- Home

- »

- Animal Health

- »

-

Veterinary Orthopedics Market Size And Share Report, 2030GVR Report cover

![Veterinary Orthopedics Market Size, Share & Trends Report]()

Veterinary Orthopedics Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (TPLO, TTA, Joint Replacement, Trauma), By Animal (Canine, Feline), By Product (Implants, Instruments), By End-use (Veterinary Hospitals & Clinics), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-881-7

- Number of Report Pages: 163

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Orthopedics Market Summary

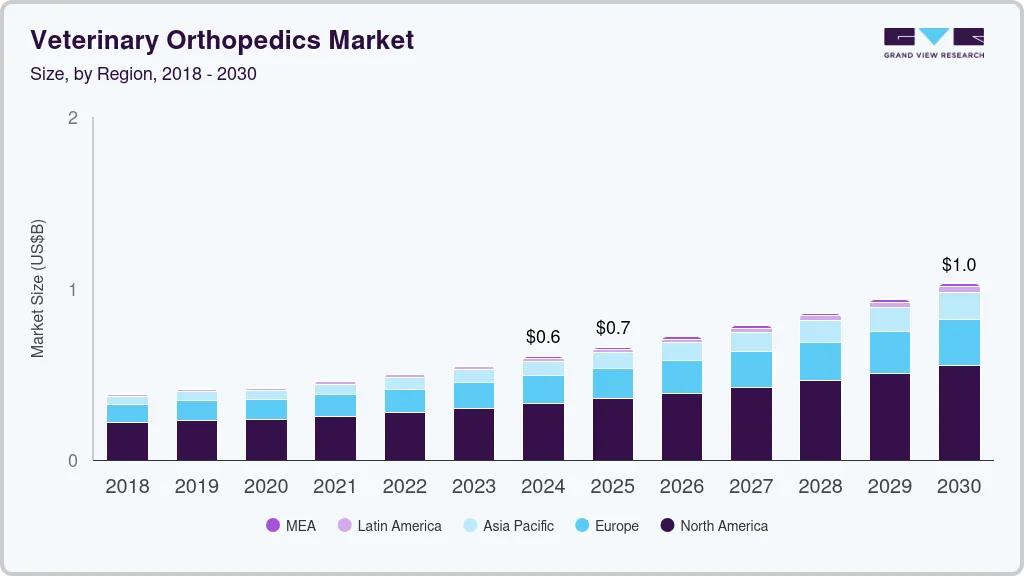

The global veterinary orthopedics market size was valued at USD 577.97 million in 2024 and is projected to reach USD 956.94 million by 2030, growing at a CAGR of 8.85% from 2025 to 2030. Leading market drivers include increasing prevalence of several diseases in pets, growing pet insurance coverage, technological advancements, supportive initiatives, and increase in pet population & pet spending.

Key Market Trends & Insights

- The North America veterinary orthopedics market accounted for the largest share of 53% of the market in 2024.

- The U.S. veterinary orthopedics market holds the largest share of the North America market.

- By application, the TPLO segment dominated the market with a share of about 29.04% in 2024.

- On the basis of animal type, the canine segment held the highest market share in 2024.

- On the basis of product, the implants segment accounted for the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 577.97 Million

- 2030 Projected Market Size: USD 956.94 Million

- CAGR (2025-2030): 8.85%

- North America: Largest market in 2024

Primary factors that lead to orthopedic problems in pets are obesity and poor nutrition. Obesity increases pressure on joints & bones. According to the Association for Pet Obesity Prevention’s (APOP) 2023 survey, 59% of dogs and 61% of cats were overweight or obese in the U.S. in 2022. In the U.S., Canada, and Europe, an estimated 63% of pet cats and 59% of pet dogs are overweight or obese.

