- Home

- »

- Next Generation Technologies

- »

-

Vision Processing Unit Market Size & Share Report, 2030GVR Report cover

![Vision Processing Unit Market Size, Share & Trends Report]()

Vision Processing Unit Market Size, Share & Trends Analysis Report By Fabrication Process, By Application (Drones, AR/VR, ADAS), By Vertical (Security & Surveillance, Automotive, Healthcare), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-454-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Vision Processing Unit Market Size & Trends

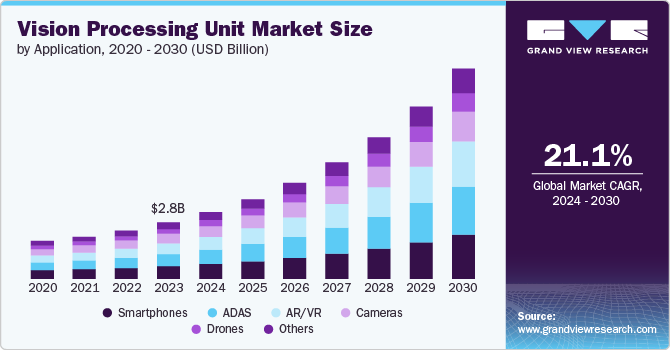

The global vision processing unit market size was estimated at USD 2.81 billion in 2023 and is expected to grow at a CAGR of 21.1% from 2024 to 2030. Numerous factors such as proliferation of AI-driven solutions, increasing adoption of IoT devices, and demand for smart surveillance systems are primarily contributing to the growth of the VPU market. VPUs are also deployed in border security systems, where they enable advanced surveillance and monitoring capabilities, enhancing the ability to detect and respond to potential threats. In industrial automation, VPUs are used to enable machine vision systems that inspect products, monitor production lines, and control robotic systems. These processors are essential for achieving high levels of precision and efficiency in manufacturing processes, driving the market growth.

In consumer electronics devices such as smartphones, AR/VR devices, and gaming consoles, VPUs are used to deliver enhanced visual experiences. These processors enable real-time processing of complex visual effects, improving the realism and responsiveness of AR/VR applications and gaming experiences. Modern smartphones and cameras are incorporating advanced features such as AI-based photography, real-time video enhancement, and augmented reality. VPUs play a crucial role in enabling these features by providing the necessary processing power without compromising battery life.

In healthcare, VPUs are increasingly used in medical imaging equipment, such as MRI and CT scanners, to process and analyze images more quickly and accurately. This is crucial for improving diagnostic accuracy and speed, which can lead to better patient outcomes. VPUs also power portable diagnostic devices, enabling real-time analysis at the point of care. VPUs are being integrated into AI-driven health monitoring systems, which analyze visual data from sensors and cameras to monitor patients' conditions in real-time. This is essential in telemedicine, remote patient monitoring, and wearable health devices, where quick and accurate processing of visual data is essential for effective healthcare delivery.

Fabrication Process Insights

The >16-28 nm segment led the market in 2023, accounting for over 56.0% share of the global revenue. Smaller fabrication nodes enable higher performance by allowing more transistors on a chip, which enhances computational capabilities and processing speed crucial for vision processing tasks. These smaller nodes offer better power efficiency, which is essential for mobile and embedded vision systems where energy consumption is a critical concern. Furthermore, the 16-28 nm process allows for more compact and integrated designs, leading to smaller and more versatile VPUs that can be used in various devices, including smartphones, drones, and automotive systems.

The ≤16 nm segment is anticipated to exhibit a significant CAGR over the forecast period. Older fabrication processes, such as those larger than 16 nm, often have lower production costs. This makes them suitable for applications where high performance is less critical, helping maintain a larger market share.VPUs based on these older processes are still used in legacy systems and in lower-end devices where advanced processing power is not required. They serve markets where cost efficiency is more important than advanced performance.

Application Insights

The smartphones segment accounted for the largest market revenue share in 2023. Various factors such as, growing need to improve user experience, integration of advanced technologies, and power efficiency are driving the growth of the segment’s growth. Moreover, the growing popularity of AR and VR applications in smartphones requires powerful vision processing to deliver seamless and high-quality experiences. Furthermore, the demand for AI-powered features, such as facial recognition, and advanced image enhancements, drives the need for efficient VPUs that can handle these complex tasks.

