- Home

- »

- Petrochemicals

- »

-

Global Wax Market Size, Share & Growth Analysis Report 2030GVR Report cover

![Wax Market Size, Share & Trends Report]()

Wax Market Size, Share & Trends Analysis Report By Product Type (Mineral, Synthetic, Natural), By Application (Candles, Packaging, Plastic & Rubber), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-024-8

- Number of Pages: 122

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Bulk Chemicals

Report Overview

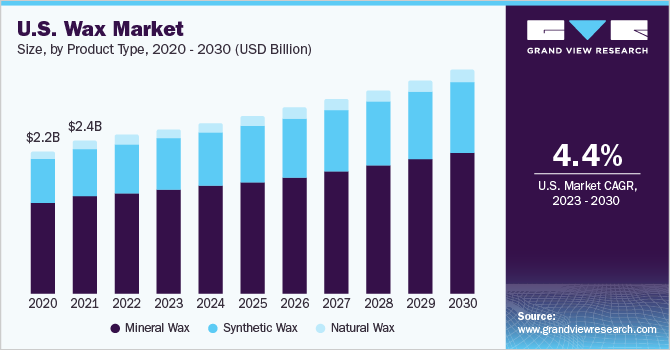

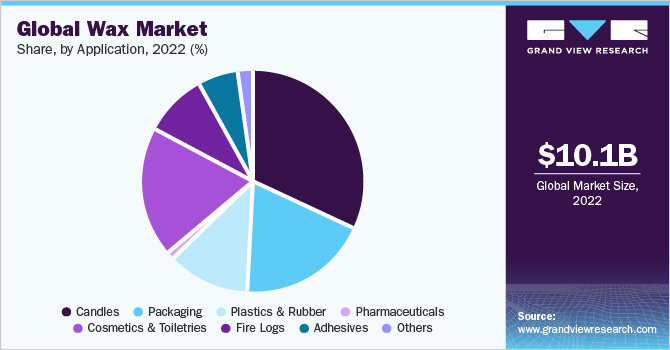

The global wax market size was valued at USD 10.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. The demand for the product is anticipated to be driven by the growing demand in various industries because of its superior properties such as high gloss, good water repellency, and outstanding chemical resistance. Furthermore, growing acceptance for synthetic wax on account of its resistance to chemicals & water, greater stability against polishing, and resistance against scratch, scuff, and metal marks are aiding the increased wax demand globally. Synthetic wax, especially polyethylene wax, has lower molecular weight compared to that of Fischer-Tropsch, microcrystalline, and paraffin wax types. This difference renders the synthetic wax to be tough. Furthermore, its varying slip characteristics & hardness make it suitable for use as additives in coatings and inks.

The global wax industry is highly competitive owing to the major involvement of multinationals in constant capacity expansion, product diversification, and innovation. To sustain in this competitive market type, companies are undergoing several strategic planning and execution programs to increase their operational efficiency and simultaneously, expand their market presence globally.

Wax finds major application in coating and printing formulations. It is highly utilized in the paint, coating, and printing ink industry owing to its features of mark & scratch resistance, rub resistance, and water repellency. It is applied as an additive in a variety of inks including letterpress, lithographic, gravure, and flexographic. Other functions of wax in the coating and ink industry play an important role in blockage, improvement in friction, anti-setting, and anti-sagging.

The growth of polymer processing, pharmaceutical, food, and personal care industries has boosted the demand for wax across countries such as India, China, Brazil, the U.S., Germany, and the U.K. Rapidly increasing demand for the product in the adhesives, agriculture, as well as in textile applications is anticipated to aid in advancements of the wax industry worldwide.

Waxes are part of organic compounds that are malleable and hydrophobic solids at ambient temperatures. These include lipids and higher alkanes that are insoluble in water but are soluble in nonpolar, organic solvents. Various wax products including mineral, natural, and synthetic wax are produced from petroleum-based products such as base oil & natural gas, and chemicals such as polyethylene, or from plants & animals.

Product Type Insights

Mineral wax product type dominated the market with a revenue share of 67.8% in 2022. This is attributed to the growing inclusion of the product in cosmetic formulation and the surge in cosmetics demand across developing and emerging economies. Mineral waxes are pure and contain no trace of esters or alcohol in beeswax or plant-based waxes. These products are extracted from coal, petroleum, lignite, and shale oil through the fractional distillation process.

A few of the commonly recognized mineral waxes include microcrystalline, paraffin, petrolatum, and ceresin. Microcrystalline waxes provide high diversity in terms of physical and thermal properties. Due to these characteristics, these wax products are broadly utilized in various applications such as adhesives, chewing gums, cosmetics, and cheese wax formulations.

Paraffin wax is one of the commonly extracted waxes from the oil industry as a by-product, which ensures continuous diligent sourcing and ease of producing the wax. Paraffin product type is broadly utilized in the formulation of candles as it has the unique property to retain both scent and color for an extremely long duration. In addition, paraffin is widely used in skin-softening treatments. On the other hand, microcrystalline wax has a higher melting point and is comparatively more flexible than paraffin and therefore, is used in large-scale industrial applications apart from the cosmetic industry.

Synthetic wax is estimated to be the fastest growing segment in the near future, wherein the growth is attributable to rising demand for paper & paperboard and building boards. Also, the increase in demand for cosmetics & personal care, adhesives, and ink & coating sectors is expected to steer the market growth over the coming years.

