- Home

- »

- Next Generation Technologies

- »

-

Virtual Try-on Market Size, Share And Growth Report, 2030GVR Report cover

![Virtual Try-on Market Size, Share & Trends Report]()

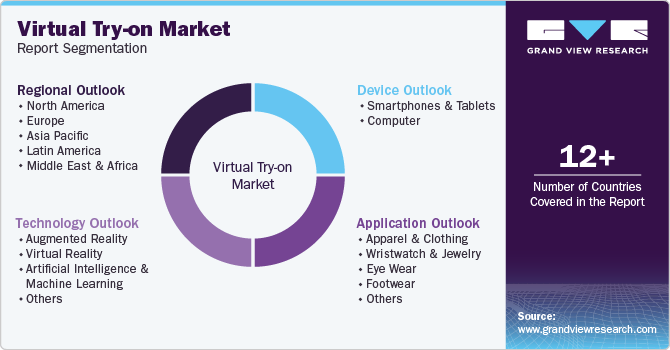

Virtual Try-on Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (AR, VR, AI & ML), By Application (Apparel & Clothing, Wristwatch & Jewelry), By Device, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-331-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Virtual Try-on Market Summary

The global virtual try-on market size was estimated at USD 9.17 billion in 2023 and is projected to reach USD 46.42 billion by 2030, growing at a CAGR of 26.4% from 2024 to 2030. The exponential growth in online shopping has fueled demand for more interactive and engaging shopping experiences and is expected to drive market growth.

Key Market Trends & Insights

- The virtual try-on market in North America accounted for the largest revenue share of nearly 31% in 2023.

- The virtual try-on market in the U.S. is anticipated to grow at a CAGR of over 24% from 2024 to 2030.

- By technology, the Augmented Reality (AR) segment accounted for the largest revenue share of over 63% in 2023.

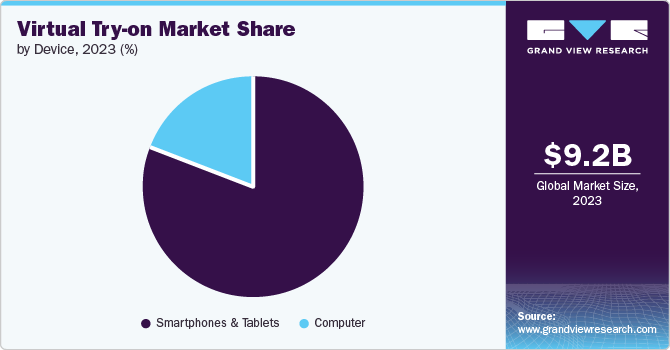

- By device, the smartphones & tablets segment accounted for the largest revenue share in 2023.

- By application, the apparel & clothing segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 9.17 Billion

- 2030 Projected Market Size: USD 46.42 Billion

- CAGR (2024-2030): 26.4%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

In addition, virtual try-on technology is becoming popular as it helps consumers with immersive shopping experiences that balance physical and online retail. This technology helps customers try products virtually before buying, reducing the uncertainty that comes with online shopping thereby expected to drive the market growth.

Furthermore, the advancements in Augmented Reality (AR) and computer vision technologies have fueled the demand for virtual try-on solutions. These technological improvements enable the creation of realistic and interactive virtual experiences, accurately portraying products to users in real-world settings. This enhanced capability attracts consumers seeking engaging and authentic online shopping experiences, contributing to the expansion of the virtual try-on market.

Moreover, the rising demand for personalized and customizable shopping experiences is propelling the virtual try-on market growth. Brands can provide personalized recommendations and customization features aligned with individual preferences, sizes, and styles with virtual try-on technology. This capability boosts engagement and also encourages customer loyalty by offering an interactive and personalized shopping experience as per each shopper's unique style and needs, thereby driving the virtual try-on market growth.

Additionally, the widespread availability of smartphones equipped with high-quality cameras and strong processing capabilities has stimulated the large acceptance of mobile-based virtual try-on applications. This accessibility empowers consumers to effortlessly utilize these features on the go, anytime and anywhere, thereby fueling the demand for such innovative technologies within the virtual try-on market.

