- Home

- »

- Advanced Interior Materials

- »

-

Welding Helmet Market Size & Share, Industry Report, 2033GVR Report cover

![Welding Helmet Market Size, Share & Trends Report]()

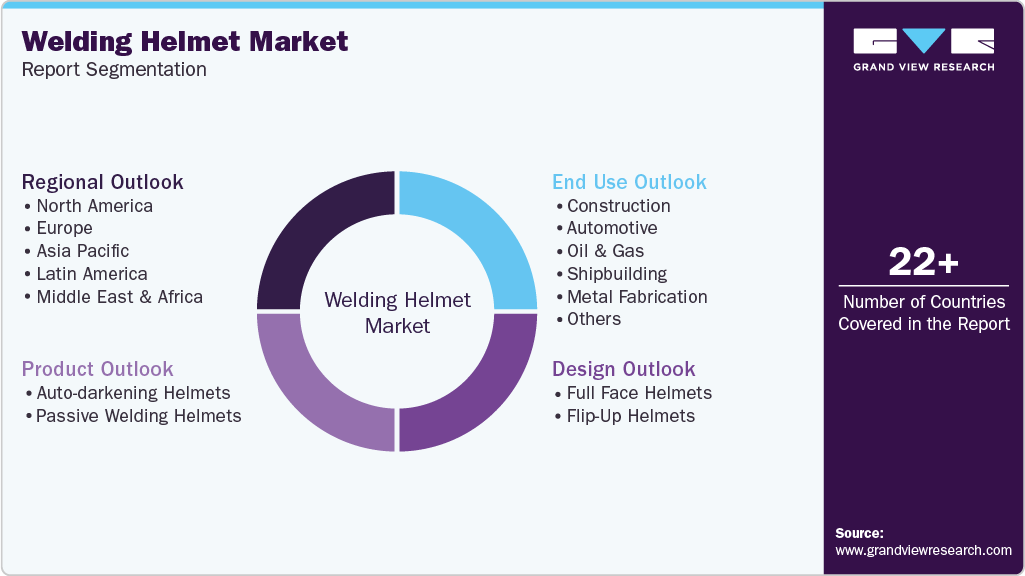

Welding Helmet Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Auto-darkening helmets, Passive Welding Helmets), By Design (Full Face Helmets, Flip-Up Helmets), By End-use (Construction, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-759-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Welding Helmet Market Summary

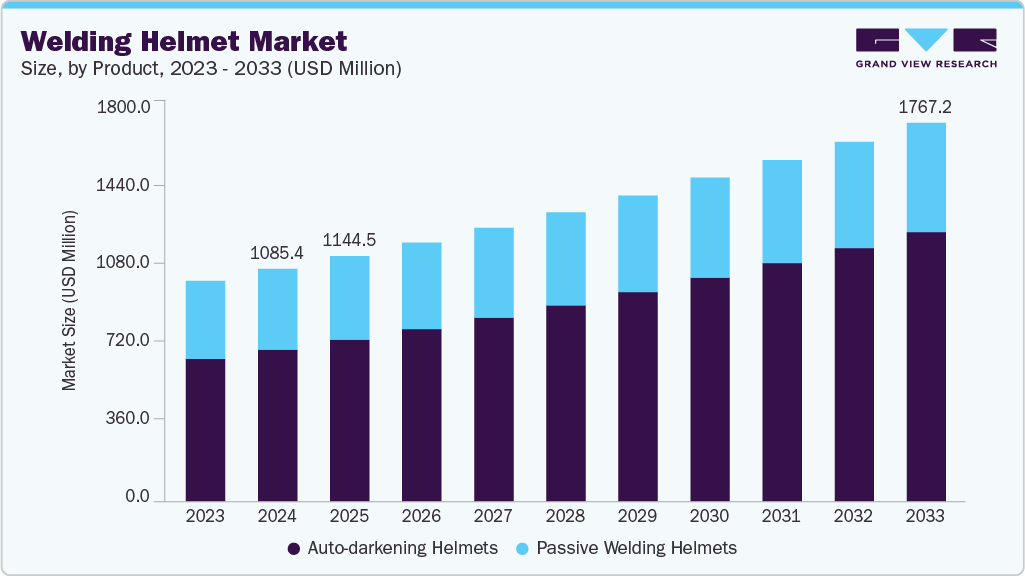

The global welding helmet market size was estimated at USD 1,085.4 million in 2024 and is projected to reach USD 1767.2 million by 2033, growing at a CAGR of 5.6% from 2025 to 2033. The rising demand for welding helmets is fueled by increasing safety regulations across industries such as automotive, construction, shipbuilding, and oil & gas.

