- Home

- »

- Animal Health

- »

-

Veterinary Point Of Care Diagnostics Market Size Report, 2030GVR Report cover

![Veterinary Point Of Care Diagnostics Market Size, Share & Trends Report]()

Veterinary Point Of Care Diagnostics Market Size, Share & Trends Analysis Report By Product, By Animal Type, By Sample Type, By Indication, By Testing Category, By End-Use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-824-2

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global veterinary point of care diagnostics market size was valued at USD 1.74 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 11.5% from 2023 to 2030. The market is primarily driven by increased pet-related expenditures, a rise in pet ownership technological advancements, and high demand for point of care diagnostics. For instance, companies are investing in R&D to develop point of care diagnostic equipment. For instance, IDEXX developed SDMA test kits, which make use of AI for assessing kidney functions in cats and dogs. Zoetis has a pipeline of point of care diagnostics, which is expected to be launched in the coming years. Heska also launched a range of point of care diagnostic products to broaden its product portfolio.

Growth in companion animal population is expected to increase the demand for veterinary healthcare services and boost the overall expenditure on pets. According to American Pet Products Association (APPA) report of 2021, overall spending in the U.S. pet industry increased to USD 123.6 billion. The number of surgeries performed on animals has increased in the recent past. According to a report by APPA, in 2021, pet owners in the U.S. spent around USD 34.3 billion on veterinary care and product sales. Soft tissue, cardiovascular, ophthalmic, dental, and orthopedic surgeries are some of the common types of veterinary surgeries. Costs associated with surgery, hospitalization, postsurgical follow-up, and medication are expected to propel market growth and offer untapped opportunities over the forecast period.

The overall veterinary medicalization rate is anticipated to increase over the forecast period owing to a rise in pet humanization, demand for safety & quality of food sourced from animals, as well as increasing availability of veterinary care solutions. Other factors include a steady increase in the animal population, expenditure on veterinary care, and adoption of insurance. For instance, as per Canadian Animal Health Institute (CAHI), canine and feline populations continued to grow in the country from 2020 to 2022. The dog population increased from 7.7 to 7.9 million, whereas the cat population grew from 8.1 to 8.5 million. As per the CAHI estimates, the annual medicalization rate for dogs remained stable at 86% during the period, whereas there was about a 3% increase in the medicalization rate of cats. This indicated a growing number of pet cats that visited a vet from 2020 to 2022.

The Point-of-Care (POC) diagnostic technology has overcome this barrier by providing results immediately at the point of use. This technology provides clinically relevant diagnostic information without the need for a core diagnostic laboratory. Therefore, they have the potential to reduce the cost and time associated with the veterinary diagnosis. The lateral flow technology applied in POC veterinary lateral flow devices and dipsticks have been used for decades in the diagnosis of infectious diseases among animals. These test products comprise portable immuno-chromatography strips with antigens and antibodies for specific disease diagnoses. The positive results obtained using lateral flow POC devices are medically accepted; however, in case of negative results, it may require other confirmatory laboratory tests owing to their lower sensitivity.

Growing investments by key players to develop advanced diagnostic products for better diagnosis are likely to propel the veterinary diagnostics market. For instance, Heska launched a full range of diagnostics products, such as Element RC, Element i+, and Element UF, which is expected to increase market penetration. In January 2020, IDEXX Laboratories launched new updates for SediVue Dx Urine Sediment Analyzer, Catalyst Dx, and Catalyst One chemistry analyzers to improve its product portfolio. Moreover, in October 2022, Virbac established a brand new production facility in Nîmes, France to handle the rising demand for the pet food line. The entire process from the first materials to the final result will be integrated into this site as it develops.

Extensive R&D investments in animal health in developed economies are creating growth opportunities. Implementation of the Nationwide Health Information Network (NHIN) that facilitates secure health information exchange is anticipated to encourage hospitals and acute care providers to adopt HIE systems. Sudden disease outbreaks and emergencies, such as feed shortages, are potential threats to this market, which may result in large-scale animal death if the countries are not technologically equipped. Foreign exchange, inflation, interest rates, supply chain, labor restrictions, pet patient visit trends, pandemic-era comparisons, delayed regulatory approvals, and a slower-than-expected product introduction in 2022 are challenges in the market. Moreover, high interest rates, tight labor markets, stubbornly low inflation of 8%, and an end to year-over-year clinic visits have all been observed in Europe.