The AR/VR segment is anticipated to exhibit the highest CAGR over the forecast period. AR and VR applications demand substantial computational power for real-time image and video processing. VPUs are crucial for handling these intensive tasks, ensuring smooth and immersive experiences. Moreover, AR/VR applications require low latency and high frame rates to maintain a seamless experience. VPUs are designed to process visual data quickly and efficiently, meeting these stringent performance needs. Furthermore, the need for advanced visual effects, including 3D rendering, spatial mapping, and depth perception, drives the adoption of VPUs. These processors help achieve high-quality graphics and realistic interactions in AR and VR environments.

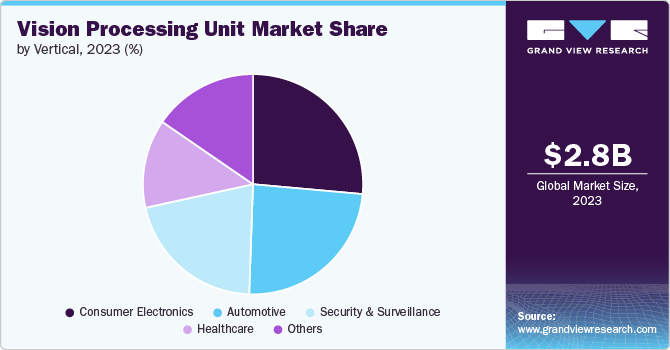

Vertical Insights

The consumer electronics segment accounted for the largest market revenue share in 2023. Consumer electronics, including smartphones, tablets, and smart cameras, benefit from improved imaging and video capabilities. VPUs enhance these devices' ability to process high-resolution images and videos quickly and efficiently. The integration of AI-driven features, such as facial recognition, object detection, and enhanced photo and video effects, relies on the processing power of VPUs. This drives demand for VPUs that can handle complex algorithms and provide real-time results. Furthermore, the rise of smart home devices, including smart TVs, smart speakers with cameras, and security cameras, drives the need for VPUs to handle numerous tasks such as video analytics, image recognition, and real-time monitoring.

The security and surveillance segment are anticipated to exhibit the highest CAGR over the forecast period. Security and surveillance applications require real-time processing of video feeds to quickly identify and respond to potential threats. VPUs provide the necessary processing power to handle large volumes of data with low latency. VPUs enable advanced video analytics, including motion detection, facial recognition, and license plate recognition, which are essential for modern security and surveillance systems. Furthermore, the demand for high-definition and ultra-high-definition cameras in security systems drives the need for VPUs that can manage and process high-resolution video streams effectively.

Regional Insights

North America dominated with a revenue share of over 38.0% in 2023. The region's strong focus on research and development in areas such as AI, machine learning, and advanced imaging drives the adoption of VPUs with advanced features. Moreover, the expansion of augmented reality (AR) and virtual reality (VR) applications, especially in gaming, entertainment, and professional training, drives the demand for North America VPU market that can handle high-performance, real-time visual processing.

U.S. Vision Processing Unit Market Trends

The U.S. vision processing unit market is anticipated to exhibit a significant CAGR over the forecast period. The U.S.’ healthcare sector's growing reliance on medical imaging and diagnostic tools creates demand for VPUs capable of handling high-resolution imaging and advanced image processing tasks. Moreover, significant investment and funding in technology startups and research institutions in the U.S. support the development and adoption of advanced VPU technologies.

Europe Vision Processing Unit Market Trends

The vision processing unit market in Europe is expected to witness significant growth over the forecast period. Increasing investments in security and surveillance systems, driven by safety concerns and regulatory requirements, create a demand for VPUs capable of advanced video analytics and real-time processing. Moreover, Europe's emphasis on industrial automation and robotics drives the need for VPUs in machine vision applications for quality control, inspection, and operational efficiency.

Asia Pacific Vision Processing Unit Market Trends

The vision processing unit market in Asia Pacific is anticipated to register the highest CAGR over the forecast period. Growing consumer electronics sector in various countries such as, China, India, and South Korea fuels demand for VPUs in smartphones, smart home devices, and wearable technology. Moreover, countries in the region are investing in smart city initiatives, which include advanced surveillance systems and IoT applications. This creates demand for VPUs capable of managing extensive video analytics and real-time data processing.

