- Home

- »

- Next Generation Technologies

- »

-

Video Surveillance Storage Market, Industry Report, 2030GVR Report cover

![Video Surveillance Storage Market Size, Share & Trends Report]()

Video Surveillance Storage Market (2025 - 2030) Size, Share & Trends Analysis Report By Offerings (Hardware, Solution), By Storage (SSD and HDD), By Enterprise Size (Small & Medium size, Large Enterprises), By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-603-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Video Surveillance Storage Market Summary

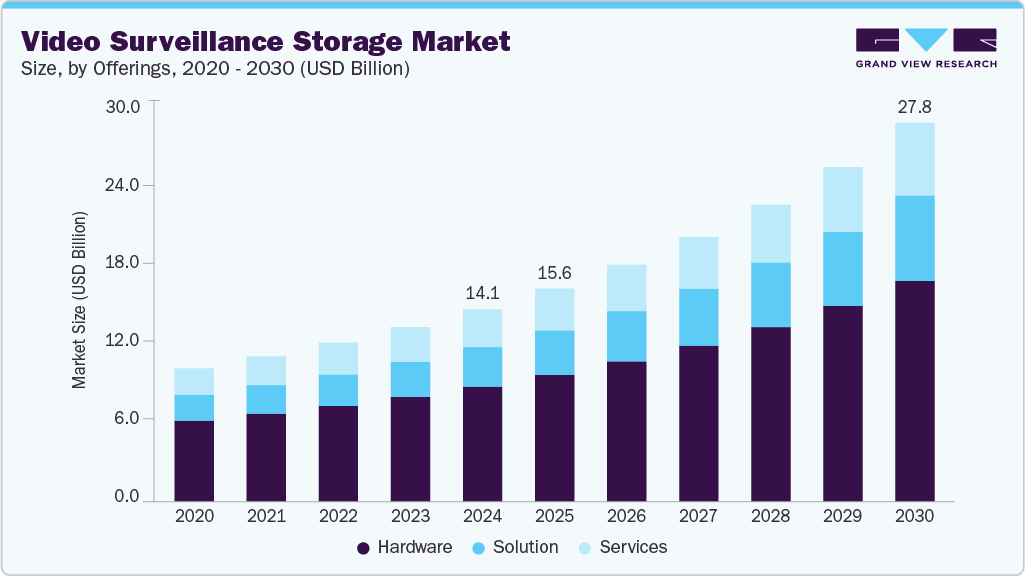

The global video surveillance storage market size was estimated at USD 14,136.7 million in 2024 and is projected to reach USD 27,829.3 million by 2030, growing at a CAGR of 12.2% from 2025 to 2030. Rising safety concerns in public spaces and within enterprises, along with the rapid expansion of the Internet of Things (IoT), are key drivers of the growth of the video surveillance storage market.

Key Market Trends & Insights

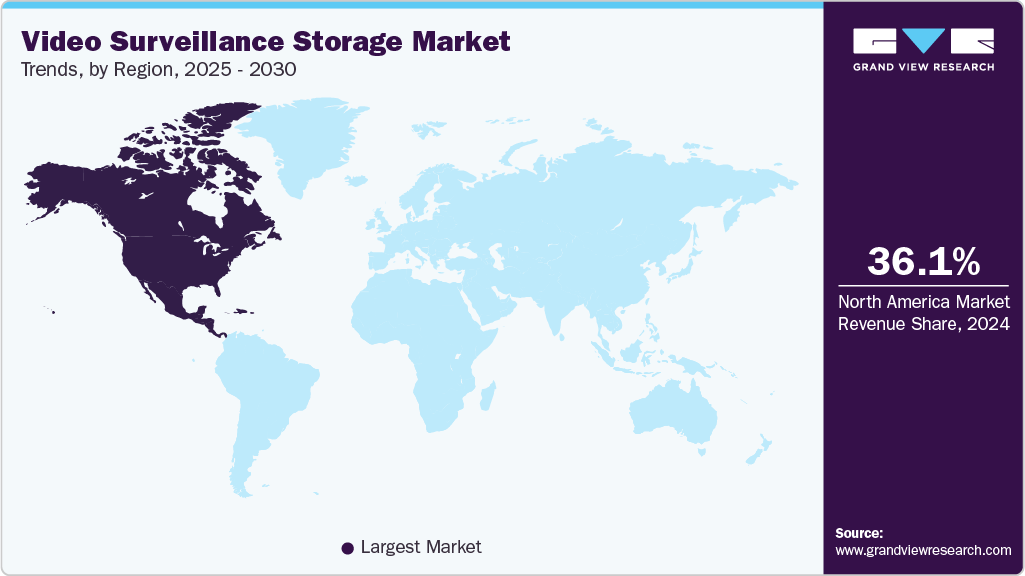

- North America video surveillance storage market accounted for a 36.1% share in 2024.

