- Home

- »

- Animal Health

- »

-

Veterinary Telemetry Systems Market, Industry Report, 2030GVR Report cover

![Veterinary Telemetry Systems Market Size, Share & Trends Report]()

Veterinary Telemetry Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Animal (Small Animals, Large Animals), By Product (Vital Signs Monitors, Wearables, ECG/EKG Monitors), By Mobility, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-965-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary Telemetry Systems Market Trends

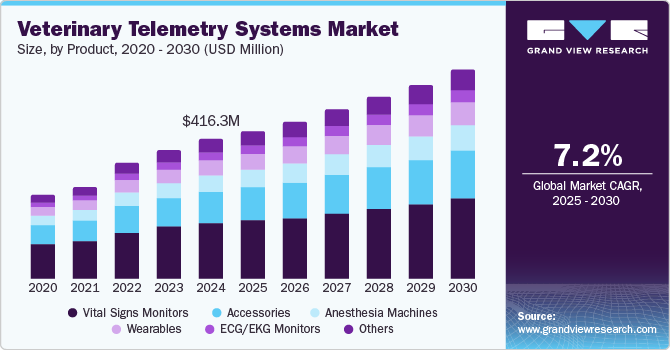

The global veterinary telemetry systems market size was estimated at USD 416.34 million in 2024 and is projected to grow at a CAGR of 7.20% by 2030. Increasing demand for remote patient monitoring in veterinary care, product R&D, number of veterinary surgeries, availability of refurbished equipment, rising pet expenditure, and insurance coverage are some of the key factors fueling the market growth. In addition, increasing collaborations among key players are driving innovation and adoption of veterinary telemetry systems. These partnerships enhance technology integration, expand product offerings, and improve accessibility, fueling market growth and advancing animal health monitoring solutions.

For instance, in October 2024, Mella Pet Care partnered with Vetster to integrate its pet health monitoring devices with Vetster's telemedicine platform, offering 24/7 veterinary care in the US, UK, and Canada. This collaboration enhances virtual pet assessments, enabling veterinarians to use Mella's diagnostic tools for more informed and accessible care.

Furthermore, technological advancement in the animal health industry is another critical factor fueling the market's expansion. Modern veterinary telemetry systems are equipped with features like wireless connectivity, real-time monitoring, and artificial intelligence integration. These advancements allow veterinarians to track vital signs such as heart rate, respiration, and body temperature remotely, improving the efficiency and accuracy of diagnoses. The ability to monitor animals in real time has made these systems valuable in emergency care and chronic condition management, driving their adoption across veterinary clinics and animal hospitals. Key players in the industry are making efforts to increase the adoption of these new systems. For instance, in August 2024, Zomedica introduced advanced audio features to its VETGuardian Zero-touch remote monitoring system, enabling veterinarians to access real-time and recorded auditory data alongside video feeds. These capabilities enhance patient monitoring, aiding in early distress detection, treatment assessment, and comprehensive care delivery for equine and companion animals.

In addition, the growing trend towards remote veterinary services plays a significant role in driving market growth. Along with the rise of telemedicine, particularly during and after the COVID-19 pandemic, veterinary telemetry systems have become essential tools for remote consultations and follow-ups. These systems allow veterinarians and pet parents to provide care to animals in rural or remote areas without the need for frequent in-person visits and improve quality of health care. Also, as awareness about the benefits of these systems increases among pet owners and farmers that have livestock animals, the demand for veterinary telemetry systems is expected to grow further and boost the market growth.

Animal Insights

The small animals segment dominated the market in 2024 and is expected to grow at the fastest CAGR during the forecast period. These high numbers are attributed to the increasing number of population of pets in the world. For instance, according to the data published by American Veterinary Medical Association in October 2024, the dog population has steadily increased from 52.9 million in 1996 to 89.7 million in 2024. The same article also mentioned that 86.8% of dog owners have regular practice of visiting a veterinarian. With advancement in technologies, pet owners are becoming more proactive about monitoring their pets' health, driving the demand for advanced veterinary technologies like telemetry systems to simplify pet care and thus fuel market growth.

