- Home

- »

- Next Generation Technologies

- »

-

Video Management Software Market, Industry Report, 2033GVR Report cover

![Video Management Software Market Size, Share & Trends Report]()

Video Management Software Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (IP-based, Analog-based), By Deployment (Cloud, On-premises), By Application, By Vertical (Retail & E-commerce, BFSI, Healthcare), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-813-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Video Management Software Market Summary

The global video management software market size was estimated at USD 11,670.6 million in 2024 and is projected to reach USD 40,933.7 million by 2033, growing at a CAGR of 14.3% from 2025 to 2033. Video management software industry growth is anticipated to be accelerated by rising security and safety concerns, AI-powered analytics, real-time monitoring, and advancements in consumer electronics and wireless audio devices.

Key Market Trends & Insights

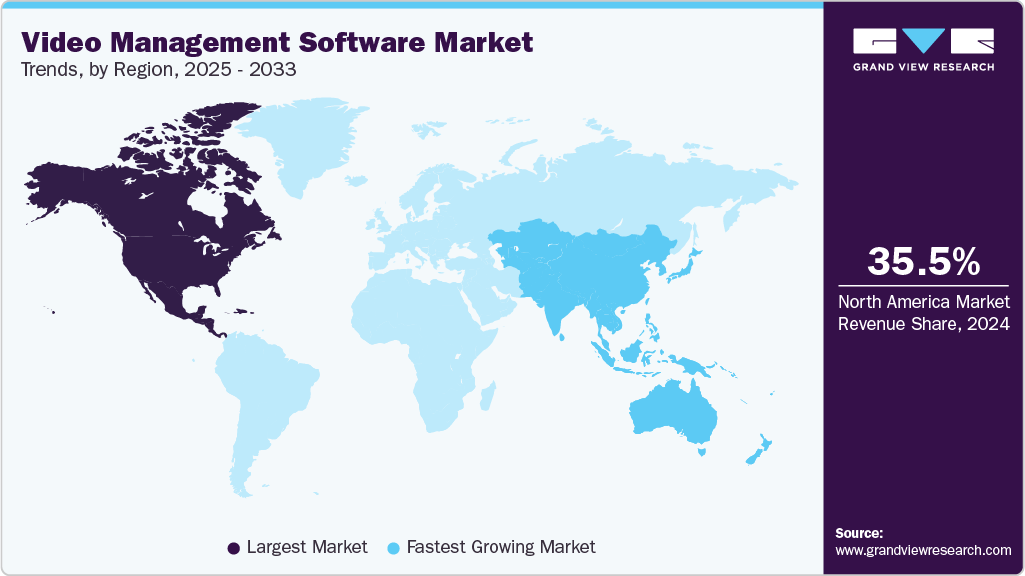

- North America dominated the global video management software market with the largest revenue share of 35.5% in 2024.

- The video management software market in the U.S. led the North America market and held the largest revenue share in 2024.

- By technology, the analog-based segment led the market in 2024, accounting for over 67.3% of global revenue.

