- Home

- »

- Animal Health

- »

-

Veterinary Renal Disease Market Size, Industry Report, 2030GVR Report cover

![Veterinary Renal Disease Market Size, Share & Trends Report]()

Veterinary Renal Disease Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Diagnosis, Treatment), By Animal Type (Canine, Feline), By Route of Administration, By Indication, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-187-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Renal Disease Market Summary

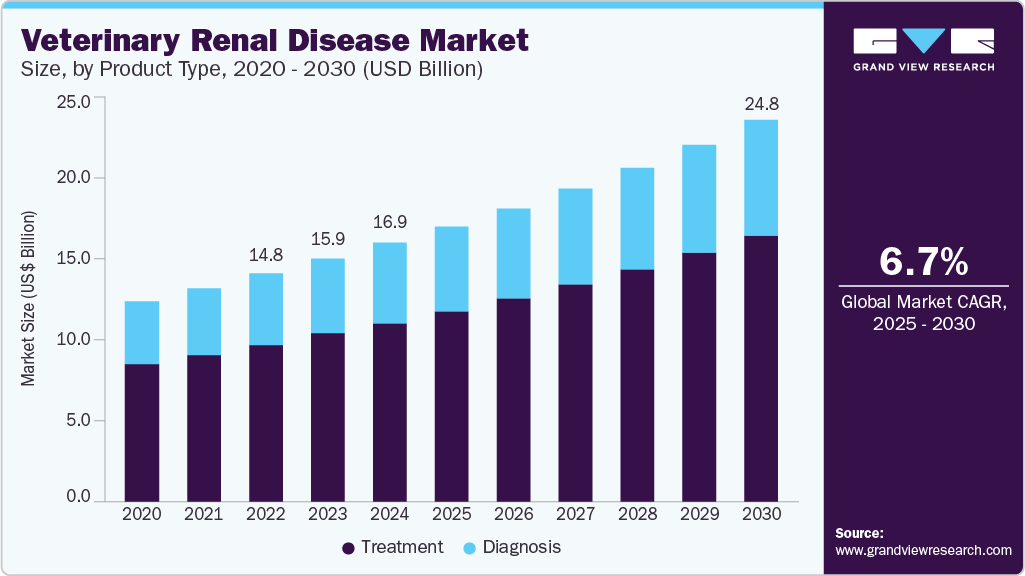

The global veterinary renal disease market size was estimated at USD 16,879.6 million in 2024 and is projected to reach USD 24,846.4 million by 2030, growing at a CAGR of 6.7% from 2025 to 2030. The increasing population of aging pets and the rising prevalence of chronic kidney conditions among companion animals are significantly impacting the veterinary healthcare landscape.

Key Market Trends & Insights

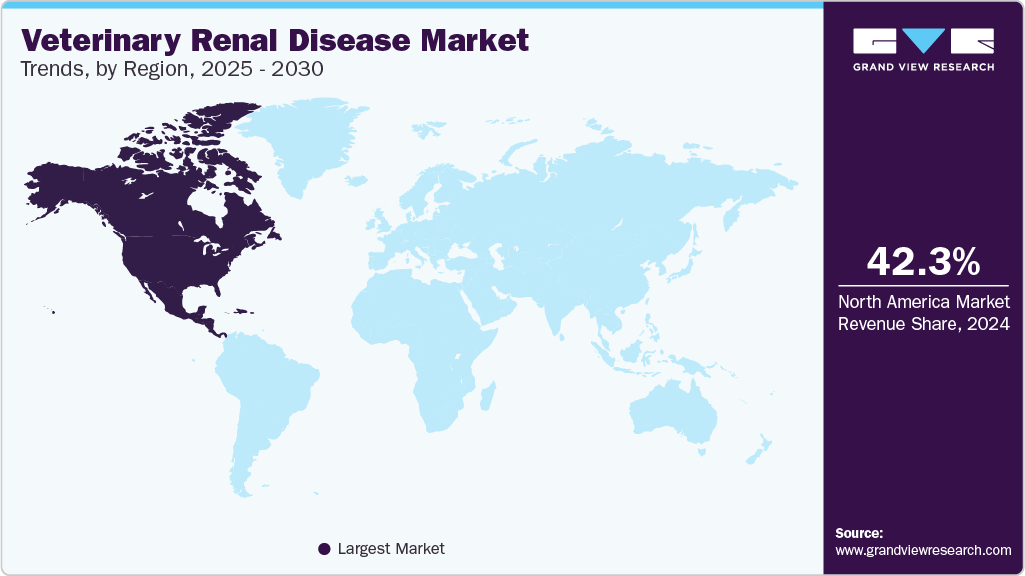

- North America veterinary renal diseases market held the largest global market share of 42.30% in 2024.

