- Home

- »

- Next Generation Technologies

- »

-

Video Wall Market Size, Share, Growth, Industry Report 2030GVR Report cover

![Video Wall Market Size, Share & Trends Report]()

Video Wall Market (2025 - 2030) Size, Share & Trends Analysis Report By Display Technology (LED, LCD), By Application (Indoor, Outdoor), By End Use (Retail, Corporate, Travel And Hospitality), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-596-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Video Wall Market Size & Trends

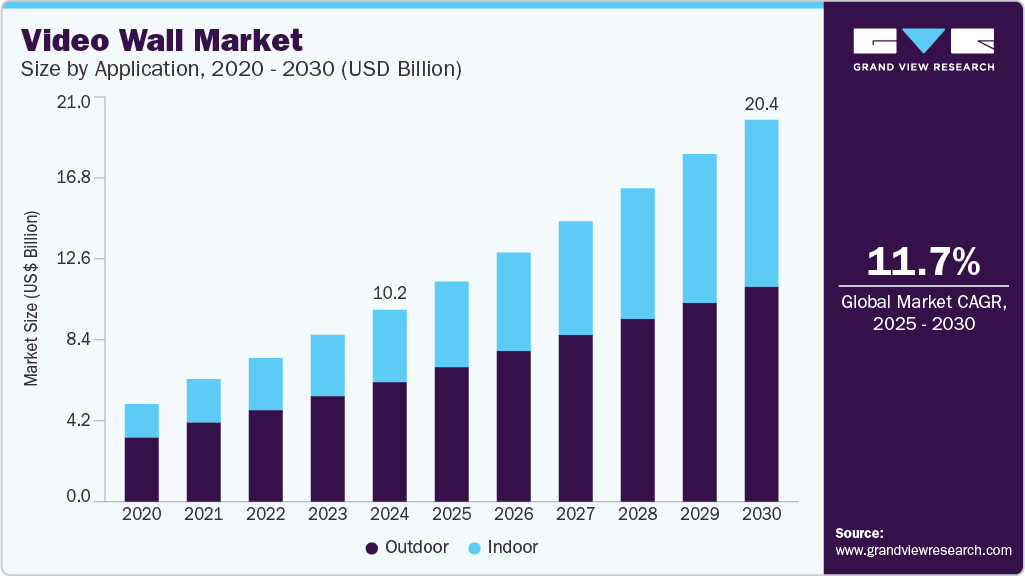

The global video wall market size was estimated at USD 10.23 billion in 2024 and is expected to grow at a CAGR of 11.7% from 2025 to 2030. The market is driven by the increasing demand for large-format, high-impact visual displays across various retail, transportation, and entertainment sectors.

Key Highlights:

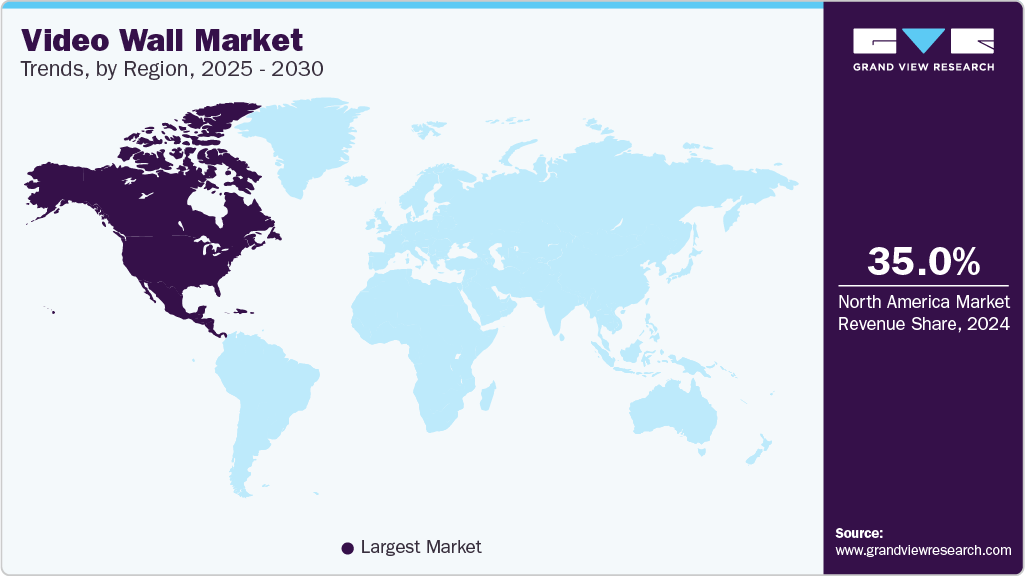

- North America video wall market dominated the global market with a revenue share of over 35% in 2024.

- The U.S. video wall market is expected to grow significantly in 2024.

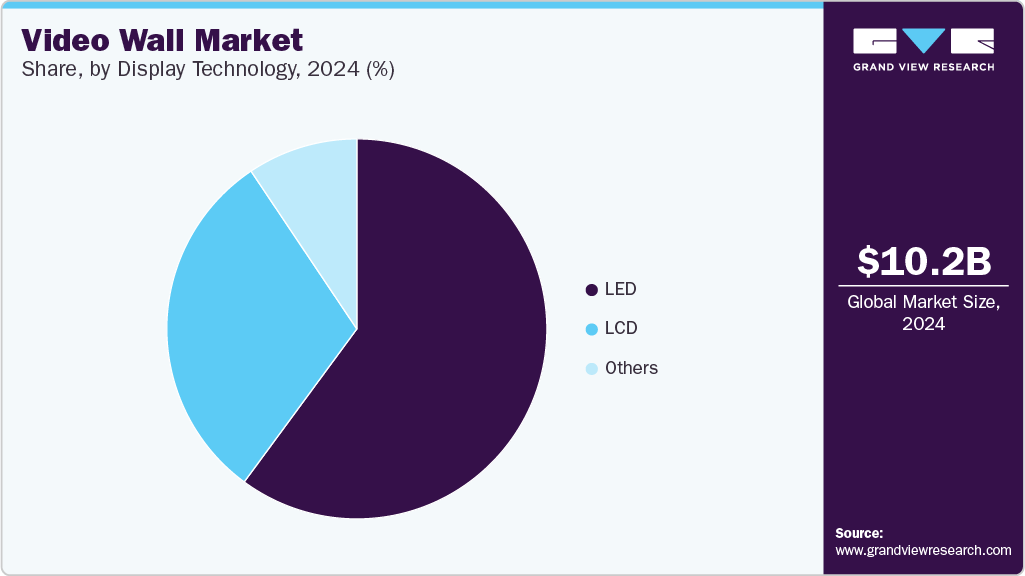

- By display technology, the LED segment led the market and accounted for over 59% of global revenue in 2024.

- By application, the outdoor segment accounted for the largest revenue share in 2024.

- By end use, the retail segment accounted for the largest revenue share in 2024.

Factors contributing to this valuation include the integration of video walls in control rooms for enhanced monitoring and decision-making capabilities and their growing adoption in corporate environments for presentations and collaborative workspaces. Technological advancements, such as narrow bezel displays and improved color reproduction, support market growth by delivering seamless and visually appealing experiences.

Moreover, the market growth is supported by technological innovations, including microLED and OLED display technologies, which offer superior brightness, contrast, and energy efficiency compared to traditional LCD and LED panels. For instance, in May 2025, Planar Systems, Inc. introduced a new line of Chip-on-Board (COB) LED video wall displays optimized for indoor settings with high ambient light levels, the DirectLight Essential Series. This series offers a cost-effective solution for fine pixel pitch LED technology, delivering enhanced brightness and image clarity suitable for applications in hospitality, retail, corporate, education, and broadcast sectors. Video walls are gaining prominence, enabling touch and gesture-based controls that facilitate user engagement in retail, education, and corporate sectors. Integrating cloud-based content management platforms allows centralized control and real-time updates of video wall content across multiple locations, enhancing enterprise operational flexibility.