Key Vision Processing Unit Company Insights

Key vision processing unit companies include Qualcomm Technologies, Inc., Intel Corporation, and NVIDIA Corporation. Companies active in the vision processing unit market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in May 2024, Nikon Corporation launched an industrial robot vision system. The product incorporates a vision system affixed to an industrial robot arm, equipped with a camera-like sensor that replicates human eye perception, and a control PC functioning as the engine. This setup identifies objects through image processing and makes decisions based on those identifications, effectively enhancing the robot arm with dynamic visual and cognitive capabilities.

Key Vision Processing Unit Companies:

The following are the leading companies in the vision processing unit market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Micro Devices, Inc.

- Ambarella International LP

- Broadcom

- Huawei Technologies Co., Ltd.

- Intel Corporation

- NVIDIA Corporation

- Qualcomm Technologies, Inc.

- Samsung

- Sony Semiconductor Solutions Corporation

- Verkada Inc.

Recent Developments

-

In May 2024, Apple Inc. launched M4 chip, for all-new iPad Pro. Constructed with the second-generation 3-nanometer technology, the M4 is a system on a chip (SoC) that pushes forward Apple silicon's power efficiency and contributes to the thin design of the iPad Pro.

-

In May 2024, Nano Labs Ltd., a fabless integrated circuit design company, launched Cuckoo3.0 chip. It marks a major advancement in both performance and power efficiency over the previous version, the Cuckoo2.0 chip. Offering single-core computing capability of 1.2GH/s, Cuckoo3.0 delivers roughly four times the operational performance compared to Cuckoo2.0.

-

In May 2024, Thundercomm, IoT product and solutions provider, collaborated with Qualcomm Technologies, Inc., to launch Snapdragon Dev Kit for Windows. A small-sized PC powered by Snapdragon X Elite, tailored specifically for developers who are working on or refining applications and experiences for the advanced generation of AI-powered computers.

Vision Processing Unit Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.31 billion

Revenue forecast in 2030

USD 10.44 billion

Growth rate

CAGR of 21.1% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Fabrication process, application, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Advanced Micro Devices, Inc.; Ambarella International LP; Broadcom; Huawei Technologies Co., Ltd.; Intel Corporation; NVIDIA Corporation; Qualcomm Technologies, Inc.; Samsung; Sony Semiconductor Solutions Corporation; Verkada Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vision Processing Unit Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global vision processing unit (VPU) market report based on fabrication process, application, vertical, and region:

-

Fabrication Process Outlook (Revenue, USD Million, 2017 - 2030)

-

≤16 nm

-

>16-28 nm

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Smartphones

-

Drones

-

Cameras

-

AR/VR

-

ADAS

-

Others

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Consumer electronics

-

Security and surveillance

-

Automotive

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global vision processing unit market size was estimated at USD 2.81 billion in 2023 and is expected to reach USD 3.31 billion in 2024.

b. The global vision processing unit market is expected to grow at a compound annual growth rate of 21.1% from 2024 to 2030 to reach USD 10.44 billion by 2030.

b. North America dominated the vision processing unit market with a share of 38.8% in 2023. The region's strong focus on research and development in areas such as AI, machine learning, and advanced imaging drives the adoption of VPUs with advanced features. Moreover, the expansion of augmented reality (AR) and virtual reality (VR) applications, especially in gaming, entertainment, and professional training, drives the demand for North America VPU market that can handle high-performance, real-time visual processing.

b. Some key players operating in the vision processing unit market include Advanced Micro Devices, Inc.; Ambarella International LP; Broadcom; Huawei Technologies Co., Ltd.; Intel Corporation; NVIDIA Corporation; Qualcomm Technologies, Inc.; Samsung; Sony Semiconductor Solutions Corporation; and Verkada Inc.

b. Numerous factors, such as the proliferation of AI-driven solutions, increasing adoption of IoT devices, and demand for smart surveillance systems, are primarily contributing to the growth of the VPU market. VPUs are also deployed in border security systems, where they enable advanced surveillance and monitoring capabilities, enhancing the ability to detect and respond to potential threats.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."