- The U.S. video surveillance storage market is rising the demand in the region.

- In terms of offering, the hardware segment dominated the revenue share with 59.8% in 2024.

- In terms of storage, the solid-state drive (SSD) segment accounted for the largest market revenue share in 2024.

- In terms of enterprise size, the large enterprises segment accounted to dominate the market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 14,136.7 Million

- 2030 Projected Market Size: USD 27,829.3 Million

- CAGR (2025-2030): 12.2%

- North America: Largest market in 2024

The increasing volume of video surveillance footage focuses on the need for strong and efficient data storage solutions. Video surveillance systems currently play a critical role in maintaining public safety and supporting government operations. Law enforcement agencies rely on extensive networks of surveillance cameras deployed across cities. However, advanced surveillance technologies generate large amounts of data that require secure and efficient storage.

The widespread storage of ultra-high-definition cameras and the growing network of Internet of Things (IoT) devices are resulting in an increase in video data output, creating a pressing need for storage systems that are both scalable and capable of handling high volumes. Moreover, video surveillance storage is being enhanced with AI-driven analytics like facial recognition, object tracking, and behavioral analysis, which significantly elevate the intelligence and usability of the stored footage. These advancements demand advanced storage technologies that can efficiently manage data processing and enable swift access to valuable insights. Public transportation systems such as airports, bus terminals, train stations, and subways are also dependent on video surveillance to address threats from terrorism, vandalism, and violence.

As surveillance storage continues to expand and evolve, the demand for reliable data storage solutions grows parallel. This rising need for video surveillance storage is expected to drive the video surveillance storage market. The market's strong growth potential and profitability attract numerous companies, pushing significant investments in research and development. These efforts aim to create next-generation video surveillance storage technologies capable of handling increasingly large volumes of surveillance data more effectively.

Offering Insights

The hardware segment dominated the revenue share with 59.8% in 2024. Advancements in storage hardware, such as emerging hard drive technologies like SMR and ePMR, are significantly improving the performance and reliability of continuous 24/7 surveillance systems. The growing use of network-attached storage (NAS) solutions is also contributing to this progress by enabling centralized data management, scalability, and remote access, which are essential for managing multi-camera setups and integrating with Solid State Drive (SSD) platforms. Furthermore, regulatory compliance demands, and the expansion of smart city projects are driving organizations to invest in strong storage infrastructures that ensure data security, integrity, and support for real-time analytics.

Solution segment is predicted to foresee significant growth, with a CAGR of 14.0% during the forecast period. The market is growing due to increased security needs across residential, commercial, and government sectors, which require scalable and dependable storage systems to manage the increasing volume of high-resolution video footage. The broad adoption of IP cameras, along with developments in Solid State Drive (SSD) and hybrid storage technologies, offers cost-effective, flexible, and remotely accessible options that work seamlessly with AI-driven video analytics. Furthermore, the expansion of smart city initiatives and strict data retention and security regulations are driving demand for strong and integrated storage solutions. The emergence of edge computing also plays a key role by supporting real-time data processing and minimizing latency, making advanced storage systems a core offerings of surveillance infrastructure.

Storage Insights

The solid-state drive (SSD) segment accounted for the largest market revenue share in 2024. The market is expanding due to its fast data access speeds, reliability, and resilience features which make it essential for real-time video streaming and analytics. Utilizing non-volatile flash memory and lacking moving parts, SSDs are highly resistant to shocks, vibrations, and extreme temperatures, making them well-suited for demanding environments like vehicles and outdoor surveillance setups. Their low latency and high IOPS (input/output operations per second) allow for immediate access to high-definition video, enabling AI-based analytics and swift incident response. Moreover, SSDs are energy-efficient and produce minimal heat, supporting the development of smaller, more power-conscious surveillance devices.

