- Home

- »

- IT Services & Applications

- »

-

Warehouse Management System Market Size Report, 2030GVR Report cover

![Warehouse Management System Market Size, Share & Trends Report]()

Warehouse Management System Market Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment (On-premise, Cloud), By Function, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-151-1

- Number of Pages: 90

- Format: Electronic (PDF)

- Historical Range: 2017 - 2023

- Industry: Technology

Market Size & Trends

The global warehouse management system market size was valued at USD 3.94 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 19.5% from 2024 to 2030. Growing economies across the globe have propelled various sectors such as healthcare, manufacturing, and retail to achieve highly efficient operations in order to increase their output and meet consumer demand. In an attempt to address growing demands, logistics companies are continuously progressing to overcome challenges created by fluctuating product markets and shipping schedules.

A warehouse management system (WMS) helps reduce lead time, increase product delivery speed, and minimize distribution costs. The software is designed to cater to complex, sophisticated warehouse operations as well as tackle less complex resource-constrained operations. Besides, the WMS software is used by various functions such as third-party logistics, B2B distribution companies, and other manufacturing companies.

Demand for WMS is anticipated to witness a sharp rise due to changing supply chain models of product manufacturers and rapidly growing consumer demand, especially in the transport & logistics, and retail sectors. The need for manufacturers to automate warehouse management processes and curtail costs globally is one of the key trends triggering the market growth. Spiraling demand for the system may be attributed to its ability to ship products in the fastest possible time through the shortest shipping routes.

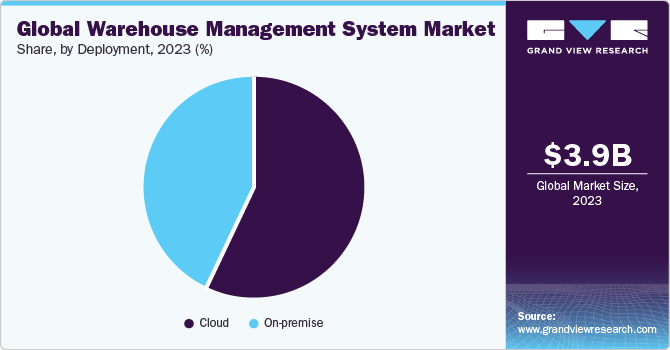

Customers prefer cloud-based WMS services to on-premise solutions, as the former ensures cost reduction on the service. Software-as-a-Component (SaaS) was introduced to meet the burgeoning demand for cloud-based services as it offers a low upfront cost and enables faster implementation in warehouses. These systems can manage both inbound and outbound freight and cross-docking. These systems are also compatible with other supply chain systems such as business analytics, transportation management systems, slotting management, and yard management.

Furthermore, cloud-based warehouse management system solutions can be accessed from any location through web-based portals. These systems extend supply chains to align fulfillment services and inventory management with advanced purchasing methods and provide real-time visibility into an entire inventory available via browsers and smartphones.

In the wake of the recent COVID-19 outbreak, there has been a significant disturbance in most industries across the globe. While few industries experienced a contraction in their productions and businesses, others faced severe outcomes such as the shutdown of businesses and movement restrictions. For instance, travel, entertainment, food & beverage, and hospitality industries had the most retrenchments, and on the other hand, healthcare and e-commerce businesses had an upsurge in demand.

The demand for warehousing has increased due to the rising trend of online purchasing. The implementation of lockdowns, social distancing, and various other safety measures in response to the pandemic has led consumers to pursue online purchasing. Therefore, several multinational companies are setting up new warehouses across numerous countries to accommodate this upsurged demand.

This has resulted in the growing use of warehouse management systems in e-commerce and third-party logistics industries. E-commerce companies such as Amazon.com, Inc., Alibaba.com., and eBay Inc. are ramping up the demand for WMS as they continue to set up new warehouses across the globe.

Market Concentration & Characteristics

The market growth stage in the warehouse management system market is high, and the pace of the market growth is accelerating. The warehouse management system market is characterized by a high degree of industry standards, innovative offerings, and dominance of key players. The warehouse management system market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain a high market share and the need to consolidate in a rapidly growing market.