- The veterinary renal disease market in the U.S. is expanding consistently with growing awareness of chronic kidney conditions in companion animals and the introduction of specialized diagnostic and treatment options.

- By product type, the treatment segment continued dominating the market with the largest revenue share of 68.96% in 2024.

- By animal type, the canine segment dominated the market with a revenue share of 40.77% in 2024.

- By route of administration, the oral segment dominated the market with a revenue share of 67.46% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 16,879.6 Million

- 2030 Projected Market Size: USD 24,846.4 Million

- CAGR (2025-2030): 6.7%

- North America: Largest market in 2024

As pets live longer due to advancements in nutrition, preventive care, and diagnostics, veterinarians are detecting renal disorders at earlier stages. Senior dogs and cats are particularly vulnerable to chronic kidney disease (CKD), which necessitates continuous monitoring and tailored management strategies. This has led to growing demand for specialized treatments such as renal diets, phosphate binders, and antihypertensive medications.Additionally, diagnostic tools including urine analysis kits and blood tests are now standard in veterinary clinics, facilitating timely and accurate treatment decisions. With pet owners placing greater emphasis on long-term wellness, the market for renal care solutions continues to gain momentum.

Increased awareness about pet wellness and the importance of early disease detection is boosting market growth. Pet owners are now more informed about symptoms of kidney diseases, such as excessive thirst, weight loss, and lethargy, prompting them to seek medical attention promptly. Veterinary clinics are equipping themselves with advanced diagnostic systems, including ultrasound and point-of-care blood analyzers, which aid in early diagnosis and effective treatment planning. The market is seeing a rise in therapeutic innovations, including newer drug formulations and nutraceuticals designed to slow disease progression. Collaborations between veterinary pharmaceutical firms and academic institutions are accelerating the development of targeted therapies. These advancements are improving clinical outcomes and encouraging greater treatment adherence.

The growing trend of pet humanization is significantly influencing spending on chronic disease management, including renal conditions. Owners increasingly view their pets as family members and are more willing to invest in prolonged and high-quality medical care. This shift in perception is supporting higher demand for premium renal therapeutics, including prescription diets formulated to reduce kidney workload. Online veterinary pharmacies and e-commerce platforms are improving accessibility to renal supplements and medications, boosting sales volumes. Additionally, rising numbers of veterinary specialists focused on nephrology are enhancing the quality of care delivered across animal hospitals.