Furthermore, market expansion is also influenced by infrastructural growth and urbanization in emerging economies, where investments in smart city projects and digital transformation initiatives drive demand for video wall installations in public spaces, government facilities, and commercial complexes. Energy efficiency remains a key priority, with manufacturers focusing on developing video wall solutions that minimize power consumption while maintaining high display quality. Furthermore, modular and scalable video wall configurations enable customization to meet diverse spatial and functional requirements, making them suitable for small-scale corporate meeting rooms and large-scale control centers.

Application Insights

The outdoor segment accounted for the largest revenue share in 2024 as they are extensively deployed for advertising, public information dissemination, and event broadcasting in open environments. Their high luminance and weatherproofing features ensure clear visibility under direct sunlight and resilience against environmental factors such as rain, dust, and temperature fluctuations. The expansion of smart city initiatives and the increasing use of digital signage in urban infrastructure, including airports, stadiums, and transportation terminals, drives demand for robust outdoor video wall solutions. These applications require reliable, large-scale displays capable of continuous operation, which outdoor video walls effectively provide.

The indoor segment is expected to grow at the highest CAGR over the forecast period due to rising adoption in retail, healthcare, corporate offices, and entertainment venues. Advanced display technologies have improved image uniformity, color precision, and bezel reduction, improving the visual quality of indoor video walls and making them well-suited for close viewing distances. Integrating interactive touchscreens and AI-powered content management systems improves user engagement and operational efficiency. Additionally, indoor environments allow for more controlled lighting and temperature conditions, which extend the lifespan and performance of video walls, encouraging broader deployment.

End Use Insights

The retail segment accounted for the largest revenue share in 2024, and video walls are powerful tools for customer engagement and brand promotion. Retailers use video walls to create immersive shopping experiences through dynamic advertising, product showcases, and interactive displays that influence purchasing decisions. The rise of experiential retail, where consumers expect personalized and engaging environments, drives demand for video walls that can be easily updated and managed remotely. Furthermore, video walls enable retailers to integrate online and offline channels, supporting omnichannel strategies that enhance customer loyalty and sales.

The healthcare segment is anticipated to grow at the highest CAGR during the forecast period due to the increasing adoption of video wall solutions in medical facilities for enhanced patient care, operational efficiency, and communication. Hospitals and healthcare centers utilize video walls to display real-time patient data, diagnostic imaging, and urgent alerts, which improve clinical decision-making and patient monitoring. These large-format, high-resolution displays enable simultaneous visualization of multiple data sources, facilitating collaboration among medical staff and supporting telemedicine and remote consultations.

Display Technology Insights

The LED segment led the market and accounted for over 59% of global revenue in 2024, driven by its ability to deliver high brightness levels and superior color accuracy, essential for indoor and outdoor applications. Its modular design allows for flexible screen sizes and resolutions, enabling seamless large-format displays without visible bezels. Furthermore, LED video walls offer better energy efficiency and longer operational life than other technologies, reducing the total cost of ownership for end-users. These advantages position LED technology as a convenient solution across various sectors such as advertising, sports venues, transportation centers, and corporate environments, thereby driving its substantial market share.

The LCD segment is anticipated to grow at a significant CAGR during the forecast period due to continuous improvements in panel technology, such as ultra-narrow bezels and higher resolution displays, which enhance visual quality and design flexibility. LCD video walls are preferred in corporate, education, and healthcare sectors where sharp image quality and interactive capabilities are important. In addition, LCD panels are generally more cost-effective to produce and maintain, making them accessible for small to medium-sized enterprises. The growing demand for video walls in control rooms and conference rooms further supports the segment’s growth within the market.

Regional Insights

North America video wall market dominated the global market with a revenue share of over 35% in 2024. This can be attributed to its advanced technological infrastructure, high adoption rates of digital display technologies, and significant investments in corporate, retail, transportation, and public safety sectors. The region hosts several leading video wall manufacturers and technology innovators, facilitating early adoption and continuous development of new products. Government initiatives supporting smart city projects and infrastructure modernization also contribute to the high demand for video walls.

