- Home

- »

- Medical Devices

- »

-

Viral Vaccines CDMO Market Size, Industry Report, 2033GVR Report cover

![Viral Vaccines CDMO Market Size, Share & Trends Report]()

Viral Vaccines CDMO Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Attenuated Vaccine, Inactivated Vaccine, DNA Vaccines, Subunit Vaccines), By Service, By Workflow, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-624-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Viral Vaccines CDMO Market Summary

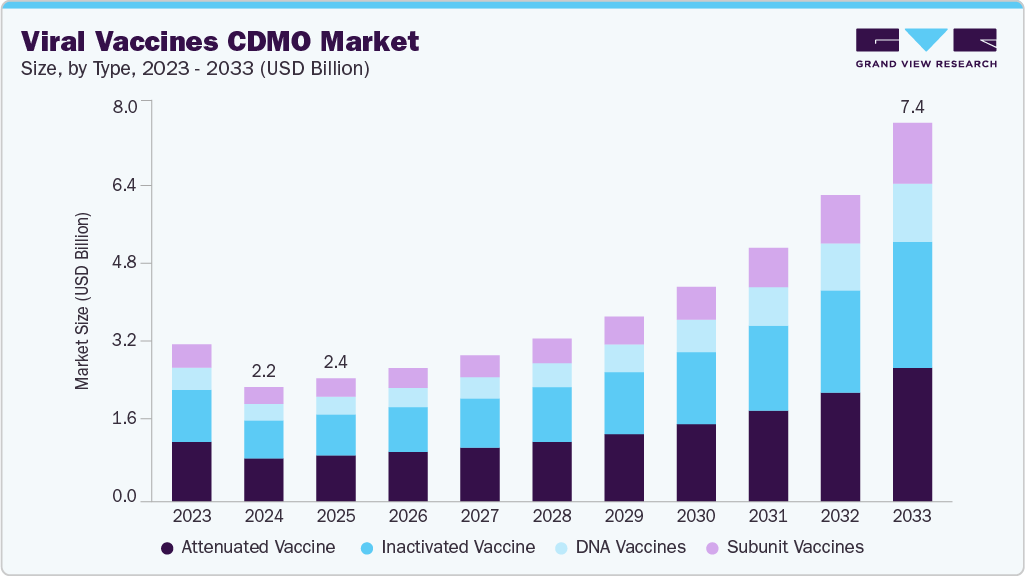

The global viral vaccines CDMO market size was estimated at USD 2.23 billion in 2024 and is projected to reach USD 7.39 billion by 2033, growing at a CAGR of 15.1% from 2025 to 2033. The growth of the market is mainly due rising demand for outsourced manufacturing of viral vaccines, driven by increased prevalence of infectious diseases, growing adoption of viral vector-based platforms for both prophylactic and therapeutic use, and the need for rapid, scalable production solutions.