Similarly, according to 2022 data published by the American Association of Equine Practitioners, approximately 51% of horses had a Body Condition Score (BCS) greater than 6, which is considered overweight, and around 19% of the 50% had a BCS of 8 to 9, which is considered obese. The growing pet population and ailments, combined with rising pet health concerns & pet expenditure, have led to an increase in number of surgical procedures on animals. These include orthopedic surgeries for treating a variety of acute & chronic conditions, such as trauma, fractures, arthrodesis, ligament tear, etc. The most common orthopedic surgeries performed on canines were femoral head osteotomy, bone fracture repair, cruciate ligament repair, and medial patellar luxation. BioMedtrix offers Cemented Fixation (CFX) and Biologic Fixation (BFX) Total Hip Systems for hip replacement surgeries. Since the product's launch, over 54,000 procedures have been performed globally, with about 95% of pet patients completely recovering.

3D printing has emerged as another significant advancement in veterinary orthopedics. 3D-printed anatomical guides, surgical guides, and implants are gradually finding applications in treating animals suffering from angular limb deformity or spinal malformation. However, there is scope for development. Anatomical and surgical guides are more prevalent than implants as they enhance surgical precision, predictability of outcomes, and reduce operating time.

For example, New Generation Devices (NGD) and its other products provide 3D bone & joint copies for surgical teaching and training. Specifications for 3D printing are obtained from CT, MRI, or diagnostic imaging data provided by surgeons. 3D modeling can significantly improve visualization during surgery. It also helps train veterinarians in various orthopedic surgeries.

Growing investments by key players to develop technologically advanced devices in different sizes for better treatment options are expected to contribute to market growth. Market players are actively focused on innovating and developing new orthopedic devices & implants. For instance, in June 2024, Fusion Implants, in collaboration with Chestergates Veterinary Hospital, successfully enabled a paralyzed puppy to walk again using bespoke 3D-printed spinal screws and surgical cement.

This innovative approach significantly improved the puppy’s prognosis and highlighted Fusion Implants’ commitment to advancing veterinary care through precision 3D printing technology and strategic partnerships in specialized surgeries.

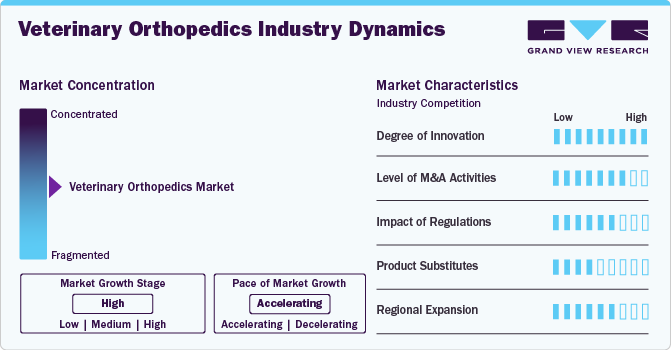

Market Concentration & Characteristics

The market growth stage is medium, while the pace of market growth is accelerating. Moreover, it is characterized by a medium to a very high degree of innovation with a medium threat of product substitutes. It is also characterized by the notable number of merger & acquisition activities and has a low to medium impact of regulations. Market dynamics vary across regions, influenced by pet adoption, veterinary infrastructure, and economic conditions.

Advancements in veterinary medicine, including orthopedic procedures, contribute to market expansion. This veterinary orthopedics industry encompasses a wide range of orthopedic implants, including plates, screws, pins, joint implants, and others. Manufacturers develop specialized products for different types of animals, considering variations in size and anatomy. Ongoing technological developments in materials and design contribute to improving implant quality and efficacy. This is anticipated to contribute to market growth in the coming years.

Key players in this market engage in strategic initiatives, such as product launches, collaborations, and acquisitions, to strengthen their market presence and propel market growth. For instance, in March 2024, Movora (Vimian Group AB) acquired Veterinary Transplant Services (VTS), a leader in veterinary grafts and tissue, enhancing its offerings in the market. This acquisition is expected to expand the company’s portfolio with VTS’s unique graft materials, supporting advanced healing solutions and continuing education for veterinary professionals.