U.S. Video Wall Market Trends

The U.S. video wall market is expected to grow significantly in 2024, driven by increasing deployment of video walls in retail environments, corporate offices, healthcare facilities, and transportation hubs. Digital transformation initiatives and investments in smart infrastructure encourage the adoption of advanced video wall technologies that offer interactive features and AI-based content management. The expansion of esports, live events, and entertainment venues also supports demand for large-scale, high-resolution video walls.

Europe Video Wall Market Trends

The video wall market in Europe is expected to grow significantly over the forecast period. The growth is supported by the increasing adoption of video walls in retail, public transportation, government facilities, and cultural institutions. Investments in smart city developments and digital infrastructure across countries such as Germany, the UK, and France drive the deployment of video wall solutions for public information and security monitoring. The region’s regulatory focus on energy efficiency and sustainability promotes the use of eco-friendly display technologies. Moreover, growing demand for interactive and customizable video walls in corporate and educational environments contributes to market expansion.

Asia Pacific Video Wall Market Trends

The video wall market in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period, driven by urbanization, infrastructure development, and expanding retail and entertainment sectors in countries including China, India, Japan, and South Korea. Large-scale projects in smart cities, transportation, and public spaces increase demand for video walls capable of delivering high-impact visual communication. The rise of digital advertising and interactive customer experiences in shopping malls, airports, and stadiums further accelerates adoption. Government initiatives promoting digital transformation and investments in display manufacturing capabilities support the region’s fast-paced market expansion.

Key Video Wall Company Insights

Some key companies in the video wall industry are Samsung, Planar Systems, Inc., Panasonic Corporation, and Christie Digital Systems USA, Inc.

-

Planar Systems, Inc. specializes in high-performance LCD and LED video wall solutions for demanding environments such as control rooms, retail, corporate, and public spaces. Their LCD video walls feature ultra-narrow bezels, high brightness up to 700 nits, and advanced durability with protective glass options, enabling continuous 24/7 operation in high-traffic areas. Planar System Inc.’s product portfolio includes interactive touch-enabled displays and stereoscopic 3D capabilities, supporting enhanced collaboration and immersive visual experiences.

-

Samsung offers a comprehensive range of video wall solutions, including high-resolution LED and LCDs that cater to diverse sectors such as retail, corporate, transportation, and entertainment. Their video walls are recognized for ultra-thin bezels, vivid color reproduction, and energy-efficient performance, delivering seamless, large-format visuals suitable for indoor and outdoor use. Samsung integrates advanced technologies such as microLED and AI-based content management, enabling dynamic and customizable display experiences.

Key Video Wall Companies:

The following are the leading companies in the video wall market. These companies collectively hold the largest market share and dictate industry trends.

- Christie Digital System USA, Inc.

- eyefactive GmbH

- Ideum Inc.

- Intermedia Touch

- Leyard

- MultiTaction Inc.

- Panasonic Corporation

- Planar Systems, Inc.

- Prestop B.V.

- Samsung

Recent Developments

-

In May 2025, Datapath Ltd. expanded its video wall controller portfolio by introducing VSN3-5, a five-slot processor designed for compact yet demanding video wall applications. Positioned as a cost-effective, high-performance alternative to the larger 11-slot VSN V3 model, the VSN3-5 caters to customers requiring fewer graphics and capture cards without compromising functionality. This addition complements Datapath’s Aetria platform, which provides comprehensive control room and multi-video source management, enabling more flexible and scalable video wall solutions tailored to diverse operational needs.

-

In April 2025, Prime AV launched its Premier LED Wall Display Solutions in Washington, D.C., introducing advanced visual technology designed to elevate event experiences across the region. This expansion reinforces Prime AV’s position as a leading provider of high-impact audiovisual solutions, particularly catering to government, corporate, and civic events. Premier LED Wall Solutions offer enhanced brightness, resolution, and scalability, enabling immersive and dynamic presentations that meet the demanding standards of professional productions.