The COVID-19 pandemic has had a profound impact on the virtual try-on market. The pandemic accelerated the adoption of virtual try-on technology as physical stores closed or faced restrictions, and consumers required safer ways to try products. This shift highlighted the benefits of virtual try-on solutions in providing contactless yet engaging shopping experiences, thereby boosting the demand for the virtual try-on market.

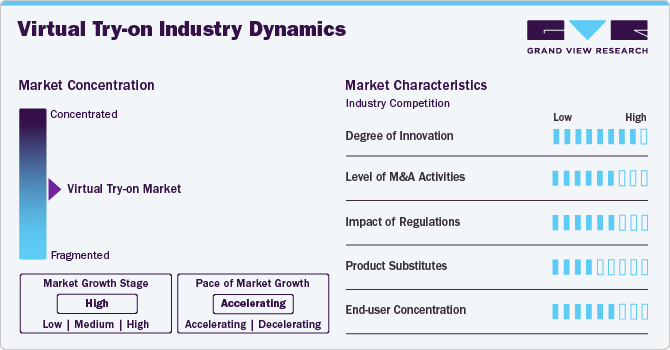

Market Concentration & Characteristics

The market for virtual try-ons is witnessing a high degree of innovation, particularly with the integration of AI and ML, among others. Increasing penetration of technologies has brought various innovations in virtual try-on and benefited developers to enhance the user experience of their products & expand their customer base across the globe.

The virtual try-on market is witnessing a significant impact of regulations and policies. For instance, regulations regarding the collection and use of biometric data can shape how virtual try-on platforms operate.

The market is also being influenced by the rising number of mergers & acquisition activities that help companies increase market share, expand the customer base, and strengthen product portfolios.

Product substitutes are having a considerable impact on the virtual try-on market. The presence of substitutes increases competition within the virtual try-on market and the availability of substitutes can make customers more price sensitive.

End-user concentration is high in the market, as several industry verticals are adopting virtual try-on solutions to enhance user experience. Moreover, by eliminating the need for travel and associated expenses, virtual try-ons help end-users save money and time.

Technology Insights

The Augmented Reality (AR) segment accounted for the largest revenue share of over 63% in 2023. The segment growth is attributed to personalized recommendations based on individual preferences, sizes, and styles, making the shopping experience more personalized and relevant. Moreover, AR enhances the experience, which leads to higher conversion rates and stronger brand engagement, as customers are more likely to complete purchases.

The Artificial Intelligence (AI) & Machine Learning (ML) segment is expected to record the highest CAGR of 30.1% from 2024 to 2030 as AI & ML technology enhances the accuracy and personalization of the shopping experience. Additionally, ML continuously improves these simulations by learning from user interactions and feedback, ensuring a progressively better and more realistic virtual try-on experience. This, in turn, is driving the segmental growth.

Device Insights

The smartphones & tablets segment accounted for the largest revenue share in 2023. The segment growth is attributed to the widespread adoption of smartphones and tablets globally. In addition, the rapid advancement of augmented reality (AR) and virtual reality (VR) technologies has significantly improved the capabilities and realism of virtual try-on experiences on smartphones and tablets. These advancements have made virtual try-on experiences more immersive and accurate, enhancing the appeal of such applications to consumers, and thereby driving segment growth.

The computer segment is expected to register a significant CAGR from 2024 to 2030. The virtual try-on solutions on computers allow users with more personalized experience and also help in experiencing the product with more resolution & clarity, which is expected to drive the segment growth. Moreover, the virtual try-on experiences on computers serve as effective marketing tools for brands as they can engage with their target audience more interactively, increasing brand awareness and customer engagement. Such experiences are expected to drive segmental growth in the coming years.

