- Home

- »

- Animal Health

- »

-

Veterinary Wound Cleansers Market, Industry Report, 2030GVR Report cover

![Veterinary Wound Cleansers Market Size, Share & Trends Report]()

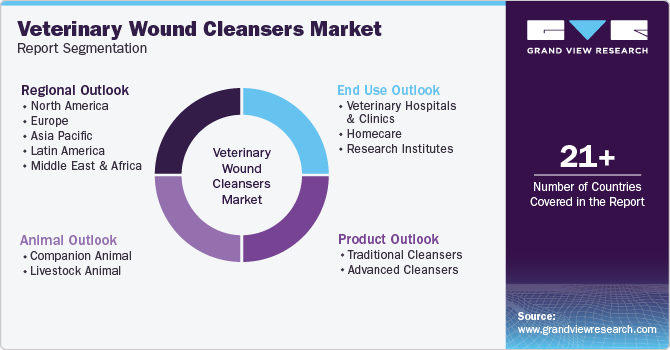

Veterinary Wound Cleansers Market (2025 - 2030) Size, Share & Trends Analysis Report By Animal (Companion Animal, Livestock Animal), By Product (Traditional Cleansers), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-414-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

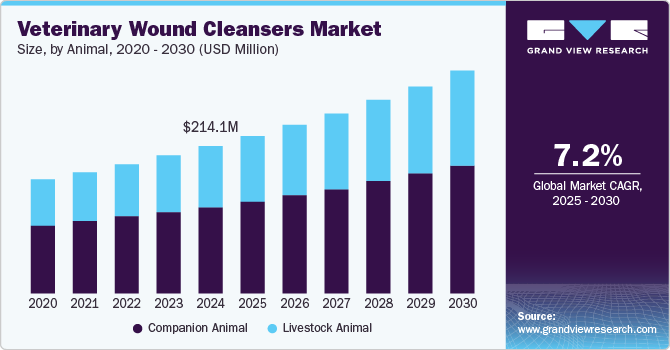

The global veterinary wound cleansers market size was valued at USD 214.11 million in 2024 and is projected to grow at a CAGR of 7.23% from 2025 to 2030 to reach USD 323.81 million by 2030. The growing incidences of injuries in animals, heightened consciousness about animal well-being, advancements in veterinary cleansers and other technologies to manage different types of injuries, and rising demand for specialized animal healthcare products collectively shape consumer preferences and market dynamics. Several players in the industry are developing advanced solutions for injury site cleansing in animals, thereby playing a pivotal role in contributing to the market growth.

For instance, in November 2024[, Vet Aid introduced its innovative products- “Vet Aid Wound Care Spray and Foam,” a natural solution formulated with Red Sea minerals. These eco-friendly and effective products cater to the increasing demand for safer and more natural alternatives to chemical-based treatments. By addressing diverse needs across pets, livestock, and exotic animals, such innovations enhance the range of options available to veterinarians and pet owners. Furthermore, the emphasis on natural and regenerative properties aligns with the growing consumer preference for sustainable and holistic care, thereby fostering market expansion and setting new standards in veterinary wound management.

Educational conferences and awareness programs for veterinary professionals significantly contribute to the market growth of veterinary wound cleansers by promoting best practices and advancements in this sector. For instance, Essity had organized five workshops, each in Nottingham, Derby, Dunstable, and two in Manchester in 2024. These events dealt with wound assessment, post-operative complications, case studies, and practicals. The professionals were shown practical demonstrations on how to manage injuries in companion animals, emphasizing the importance of holistic assessment and more. Such gatherings help veterinary practitioners stay updated on the latest research, technologies, and products, leading to increased adoption of effective care solutions and fosters the use of high-quality cleansers in clinical settings, ultimately driving market growth.

A growing demand is observed for specialized veterinary products tailored to specific needs within the animal healthcare sector. This includes cleansers designed for different animals such as dogs, cats, and horses-and various conditions ranging from minor cuts to surgical wounds. For example, NoBACZ Bovine, launched in December 2023, is specifically developed for bovine care. It uses a patented natural polymer along with copper and zinc ions that rapidly set on contact with the skin. It also contains a surgical spirit solvent that cleanses the site on application. The development and adoption of such tailored products are expected to further propel the demand for specific cleansers and thus drive the market growth.

