- Home

- »

- Next Generation Technologies

- »

-

Voice Search Market Size, Share & Growth Report, 2030GVR Report cover

![Voice Search Market Size, Share & Trends Report]()

Voice Search Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Generic Search, Context-aware Search), By Application (Consumer Electronics, Smart Speakers), By End-use (Automotive, Retail), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-272-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Voice Search Market Size & Trends

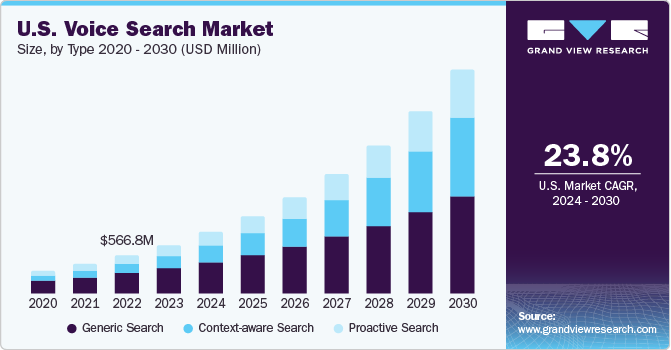

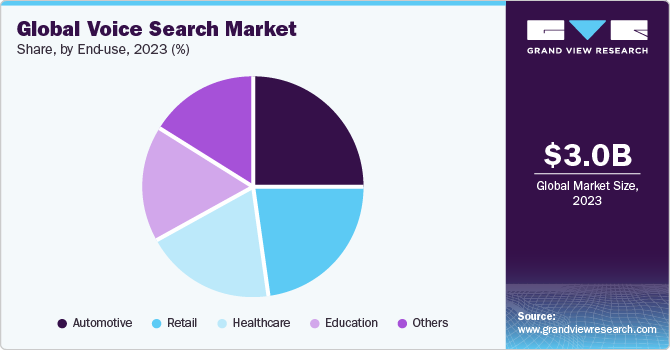

The global voice search market size was estimated at USD 3.05 billion in 2023 and is projected to grow at a CAGR of 23.8% from 2024 to 2030. The growth is attributed to technological advancements and the increasing integration of advanced electronic devices. Voice-activated biometrics, employed for security measures, enable authenticated user access, facilitating secure transactions. The increasing adoption of voice biometrics contributes to market expansion, as it offers enhanced security protocols and streamlined authentication processes.

The adoption of voice-enabled in-car infotainment systems is surging, driven by the implementation of hands-free functionality in various countries to curb mobile phone use while driving. Concurrently, developers of voice and speech products are directing their efforts to innovative solutions, which is expected to accelerate the market growth over the forecast period. Moreover, integrating voice recognition technology in smartphones empowers healthcare professionals to efficiently translate verbal input into comprehensive clinical descriptions stored within Electronic Health Record (EHR) systems. This trend supports the expanding presence of voice-enabled Internet of Things (IoT) devices in smart home automation, which is anticipated to drive in the market growth. IoT-enabled devices transform user experiences by integrating innovative user interaction capabilities, such as touch screens and buttons, into traditionally offline devices.

The adoption of voice search functionality within mobile applications is increasingly prevalent, transforming users’ interaction with their devices and access information. This trend is fueled by several factors, including the advancements in natural language processing and machine learning algorithms. Mobile app developers are developing this trend by incorporating voice search capabilities into a diverse range of applications, including e-commerce platforms, navigation apps, productivity tools and virtual assistants. For instance , in March 2021, Flipkart added a voice search capability supporting both Hindi and English languages. This new feature enables Flipkart customers to search for products using voice. Flipkart introduced a voice assistant to their platform in the grocery section last year. With this new feature, customers can search for over 150 million products across 80+ categories listed on Flipkart using their voice.

Market Concentration & Characteristics

Industry growth stage is high and pace of the industry growth is accelerating. The industry is characterized by a high degree of innovation owing to the rapid technological advancements. This is driven by factors such increasing implementation of AI, ML, and IoT technologies and the growing adoption of voice-based authentication in smartphones. For instance , in July 2023, Swiggy, a food and grocery ordering app, announced the integration of AI features into its platform. The AI feature offers neural voice searches and filtered recommendations in selected Indian languages using a Large Language Model (LLM) that recognizes dishes, recipes, restaurant terms, and Swiggy-specific data that can also be fed to the AI.

Key competitors in the voice search industry are increasingly engaging in merger and acquisition (M&A) transactions. Major players aim to enhance their portfolios by integrating complementary technologies, increasing the demand in healthcare for improving efficiency, and the growing use of advanced smart appliances in a rapidly growing industry. These activities are strategic moves to strengthen the market position.

The presence of numerous vendors and the availability of open-source software contribute to the availability of service substitutes in the industry. However, accuracy is crucial, and open-source software options available may not meet the required level of precision. Consequently, there is an increased demand for premium software solutions from industry leaders, particularly from users who prioritize high speech and voice recognition accuracy.