Key Market Trends & Insights

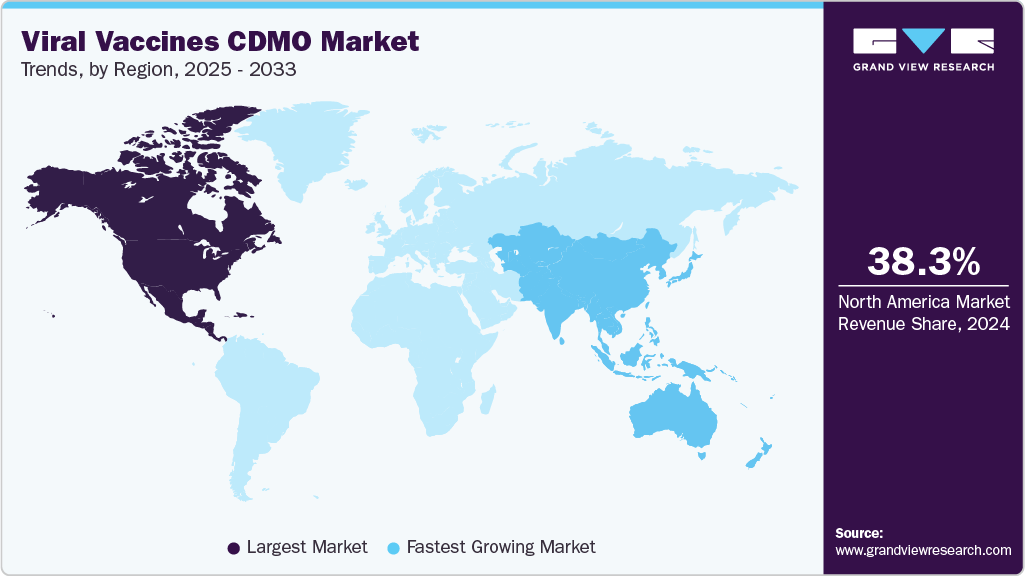

- North America viral vaccines CDMO market held the largest share of 38.04% of the global market in 2024.

- The viral vaccines CDMO industry in the U.S. is expected to grow at the fastest CAGR over the forecast period.

- By type, the attenuated vaccine segment held the largest market share of 37.76% in 2024.

- Based on service, the formulation & process development segment held the largest market share in 2024.

- By workflow, the commercial segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.23 Billion

- 2033 Projected Market Size: USD 7.39 Billion

- CAGR (2025-2033): 15.1%

- North America: Largest market in 2024

- Asia-Pacific: Fastest growing market

Furthermore,the increasing prevalence of viral illnesses such as influenza, human papillomavirus (HPV), hepatitis, and emerging threats like dengue, RSV, and viral hemorrhagic fevers has pushed public and private vaccine developers to accelerate production timelines. Given the high biosafety, quality, and process control requirements associated with live-attenuated, inactivated, and recombinant viral vaccines, pharmaceutical companies are increasingly turning to CDMOs with established viral platforms, BSL-2/3 containment infrastructure, and end-to-end compliance capabilities. Moreover, post-COVID-19, governments and global health agencies have significantly increased funding and long-term procurement agreements for pandemic preparedness, which has increased demand for scalable viral vaccine production. CDMOs offer specialized knowledge in viral seed banking, cell line development, vector engineering, and cGMP-grade virus production, enabling vaccine innovators to shorten development timelines and meet regulatory milestones with lower operational risk.

The growing adoption of single-use bioreactors, modular cleanrooms, and high-speed fill-finish lines including prefilled syringes and lyophilized vials has made outsourcing an efficient alternative for both small biotech firms and large vaccine players. Additionally, as several developers seek to expand into global markets, CDMOs with multi-regional regulatory compliance such as U.S. FDA, EMA, WHO PQ and distributed manufacturing footprints are favored for commercial supply contracts. Further, the rise of viral vector technologies in gene therapy and oncology has also unclear the lines between traditional vaccines and therapeutic platforms, increasing cross-application demand for viral CDMO services. As biologics become more personalized and technically complex, companies like Lonza, Fujifilm Diosynth, Samsung Biologics, and WuXi Biologics are scaling both upstream viral production and downstream sterile fill-finish capacities, positioning themselves as strategic manufacturing partners in the next era of global viral vaccine development.

Opportunity Analysis

The viral vaccines CDMO market is positioned for significant expansion due to recurring demand for routine immunizations, and the emergence of novel therapeutic applications and regional manufacturing gaps. A major opportunity lies in the convergence of oncolytic viral therapies and traditional prophylactic vaccines, particularly in immuno-oncology, where engineered viral vectors are being developed as both delivery vehicles and tumor-targeting agents. This blurs the boundary between vaccines and therapeutics, opening up high-value outsourcing needs across viral vector design, scale-up, and GMP production. CDMOs that offer integrated viral engineering, plasmid DNA production, and regulatory expertise in both vaccine and cell/gene therapy spaces are uniquely positioned to attract dual-market clients. Companies with flexible facilities capable of switching between recombinant viral vaccines like adenovirus or measles vectors and therapeutic vectors are likely to capture a growing pipeline of experimental vaccines entering clinical trials.

