- Home

- »

- Animal Health

- »

-

Veterinary Software Market Size And Share Report, 2030GVR Report cover

![Veterinary Software Market Size, Share & Trends Report]()

Veterinary Software Market Size, Share & Trends Analysis Report By Product, By Delivery Mode (Cloud/Web-based, On-premise), By Practice type, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-621-9

- Number of Report Pages: 165

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Veterinary Software Market Size & Trends

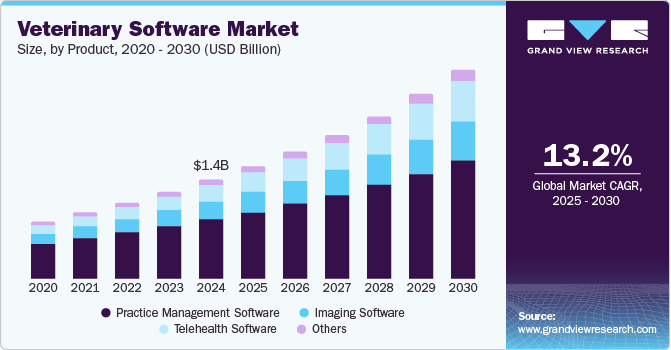

The global veterinary software market size was estimated at USD 1,292 million in 2023 and is projected to grow at a CAGR of 12.66% from 2024 to 2030. The market is primarily driven by factors like growing adoption of veterinary software integrators, number of veterinary hospitals/clinics, increase in adoption of telehealth software, and rising prevalence of animal diseases leading to an increase in veterinary patient volume. The digital transformation continues to unfold in the veterinary industry. In an effort to foster efficiency, streamline workflow, and improve patient care, practices are gradually transitioning from recording documentation on paper to employing software.

Veterinary clinics are seeking veterinary software with which they can effortlessly integrate with external databases and other platforms, such as imaging software, telehealth software, etc. Healthcare administration and data exchange are facilitated by this connection. Data analysis technologies that offer insightful data on patient demographics, treatment outcomes, and clinic performance are frequently included in veterinary software. Clinics can optimize their operations and make data-driven decisions using the assistance of these findings.

The market is influenced by various technological advancements that drive innovation, improve software integration, and enhance overall performance of these veterinary software program. Ongoing efforts are in progress to integrate healthcare and IT to develop technologies that are beneficial for the management, diagnosis, and treatment of diseases in human and animals. This software offers robust analytical capabilities that enable insightful data on patient demographics, treatment outcomes, and clinic performance. Healthcare facilities can enhance their operations and make data-driven decisions with the assistance of these insights.

Existing veterinary software is offering integration with multiple other software’s in the market. Software integrations connect programs to one another to streamline data entry, retrieval, and several other tasks. Software integration enables users to combine applications and streamline processes within Practice Management Systems (PMS). Standalone software frequently has functionalities that are replicated across several systems. This multiple integration allows the users to combine multiple features of a multiple other software’s to ensure that all the necessary features are available for use.

For example, ezyVet Veterinary Software by Idexx Laboratories, has multiple integrations with an array of other veterinary softwares for categories like, finance & analytics, insurance, controlled drugs management, diagnostics, telemedicine, online pharmacy, patient care, reference labs, etc. When it comes to veterinary diagnostics, this software integrates with other softwares by Gribbles Veterinary Pathology, Heska (Antech Diagnostics), Ellie Diagnostics, Vetnostics, etc. Also, for telehealth, this software can integrate with other softwares like Otto, VetChip, etc.

Another such software known as Hippo Manager has been designed to integrate with multiple others like Covetrus, Idexx, PetDesk, GreenLine, mCLub, etc. for functionalities such as medical records, client communication tools, payment, etc. Through an amalgamation of features from multiple software providers, these integrations elevate user experience and assure seamless integration within Practice Management Systems (PMS). The market is steadily expanding because these software solutions are appealing to veterinarians considering their versatility and ease of compatibility with other prominent platforms in sector.