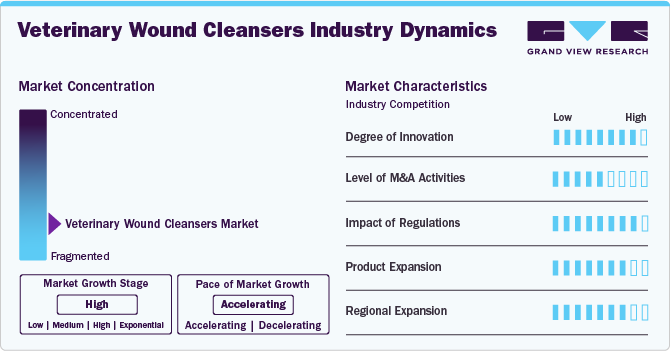

Market Concentration & Characteristics

The degree of innovation in the veterinary wound cleanser market is high, driven by advancements in formulations and delivery systems. Companies increasingly focus on developing products that cleanse, promote healing, and reduce infection risk. For instance, introduction of bioactive wound cleansers incorporating antimicrobial peptides has gained traction; Vetericyn Plus VF Wound and Skin Care Liquid is a modern and safe cleanser that facilitates healing by effectively cleansing, rinsing, and debriding wounds while keeping dressings moist as well.

The market's level of merger and acquisition (M&A) activities is considered medium. The sector witnessed several strategic acquisitions to expand product portfolios and enhance market reach. Companies focus on strategic partnerships to expand their product portfolios and distribution channels. Major players are continuously involved in various strategic activities such as mergers, acquisitions, and partnerships, consolidating market positions, and expanding geographic reach.

The impact of regulations on the veterinary wound cleanser market is high, as stringent guidelines govern product safety and efficacy. Regulatory bodies such as the FDA impose rigorous testing requirements for new formulations, which can delay product launches and ensure consumer safety.

Product expansion within the market is high, with companies actively diversifying their offerings to meet varying customer needs. Introducing specialized products for different animal species, such as equine-specific or small animal-focused cleansers, illustrates this trend. For instance, compliance with new antimicrobial stewardship guidelines prompted manufacturers to reformulate existing products or develop new ones that align with these standards. These regulations aim to protect animal welfare and can also create barriers to entry for smaller firms lacking compliance resources.

The market's region expansion aspect is identified as high, driven by rising pet ownership rates globally and increased spending on pet healthcare. Emerging markets in Asia-Pacific are particularly noteworthy; China and India are witnessing rapid growth in their veterinary sectors due to changing lifestyles and increased disposable incomes among pet owners. For instance, several international companies have established regional distribution networks to capitalize on this growth potential.

Animal Insights

The companion animal segment dominated the market, capturing a significant revenue share of 59.06% in 2024. This trend is driven by the increasing awareness among pet owners regarding wound care and the launch of several exclusive products for its management in pets. As pet owners become more invested in their pets' health, there is a rising demand for effective management solutions. For instance, in August 2024, Charlie The Vet received the Pet Innovation Award for its wound & skin care spray. This spray is used as a first aid for cuts, wounds, insect bites, itchy or irritated skin, and post-surgery care. The company also claims that it kills 99.99% of germs including bacteria, viruses, and fungal spores. The availability of breakthrough products in pet care to treat their wounds is attributed to the growth of the companion animal segment.

Due to several key drivers, the livestock animal segment experienced the fastest-growing CAGR within the market. Many market players are involved in investing and raising funds to develop new solutions specific to livestock animals. For instance, in March 2023, NoBACZ Healthcare Ltd. closed a USD 3.4 million seed round to launch a solution for livestock animals- dairy and beef cattle. This funding was also intended to support the company’s commercial growth and facilitate the research teams in the development of wound-dressing solutions tailored to the specific needs of horses and companion animals. Strategic collaborations and investments like these are expected to fuel the segment’s growth during the forecast period.

Product Insights

Traditional Cleansers segment held the largest revenue share of 60.83% in 2024, driven by their efficacy and widespread use among veterinary professionals. These cleansers, often formulated with saline or antiseptic solutions, are favored for their simplicity and effectiveness in cleaning wounds and preventing infections. The increasing prevalence of animal injuries and a growing emphasis on preventive care increased demand for traditional cleansing products. Additionally, the familiarity and cost-effectiveness of conventional cleansers contribute to their popularity, ensuring they remain a staple in veterinary practices despite the emergence of advanced alternatives.