Application Insights

By application, the TPLO segment dominated the market with a share of about 29.04% in 2024. TPLO is a popular method for repairing CCL rupture in dogs. CCL rupture is among the most common reasons for pain, hind limb lameness, and knee arthritis in dogs. A combination of factors that causes CCL, such as ligament aging, obesity, poor physical condition, genetics, and breed. CCL disease can affect dogs of all ages, sizes, and breeds, but rarely cats. The most vulnerable dog breeds include Rottweiler, Staffordshire Terrier, Newfoundland, Mastiff, Chesapeake Bay Retriever, Akita, Saint Bernard, and Labrador Retriever.

The other applications segment, comprising corrective osteotomies, tightrope, and tibial tuberosity transposition, is anticipated to grow at the fastest CAGR over 2025 - 2030. Patellar luxation is a common orthopedic condition in dogs. A March 2024 research study published in Wiley suggests that medial patellar luxation is as high as 98% in small dog breeds; on the other hand, lateral patellar luxation ranges between 17% & 33% in large dog breeds. Patellar luxation also affects dogs much more commonly than cats. Corrective osteotomies and tibial tuberosity transposition are the surgical treatments for canines with patellar luxation. Devices used in these procedures include jigs, Kirschner wires, osteotome, mallets, saw blades, and bone plates.

Animal Insights

By animal type, the canine segment held the highest market share in 2024. The increasing prevalence of orthopedic injuries in dogs participating in agility competitions is anticipated to be one of the key factors driving the veterinary orthopedics market due to the growing need for specialized care. For instance, according to a February 2024 Frontiers in Veterinary Science publication, orthopedic injuries (32.9%) were the most common health complication among dogs participating in Yukon Quest International Sled Dog Race. The data further suggests that these injuries were the most common reason participant dogs withdrew (75%) from the competition.

The feline segment is expected to register the highest CAGR from 2025 to 2030, owing to their increasing adoption and prevalence of orthopedic disorders, risk factors such as obesity, and improving diagnostic rates. Cats are frequently considered low-maintenance pets since they do not need special training for basic self-cleaning. According to the American Pet Products Association Report 2024, approximately 40 million U.S. households own cats, and cat ownership has increased among younger generations, especially millennials. Moreover, advancements in treatment options, including minimally invasive techniques and novel implants, contribute to the evolving landscape of the veterinary orthopedic market. As pet owners increasingly seek advanced care for their cats, the market will likely continue growing and adapting to meet the specific needs of feline orthopedic patients.

Product Insights

The implants segment accounted for the highest market share in 2024 and is anticipated to maintain its position during the forecast period. In recent years, there has been a significant surge in growth of veterinary orthopedic implants. Many pet owners opt for extensive orthopedic surgeries as pet insurance policies become more affordable. This advanced technology is crucial in restoring joint functionality and reducing medical expenses.

Moreover, to meet the growing demand for orthopedic devices, veterinary orthopedic implant companies are actively responding by developing and manufacturing a wide range of implants suitable for various types of animals. This signifies a positive shift in veterinary industry toward more advanced and tailored solutions for pet orthopedic interventions. Similarly, the ability to customize implant designs based on the specific needs of individual animals has significantly improved. This personalization enhances the effectiveness of the implant and contributes to better long-term outcomes. These advancements contribute to the improvement of veterinary orthopedic surgeries, making them more precise, less invasive, and tailored to the unique characteristics of each animal patient.