Key Market Trends & Insights

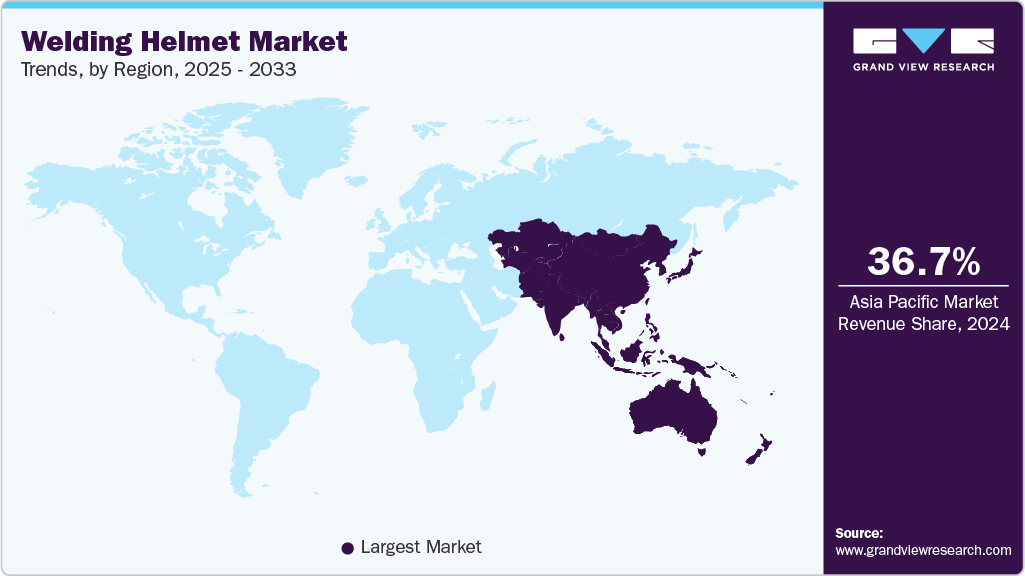

- Asia Pacific dominated the welding helmet industry with the largest revenue share of 36.7% in 2024.

- The usage of welding helmets in China dominated the global welding helmet usage due to its massive infrastructure projects, rapid urbanization, and dominance in the steel and shipbuilding industries.

- By product, the auto-darkening helmet segment led the market and accounted for 65.3% of revenue share in 2024.

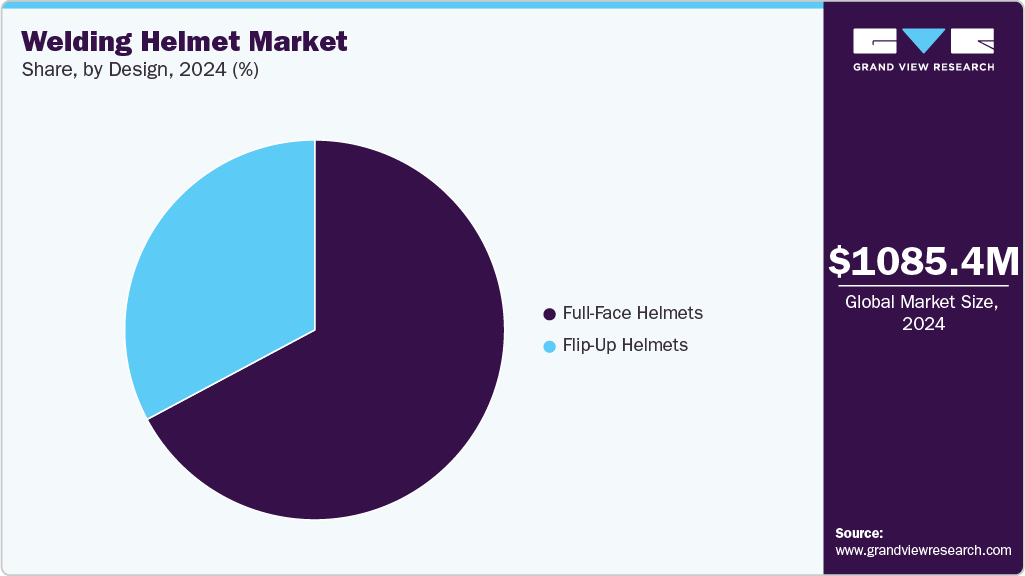

- By design, the full face helmets segment accounted for the largest share, holding 67.2% of the market share in 2024.