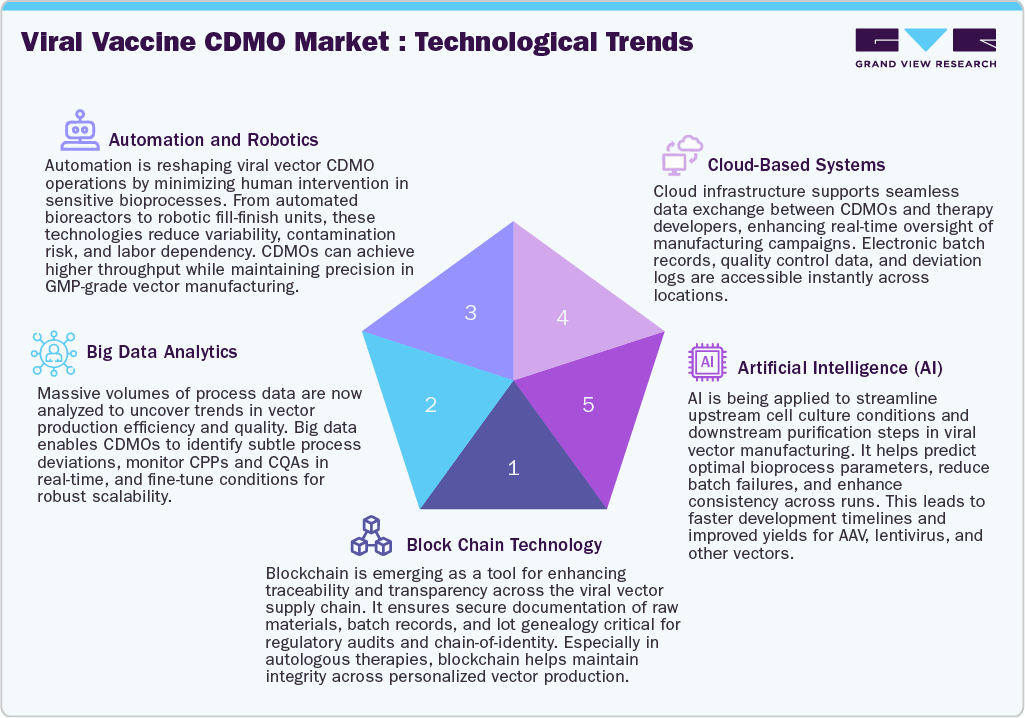

Technological Advancements

The viral vaccines CDMO market is being reshaped by a wave of innovative technological innovations that enhance manufacturing precision, scalability, and product stability. One of the most significant advancements is the widespread adoption of single-use bioreactor systems in upstream processing. These systems reduce cross-contamination risks and turnaround times between batches, which are critical for producing viral vaccines under stringent biosafety regulations. Companies like Thermo Fisher Scientific, Lonza, and Fujifilm Diosynth Biotechnologies have integrated large-scale single-use bioreactors up to 2,000L into their GMP manufacturing suites, aiding faster response to surge demands, such as during pandemics. Parallel advances in serum-free and chemically defined media have improved consistency and yield in viral vector production platforms, such as Vero, MDCK, and HEK293 cell lines, which are central to many live-attenuated and inactivated viral vaccines.