The warehouse management system (WMS) market operates within a regulatory landscape that places emphasis on critical aspects such as data privacy, trade compliance, and labor restrictions. In the context of data protection, especially in warehouses dealing with healthcare products, strict adherence to the Health Insurance Portability and Accountability Act (HIPAA) is imperative to safeguard sensitive health information stored within the WMS. For warehouses engaged in international trade, compliance with the Customs-Trade Partnership Against Terrorism (C-TPAT) standards is vital. This compliance not only ensures the security of cross-border supply chains but also contributes to the overall efficiency of global logistics operations.

The warehouse management system currently has limited alternatives, given its unique model of providing comprehensive warehouse management solutions. However, challenges may arise from solutions such as enterprise resource planning and supply chain management solution providers, owing to their broader visibility into the entire supply chain, including procurement, production, distribution, and logistics.

End-use concentration plays a pivotal role in the warehouse management system market, the adoption of WMS is driven by the need for real-time visibility, accuracy in inventory management, and increased efficiency in warehouse operations across diverse industries. The warehouse management system is crucial for managing inventory, picking, packing, and shipping orders efficiently in retail and e-commerce warehouses.

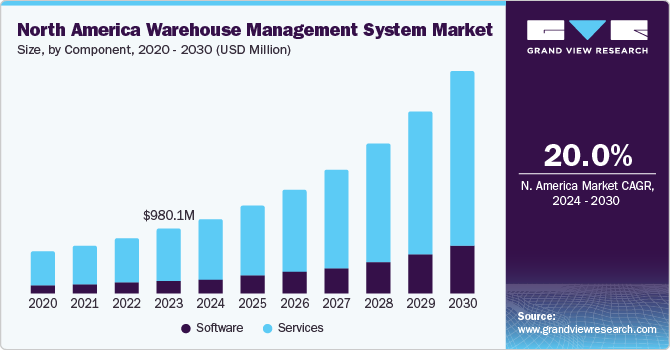

Component Insights

The services segment held the highest revenue share in the WMS market, contributing to more than 81.23% revenue share in 2023. The services segment includes consulting, system integration, operation, and maintenance services. Warehouse management can be provided as a service by third-party vendors, which is outsourced by WMS providers. Vendors sell their products by either offering them as a service, which helps the clients to focus on their core business operations or by selling the software to the client without the service.

The software segment is expected to emerge as the fastest-growing segment, registering a highest CAGR from 2024 to 2030. The growth can be attributed majorly to the increasing adoption of WMS software by small and midsized enterprises (SMEs) worldwide. The software is hosted via a cloud-based computing system.

Furthermore, factors such as spurring demand in the retail and manufacturing sectors and high disposable incomes of consumers are major factors expected to support the segment growth in the forthcoming years. Besides, warehouse management system software can be a standalone system or part of a supply chain execution suite, and is widely used as a tactical tool by businesses to meet the unique customer requirements of their supply chain and distribution channel.

Deployment Insights

The cloud segment held the highest revenue share in 2023 and is expected to emerge as the fastest-growing segment, registering a CAGR of 20.1% from 2024 to 2030. Cloud-based technology has revolutionized the way businesses function. When deployed on the cloud, WMS offers a reduction in companies' upfront costs and drastically increases warehouses' efficiency.

Over the years, cloud deployment has become as secure as the on-premise system on account of data sovereignty and successful curbing of data thefts. Companies are now able to customize and provide a WMS service based on the client’s requirements. For instance, the cloud-based WMS enables clients to scale or downsize the level of operations based on their seasonal demand.

On the other hand, the on-premise deployment has been prominent since the advent of WMS and is characterized by huge servers and high maintenance costs, ultimately increasing the company’s expenditures. These upfront costs and ownership of maintaining the on-premise server are incredibly high compared to the cloud-based technology. The significant difference between on-premise and cloud-based solutions is the longer time taken in the implementation process of on-premise WMS as compared to the latter.