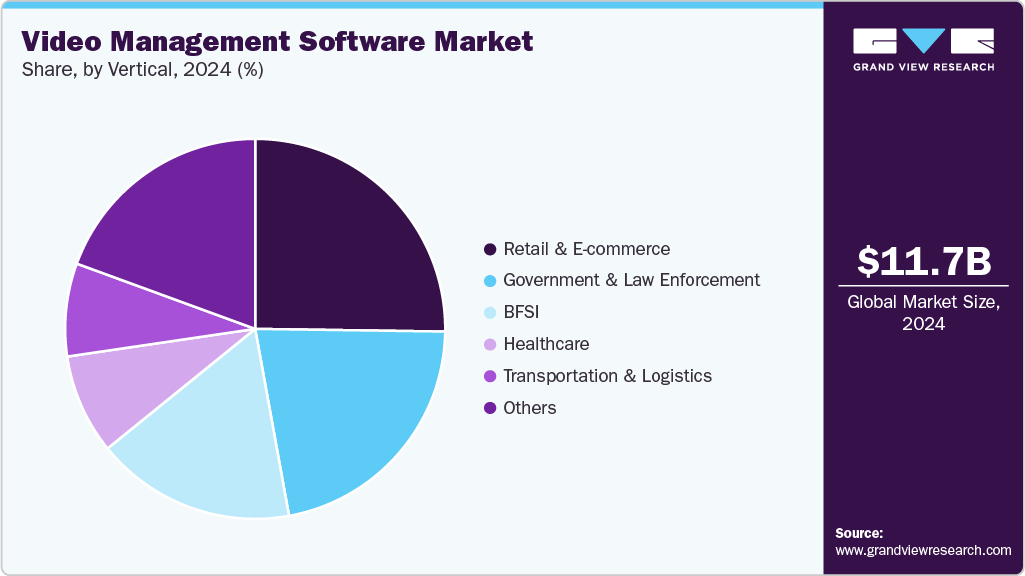

- By vertical, the retail and e-commerce segment held the dominant position in the market, with a revenue share of 25.2% in 2024.

- By deployment, the on-premises segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11,670.6 Million

- 2033 Projected Market Size: USD 40,933.7 Million

- CAGR (2025-2033): 14.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The demand for innovations of voice-controlled devices and smart home audio systems available in the market is increasing the need for video management systems. The VMS market works around efficient communication between hardware and software systems that decode and encode digital data to store, transmit, and playback the audio and video data stored in the systems. Integration with high-resolution video and audio features is supported by many products, which are the other drivers for the expansion of the video management software market.The demand for video management software is majorly influenced by the requirement for high-resolution audio support and energy-efficient designs, which are standard features in many modern products. Manufacturers continuously update the codec's performance to meet the audio and video resolution quality expectations. Meanwhile, the widespread adoption of wireless technologies such as Bluetooth and USB-C has eventually increased the need for reliability, scalability, and high-quality audio transmission, making codecs crucial for the quality. Advanced codecs with noise reduction and low-latency features are required in applications such as gaming, smart home devices, and conferencing tools. These enhancements are crucial for codecs to become a central element in developing user-focused audio and video solutions.

Algorithm innovations and advancements are transforming codec performance. The market players highly recommend reducing data size while maintaining high-resolution audio quality, which is particularly required for streaming and real-time communication. Open-source systems and proprietary codecs compete based on efficiency, platform compatibility, and licensing terms for their products or services. The growing demand for immersive and spatial audio also creates fresh opportunities for tailored codec development.

Technology Insights

The analog-based segment led the market in 2024, accounting for over 67.3% of global revenue because they are less expensive and easily available for small and medium-sized businesses and for cost-sensitive organizations. Analog based cameras and infrastructure are preferably more budget-friendly than other systems. These systems are in high demand by users looking for a simple and dependable surveillance solution without advanced technical features due to their easy integration. They are also easier to install, require less technical setup, and are time-saving, making them ideal. Analog-based VMS solutions are best for areas with limited internet connectivity or bandwidth, the other factors driving the market.

The IP-based segment is expected to grow at the highest CAGR during the forecast period. The video management software market is expected to grow and evolve as organizations seek to optimize their video management processes and gain a competitive advantage through improved data-driven decision-making. The market is driven by the increasing use of IP cameras for high-resolution video capture, scalability, and remote and mobile monitoring support. These systems offer advanced security features and real-time monitoring, saving ownership costs and integrating motion detection and license plate recognition. Additionally, it can centrally monitor multiple areas and drive insights through AI-driven analytics to make data-driven decision making; it is a major contributor to the market’s expansion.

Deployment Insights

The on-premises segment accounted for the largest market revenue share in 2024, due to the deployment of video management software tools and components on local infrastructure rather than in the cloud, minimizing the risks associated with third-party storage. As data privacy and security concerns continue to grow, on-premises deployment will likely become more attractive to organizations that must comply with strict regulations and data protection laws. Moreover, on-premises deployments allow organizations to customize and control their video management software processes and workflows to meet their specific needs, which is especially important for organizations that deal with sensitive or complex data. Strong demand from sectors like government, banking, and healthcare, where data security and regulatory compliance are critical. Cybersecurity concernsarise from the need for secure storage to store and manage sensitive information on local systems, making on-premises VMS a preferred choice in the market.