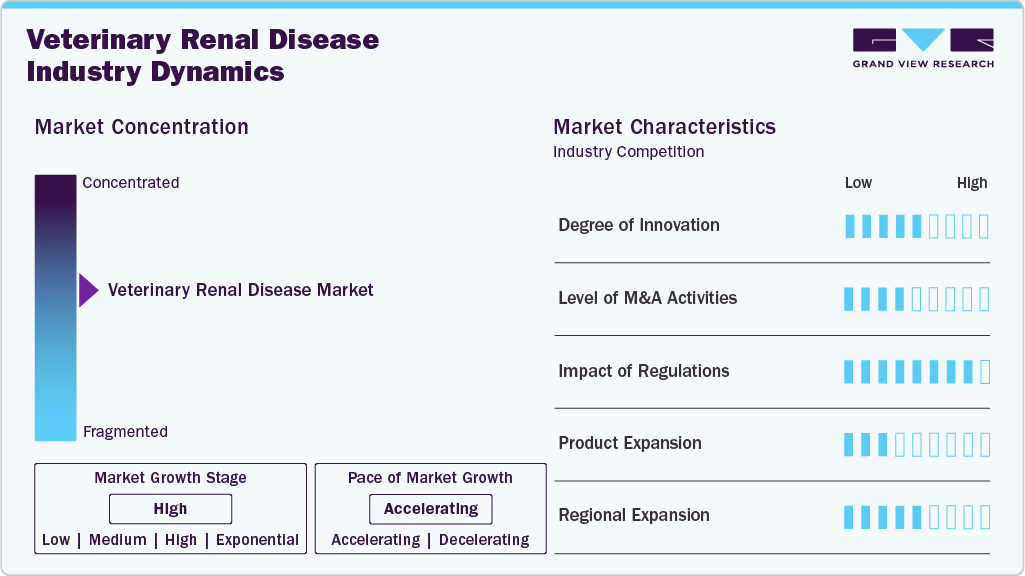

Market Concentration & Characteristics

The veterinary renal disease market exhibits a moderate degree of innovation, with advancements focused on early diagnostics and renal-specific therapeutics. Companies are investing in improved formulations such as phosphate binders and therapeutic diets tailored for companion animals. Innovation is further driven by the rising demand for chronic kidney disease (CKD) management in aging pets. However, breakthrough technologies remain limited due to high development costs and regulatory complexity. Incremental improvements dominate the competitive landscape.

Mergers and acquisitions in this market are moderate, with larger animal health firms acquiring niche companies offering renal health products. These activities are aimed at expanding therapeutic portfolios and gaining access to novel technologies or distribution networks. Strategic deals also support entry into emerging regional markets. While not as aggressive as in human pharmaceuticals, consolidation trends are noticeable among diagnostics and specialty care players. M&A serves as a tool for rapid capability enhancement.

Regulations significantly influence product development and market entry, particularly regarding drug approvals and labeling for companion animals. Compliance with regional veterinary drug authorities adds complexity to the commercialization process. In regions like the EU and U.S., strict guidelines around safety and efficacy often slow down the introduction of innovative therapies. Regulations also govern nutritional supplements and diet-based interventions, affecting formulation standards. While intended to ensure safety, regulatory hurdles can limit smaller firms’ participation.

Substitution risk in this market is moderate, with alternatives including dietary management, herbal supplements, and off-label human medications. While veterinary-specific treatments offer targeted efficacy, pet owners often explore cost-effective or holistic approaches. Therapeutic diets are widely used as standalone or adjunct options, sometimes replacing pharmacological interventions in early-stage renal conditions. However, substitutes may not deliver the same consistency or clinical benefits. Education of pet owners plays a key role in reducing substitution.

Supportive initiatives from veterinary associations and academic institutions have helped raise awareness of renal disease in pets. Educational campaigns and continued professional development for veterinarians encourage early diagnosis and intervention. Collaborative research programs are fostering better understanding of disease progression and treatment efficacy. Pet insurance expansion also supports access to renal care products and diagnostics. These initiatives collectively enhance market growth by improving diagnosis rates and treatment compliance.

Product Type Insights

The treatment segment continues to dominate the veterinary renal disease market, holding the largest market share of 68.96% in 2024 and maintaining its lead due to the growing prevalence of kidney disorders across companion and livestock animals. The high prevalence of chronic kidney disease (CKD) in aging dogs, especially among breeds like German Shepherds and Labradors, points to a growing need for effective renoprotective treatments and long-term management solutions. Risk factors such as prolonged consumption of high-protein diets and concurrent health conditions further emphasize the necessity for tailored therapeutic approaches. This is driving continued advancements in pharmaceuticals, therapeutic diets, and supportive care options that address the specific needs of individual animals. Observations from veterinary clinics and hospitals further confirm the rising incidence of CKD in dogs, highlighting the urgent demand for accessible and innovative treatment strategies to enhance canine health outcomes. The increasing number of diagnoses has driven demand for effective therapeutic interventions aimed at slowing disease progression, managing symptoms, and improving quality of life. Veterinary advancements have expanded the treatment arsenal to include a broad range of pharmaceuticals, specialized renal diets, intravenous fluids such as Ringer’s lactate solution, and novel biologics.