The advanced cleansers segment is the fastest-growing category in the market, fueled by increasing demand for innovative and effective solutions. These advanced formulations often incorporate antiseptic and antibacterial properties, specifically designed to address the unique needs of various animal species and types of wounds. The rising prevalence of animal injuries and surgical procedures heightened the need for specialized care products that promote faster healing and reduce infection risks. For instance, Vetericyn Plus VF Wound and Skin Care Liquid aids in the healing process by effectively cleaning, flushing, and removing debris from wounds while keeping dressings moist. Also, stem cells are being extensively studied for application in wound healing and veterinary dermatology. Such developments in the advanced cleanser segment are anticipated to fuel the market growth over the forecast period.

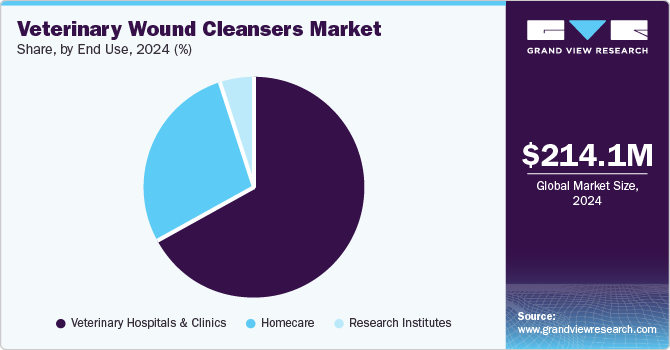

End Use Insights

The veterinary hospitals and clinics segment dominated the market with the largest revenue share of 66.70% in 2024. This trend is driven by these facilities' critical role in providing comprehensive animal healthcare, particularly treating injuries and managing post-operative care. Veterinary hospitals and clinics are the primary sites for administering advanced treatments, utilizing specialized cleansers tailored to various animal species and wound types. The presence of skilled veterinary professionals and access to state-of-the-art equipment in these facilities contribute to the high demand for effective cleansers.

The homecare segment experienced the fastest growth in the market, driven by an increasing preference among pet owners for convenient and effective at-home care solutions. As pet ownership rises and owners become more proactive about their pets' health, there is a growing demand for user-friendly wound care products that can be easily applied at home. This trend is further supported by the increasing awareness of proper wound management, which encourages pet owners to seek out reliable cleansing solutions for minor injuries and post-operative care. The convenience of having effective wound care products readily available at home significantly contributes to this segment's rapid expansion.

Regional Insights

The North American veterinary wound cleanser market held largest revenue share of 38.31% in 2024. There is a rising demand for effective management solutions. Innovations in product formulations, such as the introduction of antimicrobial wound cleansers, are becoming more common and reflecting advancements in veterinary care. Additionally, the prevalence of chronic conditions in pets, including orthopedic issues, necessitates effective management, further fueling market growth. Pet owners with insurance are more inclined to pursue veterinary care for their pets, including treatment for minor injuries and wounds. According to the North American Pet Health Insurance Association Inc., the growth of the total premium value of pet insurance in Canada rose by 29.8% in 2023 compared to the previous year.

U.S. Veterinary Wound Cleansers Market Trends

In the U.S., factors influencing the veterinary wound cleanser market include the prevalence of chronic conditions such as diabetes and orthopedic issues in pets, which necessitate effective management. The rising incidence of these health issues led to an increased focus on post-surgical care and the need for specialized care products. In the U.S., 66.0% of households own a pet, with dogs being the most common at 65.1 million households, followed by cats at 46.5 million. Pet owners are increasingly spending money on their companions' health and pain management, reflecting the growing humanization of pets. Additionally, U.S. is home for multiple biopharmaceutical companies engaged in producing advanced wound cleansing solutions. For instance, Armis Biopharma, a U.S.-based biopharmaceutical company, is working on VeriClenz, a professional antibiotic wound cleanser for animals. Many pipeline veterinary wound cleansing products can increase the product range for consumers and contribute to market growth.