- By end use, the construction segment dominated the market and accounted for a 28.5% share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,085.4 Million

- 2033 Projected Market Size: USD 1,767.2 Million

- CAGR (2025-2033): 5.6%

- Asia Pacific: Largest market in 2024

Stricter workplace safety standards have compelled employers to invest in personal protective equipment (PPE) that minimizes risks of radiation, sparks, and fumes, thereby boosting helmet adoption. At the same time, higher awareness among workers about long-term health hazards associated with welding is pushing demand for helmets with auto-darkening filters and better optical clarity. Technological innovation has emerged as a major driver, with manufacturers introducing helmets featuring solar-assisted power, adjustable shade ranges, lightweight designs, and digital control systems.

These advancements not only improve operator comfort but also enhance precision and productivity, encouraging industries to upgrade older models. Growing integration of welding helmets with smart technologies, including sensors and connectivity, further attracts interest from high-performance welding applications in aerospace, defense, and heavy engineering.

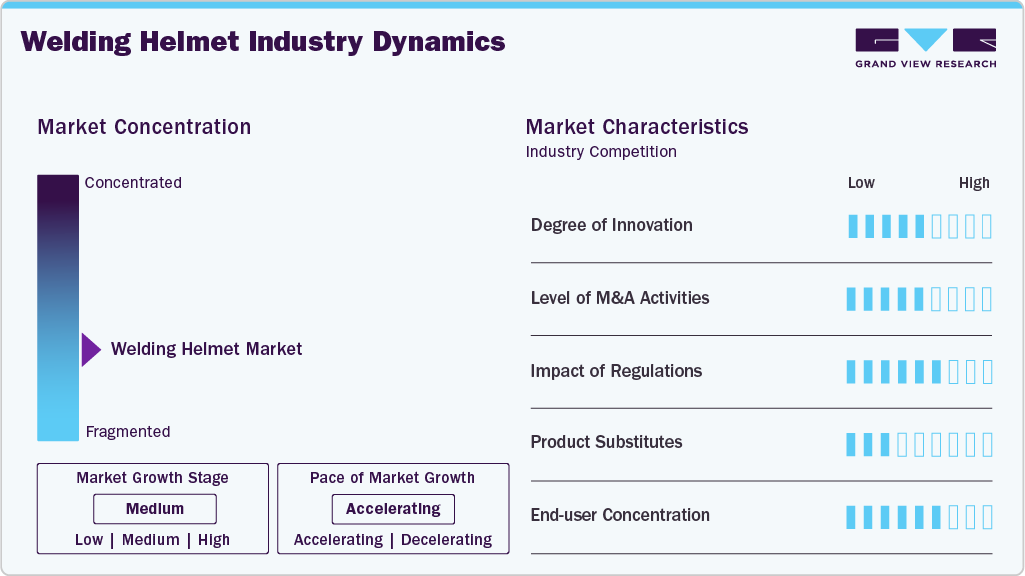

Market Concentration & Characteristics

The global welding helmet industry is moderately concentrated, with a mix of established international brands and regional manufacturers. Leading players such as 3M, Lincoln Electric, ESAB, and Miller dominate due to their strong product portfolios, extensive distribution networks, and reputation for reliability. However, local and mid-sized companies are carving out niches in cost-sensitive and emerging markets by offering affordable alternatives. This balance of global dominance and regional competition gives the market a moderately fragmented but competitive structure.

The welding helmet industry demonstrates a steady pace of innovation, with manufacturers focusing on enhancing worker safety, comfort, and productivity. Key advancements include auto-darkening filters with variable shade ranges, solar-assisted power systems, lightweight and ergonomic designs, and integration of digital controls. Smart PPE features, such as connectivity and sensors for monitoring welder health and productivity, are gradually entering the market. Continuous R&D efforts are also aimed at improving optical clarity, durability, and user comfort to meet rising safety standards and end-user expectations.

Mergers and acquisitions play a moderate role in shaping the market, with global leaders acquiring niche players or regional brands to expand market reach and strengthen product lines. Collaborations with training institutes and industrial automation companies further broaden adoption. Such strategic moves also help manufacturers accelerate technological development, reduce costs, and enhance their presence in fast-growing markets like the Asia Pacific and Latin America. This trend is likely to continue as players seek competitive advantages through scale and innovation.