Application Insights

The apparel & clothing segment accounted for the largest revenue share in 2023, owing to the implementation of AR, VR, AI & ML, among other technologies. These technologies help in a more accurate and user-friendly experience of clothing try-on, allowing customers to make purchase decisions. Moreover, market players are launching services to enhance the user experience. For instance, in September 2022, Walmart, Inc. launched a new virtual try-on feature in collaboration with Zeekit, a start-up company, to enhance the shopping experience for its US customers.

The wristwatch and jewelry segment is expected to register the highest CAGR from 2024 to 2030. Technological advancements help reduce the uncertainty related to purchasing high-value items online, thereby boosting consumer confidence and driving sales growth in this segment. Moreover, advanced features, such as high-definition 3D rendering and AR, provide a realistic and immersive experience that has resulted in the growing adoption of virtual try-on solutions.

Regional Insights

The virtual try-on market in North America accounted for the largest revenue share of nearly 31% in 2023. The region has witnessed substantial growth in online shopping, partly augmented by the COVID-19 pandemic. The shift of consumers towards purchasing items online, including high-value products like jewelry and wristwatches, further drives the adoption of the virtual try-on market in the region.

U.S. Virtual Try-on Market Trends

The virtual try-on market in the U.S. is anticipated to grow at a CAGR of over 24% from 2024 to 2030. The widespread use of smartphones and high-speed internet in the country provides an ideal platform for virtual try-on technologies.

Asia Pacific Virtual Try-on Market Trends

The Asia Pacific virtual try-on market is expected to grow by around 28% from 2024 to 2030. The rising demand for innovative and progressive solutions that can aid customers in making quick buying decisions is likely to contribute to the regional market's growth.

The virtual try-on market in India is estimated to record a notable growth rate of over 30% from 2024 to 2030, owing to the growing e-commerce sector and increasing smartphone penetration. Young consumers are particularly keen on using virtual try-on features when purchasing fashion and beauty products online, pushing brands to invest in these technologies.

China virtual try-on market is projected to grow at a CAGR of around 26% from 2024 to 2030, owing to its tech-savvy population and the dominance of e-commerce giants like Alibaba, among others.

The virtual try-on market in Japan is projected to grow at a CAGR of around 27% from 2024 to 2030. The growth is driven by a combination of an aging population interested in convenience and a youthful demographic that values innovation and technology.

Europe Virtual Try-on Market Trends

The Europe virtual try-on market is expected to grow at a CAGR of around 26% from 2024 to 2030. The growth in this region is fueled by the presence of numerous fashion brands using virtual try-on technology. Moreover, the increasing emphasis on enhancing the customer buying experience is also driving the market growth in the region.

The virtual try-on market in the UK is projected to grow at a CAGR of nearly 24% from 2024 to 2030. The UK’s market is expanding as retailers are trying to blend the convenience of online shopping with the personalized experience of in-store purchases.

Germany virtual try-on market is estimated to record a CAGR of over 25% from 2024 to 2030. The country shows a strong interest in sustainable and efficient shopping solutions, with virtual try-on technologies being adopted to reduce waste associated with returns.

Middle East and Africa (MEA) Virtual Try-on Market Trends

The virtual try-on market in the Middle East and Africa (MEA) region is anticipated to grow at a significant CAGR of about 27% from 2024 to 2030. The market growth is being driven by e-commerce growth, coupled with high mobile connectivity, which leads to the adoption of virtual try-on technologies in the region.

Saudi Arabia virtual try-on market accounted for a considerable revenue share in 2023. Luxury brands and retailers are increasingly adopting virtual try-on solutions to attract the young and affluent population, augmenting the market's growth in the country.

Key Virtual Try-on Company Insights

Some key players operating in the market are 3DLOOK Inc., MySize Inc., Quy Technology Pvt. Ltd. (QUYTECH), and others.

-

3DLOOK Inc. is an innovative company operating in the virtual try-on market. The company caters to a wide range of applications within the fashion industry, from size recommendation and virtual try-on to personalized shopping experiences and inventory management.

-

MySize Inc. Company operates in the virtual try-on and fashion technology markets. The company offers its patented measurement technology, which controls the sensors built into smartphones to help users obtain their body measurements quickly and accurately.