End-user concentration plays a crucial role in the voice and speech recognition industry. As a result, several industries are witnessing increased demand for smart appliances and devices. The high demand concentration in a few end-user industries creates opportunities for companies that specialize in developing smart appliances and devices for specific industries.

Type Insights

The generic search segment accounted for the largest revenue share of 53.6% in 2023.The growth of smart assistants and chatbots in various applications and services has contributed to the popularity of voice search. These virtual assistants use voice recognition technology to understand user queries and provide relevant responses or actions. As businesses integrate smart assistants into their websites, apps, and customer support channels, the demand for the generic search segment is expected to further propel.

The context-aware search segment is anticipated to witness significant growth during the forecast period. The advancements in AI and Natural Language Processing (NLP) technologies drive the growth of this segment. These advancements enable voice search systems to understand better and interpret user queries, accurately recognizing spoken words and phrases and delivering contextually relevant search results. For instance, in May 2023, Microsoft launched the Bing Chat. The company launched new features such as adding images in responses, new widgets for both Android and iOS devices, and the ability to save chat history. In addition, the AI-powered chatbot enables responding to questions in its voice.

Application Insights

The consumer electronics segment accounted for the largest revenue share in 2023 owing to the technological advancements and changing consumer preferences. The increasing integration of voice recognition technology into a wide range of consumer devices, including smartphones, smart speakers, wearables, and home entertainment systems, is driving the market growth. The growing popularity of virtual assistants such as Amazon's Alexa, Apple's Siri, and Google Assistant enables voice-activated features and services, thereby enhancing the overall user experience.

The smart speakers segment is anticipated to witness significant growth during the forecast period. The growing use of smart speakers such as Amazon Echo, Google Home, and Apple HomePod enables users to interact with their environments. These devices serve as central hubs for voice-activated commands, enabling users to control smart home devices, access information, and perform various tasks using natural language. The seamless integration of voice search capabilities into smart speakers enhances their utility, making them essential tools for managing daily routines and accessing services and content. For instance, in August 2023, JBL, in collaboration with Alexa and Google Assistant, launched three new smart speakers. These speakers are the first to offer simultaneous voice assistants with the help of audio focus software. This feature ensures that Alexa and Google Assistant do not speak over each other, providing a smooth experience for users.

End-use Insights

The automotive segment accounted for the largest revenue share in 2023 due to the increasing emphasis on safety regulations and distracted driving prevention measures. AI-driven voice recognition technology offers enhanced accuracy and contextual understanding, enabling more natural and intuitive interactions between drivers and their vehicles. For instance , in December of 2023, TomTom, a company that provides location technology, partnered with Microsoft to introduce a voice assistant that uses artificial intelligence technology for drivers. The solution is integrated with other automotive infotainment systems. Users utilize voice and access entertainment, location search, and vehicle command systems to interact with the solution.

The retail segment is anticipated to witness significant growth during the forecast period. The rising demand for seamless and personalized shopping experiences drives retailers to integrate voice search capabilities into their digital platforms. Voice search enables customers to search for products effortlessly, receive personalized recommendations, and place orders using natural language commands, thereby enhancing the overall shopping experience and driving customer satisfaction and loyalty.

Regional Insights

North America dominated the voice search market with a share of 31.9% in 2023 due to the rising adoption of voice commerce, or v-commerce, as consumers increasingly use voice commands to shop and perform various transactions and the increasing demand for personalized and contextualized search experiences. Voice search technology enables users to interact with content more conversationally and naturally, allowing for more precise and relevant search results tailored to individual preferences and contexts.

U.S. Voice Search Market Trends

The U.S. accounted for a market share of 23.7% in 2023. The growing trend towards hands-free interaction with technology, particularly during multitasking or driving, is expected to fuel the demand for voice search solutions. Factors such as expanding device accessibility, technological advancements, and evolving user preferences are propelling the growth of the market in the country. According to the Smart Audio Report for 2022, 62% of Americans aged 18 and above use voice assistants on various devices, including smart speakers, in-car systems, and smartphones, amongst others.

Asia Pacific Voice Search Market Trends

The market in the Asia Pacific region is expected to grow over the forecast period due to the rapid adoption of smartphones and smart devices across the region, expanding the user base for voice search technology. The growing penetration of high-speed internet and improving infrastructure support the integration and usage of voice search across various platforms and devices, further propelling market expansion.

Moreover, the increasing investment by technology companies in AI and natural language processing capabilities improves the ecosystem for voice search, boosting its adoption across diverse industries such as e-commerce, entertainment, and automotive, and others. According to the Mobile Economy APAC report by the Global System for Mobile Communications Association, it is estimated that 5G is expected to account for 41% of mobile connections with over 1.4 billion 5G connections in use in the region by 2030.

The China voice search market is expected to grow rapidly over the forecast period due to the increasing internet penetration and smartphone usage across the country, particularly in rural areas and lower-tier cities. This broader connectivity expands the potential user base for voice search applications, driving the market growth.

The voice search market in India is expected to grow over the forecast period due torising digital literacy rates and the growing comfort among users with voice-based interactions, particularly in regional languages.According to The World Economic Forum, as of 2023, India boasts over 700 million smartphone users, of which 425 million reside in rural areas, marking a penetration of around 50% of the population. There has been a 45% surge in active internet users since 2019.