Regulatory frameworks are a major factor influencing the welding helmet industry, as governments worldwide enforce stricter occupational safety and health standards. Organizations such as OSHA (U.S.) and EU safety directives mandate proper use of protective equipment, directly supporting helmet demand. At the same time, rising emphasis on worker well-being and productivity pushes companies to align product development with these regulations. Compliance with evolving safety norms drives both innovation and product differentiation, ensuring helmets remain an indispensable part of workplace protection.

Drivers, Opportunities & Restraints

A critical factor supporting market growth is the expansion of welding activities in both developed and emerging economies. Infrastructure development projects, rising vehicle production, and renewable energy installations are increasing the demand for skilled welders and protective gear. Training institutions are also adopting welding helmets, adding to overall market demand. This broad industrial base ensures steady adoption across diverse applications worldwide.

Opportunities lie in the increasing trend toward automation and the adoption of smart PPE integrated with digital features, such as Bluetooth connectivity and data monitoring. In addition, growth in infrastructure investment and renewable energy projects creates new welding helmet demand across emerging markets. Rising focus on worker productivity and comfort also opens avenues for lightweight, ergonomic designs that appeal to both industrial and commercial end users.

The high costs of advanced auto-darkening helmets compared to conventional models limit penetration in cost-sensitive regions. Counterfeit and low-quality products further hinder brand value and end user trust. In addition, lack of awareness about long-term welding hazards in developing countries slows adoption of higher-quality helmets, particularly in small-scale workshops.

Product Insights

The auto-darkening helmet segment led the market and accounted for 65.3% of revenue share in 2024, owing to its superior convenience, safety, and performance advantages. These helmets automatically adjust lens shade in response to arc intensity, allowing welders to maintain focus and efficiency without lifting the helmet. Their popularity is especially strong in industries such as automotive, shipbuilding, and heavy machinery, where precision and productivity are critical. Moreover, ongoing innovations such as solar-assisted power, digital controls, and lightweight ergonomic designs are further strengthening the dominance of this segment across global markets.

Passive welding helmets remain popular among small workshops, training institutions, and cost-sensitive markets where budget-friendly PPE solutions are prioritized. Their simple design, ease of maintenance, and reliability in basic welding operations ensure steady adoption. In addition, growing welding activities in emerging economies and increased demand for protective gear in vocational training programs are contributing to the segment’s consistent growth.

Design Insights

The full face helmets segment held the largest share in the market and accounted for a share of 67.2% in 2024, as they provide comprehensive protection for welders against sparks, heat, radiation, and debris. Their ability to shield not just the eyes but also the entire face and neck makes them the preferred choice in high-risk industrial environments such as shipbuilding, oil & gas, and heavy construction. Growing enforcement of stringent workplace safety standards worldwide has further reinforced demand for these helmets. In addition, technological advancements like auto-darkening filters and lightweight materials have enhanced comfort and usability, helping the segment maintain its dominant position.

Flip-up helmets allow users to switch easily between welding and inspection tasks without removing the gear, improving efficiency and comfort for workers. Their cost-effectiveness compared to fully auto-darkening helmets makes them attractive in cost-sensitive markets and among small workshops. Increasing adoption in construction, repair, and maintenance projects, where frequent task-switching is common, continues to drive steady growth in this segment.

End Use Insights

The construction segment dominated the market and accounted for a 28.5% share in 2024, owing to the sheer scale of welding activities involved in infrastructure, residential, and commercial projects. Rapid urbanization and government-led investments in smart cities, transport networks, and energy infrastructure have significantly increased welding intensity. Helmets are indispensable for protecting workers from sparks, radiation, and fumes during steel fabrication and structural welding.

Expanding international trade volumes and growing seaborne transportation are fueling investments in shipyards, especially in the Asia Pacific and Europe. Advanced welding techniques are increasingly required for the construction of large vessels and complex offshore rigs, which heightens demand for high-quality protective gear such as welding helmets. Furthermore, government-backed naval modernization programs and offshore energy projects add steady momentum to the segment’s growth.

Regional Insights

The North America welding helmet industry is projected to grow at a CAGR of 4.6% over the forecast period, driven by OSHA’s stringent workplace safety regulations, which mandate protective gear for welding professionals. The region benefits from widespread adoption in automotive manufacturing, aerospace, shipbuilding, and oil & gas sectors, all of which are welding-intensive. High levels of investment in industrial automation and robotics create demand for helmets compatible with advanced welding systems. Furthermore, the U.S. infrastructure renewal initiatives are spurring construction welding activities, adding momentum to the market.