Function Insights

The analytics & optimization segment is expected to emerge as the fastest-growing segment, registering a CAGR of 21.8% from 2024 to 2030. On the other hand, the revenue contributed by the systems integration & maintenance segment is likely to be the highest throughout the same period. Functions such as inventory receiving and putting away, optimization of picking and shipping of orders, and guidance in inventory replenishment are being carried out by WMS.

Order picking functionality is one of the most crucial features in a warehouse management optimization suite that is designed to automate the paper-based picking process. The material handling process and picking are affected by many factors, including warehouse layout, customer requirements, order type, and product velocity. A warehouse management system capable of accommodating fulfillment requirements irrespective of individual warehouse characteristics is more beneficial than a WMS with a limited scope of application.

Further, order allocation is another essential feature of any robust warehouse management system. As soon as a sales order is received, it is entered into the enterprise resource planning (ERP) system and gets immediately updated in the WMS software. Order management is expedited as there is no time lapse between the product being received in the warehouse and being available for order allocation.

Application Insights

The transportation & logistics segment is expected to emerge as the fastest-growing segment, registering a CAGR of 20.7% from 2024 to 2030. The growth can be attributed to the increased popularity of e-commerce portals, coupled with the growing disposable income levels of consumers, especially in emerging nations such as India and China.

Logistics and supply chain companies are rapidly adopting WMS to improve their operations and increase the warehouse's efficiency and productivity. Also, companies understand that having a well-integrated WMS is needed to efficiently run the warehouse operations and meet the consumers' rising demand.

The manufacturing segment held the highest revenue share in 2023. The manufacturing companies initially integrated their ERP and WMS solutions. They are integrating their logistics & transport management systems too in order to gain full control of the supply chain. In addition, the use of cloud-based technology is enhancing the efficiency and performance of supply chain management in the manufacturing sector.

The healthcare segment is anticipated to emerge as a prominent adopter of WMS, as providers are building facilities taking into consideration the pre-requisites of the healthcare sector. For instance, DHL’s Cherwell European healthcare center is the largest user-shared logistics center in the U.K. that offers a healthcare warehouse management system. The facility uses OBS Logistics system, and its services include inventory management for a wide range of temperature-controlled pharmaceutical products, diagnostic reagents, and medical devices.

Regional Insights

Factors such as the presence of wide networks of third-party logistics (3PL) companies & large companies with global distribution operations & warehousing, and sustained growth in the e-commerce industry are propelling the WMS market growth in North America.

U.S. Warehouse Management System Market

In the year 2023, warehouse management system market in U.S. held the largest market share in the region due to the strong presence of ERP vendors, which supports the overall market growth. Moreover, the nation has a high demand for food and beverages on a broader range, which requires continuous supply from warehouses, as it adds quality control, efficiency, and consistency to the process.

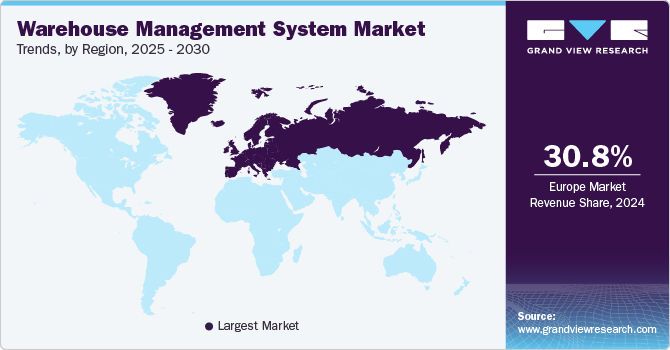

Europe Warehouse Management System Market Trends

Europe dominated the WMS market and accounted for over 31.16% of the global revenue share in 2023, followed by Asia Pacific and North America. The advancement in the warehouse management system and increasing awareness of cloud-based warehouse management systems are primary factors driving the WMS market growth in the European region.

The warehouse management system market in the U.K. is expected to account for a major revenue share in the Europe market. The growth can be attributed to the end-user approach towards reducing lead time, increasing product delivery speed, and minimizing distribution costs.