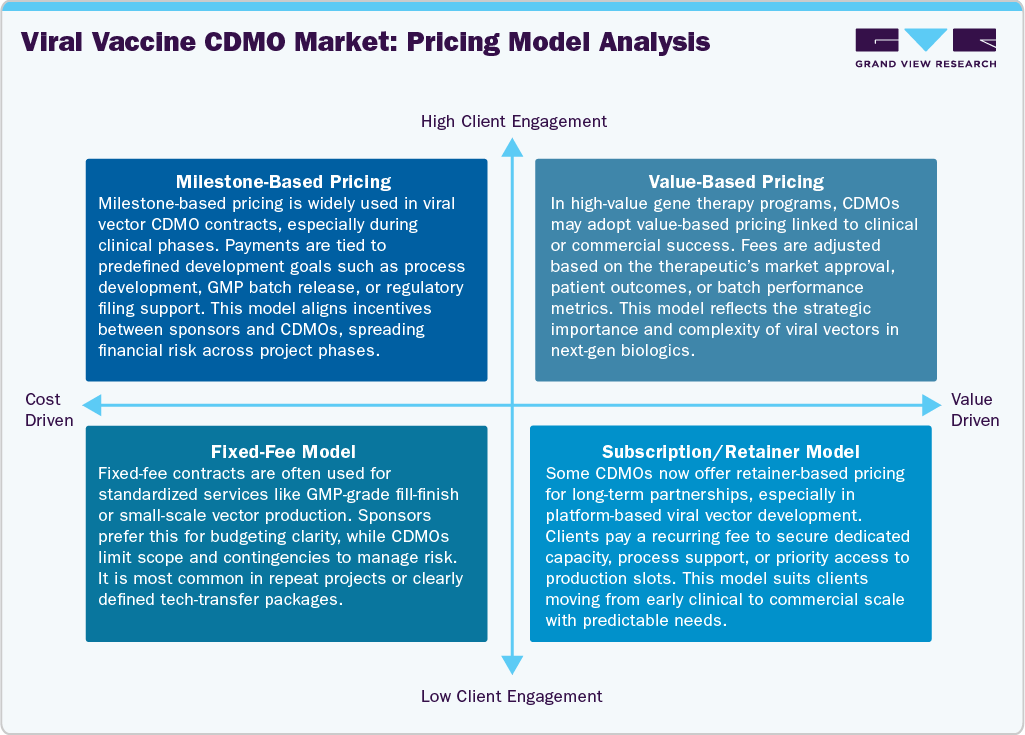

Pricing Analysis

Pricing in the viral vaccines CDMO market is structured around a modular and milestone-based model that reflects the complexity and risk of each stage of development and manufacturing. Costs are typically segmented into distinct service components such as process development, drug substance manufacturing, drug product fill-finish, analytical testing, and regulatory support, each priced separately depending on technical requirements and scale. Factors influencing pricing include biosafety level like BSL-2 vs BSL-3, viral strain characteristics, delivery format such as prefilled syringes vs multi-dose vials, batch size, and compliance with global regulatory standards. Fixed-fee models are often used in early-stage development projects, while variable, volume-based pricing becomes more common in commercial-scale manufacturing. CDMOs also apply premium pricing for turnkey, end-to-end solutions that include formulation, process optimization, GMP manufacturing, and global tech transfer support.

Type Insights

The attenuated vaccine segment held the largest market share of 37.76% in 2024 due to its widespread use in national immunization programs and its proven efficacy in generating long-lasting immunity. These vaccines, which use live but weakened viruses, have been foundational in the prevention of diseases such as measles, mumps, rubella, rotavirus, and yellow fever. Their continued inclusion in global childhood vaccination schedules ensures consistent, large-scale production volumes making them a commercially attractive and stable segment for CDMOs.

In addition,the subunit vaccines segment is anticipated to witness fastest growth over the forecast perioddue to its safety profile and adaptability across diverse viral diseases. Unlike live attenuated vaccines, subunit vaccines use specific protein components of the virus, reducing the risk of adverse reactions while eliciting targeted immune responses. This makes them especially attractive for immuno-compromised populations and for emerging viruses where safety is paramount. Advances in recombinant DNA technology and protein expression systems have streamlined the production process, allowing CDMOs to offer scalable and cost-effective manufacturing solutions for subunit vaccines.