Europe Veterinary Wound Cleansers Market Trends

The European veterinary wound cleansers market is witnessing a significant shift towards innovative products catering to increasing animal health and welfare awareness. One prominent trend is the rise of natural and organic cleansers, driven by consumer demand for safer and more environmentally friendly options. Additionally, the prevalence of chronic diseases among pets, such as diabetes and obesity, led to an increase in surgical procedures, thereby boosting the need for effective wound management solutions. The European market is also seeing a surge in product launches incorporating advanced technologies such as nanotechnology and antimicrobial agents to enhance healing processes.

A well-established veterinary care infrastructure and a strong emphasis on innovation in the market characterize the veterinary wound cleansers market in the UK. British companies are at the forefront of developing advanced wound care products tailored to the specific needs of companion animals and livestock. For instance, Beaphar Wound Ointment is a natural ointment made with honey designed to soothe, protect, and support the healing of superficial wounds. Additionally, companies such as Advancis Veterinary Ltd, are actively involved in developing advanced wound care solutions for animals. These companies have well-equipped manufacturing facilities in the country.

The veterinary wound cleanser market in France is driven by most livestock conditions and the rising focus on enhancing animal interest criteria. The country's diverse agricultural landscape, which includes a significant cattle population, contributes to the demand for effective wound care solutions. French veterinary authorities implemented regulations to reduce antibiotic use in livestock, leading to a greater emphasis on preventive measures such as proper management.

Asia Pacific Veterinary Wound Cleansers Market Trends

The APAC region is witnessing significant growth. The region saw a surge in the adoption of companion animals, with countries such as China and India leading in pet ownership. This trend is accompanied by a growing recognition of the importance of proper wound care, fostering demand for specialized veterinary wound cleansers. Recent statistics indicate that the Asia-Pacific region boasts a larger population of pet dogs and cats than any other part of the world, with approximately 300 million of these animals living in households throughout the area-this figure is about 100 million higher than in North America.

In Japan, unique market trends are emerging due to the country's advanced veterinary healthcare system and high standards of animal care. The Japanese market is characterized by the introduction of innovative wound care products that cater to companion animals and livestock. With a strong focus on research and development, Japanese companies are launching advanced formulations that enhance healing and prevent infections. Additionally, the aging pet population in Japan is driving the demand for effective wound management solutions, as older animals are more susceptible to injuries and chronic conditions. A policy issued by Japan's Ministry of Environment indicates that cats in the nation have an increased lifespan, with the average age reaching a remarkable 15.79 years in 2023, roughly comparable to 79 years in human terms.

The veterinary wound cleanser market in India is growing. The country's diverse agricultural landscape contributes to a high demand for wound care products, particularly for cattle and other livestock. Strategic collaborations and partnerships in the region also fuel the market growth. For instance, Axio Biosolutions expanded its veterinary segment with SureKlot, country’s first complete veterinary wound management solution. SAVA Healthcare Limited announced its partnership with the French pet dermo-cosmetic brand Dermoscent in January 2024, which offers sprays and cleansing solutions to apply over scratches or lesions for pets. Moreover, the rise of e-commerce platforms made it easier for pet owners to access various veterinary products, including wound cleansers.

Latin America Veterinary Wound Cleansers Market Trends

The veterinary wound cleansers market in Latin American is experiencing increasing awareness of animal health and the rising number of pet owners. The growing importance of wound care in animals, particularly among pet owners, is leading to a higher demand for effective veterinary wound cleansers. Additionally, advancements in veterinary medicine and technology are fostering the development of innovative wound care products tailored for various animal species. For instance, introducing specialized formulations designed to prevent infections and promote faster healing is becoming increasingly common, reflecting a shift towards more comprehensive animal healthcare solutions.

A significant prevalence of diseases affecting livestock and companion animals, coupled with a large animal population, is driving Brazil's veterinary wound cleansers market. The country's diverse agricultural landscape contributes to a high demand for effective wound care solutions, especially in the livestock sector, where injuries are common. Moreover, Brazil's growing focus on improving animal welfare standards drives investments in advanced veterinary care products. According to a household survey by the Brazilian Institute of Geography and Statistics (IBGE), Brazil has more pet dogs than young children. In 2022, Brazil ranked as the third-largest pet market globally, following the United States and China. With approximately 149 million pets in the country, the demand for pet products has nearly doubled over the last six years.