U.S. Welding Helmet Market Trends

The U.S. welding helmet industry is projected to grow at a CAGR of 4.5% over the forecast period. Strict OSHA regulations and a strong industry safety culture remain central to welding helmet adoption in the country. Demand is reinforced by high welding activity in automotive, aerospace, and defense manufacturing, which requires advanced protective gear.

Europe Welding Helmet Market Trends

The welding helmet industry in Europe is propelled by the demand for welding helmets due to the expansion of construction and transportation sectors, along with EU-wide worker safety directives that emphasize protective PPE use. Germany, Italy, and Central & Eastern Europe serve as strong hubs for the automotive, machinery, and shipbuilding industries, ensuring steady consumption. Increasing adoption of lightweight, ergonomically designed helmets reflects a focus on worker comfort and efficiency. In addition, sustainability-focused industrial practices are driving demand for helmets that integrate with eco-efficient welding technologies.

The welding helmet industry in Germany generates significant helmet demand through its extensive industrial base and it also being the Europe’s automotive and machinery hub. Welding-intensive processes in automotive assembly lines and metal fabrication require protective helmets that enhance precision and safety. Compliance with EU and national worker safety standards strengthens adoption, while manufacturers focus on premium-quality helmets suited for advanced automation. In addition, growing renewable energy projects and green manufacturing initiatives add new layers of welding activity.

The UK welding helmet industry benefits from infrastructure modernization projects, renewable energy installations, and a growing focus on skilled labor development through welding training programs. Auto-darkening helmets are increasingly preferred for their convenience and efficiency in professional use. Strong adherence to health and safety regulations ensures consistent PPE investments across industries. Moreover, the rising adoption of helmets in offshore oil & gas and shipbuilding further boosts demand.

Asia Pacific Welding Helmet Market Trends

The welding helmet industry in the Asia Pacific dominated the global market for welding helmets in terms of global revenue share, accounting for 36.7% share in 2024, due to rapid industrialization and large-scale infrastructure development across China, India, and Southeast Asia. The automotive, shipbuilding, and energy sectors account for major welding volumes, with demand supported by government-backed manufacturing initiatives. Rising exports of steel and fabricated products also boost helmet consumption among small and medium enterprises.

The usage of welding helmets in China dominated the global welding helmet usage due to its massive infrastructure projects, rapid urbanization, and dominance in the steel and shipbuilding industries. The country’s government-backed manufacturing initiatives sustain high welding volumes across construction, transportation, and heavy industry.

India’s welding helmet industry is supported by rapid industrialization, megaprojects in infrastructure, and the “Make in India” program, which prioritizes domestic manufacturing. Construction, automotive, and rail sectors are among the largest contributors to demand.

Middle East & Africa Welding Helmet Market Trends

The Middle East & Africa welding helmet industry is driven by large-scale oil & gas exploration, pipeline projects, and infrastructure developments linked to urban expansion. Countries such as Saudi Arabia and the UAE are investing heavily under diversification plans, raising welding activity across industrial sectors. Enforcement of workplace safety standards has improved significantly, spurring helmet demand. Moreover, growing participation of global PPE brands in regional markets is expanding access to advanced helmets with better safety and performance features.

Saudi Arabia’s welding helmet market’s demand is closely tied to the Kingdom’s Vision 2030 initiatives, which prioritize infrastructure, manufacturing, and energy diversification. Large-scale oil & gas projects, pipelines, and refineries continue to drive intensive welding activity. Safety regulation enforcement has improved, encouraging companies to adopt modern PPE.

Latin America Welding Helmet Market Trends

Latin America welding helmet industry experiences steady welding helmet demand, with Brazil and Argentina emerging as core growth markets due to strong construction, mining, and oil & gas industries. Growing industrial training programs and government-backed initiatives to upskill welders increase equipment usage. Rising demand for safer and more comfortable helmets is evident in both industrial and commercial applications.

The welding helmet industry in Brazil drives Latin America’s welding helmets demand through robust oil & gas exploration, energy projects, and extensive construction activity. Mining and metal fabrication also contribute to steady adoption in industrial hubs. Government programs aimed at industrial growth and vocational training reinforce welding PPE demand.

