- Home

- »

- Biotechnology

- »

-

Virus Filtration Market Size & Share, Industry Report, 2030GVR Report cover

![Virus Filtration Market Size, Share & Trends Report]()

Virus Filtration Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Consumables, Instruments, Services), By Application (Biologicals, Medical Devices, Air Purification, Water Purification), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-570-0

- Number of Report Pages: 138

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Virus Filtration Market Summary

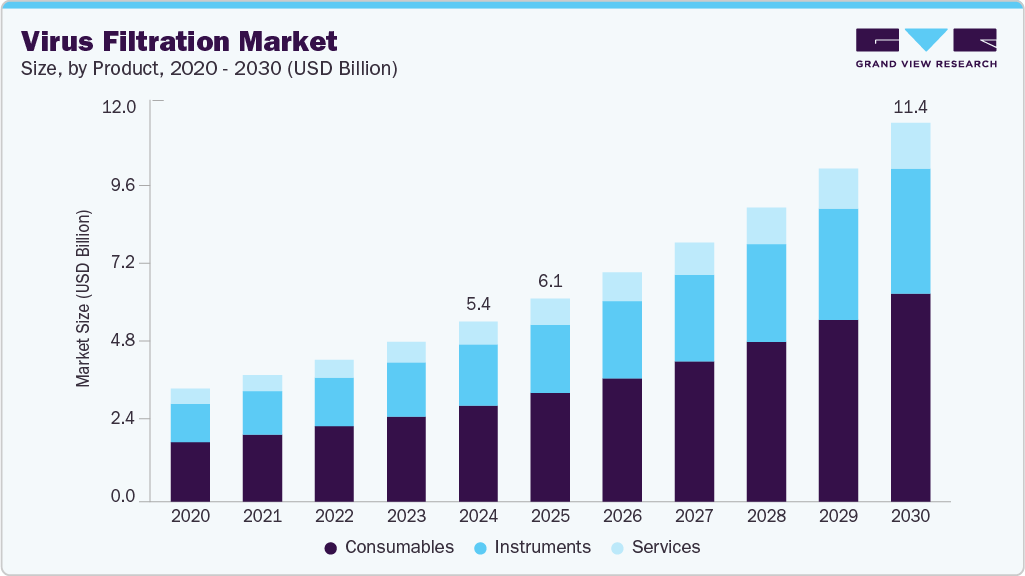

The global virus filtration market size was estimated at USD 5.43 billion in 2024 and is projected to reach USD 11.43 billion in 2030, growing at a CAGR of 13.3% from 2025 to 2030. The rising prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders is anticipated to propel the demand for biologics.

Key Market Trends & Insights

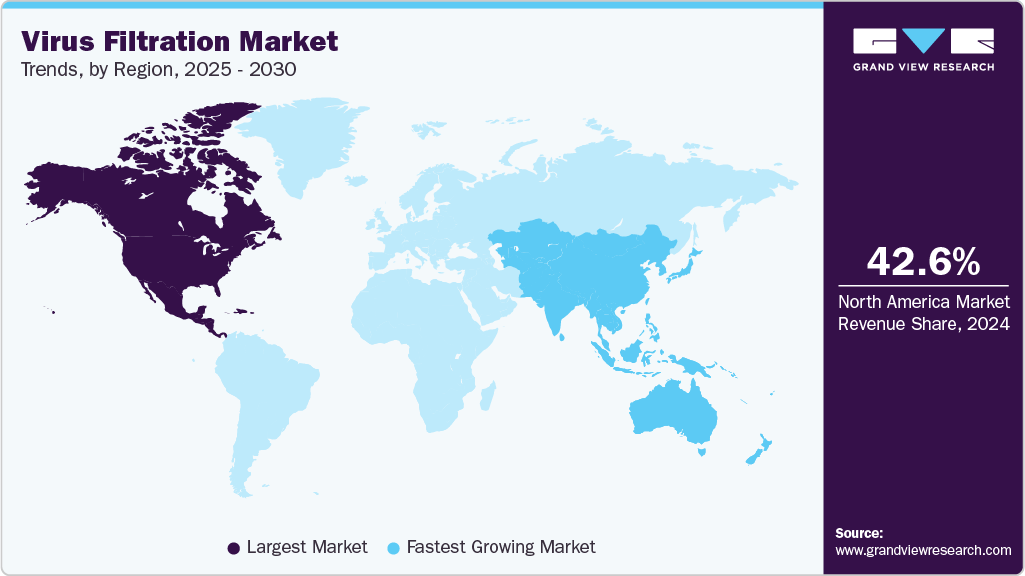

- The North America virus filtration market dominated the global market, accounting for the largest revenue share of 42.6% in 2024.

- The U.S. virus filtration market led the North American market with the largest revenue share in 2024.