The cloud segment is expected to grow at the highest CAGR over the forecast period, driven by the increasing demand for cloud-based deployment offering scalability, flexibility, and cost-effectiveness. Organizations increasingly adopt multi-cloud and hybrid cloud strategies to take advantage of different cloud providers' benefits and avoid vendor lock-in without heavy investments to reduce capital expenditure. Moreover, cloud-based video management software offers unlimited storage, is accessible from multiple areas, and has automatic backups, making it different and more preferred in the market. These deployments can help organizations reduce costs, improve productivity, and gain insights quickly.

Application Insights

The video analytics segment leads the market with revenue share in 2024 due to the integration of machine learning algorithms and artificial intelligence in the systems that transform video surveillance into intelligent systems, which include facial and audio recognition, bus telematics, object detection, and threat prediction. Organizations are integrating these systems for security purposes, reducing false alarms in public and government areas, and extracting data insights from a large amount of data stored in the systems. The advanced technology of the Large Language Model (LLM) is integrated into the video analytics system, and the data is processed, enabling natural language and automated report generation.

The remote monitoring segment is expected to grow at the highest CAGR over the forecast period. The market is driven as it offers real-time access to recorded video and analytics data, receives and reduces alerts, and receives emergency responses from anywhere and anytime. It allows monitoring and recording multiple areas with fewer cameras and a network. VSaaS is a good software for the remote management of videos. The factor for market driving is artificial intelligence, a crucial component of remote monitoring that enables smart alert filtering, automated classification of incidents, and predictive maintenance alerts. These capabilities help remote operators concentrate on actual security threats rather than being distracted by routine system notifications.

Vertical Insights

The retail & e-commerce segment accounted for the largest market revenue share in 2024, driven by the need to reduce losses, optimize operations efficiently, and analyze offline and online store customer behavior. VMS integration in retail stores helps in various factors such as threat detection, heat mapping, queue management, and more. This reduces the shrinkage and improves customer experience while maintaininga safe shopping experience for their customers. Advanced technologies include facial and audio recognition, as well as behavioral analysis for inventory management and customer relationship management tools.

The healthcare segment is anticipated to grow at the highest CAGR during the forecast period. Healthcare VMS deployments are popular as they help monitor patient areas, emergency rooms, restricted zones, and pharmaceutical storage while ensuring compliance with privacy rules and regulations like HIPAA using secure cloud solutions and technologies. It incorporates advanced analytics such as fall detection, alerts for wandering patients, and automated incident recording to enhance safety and operational efficiency. Integrating video management systems with electronic health records, nurse call systems, and building management platforms fosters smart healthcare environments that enhance patient care and lower operational expenses.

Regional Insights

North America dominated the video management software industry with a revenue share of over 35.5% in 2024, driven by the advanced technologies available in the market to adopt VMS in various sectors such as healthcare, retail, transportation, education, and many more. High internet connectivity in the region allows for real-time monitoring, remote video streaming, and smooth data transfer, which is crucial for deploying and using advanced VMS systems and hence enhancing them.

U.S. Video Management Software Market Trends

The U.S. video management software market is expected to grow significantly in 2024, driven by the increased demand for video management software (VMS), as these technologies enable real-time, comprehensive video analytics and monitoring across urban environments. A key factor to market growth is transitioning from traditional analog systems to IP-based solutions, which provide enhanced image quality, scalability, and remote access capabilities. The growing preference for cloud-based VMS platforms is also boosting the country's market, as they offer cost-effective, flexible, and easily accessible video management. Furthermore, widespread demand across diverse retail, healthcare, transportation, and government sectors continues to support the market’s expansion.

Europe Video Management Software Market Trends

The Europe video management software market is witnessing steady growth over the forecast period, driven by the requirement of real-time video feeds, and incident response power to respond quickly in emergencies such as natural disasters, terrorist threats and other emergencies in this region, hence, focuses on the public safety and management in the emergency. Furthermore, the rising demand for cloud–based VMS solutions offers various advantages such as cost-saving, scalability, and remote monitoring in the region.

Asia Pacific Video Management Software Market Trends

The video management software market in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period led by China, India, South Korea, and Japan, where people of urban area demands for advance surveillance systems to monitor remotely which is enhanced by 5G networks to manage traffic, public safety and preventing incidents in the region by adopting advanced technologies such as AI, ML and edge computing. Government & Law Enforcement initiatives for smart cities require the integration of VMS systems to improve the region's security and operational services.