-

In November 2024, Barco signed a contract to renovate the largest video wall in LATAM, located at the CPTM control room in São Paulo, Brazil. Originally installed in 2011, this 50-meter-wide video wall, composed of over 60 screens, is used by CPTM, South America's largest rail passenger transport operator. The upgrade will replace the existing LED technology with advanced laser technology, extending the system’s lifespan by 15 years.

Video Wall Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.71 billion

Revenue forecast in 2030

USD 20.37 billion

Growth rate

CAGR of 11.7% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Display technology, end use, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Christie Digital System USA, Inc.; eyefactive GmbH; Ideum Inc.; Intermedia Touch; Leyard; MultiTaction Inc.; Panasonic Corporation; Planar Systems, Inc.; Prestop B.V.; SAMSUNG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Video Wall Market Report Segmentation

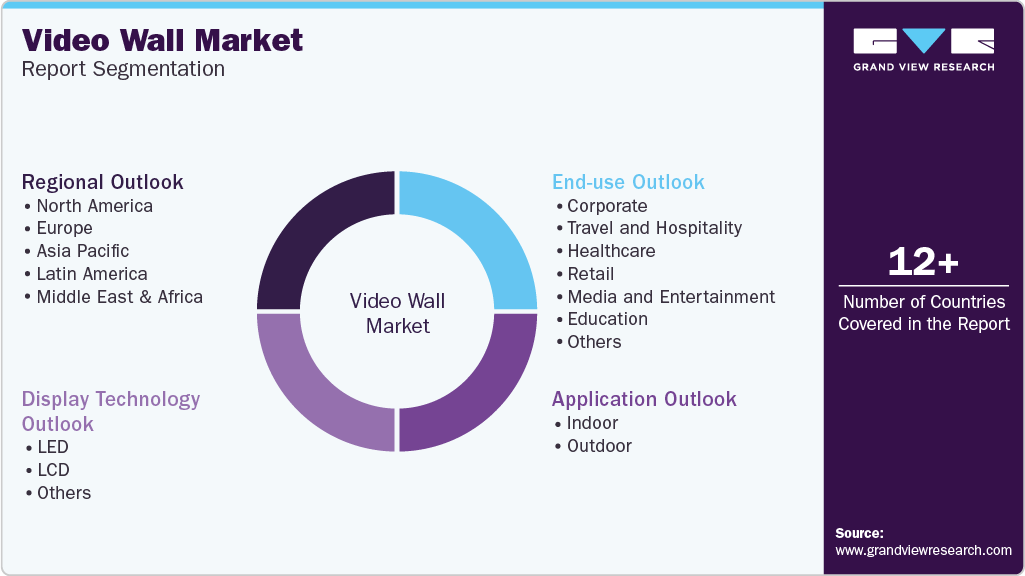

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global video wall market report based on display technology, application, end use, and region:

-

Display Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

LED

-

LCD

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Indoor

-

Outdoor

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Corporate

-

Travel and Hospitality

-

Healthcare

-

Retail

-

Media and Entertainment

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global video wall market size was estimated at USD 10.23 billion in 2024 and is expected to reach USD 11.71 billion in 2025.

b. The global video wall market is expected to grow at a compound annual growth rate of 11.7% from 2025 to 2030 to reach USD 20.37 billion by 2030

b. North America dominated the video wall market with a share of 35% in 2024. This can be attributed to its advanced technological infrastructure, high adoption rates of digital display technologies, and significant investments in corporate, retail, transportation, and public safety sectors.

b. Some key players operating in the video wall market include Christie Digital System USA, Inc.; eyefactive GmbH; Ideum Inc.; Intermedia Touch; Leyard; MultiTaction Inc; Panasonic Corporation; Planar Systems, Inc.; Prestop B.V.; SAMSUNG

b. Key factors that are driving the market growth include rising demand for large-scale displays and advancements in display technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.