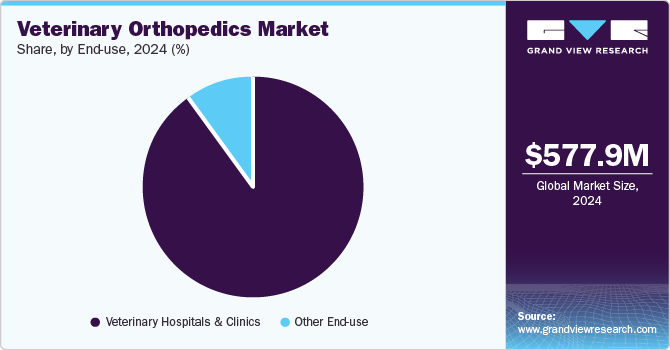

End-use Insights

By end use, the veterinary hospitals & clinics segment held the highest share of this market in 2024. Examples of orthopedic services in veterinary hospitals include surgical interventions for fractures, joint disorders, and ligament injuries. Hospitals and clinics report the most considerable footfall and are better equipped to handle orthopedic procedures & surgeries. This contributed to the dominant share held by this segment. Moreover, the availability of the required set-up for diagnostic tests and postsurgical procedures makes this segment a preferred choice for pet parents. Multiple veterinary welfare organizations have framed guidelines to maintain proper safety practices & standards in these healthcare settings, which has broadened the scope for segment growth over the past few years.

The others segment is poised to grow most over the forecast period. This segment comprises veterinary academic and research centers and academic & ambulatory care units. It is anticipated to grow at a lucrative rate during the forecast period, which can be attributed to increasing R&D investments and funding for developing therapeutically advanced surgical techniques & implants. Some investments are also made to enhance diagnostic procedures by developing new-generation technology for animal diagnosis.

Regional Insights

The North America veterinary orthopedics market accounted for the largest share of about 53% of the market in 2024. This can be attributed to the growing pet population, increasing expenditure on pet health, rising prevalence of chronic conditions, and growing orthopedic surgeries. Furthermore, key market players, well-established healthcare infrastructure, and favorable pet insurance policies can continue to drive this market over the coming years. For instance, in November 2023, Vegas Valley Pet Hospital announced the opening a veterinary facility in Las Vegas. The hospital will offer specialized care, providing pet orthopedic and soft tissue surgery. Such factors influence market growth positively.

U.S. Veterinary Orthopedics Market Trends

The veterinary orthopedics market in U.S. holds the largest share of the North America market, owing primarily to the large number of leading animal medical device companies with a local presence. The U.S. market is driven by the rising prevalence of osteoarthritis, obesity, injuries, & chronic diseases in pet population and the increasing number of pet surgeries & veterinarians available across the country. For instance, according to Zoetis, the prevalence of osteoarthritis in U.S. dogs and cats is nearly 40%. According to the Association for Pet Obesity Prevention, the pet obesity rate has been steadily increasing in recent decades, with 61% of cats & 59% of dogs being overweight or obese in 2022.

Europe Veterinary Orthopedics Market Trends

The Europe veterinary orthopedics market is expected to grow significantly over the forecast period due to increased canine & feline pets and pet care expenditure. For instance, the number of pet owners is increasing, with 166 million out of Europe's 352 million pets owned by 50% of European households. However, steady growth in dog population is poised to propel the demand for related products and services, driving the market.

The UK veterinary orthopedics market is projected to grow significantly over the forecast years, owing primarily to large pet population, increasing pet ownership, and rising incidence of joint disorders in pets. According to the PDSA, 51% of UK adults own a pet, of which 28% of UK adults have a dog (estimated population of 10.6 million pet dogs), 24% have a cat (estimated population of 10.8 million pet cats), and 2% have a rabbit (estimated population of 800,000 pet rabbits). As per VetCompass, arthritis, limb lameness, and obesity are among the top 10 diagnoses in dogs in UK.

According to Italy’s Association of Veterinary Doctors (ANMVI), the veterinary industry is growing due to increasing availability of high-quality care. Pet owners in Italy have high expectations for the quality services for treatment & surgeries provided by veterinary practices. This has led to an increasing focus on advanced diagnostics and treatment, driving the veterinary orthopedics market. In addition, increasing veterinary orthopedics product import & export, growing product demand, rising pet ownership & investment in pet care & insurance, and expanding product portfolio activities by market players are expected to fuel the market in country.