Product Insights

The consumables, reagents, and kits segment accounted for the largest share in 2022. This is owing to large product availability, subscription-based or repetitive payments sales model for reagents and consumables, and other initiatives by key companies. More than 90% of Heska Corporation’s point-of-care consumables, for instance, are on long-term subscriptions. The total subscriptions were 2,376 in 2019 and this number increased to 2,980 in 2020. The company reported a subscriber retention rate of over 95%. In addition, North America POC Lab Consumables sales of the company were up by 13.2% in Q4 2021. Whereas International POC lab consumables sales were up 42.2% for the year 2021.

The instruments and devices segment is projected to expand at the fastest rate in the forecast period owing to growing product enhancements and demand for these products. Growing demand for animal-derived food is anticipated to increase the requirement for immunodiagnostic tests for animals over the forecast period. Clinical chemistry and immunodiagnostic kits are major products used in veterinary diagnostics. This is because of the increase in demand for detecting general health profiles of animals. On the other hand, advancements in immunodiagnostic kits for veterinary use are expected to drive their adoption over the forecast period.

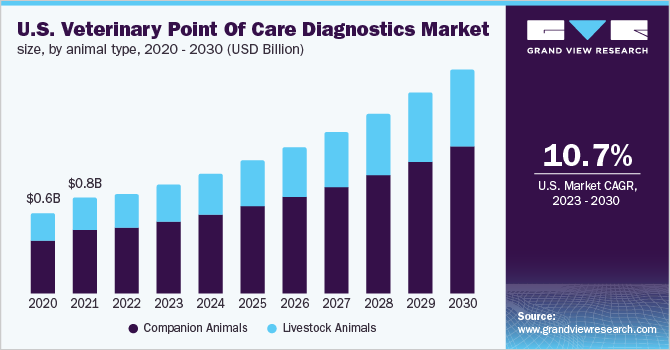

Animal Type Insights

The companion animal segment is expected to hold a significant share of the market over the forecast period. This can be attributed to increasing pet adoption during the pandemic, which is expected to propel market growth over the forecast period. For instance, nonprofit rescues, private breeders, and shelters reported high consumer demand post-COVID-19 in the U.S. Strong product pipelines of IDEXX, Zoetis, and Heska Corporation are expected to propel market growth over the forecast period. For instance, in August 2020, Zoetis acquired Scandinavian Micro Biodevices and increased its revenue in veterinary diagnostics. Commonly used point of care diagnostics for companion animals include urinalysis strips, blood glucose monitors, and pregnancy kits. The rate of consumption and usage of consumables and reagents for diagnosis is increasing during veterinary diagnostic testing. This can be attributed to a global increase in awareness about zoonotic diseases and growing pet adoption & concern regarding their health.

The livestock animal market is expected to hold a significant share of the market over the forecast period. This can be attributed to increasing livestock productivity. Livestock animals comprise cattle, swine, poultry, and others. The major drivers of the livestock animal market include the rising incidence of zoonotic diseases and the large population of livestock. An increasing number of veterinary practitioners is a major driver fueling the growth of livestock animal market. In addition, key market players are expanding their product portfolios of diagnostic kits & solutions and offering their services worldwide, which is expected to boost the market growth.

Testing Category Insights

Parasitology accounted for the largest share in 2022. Parasitological tests are used to diagnose internal and external parasites in animals. Tests for internal parasites typically involve the examination of feces for parasite eggs. Whipworm, roundworm, Giardia, hookworm, and coccidia are the most frequently diagnosed internal parasites as per the Companion Animal Parasite Council (CAPC) and are most commonly diagnosed by fecal examination. Zoetis, for instance, launched Imagyst to enable vets to make fast and accurate diagnoses at the point of care by automating the fecal examination to detect endoparasitic eggs, cysts, & oocysts. The product provides results in less than 9 minutes, allowing veterinarians to share results with pet parents and offer treatment options during the initial visit. This ultimately removes the need for a second appointment.

Cellular components of blood such as white blood cells, red blood cells, and platelets come under hematological testing. Among the various hematological tests, Complete Blood Count (CBC) test is the most common. CBC is recommended for companion animals in case of symptoms such as fever, vomiting, diarrhea, weakness, or anorexia. CBC provides details about the pet’s infection, blood clotting ability, hydration status, anemia, and immune system response. Estimating the number of red blood cells and their shape, size, & hemoglobin content can help identify disorders such as anemia. White blood cell count gives information about inflammation caused by factors such as an infection. Examination of platelets, such as changes in the total number of platelets or appearance, as part of the CBC test, can help identify blood clotting disorders.