Key Video Management Software Company Insights

Some key companies in the video management software industry are Axis Communications, Bosch Sicherheitssysteme GmbH, Genetec Inc., and Johnson Controls.

-

Axis Communications provides network video surveillance solutions, including video management software (VMS) that integrates seamlessly with their wide range of IP cameras and devices. Their VMS products-such as AXIS Camera Station Pro and AXIS Camera Station Edge-offer scalable, flexible, and secure surveillance and access control for single and multisite deployments, with support for private networks or cloud connectivity. Axis delivers open, user-friendly, scalable software that enhances security, operational efficiency, and real-time decision-making. Backed by a strong global partner network, their dedication to innovation and cybersecurity drives their vision of a smarter, safer world through advanced video management solutions.

-

Honeywell provides advanced video management software solutions through its building technologies segment, focusing on enhancing security and operational efficiency. Its MAXPRO video management solution offers powerful, scalable, and flexible video surveillance capabilities, integrating AI-based analytics and supporting multi-site centralized monitoring for real-time situational awareness. Honeywell’s Enterprise NVR software further delivers enterprise-class digital video solutions with strong scalability, managing thousands of video channels and seamlessly integrating analog and digital systems. These solutions are designed to improve safety, security, and operational performance across diverse industries.

Key Video Management Software Companies:

The following are the leading companies in the video management software market. These companies collectively hold the largest market share and dictate industry trends.

- Axis Communications AB.

- AxxonSoft

- Bosch Sicherheitssysteme GmbH

- Dahua Technology Co., Ltd

- Genetec Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Honeywell International Inc.

- Johnson Controls

- Milestone Systems A/S.

- Verint Systems Inc.

Recent Developments

-

In June 2025, Honeywell launched its first-ever CCTV camera portfolio made in India, called the 50 Series. These cameras were fully designed and produced locally in alignment with the Government and Law Enforcement of India’s Atmanirbhar Bharat initiative. These Class 1 certified cameras offer enterprise-grade cybersecurity, intelligent video analytics, enhanced imaging, and gyro sensor-based image stabilization, tailored to meet the security needs of critical infrastructure across sectors such as government, healthcare, education, and transport.

-

In January 2025, AxxonSoft and Eurotech announced a strategic partnership to deliver advanced AI-enabled video surveillance solutions by combining AxxonSoft’s intelligent video management software with Eurotech’s cybersecurity-certified ReliaCOR edge AI hardware powered by NVIDIA Jetson Orin technology. This collaboration targets industries such as smart cities, industrial automation, and critical infrastructure, with high-performance solutions that enhance security and operational efficiency.

-

In November 2024, Axis Communications launched its ARTPEC-9 SoC, enhancing imaging, AI-powered analytics, cybersecurity, and video encoding with AV1 technology. The company also expanded its distribution in India by partnering with Redington Limited. In a significant product release, Axis introduced the world's first explosion-protected thermometric camera for hazardous locations and announced an explosion-protected network horn speaker. Additionally, Axis has ventured into environmental monitoring with new indoor air quality sensors capable of detecting vaping and smoking.

Video Management Software Market Report Scope

Report Attribute

Details

Market size in 2025

USD 14,014.8 million

Revenue forecast in 2033

USD 40,933.7 million

Growth rate

CAGR of 14.3% from 2025 to 2033

Base year for estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Market revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, deployment, application, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

Axis Communications AB.; AxxonSoft.; Bosch Sicherheitssysteme GmbH; Dahua Technology Co., Ltd; Genetec Inc.; Hangzhou Hikvision Digital Technology Co., Ltd.; Honeywell International Inc.; Johnson Controls; Milestone Systems A/S.; Verint Systems Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Video Management Software Market Report Segmentation

This report forecasts revenue growth on global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global video management software market report based on the technology, deployment, application, vertical, and region:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

IP-based

-

Analog-based

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud

-

On-premises

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Video Analytics

-

Access Control Integration

-

Cloud Storage & Management

-

Perimeter Protection

-

Remote Monitoring

-

Others

-

-

Vertical Outlook (Revenue, USD Million, 2021 - 2033)

-

Retail & E-commerce

-

Government & Law Enforcement

-

BFSI

-

Transportation & Logistics

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.