The diagnosis segment is expected to be the growing segment with a significant CAGR of 6.3% over the forecast period. The rising prevalence of renal disorders in companion and livestock animals is driving demand for early and accurate diagnostic tools. Chronic kidney disease (CKD) affects around 0.5% to 1.5% of dogs and 1% to 3% of cats in general veterinary practice, with much higher rates up to 30-40% in older cats. Although CKD is less common in dogs, it still poses serious health concerns, with prevalence reaching up to 3.7%. Diagnosis relies on clinical signs such as weight loss, appetite changes, and abnormal creatinine or SDMA levels in blood or urine tests. While new biomarkers are under study, no single test is yet widely used in routine veterinary care. Research aided by text-mining and comparative studies is advancing understanding of CKD, supporting efforts to improve early detection, treatment options, and overall animal health outcomes.

Animal Type Insights

Canine segment dominated the market with a share of 40.77% in 2024. This dominance is primarily driven by the rising prevalence of chronic kidney disease (CKD) among dogs. CKD in dogs is a serious and progressively deteriorating condition, with various factors contributing to its high incidence. Aging, breed predispositions, and specific anatomical vulnerabilities make dogs highly susceptible to kidney degeneration, especially as they age. While CKD is often more common in senior dogs (typically those over 7 years old), certain breeds are genetically predisposed to renal problems, further elevating the risk. Kidney degeneration related to aging is common, with CKD becoming more frequent in cats aged 10 to 15 years, making them one of the most affected species. Certain breeds are also more prone to kidney problems. CKD incidence in the United States is estimated at 0.5% to 1.0% in Canine. However, in some populations, particularly among breeds known to be predisposed, the rate can rise to as high as 25%. The causes of CKD in dogs are diverse and often difficult to pinpoint during clinical investigation.

Feline segment is expected to exhibit the fastest CAGR of 7.30% during the forecast period. Chronic kidney disease (CKD) is a common and serious health issue in cats, with a particularly high prevalence among older felines. It is estimated that CKD affects 2% to 20% of the general cat population, with the prevalence significantly rising to 30% to 80% in cats over the age of 10 to 15 years. This makes CKD one of the leading causes of illness in cats, particularly as they age. Several factors contribute to this high prevalence, including the unique anatomical structure of cats, breed-specific genetic predispositions, and the natural aging process, which often leads to kidney degeneration. One of the major challenges in managing CKD in cats is their tendency to hide symptoms, which can delay diagnosis until the disease has progressed to more advanced stages. This can make early intervention difficult, ultimately leading to more severe health complications. Additionally, certain breeds are genetically predisposed to kidney disease, further elevating the risks for some cats. As the kidneys progressively lose function, cats can experience a range of debilitating symptoms, including weight loss, loss of appetite, dehydration, and increased thirst and urination.

Route of Administration Insights

The oral segment dominated the market with a revenue share of 67.46% in 2024, driven largely by the high adoption of therapeutic food supplements and the convenience of oral administration. Oral treatments are generally preferred in veterinary care, as they are less stressful for animals and more convenient for both veterinarians and pet owners compared to injectable methods. This ease of use plays a crucial role in maintaining long-term drug adherence, particularly for chronic conditions like chronic kidney disease (CKD). Animals suffering from renal diseases, whether in companion animals like dogs and cats or livestock such as bovine and equine, often require ongoing management, making oral administration an ideal choice. For instance, in February 2025, Boehringer Ingelheim announced the launch of SEMINTRA 4 mg/ml Oral Solution in Europe, designed to manage both chronic kidney disease (CKD) and hypertension in cats.

The injectable segment is expected to be the fastest-growing segment with the fastest CAGR of 7.7% over the forecast period. The segment growth is driven by its expanding role in treating renal diseases in animals, particularly in canines, felines, bovines, and equines, continues to expand with advancements in veterinary medicine. Injectable treatments are often preferred for acute renal conditions or when immediate therapeutic intervention is required. They provide fast and effective delivery of medications, ensuring higher bioavailability and rapid onset of action, which is particularly crucial for managing conditions like acute kidney failure, nephritis, and chronic kidney disease (CKD). While injectable therapies can be more invasive than oral medications, they are essential for treating severe cases where oral administration may not be feasible due to the animal’s condition or non-compliance.