Indication Insights

The infectious disease segment dominated the animal diagnostics market and held the largest market share in 2022. This is owing to the rising prevalence of zoonotic diseases, which is further responsible for market growth. According to United Nations Environment Programme and the International Livestock Research Institute, 75% of all emerging infectious diseases were reported as zoonotic in 2019. The increasing prevalence of foot and mouth disease in livestock animals is again a major factor responsible for market growth. According to WHO, this disease is estimated to spread in 77% of the global livestock population in the Middle East & Asia, Africa, and some areas of South America.

The general ailment disease is the fastest-growing segment in the veterinary point-of-care diagnostic market. There is an increase in the number of diagnostic companies entering the market with innovative technologies to determine diseases in animals. For instance, the Lab on a Chip technology analyzes electrolytic imbalance in the body fluids such as blood, urine, and milk.

Sample Type Insights

On the basis of sample type, the blood/plasma/serum segment held the largest share of the market in 2022. According to the Kirkwood Animal Hospital in the U.S., regular blood tests are recommended as a key part of a companion animal’s overall wellness program. This is because these tests help identify issues before they become visible or apparent, thereby ensuring timely corrective action. This, in turn, translates into better health outcomes and reduced total costs for pet parents. Blood tests are also more affordable and far less invasive than treating ailments. Kirkwood Animal Hospital, for instance, uses blood tests to identify or rule out potential congenital diseases in pets, discover issues that do not appear during a physical examination and obtain preanesthetic information before surgical or interventional procedures.

Urinalysis is based on the evaluation of constituents of urine. It is an easy-to-use, cost-effective, and key initial diagnostic test. Complete urine analysis includes the examination of turbidity, volume, color, odor, pH, protein, glucose, specific gravity, ketones, blood, epithelial cells, casts, crystal, organisms, erythrocytes, and leukocytes. Semi-quantitative urinalysis with urine dipsticks, or an automatic analyzer, provides multiple biochemical data. It provides insight into the occurrence, length, and extent of urinary tract diseases. In addition, it can provide information about physical health, fluid balance, systemic illness, physiological condition, and harmful insults, and is the best way to diagnose kidney dysfunction before renal failure happens.

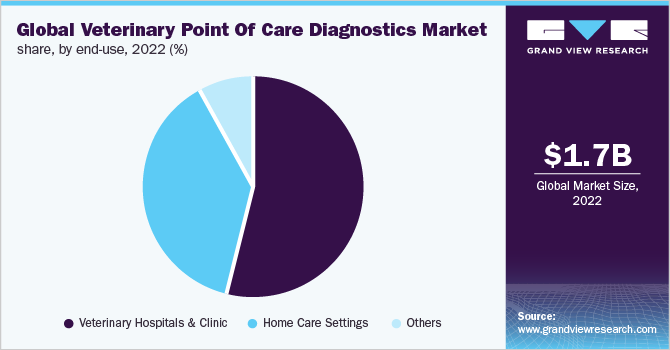

End-use Insights

The veterinary hospitals & clinics segment dominated the end-use segment, due to the increased number of patients visiting these facilities for treatment & diagnosis and the rising demand for animal diagnostic testing in the detection of infectious diseases in small & large animals. Government funding to veterinary hospitals and clinics is one of the major factors propelling the market. For example, according to SAVA-CVC, South African Veterinary Association gives support to community veterinary clinics by producing shared central fundraising & marketing, digital education information, central medical supply contract negotiations, and shared learning & mentoring.

The home care settings segment is expected to witness the fastest growth over the forecast period. The end consumers, such as pet owners, are gaining valuable benefits from the technologically advanced veterinary diagnostics such as in-house analyzers and point of care for their convenience & quick results.

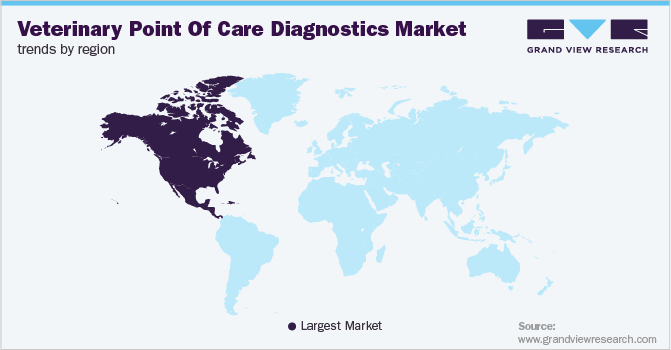

Regional Insights

North America dominated the veterinary Point-of-care (PoC) diagnostic market in 2022, which is attributed to the local presence of major animal healthcare companies. Advancements in veterinary healthcare infrastructure in Canada and the U.S. are enabling real-time diagnosis, which is anticipated to further R&D activity and new product development. Moreover, the increased number of veterinarians and veterinary clinics in the region is propelling the market growth. For example, according to American Veterinary Medical Association (AVMA), there were around 121,461 veterinarians in the U.S. in 2021.