Key Welding Helmet Company Insights

Some of the key players operating in the market include The Lincoln Electric Company and Illinois Tool Works (ITW).

-

Lincoln Electric is a global manufacturer of welding equipment, consumables, automation systems, and cutting solutions. It maintains a deep global presence with manufacturing sites and joint ventures across 20+ countries and distribution in over 160 countries. The company is known for its strong culture of performance, employee incentive programs, and continuous R&D in welding and automation technologies. In recent years, the company has expanded its focus on sustainability and Industry 4.0 solutions to meet evolving customer and regulatory needs.

-

Illinois Tool Works (ITW), headquartered in Glenview, Illinois, is a diversified U.S. industrial manufacturer with a strong presence in the welding market through its Miller Electric and related brands. The company produces arc welding equipment, consumables, and personal protective equipment, including advanced welding helmets. Miller’s helmets, such as the Digital Infinity and T94 series, feature innovations like ClearLight™ lens technology, large viewing areas, and ergonomic designs, making them popular among professional welders. With high operating margins, global distribution, and a reputation for safety and innovation, ITW is well positioned in the welding helmet industry.

Key Welding Helmet Companies:

The following are the leading companies in the welding helmet market. These companies collectively hold the largest market share and dictate industry trends.

- The Lincoln Electric Company

- Illinois Tool Works (ITW)

- ESAB

- optrel ag

- Jackson Safety

- 3M

- YesWelder

- Fronius International

- GYS

- BLUE EAGLE SAFETY

- JI SAFETY Co. Ltd

- Pan Taiwan Enterprise Co, Ltd.

- SENLISWELD

Recent Developments

-

In September 2025, Optrel’s Sphere X Series welding helmets were introduced, comprising several advanced features, focusing on optimal clarity, improved safety, and ergonomic comfort. These helmets feature a Crystal lens with 30% increased visibility compared to previous models, as well as a five-sensor system that enhances automatic shade adjustment for safer and more precise welding.

-

In October 2024, ESAB launched a new welding helmet, the ESAB Savage A50 welding helmet, which features several advanced and exclusive attributes designed to enhance user experience and safety. It includes an integrated 50-lumen dual LED work light to improve visibility, a redesigned shell for durability, and a quick-release front lens that makes lens replacement easier while reducing damage risk. The helmet also offers a simplified, pushbutton digital auto-darkening filter (ADF) interface with a five-button user control and an intuitive LCD display that is glove-friendly for quick and easy adjustments.

Welding Helmet Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,144.5 million

Revenue forecast in 2033

USD 1,767.2 million

Growth rate

CAGR of 5.6% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, design, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

The Lincoln Electric Company; Illinois Tool Works (ITW); ESAB; Optrel AG; Jackson Safety; 3M; YesWelder; Fronius International; GYS; Blue Eagle Safety; JI Safety Co. Ltd; Pan Taiwan Enterprise Co. Ltd; SENLISWELD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Welding Helmet Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global welding helmet market report based on product, design, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Auto-darkening helmets

-

Passive Welding Helmets

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Construction

-

Automotive

-

Oil & Gas

-

Shipbuilding

-

Metal Fabrication

-

Others

-

-

Design Outlook (Revenue, USD Million, 2021 - 2033)

-

Full Face Helmets

-

Flip-Up Helmets

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global welding helmet market size was estimated at USD 1,085.4 million in 2024 and is expected to be USD 1,144.5 million in 2025.

b. The global welding helmet market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2033 to reach USD 1,767.2 million by 2033.

b. The market in Asia Pacific held the largest share in the market and accounted for a share of 37.0% in 2024 driven by rapid industrialization and infrastructure expansion in China, India, Southeast Asia, and Japan. Strong growth is especially evident in the automatic-darkening helmet segment, where rising safety awareness and regulatory enforcement are pushing adoption of advanced PPE.

b. Some of the key players operating in the global welding helmet market include The Lincoln Electric Company, Illinois Tool Works (ITW), ESAB, Optrel AG, Jackson Safety, 3M, YesWelder, Fronius International, GYS, Blue Eagle Safety, JI Safety Co. Ltd, Pan Taiwan Enterprise Co. Ltd, and SENLISWELD.

b. The global welding helmet market is driven by stricter workplace safety regulations and growing awareness of welder protection, alongside rapid technological advancements such as auto-darkening filters, ergonomic designs, and smart features that enhance efficiency and comfort across industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.