The veterinary community globally has seen a rise in veterinary patient volume over the years. According to data published by American Veterinary Medical Association (AVMA), between 2019 and 2020, the average number of veterinary appointments booked grew by 4.5%. Between January and June 2021, there was a 6.5% rise in appointments as compared to the same period in 2020. This rise in veterinary appointments points towards a rise in the volume of patients. Furthermore, calling for an increase in demand for better practice management systems in the hospitals and clinics. These factors are expected to continue to drive the demand for installation of veterinary software’s into veterinary healthcare facilities to ensure efficient handling of the increasing patient volume.

Market Concentration & Characteristics

To strengthen their market dominance and meet the expanding demand, market players are executing consolidation operations such as mergers and acquisitions (M&A) and improving their existing capacities and abilities. Incorporation of elements of the acquired company's software, allows market participants to guarantee that their own software becomes formidable and gains a competitive share in the industry. For instance, in February 2024,DaySmart Software acquired Time To Pet, integrating pet sitting and dog walking features into its business management software for pet care providers, expanding its offerings beyond grooming and daycare. The acquisition improved pet business operations while improving customer experience by merging Time To Pet's cutting-edge solutions with DaySmart's industry expertise.

The market players are developing new and innovative products that will ensure that end users' efficiency is boosted while collaborating with other market players in order to improve the advantages of both software’s. These kinds of initiatives are frequently utilized to broaden a worldwide footprint or regional penetration with the objective to reach a wider audience. For example, in March 2024,Covetrus launched vRxPro, an advanced online prescription management solution within VetSuite to streamline veterinary practices' operations, enhance client engagement, and boost revenue.

In February 2024,IDEXX introduced Vello, a pet owner engagement software for veterinary practices, to reduce no-show rates by 19% and to improve client communication, streamline workflows and improve care outcomes. Vello integrates with IDEXX’s practice management software, offering more advanced features such as automated reminders, online scheduling, and mobile access to pet health records.

Veterinary Software players in market leverage merger & acquisition strategies, to promote reach of their offerings and increase their product capabilities globally. For example, in February 2024, Agtech software specialist Herdwatch acquired ComTag in Ireland and Lilac Technology in the UK. The company aims to accelerate veterinary software with this acquisition, enhancing its existing portfolio.

Vet software offering an outstanding degree of innovation and cutting-edge features like integrated diagnostics and telehealth is expected to propel market expansion by satisfying changing industry demands and optimizing user experience. Growing market concentration might arise from additional mergers and acquisitions in the veterinary software industry, resulting in better, more holistic solutions. This has the potential to improve the competitive environment and offer a wider selection of features to users.

Strict regulatory compliance will leave an impact on the global market by influencing the development of functionalities essential to patient confidentiality, data security, and market regulations compliance. Solutions that emphasize conformity may get more widely used in response to regulatory requirements.The presence of viable alternatives to a software will have an impact on market dynamics, increasing competition and driving software developers to continue upgrading their offerings. Veterinary software companies that are expanding into new areas will see a growth in market share. Adapting solutions to comply with local demands and legal constraints will help businesses succeed in a variety of industries, which will further fuel the market expansion.

Among smaller or more limited in resources veterinary clinics, particularly in developing nations, the initial expenditures associated with obtaining and deploying veterinary software can be a major obstacle. Hardware prerequisites, licensing costs, and training costs can be high. The substantial upfront costs associated with software purchase and installation can additionally divert funds away from other vital areas of a veterinary practice, such staffing expansions, equipment purchases, or facility expansions. This could discourage practitioners from choosing software-based solutions.

For instance, as of 2024 the price per month for a single user of IDEXX's cloud-based Practice Management software, ezyVet, is USD 230. For more than 190 users, this cost can reach USD 3,100 per month. 24/7 support, product upgrades, and anywhere accessibility have been incorporated into the price. Further setup requirements could result in higher initial expenses. Moreover, there are extra fees for specific products like texted texts, faxed emails, and postcards. Particularly smaller veterinarian practices might not have as much money as they would want. High initial expenses may prevent many practices from implementing cutting-edge veterinary software.