Indication Insights

The renal cystitis segment dominated the market in 2024 with a market share of 29.05%, driven by its high prevalence and clinical significance in companion animals. Renal cystitis, an inflammation of the urinary bladder, remains a growing concern in dogs and cats, often associated with bacterial infections that may ascend to affect the kidneys. The condition is notably widespread, affecting up to 12% of healthy dogs and as many as 30% of those with comorbidities such as diabetes mellitus. Clinical symptoms, including discomfort and frequent urination, can escalate into severe kidney damage if not promptly addressed. Recent advances in diagnostics, including AI-driven urine sediment analysis and cystatin B testing, have greatly improved the ability to detect renal cystitis at an early stage. Notably, Zoetis’s Vetscan Imagyst, launched in January 2024, delivers in-clinic, AI-powered urine analysis with rapid and precise results, supporting early intervention and enabling veterinarians to enhance treatment outcomes and improve the quality of life for affected pets.

The kidney stones segment is expected to grow with the fastest CAGR of 8.1% over the forecast period, driven by increased awareness and technological advancements in veterinary care. Kidney stones, or nephroliths, are a significant health issue in various animal species, though their prevalence and diagnostic rates differ by species and region. In canines, they account for only about 0.3% of analyzed cases, yet certain small breeds like Shih Tzus and Miniature Schnauzers show a higher risk, with up to 81% of dogs with lower urinary tract stones also affected in the upper tract. In horses, urolithiasis occurs infrequently, with a 1% incidence rate, but can cause severe complications such as urinary obstructions. Improved diagnostic tools like ultrasonography and the emergence of minimally invasive treatments such as laser lithotripsy and percutaneous ultrasonic lithotripsy in dogs, and experimental burst wave lithotripsy in cats-are enhancing the management of these conditions. These developments are expected to significantly contribute to the segment’s robust growth in the coming years.

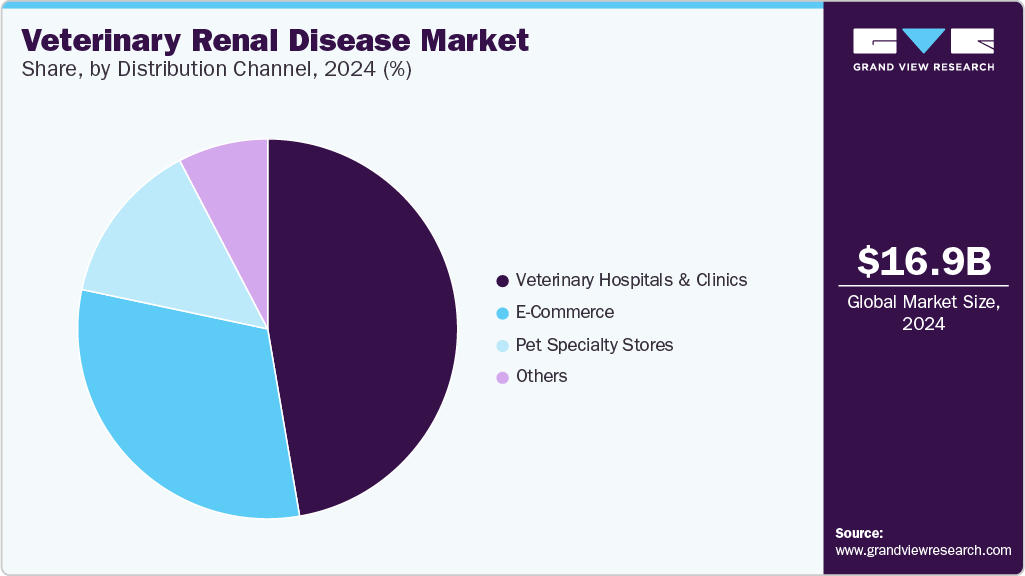

Distribution Channel Insights

The veterinary hospitals & clinics segment held the largest share at 47.31% in 2024 because more pet owners are taking their animals to hospitals for treatment. The Veterinary Hospitals & Clinics segment is crucial in diagnosing, treating, and managing renal diseases in canine, feline, bovine, and equine species. These facilities are the front line for early detection and intervention, particularly for chronic conditions like kidney failure, urolithiasis (kidney stones), and acute kidney injury. Equipped with advanced diagnostic tools such as in-house blood chemistry analyzers, ultrasonography, digital radiography, and point-of-care urine analysis systems (like Zoetis' Vetscan Imagyst), veterinary hospitals can provide timely and accurate assessments, often within minutes. For companion animals such as dogs and cats, veterinary clinics offer personalized care plans, including dietary management, fluid therapy, and drug administration for kidney-related issues.