- By product, the consumables segment dominated the virus filtration market with the largest revenue share of 53.4% in 2024.

- By application, the biologicals segment dominated the virus filtration market with the largest revenue share in 2024.

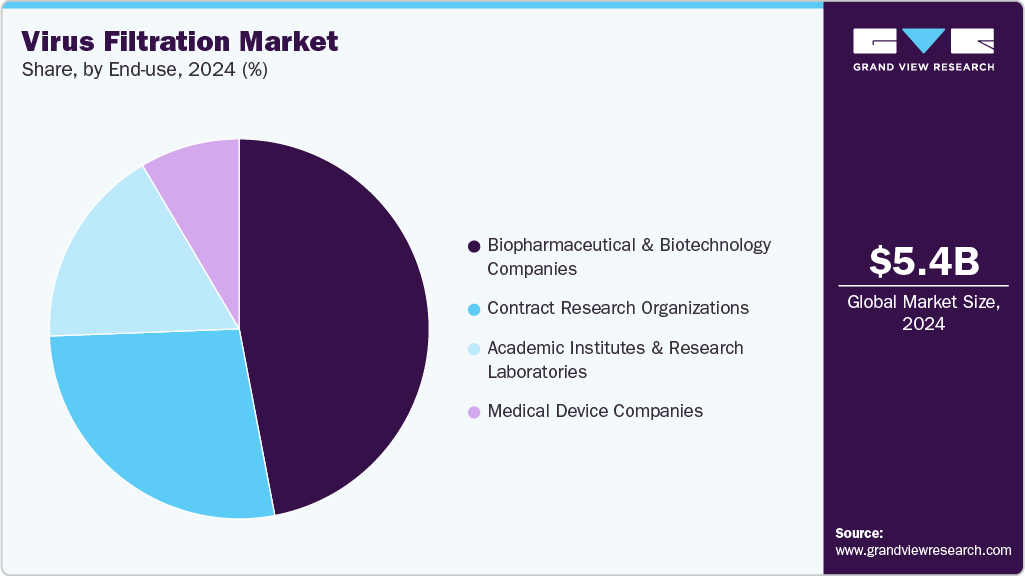

- By end-use, the biopharmaceutical and biotechnology companies led the virus filtration market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.43 Billion

- 2030 Projected Market Size: USD 11.43 Billion

- CAGR (2025-2030): 13.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

According to the World Health Organization (WHO), around 422 million people globally are affected by diabetes. The rising prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders is anticipated to propel the demand for biologics.The other significant factor anticipated to increase market growth is adherence to regulatory frameworks for drug development and production, such as Current Good Manufacturing Practice (cGMP) regulations. The manufacturers guarantee these products' virus safety through various quality control procedures, including monitoring and quality checking of raw materials, validating and implementing effective virus clearance technology, and validating the finished product for the absence of virus contamination. As a result, there is a huge market for these products in manufacturing and R&D.

Clinical Research Organizations (CROs) are collaborating with biotechnology and biopharmaceutical companies to develop novel drugs and therapies, which is also expected to support market growth. For instance, in May 2023, CRO firm IQVIA announced its partnership with RED, which aims to fight AIDS and strengthen the laboratory system. Biologics, such as biopharmaceutical drugs, require more time and money and are more complex to develop than chemical medications. Producing the same drug as the original is challenging, as every biopharmaceutical is distinct. The efficacy, quality, and safety of medicine could change due to a minor protein structure change.

Product Insights

The consumables segment dominated the virus filtration market with the largest revenue share of 53.4% in 2024. The demand for consumables such as reagents, kits, and membranes is anticipated to increase the production of vaccines, protein therapeutics, blood-related products, cellular therapy products, genetic therapy products, tissue products, and embryonic stem cell products. Several leading vendors, including Merck KGaA, Danaher, and Sartorius AG, provide a broad range of reagents, kits, and other consumables for virus filtration.

The instruments segment is expected to grow at a significant CAGR of 12.9% over the forecast period. The demand for instruments is increasing, fueled by the critical role of filtration systems in the growing production of vaccines and therapeutics. This rise is largely in response to the surge in illnesses that, if left untreated, could result in serious complications, hospitalizations, or even death. These systems are critical for purifying and clarifying materials, helping to remove impurities, ensure product safety, and support the manufacture of effective treatments. Filtration technologies often involve various filters, including membrane filtration, which uses a thin, semi-permeable membrane to separate molecules based on size and charge. Common techniques include microfiltration and tangential flow filtration (TFF).

The services segment is expected to grow from 2025 to 2030. This is due to biotechnology companies' increased outsourcing of R&D and drug development services from CROs. In addition, CROs are collaborating with biotechnology and biopharmaceutical companies to develop novel drugs and therapies, which is expected to support the segment's growth.