Germany warehouse management system market is expected to account for a significant revenue share in the Europe market. The growth can be attributed to the increasing adoption from end-users of software that caters to complex warehouse operations.

The warehouse management system market in France is expected to account for a significant revenue share in the Europe market. The growth can be attributed to the manufacturer's approach towards automating the warehouse management processes that aid in lowering operational efficiency.

Asia Pacific Warehouse Management System Market Trends

Asia Pacific is projected to be the most promising region in the coming years, owing to the presence of high-growth economies such as China, India, and the Philippines. With the increasing purchasing power of consumers, developing countries are witnessing a growth in the demand for end-use products. This is positively influencing the demand for WMS for an uninterrupted supply of products to users. Moreover, since Asia Pacific is a price-sensitive region, SaaS is highly preferred by companies using WMS technology. Advantages such as lower entry cost and risk, cost-effective growth, access to the best technology, and dynamic and advanced software features offered by the model are seizing manufacturers' attention.

The warehouse management system market in China is expected to account for a major revenue share in the Asia Pacific market. Increasing demand from manufacturers for software that aids in order tracking, labeling, and quality control management is an important factor expected to support market growth.

India warehouse management system market is expected to account for a significant revenue share in the Asia Pacific market. Manufactures approach towards increasing customer satisfaction for the business is expected to increase demand for warehouse management system solutions that aid in tracking the order from the warehouse to the final destination.

The warehouse management system market in Japan is expected to account for a significant revenue share in the Asia Pacific market. Manufacturers' approach towards increasing productivity and improving accuracy in inventory management is expected to increase demand for warehouse management solutions which is expected to support market growth.

South America Warehouse Management System Market Trends

The Warehouse Management System (WMS) market in South America is witnessing steady growth, driven by the region's expanding e-commerce sector, increasing adoption of advanced technologies, and rising demand for efficient inventory management solutions

The warehouse management system market in Brazil is expected to account for a significant revenue share in the South America market. The manufacturers' approach towards increasing productivity and improving accuracy in inventory management is expected to increase demand for warehouse management solutions which is expected to support market growth.

Middle East & Africa Warehouse Management System Market Trends

The Middle East warehouse management system (WMS) market is experiencing moderate growth, driven by the region's expanding logistics and e-commerce sectors. Also, the rapid growth of online retail, the need for streamlined supply chain operations, and government initiatives aimed at promoting digital transformation and automation in logistics are key factors contributing to the growth of the WMS market in the Middle East

The warehouse management system market in Saudi Arabia (KSA) is expected to account for a significant revenue share in the Middle East & Africa market. The government initiatives aimed at modernizing the logistics infrastructure and improving supply chain efficiency are driving the adoption of WMS solutions among Middle East & Africa businesses.

Key Warehouse Management System Company Insights

The market participants are focusing on several strategies to gain a higher market share. Mergers, acquisitions, partnerships, and other contractual agreements are being announced by them to emerge as the top warehouse management system company. Moreover, these players are investing in research and development activities to bring new services to the market.

Some of the key players operating in the market include Made4net, Manhattan Associates, Oracle, PSI Logistics among others.

-

Mad4net is a global company formed to support the growing demands of both large and small logistics companies with a cost-efficient suite of products designed to address different parts of the value chain. The company provides a strong all-in-one application suite built on an exclusive platform based on Microsoft technology. The solution is a web-based product that can run on multiple browsers and provide on-premises and cloud deployment options. Made4net received the Supply Chain Executive Green Supply Chain Award in 2018. The company has a global footprint spanning North America, the Middle East, Europe, and Asia.

-

Epicor Software Corporation develops industry-specific enterprise software solutions for businesses operating in manufacturing, distribution, retail, and services, among other industries and industry verticals. The company's product offerings include Supply Chain Management (SCM) software, Customer Relationship Management (CRM) software, Enterprise Resource Planning (ERP) systems, Human Capital Management (HCM) solutions, and Retail Management System (RMS) solutions.

PULPO WMS Germany GmbH and Jugo Limited are some of the emerging market participants in the target market.