The hard disk drive (HDD) segment is estimated to grow significantly over the forecast period. The market is driven by its ability to handle continuous 24x7 video recording from multiple cameras, making it a key offerings of dependable security system. HDDs are built for durability and long-term use, with firmware focused on withstanding heavy writing loads, minimizing frame loss, and preventing data corruption, ensuring consistent and reliable video capture. Their large storage capacities in the multi-terabyte range allow for extended retention of high-definition footage, which is essential for long-duration monitoring and post-event analysis. Additionally, HDDs provide a cost-effective solution for large-scale storage needs, offering energy efficiency, vibration resistance, and RAID support, making them ideal for enterprise-level surveillance setups that require both high capacity and strong performance.

Enterprise Size Insights

The large enterprises segment accounted to dominate the market revenue share in 2024. Prominent features are the great adoption of high-resolution IP cameras and IoT-based surveillance systems, which produce large amounts of video data and necessitate dependable, scalable storage solutions. Increased security concerns in government, commercial, and industrial sectors alongside strict regulations around data retention and privacy are driving large organizations to invest in advanced storage infrastructure. Furthermore, the growing use of Solid-State Drive (SSD) and hybrid storage models allows enterprises to efficiently manage distributed surveillance operations.

The small & medium size segment is estimated to grow significantly over the forecast period. Video surveillance storage is anticipated due to the demand for affordable, scalable, and user-friendly storage solutions like NAS and hybrid systems. These options enable SMEs to protect their facilities and store essential video footage without significant upfront costs. Cost-effective and easily manageable, these storage systems help enhance security, minimize theft, and improve operational visibility. Additionally, the growing use of IP-based surveillance and budget-friendly DVR systems further supports the increasing adoption of video storage solutions among SMEs.

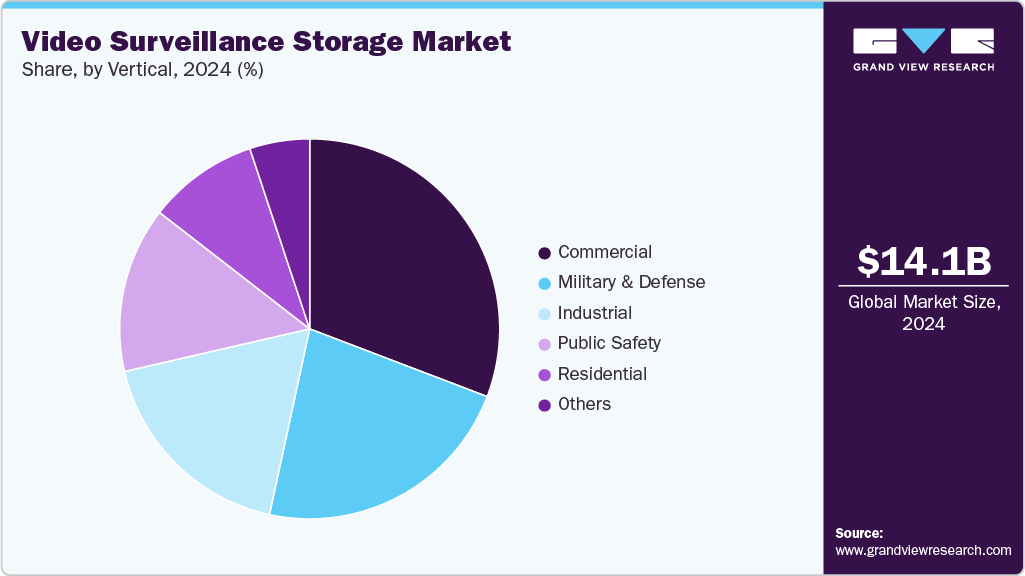

Vertical Insights

The commercial segment accounted for the largest market revenue share in 2024. The security concerns rising from increasing crime rates and the need to safeguard assets, staff, and customers in environments such as retail spaces, offices, and transportation centers are driving the market. The use of high-resolution IP cameras results in substantial video data generation, creating a strong demand for scalable, high-capacity storage solutions. Compliance with regulatory and data retention requirements further accelerates the need for secure and dependable storage systems. Moreover, the adoption of AI-driven analytics for real-time surveillance and theft prevention, combined with a shift toward Solid State Drive (SSD) and hybrid storage models, boosts operational efficiency and adaptability, contributing to the commercial sector’s market growth.