The e-commerce segment is expected to grow at the fastest CAGR of 7.8% during the forecast period. The E-Commerce segment has become a vital channel for distributing renal care products for canine, feline, bovine, and equine species, offering convenience, expanded product access, and growing integration with veterinary guidance. For companion animals like dogs and cats, pet owners can easily purchase veterinarian-recommended renal diets, supplements (such as phosphate binders, omega-3s, and potassium gluconate), and prescription medications from platforms like Chewy, Petco, Vets First Choice, and Amazon. Many platforms now feature auto-ship options, online veterinary consultations, and refill reminders, supporting long-term care for chronic kidney disease (CKD) and other renal conditions.

Regional Insights

North America veterinary renal diseases market held largest share of 42.30% of the global market in 2024, driven by the expanding focus on companion animal health and the increased demand for early diagnostic tools targeting kidney-related conditions. Rising awareness of chronic kidney disease (CKD) in cats and dogs and the region's strong pet ownership culture have pushed veterinary clinics and diagnostics providers to enhance renal screening capabilities. In June 2023, IDEXX introduced the Cystatin B Test, its first veterinary diagnostic test designed to detect kidney injury in cats and dogs. Integrated into renal health panels and performed at IDEXX Reference Laboratories across the U.S. and Canada, this development reflects a growing clinical emphasis on early intervention and proactive kidney health monitoring.

U.S. Veterinary Renal Disease Market Trends

The veterinary renal disease market in the U.S. is expanding consistently with growing awareness of chronic kidney conditions in companion animals and the introduction of specialized diagnostic and treatment options. In May 2023, Elanco Animal Health received conditional approval from the U.S. FDA for Varenzin-CA1 (molidustat oral suspension), the first drug approved to control non-regenerative anemia in cats suffering from chronic kidney disease (CKD). The oral treatment became available to veterinary clinics across the U.S. in September 2023, offering an important therapeutic tool for managing a common complication in feline CKD cases.

Europe Veterinary Renal Disease Market Trends

Europe's veterinary renal disease market is expected to expand steadily, driven by increased awareness of chronic kidney disease (CKD) in pets and the growing adoption of advanced diagnostic techniques. Toray Industries initiated a European clinical trial for RAPROS, an oral treatment for CKD in cats, in 2024. The trial aims to evaluate the safety and efficacy of RAPROS in managing feline CKD, marking a significant development in treatment options for renal diseases. This clinical initiative underscores the growing focus on finding effective therapies for kidney disease in companion animals, responding to the rising incidence of CKD.

The veterinary renal disease market in Germany is expanding with a growing focus on early diagnosis and chronic disease management in companion animals. Veterinary practices nationwide are increasingly adopting diagnostic protocols emphasizing serum creatinine testing, urinalysis, and ultrasonography to detect earlier-stage renal dysfunction. These tools are becoming more standardized in primary and specialty clinics, enabling veterinarians to initiate treatment plans that slow disease progression and improve the quality of life for animals affected by chronic kidney conditions.

Asia Pacific Veterinary Renal Disease Market Trends

The Asia-Pacific veterinary renal disease market is expanding, driven by increasing pet ownership and a heightened awareness of kidney-related health issues in companion animals. In countries like Japan and Australia, the aging pet population has resulted in a significant rise in chronic kidney disease (CKD) diagnoses, creating a stronger demand for early detection and long-term care management. Veterinary clinics in cities like Tokyo and Sydney routinely offer blood and urine tests to senior pets to detect renal problems before they advance into more severe conditions. Meanwhile, the development of veterinary clinics and diagnostic laboratories in urban areas of India and China is enhancing access to care, particularly in major cities where pet ownership is growing.