-

PULPO WMS Germany GmbH aids companies in optimizing all internal logistics processes, enhancing efficiency, and empowering organizations to implement improvements.

-

Jugo Limited is a U.K.-based warehouse management solution provider. The company provides inventory management software that allows managers to assign barcodes and images to inventory items, enhancing operational efficiency.

Key Warehouse Management System Companies:

The following are the leading companies in the warehouse management system market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these warehouse management system companies are analyzed to map the supply network.

- EPICOR

- Körber AG (HighJump)

- Infor

- Made4net

- Manhattan Associates

- Oracle

- PSI Logistics

- Reply

- SAP

- Softeon

- Synergy Ltd

- Tecsys

Recent Developments

-

In October 2022, Epicor Software Corporation announced the acquisition of eFlex Systems, a Manufacturing Execution System (MES) solutions provider. This strategic acquisition allowed Epicor Software Corporation to expand its capabilities in Industry 4.0 and help manufacturers modernize their production environments. With the addition of eFlex Systems' MES solutions to its portfolio, Epicor Software Corporation was looking forward to offering advanced functionality for real-time monitoring, control, and optimization of manufacturing operations.

-

In October 2022, SAP SE collaborated with Qualtrics, a cloud-based software platform provider specializing in experience management, to introduce Qualtrics XM for suppliers. This solution was designed to empower organizations to identify areas of improvement within the source-to-pay process and enable businesses to enhance their supply chain operations, secure critical supplies, reduce costs, manage risks, and improve overall business agility.

-

In July 2021, Epicor Software Corporation announced the extension of its partnership with Sage Clarity, an advanced Manufacturing Execution System (MES) solutions provider. This initiative was aimed at enhancing the capabilities of its MES solutions by leveraging Sage Clarity's expertise and specialized applications. The company was also looking forward to offering its customers advanced MES ecosystem applications enabling comprehensive visibility and control over their manufacturing operations.

-

In March 2022, Blue Yonder Group, Inc. announced its partnership with Snowflake, a cloud-based data warehousing company that offers a fully managed, scalable, and flexible data platform. The partnership combined Blue Yonder Group, Inc.'s expertise with Snowflake's scalable and secure data platform. By integrating their technologies, the companies aimed to provide businesses with real-time visibility into their supply chain data, enabling them to make more informed decisions, optimize operations, and drive efficiencies.

Warehouse Management System Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.94 billion

Revenue forecast in 2030

USD 13.34 billion

Growth rate

CAGR of 19.5% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, function, application, region

Regional scope

North America; Europe; Asia Pacific; South America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; China; India; Japan; Brazil

Key companies profiled

EPICOR; Körber AG (HighJump); Infor; Made4net; Manhattan Associates; Oracle; PSI Logistics; Reply; SAP; Softeon; Synergy Ltd.; Tecsys

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Warehouse Management System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented global warehouse management system market report based on component, deployment, function, application, and region:

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

On-premise

-

Cloud

-

-

Function Outlook (Revenue, USD Billion, 2017 - 2030)

-

Labor Management System

-

Analytics & Optimization

-

Billing & Yard Management

-

Systems Integration & Maintenance

-

Consulting Services

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Transportation & Logistics

-

Retail

-

Healthcare

-

Manufacturing

-

Food & Beverage

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global WMS market size was estimated at USD 3.41 billion in 2022 and is expected to reach USD 3.94 billion in 2023.

b. The global WMS market is expected to grow at a compound annual growth rate of 19.0% from 2023 to 2030 to reach USD 13.34 billion by 2030.

b. Europe dominated the WMS market with a share of 31.49% in 2022. This is attributable to the advancement in the warehouse management system and increasing awareness of cloud-based warehouse management systems across the region.

b. Some key players operating in the WMS market include Körber AG (HighJump), Manhattan Associates, Oracle, SAP, Softeon, Synergy Ltd., Tecsys, Reply, Infor, Made4net, Epicor, and PSI Logistics.

b. The key factor that is driving the WMS market growth includes changing supply chain models of product manufacturers and rapidly growing consumer demand, especially in the transport & logistics and retail sectors.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."