Application Insights

The biologicals segment dominated the virus filtration market with the largest revenue share in 2024. Biologicals are medicines from living organisms, including microorganisms, plants, and animals. They are increasingly important in the pharmaceutical industry due to their ability to provide targeted, precise, and personalized treatments, often with fewer side effects than traditional drugs. Key biological vaccines treat diseases such as measles, diphtheria, tetanus, mumps, hepatitis B, rubella (MMR), smallpox, polio, chickenpox, and influenza. According to the World Health Organization in 2022, around 254 million individuals were living with chronic hepatitis B, with approximately 1.2 million new cases reported each year. These rising health challenges have significantly increased the demand for biologicals, which in turn is driving the growing need for virus filtration solutions.

The medical devices segment is expected to grow significantly over the forecast period. The growth is driven by the increasing demand for medical devices due to the increasing aging global population, a rising incidence of chronic diseases, advancements in medical technology, and improved healthcare awareness and accessibility.

End-use Insights

The biopharmaceutical and biotechnology companies led the virus filtration market with the largest revenue share in 2024. The increasing R&D activities, production of biologics, and growth in the biopharmaceutical industry drive the demand. Some drivers are increasing demand for innovative drugs and vaccines, scientific research and development advancements, and supportive governmental schemes and policies.

The Contract Research Organizations (CRO) sector is expected to grow at the fastest CAGR over the forecast period. The demand is driven by pharmaceutical, biotechnology, and medical device companies that opt for specialized research services on a contractual basis as it leverages cost savings, accesses specialized expertise, and gains flexibility in their research and development (R&D) processes. The medical device companies segment is projected to witness a significant CAGR during the forecast period. Viral removal products are widely used in various medical devices, including anesthesia systems and ventilators.

Regional Insights

The North America virus filtration market dominated the global market, accounting for the largest revenue share of 42.6% in 2024. The established biotechnology and biopharmaceutical sectors in the U.S. have increased the region's demand for advanced virus filtration products for research and development and biologics manufacturing. The increasing prevalence of chronic diseases further drives the market growth in the region.

U.S. Virus Filtration Market Trends

The U.S. virus filtration market led the North American market with the largest revenue share in 2024. Major research and advancements by biopharmaceutical companies in the country drive the demand for virus filtration. For instance, in February 2025, Gilead Sciences revealed that the FDA had accepted its New Drug Applications for lenacapavir, an injectable HIV-1 capsid inhibitor for preventing HIV as PrEP,

Europe Virus Filtration Market Trends

The Europe Virus Filtration Market held a substantial market share in 2024. The demand is largely driven by the growing biopharmaceutical industry, the rising need for viral safety in biologics production, and better protection from chronic diseases. This is further supported by a strong emphasis on R&D, especially in countries such as Germany, the UK, and France.

Asia Pacific Virus Filtration Market Trends

The Asia Pacific virus filtration market is expected to grow at the fastest CAGR of 15.0% over the forecast period. The presence of untapped growth opportunities in the rapidly growing Asian economies such as China, India, Japan, and Indonesia is estimated to propel regional growth. Rising government support for industrialization, the growing presence of CROs, the availability of labor at low cost, and a relatively less stringent regulatory environment are attracting manufacturers of biologics and medical devices for market expansion in these regions. For instance, in April 2025, a Japan-based company, Asahi Kasei Corporation, launched, unifying its bioprocess operations under one entity, including virus removal filters such as Planova and BioOptimal Microfilters, CDMO services from Bionova Scientific, CRO testing services from ViruSure, and Bionique Testing Laboratories.

The China virus filtration market led the Asia Pacific market with the largest revenue share in 2024. China is making substantial investments in research and development, driving rapid growth in its biopharmaceutical sector. This expansion has heightened the need for virus filtration to maintain the safety and efficacy of its products.

Key Virus Filtration Company Insights

Some major companies in the virus filtration market are Merck KGaA; Danaher, Sartorius AG; and Thermo Fisher Scientific Inc.; among others. The rise in competition is leading to rapid technological advancements and companies are constantly working towards the improvement of their products with a major focus on research and development. The market players are indulging in developing new and better virus filtration. Major manufacturers provide advanced products through strong distribution channels across the globe.

-

Merck KGaA provides virus filtration solutions, offering advanced membrane filters and integrated systems for biopharmaceutical manufacturing. Its technologies ensure viral safety, regulatory compliance, and process efficiency, supporting the production of vaccines, monoclonal antibodies, and other biologics globally.

-

Danaher, through its life sciences subsidiaries such as Pall Corporation and Cytiva, provides virus filtration technologies essential for ensuring the safety of biopharmaceutical products. Its solutions support efficient, scalable filtration processes for producing vaccines, biologics, and gene therapies.