Product Insights

The practice management software (PMS) segment led the market with the largest revenue share of 56.80% in 2023, owing to wide usage in hospitals and clinics both in established and developing economies. Several standard-of-care practices and health guidelines are supported documented by this system. In addition to helping with billing and invoicing, resource management, inventory control, and treatment procedure management, it also maintains track of the health conditions of the patients. Consequently, PMS raises profitability and operational efficacy. These factors are anticipated to fuel market growth over the forecast period.

A rise in strategic initiatives by important players is anticipated to propel segment expansion over the forecasted period. For example, MWI Animal Health launched an improved version of the PetPage Patient Portal, a web and mobile application platform for pet wellness, in May 2023. This software is delivered via MWI's cloud-based AllyDVM veterinary software suite. This program makes it easier for veterinary offices and their clients to communicate by giving pet owners smartphone access from a distance.

The veterinary telehealth software segment is anticipated to grow at the fastest CAGR of 19.65% during the forecast period, due to increasing demand for remote healthcare services and the adoption of telemedicine in veterinary practices. Telehealth softwares enables veterinarians to provide consultations, diagnose cases, and offer follow-up care virtually.Moreover, advancements in telehealth technology, coupled with the growing acceptance of virtual consultations among both veterinarians and animal owners, are driving the rapid growth of this segment.

Delivery Mode Insights

Based on delivery mode, the cloud/web-based segment led the market with the largest revenue share of 80.92% in 2023. Cloud-based solutions are easily scalable, accomplishing the specifications of veterinary clinics of every kind. This makes it available to significant, multilocation veterinary hospitals as well as tiny, independent clinics. Veterinarians can examine patient data, identify trends, and make better decisions regarding patient care and practice management with the help of this software, which frequently has sophisticated analytics and reporting capabilities. By enabling online appointment booking, email or SMS reminders, and patient portals where clients can view their pet's records and contact the practice, they can enhance the client experience.

Cloud-based software providers update their products often to resolve vulnerabilities and enhance functionality. Veterinarians no longer need to spend their resources and energy updating and maintaining the software by hand. Together, these elements fuel the need for cloud-based veterinary software, which helps clinics increase productivity, improve patient care, cut expenses, and maintain their competitiveness in a market that is changing quickly.

Practice Type Insights

Based on practice type, the small animals segment led the market with the largest revenue share of 60.37% in 2023. The segment includes software revenue from veterinarian practices that treat small companion animals (dogs and cats) as their primary source of care. Veterinarians and veterinary clinics can more efficiently manage their daily activities and deliver high-quality animal care with the aid of small animal PMS, a specialized tool. The primary factors propelling the market growth of this segment are the increasing number of product developments, software integration, and practice management opportunities in small animal practices.

For instance, according to data from November 2023 from the US Bureau of Labor Statistics, the amount spent on pets in 2013 was $57.8 million. This amount increased to $102.8 million by the end of 2021, a 77.9% increase in just 8 years. This demonstrates how the need for more advanced equipment, protocols, and-above all-systems and software has grown along with the demand for pet care. Veterinarians have approved and acknowledged the use of more advanced and integrated software to manage pet animal practices professionally, according to VHMA. Thanks to veterinarians' growing interest in software administration in small animal practices, leading companies are bringing innovative products to market.