Application Insights

Candle application dominated the market with a revenue share of 31.6% in 2022. This high share is attributable to the growing demand for aromatherapy through scented candles which have become a critical household essential. Candles are available in a variety of sizes, shapes, and their product range includes birthday, taper, utility, teal light containers to novelty candles. These are used for multiple purposes such as aromatherapy for relaxation & stress reduction and home décor.

According to National Candle Association, approximately 7 out of 10 households use candles for stress-related therapies and scented candles as home fragrance products. The market is characterized by the availability and ease of purchase of a variety of candles through numerous distribution channels. An increasing number of distribution channels such as décor & mass merchandise stores and e-commerce platforms have aided in propelling candle demand worldwide.

The packaging application segment accounted for the second-largest revenue contribution globally. This can be traced to increasing utilization in the coating, treatment, impregnation, and lamination of primary food contact materials such as paper, boards, and aluminum. Wax is not only used as a lubricant to reduce friction in production but is also often used to coat food products such as cheese, vegetables, and fruits directly. However, corrugated wax packaging demand is anticipated to register limited growth due to the easy availability of feasible alternate packaging solutions including suspended packaging, retention packaging, self-sealing boxes, and corrugated mailers.

Regional Insights

Asia Pacific region dominated the wax industry with a revenue share of 34.2% in 2022. The growth is attributed to rising living standards and increasing industrialization, especially in countries like China and India. Market growth is also anticipated due to low labor, raw material, and operational costs.

The rising utilization of cosmetic products such as creams, lotions, sunscreens, and makeup among the youth of Japan, India, Indonesia, Korea, and China is expected to boost the wax industry's growth. Emerging economies, such as Indonesia and Malaysia, among other Southeast Asian countries, are anticipated to reflect steady economic growth from 2023 to 2030. The demand for printing ink is projected to rise in the region due to the significantly growing packaging sector.

North America region accounted for the second largest revenue share in 2022. This is attributable to owing to the presence of various personal care and cosmetics companies such as Colgate-Palmolive, Maybelline, Avon, Unilever, Johnson & Johnson, and Procter & Gamble among others. The increasing popularity of cosmetics has resulted in extensive product development, which, in turn, is expected to promote the demand for paraffin wax over the forecast period.

Key Companies & Market Share Insights

The key wax manufacturers are implementing various growth strategies to keep up with the rising demand from various applications. To gain further access to the global and regional markets, the companies are integrating forward through the value chain. Key innovators in the global ecosystem include British Petroleum; Baker Hughes; and Honeywell Corporation, among others. These companies invest heavily in research and development to create novel products, the vast majority of which are patented.

The market is observed to be strategically evolving with several multinationals involved in mergers & acquisitions, joint ventures, project expansion, and more to establish a sizeable market presence across the globe. One such example would be the acquisition of Puget Sound Refinery by HollyFrontier Corporation for USD 613.6 million in 2021. Some prominent players in the global wax market include:

-

Sinopec Corp

-

China National Petroleum Corporation

-

HollyFrontier Corporation

-

BP P.L.C

-

Nippon Seiro Co., Ltd

-

Baker Hughes Company

-

Exxon Mobil Corporation

-

Sasol Limited

-

The International Group, Inc.

-

Evonik Industries AG

-

BASF SE

-

Dow

-

Honeywell International Inc.

-

Royal Dutch Shell P.L.C

-

Mitsui Chemicals, Inc.

Wax Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 10.46 billion

Revenue forecast in 2030

USD 14.16 billion

Growth Rate

CAGR of 4.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kiloton, revenue in USD million/billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

US; Canada; Germany; U.K.; China; India; Brazil

Key companies profiled

Sinopec Corp; China National Petroleum Corporation; HollyFrontier Corporation; BP P.L.C; Nippon Seiro Co., Ltd; Baker Hughes Company; Exxon Mobil Corporation; Sasol Limited; The International Group, Inc.; Evonik Industries AG; BASF SE; Dow; Honeywell International Inc.; Royal Dutch Shell P.L.C; Mitsui Chemicals, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Wax Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global wax market report based on product type, application, and region:

-

Product Type Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

-

Mineral wax

-

Synthetic Wax

-

Natural Wax

-

-

Application Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

-

Candles

-

Packaging

-

Plastics & Rubber

-

Pharmaceuticals

-

Cosmetics & Toiletries

-

Fire Logs

-

Adhesives

-

Others

-

-

Regional Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The Asia Pacific dominated the wax market with a share of over 34.2% in 2022. This is attributable to growing construction activities, particularly in emerging economies like India & China coupled with technological developments leading to the growth of the adhesives market.

b. Some key players operating in the wax market include Sinopec Corp., China National Petroleum Corporation (CNPC), HollyFrontier Corporation, BP P.L.C., Nippon Seiro Co., Ltd., Baker Hughes Incorporated, Exxon Mobil Corporation, Sasol Limited, International Group Incorporated (IGI), Evonik Industries AG, BASF SE, Dow Corning Corporation, Honeywell International Inc.,Royal Dutch Shell Plc., and Mitusi Chemicals.

b. Key factors that are driving the wax market growth include superior properties of wax such as good water repellency, non-toxicity, & outstanding chemical resistance, and a rise in demand for paperboard, paper, & building boards.

b. The global wax market size was estimated at USD 10.1 billion in 2022 and is expected to reach USD 10.46 billion in 2023.

b. The global wax market is expected to grow at a compound annual growth rate of 4.3% from 2023 to 2030 to reach USD 14.16 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."