India veterinary renal disease market is experiencing steady growth, supported by the rising incidence of chronic kidney disease (CKD) among aging pets and the ongoing development of veterinary healthcare infrastructure. Data from a 2024 study at the Veterinary Clinical Complex in Namakkal reported CKD in 2.64% of over 2,400 dogs examined, indicating a growing need for early diagnosis and management. Clinics in urban centers such as Bengaluru, Mumbai, and Hyderabad are increasingly equipped with tools for renal function assessment, including serum creatinine testing and ultrasonography. These improvements allow for early-stage intervention, especially in geriatric pets, who are more vulnerable to kidney conditions.

Latin America Veterinary Renal Disease Market Trends

Latin America’s veterinary renal disease market is growing, with more pet owners and veterinarians focusing on kidney problems in dogs and cats. In Brazil and Argentina, clinics offer better ways to find and manage kidney disease, especially in older pets. More checkups and improved testing tools are helping vets catch these health problems early, which is important for long-term care. The market is also seeing more use of special kidney diets, supplements, and medicines to support kidney health. Pet stores and clinics are working together to make these products easier to get. Training programs for vets and information for pet owners are helping people understand how to care for pets with kidney disease. With pets living longer and people spending more on their health, demand for kidney care products and services is expected to keep rising across the region.

Brazil Veterinary Renal Disease Market Trends

Brazil’s veterinary renal disease market is growing due to increased awareness of chronic kidney disease (CKD) in pets and better diagnostic tools. More pets, especially older ones in cities, need specialized care for long-term conditions like CKD. Veterinary clinics in Brazil use advanced tests, such as blood and urine checks, to help detect and manage kidney diseases early. The rise of pet insurance is also helping owners afford these treatments, making specialized care more accessible.

Middle East & Africa Veterinary Renal Disease Market Trends

The veterinary renal disease market in the Middle East and Africa (MEA) is shaped by cultural factors and varying access to veterinary care. In countries like the United Arab Emirates and Saudi Arabia, there is growing attention to the health of pets, with increasing awareness about chronic kidney disease (CKD). While routine health checks and early detection are uncommon, many veterinary clinics in larger cities are starting to offer tests, such as blood and urine analysis, to detect kidney problems in older pets. This shift toward preventive care is slowly gaining traction as pet owners become more aware of CKD.

South Africa Veterinary Renal Disease Market Trends

The veterinary renal disease market in South Africa is experiencing growth, driven by increasing awareness and the availability of specialized products and services for managing chronic kidney disease (CKD) in pets. Companies like Virbac South Africa offer renal support products, such as Pronefra and VetsBrands RenoFocus Powder, which are designed to manage CKD symptoms and support kidney function in pets. This aligns with the growing trend toward specialized care, with pet owners and veterinarians recognizing the importance of early intervention in managing renal health. Events and webinars, such as Purina South Africa's 2024 session on feline CKD management, contribute to expanding knowledge on the condition, focusing on aspects like tailored nutritional plans and strategies to improve the quality of life for pets suffering from CKD.

Key Veterinary Renal Disease Company Insights

The global veterinary renal disease market is gaining momentum due to the rising incidence of chronic kidney conditions in companion animals, especially aging cats and dogs. Increasing awareness of early diagnosis and advancements in diagnostic tools have led to improved detection and management of renal disorders. Pet owners seek specialized nutritional, pharmaceutical, and diagnostic solutions that support kidney function and extend pet lifespan. Leading companies driving this market include Mars, Incorporated; Nestlé Purina PetCare; Arkray; General Mills; Zoetis Inc.; and Merck & Co., Inc., among others. These firms innovate across categories such as renal-support diets, point-of-care testing devices, and veterinary therapeutics. As veterinary care standards rise globally, demand for integrated renal health management solutions grows.

Market leaders are expanding their portfolios by developing species-specific renal support products, investing in research, and enhancing access through digital channels and clinic partnerships. Mars, Incorporated and Nestlé Purina PetCare offer therapeutic diets that support pet kidney function through precise nutrient formulations. Pharmaceutical giants like Zoetis Inc., Merck & Co., Inc., and Elanco provide medications to slow the progression of renal disease and manage associated symptoms. Diagnostic-focused companies such as Arkray, Bionote U.S.A., and IDEXX Laboratories, Inc. play a critical role in early detection with advanced analyzers and biomarker testing. Meanwhile, Ceva Santé Animale, Boehringer Ingelheim, and Dechra Pharmaceuticals PLC contribute to targeted treatment and veterinary education initiatives. With a growing population of aging pets and increased demand for comprehensive renal care, the veterinary renal disease market is expected to see sustained growth supported by innovation and cross-sector collaboration.