Asia Pacific Veterinary Orthopedics Market Trends

The Asia Pacific market for veterinary orthopedics in Asia Pacific has been proliferating and is projected to grow significantly over the forecast period. Primary reasons anticipated to propel the regional market are the rise in middle-class families, the growing adoption of companion animals, increasing pet expenditure, humanization of pets, strong presence of market players, and favorable government initiatives. Besides, countries such as China & India are anticipated to have strong growth potential as the number of regional facilities increases. In addition, rising consumer awareness for pet surgeries & treatment and pet insurance is expected to boost the industry in coming years.

The veterinary orthopedics market in India is expected to grow rapidly over 2025 - 2030, attributed primarily to an increase in pet ownership, pet insurance for veterinary orthopedic surgeries, growing expansion of hospitals, and numerous funding schemes by state & national agencies. In India, pet ownership is likely to continue to rise. These factors, combined with people changing their attitudes about pets and welcoming them as family members, have led to India's fast-growing pet industry. Over the past decade, the demand for quality pet care has been increasing in terms of treatment and surgeries.

Latin America Veterinary Orthopedics Market Trends

The increasing prevalence of pet injuries and product sales drives the Latin American veterinary orthopedics market. In addition, rising pet care and the presence of animal medical device companies are expected to drive the market over the forecast period. Brazil and Mexico are critical countries in the Latin American market; both have rapidly developing infrastructure & growing veterinary care services due to increasing pet population. In addition, expanding private services in country is anticipated to drive the demand for veterinary orthopedics in the region.

Brazil has the most extensive pet population in Latin America. Its market is dynamic and unique, with lucrative opportunities for veterinarians. The industry is driven by the increasing humanization of pets, demand for quality treatment, and growing pet expenditure. Furthermore, the expanding number of clinics has led to rising sales of veterinary orthopedics, creating substantial market growth in recent years. Likewise, numerous companies are expanding their presence in Brazil to support pet healthcare by developing new products. The comprehensive product offering in the country includes high-quality orthopedic-specific products & value-added services designed to help practitioners operate the most efficient practices & provide high-quality care. Such factors are expected to drive the market.

Middle East & Africa Veterinary Orthopedics Market Trends

South Africa, Saudi Arabia, UAE, and Kuwait are the key countries in the MEA market. Many regional companies are innovating veterinary orthopedics due to growing pet health concerns. The rising incidence of obesity & injuries has led to an increase in the number of veterinary surgical procedures in animals. This has led to increasing adoption of implants and other orthopedics devices for treating several acute and chronic conditions, such as trauma, fractures, arthrodesis, ligament tear, etc. Such factors are expected to drive market growth.

Saudi Arabia veterinary orthopedics market is primarily driven by increasing pet ownership and growing investments in veterinary care. As a result, veterinary care is becoming more important in Saudi Arabia for treating various bone & joint-related disorders and pet surgeries. The market in Saudi Arabia is anticipated to gain substantial revenue over the forecast period with the growing prevalence of osteoarthritis and cruciate ligament injuries. In addition, the increasing requirement for veterinary care is driving market growth. The rapidly growing animal healthcare investments and numerous facilities are expected to propel market growth.

Key Veterinary Orthopedics Company Insights

The market is significantly competitive due to several small and large companies. These companies offer a comprehensive portfolio of orthopedic implants & instruments spanning segments and target species. Furthermore, key market players like B Braun SE and Movora (Vimian) implement various strategic initiatives, such as acquisitions, regional expansion, partnerships, and collaborations, to support their growth objectives. Especially in recent years, the industry has been experiencing rapid developments due to rising innovative technologies to treat animal orthopedic complications better.

Key Veterinary Orthopedics Companies:

The following are the leading companies in the veterinary orthopedics market. These companies collectively hold the largest market share and dictate industry trends.

- B. Braun SE

- Movora (Vimian Group AB)

- Integra LifeSciences

- DePuy Synthes (Johnson & Johnson)

- AmerisourceBergen Corporation.