Service Insights

The fill-finish services segment held the largest share in 2024. The segment’s growth is driven due to its critical role as the final and highly specialized step in vaccine manufacturing. This segment includes aseptic filling, vial or syringe packaging, labeling, and final product inspection, all of which require strict sterile conditions and regulatory compliance. Increasing demand for ready-to-use vaccine formats such as prefilled syringes and multi-dose vials has driven growth in fill-finish outsourcing, as vaccine developers seek to leverage CDMOs’ advanced isolator technologies and high-throughput capabilities.

In addition, the analytical testing segment is expected to witness the fastest growth over the forecast period due to increasing regulatory scrutiny and the complexity of viral vaccine products. As vaccine candidates evolve to include novel platforms such as viral vectors, subunits, and mRNA-based technologies, comprehensive characterization and quality control become critical to ensure safety, efficacy, and consistency. Regulatory agencies worldwide are imposing more rigorous requirements for potency assays, viral clearance, impurity profiling, and stability testing, which significantly expands the scope of analytical services needed.

Workflow Insights

The commercial segment accounted for the largest share in 2024 due to the growing demand for large-scale manufacturing and supply of approved viral vaccines worldwide. Established vaccines with proven safety and efficacy profiles, such as those for measles, influenza, and HPV, drive consistent production volumes, making commercial manufacturing a stable and high-revenue area for CDMOs.

On the other hand, the clinical segment is expected to witness the fastest growth over the forecast period due to the increasing number of viral vaccine candidates entering early and late-stage clinical trials. Advances in vaccine technology and new viral threats have accelerated R&D pipelines, resulting in a higher demand for flexible and scalable CDMO services tailored to clinical-scale manufacturing.

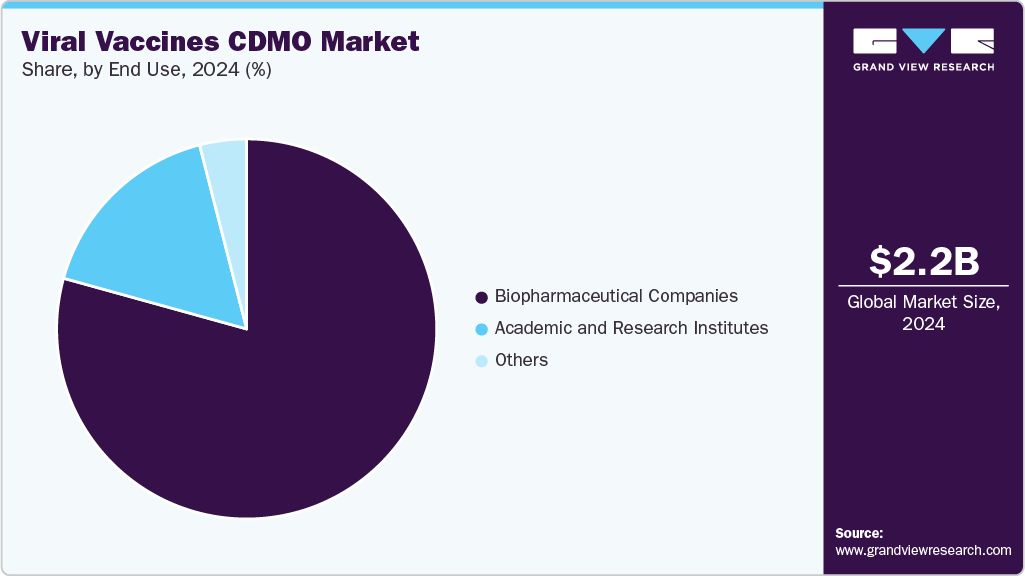

End Use Insights

The biopharmaceutical companies segment held the largest market in 2024due to an increasing reliance on outsourcing to accelerate vaccine development and manufacturing. These companies often focus on innovative and complex vaccine platforms that require specialized expertise, advanced technologies, and stringent regulatory compliance, which many biopharmaceutical firms prefer to access through established CDMOs.