The large animals segment is expected to grow at a significant CAGR over the forecast period. The growth of this segment is driven by the increasing focus on livestock health and productivity. Farmers and livestock owners are adopting telemetry systems to monitor the health of cattle, horses, and other large animals, aiming to prevent diseases, improve breeding efficiency, and enhance overall herd management. Telemetry devices such as Jacketed External Telemetry (JET) are used among large animals to monitor ECG, blood pressure, and respiratory patterns. Moreover, government initiatives promoting animal welfare are encouraging the adoption of advanced veterinary technologies, further supporting the growth of this segment in the market.

Product Insights

The vital sign monitors segment dominated the market with the largest market share of 40.0% in 2024. These numbers can be attributed to their high importance in monitoring critical health parameters such as heart rate, respiratory rate, temperature, and blood pressure in animals. These devices are widely used in clinical and remote settings, providing veterinarians with real-time data to ensure accurate diagnoses and effective treatment plans. Their versatility makes them suitable for use across various animal types, including pets, livestock, and exotic species. Increasing awareness about preventive animal healthcare and the growing adoption of advanced diagnostic tools further bolster the demand for vital sign monitors, securing their leading position in the veterinary telemetry systems industry.

The wearables segment is expected to grow at the fastest CAGR of 8.66% over the forecast period majorly due to their convenience, versatility, and increasing adoption for ambulatory health monitoring. These devices, such as collars, harnesses, and implantable sensors, provide real-time data on vital signs, activity levels, and overall well-being of animals, making them highly popular among pet owners and livestock managers. Advances in wireless technology, IoT integration, and miniaturization of devices have made wearable devices more accessible and effective for various applications, from tracking chronic conditions to optimizing farm productivity. For instance, as per the news published in January 2023 by GE HealthCare, the company partnered with Sound Technologies to expand the distribution of Vscan Air, a handheld, pocket-sized, wireless ultrasound device for whole-body scanning. This enabled veterinarians to examine internal organs of animals such as dogs, cats, horses, pigs and many others. Such strategic partnerships among leading players in the market is anticipated to boost market growth in the coming future.

Mobility Insights

The compact/ tabletop segment dominated the market with the largest market share of 34.9% in 2024. These systems are mainly used in hospital or clinical settings for their notable performance. LifeSense VET by Nonin for instance, is a tabletop multi-parameter monitor designed exclusively for veterinary use. It measures EtCO2, SpO2, respiration, FiCO2, and pulse rate of intubated animals. The widescreen display offers a user-friendly touch panel for varied settings and adjustments. Also, VTA-1100 Table Top Veterinary Anesthesia System is used for small animals in healthcare settings.

The portable segment is expected to grow at the fastest CAGR of 7.8% over the forecast period. Portable veterinary telemetry systems include hand-held monitors, wearable health trackers, fingertip devices etc. Established companies are also releasing travel-friendly portable versions of their devices and equipment to provide more flexibility and control to the veterinarian. Veterinary Pulse Oximeter by eKuore for example, functions as a substitute multi-parameter monitor during post-op and in low-risk settings.

Application Insights

The respiratory segment dominated the market with the largest market share of 35.2% in 2024. This is because most telemetry systems offer some kind of respiratory parameter measurement including respiratory rate, SpO2, CO2, etc. Respiratory rate measurement is among the core vital signs measured to track the body's most basic functions. Respiratory monitoring can thus help identify pets with a risk of developing congestive heart failure and significant heart disease before the condition develops into an emergency situation.