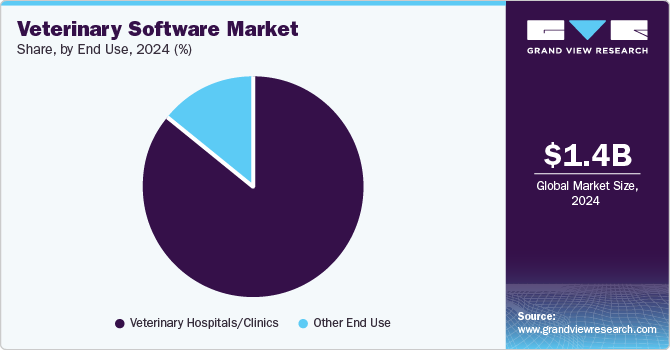

End Use Insights

Based on end use, the hospitals/ clinics segment led the market with the largest revenue share of 85.80% in 2023 and is expected to grow at a rapid CAGR during forecast period. The accelerating digitization of veterinary practices and the growing awareness of the advantages that software provides to both patient care and business operations are what are driving the overall growth of the hospitals/clinics segment. A wider variety of services, such as surgery, imaging, emergency care, and specialized treatments, are generally provided by veterinary hospitals and clinics. Software that can easily handle multiple facets of patient care is required due to this complexity.

Compared to smaller practices or individual veterinarians, veterinary hospitals and clinics frequently manage a higher patient volume. More sophisticated software must be installed to effectively manage appointments, patient records, billing, and inventory in light of the increased patient load. Veterinary clinics and hospitals can gain a competitive advantage by implementing technology to provide better services, increase customer satisfaction, and draw in new customers who value the efficiency and convenience of digital tools. The need for veterinary software used in clinics and hospitals is anticipated to rise in the upcoming years as a result of these factors.

The other end use segment is expected to grow at the fastest CAGR during the forecast period. Other end users are adopting more veterinary software, including imaging and telehealth software, in order to stay current with technological advancements in veterinary medicine, improve workflow efficiency, boost collaboration, and offer high-quality diagnostic services. The use of imaging software in veterinary laboratories is expected to grow steadily as technology develops.

Regional Insights

North America dominates the veterinary software market with the revenue share of 35.85% in 2023. The existence of well-established competitors and the rising need for maintenance from veterinary clinics to support daily operations are what are driving the market. It makes it possible to keep track of patient demographics, appointments, and the routine tasks that go along with running a veterinary clinic. Because so many of the top animal healthcare companies are based there, the U.S. is the largest market in the region for veterinary software.

It is anticipated that rising innovation in veterinary software will aid in market expansion. For example, in April 2023, DaySmart Software acquired ReCPro Software, a veteran provider of recreation management software, expanding its portfolio to support the recreation vertical. The acquisition aimed to offer ReCPro customers access to DaySmart's cloud-based solution and customer service, reinforcing DaySmart's commitment to serving parks and recreation departments with integrated solutions.

U.S. Veterinary Software Market Trends

The veterinary software market in the U.S. held the largest share of North America in 2023. The U.S. has an all-time high number of veterinary clinics and veterinarians due to rising pet adoption and pet ownership. The veterinary field has also changed as a result of the introduction of innovative ways to manage patient data, such as veterinary software. Veterinarians, clinics, and hospitals obtain superior assistance with veterinary practice management when veterinary software is integrated. Its adoption is anticipated to soar as it meets the clinical and managerial needs of veterinary practitioners.

Europe Veterinary Software Market Trends

The veterinary software market in Europe held the second largest share in 2023. Due to the extensive local veterinary markets, rising zoonotic disease prevalence, and increased consumption of livestock products, Europe holds the second-largest share in the global market. Furthermore, driving market expansion are the existence of well-established competitors and recent advancements in software, such as real-time veterinarian engagement software that offers high accuracy and data accessibility. The changing trend in this area toward new technology-based practice management and imaging software might serve as a factor in the rising demand for veterinary software.

The Germany veterinary software market held the largest share in Europe in 2023. In order to increase productivity in clinical practices for pets and livestock, the major players in the market in Germany are offering their software for a variety of applications, including appointment scheduling, medical record management, billing, and other clinical practices. The best patient care provided by evidence-based veterinary services, scientific methods to enhance animal welfare, the rise in zoonotic illnesses, and the growing use of acquisition strategies by major players are some of the factors propelling the market's expansion. In addition, there is a need for appropriate services and software because a large number of hospitals and veterinary clinics offer emergency care for animals. The General Administrative Regulation for Zoonoses in the Food Production Chain establishes the legal framework for zoonotic agent monitoring, while the European Council and European Parliament's Directive on the monitoring of zoonoses & zoonotic agents presents significant guidance.