Middle East And Africa Voice Search Market Trends

The market in the MEA region is expected to grow at a modest pace over the forecast period.The governments in the region support healthcare innovation and digital transformation to enhance healthcare delivery and patient outcomes. Voice search technology offers potential applications in healthcare settings, enabling healthcare providers to access patient records, recover medical information, and input data using voice commands, thereby streamlining workflows and improving overall efficiency in healthcare delivery.

The UAE voice search market is expected to grow over the forecast period due to the UAE government's initiatives to drive digital transformation and invest in artificial intelligence technologies, creating a favorable environment for innovation and entrepreneurship in the region. For instance, in May 2023, the UAE government launched a platform, U-Ask, an AI-powered chatbot for government services. It provides information about government services in English and Arabic, including service requirements, relevant information, and direct application links. The platform can handle various inquiries and requests, providing comprehensive answers.

Key Voice Search Company Insights

Some of the key players operating in the market include Advanced Voice Recognition Systems, Inc. and Google, Inc. among others.

-

Advanced Voice Recognition Systems, Inc. is a software development company specializing in creating interface and application solutions for speech recognition technologies. The company's primary product is speech recognition software and related firmware that enables dictation into various applications, including DOS applications running in Windows, UNIX, mainframe applications, custom applications, and Windows programs. They offer AVRS Enterprise solutions for desktop, mobile, web-based, and cloud applications, targeting software developers and hardware manufacturers.

-

Google, Inc. offers various internet services and products, ranging from email and online document creation to hardware such as mobile phones. Google Voice Search allows users to search by voice command, providing quick and relevant results. It offers an alternative and efficient method to interact with the search engine. This feature gained popularity due to its ease of use & accuracy and Google's innovation in enhancing user experience.

MModal, Inc. and Nortek Holdings, Inc. are among the emerging market participants.

- MModal, Inc. specializes in providing medical information services, including medical transcription, digital voice capture, speech recognition, medical coding systems, mobile dictation, and imaging. The company aims to enhance clinical documentation by offering innovative speech recognition solutions that improve the quality, completeness, and compliance of medical records. MModal's AI-powered solutions cater to various clinical documentation needs and offer advanced features such as NLU technology and CAPD functionality.

Key Voice Search Companies:

The following are the leading companies in the voice search market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Voice Recognition Systems, Inc.

- Apple, Inc.

- Baidu, Inc.

- BioTrust ID B.V.

- CastleOS Software, LLC

- Google, Inc.

- International Business Machines Corp.

- Microsoft Corp.

- MindMeld

- MModal, Inc.

- Nortek Holdings, Inc.

- Sensory, Inc.

Recent Developments

-

In August 2023, Google, the parent company of YouTube, launched an experimental feature for Android devices that allows users to identify songs by humming. YouTube, a video-sharing platform, initiated testing a song search feature within its Android app. This new capability enables users to find songs on YouTube by simply humming, singing, or recording them.

-

In April 2023, 3M Health Information Systems partnered with Amazon Web Services (AWS) to accelerate the advancement of 3M M*Modal ambient intelligence. AWS Machine Learning and generative AI services are expected to be used to refine and scale 3M's ambient clinical documentation and virtual assistant solutions. The collaboration aimed to improve the patient-physician experience and reduce the administrative burden for physicians.

Voice Search Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.86 billion

Revenue forecast in 2030

USD 13.88 billion

Growth rate

CAGR of 23.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; China; India; Japan; South Korea; Australia; Brazil; Mexico;; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Advanced Voice Recognition Systems, Inc.; Apple, Inc.; Baidu, Inc.; BioTrust ID B.V.; CastleOS, Software, LLC; Google, Inc.; International Business Machines Corp.; Microsoft Corp.; MindMeld; MModal, Inc.; Nortek Holdings, Inc.; Sensory, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Voice Search Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global voice search market report based on type, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Generic Search

-

Context-aware Search

-

Proactive Search

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer Electronics

-

Smart Speakers

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Retail

-

Healthcare

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global voice search market size was estimated at USD 3.05 billion in 2023 and is expected to reach USD 3.86 billion in 2024

b. The global voice search market is expected to grow at a compound annual growth rate of 23.8% from 2024 to 2030 to reach USD 13.88 billion by 2030

b. North America dominated the voice search market with a share of 31.9% in 2023, due to due to the rising adoption of voice commerce, or v-commerce, as consumers increasingly use voice commands to shop and perform various transactions.

b. Some key players operating in the voice search market include Advanced Voice Recognition Systems, Inc., Apple, Inc., Baidu, Inc., BioTrust ID B.V., CastleOS, Software, LLC, Google, Inc., International Business Machines Corp., Microsoft Corp., MindMeld, MModal, Inc., Nortek Holdings, Inc., Sensory, Inc.

b. Factors such as Increasing integration of advanced electronic devices and growing use of smart assistants and chatbots in various applications is driving the market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.