The neurology segment is expected to grow at a significant CAGR of 7.6% over the forecast period. Conditions such as epilepsy, traumatic brain injuries, and spinal cord disorders in pets and livestock have highlighted the need for specialized monitoring tools. For instance, according to the data reported in National Library of Medicine in June 2024, degenerative, neoplastic, and vascular diseases are the most common neurologic diseases found in dogs. Moreover, the majority of deaths in dogs are attributed to intracranial neoplasia which is prevalent in approximately 2-4.5% of dogs. Such conditions and increasing number of cases fuel the demand for better management of complex neurological cases in veterinary practices and thus, it is expected to continue propelling its rapid expansion.

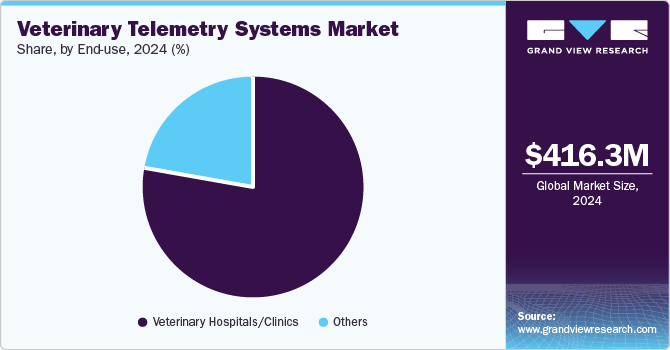

End-use Insights

Veterinary Hospitals/Clinics dominated the market with the largest share of 78.2% in 2024, driven by the increasing prevalence of animal diseases. Pemberton Veterinary Hospital in Canada, for example monitors heart rate, blood pressure, oxygen saturation, respiratory rate, end tidal carbon dioxide and body temperature in anesthetized pets. Most key companies targeting hospitals and clinics to promote their line of veterinary monitors is also propelling the segment growth. Bionet for instance, offers a range of multi-parameter monitors to companion animals or equine clinics. The benefits provided include no need for reconfiguration, ease of use, customizable settings, and 4 years warranty.

The others segment is the fastest-growing segment and is expected to grow at a CAGR of 7.9% over the forecast period. It includes veterinary research institutes, academic settings, and specialty veterinary centers. The growth of this segment is driven by the increasing use of telemetry systems in animal research and education organizations for studying physiology, disease progression, and treatment efficacy. Research institutes rely on these systems for detailed, real-time data collection in both small and large animal studies, enhancing the quality and precision of their work. The growing emphasis on veterinary research, coupled with advancements in telemetry technology, is expected to fuel the rapid expansion of this segment during the forecast period.

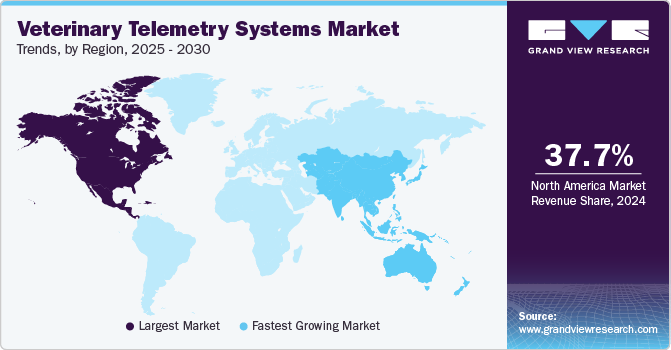

Regional Insights

The North America veterinary telemetry systems market dominated the global market and accounted for 37.68% of revenue share in 2024, which can be attributed to the advanced veterinary healthcare infrastructure, rising adoption of pet insurance, and strategic initiatives by key players. For instance, in March 2024, HaloLights LLC and DHS S&T developed a wearable health monitoring device for dogs to analyze and monitor vital signs and other health indicators. The device is currently in Phase 4 of clinical trials and can significantly contribute to the markets’ growth if successfully launched.