The markets in the Asia Pacific include China, Japan, India, and Australia. The development of rapid, accurate, and sensitive diagnostic methods for detecting pathogens responsible for animal diseases; development of innovative products, software, & applications; and development & adoption of advanced technologies are expected to boost the market in this region. The increasing demand for veterinary POC diagnosis is growing, owing to the reduced number of clinical visits, as well as the better accuracy & faster results offered by it. Some of the key market players that have contributed significantly to the revenue generation in the Asia Pacific market are FUJIFILM Corporation, SOUND, Heska Corporation, Thermo Fisher Scientific, Inc., Zoetis, IDEXX Laboratories, Inc., and others.

Key Companies & Market Share Insights

The competitive rivalry in this market is expected to be moderate. There are few major companies in the veterinary point-of-care diagnostics space. Many new drugs and diagnostics are expected to be introduced in the market over the next few years. Local players and online sales of these devices & kits present huge competition. Existing players are enhancing their product portfolios with technologically advanced products and are widening their geographic reach by acquiring small and local players. For instance, in January 2022, IDEXX Laboratories expanded its reference laboratory menu for different tests and services. This can enable veterinarians to meet the challenges of treating and diagnosing cancer. Some of the prominent players in the global veterinary point of care diagnostics market include:

-

Zoetis

-

IDEXX

-

Virbac

-

Heska Corporation

-

Thermo Fisher Scientific, Inc

-

SOUND

-

Mindray

-

Esaote SPA

-

FUJIFILM Corporation

-

Woodley Equipment Company Ltd

Veterinary Point Of Care Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.92 billion

Revenue forecast in 2030

USD 4.13 billion

Growth Rate

CAGR of 11.5% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Product, animal type, indication, testing category, sample type, end-use, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Germany; France; Italy; Spain; UK; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; Israel

Key companies profiled

Zoetis; IDEXX; Virbac; Heska Corporation; Thermo Fisher Scientific Inc; SOUND; Mindray; Esaote SPA; FUJIFILM Corporation; Woodley Equipment Company Ltd

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Point Of Care Diagnostics Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary point of care diagnostics market report based on product, animal type, indication, testing category, sample type, end-use, and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Consumables, Reagents, & Kits

-

Instruments & Devices

-

-

Animal Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Companion Animals

-

Dogs

-

Cats

-

Horses

-

Others

-

-

Livestock Animals

-

Cattle

-

Swine

-

Poultry

-

Others

-

-

-

Sample Type Outlook (Revenue, USD Million; 2018 - 2030)

-

Blood/Plasma/Serum

-

Urine

-

Fecal

-

Others

-

-

Indication Outlook (Revenue, USD Million; 2018 - 2030)

-

Infectious Disease

-

General Ailments

-

Others

-

-

Testing Category Outlook (Revenue, USD Million; 2018 - 2030)

-

Hematology

-

Diagnostic Imaging

-

Bacteriology

-

Virology

-

Cytology

-

Clinical Chemistry

-

Parasitology

-

Serology

-

Others

-

-

End-Use Outlook (Revenue, USD Million; 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Home Care Settings

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

South Arabia

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global veterinary point of care diagnostics market size was estimated at USD 1.74 billion in 2022 and is expected to reach USD 1.92 billion in 2023.

b. The global veterinary point of care diagnostics market is expected to grow at a compound annual growth rate of 11.5% from 2023 to 2030 to reach USD 4.13 billion by 2030.

b. North America dominated the veterinary PoC diagnostics market with a share of about 53.33% in 2022. This is attributable to the presence of key market players and advanced veterinary healthcare infrastructure in the U.S. and Canada.

b. Some key players operating in the veterinary PoC diagnostics market include IDEXX; Zoetis; Virbac; Heska Corporation; Thermo Fisher Scientific, Inc.; SOUND; Mindray; Esaote SpA; FUJIFILM Corporation; and Woodley Equipment Company Ltd.

b. Key factors that are driving the veterinary point of care diagnostics market growth include technological advancements, rising pet population & humanization, the need to reduce antimicrobial resistance, and expansion of service offerings by vet clinics.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."