The veterinary software market in UK is believed as one of the world's most concentrated veterinary markets. The country's growth can be attributed to the rising incidence of diseases as well as the healthcare and control initiatives for pets and farm animals. Approximately 60% of UK households have pets that need to be seen by a veterinarian, which has driven up demand for veterinary software. The revenue of the major players has increased due to the increasing use of veterinary software for standard services in hospitals and clinics.

The France veterinary software market is widely recognized for its animal health services. There are two primary categories of healthcare services in the nation: companion animals and animals raised for food. In France, veterinary care is essential for preserving the health and welfare of domestic animals as well as livestock, particularly when it comes to the detection, management, and treatment of animal illnesses. Furthermore, the nation has stringent guidelines for high-quality medical care, with a focus on routine health examinations and preventive veterinary care.

Asia Pacific Veterinary Software Market Trends

The veterinary software market in Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period. The market is expanding rapidly in Asia Pacific, which can be attributed to the growing number of pets, rising livestock product demand, and rising incidence of zoonotic diseases. In addition, in order to save time and concentrate on patient care, veterinary practices in developing nations like China and India are progressively implementing veterinary software. The market's expansion has been significantly aided by the existence of well-established competitors and cutting-edge software solutions. For example, FUJIFILM Healthcare Asia Pacific Pte. Ltd. expanded its healthcare operations in Thailand in February 2023. As part of its One-stop, Total Healthcare Solution, the company unveiled a comprehensive portfolio of diagnostic imaging and informatics solutions, backed by cutting-edge medical image analysis & Artificial Intelligence (AI).

The India veterinary software market is expected to grow at the fastest CAGR during the forecast period. The market growth is attributable to the rising need from hospitals and veterinary clinics for software to meet their expanding needs. Furthermore, to promote better resilience against disease control and potentially boost market growth, Indian veterinary care organizations are pushing for the use of cutting-edge technologies like imaging software and veterinary practice management.

The veterinary software market in China held the largest share in Asia Pacific in 2023. During the past ten years, pet adoption has dramatically increased in several major countries, including China. China's market is expanding quickly as a result of higher disposable income and a surge in pet ownership. Companies have developed creative software products, including practice management and imaging software, as a result of the nation's growing growth potential and its position as a global leader in the industry. The nation's requirements for timely appointment scheduling, quality veterinary care, and daily operations have also increased demand for veterinary software. In addition, the emergence of well-known major players and fresh, creative software solutions are supporting the expansion of the market in China.

Key Veterinary Software Company Insights

Some of the key players operating in market include Idexx Laboratories, Covetrus Inc. (Henry Schein), Heska Corporation (Mars Inc.), Asteris, Planmeca OY, Instinct Science, LLC, etc.

Shepherd Veterinary Software, OnwardVet, Digitail, DaySmart Software, Oehm und Rehbein GmbH, etc. are some of the emerging market participants in global market.

There is severe competition in the veterinary services market because there are both well-established and newly started companies. These organizations are actively carrying out strategic initiatives meant to increase their market share and market presence. Both large and small businesses are implementing a variety of tactics in an effort to obtain a competitive advantage. Additionally, an enhanced and holistic strategy for veterinary care services can be facilitated by strategic alliances and collaborations in form of software integrations with other players in the industry.

Key Veterinary Software Companies:

The following are the leading companies in the veterinary software market. These companies collectively hold the largest market share and dictate industry trends.

- Idexx Laboratories

- Covetrus Inc. (Henry Schein)

- Hippo Manager

- Shepherd Veterinary Software

- DaySmart Software

- Digitail

- ProVet (NordHealth)

- OnwardVet

- Asteris

- Carestream Health

- Heska Corporation (Mars Inc.)

