanced diagnostic laboratories and specialized veterinary clinics, is supporting the effective management of these conditions. Moreover, China's growing middle class and rising disposable incomes are enabling more pet owners to afford comprehensive veterinary care.

Latin America Veterinary Endocrinology Market Trends

The Latin American market is poised for notable expansion in the near future, driven by several key factors. As urbanization and economic development continue across the region, more households are adopting pets and investing in their care. Veterinary practices are evolving, with improved access to advanced diagnostic tools and treatment options for endocrine disorders like diabetes, hypothyroidism, and Cushing's syndrome. Additionally, the growth of veterinary education and professional training programs is enhancing the capabilities of veterinarians in managing complex endocrine conditions.

The Brazil veterinary endocrinology market dominated the Latin American market by country in 2023. Economic growth and increasing disposable incomes allow pet owners to invest more in comprehensive veterinary care, making Brazil a key market within Latin America for veterinary endocrinology. In 2020, Dechra reported that its key endocrine brands- Vetoryl, Zycortal, and Felimazole were progressing though the fast track process in Brazil. This would allow the company to commercialize the products.

Middle East & Africa Veterinary Endocrinology Market Trends

The market in the Middle East & Africa region is projected to grow notably in the coming years. This is attributed to the increasing awareness of pet health and the rising adoption of companion animals. Although the market is not as mature as in other regions, there is a growing recognition of endocrine disorders in pets, such as diabetes and thyroid conditions, which necessitates advanced veterinary care. Improvements in veterinary infrastructure, coupled with greater access to diagnostic and treatment options, are contributing to market growth.

The South Africa veterinary endocrinology market dominated the MEA market by country in 2023. The veterinary sector in South Africa is becoming more sophisticated, with improvements in diagnostic capabilities and treatment options available for managing endocrine disorders. Additionally, as the pet ownership culture grows and the economy strengthens, pet owners are more willing to invest in comprehensive health care for their animals, supporting the expansion of the market in South Africa.

Key Veterinary Endocrinology Company Insights

The market is highly competitive, driven by the increasing prevalence of endocrine disorders such as diabetes, Cushing's disease, and Addison's disease in pets. Major pharmaceutical companies like Dechra Pharmaceuticals, Zoetis, Boehringer Ingelheim, Elanco, and Merck are prominent players, each offering specialized medications and treatments. These companies invest significantly in research and development to innovate and improve treatment options, striving to address the unique needs of veterinary endocrinology. The competition is further fueled by advancements in diagnostic technologies and a growing emphasis on early detection and comprehensive disease management.

To maintain a competitive edge, these companies not only develop new drugs but also provide extensive support and education to veterinarians, ensuring the effective use of their products. Strategic partnerships, acquisitions, and expanding product portfolios are common strategies employed to capture larger market shares. The competitive landscape is characterized by a constant push for better efficacy, safety, and convenience in treatment protocols, reflecting the broader trend of improving pet healthcare standards.

Key Veterinary Endocrinology Companies:

The following are the leading companies in the veterinary endocrinology market. These companies collectively hold the largest market share and dictate industry trends.

- Dechra Pharmaceuticals PLC

- Elanco

- Merck & Co., Inc.

- Boehringer Ingelheim

- ZoetisL

- LLOYD, Inc.

Recent Developments

-

In October 2023, Royal Veterinary College (RVC) partnered with Dechra in the UK to develop and launch a new Endocrinology App based around a machine learning form of AI to help vets diagnose and manage endocrine disorders in pets.

-

In December 2022, Elanco received FDA approval for Bexacat- the first oral medication for feline diabetes management. This expanded the company’s feline products lineup.

Veterinary Endocrinology Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 323.37 million

Revenue forecast in 2030

USD 480.28 million

Growth Rate

CAGR of 6.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal type, application, route of administration, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Dechra Pharmaceuticals PLC; Elanco; Merck & Co., Inc.; Boehringer Ingelheim; Zoetis; LLOYD, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Endocrinology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary endocrinology market report based on animal type, application, route of administration, and region.

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Other Animals

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pancreatic Disorders

-

Other Disorders

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Other Routes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global Veterinary Endocrinology market size was estimated at USD 304.24 million in 2023 and is expected to reach USD 323.37 million in 2024.

b. The global Veterinary Endocrinology market is expected to grow at a compound annual growth rate of 6.82% from 2024 to 2030 to reach USD 480.28 million by 2030.

b. The North American Veterinary Endocrinology Market attributed to the largest share of 40.34% of the total market by region in 2023. The market continues to expand due to the high prevalence of endocrine disorders among companion animals and the advanced state of veterinary care in the region.

b. Some key players operating in the Veterinary Endocrinology market include Dechra Pharmaceuticals PLC; Elanco; Merck & Co., Inc.; Boehringer Ingelheim; Zoetis; LLOYD, Inc.

b. Key factors that are driving the market growth include increasing pet humanization, disease prevalence, medicalization rate, adoption of pet insurance, R&D initiatives, and other strategic initiatives by key companies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.