The industrial segment is projected to grow significantly over the forecast period. The market is driven by the growing security and safety concerns in manufacturing facilities, warehouses, and critical infrastructure, which require dependable storage solutions for continuously recording high-resolution video. Regulatory requirements for data retention and secure storage also contribute to the rising demand for scalable and strong storage systems. Furthermore, the transition to Solid State Drive (SSD) and hybrid storage architecture allows industrial organizations to handle large amounts of data more effectively, while enabling remote access and seamless integration with AI-driven analytics tools.

Regional Insights

North America video surveillance storage market accounted for a 36.1% share in 2024. The market is witnessing strong growth due to rising security concerns across residential, commercial, and governmental sectors, leading to a greater need for dependable storage of expanding video data. The adoption of advanced technologies such as AI-driven video analytics, high-definition surveillance cameras, and Solid-State Drive (SSD)-based storage is improving the performance and scalability of modern surveillance systems. Moreover, strict regulatory requirements in industries like retail, healthcare, and public administration are reinforcing the necessity for secure, easily accessible video storage. Further fueling market expansion are substantial government investments in public safety and smart city initiatives, which are driving the demand for sophisticated video surveillance storage solutions throughout the region.

U.S. Video Surveillance Storage Market Trends

The U.S. video surveillance storage market is rising the demand in the region. The market is in demand due to significant investments by the government and defense sectors are being made to expand surveillance coverage across essential infrastructure and public areas, resulting in the generation of vast amounts of video data that require robust, scalable storage solutions. The growing adoption of Solid-State Drive (SSD)-based storage is another major driver, providing cost-effective scalability and advanced security features essential for managing sensitive surveillance footage. Additionally, the rise in public-private collaborations and stricter regulations around data retention and security are accelerating the adoption of advanced, compliant storage technologies, further making the market expansion.

Europe Video Surveillance Storage Market Trends

In Europe, the video surveillance storage market is being driven by the rising adoption of smart and high-definition surveillance technologies across various sectors, including residential security, healthcare, transportation, retail, and banking and financial services (BFSI). The shift from analog to digital systems, along with the growing use of surveillance-optimized solid-state drives (SSDs), is improving data storage speed and reliability, particularly in mobile or high-vibration settings such as vehicles. Moreover, the increasing popularity of electric and autonomous vehicles in the region is driving demand for high-performance storage solutions capable of managing the large volumes of data generated by onboard cameras.

Asia Pacific Video Surveillance Storage Market Trends

In the Asia Pacific region, the video surveillance storage market is largely driven by the booming transportation and logistics industry, where in-vehicle surveillance systems are increasingly used to improve safety, efficiency, and prevent theft. The demand for electric vehicle sales, many of which have multiple high-resolution cameras for autonomous driving and dashcam purposes, is further increasing the demand for high-capacity storage. Moreover, major government-led initiatives in countries like China, such as smart city developments and public safety programs like Golden Shield and SkyNet, are significantly increasing the need for advanced video surveillance storage solutions.

Key Video Surveillance Storage Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry.

-

Hikvision is a provider of video surveillance products and solutions, known for its extensive range of advanced video storage technologies. The company focuses on delivering high-capacity, scalable storage systems tailored for various surveillance needs across sectors like public safety, transportation, and smart city infrastructure. By integrating innovations in AI, Solid State Drive (SSD) storage, and high-definition video technology, Hikvision offers dependable and efficient storage solutions that meet the increasing demands of today’s surveillance environments. With a solid global footprint and continuous investment in R&D, Hikvision remains at the forefront of advancing the video surveillance storage industry.

-

Honeywell is a technology innovator with deep expertise in automation, building solutions, and industrial advancements, and it plays a significant role in the video surveillance storage market. Drawing on its strengths in building automation, Honeywell provides cutting-edge surveillance and storage systems that improve safety, security, and operational performance in commercial facilities and critical infrastructure. Its integrated platforms, such as Honeywell Forge, offer efficient data management, scalable storage capabilities, and real-time analytics for surveillance Enterprise Sizes. With more than a century of innovation and a strong focus on creating smarter, safer environments, Honeywell is a trusted provider of dependable and future-focused video surveillance storage solutions.