- Oehm und Rehbein GmbH

- VetStoria

- Instinct Science, LLC

- Planmeca OY

Recent Developments

-

In April 2024, Weave integrated with Shepherd, enhancing its capabilities in client communication and engagement for businesses. This integration streamlined communication processes and improved customer service, benefiting businesses using Weave's platform

-

In January 2024, Covetrus showcased its VetSuite solution at VMX 2024, offering integrated technology and services to improve veterinary practice efficiency and pet care. The company entered into partnership with Zoetis Diagnostics for seamless data exchange, enhancing diagnostic capabilities for veterinarians and improving patient care

-

In November 2023, a brand-new reference lab for Antech Diagnostics opened in Warwick. With its debut, Antech's first comprehensive and adaptable portfolio-which comprises software solutions, in-house diagnostics, imaging, and reference lab-arrived in the UK

-

In October 2023, MWI Animal Health announced that its AllyDVM client engagement platform has fully integrated with Shepherd Veterinary Software, a provider of veterinary practice information management software (PIMS). AllyDVM's extensive service offerings, which include effective client communications, retention, and analytics tools, are now available to Shepherd users

-

In August 2023, Aspiritech and Hippo Manager formed a partnership to enhance the software development capabilities of the latter

Veterinary Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,478.54 million

Revenue forecast in 2030

USD 3.02 billion

Growth rate

CAGR of 12.66% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, delivery mode, practice type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

US; Canada; UK; Germany; France; Italy, Spain; Sweden; Russia; Netherlands; Switzerland; Poland; Ireland; Japan; China; India; Australia; South Korea; Thailand; Indonesia; Philippines; Malaysia; Singapore; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Iran; Turkey; Israel

Key companies profiled

Idexx Laboratories; Covetrus Inc. (Henry Schein); Hippo Manager; Shepherd Veterinary Software; DaySmart Software; Digitail; ProVet (NordHealth); OnwardVet; Asteris; Carestream Health; Heska Corporation (Mars Inc.); Oehm und Rehbein GmbH; VetStoria; Instinct Science, LLC; Planmeca OY

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of latest industry trends in each of sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary software market report based on product, delivery mode, practice type, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Practice Management Software

-

Imaging Software

-

Telehealth Software

-

Others

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud/Web-Based

-

On-premise

-

-

Practice Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Animals

-

Mixed Animals

-

Equine

-

Food-producing Animals

-

Other Practice Types

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals/Clinics

-

Other End Use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

Russia

-

Sweden

-

Switzerland

-

Ireland

-

Poland

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Indonesia

-

Philippines

-

Malaysia

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Iran

-

Turkey

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global veterinary software market size was estimated at USD 1,292 million in 2023 and is expected to reach USD 1,478.54 million in 2024.

b. The global veterinary software market is expected to grow at a compound annual growth rate of 12.66% from 2024 to 2030 to reach USD 3.02 billion by 2030.

b. North America dominated the veterinary software market with a share of 41.31%. This can be attributed to the high adoption of digital technologies and the local presence of key companies. For instance, IDEXX Laboratories, Inc.; Covetrus; Hippo Manager Software, Inc.; Vetspire LLC; and DaySmart Software, Inc. are some of the key companies based in the U.S.

b. Some key players operating in the veterinary software market include IDEXX Laboratories, Inc., Covetrus Inc. (Henry Schein), Hippo Manager Software, Inc., Shepherd Veterinary Software, DaySmart Software, Digitail, Nordhealth AS, OnwardVet, Patterson Companies, Inc., Carestream Health, Antech Diagnostics, Inc. (Mars), Oehm und Rehbein GmbH, Vetstoria, Instinct Science, LLC, and Planmeca OY

b. Key factors that are driving the veterinary software market growth include increasing technological advancements, medicalization rate, pet humanization, digitalization across veterinary care, and initiatives undertaken by key companies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."