DeepAR (I Love Ice Cream Ltd.), metadome.ai (Formerly Adloid), WEARFITS, and Wannaby Inc. are some of the emerging market participants in the market.

-

DeepAR, operated by I Love Ice Cream Ltd., is an augmented reality (AR) company, specializing in offering innovative AR solutions for the virtual try-on market. The company's technology enables real-time, highly realistic AR experiences across various applications, with a strong emphasis on virtual try-ons for the beauty and fashion industries.

-

WEARFITS is an innovative technology company that is making significant growth in the virtual try-on market. It focuses on enhancing the online shopping experience for consumers and retailers. Leveraging the power of augmented reality (AR) and artificial intelligence (AI), the company provides a highly realistic and interactive platform for users to try on clothing, footwear, and accessories virtually before making a purchase.

Key Virtual Try-On Companies:

The following are the leading companies in the virtual try-on market. These companies collectively hold the largest market share and dictate industry trends.

- DeepAR (I Love Ice Cream Ltd.)

- metadome.ai (Formerly Adloid)

- 3DLOOK Inc.

- AUGLIO

- Wannaby Inc.

- Quy Technology Pvt. Ltd. (QUYTECH)

- WEARFITS

- MySize Inc.

- Zugara, Inc.

- Banuba Limited

- Queppelin

- ZAKEKE

Recent Developments

-

In May 2024, Wannaby Inc. partnered with Valentino Garavani (VALENTINO S.p.A.) and launched the VSLING bag, a virtual try-on experience. This collaboration makes the brand Valentino the first luxury brand to integrate the bags VTO technology into its website. This integration helps customer to experience the bag virtually on their website before making the purchase.

-

In April 2024, AUGLIO collaborated with ZOFF, Japan's eyewear retailer e-commerce platform and launched the EASee Zoff Virtual Fitting service. The product is considered as web fitting feature, which is available in over 300 stores of ZOFF domestically and internationally.

-

In March 2024, Banuba Limited collaborated with Océane, a Brazilian cosmetics manufacturer and retailer. The company integrated Banuba’s TINT product to provide a better user experience and invite purchases. The TINT experience is integrated with company’s product portfolio and can be experienced on their website.

Virtual Try-on Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.38 billion

Revenue forecast in 2030

USD 46.42 billion

Growth rate

CAGR of 26.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, device, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; and South Africa

Key companies profiled

DeepAR (I Love Ice Cream Ltd.); metadome.ai (Formerly Adloid); 3DLOOK Inc.; AUGLIO; Wannaby Inc.; Quy Technology Pvt. Ltd. (QUYTECH); WEARFITS; MySize Inc.; Zugara, Inc.; Banuba Limited; Queppelin; ZAKEKE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Virtual Try-on Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global virtual try-on market report based on technology, application, device, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Augmented Reality

-

Virtual Reality

-

Artificial Intelligence & Machine Learning

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Apparel & Clothing

-

Wristwatch & Jewelry

-

Eye Wear

-

Footwear

-

Others

-

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Smartphones & Tablets

-

Computer

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global virtual try-on market size was estimated at USD 9.17 billion in 2023 and is expected to reach USD 11.38 billion in 2024.

b. The global virtual try-on market is expected to grow at a compound annual growth rate of 26.4% from 2024 to 2030 to reach USD 46.42 billion by 2030.

b. The North America region accounted for the largest share of 30.8% in the virtual try-on market in 2023 and is expected to continue its dominance in the coming years.

b. Some key players operating in the virtual try-on market include DeepAR (I Love Ice Cream Ltd.); metadome.ai (Formerly Adloid); 3DLOOK Inc.; AUGLIO; Wannaby Inc.; Quy Technology Pvt. Ltd. (QUYTECH); WEARFITS; MySize Inc.; Zugara, Inc.; Banuba Limited; Queppelin; ZAKEKE.

b. Key factors that are driving the virtual try-on market growth include the exponential growth in online shopping that has fueled the demand for more interactive and engaging shopping experiences.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.