The academic and research institutes segment is expected to witness the second fastest growth over the forecast period. Growing public and private funding for infectious disease research has accelerated the number of preclinical and clinical vaccine candidates originating from academic labs and research centers. Limited in-house manufacturing capabilities prompt many of these institutions to partner with CDMOs for scalable, compliant production of vaccine candidates to support clinical trials.

Regional Insights

North America the viral vaccines CDMO market held the largest revenue share of 38.27% in 2024. This can be attributed to advanced biomanufacturing infrastructure and rising demand for outsourced development and production of vaccines. The region benefits from established pharmaceutical and biotechnology sectors that increasingly rely on CDMOs to accelerate time-to-market and reduce capital expenditure. Technological innovations in vector-based vaccine platforms and increasing public-private partnerships further support market growth.

U.S. Viral Vaccines CDMO Market Trends

The viral vaccines CDMO market in the U.S. is driven by the rapid evolution of vaccine technologies, robust federal funding for pandemic preparedness, and strong regulatory support. Growth is also influenced by the presence of leading CDMO players and a high concentration of biotech firms that prefer outsourcing viral vector development, clinical manufacturing, and commercial-scale production.

Europe Viral Vaccines CDMO Market Trends

The viral vaccines CDMO market in Europe is expected to grow significantly due to increasing R&D activities and strong regional focus on vaccine innovation and pandemic readiness. Rising demand for high-containment biologics facilities and compliance with evolving EU regulatory standards make outsourcing an attractive option for vaccine developers in this region.

The viral vaccines CDMO market in Germany is anticipated to grow over the forecast period owing to the presence of several pharmaceutical manufacturing companies and continuous investments in bioprocessing capabilities. Demand is also supported by domestic biotech innovation and collaborations between academic research and commercial manufacturing.

UK viral vaccines CDMO market is anticipated to grow over the forecast period. The country benefits from an advanced clinical trial ecosystem and strong governmental support for life sciences. Investments in bioproduction parks and focus on strengthening vaccine resilience post-COVID have positioned the UK as a key outsourcing hub for early-stage and commercial vaccine manufacturing.

The viral vaccines CDMO market in the France is anticipated to grow over the forecast period. The growth of the market is due to supportive public funding programs and collaborative efforts between research institutions and biopharma companies. The country is investing in domestic vaccine manufacturing capacity, particularly for viral vectors used in both preventive and therapeutic vaccines, such as for cancer and rare diseases.

Asia Pacific Viral Vaccines CDMO Market Trends

Asia Pacific region is projected to witness the fastest growth rate due to the rapid expansion in biologics capabilities and increasing domestic demand for vaccines. Countries like India and China lead with large-scale, GMP-compliant facilities offering end-to-end services from process development to fill-finish, at competitive costs. The region is also witnessing a surge in contract manufacturing for global clients.

The viral vaccines CDMO market in China is expected to grow over the forecast period due to government incentives for biopharma innovation, local production targets, and a maturing CDMO ecosystem. Major CDMOs are expanding capacity for viral vector production, supported by a growing domestic biotech pipeline and rising international demand.

Japan viral vaccines CDMO market is expected to grow over the forecast period due to growing aging population, robust healthcare infrastructure, and the need for high-quality, localized vaccine manufacturing. Strategic partnerships between local firms and global CDMOs are enabling technology transfers and rapid scale-up of viral vaccine production.

The viral vaccines CDMO market in India is anticipated to grow at the considerable CAGR over the forecast period owing to low-cost biomanufacturing, skilled workforce, and strong government support for vaccine exports. Indian CDMOs are expanding their offerings from process development and analytics to full-scale production of viral vaccines including adenoviral and inactivated platforms.