Key Video Surveillance Storage Companies:

The following are the leading companies in the video surveillance storage market. These companies collectively hold the largest market share and dictate industry trends.

- Western Digital Corporation

- Seagate Technology LLC

- Hitachi, Ltd.

- Dell Inc.

- Honeywell International Inc.

- NetApp

- Axis Communications AB

- Bosch Limited

- Toshiba Electronics Europe GmbH

- Hangzhou Hikvision Digital Technology Co., Ltd.

Recent Developments

-

In May 2025, Western Digital introduced the OpenFlex Data24 4100 EBOF and the Ultrastar Data102 3000 ORv3 JBOD at computex 2025. The OpenFlex Data24 4100, optimized for Solid State Drive (SSD)-based environments, incorporates single-port SSDs and system-level mirroring to strengthen data protection. Meanwhile, the Ultrastar Data102 3000 ORv3 JBOD offers enhanced efficiency and simplified management, making it ideal for large-scale video storage installations.

-

In August 2024, Toshiba introduced its latest S300 Pro Surveillance HDDs, engineered for large-scale video surveillance systems and offering storage capacities of up to 10TB. These next-generation hard drives are built to support as many as 64 high-definition cameras, delivering a maximum sustained data transfer speed of 268MiB/s and featuring an expanded 512MiB cache buffer for enhanced performance. The S300 Pro drives also offer improved power efficiency and come with a 5-year warranty, making them a reliable choice for intensive, round-the-clock surveillance operations and advanced video analytics Enterprise Sizes.

-

In January 2024, Western Digital launched the 24TB Ultrastar DC HC580 CMR HDD and the 28TB Ultrastar DC HC680 SMR HDD, along with its WD Purple and WD Purple Pro, at Intersec Dubai 2024. These high-capacity solutions are designed to meet the demands of security, safety, and enterprise data centers, delivering efficient storage with reduced power consumption. The event also marked the official launch of these products in the Middle East, underscoring Western Digital’s ongoing commitment to advancing video surveillance and data analytics technologies.

Video Surveillance Storage Market Report Scope

Report Attribute

Details

Market size in 2025

USD 15,649.6 million

Revenue forecast in 2030

USD 27,829.3 million

Growth rate

CAGR of 12.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offerings, storage, enterprise size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Western Digital Corporation; Seagate Technology LLC; Hitachi, Ltd.; Dell Inc.; Honeywell International Inc.; NetApp; Axis Communications AB; Bosch Limited; Toshiba Electronics Europe GmbH; Hangzhou Hikvision Digital Technology Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Video Surveillance Storage Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global video surveillance storage market report based on the offerings, storage, enterprise size, vertical, and region:

-

Offerings Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Solution

-

Services

-

-

Storage Outlook (Revenue, USD Million, 2018 - 2030)

-

Hard Disk Drive (HDD)

-

Solid State Drive (SSD)

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & Medium size

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Residential

-

Industrial

-

Military & Defence

-

Public Safety

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global video surveillance storage market is expected to register 14.14 billion revenue in 2024 and significantly hold 15.65 billion revenue in 2025.

b. The global video surveillance storage market is expected to grow at a compound annual growth rate of 12.2% from 2025 to 2030 to reach USD 27.83 billion by 2030.

b. North America dominated the video surveillance storage market with a share of 36.1% in 2024. Rising safety concerns in public spaces and within enterprises, along with the rapid expansion of the Internet of Things (IoT), are key drivers of the growth of the video surveillance storage market. The increasing volume of video surveillance footage focuses on the need for strong and efficient data storage solutions.%

b. Some key players operating in the video surveillance storage market include Western Digital Corporation; Seagate Technology LLC; Hitachi, Ltd.; Dell Inc.; Honeywell International Inc.; NetApp; Axis Communications AB; Bosch Limited; Toshiba Electronics Europe GmbH; Hangzhou Hikvision Digital Technology Co., Ltd.

b. Key factors that are driving the market growth are, as surveillance Storages continue to expand and evolve, the demand for reliable data storage solutions grows in parallel. This rising need of video surveillance storage is expected to drive the video surveillance storage market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.