Key Virus Filtration Companies:

The following are the leading companies in the virus filtration market. These companies collectively hold the largest market share and dictate industry trends.

- Merck KGaA

- Danaher

- Sartorius AG

- Thermo Fisher Scientific Inc.

- GE HealthCare

- Charles River Laboratories

- Asahi Kasei Medical Co., Ltd.

- WuXi AppTec

- Lonza

- Clean Biologics

Recent Developments

-

In February 2025, Thermo Fisher Scientific announced an agreement to acquire Solventum’s Purification & Filtration business, a global virus filtration and purification technology provider.

-

In October 2024, Asahi Kasei Medical launched Planova FG1, a next-generation virus removal filter with seven times higher flux than previous models, enhancing productivity in biopharmaceutical manufacturing.

Virus Filtration Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.12 billion

Revenue forecast in 2030

USD 11.43 billion

Growth Rate

CAGR of 13.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

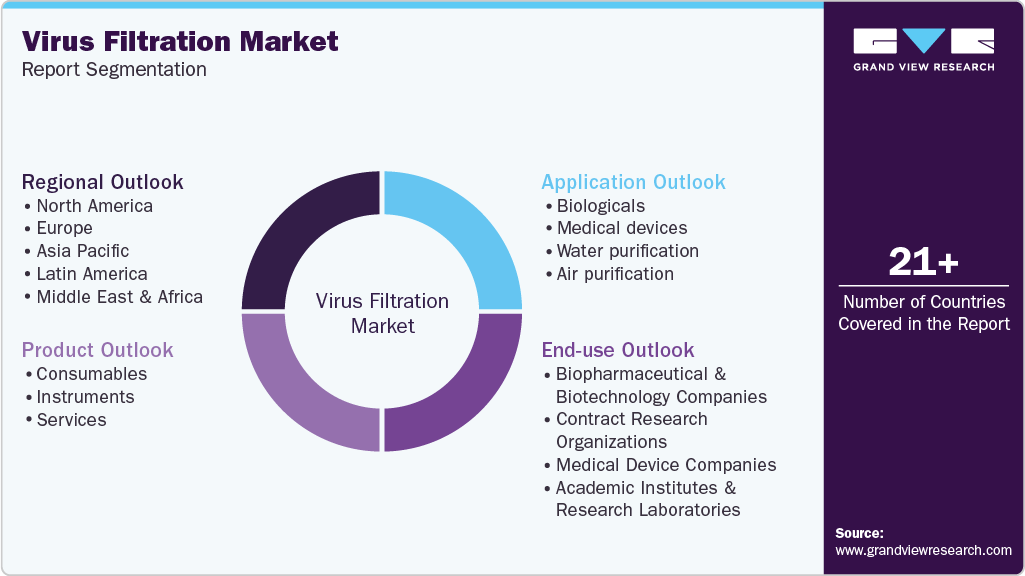

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Merck KGaA; Danaher; Sartorius AG; Thermo Fisher Scientific Inc.; GE HealthCare; Charles River Laboratories; Asahi Kasei Medical Co., Ltd.; WuXi AppTec; Lonza; Clean Biologics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Virus Filtration Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global virus filtration market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Consumables

-

Kits and reagents

-

Others

-

-

Instruments

-

Filtration systems

-

Chromatography systems

-

-

Services

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Biologicals

-

Vaccines and therapeutics

-

Blood and blood products

-

Cellular and gene therapy products

-

Tissue and tissue products

-

Stem cell products

-

-

Medical devices

-

Water purification

-

Air purification

-

-

End-use Outlook (Revenue, USD Million; 2018 - 2030)

-

Biopharmaceutical & biotechnology companies

-

Contract research organizations

-

Medical device companies

-

Academic institutes & research laboratories

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global virus filtration market size was estimated at USD 4.26 billion in 2022 and is expected to reach USD 4.8 billion in 2023.

b. The global virus filtration market is expected to grow at a compound annual growth rate of 10.1% from 2023 to 2030 to reach USD 9.5 billion by 2030.

b. The consumables segment dominated the market with a share of 46.5% in 2022. This is attributable to their continuous usage by pharmaceutical and biopharmaceutical companies and rises in R&D spending for the purpose of new drug development.

b. Some key players operating in the virus filtration market include Sartorius AG, Merck KGaA, Parker Hannifin, Rad Source Technologies, Clean Cells, WuXi PharmaTech (Cayman) Inc., and Danaher.

b. Key factors that are driving the virus filtration market growth include the global rise in the number of pharmaceutical and biopharmaceutical companies, increasing investment in the life sciences sector, rise in the number of drug launches & approvals, increase in funding by government for the development of pharmaceutical and biopharmaceutical industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.