Key Viral Vaccines CDMO Company Insights

The major players operating across the viral vaccines CDMO market are focused on adopting strategic partnerships, capacity expansion, and platform specialization to meet the increasing demand for viral vector-based vaccines. Companies such as Lonza Group, Catalent Pharma, Thermo Fisher Scientific, Samsung Biologics, Fujifilm Diosynth Biotechnologies, WuXi Biologics are actively adopting strategies including large-scale capacity expansion, viral platform specialization, and strategic collaborations with vaccine innovators. These companies are improving their upstream capabilities in viral vector production and cell line development, while also investing in downstream services such as aseptic fill-finish and cold-chain packaging.

Key Viral Vaccines CDMO Companies:

The following are the leading companies in the viral vaccines CDMO market. These companies collectively hold the largest market share and dictate industry trends.

- Lonza Group

- Catalent Pharma

- Thermo Fisher Scientific, Inc.

- Alcami Corporation

- Samsung Biologics

- Fujifilm Diosynth Biotechnologies

- WuXi Biologics

- Recipharm AB

- HALIX B.V

- Batavia Biosciences B.V

Recent Developments

-

In November 2024, FUJIFILM Diosynth Biotechnologies lunched the first phase of its global CDMO ecosystem expansion at the Hillerod site in Denmark. This phase added six 20,000-liter bioreactors, with plans to increase to 20 bioreactors and commence fill/finish production by mid-2025.

-

In November 2024, WuXi Biologics announced of enhancing its drug product capabilities at the Leverkusen, Germany facility by installing a new sterile filling line for prefilled syringes (PFS) utilizing isolator technology. The expansion will strengthen WuXi Biologics’ capacity to support large-scale commercial fill-finish of viral vaccines in prefilled syringe formats, boosting downstream CDMO demand in Europe.

-

In April 2024, FUJIFILM Diosynth Biotechnologies announced the additional investment of USD 1.2 billion to expand its biomanufacturing facility in Holly Springs, North Carolina. This expansion aimed to add eight 20,000-liter mammalian cell culture bioreactors by 2028, enhancing large-scale production capacity for biologics and vaccines.

Viral Vaccines CDMO Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.40 billion

Revenue forecast in 2030

USD 7.39 billion

Growth rate

CAGR of 15.1% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, workflow, service, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; India; Japan; China; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Lonza Group; Catalent Pharma; Thermo Fisher Scientific; Samsung Biologics; Alcami Corporation; Fujifilm Diosynth Biotechnologies; WuXi Biologics; Recipharm; HALIX B.V; Batavia Biosciences B.V

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Viral Vaccines CDMO Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global viral vaccines CDMO market report based on type, workflow, service, end use, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Attenuated Vaccine

-

Inactivated Vaccine

-

DNA Vaccines

-

Subunit Vaccines

-

-

Workflow Outlook (Revenue, USD Million, 2021 - 2033)

-

Clinical

-

Commercial

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Formulation & Process Development

-

Upstream Development

-

Downstream Development

-

-

Analytical Testing

-

Fill-Finish Services

-

Packaging & Labeling

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Biopharmaceutical Companies

-

Academic and Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global viral vaccines CDMO market size was estimated at USD 2.23 billion in 2024 and is expected to reach USD 2.40 billion in 2025.

b. The global viral vaccines CDMO market is expected to grow at a compound annual growth rate of 15.07% from 2025 to 2033 to reach USD 7.39 billion by 2033.

b. North America dominated the viral vaccines CDMO market with a share of 38.1% in 2024. This is attributable to advanced biomanufacturing infrastructure and rising demand for outsourced development and production of vaccines.

b. Some key players operating in the viral vaccines CDMO market include Lonza Group, Catalent Pharma, Thermo Fisher Scientific, Samsung Biologics, Fujifilm Diosynth Biotechnologies, WuXi Biologics, Recipharm, HALIX, B.V Batavia Biosciences B.V

b. Key factors that are driving the market growth includes the rising demand for outsourced manufacturing of viral vaccines, driven by increased prevalence of infectious diseases, growing adoption of viral vector-based platforms for both prophylactic and therapeutic use, and the need for rapid, scalable production solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.