U.S. Veterinary Telemetry Systems Market Trends

The U.S. veterinary telemetry systems market held a significant share of North America market in 2024, driven by advancements in research and increased demand for telemetry systems for vets. Rising investments in research, regulatory support for veterinary healthcare, and a growing emphasis on remote patient care further propel market expansion in this sector. For instance, in June 2024, Mella Pet Care entered into partnership with Vetspire to integrate real-time vitals collection into its PiMS platform to streamline workflows and to reduce manual data entry for veterinarians. This integration, along with Mella’s health monitoring devices, enhances efficiency, minimizes animal stress, and improves patient care in veterinary practices.

Europe Veterinary Telemetry Systems Market Trends

The Europe veterinary telemetry systems market driven by the region's strong emphasis on pet ownership, growing number of households adopting companion animals, has boosted demand for innovative diagnostic tools. Additionally, Europe's robust livestock industry, particularly in countries like Germany, France, and the Netherlands, is encouraging the adoption of telemetry systems to enhance productivity and disease management in animals. Government regulations and initiatives promoting animal welfare, along with rising investments in veterinary research and technology, further support market growth. For instance, according to the data published in May 2024, European Partnership on Animal Health and Welfare” (EUPAHW) is expected to gather 360 million euros of funds for seven years to use it in the development of veterinary products to benefit animal health.

The UK veterinary telemetry systems market is expected to show significant growth driven by increasing research and development investments and enhanced funding for innovative projects over the forecast period. This financial support facilitates the innovation of novel devices or systems, leading to improved diagnosis, monitoring and treatment, ultimately enhancing the market growth across the region.

The Germany veterinary telemetry systems market is experiencing significant growth, largely due to the rising prevalence of veterinary diseases. This increasing burden on healthcare systems is driving demand for improved diagnosis and monitoring devices. There are many global as well as local companies in the region that manufacture and distribute such devices and contribute to country’s market growth. Companies such as VISIOVET Medizintechnik GmbH offer several veterinary telemetry systems in the country.

Asia Pacific Veterinary Telemetry Systems Market Trends

The Asia Pacific veterinary telemetry systems market is expected to grow at the fastest CAGR over the forecast period. The growth of the market in the region is owing to improving veterinary healthcare facilities and services, increasing number of local companies, and growing pet population. The market in this region is driven by rapid urbanization, increasing disposable incomes, and the rising trend of pet ownership in countries like China, India, and Japan. Furthermore, the expanding livestock sector in the region, coupled with a growing focus on improving productivity and managing diseases, is further propelling the adoption of telemetry systems among farmers.

The China veterinary telemetry systems market is growing at a lucrative rate. The increasing adoption of pets, coupled with rising disposable incomes in the region and growing awareness about animal health, has led to greater demand for advanced veterinary technologies. In the livestock sector, the need to enhance productivity, prevent disease outbreaks, and comply with stringent food safety regulations is encouraging farmers to adopt telemetry systems thus driving the market growth during the forecast period.

Latin America Veterinary Telemetry Systems Market Trends

The Latin American veterinary telemetry systems market exhibits high growth potential, driven by the region’s significant livestock industry and increasing awareness of animal health management. Countries such as Brazil and Argentina, which are major players in global meat production, are adopting advanced technologies to improve herd productivity and prevent disease outbreaks. Government initiatives focusing on food safety, zoonotic disease control, and animal welfare further support the adoption of telemetry systems in the region and contribute to market growth.

Middle East And Africa Veterinary Telemetry Systems Market Trends

The MEA veterinary telemetry systems market growth is driven particularly due to the investments by countries, especially in the Gulf Cooperation Council (GCC), that are investing in advanced animal health technologies to enhance productivity and combat the challenges posed by harsh climates and disease outbreaks. In addition, rising awareness about animal welfare and the increasing prevalence of zoonotic diseases are encouraging the use of telemetry systems for monitoring and diagnostics which in turn, contribute to market growth.

The UAE veterinary telemetry systems market is witnessing growth in the sector due to the increasing focus on livestock health and productivity. Government in these countries as well as other veterinary organizations are making efforts to increase awareness and enhance veterinary education. For instance, in April 2024, International Conference on Veterinary Care was held in UAE which was organized in collaboration with Thumbay Veterinary Clinic to delve into crucial animal health topics and discuss new innovations. Such conferences support partnerships, collaborations and research in veterinary medical systems, further increasing market growth.