Middle East & Africa Veterinary Wound Cleansers Market Trends

The veterinary wound cleanser market in the Middle East and Africa is experiencing significant growth, driven by increasing animal health and welfare awareness. This trend is particularly pronounced due to rising pet ownership rates and a growing livestock industry, which increased demand for effective wound management solutions. The region witnessed a surge in veterinary clinics and animal hospitals, increasingly adopting advanced wound care products to treat animal injuries and infections. Additionally, the prevalence of zoonotic diseases prompted governments and organizations to invest more in veterinary healthcare, further boosting the market for wound cleansers.

In Saudi Arabia specifically, rapid urbanization, changing lifestyles, and a growing population of pets contributed to the expansion of the veterinary wound cleanser market. The Kingdom's Vision 2030 initiative emphasizes improving healthcare services, including veterinary care, which led to increased funding for animal health initiatives. The country also faces challenges related to livestock diseases such as foot-and-mouth disease (FMD) and avian influenza, necessitating effective wound management solutions for affected animals. Riyadh's MAS Company signed a USD 60.0 million agreement with Argentina's Biogénesis Bágo to establish Saudi Arabia's first foot-and-mouth disease vaccine manufacturing plant, supported by the Saudi Ministry of Environment.

Key Veterinary Wound Cleansers Company Insights

The veterinary wound cleanser market is characterized by various companies dominating various segments, including antiseptic solutions, saline washes, and enzymatic cleaners. These companies established significant market shares through strategic partnerships, innovative product development, and extensive distribution networks. The competitive landscape is marked by a mix of well-established players and emerging firms, with the former typically holding a more significant share due to their brand recognition and extensive research capabilities.

Key Veterinary Wound Cleansers Companies:

The following are the leading companies in the veterinary wound cleanser market. These companies collectively hold the largest market share and dictate industry trends:

- Elanco

- Vetoquinol

- Virbac

- Innovacyn, Inc.

- Axio Biosolutions Pvt Ltd

- Jorgen Kruuse

- Dechra Pharmaceuticals

- Neogen Corporation

- B Braun Melsungen

- Pet Natural Remedies

- Zoetis

Recent Developments

-

In August 2024, KeraVet Bio announced the May 2025 launch of KeraVet Gel that will support faster wound healing in companion animals.

-

In April 2024, Kane Biotech Inc., a market leader in wound care, announced the sale of STEM Animal Health Inc. Dechra Veterinary Products, Inc. to achieve commercial launches and global in the future.

Veterinary Wound Cleansers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 228.42 million

Revenue Forecast in 2030

USD 323.81 million

Growth rate

CAGR of 7.23% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Animal, product, end use, and region.

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait.

Key companies profiled

Elanco, Vetoquinol, Virbac, Innovacyn, Inc., Axio Biosolutions Pvt Ltd, Jorgen Kruuse, Dechra Pharmaceuticals, Neogen Corporation, B Braun Melsungen, Pet Natural Remedies, Zoetis.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Wound Cleansers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary wound cleansers market report based on animal, product, end use and region:

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Companion Animal

-

Livestock Animal

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Traditional Cleansers

-

Advanced Cleansers

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Homecare

-

Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global veterinary wound cleansers market size was valued at USD 214.11 million in 2024 and is projected to reach USD 228.42 million in 2025.

b. The global veterinary wound cleansers market is projected to grow at a compound annual growth rate (CAGR) of 7.23% from 2025 to 2030 to reach USD 323.81 million in 2030.

b. By product, Traditional Cleansers segment held the largest revenue share of 60.83% in 2024, driven by their efficacy and widespread use among veterinary professionals. These cleansers, often formulated with saline or antiseptic solutions, are favored for their simplicity and effectiveness in cleaning wounds and preventing infections.

b. Some of the key players operating in the veterinary wound cleansers market include Elanco, Vetoquinol, Virbac, Innovacyn, Inc., Axio Biosolutions Pvt Ltd, Jorgen Kruuse, Dechra Pharmaceuticals, Neogen Corporation, B Braun Melsungen, Pet Natural Remedies, Zoetis.

b. The growing incidences of injuries in animals, heightened consciousness about animal well-being, advancements in veterinary cleansers and other technologies to manage different types of injuries, and rising demand for specialized animal healthcare products collectively shape consumer preferences and market dynamics

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.