Key Veterinary Renal Disease Companies:

The following are the leading companies in the veterinary renal disease market. These companies collectively hold the largest market share and dictate industry trends.

- Mars, Incorporated

- Nestle Purina PetCare

- Arkray

- General Mills

- Zoetis Inc.

- Merck & Co., Inc.

- Elanco

- Bionote U.S.A

- Ceva Santé Animale

- Boehringer Ingelheim International GmbH

- Dechra Pharmaceuticals PLC

- Vedco Inc.

- Mission Pharmacal Company

- Neogen Corporation

- IDEXX Laboratories, Inc.

Recent Developments

-

In January 2024, Zoetis expanded its Vetscan Imagyst multi-application diagnostics platform by introducing AI-based urine sediment analysis. This new application utilizes deep learning artificial intelligence to provide accurate in-clinic sediment analysis of fresh urine for quick treatment decisions by veterinarians.

-

In September 2023, Elanco Animal Health, a subsidiary of Merck, announced the first shipment of Varenzin-CA1, a treatment for nonregenerative anemia associated with chronic kidney disease (CKD) in cats, within the U.S. market. This launch addresses a significant unmet need in veterinary renal care.

Veterinary Renal Disease Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.94 billion

Revenue Forecast in 2030

USD 24.85 billion

Growth rate

CAGR of 6.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product type, animal type, route of administration, indication, distribution channel, and region.

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Mars Incorporated; Nestle Purina PetCare; Arkray; General Mills; Zoetis Inc.; Merck & Co., Inc.; Elanco; Bionote U.S.A; Ceva Santé Animale; Boehringer Ingelheim International GmbH; Dechra Pharmaceuticals PLC; Vedco Inc.; Mission Pharmacal Company; Neogen Corporation; IDEXX Laboratories, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Renal Disease Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary renal disease market report based on product type, animal type, route of administration, indication, distribution channel, and region.

-

Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Diagnosis

-

Test Kits & Consumables

-

Instruments

-

-

Treatment

-

Drugs

-

NSAIDs

-

Antibiotics

-

Cystine-binding Agents

-

Diuretics

-

Others

-

-

Therapeutic Food Supplements

-

Ringer Lactate Solution

-

-

-

Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Canine

-

Feline

-

Bovine

-

Equine

-

Others

-

-

Route of Administration Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oral

-

Injectable

-

-

Indication Outlook (Revenue, USD Billion, 2018 - 2030)

-

Renal Failure

-

Chronic Kidney Disease (CKD)

-

Renal Cystitis

-

Kidney Stones

-

Neprhritis

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Pet Specialty Stores

-

E-Commerce

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of Middle East & Africa

-

-

Frequently Asked Questions About This Report

b. The global veterinary renal diseases market size is estimated at USD 16,879.6 million in 2024 and is expected to reach USD 17,940.0 million in 2025.

b. The global veterinary renal diseases market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2030 to reach USD 24,846.4 million by 2030.

b. North America dominated the veterinary renal diseases market with a share of 42.30% in 2024. This is attributable to rising animal healthcare awareness coupled with high penetration of pet insurance and constant research and development initiatives.

b. Some key players operating in the veterinary renal diseases market include Mars Inc., Nestle Purina PetCare, Hills Pet Nutrition, J.M.Smucker, General Mills, Zoetis Inc., Merck & Co., Inc., Elanco, Phibro Animal Health Corporation, Ceva Sante Animale, Boehringer Ingelheim Animal Health, Dechra Pharmaceuticals, VetPharma, Vedco Inc., Mission Pharmacal Company, Rayne Clinical Nutrition, Neogen Corporation, Roquette Frères, JP Farma, Richmond Vet Pharma, IDEXX Laboratories, Inc., FUJIFILM Holdings Corporation, Carestream Health, Mindray Bio-Medical Electronics Co., Ltd., etc.

b. Key factors that are driving the market growth include rising prevalence of a variety of renal complications in animals, prominent usage of pet food, growing disease awareness initiatives, etc.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.