Key Veterinary Telemetry Systems Company Insights

The market is highly competitive due to several strategic initiatives such as new product launches, mergers and acquisitions, and regional expansion, undertaken by key market players to increase their global footprints. Companies are diversifying their product portfolios to address a broader range of applications.

Key Veterinary Telemetry Systems Companies:

The following are the leading companies in the veterinary telemetry systems market. These companies collectively hold the largest market share and dictate industry trends.

- Avante Animal Health, an Avante Health Solutions company

- Medtronic

- Shenzhen Mindray Animal Medical Technology Co., LTD.

- Nonin

- Masimo

- Dextronix, Inc.

- Midmark Corporation.

- BIONET

- Smiths Medical (ICU Medical)

Recent Developments

-

In August 2024, Zomedica Corp. announced new advanced audio capabilities in its VETGuardian Zero-touch remote vital signs monitoring system. This new feature enables live audio monitoring, recorder, to detect even a minor change in the animal behaviour and improve the quality of veterinary care.

-

In April 2024, Aiforia Technologies Plc. signed an agreement with a global veterinary company in the U.S. for AI-assisted image analysis in animal samples.

-

In January 2024, SunTech launched the Vet40, a versatile surgical vital signs monitor for companion animals, featuring non-invasive blood pressure, temperature, SpO2, ECG, and optional ETCO2 and respiratory rate monitoring. Portable and equipped with data storage, touchscreen, and connectivity options, the Vet40 supports precise monitoring in both exam and operating rooms.

Veterinary Telemetry Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 441.05 million

Revenue forecast in 2030

USD 624.40 million

Growth rate

CAGR of 7.20% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, product, mobility, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Denmark, Sweden, Norway, Japan; China; India; Australia; South Korea; Thailand, Brazil; Argentina; South Africa; Saudi Arabia; UAE, Kuwait

Key companies profiled

Avante Animal Health, an Avante Health Solutions company, Medtronic, Shenzhen Mindray Animal Medical Technology Co., LTD., Nonin, Masimo, Dextronix, Inc., Digicare Biomedical, Midmark Corporation., BIONET, Smiths Medical (ICU Medical)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Veterinary Telemetry Systems Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global veterinary telemetry systems market report based on animal, product, mobility, application, end-use, and region.

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Animals

-

Large Animals

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vital Signs Monitors

-

ECG/EKG Monitors

-

Wearables

-

Anesthesia Machines

-

Accessories

-

Others

-

-

Mobility Outlook (Revenue, USD Million, 2018 - 2030)

-

Portable

-

Floor Standing

-

Compact/ tabletop

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Respiratory

-

Cardiology

-

Neurology

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals/Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global veterinary telemetry systems market size was estimated at USD 416.34 million in 2024 and is expected to reach USD 441.05 million in 2025.

b. The global veterinary telemetry systems market is expected to grow at a compound annual growth rate of 7.20% from 2025 to 2030 to reach USD 624.40 million by 2030.

b. North America accounted for the largest revenue share of 37.68% in 2024. This is owing to advanced veterinary healthcare infrastructure, rising adoption of pet insurance, and strategic initiatives by key players.

b. Some key players operating in the veterinary telemetry systems market include Avante Animal Health, an Avante Health Solutions company, Medtronic, Shenzhen Mindray Animal Medical Technology Co., LTD., Nonin, Masimo, Dextronix, Inc., Digicare Biomedical, Midmark Corporation., BIONET, Smiths Medical (ICU Medical)

b. Key factors that are driving the veterinary telemetry systems market growth include increasing demand for remote patient monitoring in veterinary care, product R&D, number of veterinary surgeries, availability of refurbished equipment, rising pet expenditure, and insurance coverage.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.