- Arthrex, Inc. (Arthrex Vet Systems)

- Orthomed (UK) Ltd.

- Veterinary Instrumentation

- Fusion Implants

- Narang Medical Limited

Recent Developments

-

In October 2024, veterinarians at Johnson Family Equine Hospital utilized a 3D-printed to assist them in executing complex arthrodesis deformity surgery in a horse.

-

In October 2024, VCA Animal Hospitals launched a separate laboratory with 3D printing technology dedicated to pet orthopedic surgeries.

-

In September 2024, researchers at Colorado State University announced novel research programs for orthopedic treatment in horses.

-

In August 2024, veterinarians at the College of Veterinary Medicine, Michigan State University, announced successful TPLO & I-Loc Interlocking Nail implant procedure completion in caprine (goats).

-

In June 2024, Viticus Group and Movora (Vimian) partnered to offer hands-on veterinary orthopedic training on the East Coast, specifically at the Movora Education Center in Boston. This collaboration expands continuing education opportunities in veterinary orthopedics, emphasizing advanced fracture repair techniques for veterinary professionals.

-

In April 2024, scientists at UC Davis Veterinary Medicine announced the development of Temporomandibular Prosthesis for use in orthopedic complications of cats & dogs. The institution also announced that this innovation is in the process of being patented.

-

In June 2023, Vimian acquired New Generation Devices to expand its offerings in veterinary orthopedic implants.

-

In December 2022, Vimian announced the completion of one of the first orthopedic surgeries with 3D-printed implants in dogs and horses.

Veterinary Orthopedics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 626.13 million

Revenue forecast in 2030

USD 956.94 million

Growth Rate

CAGR of 8.85% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Application, product, animal, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Brazil; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

B. Braun Melsungen AG; Vimian Group AB; Integra LifeSciences; DePuy Synthes (Johnson & Johnson); AmerisourceBergen Corporation; Arthrex, Inc.; Orthomed (UK) Ltd; Veterinary Instrumentation; Fusion Implants; Narang Medical Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Orthopedics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary orthopedics market report based on application, animal, product, end-use, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

TPLO

-

TTA

-

Joint Replacement

-

Trauma

-

Other Applications

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Implants

-

Plates

-

TPLO Plates

-

TTA Plates

-

Specialty Plates

-

Trauma Plates

-

Other Plates

-

-

Other Implants

-

Instruments

-

-

Animal Outlook (Revenue in USD Million; 2018 - 2030)

-

Canine

-

Feline

-

Other Animals

-

-

End Use Outlook (Revenue in USD Million; 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Other End-use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

Rest of Europe

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Rest of Asia Pacific

-

Latin America

-

Brazil

-

Rest of Latin America

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

Frequently Asked Questions About This Report

b. The global veterinary orthopedics market size was estimated at USD 577.97 million in 2024 and is expected to reach USD 626.13 million in 2025.

b. The global veterinary orthopedics market is expected to grow at a compound annual growth rate of 8.85% from 2024 to 2030 to reach USD 956.94 million by 2030.

b. Some key players operating in the veterinary orthopedics market include B. Braun Melsungen AG; Vimian Group AB; Integra LifeSciences; DePuy Synthes (Johnson & Johnson); AmerisourceBergen Corporation; Arthrex, Inc.; Orthomed (UK) Ltd; Veterinary Instrumentation; Fusion Implants; and Narang Medical Limited.

b. North America accounted for the largest share of about 53% of the veterinary orthopedics market in 2023. This can be attributed to the growing pet population, increasing expenditure on pet health, rising prevalence of chronic conditions, and growing orthopedic surgeries. Furthermore, key market players, well-established healthcare infrastructure, and favorable pet insurance policies can continue to drive this market over the coming years.

b. Some of the key factors accounting for market growth include increasing prevalence of several diseases in pets, growing pet insurance coverage, technological advancements, supportive initiatives, and increase in pet population & pet spending.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.